Fixed Charge Coverage Ratio: Formula and How To Calculate

The fixed charge coverage ratio (FCCR) shows how well a business can pay its fixed expenses, including mandatory debt payments and interest.

Lenders and investors often use this metric to determine whether to approve a loan application or invest in the business. Here’s what you need to know about the fixed charge coverage ratio and how to calculate it.

What is the fixed charge coverage ratio?

The fixed charge coverage ratio measures a company’s ability to meet fixed charges from its earnings before interest and taxes (EBIT). Examples of fixed charges include insurance premiums and lease and loan payments. These payments are the same each month, no matter how much revenue the company earns.

Essentially, the FCCR shows how many times over your business can satisfy its predictable financial responsibilities. An FCCR of 1 means you have just enough earnings before interest and taxes to meet them. An FCCR of 2 shows you could pay them all two times over.

So what is a good fixed charge coverage ratio? The ideal FCCR varies by industry, but many lenders look for borrowers to have a ratio of at least 1.2.

The FCCR tells you about your business’s financial health

The FCCR indicates how well your business can cover its fixed obligations like loan payments and lease costs out of operating income. Using this ratio, you can assess your company’s ability to meet these critical expenses and measure its financial health in terms of solvency and borrowing capacity.

Understanding your FCCR also helps you make more informed decisions about managing debt and planning for future financial obligations.

The FCCR doesn’t tell you about your future growth prospects

While the FCCR provides insight into your company’s ability to cover its fixed financial obligations, it doesn’t consider variability in revenue, future growth prospects, or non-fixed expenses like variable costs and one-time expenditures.

For that reason, it’s important to consider the FCCR along with other financial forecasts and metrics.

How to calculate fixed charge coverage ratio

Here is the FCCR formula:

Fixed charge coverage ratio = (EBIT + fixed charges before taxes) / (fixed charges before taxes + interest)

Key terms to know include:

- EBIT: earnings before taxes, calculated by adding tax and interest expenses back to your net income

- Fixed charges: Recurring business expenses that are paid regardless of sales volumes, such as debt and lease expenses

To calculate your FCCR ratio, add the company’s earnings before interest and taxes to its fixed obligations before tax. Then divide that total by the sum of fixed charges before tax plus interest.

The resulting number represents how solvent your company is, with a higher number (2 or above) indicating a healthier company with less financial risk. Conversely, a ratio below 1 means you may have problems meeting your regular financial obligations, and a sudden drop in earnings could be disastrous.

Fixed charge coverage ratio examples

Here are two examples to help you better understand how to calculate your fixed charge coverage ratio — one with a higher FCCR and one with a lower ratio.

Higher FCCR

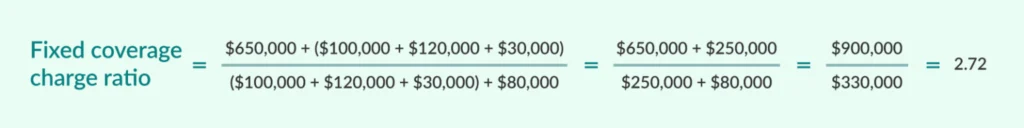

Company A has earnings before interest and taxes of $650,000. It pays $10,000 per month for a building lease, $100,000 annually for equipment, $30,000 per year in principal payments towards loans and $80,000 annually in interest payments.

Based on the numbers below, here’s how Company A would calculate its FCCR.

- EBIT: $650,000

-

Fixed charges before taxes:

- Equipment expenses: $100,000

- Annual lease: $120,000 (monthly lease of $10,000 x 12 months)

- Annual principal on a loan: $30,000

- Annual interest payments: $80,000

With an FCCR of 2.72, Company A could pay its fixed charges close to three times over from its earnings before interest and taxes. That’s a healthy number and likely means Company A wouldn’t have too much trouble getting a business loan or finding investors.

Lower FCCR

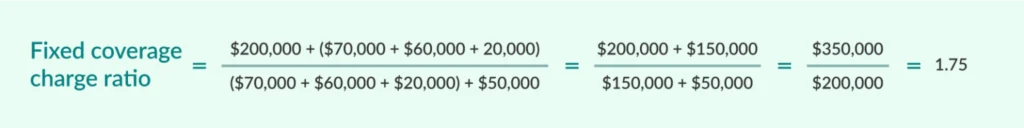

Company B has earnings before interest and taxes of $200,000. It pays $5,000 per month for a building lease, $70,000 annually for equipment, $20,000 per year in principal payments towards secured business loans and $50,000 annually in interest.

Based on the numbers below, here’s how Company A would calculate its FCCR.

- EBIT: $200,000

-

Fixed charges before taxes:

- Equipment expenses: $70,000

- Annual lease: $60,000 (monthly lease of $5,000 x 12 months)

- Annual principal on a loan: $20,000

- Annual interest payments: $50,000

Company B’s FCC ratio is 1.75. That means Company B’s earnings before interest and taxes are 1.75 times higher than its fixed expenses. While its FCCR isn’t as high as Company A’s, it’s still above the typical 1.2 required by many lenders. So the company may be able to get a business loan, but it might not have as many options — or get as competitive an interest rate offer — as Company A.

How to improve your FCCR

Companies with the best chances of getting a small business loan at an affordable rate have an FCCR above 2. If your company’s FCCR isn’t quite there, here are some ways to help adjust the formula and improve your ratio.

- Refinance debts. Refinancing your existing debts into a lower interest rate can lower your interest payments and thus improve your FCCR.

- Negotiate your lease or interest rates. Negotiating your lease payments or interest rate brings down your fixed charges. This can also help raise your ratio.

- Lower expenses by relocating or reducing overhead. Lowering your overall costs by relocating or reducing overhead increases your EBIT. This gives you a larger numerator for your FCCR calculation, which improves your ratio.

- Buy used equipment. Buying used equipment is generally less expensive than buying or leasing new equipment. This can lower your lease payments or improve your EBIT, positively impacting your FCCR.

- Increase revenue. Increasing revenues without generating more expenses also improves your EBIT and thus raises your FCCR.

These changes might not have a huge impact immediately, but over time, paying down debts, increasing revenues and lowering expenses will make your numbers look better and improve your financing options.

Fixed charge coverage ratio vs. times interest earned

The times interest earned (TIE) ratio is also a measurement of a company’s ability to meet its obligations. However, it focuses solely on debt obligations, whereas the FCCR takes into account all fixed charges.

You calculate the TIE ratio by dividing a company’s earnings before interest and taxes by its periodic interest expense.

TIE formula: TIE ratio = EBIT / interest expense

A company with a TIE of 2 could pay its periodic interest payments twice over if it devoted all of its earnings before interest and taxes to debt repayment.

FCCR vs. debt service coverage ratio

The debt service coverage ratio (DSCR) measures a business’s ability to meet its debt obligations — specifically interest and principal payments — from its operating cash flow.

Unlike the FCCR, which includes fixed financial obligations beyond debt service payments, DSCR focuses solely on debt repayment.

The DSCR formula typically uses earnings before interest, taxes, depreciation and amortization (EBITDA) as a stand-in for operating cash flow. So the DSCR formula is:

DSCR = EBITDA / Total Debt Service Interest & Principal

This financial metric gives lenders and investors a clearer picture of the business’s ability to service its debt. Both ratios assess financial health but cater to different aspects: FCCR considers broader fixed expenses, while DSCR homes in on debt repayment capacity alone.

Compare business loan offers