58% of Insured Drivers Say Insurance Is a Burden; 30% Have Driven Without It

When was the last time you paid for something hoping you’d never use it? If you’re like most people, it was last month’s car insurance bill. No matter the cost, paying premiums can be a drag. And for 58% of insureds, it’s more than a drag; it’s a burden. Almost a third of insured drivers admit to having driven without insurance at some point, which is illegal in almost every state.

This LendingTree survey pulls back the curtain on the decisions insured drivers face just to hold onto their coverage.

Key findings

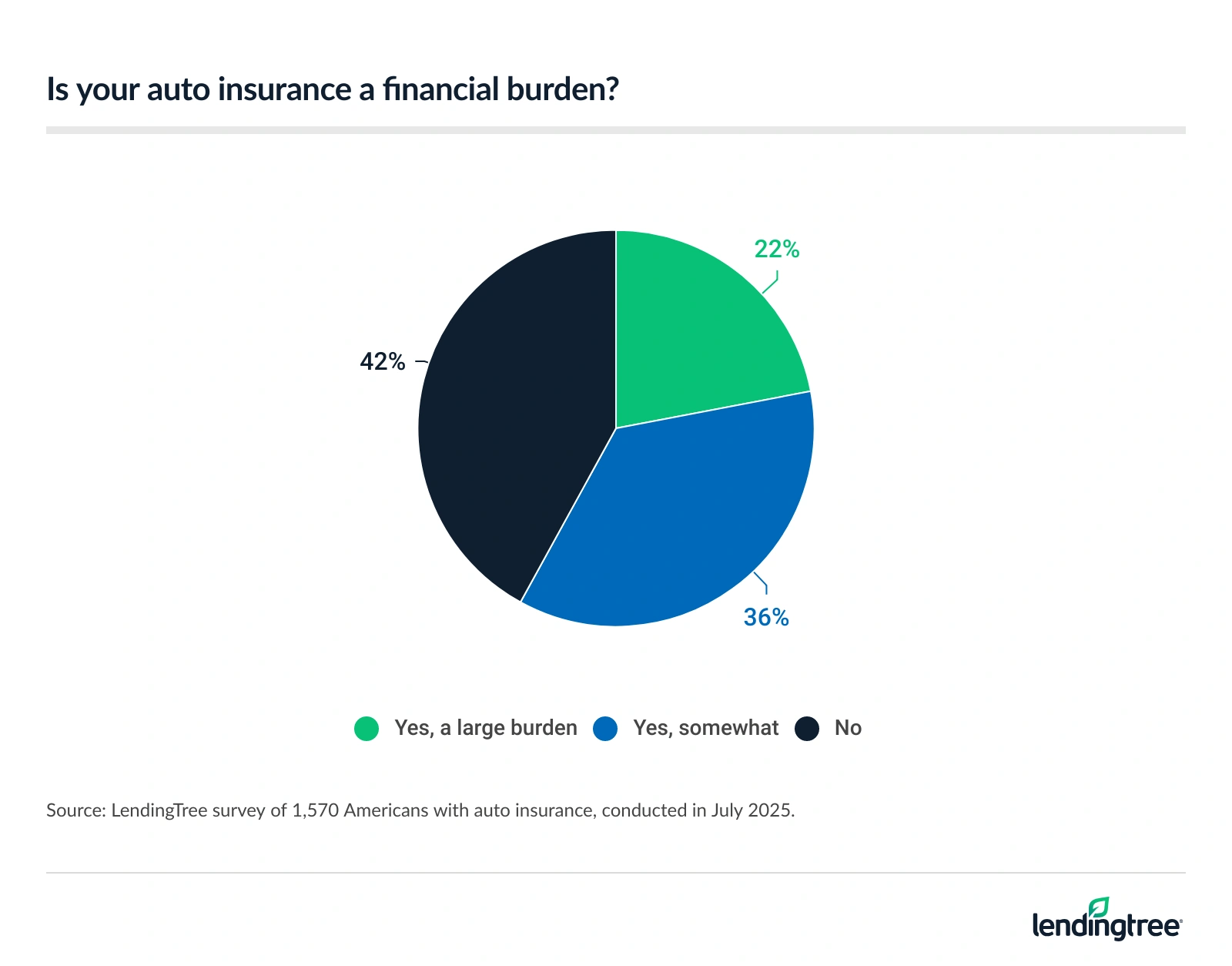

- More than half of insured drivers say auto insurance is a financial burden. 58% cite this, including 22% who say it’s not just a burden, but a large one. 43% of insureds say monthly premiums are what’s causing the most financial strain.

- About a third of insured drivers have driven without coverage. 30% of our survey respondents with auto insurance admitted to having driven without car insurance at some point, including 43% of parents with kids under 18 — the highest of all the groups we asked.

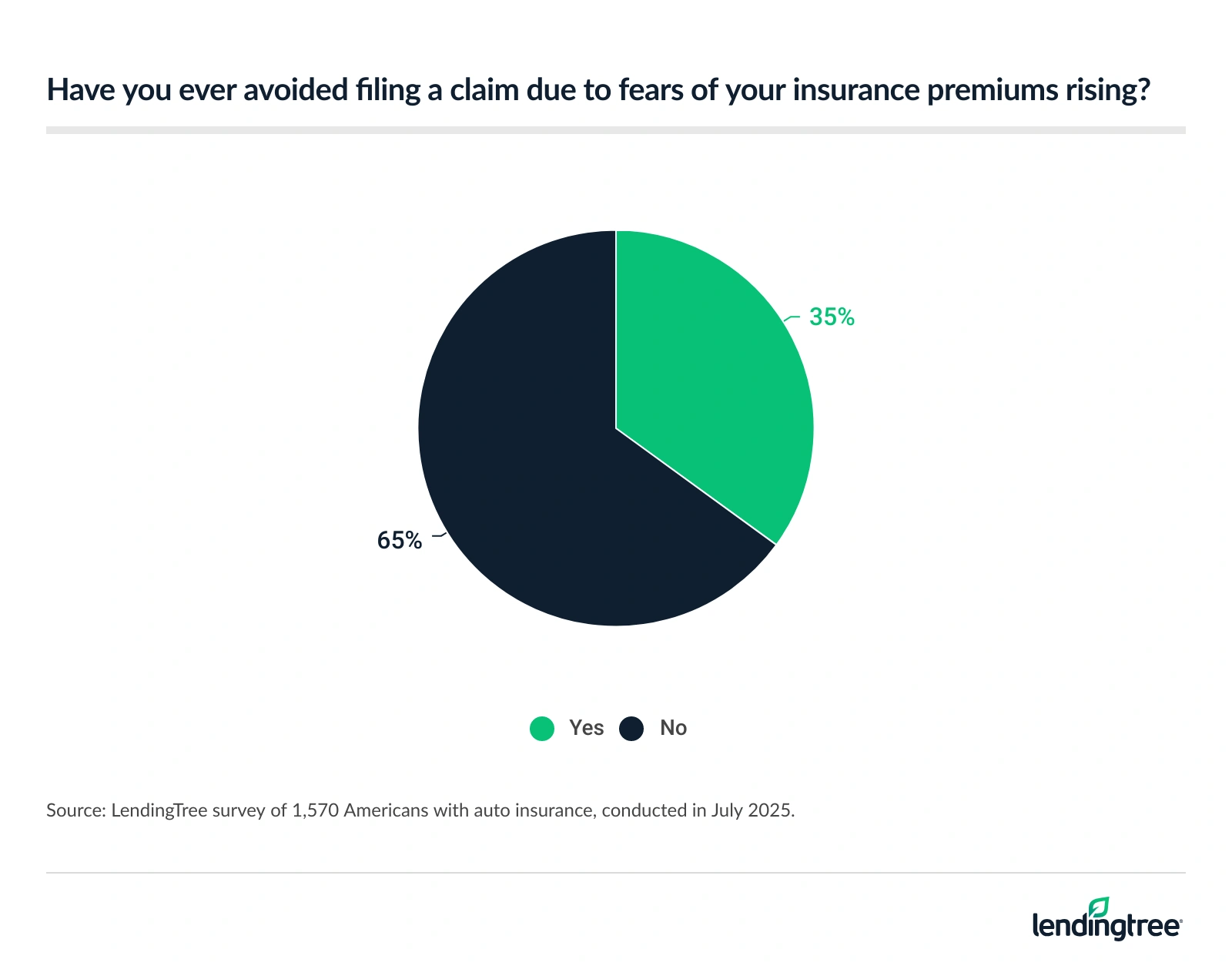

- More than a third of insured drivers have avoided filing a claim because they were afraid their premiums would go up. 35% say that they didn’t file a claim due to fear of premium increases. But baby boomers are the least worried, as 78% say they’ve never skipped filing a claim to avoid a jump in rates.

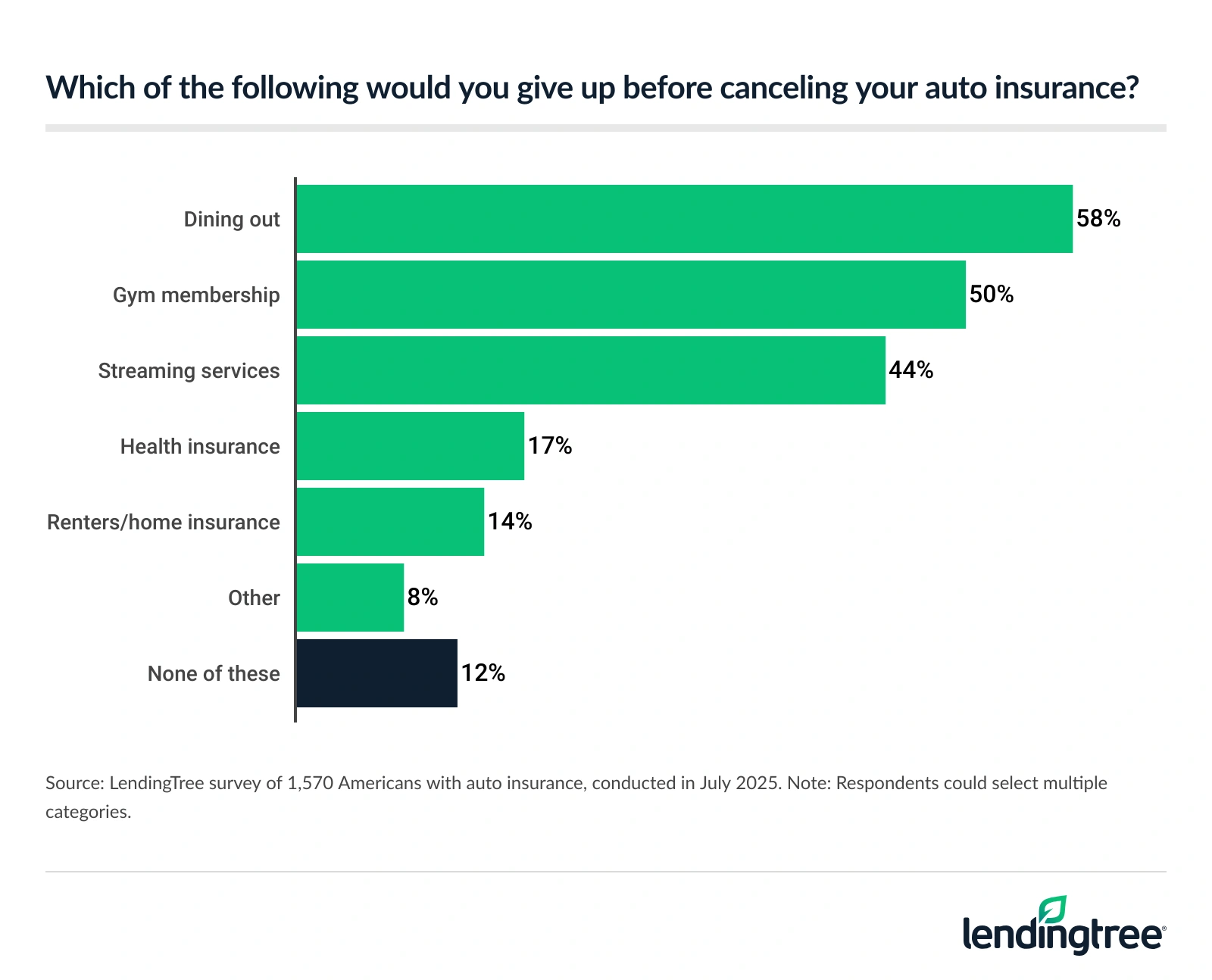

- Insured drivers adjust their budgets due to increased car insurance. 53% say rising auto insurance premiums have caused them to cut back in other aspects of life. When asked what they would give up before canceling their auto insurance, dining out (58%), gym memberships (50%) and streaming services (44%) were most popular.

Most insured drivers say car insurance premiums are a burden

Car insurance is a must-have, legally and financially. Unfortunately for most, it’s also a strain. A little over a third (36%) say car insurance is somewhat of a burden, and 22% say it’s a large one. Perhaps not coincidentally, a past LendingTree survey found that insurance is often the largest expense of car ownership.

Our survey respondents pay around $204 a month on average for car insurance. That may be why, according to 43%, monthly premiums are hardest to swallow. Deductibles after a claim come in second, with 19% citing them as the most financially straining aspect of car insurance.

Despite the cost, the majority think their car insurance is worth it — especially high-income households

Most insured drivers (64%) report that their car insurance is worth the cost, particularly high-income earners. Three-quarters of those who make an annual household income of $100,000 or more say their coverage is worth it. Following not far behind is Gen Zers ages 18 to 28, at 72%.

A third of insured drivers have driven without insurance

Driving without car insurance is illegal in all but one state: New Hampshire. That hasn’t stopped nearly a third of our insured survey respondents from driving without coverage at some point.

Only 13% of baby boomers ages 61 to 79 say they’ve ever driven uninsured, the lowest percentage of the groups we asked. The highest percentage of past uninsured drivers comes from parents with minor children (43%), followed by millennials ages 29 to 44, at 40%.

Notably, there doesn’t seem to be a correlation between how much someone makes and how likely they are to drive uninsured. From under $30,000 to over $100,000, about 30% of respondents have driven without insurance, with only slight variation by annual household income.

We asked LendingTree auto insurance expert and licensed insurance agent Rob Bhatt about the dangers of driving uninsured. He urges anyone considering doing so to rethink it. “Driving without insurance is never a good idea. The costs that can arise out of a car accident can quickly escalate to tens of thousands of dollars or more.”

Unless you’re incredibly wealthy, paying for an accident out of your own pocket can devastate your finances. It’s just not worth it.

35% of insured drivers pay for coverage that they’re afraid to use

Insurance is designed to be a peace of mind. For some, it’s a source of fear.

A little over a third (35%) of our insured drivers have avoided filing a claim because they were afraid their premiums would go up. A similar LendingTree survey found that 39% of drivers opted to pay out of pocket for car repairs after an accident. Of those, 42% said they didn’t file to avoid a rate increase.

Almost half of parents with children under 18 have avoided filing claims out of fear

When 66% of parents struggle to pay for essentials like summer child care, it makes sense that this group would also be the most afraid to use their insurance — 48% say they’ve skipped filing a claim out of fear of rising premiums.

Curiously, high earners come in second place when it comes to the fear factor. Some 44% of insureds with a household income of $100,000 or higher have skipped a claim because of the possible increase in premiums, tied with Gen Zers, and followed closely by millennials, at 43%.

In contrast, the vast majority of baby boomers say they’ve never avoided filing a claim out of fear

More than three-quarters of the baby boomers we surveyed (78%) say they have never avoided filing a claim because of a potential premium increase.

Maybe this is because, at 61%, baby boomers are the most likely to feel uncomfortable taking on more financial risk to lower their monthly premiums. For instance, raising deductibles or lowering liability coverage can lead to a higher out-of-pocket expense in case of an accident.

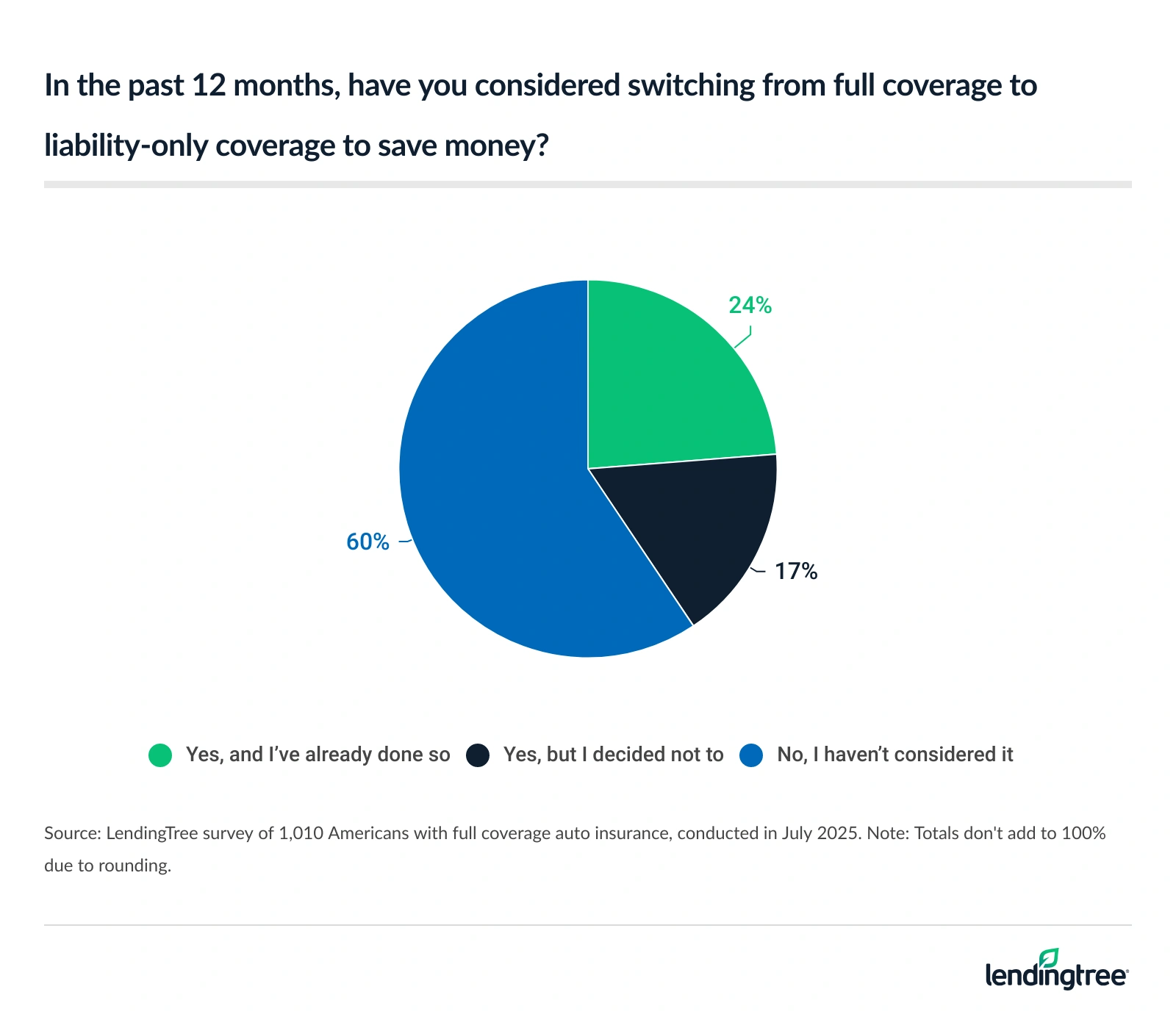

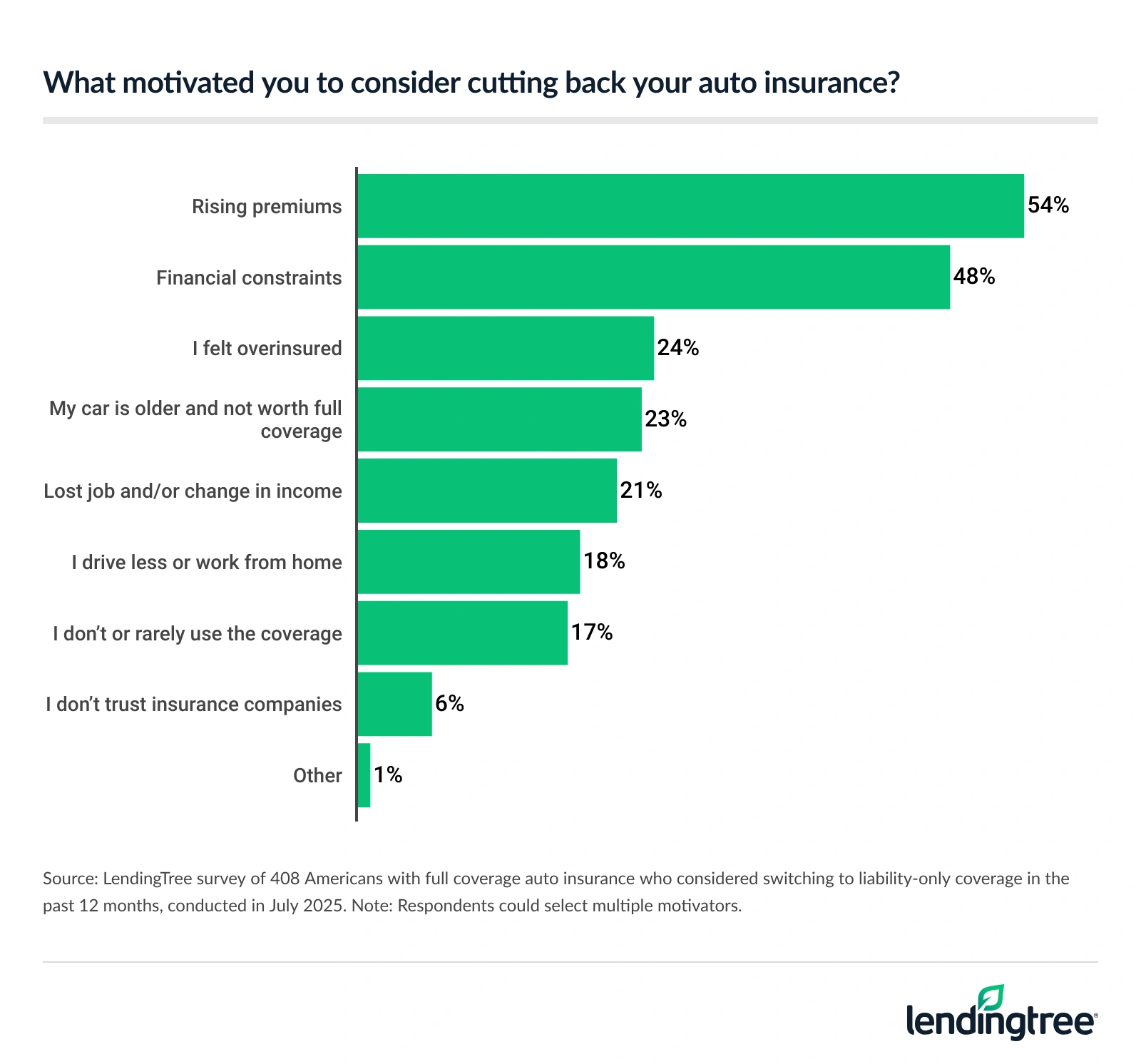

40% have considered reducing coverage to save money

Over the last year, 40% of drivers with full coverage considered switching to liability-only to save money. This includes about a quarter (24%) who actually did it, as well as 17% who thought about it but decided not to.

Rising premiums are a catalyst for most potential policy cutbacks, but general financial constraints are also to blame. Almost half (48%) cited this as a reason they considered scaling back.

Most would give up dining out before giving up car insurance

When faced with the decision between auto insurance and something else, dining out is the first to go — 58% of our insured survey respondents say they would give up eating at restaurants before canceling their car insurance. Half would give up their gym memberships, and 44% would give up their streaming services.

Among those who said they’d skip dining out, 52% were parents of kids under 18.

Considering the annual cost of raising a child — $29,419, according to our data — dining out may already be a splurge for most parents, and for most Americans in general. Nearly 80% say fast food is now a luxury because of higher prices.

To those afraid of filing a claim: Advice from an agent

Few people are thrilled to use their insurance, but the truth is, that’s what it’s there for. We asked our insurance expert and licensed agent, Bhatt, what he would tell drivers who are nervous about filing a claim.

- Not all claims count. “Most companies won’t raise your rate after a comprehensive claim. Comprehensive covers your car for theft and noncollision damage, including a broken windshield, vandalism and damage from a fire or flood.”

- If your rate rises, bring it back down strategically. “Increasing your deductible is usually better than dropping coverage, but only to a certain point. If you have an older car that’s only worth a few thousand dollars, dropping collision coverage might be worth it.”

- Sometimes, it can be better not to file. “It’s usually not worth filing a claim for surface damage you cause to your own car. If you brush up against a guard rail or bump into a light post, you’re typically better off paying for repairs out of your own pocket.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from July 14 to 15, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Recommended Articles