USDA Eligibility Map: How To Use It for Your Home Loan

The USDA eligibility map shows whether a property can qualify for a mortgage backed by the U.S. Department of Agriculture (USDA). Because USDA loans are restricted to certain geographic areas, the map is an essential tool for determining eligibility. You can search the interactive map by county, neighborhood or exact address. We’ll show you how, step-by-step, below.

What is the USDA home loan map?

The USDA’s map is an online tool that helps you determine where in the country you can finance a home with a USDA loan. Since USDA loans only finance homes in places the USDA has decided are “rural,” one of the first steps to applying for a USDA loan is to see if your desired area qualifies.

While most of us may think farms, fields and tiny villages define a rural area, the USDA definition of a designated rural area is broader.

What qualifies as a designated rural area?

The USDA defines a rural area as any area that is:

- Not part of an urban area. This can include a wide variety of land types, including open country, towns, villages and even some cities.

-

Has a small population, consisting of any of the following:

- 2,500 inhabitants or fewer

- Between 2,500 and 10,000 inhabitants, but “rural in character”

- More than 10,000 inhabitants, but no more than 20,000

- Not within a Metropolitan Statistical Area (MSA).

- Has a “serious lack of mortgage credit,” which is determined by the Secretary of Agriculture and the Secretary of Housing and Urban Development (HUD).

Each USDA field office reevaluates the designation of the land in its local area every three to five years.

However, just because a property is in an area designated as rural on the USDA loan map, it doesn’t guarantee that you’ll be able to finance it with a USDA loan. You’ll still need to apply for a loan to determine your personal eligibility based on your financial situation.

Can I check by address or ZIP code?

Yes, if you already have a specific home in mind, you can use the USDA loan map to check that address, ZIP code or state. To view more information about your state’s USDA programs and rural development office contact, choose your state from this alternative map.

Is the USDA eligibility map official?

Yes, the map is official and maintained by the U.S. Department of Agriculture.

How often is the map updated?

It’s updated if the status of any areas change, which often happens after U.S. Census data is released. The USDA also reevaluates the eligibility of land every three to five years. If you have questions about changes or details on the map, contact your local Rural Development office.

How to use the USDA eligibility map: Step-by-step instructions

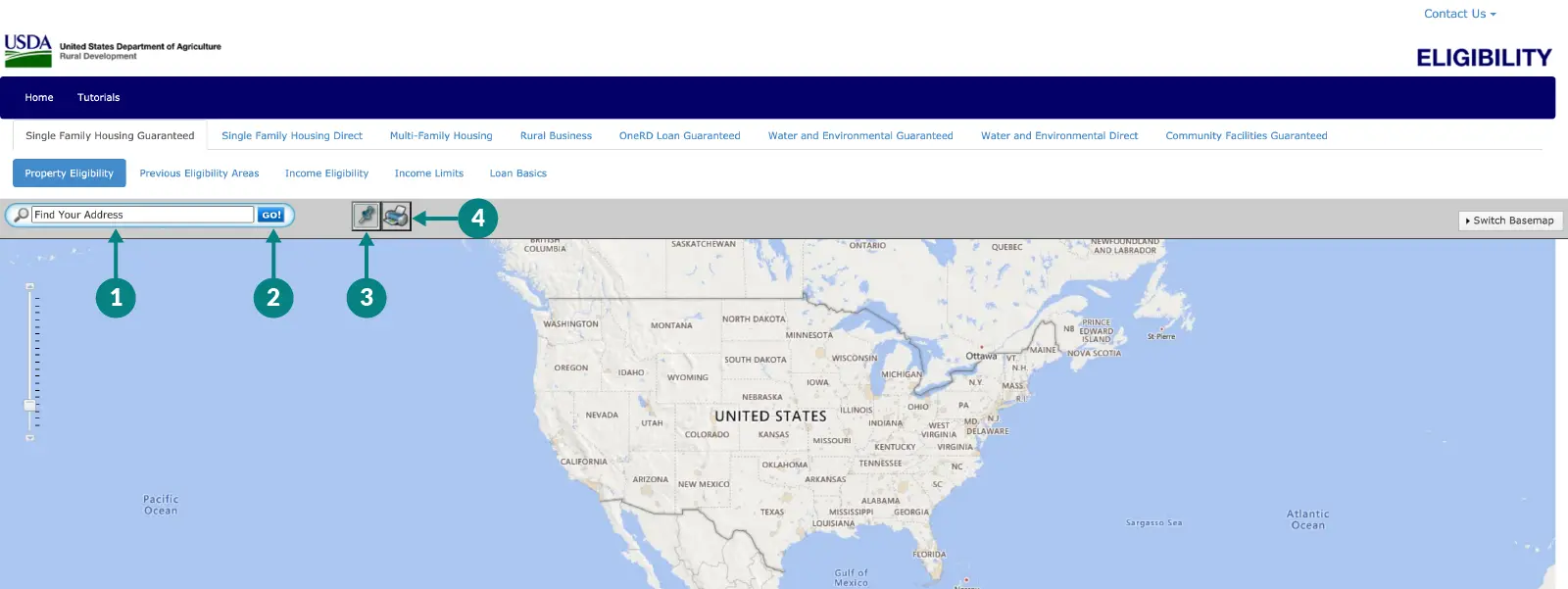

Whether you have a property in mind that you want to buy, or you just want to look for USDA-eligible homes, start by opening the USDA loan map and following these steps:

Step 1: If you have a specific address to check, type the full address (including the ZIP code) into the search bar on the map. Then, click “Go” next to the search bar.

Step 2: The map will zero in on the address and put a pushpin on the location. Then, you’ll see a pop-up that’ll let you know immediately whether that address is located in an eligible area.

Step 3: If you want to continue searching on the map for another address, you can simply delete the address you entered and type in a new one. You also have the option to click on the pushpin icon above the map next to the search bar, which then allows you to drop a new pin on the map.

Step 4: If you want to print a map copy at any time, you can click on the printer icon next to the search bar.

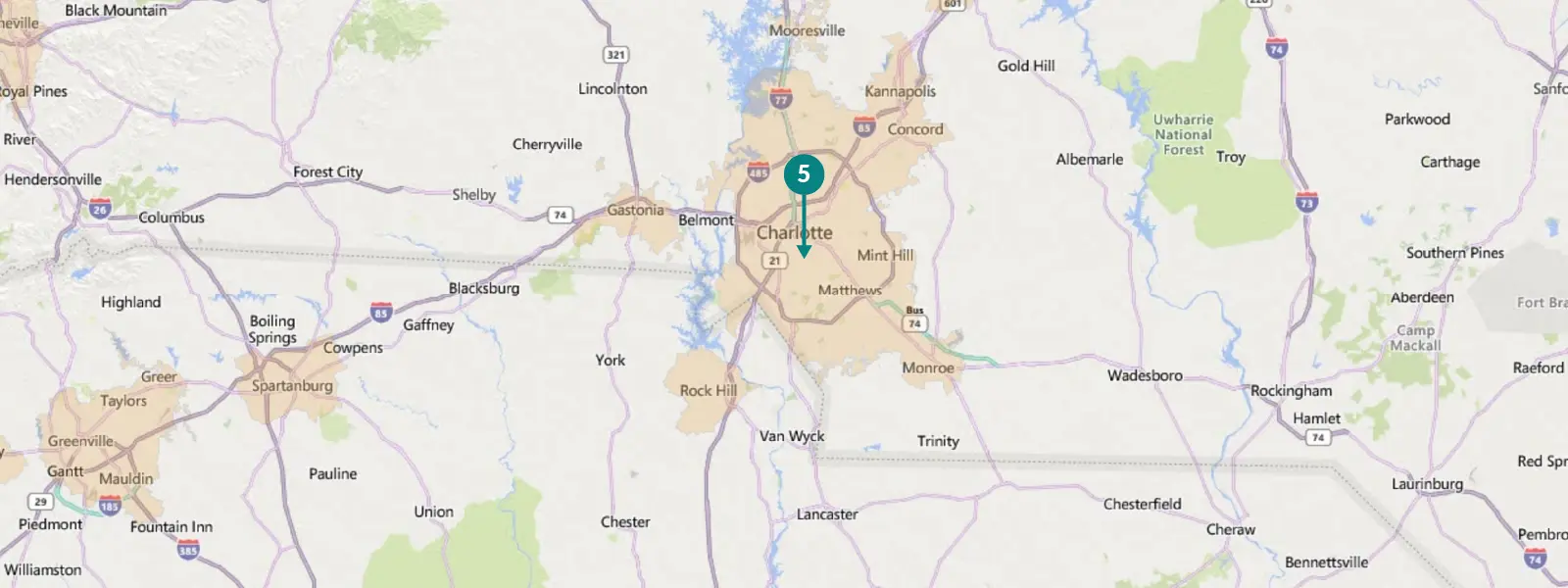

Step 5: If you don’t have a property address to check, you can zoom out on the map and look at a larger area.

Areas with a white background are USDA-eligible. Areas with a peach background aren’t USDA-eligible.

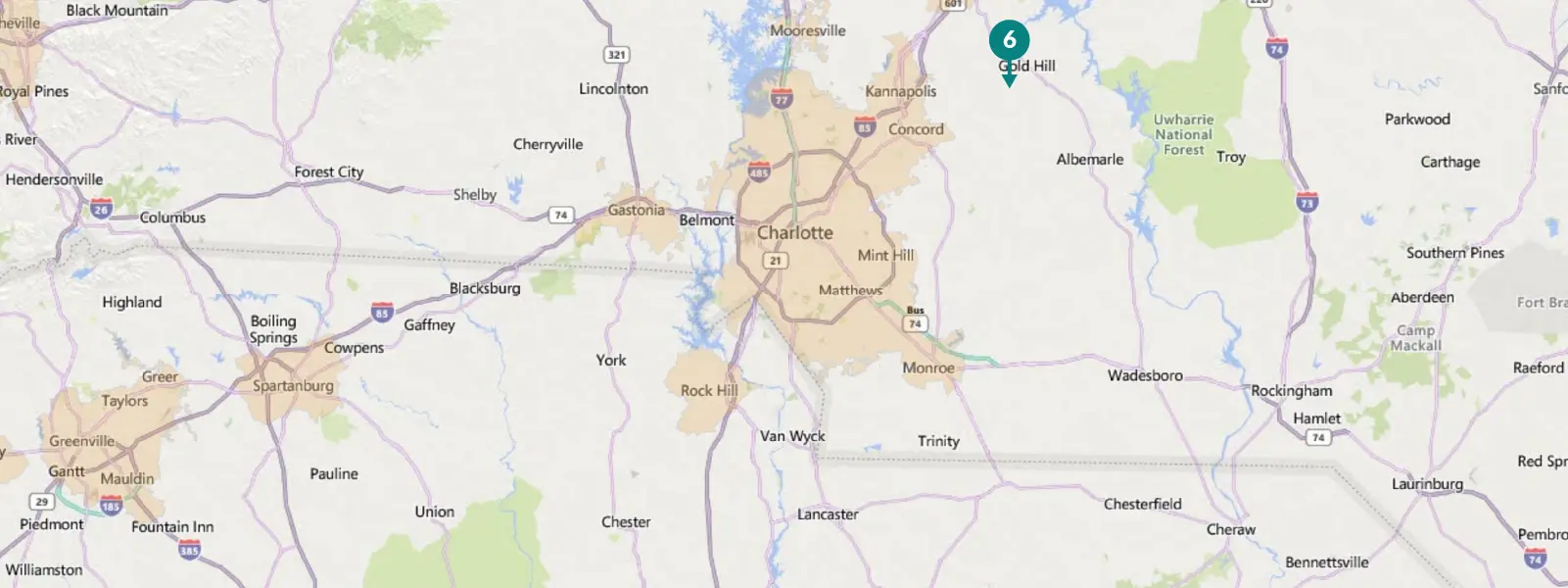

Step 6: In addition to looking at the color indicators on the USDA property eligibility map, you can click on the pushpin icon and drop it in any location on the map. A pop-up box will tell you whether that location meets USDA property eligibility requirements.

Step 7: Simply refresh your browser if you want to clear the map and start a new search.

Zooming in and out on the USDA loan map can give you an idea of which areas have available properties that may meet USDA eligibility. While USDA loan requirements start with a property’s location, there are many other USDA loan qualifications to meet.

- The single-family housing income eligibility calculator. Enter your financial, household and location information to find out whether you qualify for a USDA single-family housing guaranteed loan.

- The single-family housing self-assessment. Enter information about your household, location and whether you want to build, purchase or refinance a home to find out if a USDA single-family housing direct loan is an option for you.

Read more about USDA loan requirements.

USDA property eligibility requirements

“Property eligibility” may not be a familiar term, even if you’ve purchased a home in the past. However, it’s relatively simple: Property eligibility requirements are limitations on which properties can be financed with a USDA loan.

The USDA loan program is designed to improve access to affordable homeownership in rural areas, which means it has more specific requirements about the properties it’ll guarantee than the average loan program.

Here are some of the main eligibility requirements for properties purchased using USDA loans:

Location: Must be rural

As we’ve covered, the USDA requires a financed property be located in an approved rural area.

Property type: Must be a single-family dwelling

The USDA’s definition includes detached single-family homes; attached homes (like duplexes, townhouses or villas); condos; modular homes or manufactured homes. The property also needs to be a primary residence.

Quality: Must be safe, sanitary and sound

Homes financed with USDA loans have to meet HUD’s minimum property requirements, which are outlined in the FHA Single Family Housing Policy Handbook. These standards also apply to homes financed with Federal Housing Administration (FHA) loans, and address the very basic aspects of a home that ensure a minimum level of comfort, health and safety. They include access to clean, hot water; sufficient systems for dealing with human waste; electricity; and adequate heating.

Property value and size: Must be modest

USDA loan programs are intended to be used to purchase “modest” homes, which means that eligible properties cannot:

- Be used primarily for producing income, for example, through farming, agriculture or any other commercial use.

- Consist of buildings designed for industrial or commercial use, rather than residential use.

- Be worth more than the loan limit for the area they are located in. There are loan limits for homes purchased with some types of USDA loans. The limits are typically 80% of the local FHA loan limit, but there are exceptions.

- Have excessively large living areas. Most dwellings financed by USDA loans are 2,000 square feet or less. However, eligible properties can be any size — there’s no specific size limit on acreage.

- Have certain prohibited amenities, like in-ground swimming pools, if you’re using a USDA Direct loan.

USDA home loan programs and lenders

Three main USDA rural housing loan programs apply to individual homebuyers:

→ Single-family housing direct loans are called “direct” because they’re issued by the USDA, rather than a third-party lender.

→ Single-family housing guaranteed loans are issued by an approved lender but “guaranteed” by the USDA. If you default on your loan, the USDA will pay the lender up to 90% of the loan balance.

→ Section 504 single-family repair loans and grants help rural homeowners with very low incomes pay for home repairs. To qualify, homeowners’ earnings need to be within the “very low” income limit in their area.

How to apply: Finding USDA lenders

Direct loans

As mentioned above, USDA direct loans come directly from the government. This means skipping the search for a lender and applying directly at a local USDA office. You can look up your Rural Development state office on the USDA website.

Guaranteed loans

Third-party lenders issue USDA guaranteed loans. To find a lender in your area, you can use the USDA list of active Single Family Housing Guaranteed Loan Program (SFHGLP) Lenders. The list shows lenders that have recently issued USDA loans in each state, but don’t feel limited to only this list.

Find top USDA lenders using our list of the best mortgage lenders of 2026.

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles