A Bachelor’s Paradise? Here Are the Best Large Metros for Single Men

Single life is coveted by some men and dreaded by others.

Whether you love or hate being in a relationship, there’s no getting around how challenging making it on your own can be. This can be especially true in many of the nation’s large metropolitan areas, where long commute times and high housing costs can quickly drain a single person’s time and money.

That said, some parts of the country could be a bit easier for men on their own. To pinpoint those areas, LendingTree looked at seven variables to determine which of the nation’s 50 largest metros are best for single men:

- Homeownership rate among men without a spouse present

- Share of unmarried or separated men

- Share of men older than 25 with at least a bachelor’s degree

- Median annual earnings for employed men

- Average commute time to work for men who don’t work from home

- Median monthly rent as a share of median monthly earnings for men

- Median monthly housing costs for owner-occupied homes with a mortgage as a share of median monthly earnings for men

Though these variables aren’t the only things for single men to consider when deciding where to live, they’re all likely to impact their quality of life. Owing to this, metros strong in multiple categories may make it easier for single men to thrive.

See the methodology below for more information on why we chose each variable.

On this page

Key findings

- Buffalo, N.Y., is the best metro for single men. While Buffalo is often overshadowed by its downstate sibling, New York City, it can be an excellent place for single men to live. The western New York metro boasts the highest homeownership rate for men who don’t live with a spouse and the shortest commute time of the metros featured in our study — and it’s relatively affordable for single men renters and homeowners.

- Minneapolis and Hartford, Conn., are the next best metros for single men. Despite these metros coming up short of Buffalo overall, they outperform it in some categories. Both metros have a larger share of men with at least a bachelor’s degree than Buffalo, and median earnings are higher for men in these areas than in Buffalo. Strong showings in categories where the two metros are a bit weaker than Buffalo, like the homeownership rate for men who don’t live with a spouse, help Minneapolis and Hartford clinch No. 2 and No. 3.

- Riverside, Calif., Miami and Los Angeles are the metros least friendly to single men. Even though men in these metros are more likely to be unmarried or separated, low homeownership rates for men who don’t live with a spouse, long commute times and relatively steep housing costs as a share of earnings for both renters and homeowners pull these metros down to the bottom three spots overall.

- Metros don’t have to be perfect in every way to rank highly or be universally horrible to rank poorly. This study’s overall ranking is based on seven equally weighted variables. Owing to this, a metro can rank poorly in one or two individual areas and rank highly overall. Similarly, a metro can be strong in some ways but weak overall. For this reason, Buffalo can rank first despite having relatively low median earnings for men and Riverside can rank last despite having a high share of unmarried or separated men.

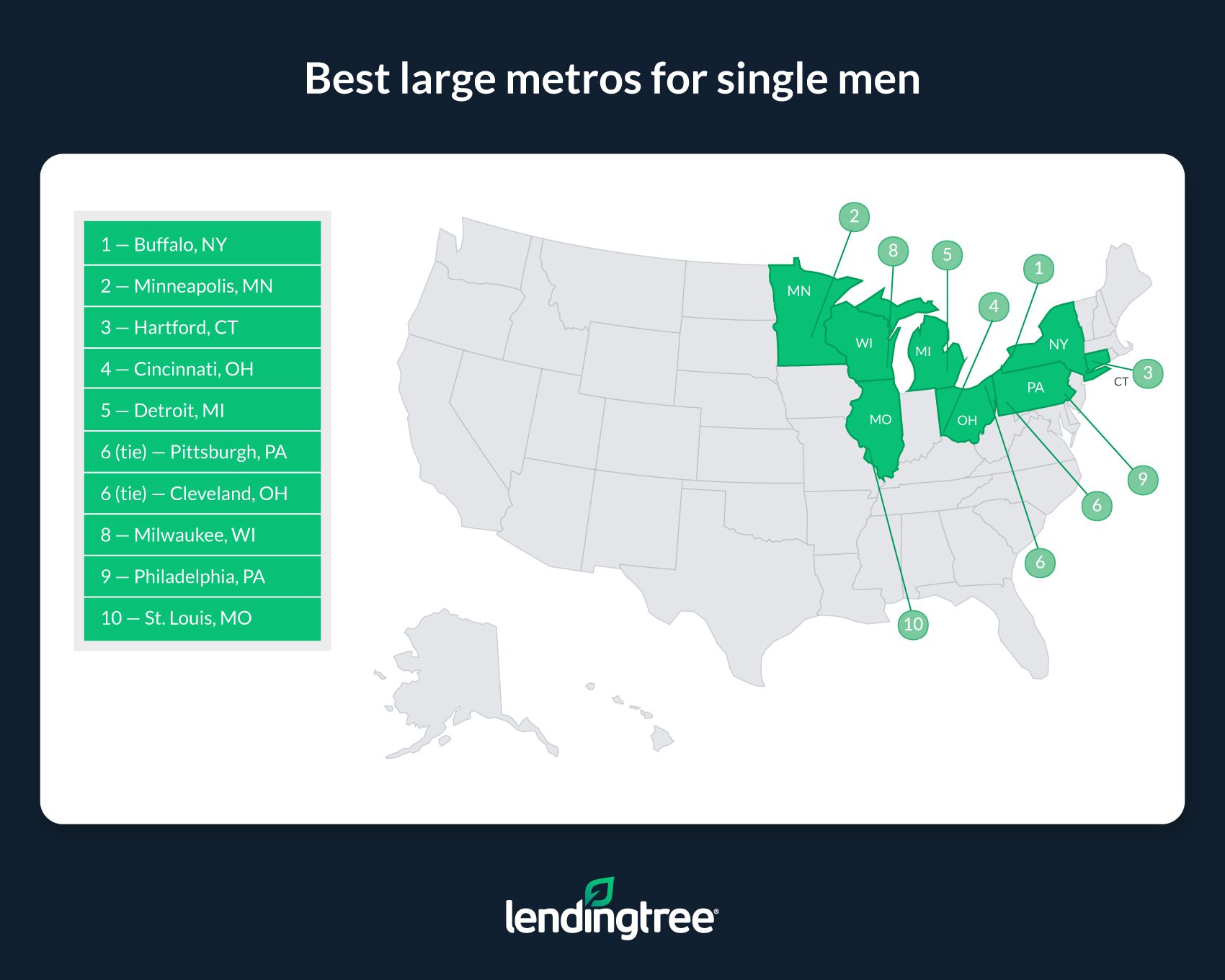

Best large metros for single men

1. Buffalo, N.Y.

- Homeownership rate among men without a spouse present: 69.89%

- Share of unmarried or separated men: 54.03%

- Share of men older than 25 with at least a bachelor’s degree: 35.82%

- Median annual earnings for employed men: $50,128

- Average commute time to work for men who don’t work from home: 21.6 minutes

- Median monthly rent as a share of median monthly earnings for men: 21.26%

- Median monthly housing costs for owner-occupied homes with a mortgage as a share of median monthly earnings for men: 33.56%

2. Minneapolis

- Homeownership rate among men without a spouse present: 64.13%

- Share of unmarried or separated men: 48.20%

- Share of men older than 25 with at least a bachelor’s degree: 43.49%

- Median annual earnings for employed men: $59,940

- Average commute time to work for men who don’t work from home: 24.6 minutes

- Median monthly rent as a share of median monthly earnings for men: 24.94%

- Median monthly housing costs for owner-occupied homes with a mortgage as a share of median monthly earnings for men: 36.44%

3. Hartford, Conn.

- Homeownership rate among men without a spouse present: 62.40%

- Share of unmarried or separated men: 51.67%

- Share of men older than 25 with at least a bachelor’s degree: 40.28%

- Median annual earnings for employed men: $58,095

- Average commute time to work for men who don’t work from home: 25.2 minutes

- Median monthly rent as a share of median monthly earnings for men: 25.41%

- Median monthly housing costs for owner-occupied homes with a mortgage as a share of median monthly earnings for men: 40.09%

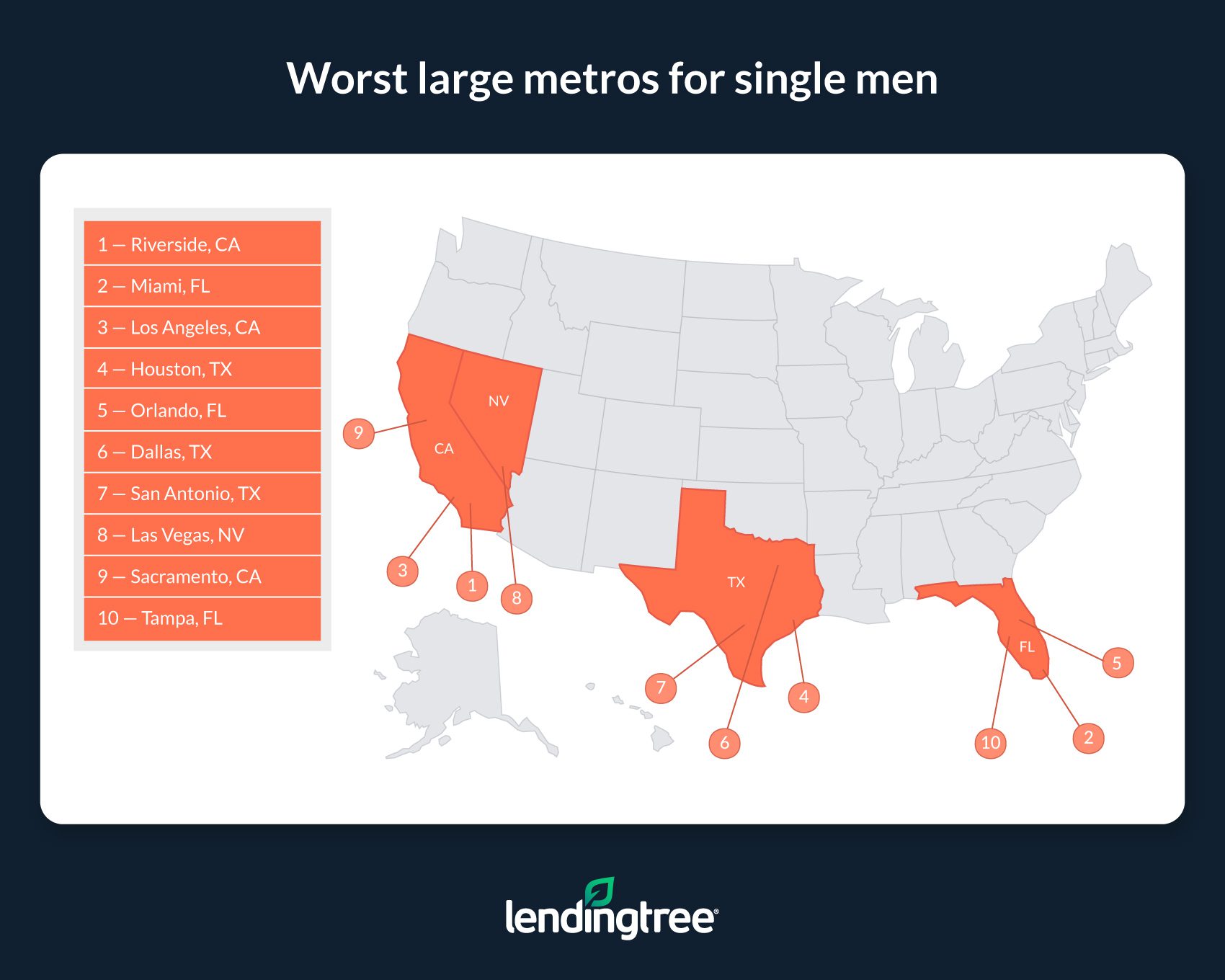

Worst large metros for single men

1. Riverside, Calif.

- Homeownership rate among men without a spouse present: 54.06%

- Share of unmarried or separated men: 51.84%

- Share of men older than 25 with at least a bachelor’s degree: 22.74%

- Median annual earnings for employed men: $46,406

- Average commute time to work for men who don’t work from home: 35.7 minutes

- Median monthly rent as a share of median monthly earnings for men: 40.13%

- Median monthly housing costs for owner-occupied homes with a mortgage as a share of median monthly earnings for men: 54.72%

2. Miami

- Homeownership rate among men without a spouse present: 52.23%

- Share of unmarried or separated men: 52.45%

- Share of men older than 25 with at least a bachelor’s degree: 34.74%

- Median annual earnings for employed men: $41,654

- Average commute time to work for men who don’t work from home: 29.2 minutes

- Median monthly rent as a share of median monthly earnings for men 43.76%

- Median monthly housing costs for owner-occupied homes with a mortgage as a share of median monthly earnings for men: 57.76%

3. Los Angeles

- Homeownership rate among men without a spouse present: 39.26%

- Share of unmarried or separated men: 53.98%

- Share of men older than 25 with at least a bachelor’s degree: 36.54%

- Median annual earnings for employed men: $48,420

- Average commute time to work for men who don’t work from home: 29.7 minutes

- Median monthly rent as a share of median monthly earnings for men: 44.26%

- Median monthly housing costs for owner-occupied homes with a mortgage as a share of median monthly earnings for men: 68.92%

Focus on the big picture when deciding where to live

Choosing a place to live is no simple task. While deciding to move to/avoid an area because one or two specific qualities can work out for some, it isn’t always the best choice.

For example, a single man may have trepidations about moving to Buffalo, N.Y. because men in the area tend to earn less than those in other large metros. However, by focusing solely on income, a person would ignore all of the area’s positives like its short commute times and affordable housing. Of course, this doesn’t mean Buffalo is the ideal place to live for everyone, but it shows how places can have more to them than initially meets the eye.

Looking at a metro holistically is generally the best choice when deciding whether to live there. By focusing on only one or two specific aspects of a place, you can potentially ignore its other qualities to your detriment.

Tips for finding a place to live when single

While finding a place to live in today’s expensive housing market is far from impossible, it can still be difficult — especially for single people. Here are a few tips to help single men make house hunting a bit less of a hassle.

- Seek out lower-cost options, like renting, even if they’re not ideal for you. Though your ambition might be to own a home, that’s not always feasible for a single person. Since renting is usually considerably cheaper than buying, it can be a better option for someone with only one income. Dealing with a landlord might not thrill you, but it’s better than other options.

- Find some roommates. Roommates, whether friends or family, can help you more easily manage housing costs. In the same way that renting instead of buying may not be your first choice, having a roommate might not be your preferred option. But if it’s the only one that makes housing affordable, then it might be your best option.

- Remember you don’t have to stay in your current place forever. While living in a place you’re not in love with isn’t always fun, most people don’t stay in one house for their entire lives. Even if you plan on staying single, living in a more affordable place while you save money for a down payment and/or work on improving other aspects of your financial profile — like your credit score — can help you move into your dream home down the line.

Methodology

The data in this study comes from the U.S. Census Bureau 2021 American Community Survey with one-year estimates (the latest available at this study’s writing). The seven variables that make up the overall ranking were weighted equally. They were chosen for the following reasons.

- Homeownership rate among men without a spouse present: Though some men who fall into this category may co-own their home with a spouse with which they don’t live — or with a partner, friend or family member they do — a higher share of male householders who own a home without the help of a spouse they live with can mean homeownership in a given area is more affordable to single men.

- Share of unmarried or separated men: A larger share of unmarried or separated men living in a given metro can indicate that that area is a bit easier to navigate for those not in relationships. It can also mean that unmarried or separated men may find it easier to fit into a community where many of their peers are in the same boat.

- Share of men older than 25 with at least a bachelor’s degree: People with college degrees, specifically bachelor’s degrees or higher, tend to significantly outearn those without degrees. Being home to a larger share of men with at least a bachelor’s degree can indicate that men in a metro may have an easier time getting financially ahead, especially in the long term.

- Median annual earnings for employed men: Higher earnings can make it easier for single men to afford necessities like housing and food.

- Average commute time to work for men who don’t work from home: Shorter commute times can give single men more free time to date or enjoy their lives.

- Median monthly rent as a share of median monthly earnings for men: The smaller rent costs are as a portion of a person’s earnings, the more affordable rent is. The less of their earnings men need to allocate toward rent, the more money they’ll have left over for other important expenses.

- Median monthly housing costs for owner-occupied homes with a mortgage as a share of median monthly earnings for men: Like rent, the smaller a homeowner’s housing costs are as a portion of their earnings, the more affordable owning a home is. The less money men who own a home need to put toward their housing costs, the more money they’ll have left over for other expenses.