Employee Loans: What To Know Before Loaning Money to Employees

Although it might sound risky, issuing employee loans with money from your small business could be a big help for employees who are struggling with debt or living paycheck-to-paycheck. These issues in employees’ personal lives may negatively impact their work. Employee loans can give you a chance to step in to help.

What are employee loans?

Employee loans are funds that the company advances to assist workers. As with a traditional loan, employees are expected to repay these loans to their employer. If the total balance is due within a year, the company may consider the loan a current asset on its balance sheet. If the loan term exceeds one year, the loan would be considered a long-term asset on the company balance sheet.

Employees may ask business owners for loans to cover a personal expense, such as a home purchase or school tuition, or to help bridge a period of financial hardship. Employers can set the parameters of their own loan program, determining how much employees can borrow and how long they have to repay their debt.

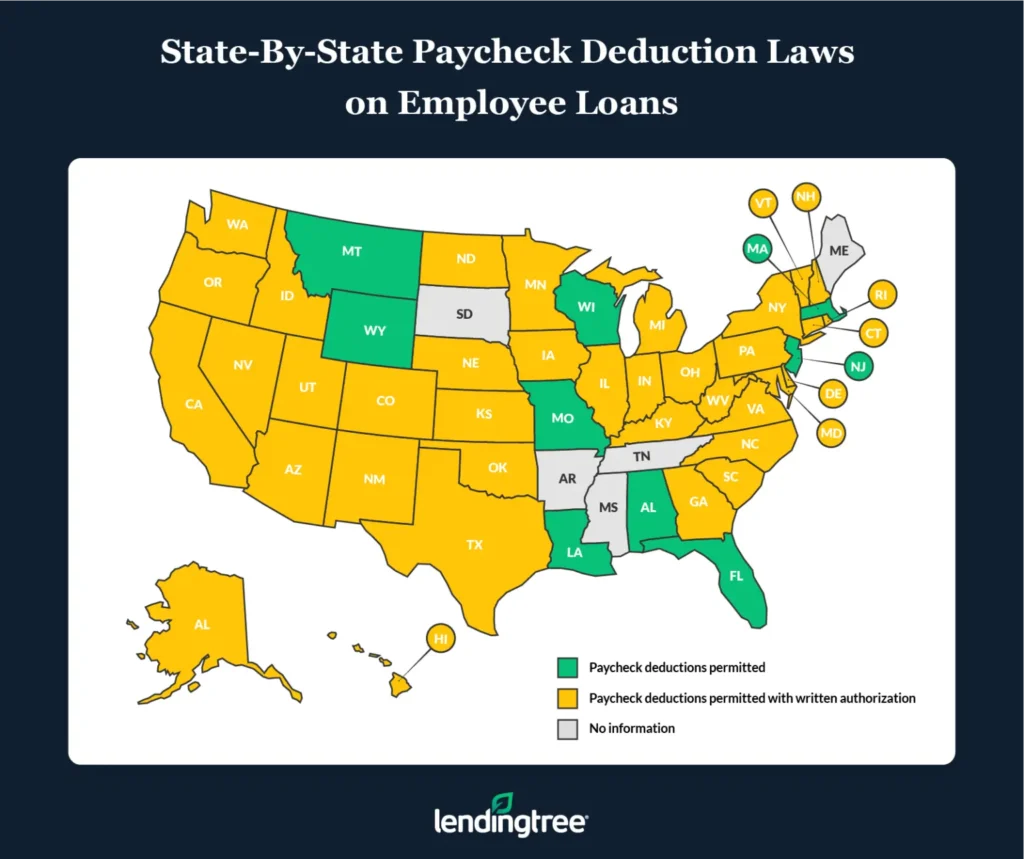

Business owners may need to abide by state wage reduction laws when it comes to collecting payments from employees’ paychecks. We’ll discuss state laws for employee loans below.

Employee loans: Pros and cons

There are compelling reasons to offer employee loans as a small business owner, but it’s important to consider both the potential positive and negative aspects of making the decision to do so.

Pros of employee loans

- Alleviate stress for employees. Financial issues such as general debt, medical expenses, education costs or even basic living expenses can cause stress. Employee loans might help alleviate some of that stress, so your staff can concentrate on their work.

- Increase production. Personal financial worries could cause an employee to be less productive. Offering reprieve may benefit your company in the long run, as employees would be able to better focus on their work.

- Build loyalty. By loaning money to employees, you may be able to boost staff retention. Your company may also gain a reputation as a workplace that values and cares for its employees.

Cons of employee loans

- Risk of losing money. As with any kind of loan, there is always a risk of being paid back late or not at all. If the employee quits, it may be difficult to collect your money. Evaluate whether this is a risk your business is able to take before initiating any employee loan programs.

- Danger of workplace friction. Owing money to an employer could create an uncomfortable workplace atmosphere for an employee. It’s also possible that if you offer one employee a loan, other employees may expect one as well. This could put financial strain on your business.

- Pressure to continue lending money. Employees who have received a prior loan from you may request more money down the road. Borrowers may also try to negotiate a longer repayment term or reduce their interest rate.

Key considerations for employee loans

In any situation involving money, there can be complications. In some cases, these complications or concerns might mean that lending money to an employee is not the best idea for you or your business.

But if you decide to move forward to become a lender for your employees, you should take steps to set up a formal employee loan program. You should keep these loans on the books, charge fair interest rates — we’ll talk about the Applicable Federal Rate in Step 1 — and set repayment terms and schedules. It would also be your responsibility to make sure employees are aware of the rules and expectations related to employee loans.

Step 1: Set proper employee loan rates and terms

You may be hit with some extra taxes if you improperly issue a loan. To avoid this, make sure you offer clearly detailed loan terms and keep track of the Applicable Federal Rate (AFR), a rate which is used when friends, relatives or other private parties lend money and published monthly by the IRS. If your loan is over $10,000, you must charge interest at that rate or higher. If you don’t, the IRS may consider you to have received “phantom income,” which is taxable. You can find more information about how employee loans may affect your taxes through the IRS.

Step 2: Establish a written employee loan policy

If you offer a loan to one employee, it’s unlikely they’ll be the last to ask for one. Having a general policy will help employees understand their financial options and limitations. A formal policy is a good place to clearly designate who has the authority to authorize a loan.

Be sure to list the circumstances in which you will extend a loan and outline how quickly you expect to be repaid. Having a blanket policy can eliminate confusion and give employees honest information. It’s best to get ahead of this situation by creating guidelines for an employee lending program. That way, when an employee asks for a loan, you’ll already have a procedure in place.

Questions to ask before lending money

Your policy may want to address these questions:

- What is my employee’s financial history?

- How does my employee treat their finances? Are they a responsible money manager? What will they use the money for?

- Do I have any concerns about being repaid?

An employee who needs money for a one-time unexpected expense may be different from someone who needs money because they can’t budget or doesn’t live a lifestyle within their means. However, keep in mind that granting a loan to one employee, but refusing a loan to another, could make you vulnerable to discrimination lawsuits.

Step 3: Keep detailed employee loan records

Don’t be tempted to keep the loan “off the books” — always keep detailed and accurate financial records. That will help prevent your employee’s repayments from being reported as income.

What to include in an employee loan agreement

Creating an employee loan agreement would help you avoid penalties and ensure that the loan is repaid on time. Consider hiring a business lawyer to look over the agreement to make sure you’ve included the necessary components, such as:

- Names of the parties involved: This includes the name of the business and the name of the employee who is taking out the loan.

- Date: The agreement should include the date of signing and the date when the loan goes into effect.

- Promissory note: A promissory note is basically a legal I-O-U: A written promise that one party will repay another party a definite sum money. This will outline the employee’s repayment terms, including payment amount, payment frequency, interest rate and what happens in the event of default (for example, automatic deductions from the employee’s paycheck or legal action if the employee has quit).

- Signatures: Collect the signature of the employee who is borrowing money and signatures of any witnesses who are present during the signing.

You can look online for a template for a loan agreement between employer and employee.

State laws for employee loans

Employers in the U.S. can provide loans to their employees, but may have to comply with different laws depending on your state. Some states allow employees to repay loans through payroll deductions, but only if it doesn’t reduce their wages below the $7.25-per-hour federal minimum wage. Most states require employees to authorize that kind of repayment in writing.

Alternatives to employee loans

If you’ve decided that giving your employee a loan isn’t right for you, that doesn’t mean you’re out of options to offer financial assistance — there are some alternatives for financial aid that might be a better fit than a loan.

Loans from retirement plans

A loan from an employee’s 401(k) might be a good option. People can borrow up to 50% against an account balance, up to $50,000. Repayment must be made within five years (the only exception to this is for buying a home), including a reasonable rate of interest.

However, if the employee leaves the job, they may have to repay the loan in full; otherwise, their outstanding balance will be treated as a taxable distribution. If the employee is under the age of 59 1/2, the distribution is also subject to a 10% penalty.

Paycheck advance

Sometimes emergency expenses, like sudden medical costs or urgent car trouble, don’t actually require a loan. A paycheck advance might be a good solution if your employee is hitting a financial rough patch because they have expenses they can’t pay until they have their next paycheck.

Advancing a paycheck may be a simple answer for a short-term financial need that’s dependent on the timing of the employee’s cash flow. This solution could also reduce your business’s potential loss to the amount of one paycheck.

Compare business loan offers