Tariffs Rev Up Car-Buying Behavior: Changing Timelines, Budgets and Insurance Costs

Buying a car hasn’t always been easy — and COVID-19 pandemic shortages and price hikes didn’t help. Looming tariffs threaten to make it even harder.

In fact, according to a LendingTree survey of 2,000 U.S. consumers, 72% of car buyers have shifted their timeline due to tariffs, while 55% of Americans expect to see their auto insurance premiums rise.

Here’s a closer look.

Key findings

- Tariffs shake up Americans’ car-buying plans. Half (50%) of those who plan to buy a car this year have increased their budget due to tariffs. Additionally, 72% have adjusted their timeline, with 37% planning to buy sooner and 36% putting it off until later.

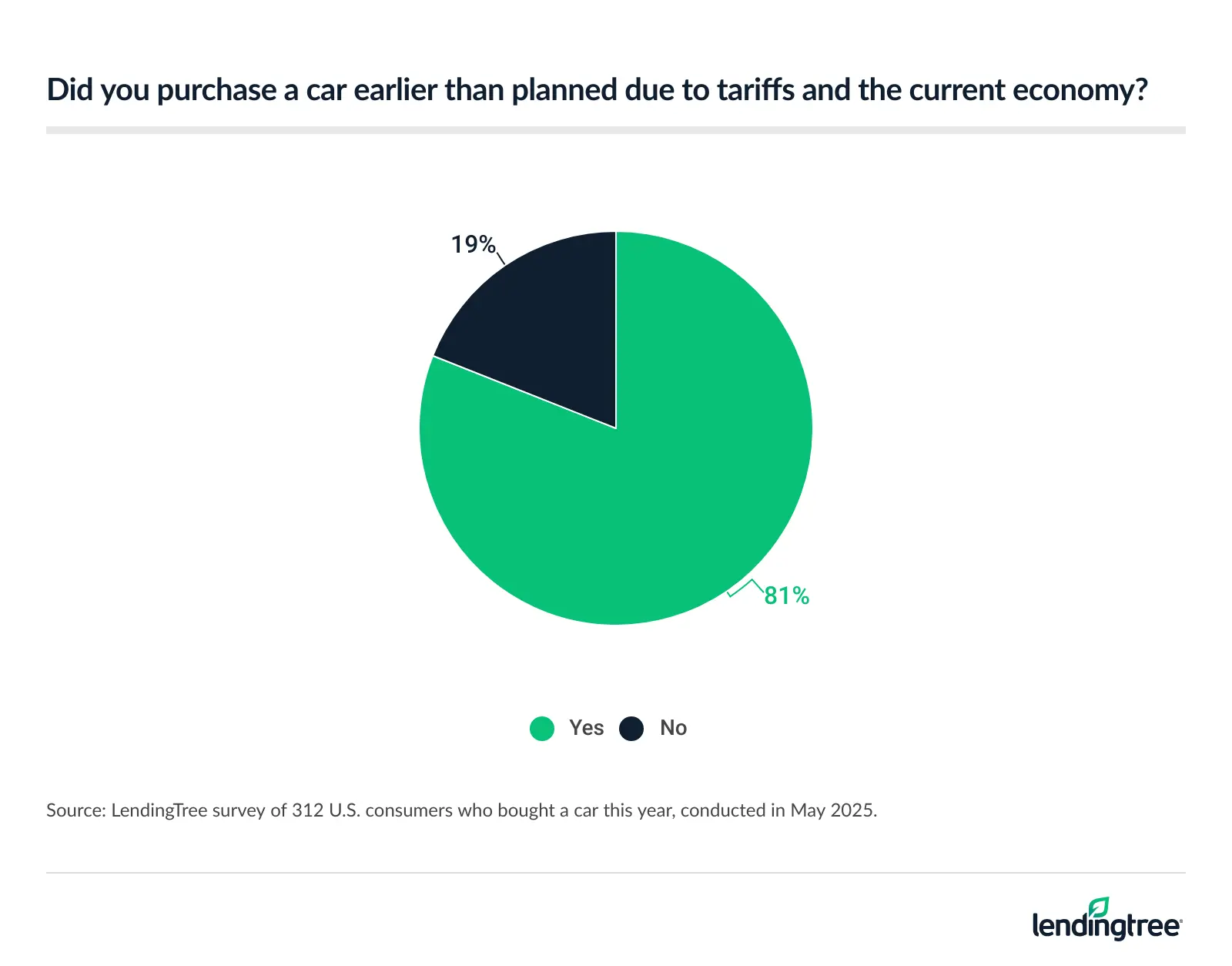

- Some have already pulled the trigger on a new ride. Of those who’ve already bought a car in 2025, about 4 in 5 (81%) did so earlier than planned due to tariffs. Among those who plan to buy this year, 67% are more likely to buy a vehicle produced in the U.S.

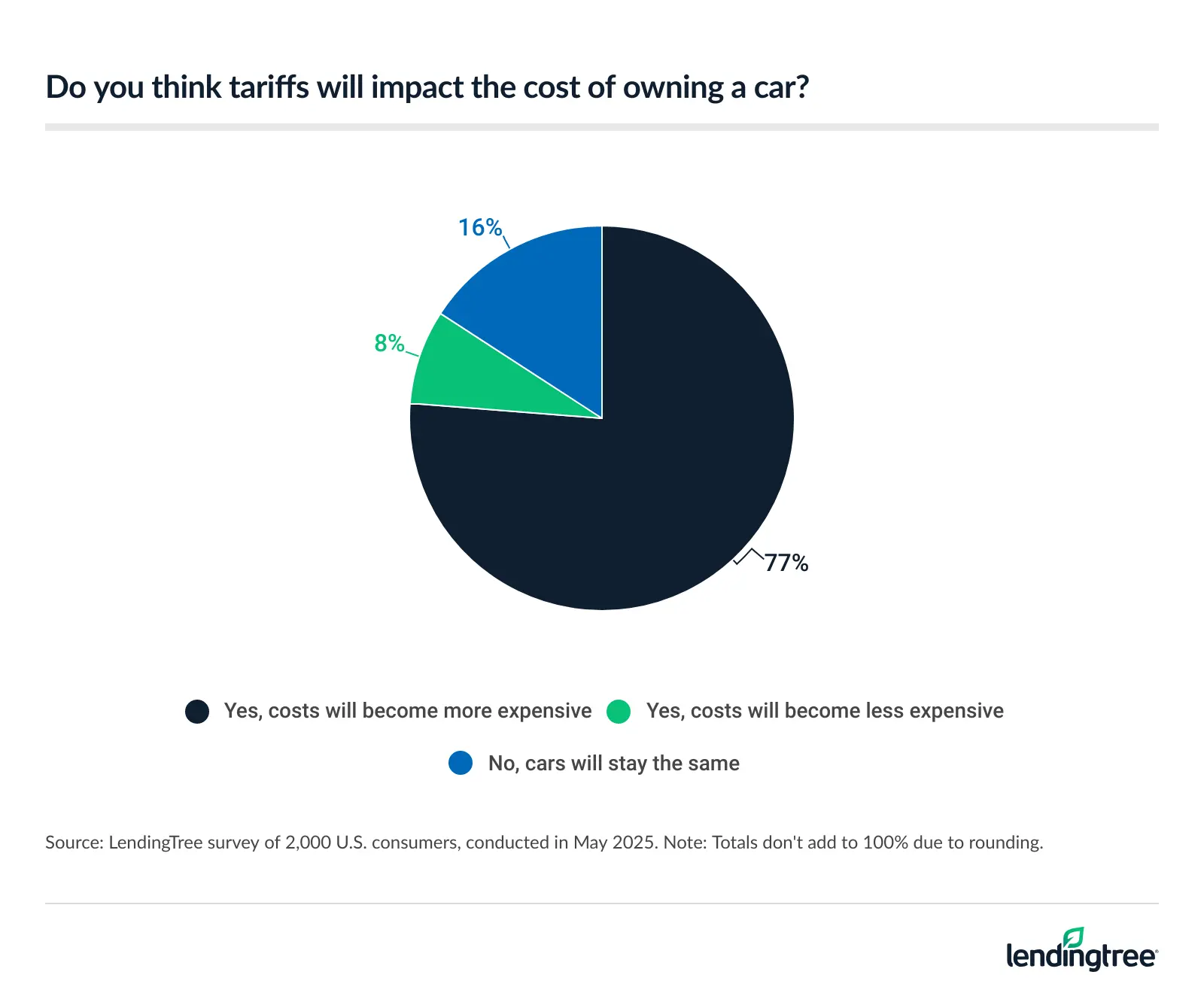

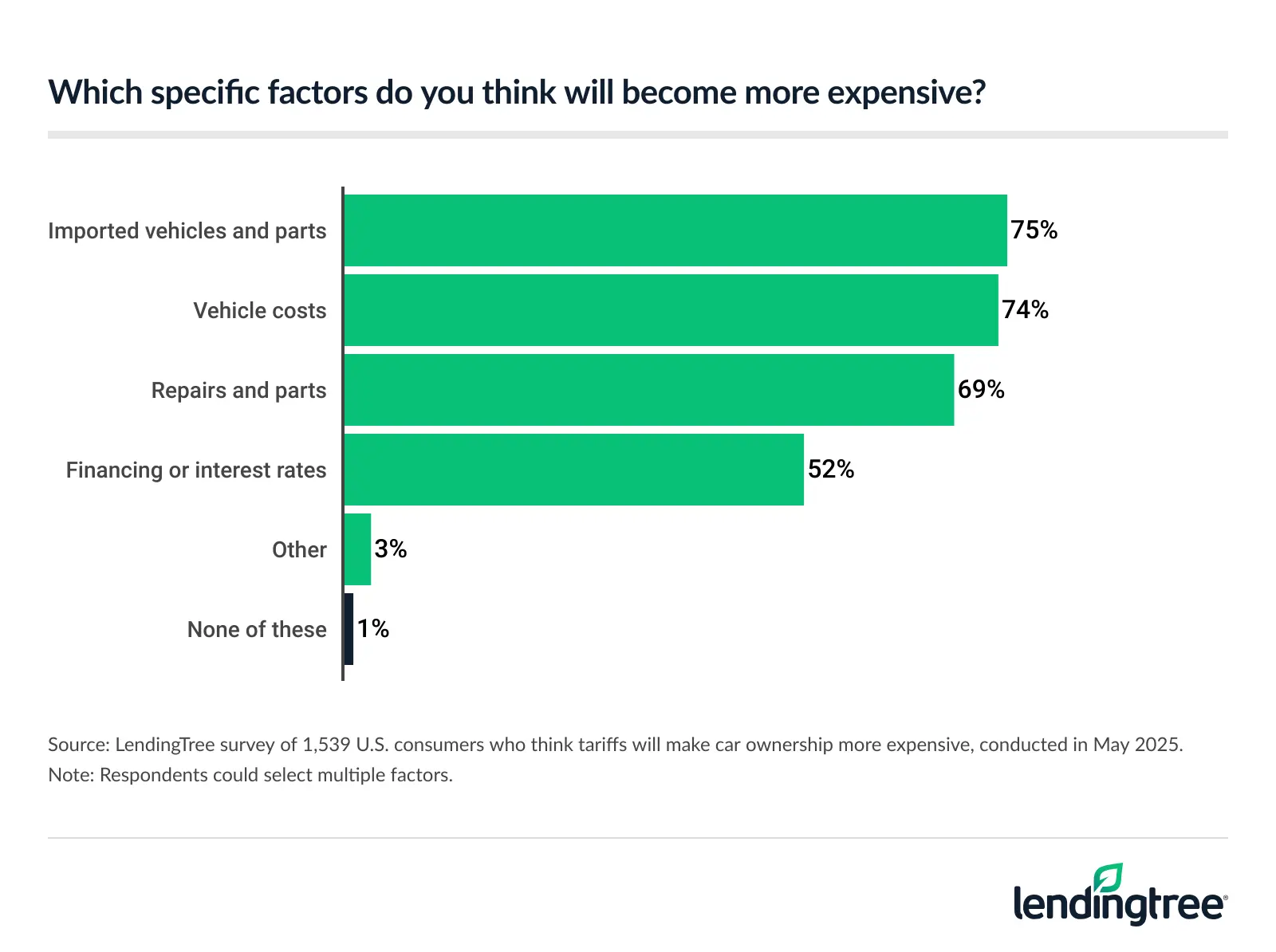

- Over 3 in 4 (77%) Americans are wary that tariffs will drive up car ownership costs. When asked what they think will rise, imported vehicles and parts (75%), vehicle costs (74%) and repairs and parts (69%) were at the top for these respondents. As a result, 40% of those who believe car ownership will become more expensive plan to drive less.

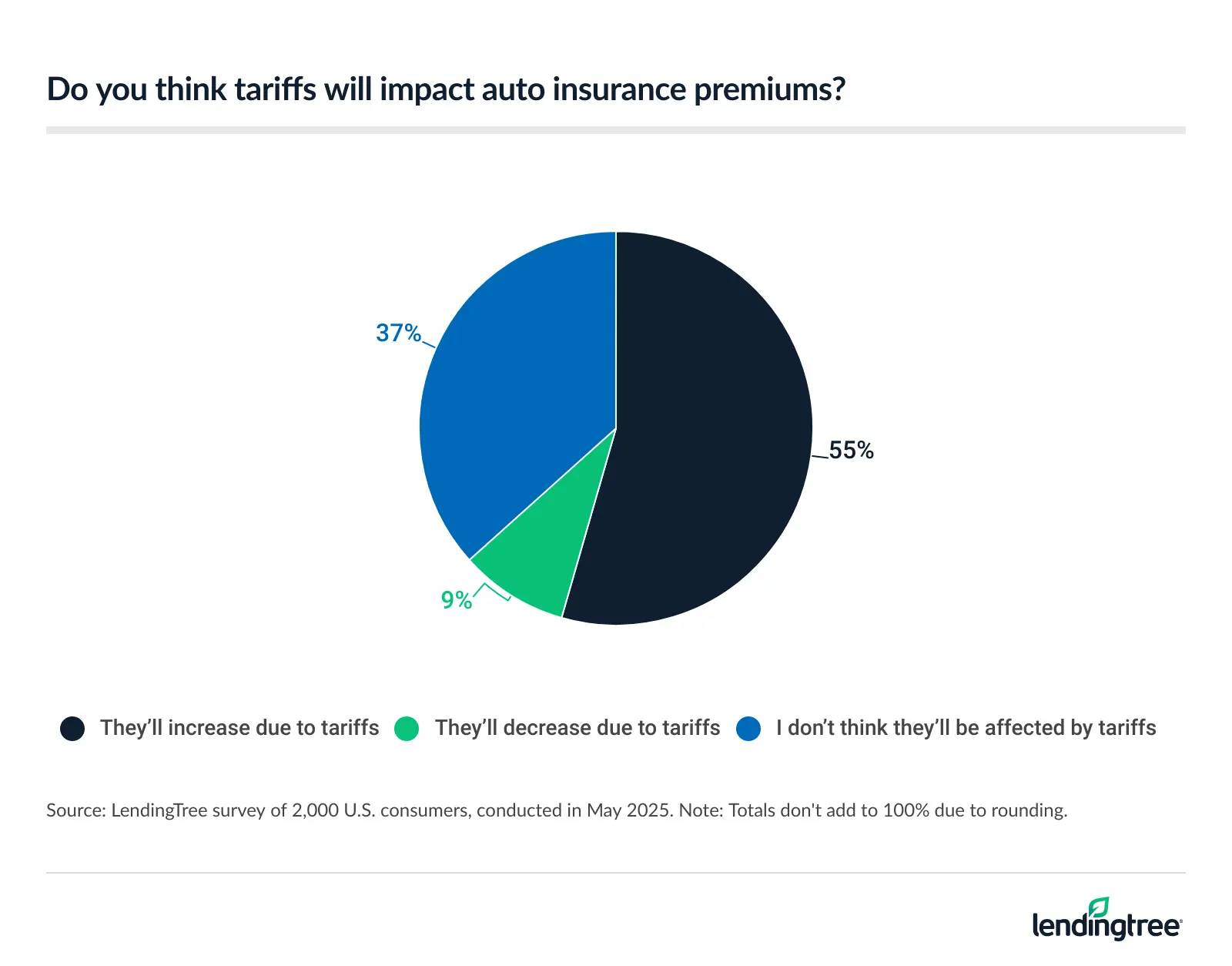

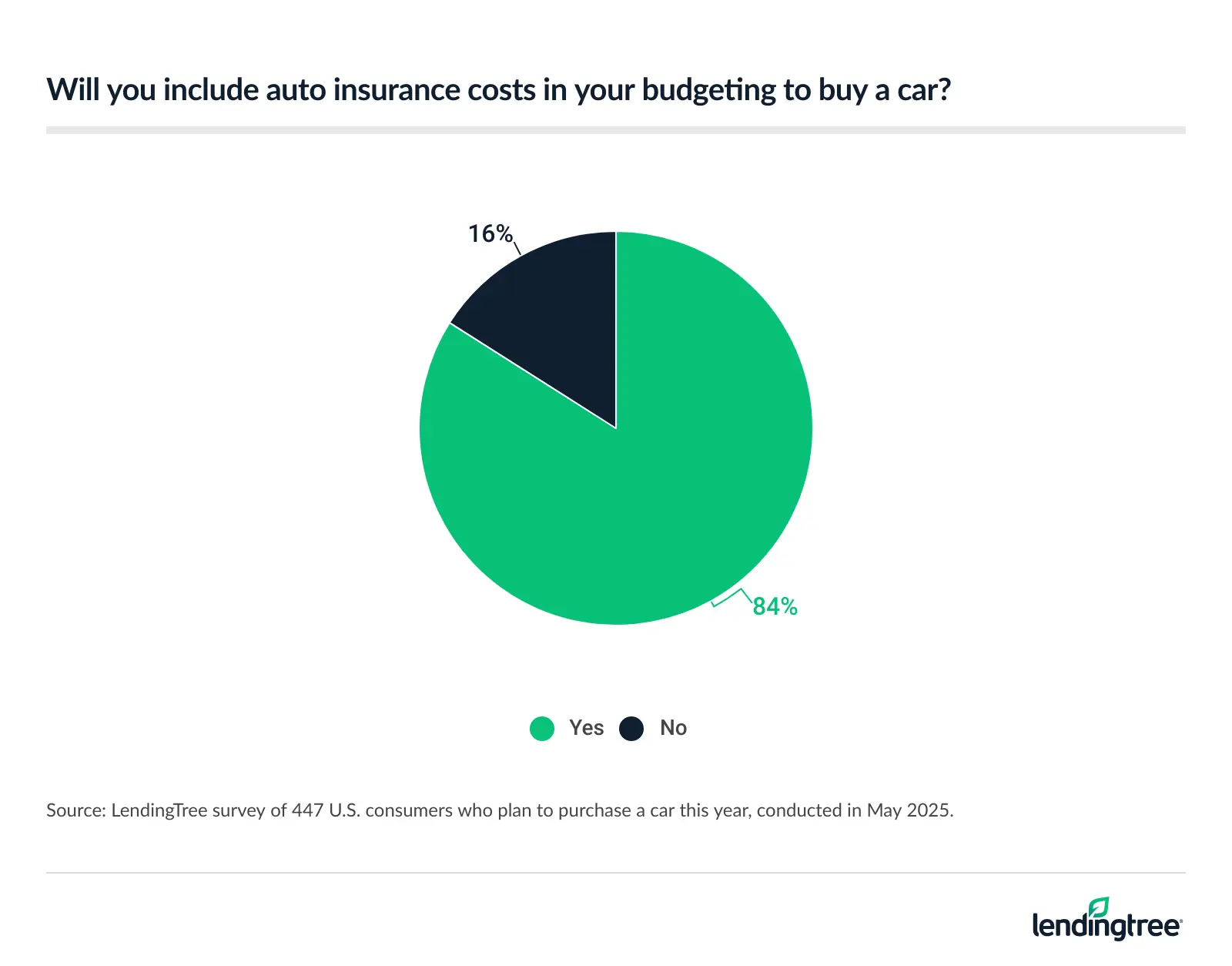

- More than half of Americans think auto insurance premiums will increase due to tariffs. 55% expect to see their auto insurance premiums rise due to tariffs, while 37% believe their premiums won’t be affected. 84% who plan to buy this year will consider auto insurance costs in their budget.

Half of car buyers increased budgets due to tariffs

This year, 22% of Americans plan to buy a car, while 16% have already done so. Of those planning to buy, 50% have increased their budget due to tariffs, while 30% didn’t change their budget and 20% decreased it.

While tariffs are still changing rapidly, the tariffs on cars and car parts have been in effect since early April and May. With that in mind, 72% of car buyers have adjusted their timeline, with 37% planning to buy a car sooner and 36% putting it off until later.

LendingTree auto insurance expert and licensed insurance agent Rob Bhatt says it’s wise to set aside a little more money in your budget to account for higher costs — but only if you’re planning to purchase a car soon.

“We don’t know the full impact of tariffs on car prices yet, and we may not know for a month or longer,” he says.

“The best way to budget for a car purchase depends largely on your financial situation. If increasing your car budget is only going to reduce your discretionary spending for things like entertainment or a vacation, it’s fine. Painful, but fine. However, it’s generally best to avoid situations that leave you short on funds for essentials or leave you with excessive debt.”

If increasing your car budget is only going to reduce your discretionary spending for things like entertainment or a vacation, it’s fine. Painful, but fine.

81% bought a car earlier than planned

With car tariffs only recently enacted, it may not be surprising that 16% of Americans have already bought a car in 2025. Notably, of this group, 81% did so earlier than planned due to tariffs.

If you need a car and have the funds available in your budget, Bhatt says you may be better off purchasing a car sooner rather than later.

“You may have to pay more if you wait to purchase,” he says. “On the other hand, it’s generally bad to rush into a car purchase that’s going to require you to take on too much debt. If you’re not financially ready to purchase a car just yet, it’s usually better to get your finances in order first — but there isn’t a one-size-fits-all solution.”

Bhatt says it’s tough to predict the actual impact that tariffs will have on car prices. Trade negotiations are still in progress, and the proposals keep changing. “That said, it’s safe to assume that tariffs are going to have at least a small impact on car prices in the future,” he says. “Interest rates are another big factor in all this. Obviously, if interest rates go down, they’ll provide some relief for your new car purchase.”

Among those who plan to buy this year, 67% are more likely to buy a vehicle produced in the U.S., whose costs aren’t as heavily affected by tariffs as foreign cars. According to the Kogod School of Business 2024 Made in America Auto Index, there are 140 car models that have at least half of their components made in the U.S. Those cars are produced by just 21 automakers.

Generally, car-buying comes from necessity. Of those planning to buy a car in 2025, 68% say they need one, while just 32% are buying because they want a new car.

Americans are concerned tariffs will increase ownership costs

It’s not just car-buying to consider, but car ownership itself. In fact, 77% of Americans are worried tariffs will drive up car ownership costs, particularly Democrats (88%), baby boomers ages 61 to 79 (82%) and those earning between $50,000 and $99,999 (80%).

“Americans are right to expect tariffs to increase the price of car ownership,” Bhatt says. “Very few cars are built entirely in America. Even those assembled in America often rely on imported parts. Tariffs are likely to impact foreign-made models the most, but prices for domestic models and their parts may also increase.”

When asked what exactly they think will become more costly, 75% of these consumers said imported vehicles and parts — the most common response. That’s followed by vehicle costs (74%), and repairs and parts (69%).

Among those concerned about rising car ownership costs, 40% plan to drive less. That rate is especially high among those with children younger than 18 (54%) and Gen Zers ages 18 to 28 (50%).

Auto insurance increases are expected due to tariffs

As another cause for concern, 55% of Americans expect to see auto insurance premiums rise due to tariffs, with Democrats (67%) the most likely to believe premiums will go up. Meanwhile, 37% of Americans believe premiums won’t be affected.

With that in mind, 84% of Americans who plan to buy a car this year will consider auto insurance costs while calculating their car-buying budget.

Bhatt says Americans should expect insurance costs to be impacted by tariffs, and it’s a good idea to factor insurance costs into a car purchase.

“Insurance companies factor the cost of car repairs into their rates,” he says. “If tariffs make the cost of repair parts go up, car insurance rates are also likely to go up. When it comes to car-buying, you can usually start getting insurance quotes once you’ve narrowed your search down to a couple or few makes and models. This helps further inform your purchasing decision. It also removes a potential budget surprise from your car-buying experience.”

Car-buying and tariffs: What to consider

Navigating car-buying while tariffs remain unpredictable can be difficult, but Bhatt says some of the old adages you may have already heard are as relevant as ever.

“Shopping around can often help you find cheaper car insurance, and raising your collision deductible is going to get you a lower rate from any company,” he says. “It’s generally good to avoid insurance claims for small repairs you can afford out of pocket, just to avoid a potential rate increase. However, you should only consider private payment for a fender bender if the other driver is cooperative.”

Additionally, Bhatt says to make sure to ask your current insurance agent (or the ones you contact for quotes) about any discounts that may be available. Some car insurance discounts can get overlooked during the application process.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from May 1 to 6, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79