Twice as Many Women as Men Aren’t Ready to Resume Student Loan Repayment

For the past 16 months, the government has allowed federal student loan borrowers to pause their repayment (interest-free) to provide relief amid the coronavirus pandemic. This pause — technically called an “emergency forbearance” — is set to expire at the end of January. [Update: The student loan repayment freeze has been extended — read our post for more details.]

But according to the results of our latest LendingTree survey, many borrowers are not prepared to start paying again.

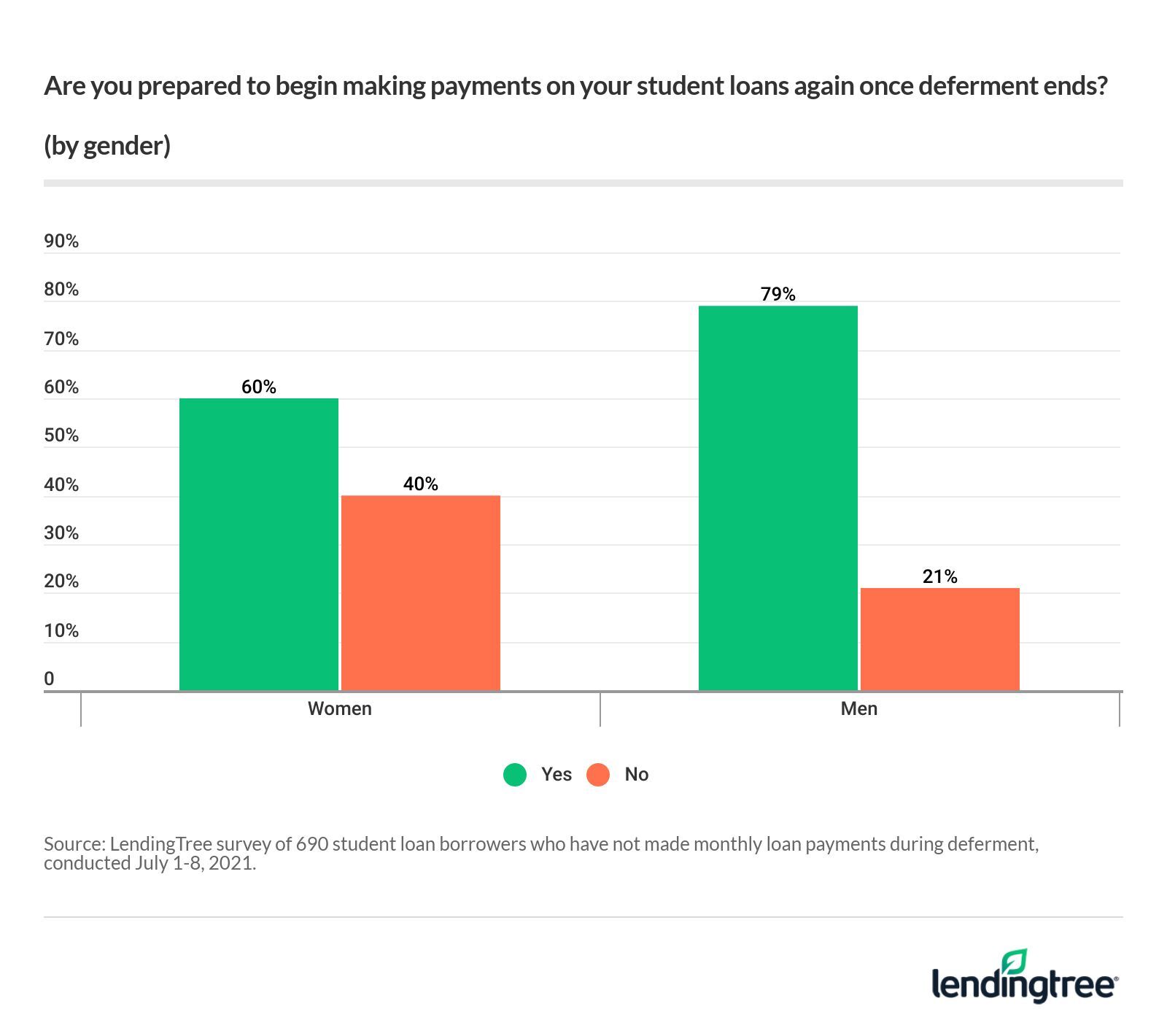

In fact, nearly 1 in 3 of those with student loans said they weren’t ready to resume repayment. And that number was nearly twice as high among women as men.

Key findings

- Women are nearly twice as likely as men to say they’re not prepared to start paying their federal loans again. (Read more)

- Despite forbearance, nearly half of borrowers continued making progress toward debt repayment. (Read more)

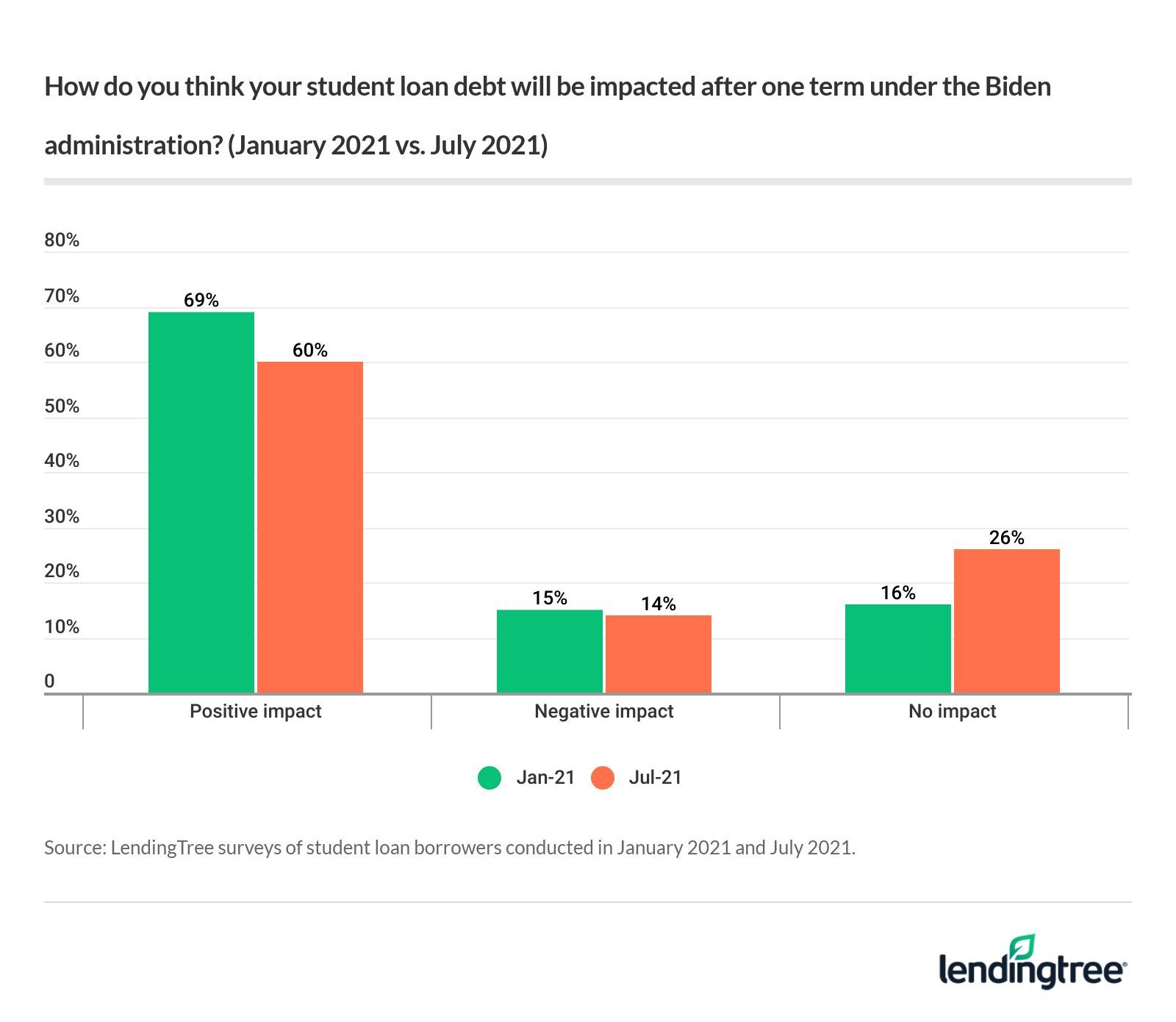

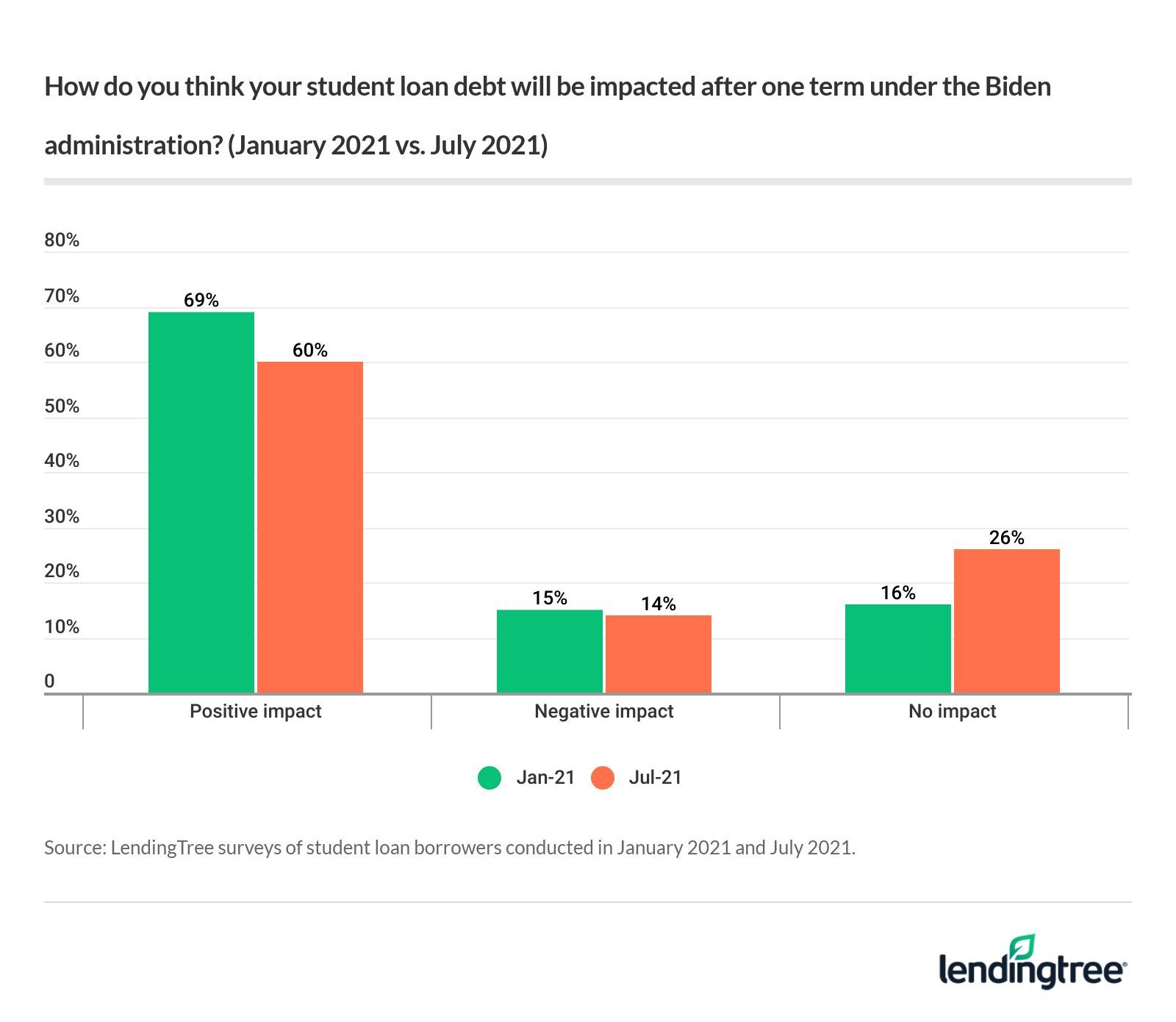

- Borrowers are slightly less optimistic than they were in January over whether the Biden administration will have a positive impact on their student debt. (Read more)

- 24% of borrowers believe it’s extremely likely all of their debt will be canceled during Biden’s four-year term. (Read more)

- Student loan forgiveness would help many borrowers achieve their financial goals. For example, 39% said they would be able to buy a home if all their loans were forgiven. (Read more)

- 86% of student loan borrowers say they are negatively impacted from their student debt.

Twice as many women as men unready to resume student loan payments

Starting in March 2020, the government offered relief to most federal student loan borrowers: No payments were due, and no interest would be charged during that time. In other words, you could stop making payments on your loans without having to worry about falling behind or accruing interest charges.

This period of emergency forbearance was extended multiple times, but it’s now set to expire next summer or earlier, depending on how legal challenges to the separate student loan forgiveness program go. But once borrowers resume payments as normal, their regular interest rates will return as well.

Not everyone feels financially ready, however. Our survey found that 31% of borrowers aren’t prepared to resume student payments on their loans if the forbearance ends.

Women were far more likely than men (40% versus 21%) to say they didn’t feel ready to return to repayments. This suggests women — who often face a pay gap with their male peers — may be in a weaker financial position than men at this point in the pandemic and could struggle to afford their monthly student loan payments.

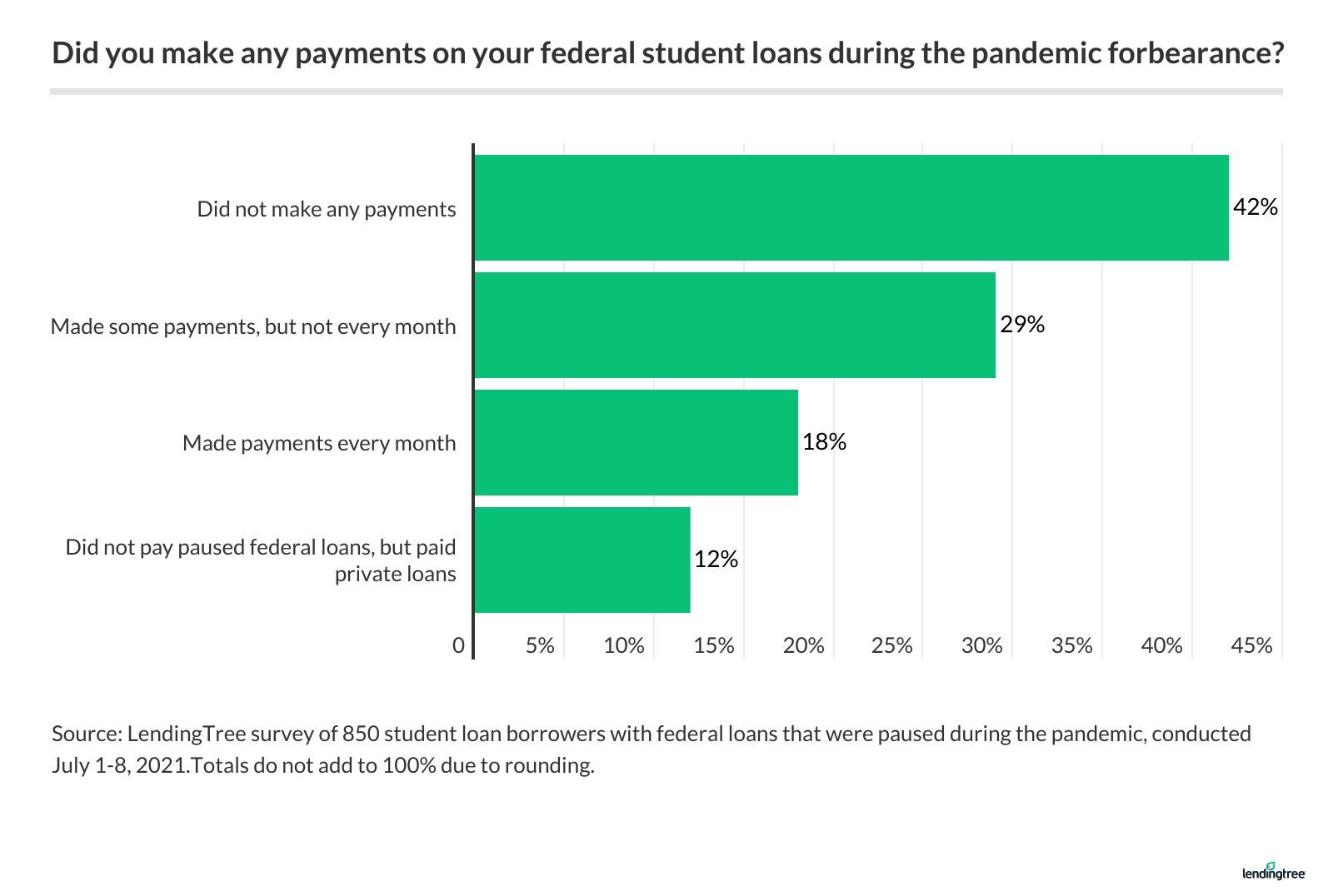

Nearly half of borrowers kept up repayment during forbearance

While a large number of borrowers don’t feel prepared to resume their student loan payments, other borrowers have been making them all along.

Our survey found that nearly half of borrowers (47%) continued making payments on their loans, despite the forbearance relief.

Almost 1 in 5 (18%) kept making payments every month, while 29% made some payments, though not every month. Continuing repayment during this period may have helped some borrowers chip away at their debt faster than they normally would have, thanks to the pause in interest charges.

This opportunity to accelerate repayment may be one reason why 52% of borrowers said they were satisfied with the way they had managed their student loan debt over the past year.

Borrowers slightly less optimistic, but still feel forgiveness is possible

When President Biden was first sworn in, many borrowers (69%) thought that his administration would have a positive impact on their student loans, according to an earlier LendingTree study.

Now, more than six months into Biden’s presidency, that number has dropped to 60%.

But although some borrowers are no longer as optimistic, almost 1 in 4 (24%) still think it’s “extremely likely” that all their debt will be canceled during Biden’s four-year term. Another 29% said it was “somewhat likely.”

This matched up with our finding in January, when 23% of borrowers believed total forgiveness was certain, and 64% saw at least a 50-50 chance of such an outcome.

Student loan forgiveness would help borrowers achieve their financial goals

If mass student loan forgiveness were to become reality, many borrowers say they would be able to achieve other financial goals.

Specifically, 39% said they would be able to buy a home, and 35% said they could save for retirement if all their loans were forgiven.

Meanwhile, 46% said their mental health would improve, 38% said their credit score would get better, and 34% said they’d be able to start an emergency fund. Another 27% said that getting rid of their student loan payments would allow them to live on their own.

Borrowers say even partial student loan forgiveness could bring a major boost to their finances. If only $10,000 were forgiven, 24% of respondents said they could still buy a home and an equal 24% said they could save for retirement.

Under this limited forgiveness scenario, 39% said their mental health would improve, 29% said their credit score would increase, and 26% would be able to save for emergencies. More than 1 in 5 (21%) said $10,000 in forgiveness would be enough to allow them to live on their own.

The burden of student loan debt has caused many borrowers to delay major life milestones, such as buying a home or starting a family. The survey findings suggest that even some measure of forgiveness could have a big impact on this.

Student loans remain as daunting challenge for many

While the temporary forbearance during the pandemic has offered some relief to borrowers, many are still feeling the negative effects of their student loans. Specifically, 47% say their debt has hurt their ability to save money, 47% say it’s harmed their mental health and 33% say their credit score has suffered.

At the same, 70% said they feel they’re missing out on life because of the sacrifices they make to pay off their student loans. These include: having an undesirable living situation (34%), not saving for the future (25%), remaining in a job they don’t like (23%) and not traveling (23%).

When it comes to paying down debt, the biggest obstacle borrowers face is not making enough money (cited by 30%). This is followed by having a sky-high debt balance (18%) and having other forms of debt in addition to student loans (18%).

Learn about your repayment options before forbearance ends

Whether or not the government extends the emergency forbearance for another few months, borrowers will likely need to resume repayment at some point. For many, this monthly bill could be a huge burden that hinders their ability to achieve financial security.

If you owe student loans, you could prepare for the end of forbearance by checking exactly how much you owe and to whom you owe it. Explore your options for repayment plans to find one that matches your budget.

Income-driven repayment plans, for example, can adjust your monthly student loan bill to 10%-20% of your discretionary income. For more information, have a look at our guide on how to choose the right repayment plan for you.

Methodology

LendingTree commissioned Qualtrics to field an online survey of 1,020 student loan borrowers, conducted July 1-8, 2021. The survey was administered using a non-probability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.