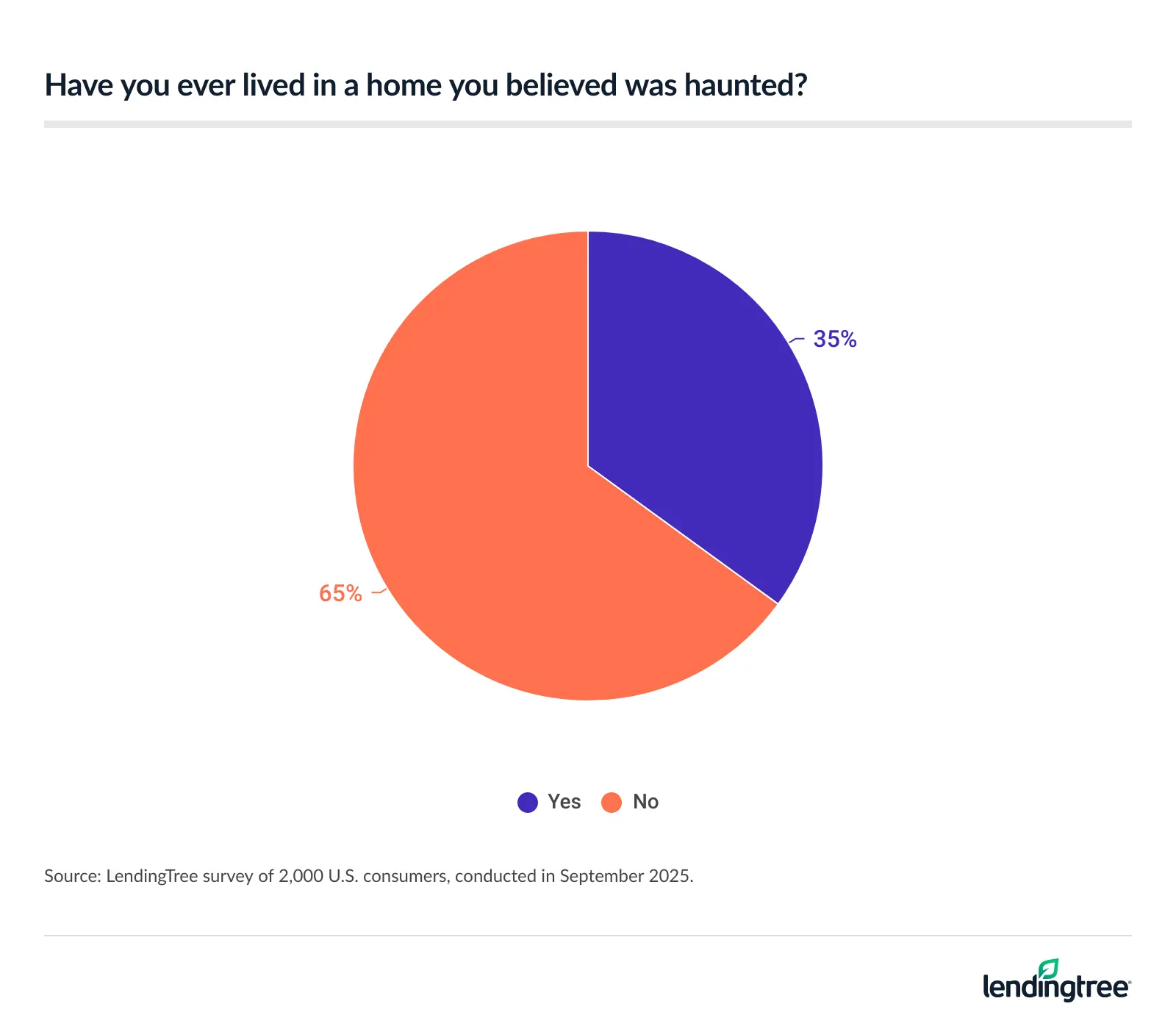

Haunted Housemates: 35% of Americans Say They’ve Lived With Ghosts

Homebuyers can overlook a lot in today’s competitive market — peeling wallpaper, creaky floors, a nosy homeowners association. But what about a few disembodied whispers in the night?

According to a LendingTree survey of 2,000 U.S. consumers, 30% would consider buying a home they believed was haunted — and 8% of them would pay more for the experience. Here’s a closer look at the percentage of Americans who believe they’ve lived in a haunted house, opinions on disclosing paranormal activity and more.

Key findings

- Haunted houses aren’t just for Halloween. 35% of Americans say they’ve lived in a home they believed was haunted, and 50% of them believe their current home has some paranormal activity. This has real consequences, too, as 59% of those who’ve lived in a home they felt was haunted have considered moving because of it — including 19% who have done so.

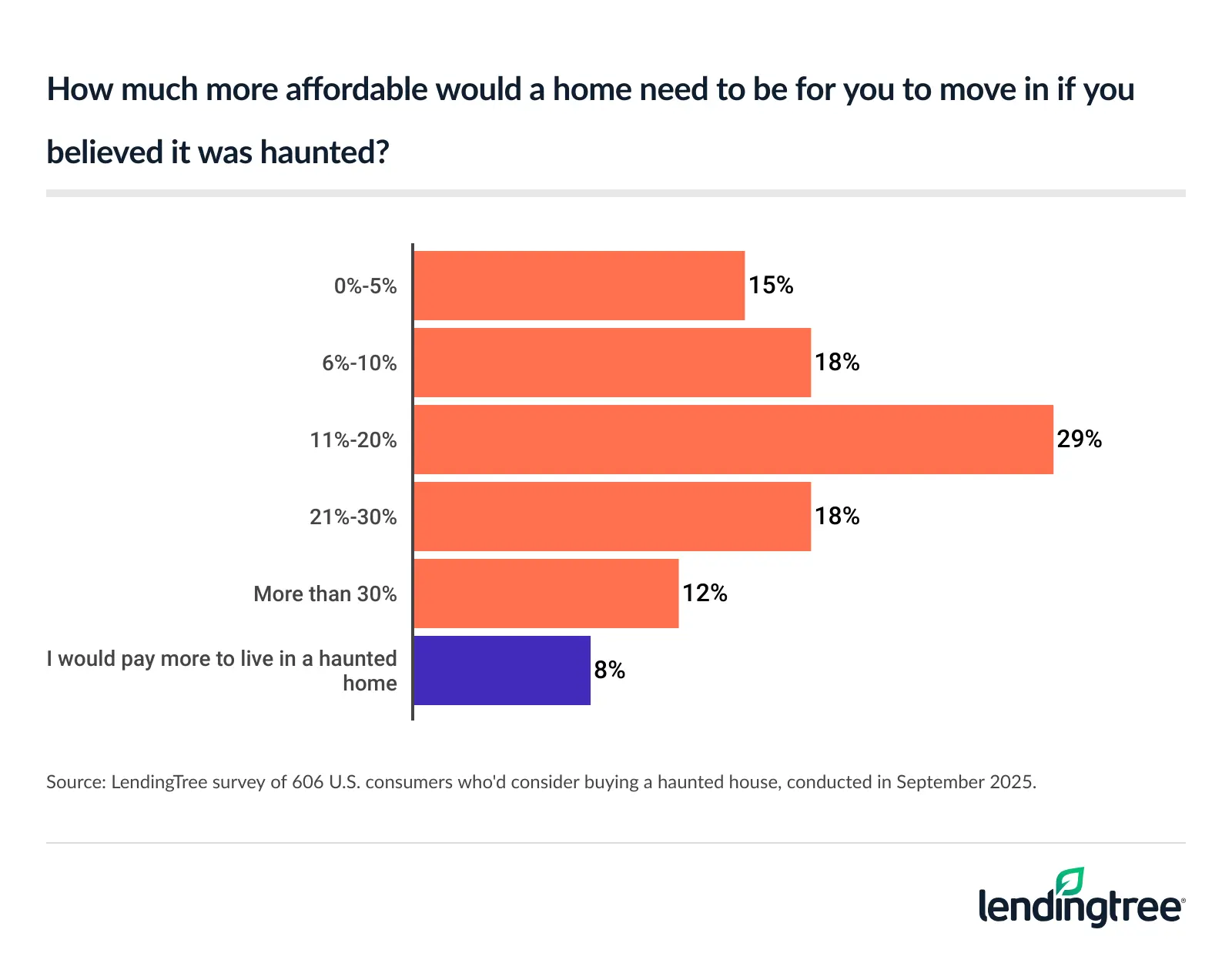

- Some Americans would live with ghosts if the price was right. 56% say they wouldn’t consider buying a home they believed was haunted, while 30% would — though most would require a steep discount. 59% of those who’d consider it say the home price would need to be at least 11% lower. Just 8% admit they’d pay extra for the spooky factor.

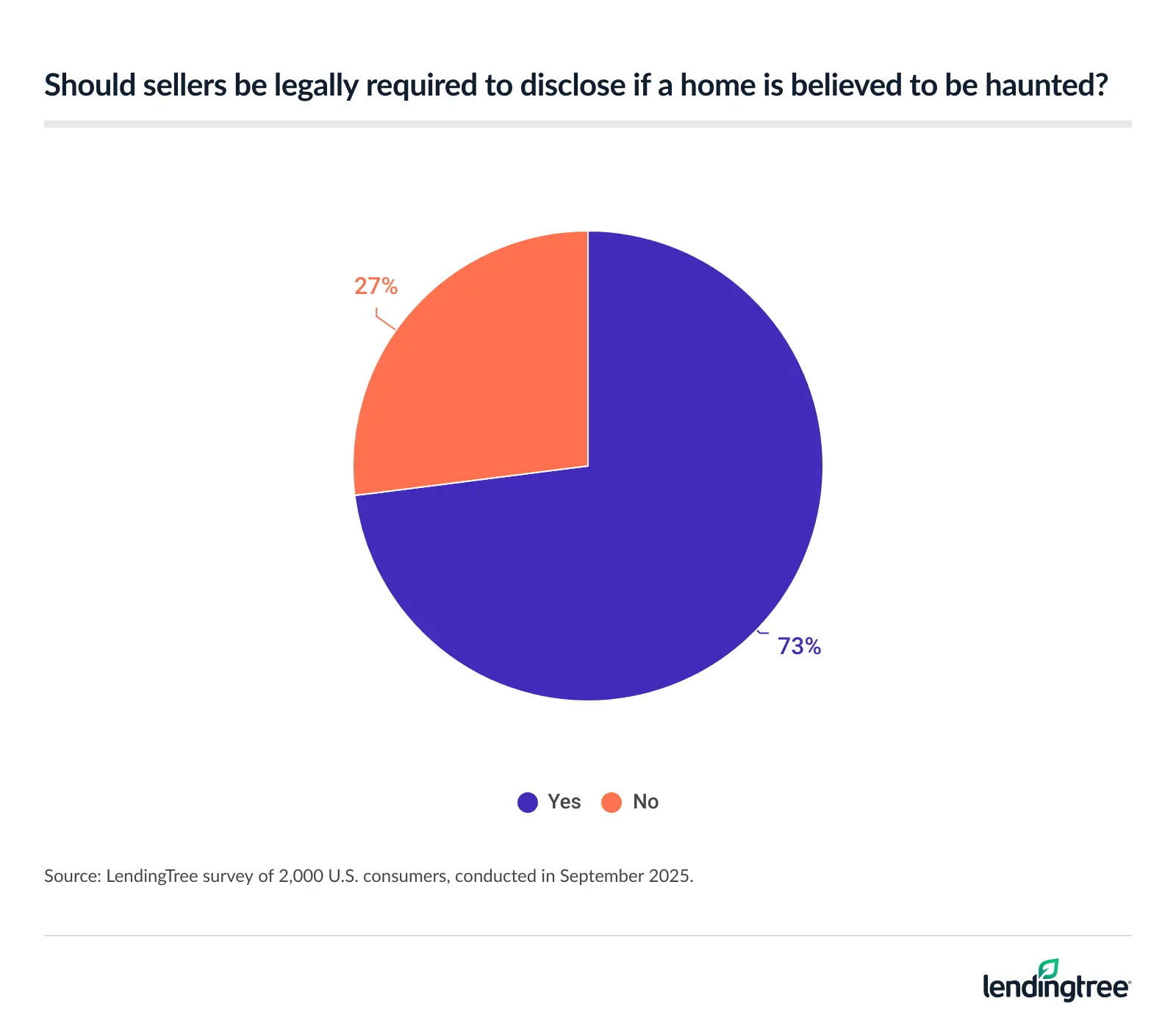

- Secrets and spirits can make real estate decisions trickier. 73% of Americans think sellers should be legally required to disclose if a home is believed to be haunted. 37%, though, admit they wouldn’t disclose a haunting as a seller.

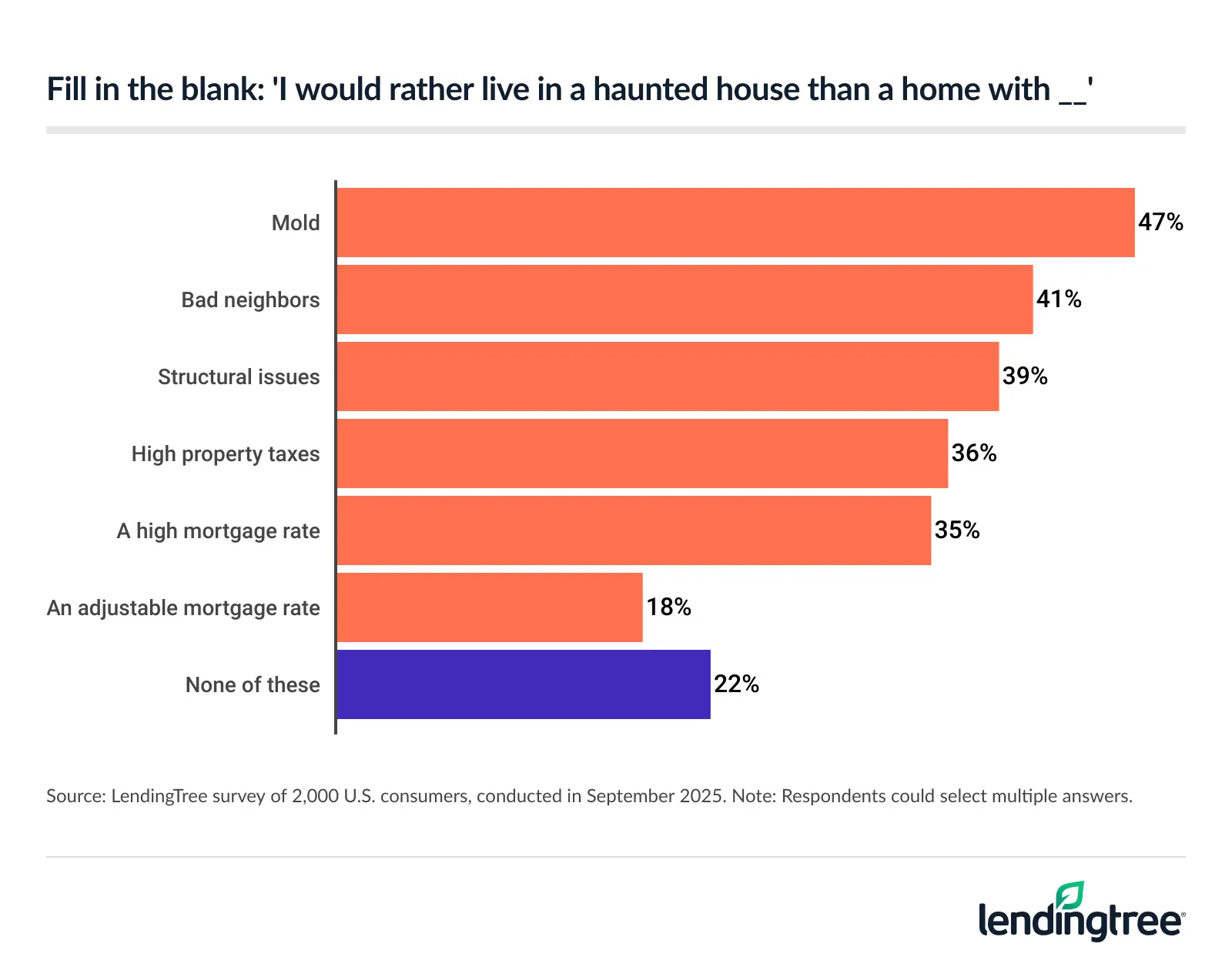

- When it comes to housing headaches, some Americans would take ghosts over real-world problems. 47% say they’d rather live in a haunted house than deal with mold, while 41% would prefer hauntings over bad neighbors, and 39% would choose spirits instead of structural issues.

Some Americans believe they live or have lived in a haunted house

For some Americans, ghosts are more than a seasonal thrill. In fact, 35% say they’ve lived in a home they believed was haunted. That rises to 49% among those with kids younger than 18.

Of this group, 50% believe their current home is haunted, although 19% of them didn’t believe it was haunted before moving in.

Meanwhile, 16% of Americans say there’s a room in their current home they’re afraid of, and 15% have asked a medium or psychic for advice on a haunted home.

Whether they believe their home is haunted, 65% say they’ve experienced paranormal activity in their home. Sensing a presence when no one is around (24%) is the most common paranormal experience, followed by pets reacting to something unseen (22%) and hearing unexplained sounds (22%). Other paranormal experiences include:

- Seeing an apparition or shadow figure (19%)

- Hearing voices or whispers when no one is around (17%)

- Being physically touched or grabbed by something unseen (15%)

- Hearing unexplained footsteps (13%)

- Noticing objects disappearing and reappearing (13%)

- Noticing objects moving on their own (13%)

- Feeling unexplained temperature changes (12%)

- Noticing unexplained electronic malfunctions (12%)

- Experiencing time anomalies (9%)

Hauntings can also come with significant consequences. Of those who’ve lived in a home they’ve thought was haunted, 59% have considered moving because of it. This includes a notable 19% who moved for this reason.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says that’s understandable.

“You want your home to be a sanctuary, a place where you can feel safe and comfortable,” he says. “Believing your home is haunted could make that impossible, so it makes sense that someone would want to leave. Fear of the paranormal likely doesn’t compare to changing jobs, expanding your family or wanting to change school systems when it comes to the most common reason for leaving a home, but our survey shows it isn’t unheard of either.”

Some would pay to live with spirits

Not all consumers believe ghosts are bad for homebuying. Although 56% wouldn’t consider buying a home they believed was haunted, 30% would. That figure is especially high among those with children younger than 18 (43%), millennials ages 29 to 44 (41%) and men (39%).

However, 33% of those who’d consider it would ask for up to a 10% discount, and 59% would want the price to be at least 11% lower.

Schulz says fear can understandably play a role in homebuying.

“People generally want a home to be a clean slate when they move in, and they want it to be in good condition,” he says. “If there are issues with a home, they want to know about them and be confident they can fix them (or get insurance coverage for future issues). It’s one thing to know about termites or bad wiring or water damage, but being haunted is something else entirely. With all due respect to the Ghostbusters, that’s not something that you can call someone to fix.”

Still, 8% say they’d pay extra for the paranormal perk.

Buying a haunted home doesn’t always mean living with a ghostly resident, though, as 29% say they cleanse potential spirits after moving into a place.

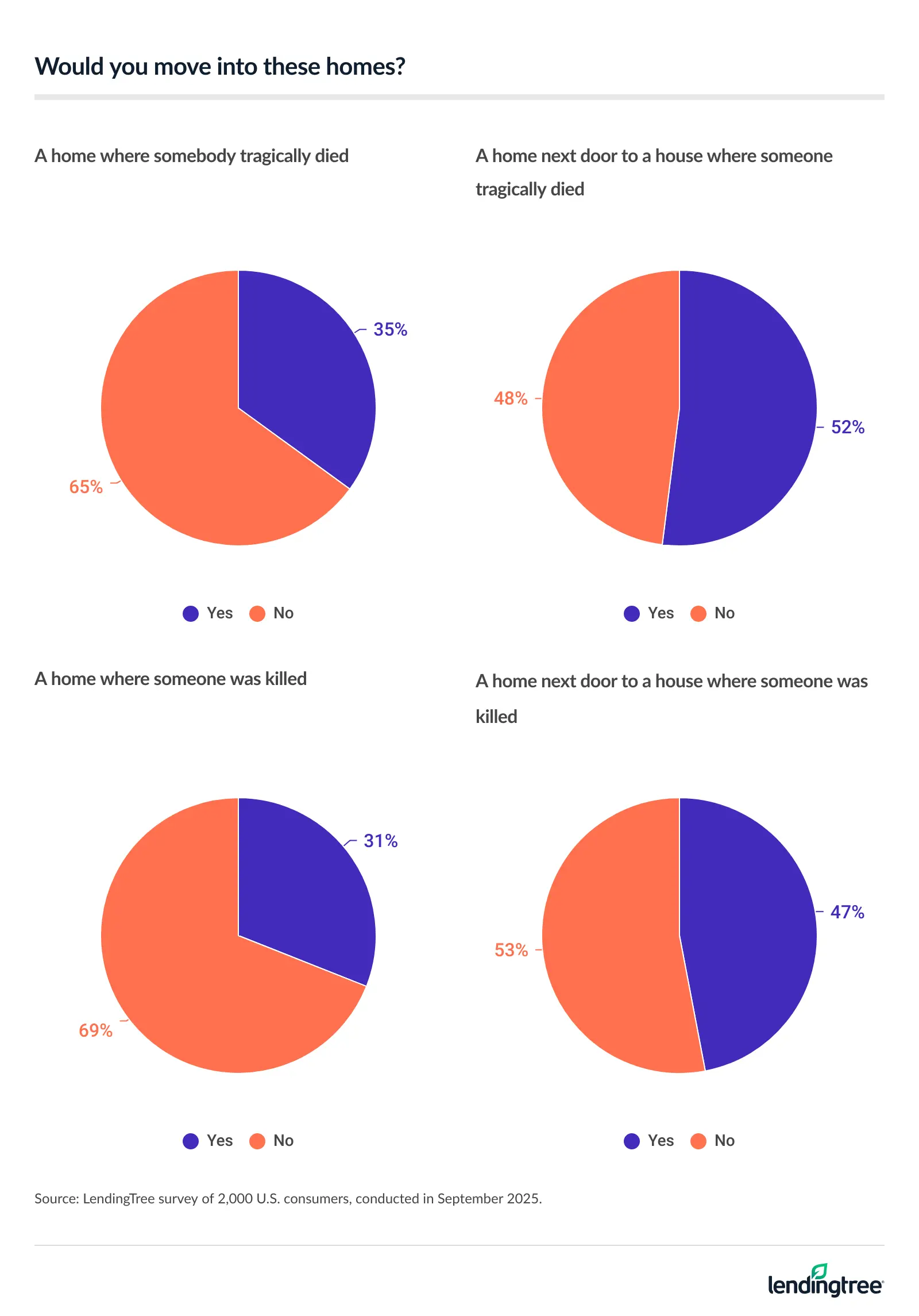

Not everyone believes in the paranormal, but real-life tragedies can still impact homebuying decisions. In fact, 69% of Americans wouldn’t move into a home where someone was killed, and 65% wouldn’t move into a home where someone tragically died.

Proximity to a tragedy doesn’t matter quite as much, though, as a smaller 53% say they wouldn’t move into a home next door to one where someone was killed, and 48% wouldn’t move into a home next door to one where someone tragically died.

Most believe paranormal disclosure should be the norm

When it comes to selling a haunted home, 73% of Americans think sellers should be legally required to disclose if a home is believed to be haunted. Those with children younger than 18 (79%), those earning $30,000 to $49,999 (77%), women (76%) and Gen Xers ages 45 to 60 (76%) are the most likely to feel that way.

But when it comes down to it, 37% admit they wouldn’t disclose a haunting as a seller.

Schulz believes people worry that they might spook buyers if they disclose their belief that the house is haunted.

“Buying and selling a home is personal and intimate,” he says. “If someone shares that their house is haunted but the potential buyer doesn’t believe in the paranormal, it could cause the buyer to think differently about the seller. In a competitive market, those things can matter. It could lead to someone choosing not to put an offer down or a seller choosing a different buyer.”

Ghosts are preferred over mold and bad neighbors

Of course, there are lots of more concrete housing headaches that consumers deal with, but some would take ghosts over those real-world problems. In total, 47% say they’d rather live in a haunted house than deal with mold.

Meanwhile, 41% would prefer hauntings over bad neighbors, and 39% would choose them over structural issues. Following that, people would most commonly choose ghosts over:

- High property taxes (36%)

- A high mortgage rate (35%)

- An adjustable-rate mortgage (18%)

However, 22% say they would prefer any of these over ghosts. That percentage is highest among women (28%) and Gen Xers (28%).

When it comes to dealing with paranormal roommates or choosing to move if you believe your home is haunted, Schulz says it’s all about what you’re willing to put up with.

“If your place has some unexplained quirks and noises every once in a while, don’t worry about it,” he says. “However, if you’re convinced there’s something paranormal happening and you’re no longer comfortable living there, it’s OK to leave. No one should stay in a home where they don’t feel safe, no matter the reason.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from Sept. 2 to 4, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

View mortgage loan offers from up to 5 lenders in minutes