Best Boat Loan Rates in February 2026

Sail into savings with rates as low as 5.99%

Learn more about how we made our picks for the best boat loans.

Best boat loan lenders with the lowest rates

Best for: Low rates and long repayment periods – Boatloan.com

- Starting APR

- 5.99%

- Longest repayment period of top boat lenders

- Offers refinancing

- Finances boats up to 30 years old (many lenders only allow up to 20 years)

- Handles title and doc process (for an extra charge)

- Have to borrow at least $10,000

- No short-term loan options

Boatloan.com is a loan marketplace that helps potential buyers finance their boat. When you apply, an agent will work with you to find an offer.

Through its partner network, you could find a boat loan with a term as long as 252 months. That’s a full year longer than most lenders offer. A longer loan term typically means lower monthly payments, but you’ll pay more overall interest.

Best for: Boat loans with extra perks – Good Sam

- Starting APR

- 6.24%

- Free membership comes with trip planning tool and discounts

- Loans available in all states

- Some loans available for non-citizens

- Offers cash-out refinancing

- May require down payment

- Approval can take up to two days and getting money can take up to 12 business days

- Some loans may have a prepayment penalty

Good Sam (a loan marketplace) doesn’t just offer boat financing. It also has a membership program that allows you to earn points and access exclusive discounts. With a free membership, you can earn points for every $1 you spend at Camping World or Overton’s. Then, you can redeem these points for discounts at Camping World.

Some plans have an annual fee. Elite status (its most expensive plan) costs $99 to $149 a month, depending on whether Good Sam is offering a sale. You can get extra perks with paid membership plans, like discounts on gas and rental cars.

Good Sam may require a 10 to 20% down payment. Also, some of Good Sam boat loans have a prepayment penalty. That means you’ll get charged extra for paying your loan off early, which some people do to save interest. If your loan has this fee, Good Sam will tell you before you sign.

To qualify for a boat loan from Good Sam, you’ll need to meet the following requirements:

- Minimum credit score: 600+

- Residency: Must live in one of the 50 U.S. states (excluding Washington, D.C.), do not need U.S. citizenship for some loans

- Boat requirements: Must be less than 25 years old

- Administrative: Must provide copies of your driver’s license, purchase agreement, current title and registration, proof of down payment and proof of insurance

Best for: Same-day credit approvals – Southeast Financial

- Starting APR

- 6.24%

- Same-day credit approvals

- Low credit score requirement

- Offers extended warranties for an extra cost

- Takes up to five business days to get money

- No loans for houseboats or speedboats

- Loans not available in Alaska or Hawaii

While many lenders require fair or even good credit to qualify for a boat loan, Southeast Financial offers boat loans for bad credit. Plus, in some cases, you’ll know whether you’re approved as soon as three hours after you apply.

Keep in mind that it could take up to five business days to get your loan money once you’re approved. Residents of Alaska and Hawaii will have to look elsewhere for a loan — Southeast Financial only operates in the continental United States.

Southeast Financial offers clear guidance on how potential borrowers can qualify for a boat loan:

- Age: 18+

- Credit score: 575+

- Residency: Must be a U.S. citizen, can’t live in Alaska or Hawaii

- Income: $25,000+

- Boat model age: 2005 and newer

Best for: Fast boat loans with no fees – LightStream

- Starting APR (with autopay)

- 6.49%

Your loan terms, including APR, may differ based on loan purpose, amount, term length, and your credit profile. Excellent credit is required to qualify for lowest rates. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Rates without AutoPay are 0.50% points higher. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice. Payment example: Monthly payments for a $25,000 loan at 6.49% APR with a term of 3 years would result in 36 monthly payments of $766.11. © 2024 Truist Financial Corporation. Truist, LightStream and the LightStream logo are service marks of Truist Financial Corporation. All other trademarks are the property of their respective owners. Lending services provided by Truist Bank.

- Get money as soon as today

- No fees

- Don’t have to put up boat as collateral

- Requires hard credit pull to see rates

- Smaller loans than other boat lenders

- Doesn’t offer long-term boat loans

- Must have at least good credit to qualify

Most boat loans come with fees and use your boat as collateral, but you can skip these requirements with LightStream. LightStream just requires your signature and at least good credit to qualify for a boat loan.

LightStream might not make sense for very expensive boats. You can only borrow up to $100,000. Loan terms are also capped to 144 months when most others allow 240 months.

LightStream doesn’t specify its exact credit score requirements, but you must have good to excellent credit to qualify. Most of the applicants that LightStream approves have the following in common:

- At least five years of on-time payments under a variety of accounts (credit cards, auto loans, etc.)

- Stable income and the ability to handle paying their current debt obligations

- Savings, whether in a bank account, an investment account or a retirement account

Best for: Large boat loans – Boatzon

- Starting APR

- 6.99%

- Some of the largest boat loans on the market

- Could get money in as little as 24 hours

- Smaller loans don’t require boat as collateral

- Need at least good credit to qualify

- Might require a 10%-20% down payment

Boatzon is a loan marketplace that can help you shop for a boat loan and compare offers.

With a funding limit of $25,000,000, Boatzon‘s partners offer more than enough to cover the cost of a luxury boat. But you don’t need to borrow millions to get competitive rates and fast funding — Boatzon connects borrowers of all budgets with more than 20 partner lenders.

Boatzon partners typically require a credit score of at least 620, and many ask for a down payment of 10% to 20% of the cost of your boat.

While Boatzon’s minimum credit score is 620, you may qualify with a slightly lower score. Boatzon doesn’t provide information about any additional credit or income requirements.

Best for: Zero down (on some loans) – iNet

- Starting APR

- Not specified

- No down payment needed for some loans under $100,000

- Boasts a 75% approval rate

- Get money in as little as 72 hours

- Unclear eligibility requirements

- Doesn’t offer loans in every state

While other companies only offer zero-down boat loans for smaller boat loans, iNet offers up to $100,000 with no down payment on some loans. You don’t need perfect credit to qualify, but keep in mind that like other lenders, iNet reserves its lowest rates for borrowers with good to excellent credit.

If you need a loan for an older boat, you’ll have to look elsewhere to lenders like Good Sam; iNet only lets you borrow money for boats less than 20 years old.

To qualify for a boat loan with iNet, your boat must be less than 20 years old. Other than that, it does not specify many of its requirements.

How LendingTree works

Don’t miss the boat on big savings. Let boat loan companies from the nation’s largest network of lenders compete for your business.

Tell us what you need

Take two minutes to tell us who you are and how much money you need for your vessel — we’ll take care of the rest. It’s free, simple and secure.

Shop your offers

We’ll send you offers from up to five trusted lenders. Compare your offers side by side to see which one will save you the most money.

Get your money

It’s smooth sailing once you finalize your loan with your lender — you could see money in your account in as soon as 24 hours.

Estimate your monthly payment

Find out your estimated monthly boat loan payment with our boat loan calculator. Consider it a handy life vest to help you stay afloat as you plan your purchase.

What to know about boat loans

Not sure how boat loans work — or if you can really afford one? You’re not alone. We’ll walk you through boat financing step by step so you can make a confident decision before you hit the water.

-

How they work

A boat loan is a secured installment loan — you’ll borrow money upfront and pay it back plus interest in equal monthly payments. Your boat is collateral, so you’ll lose it if you stop making payments. -

Cost

The boat loan’s APR is the cost of borrowing money for a boat. Use the LendingTree boat loan calculator and current boat loan rates for your credit score to estimate how much you’ll pay for your boat loan. -

Time

Your boat loan term measures how long you’ll make payments on your boat. Boat loan terms are typically 10 to 20 years, though some lenders offer terms up to 21 years. -

How to apply

You can apply for a boat loan directly with a lender, or you can use a marketplace like LendingTree to compare offers from up to five trusted boat lenders side by side. -

Qualifying

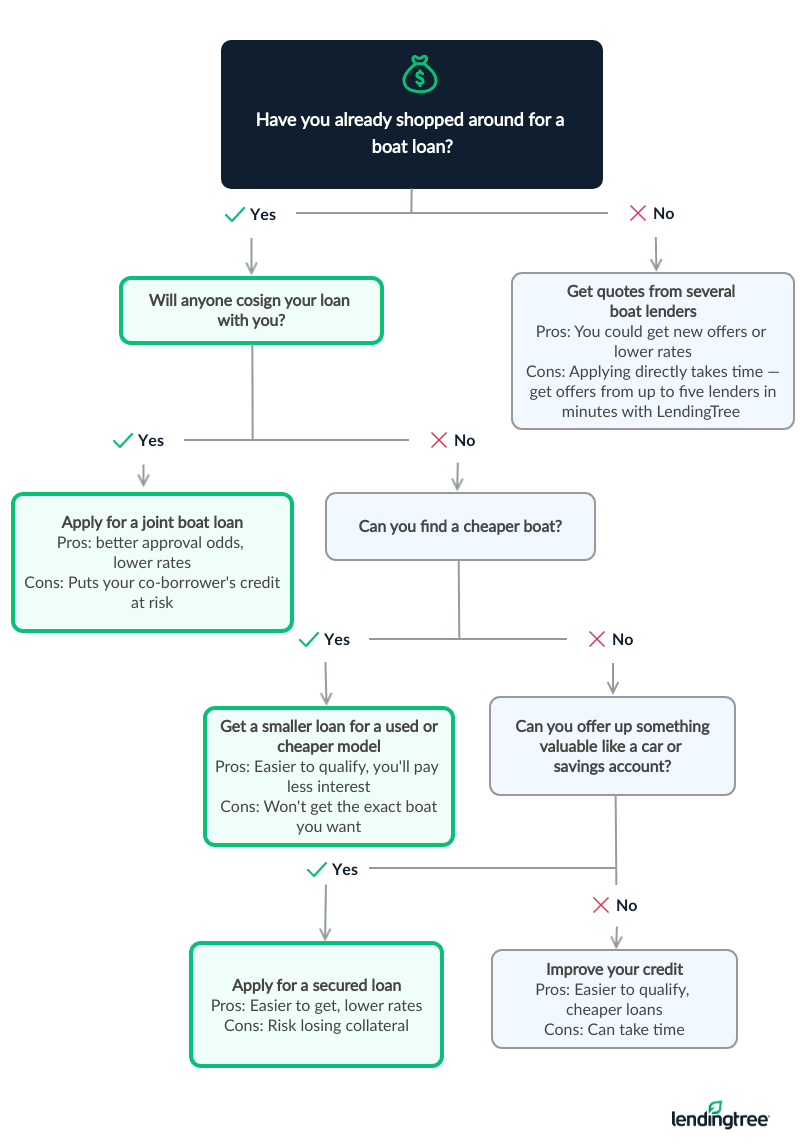

You may be worried about whether you’ll qualify. The good news? Getting preapproved for a boat loan isn’t hard, and some lenders offer boat loans for bad credit. Just know that rates can hit the double digits, making your boat loan expensive. Learn about improving your chances of getting approved with lower rates.

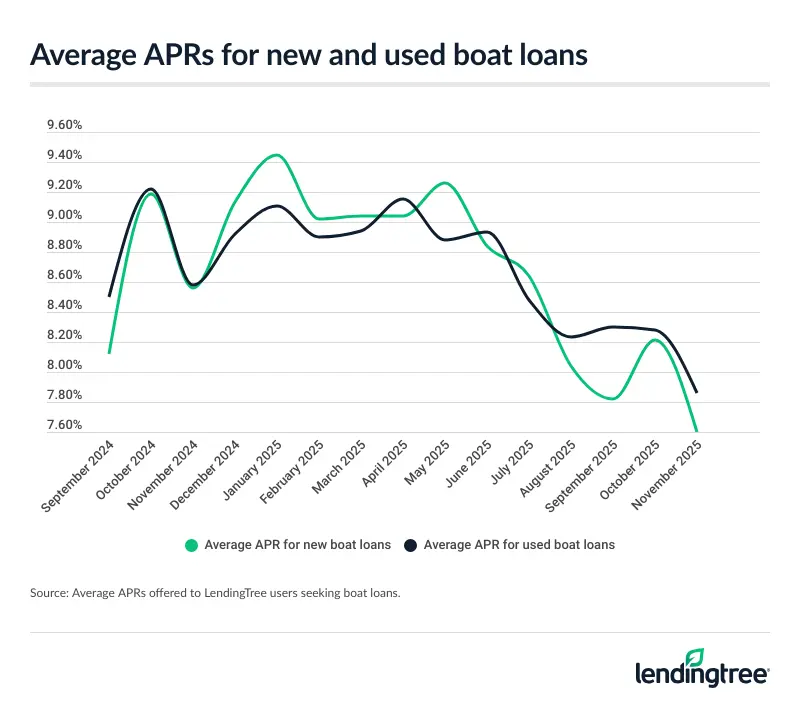

Boat loan rates

The average boat loan rate is 8.88% as of the third quarter of 2025. Use the table below to estimate your boat loan rate based on your credit score.

| Credit score | Average APR |

|---|---|

| Excellent and very good (740 – 799) | 8.73% |

| Good (670 – 739) | 8.87% |

| Fair and poor (580 – 669) | 9.85% |

Fall and winter is off-season for boat buying, so this could be a perfect time to find a deal on a new or used boat. Dealers and sellers may be more motivated to sell just to get the boat off their hands.

For more good news: Boat loan rates are trending downwards. You may want to lock in a low rate now — especially in an uncertain economy.

Expert insights on boat loans in 2026

When deciding between boat loan offers, keep both short- and long-term benefits in mind. A short repayment term can save you money on interest in the long run, but short terms tend to come with higher monthly payments. The money you save won’t be worth it if you fall behind.

If you’re worried about swinging those monthly payments, consider an extended loan term, and throw extra money toward your balance when possible to pay it off faster. Make sure your loan doesn’t come with prepayment penalties for paying off your boat early.

How to choose a boat loan

| Situation | Strategy | Tips |

|---|---|---|

| You have offers from different lenders with similar rates and terms | Compare your offers using the LendingTree boat loan calculator. Pay attention to the total cost of the loan, not just the monthly payments. | Choose the offer with the lowest total cost that still has monthly payments you can afford. |

| You don’t qualify or can’t afford your loan offers | Take steps to improve your odds of getting approved and apply again. | If you’re still stuck, consider other ways to pay for your boat. |

| You’re deciding on a repayment term | Save money on interest by choosing the shortest loan term with monthly payments you can afford. | Choosing a short loan term can make good financial sense, but don’t forget to add the costs of owning a boat to your budget. |

| You can’t decide whether to use your boat as collateral | Collateral helps you get lower rates — just make sure you can afford your payments or you’ll lose the boat. | If you don’t want to use your boat as collateral because you’re worried you can’t afford the payments, take a step back. This is a sign that the boat is out of your price range. Consider alternatives or work on your credit to qualify for lower rates (and cheaper loans). |

| You can’t afford a down payment | Save up 10% to 20% of the cost of your boat. Aim for the 20% benchmark if your boat is expensive. | It’s tempting to go with a zero-down boat loan when you can’t afford a down payment, but try to avoid it. You could end up with an upside-down loan and more debt than you can handle. |

How to improve your chances of getting approved

Other ways to pay for your boat

If you need money for a boat but don’t qualify for an affordable boat loan or don’t want to put your boat up as collateral, you still have options.

Personal loans

Best for: Lower-risk borrowing

When you take out an unsecured personal loan, you don’t risk losing your boat if you miss payments. But personal loans tend to come with higher rates, so you’ll likely spend more money on interest.

Home equity loans

Best for: Homeowners

You pay for your boat by tapping into your home equity with a home equity loan or line of credit. Financing using equity in your home comes with perks like low interest rates, but be careful — your home will be on the line if you miss payments.

Renting or leasing

Best for: Part-time boaters

You can save some serious cash by renting or leasing a boat, but it comes at a price: your captain’s hat. If you’re ready to trade in your dreams of boat ownership, you’ll save on the total cost of owning a boat with a lease or short-term rental.

What sets LendingTree content apart

Expert

Our auto loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

How we chose the best boat loans

We reviewed over a dozen top boat lenders to determine the overall top six. To make our list, lenders must offer boat loans with competitive rates to borrowers nationwide. From there, we prioritized the following factors:

Accessibility: We look for lenders with fewer barriers to approval and award points for lower credit requirements, nationwide access, fast funding and simple applications.

Rates and terms: We prioritize lenders that offer low starting rates, minimal fees, flexible terms and APR discount opportunities.

Repayment experience: We choose lenders with strong reputations, convenient self-service tools, responsive support and borrower-friendly perks.

According to our systematic rating and review process, the best boat loans come from Boatloan.com, Good Sam, Southeast Financial, LightStream, Boatzon and iNet.

Why trust LendingTree’s methodology?

Our writers and editors dig through the facts, contact lenders directly and even go through the application process ourselves if it helps better explain what you can expect. As a Certified Financial Education Instructor℠, I’m committed to breaking down complex financial details so people can make confident, informed decisions with their money.

Jessica’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.

Frequently asked questions

You usually need fair credit (a FICO Score of 580 to 669) to get a boat loan with affordable rates. Lenders like iNet and Southeast Financialoffer boat loans for bad credit, but you’ll pay more money in interest.

A typical boat loan down payment is 10% to 20% of the cost of the boat. Aim for 20% if your boat is expensive to avoid owing more on your boat than it’s worth.

Some lenders offer same-day preapproval, while others take a couple of days to decide if you qualify.

You risk losing your boat if you don’t make payments. Defaulting will also damage your credit and could prevent you from getting an affordable loan, credit card or even mortgage in the future.