Nearly 1 in 3 Businesses Expect to Raise Prices in 6 Months — a State Ranking

Inflation has been putting pressure on consumers’ wallets for quite some time, but they’re not the only ones feeling the squeeze. Businesses have been facing price increases from suppliers, too — and 50.7% of businesses expect the prices they pay for goods and services to rise in six months.

With that in mind, 30.9% of U.S. businesses expect the prices they’ll charge six months from now will be higher than today. That’s nearly a third. Here’s a closer look at where businesses are most pessimistic about prices — and what small business owners can do to juggle raising prices and thinner margins with customer satisfaction.

Key findings

- Nearly 1 in 3 (30.9%) U.S. businesses expect they’ll charge higher prices in six months. Just 4.3% expect lower prices, while 64.8% expect their prices will stay the same. Six months ago, a slightly higher 32.7% expected their prices would rise in half a year.

- Over half (50.7%) of businesses expect the prices they pay for goods and services to rise in six months. This stat highlights how inflationary pressures can build: As businesses plan to raise prices, many may just be accounting for increased costs from their own suppliers.

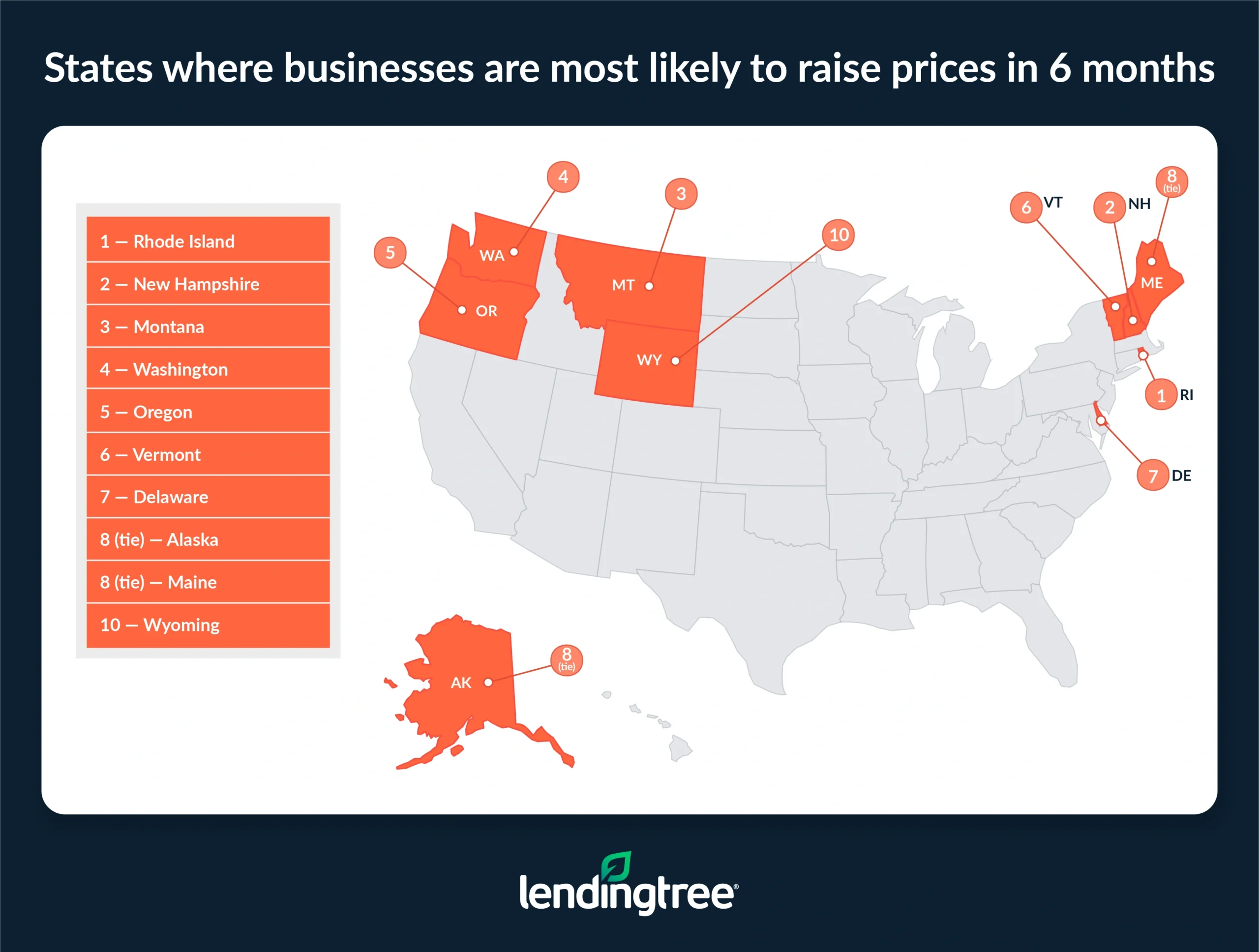

- Rhode Island businesses have the highest price-related pessimism. 40.3% of businesses in the state expect they’ll charge more in six months. (Separately, 52.9% expect higher costs for their businesses, likely fueling the expectation of future price hikes.) New Hampshire and Montana follow, with 38.0% and 36.5% of businesses, respectively, expecting to charge higher prices by 2026.

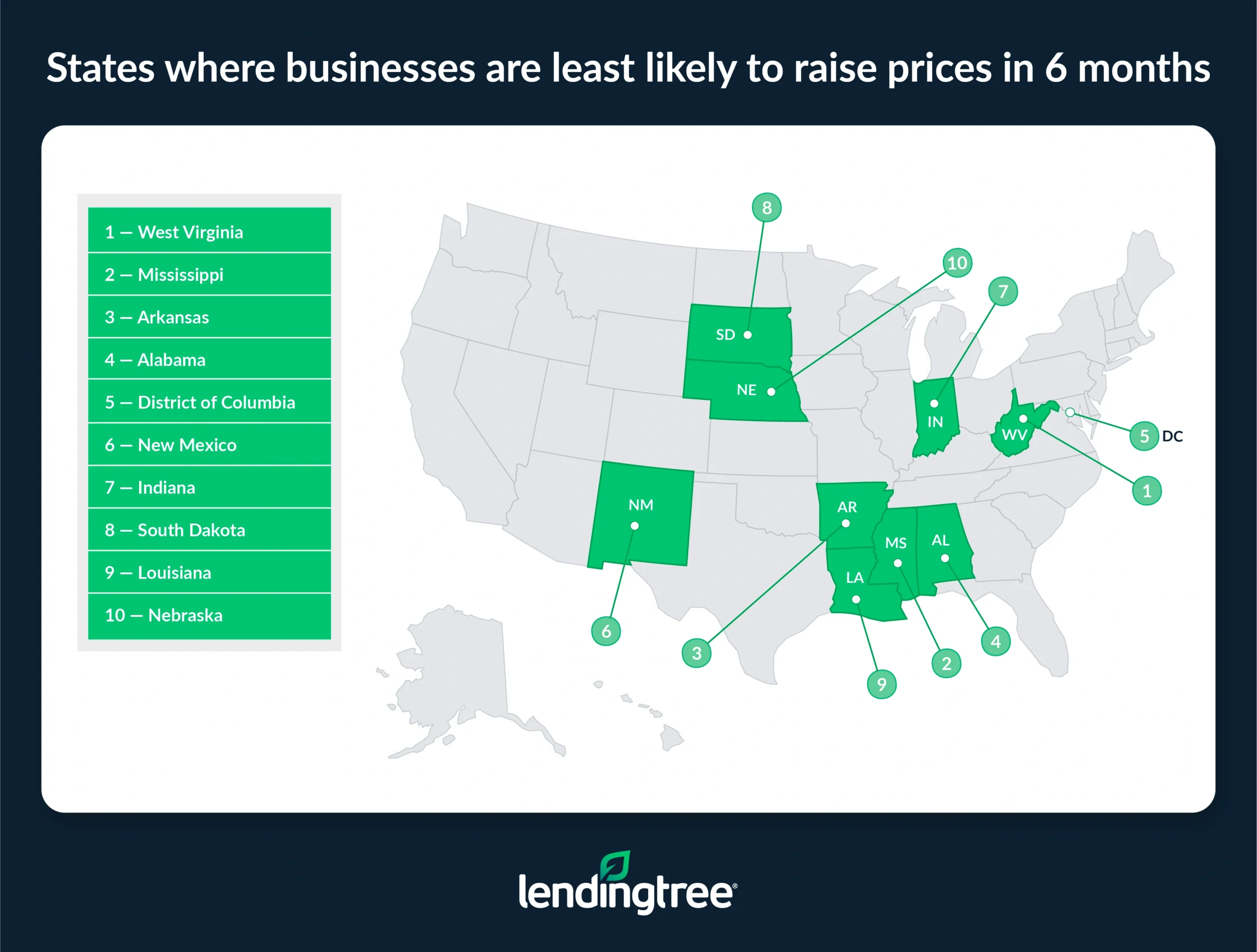

- West Virginia has the lowest share of businesses forecasting price increases. Just 21.3% of West Virginia businesses expect to charge more in six months, and 33.6% expect to be charged more — also the lowest. Mississippi (23.5%) and Arkansas (25.4%) follow.

30.9% of businesses expect to raise prices soon

In six months, a significant 30.9% of U.S. businesses expect to raise the prices they charge. Meanwhile, just 4.3% expect to lower prices and 64.8% expect to keep them the same.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says these results are further proof inflation is still very much a concern for businesses around the country.

“Tariffs are likely playing a significant role in these concerns, but so is the overall sense of uncertainty that remains in the American economy,” he says. “There are so many unknowns that it’s nearly impossible to predict what the next few weeks will look like, much less six months from now. However, this report makes it clear many businesses see continued rising prices ahead.”

Tariffs are likely playing a significant role in these concerns, but so is the overall sense of uncertainty that remains in the American economy.

Six months ago, a slightly higher 32.7% expected their prices would rise by now — indicating the pessimism is cooling (at least a little bit).

50.7% of businesses expect to pay more for goods and services

While almost a third of businesses expect to raise their own prices, even more expect to shell out more for their own goods and services. More than half (50.7%) of businesses expect the prices they pay for goods and services will rise in six months.

Under those circumstances, it’s natural for businesses to pass along rising costs to their customers in the form of higher prices, Schulz says — but there’s a risk.

“Customers can be very price-sensitive,” he says. “Continued price hikes could potentially lead to fewer customers and lower revenue.”

That tendency is “especially true if you’re competing against larger companies with greater profit margins or more negotiating power with suppliers,” he goes on. “Pricing pressure may force other choices, such as staffing reductions, in the hopes of remaining competitive.”

Rhode Island businesses most likely to hike prices

By state, Rhode Island businesses are the most likely to think their prices are on the way up. In six months, 40.3% of businesses in the state expect to charge more. That’s up 5.2 percentage points from 35.1% in December.

Separately, 52.9% of Rhode Island businesses expect higher costs for their businesses in six months.

Following:

- New Hampshire ranks second, with 38.0% expecting to raise prices — down 1.1 percentage points from 39.1% six months ago. Here, 59.9% expect higher costs for their businesses.

- Montana ranks third, with 36.5% expecting to raise prices — a figure that’s remained the same since December. In Big Sky Country, 53.6% expect higher costs for their businesses.

Looking at the states most likely to expect to be charged more for their goods and services, Hawaii (63.5%) ranks first, ahead of Alaska (63.3%) and Kentucky (62.1%).

Conversely, West Virginia has the lowest share of businesses forecasting a price increase: Just 21.3%, a figure that’s down 5.8 percentage points from 27.1% in December. Meanwhile, 33.6% of West Virginia business owners expect to be charged more for goods and services — also the lowest in the nation.

Mississippi (23.5%) follows, experiencing a 3.5 percentage point bump from the 20.0% that expected price increases last December. Meanwhile, 39.4% expect the cost of business to rise. Arkansas (25.4%) ranks third. Six months ago, 29.0% expected to raise prices — a 3.6 percentage point decrease. Here, 45.8% expect the cost of business to rise.

When it comes to the states least likely to expect rising supplier costs, Alabama (38.2%) and Mississippi (39.4%) follow West Virginia.

Full rankings

| Rank | State | % that expect to raise prices over 6 months (June) | % that expect to raise prices over 6 months (December) | % point difference, December to June | % that expect to be charged more over 6 months (June) |

|---|---|---|---|---|---|

| 1 | Rhode Island | 40.3% | 35.1% | 5.2 | 52.9% |

| 2 | New Hampshire | 38.0% | 39.1% | -1.1 | 59.9% |

| 3 | Montana | 36.5% | 36.5% | 0.0 | 53.6% |

| 4 | Washington | 36.4% | 40.7% | -4.3 | 60.1% |

| 5 | Oregon | 36.2% | 41.1% | -4.9 | 56.9% |

| 6 | Vermont | 36.1% | 27.0% | 9.1 | 61.3% |

| 7 | Delaware | 35.8% | 35.9% | -0.1 | 57.0% |

| 8 | Alaska | 35.5% | 39.3% | -3.8 | 63.3% |

| 8 | Maine | 35.5% | 40.1% | -4.6 | 57.0% |

| 10 | Wyoming | 34.5% | 26.1% | 8.4 | 58.2% |

| 11 | Hawaii | 34.4% | 37.9% | -3.5 | 63.5% |

| 12 | Kentucky | 33.8% | 33.5% | 0.3 | 62.1% |

| 13 | Utah | 33.4% | 34.9% | -1.5 | 53.5% |

| 14 | Tennessee | 32.9% | 31.8% | 1.1 | 47.2% |

| 15 | Georgia | 32.8% | 30.8% | 2.0 | 51.1% |

| 15 | Minnesota | 32.8% | 37.9% | -5.1 | 54.4% |

| 15 | Ohio | 32.8% | 38.0% | -5.2 | 53.7% |

| 18 | Pennsylvania | 32.4% | 32.2% | 0.2 | 51.1% |

| 19 | Idaho | 32.2% | 35.2% | -3.0 | 57.8% |

| 19 | Michigan | 32.2% | 35.6% | -3.4 | 51.7% |

| 19 | Missouri | 32.2% | 38.6% | -6.4 | 49.6% |

| 22 | New Jersey | 32.0% | 29.5% | 2.5 | 49.8% |

| 23 | Oklahoma | 31.8% | 32.1% | -0.3 | 46.5% |

| 24 | California | 31.7% | 32.6% | -0.9 | 51.3% |

| 25 | Connecticut | 31.6% | 35.8% | -4.2 | 53.7% |

| 26 | Virginia | 31.3% | 32.4% | -1.1 | 48.9% |

| 27 | Wisconsin | 30.8% | 41.7% | -10.9 | 49.8% |

| 28 | Kansas | 30.6% | 30.4% | 0.2 | 49.6% |

| 29 | Colorado | 30.3% | 35.6% | -5.3 | 52.2% |

| 29 | Illinois | 30.3% | 35.0% | -4.7 | 51.4% |

| 31 | Nevada | 30.1% | 28.5% | 1.6 | 49.6% |

| 32 | Florida | 29.8% | 30.3% | -0.5 | 48.0% |

| 33 | Iowa | 29.7% | 38.1% | -8.4 | 52.9% |

| 33 | South Carolina | 29.7% | 31.0% | -1.3 | 50.6% |

| 35 | Massachusetts | 29.5% | 35.3% | -5.8 | 53.4% |

| 36 | New York | 29.3% | 27.3% | 2.0 | 47.4% |

| 37 | North Carolina | 29.2% | 30.5% | -1.3 | 51.5% |

| 38 | Arizona | 28.9% | 34.5% | -5.6 | 49.4% |

| 38 | North Dakota | 28.9% | 36.5% | -7.6 | 54.8% |

| 40 | Maryland | 28.7% | 35.0% | -6.3 | 47.7% |

| 40 | Texas | 28.7% | 29.4% | -0.7 | 49.4% |

| 42 | Nebraska | 28.0% | 30.7% | -2.7 | 49.7% |

| 43 | Louisiana | 27.7% | 25.7% | 2.0 | 45.3% |

| 44 | South Dakota | 27.5% | 33.4% | -5.9 | 42.5% |

| 45 | Indiana | 27.3% | 30.8% | -3.5 | 49.4% |

| 46 | New Mexico | 27.2% | 31.4% | -4.2 | 46.5% |

| 47 | District of Columbia | 25.7% | 34.0% | -8.3 | 49.2% |

| 48 | Alabama | 25.6% | 26.2% | -0.6 | 38.2% |

| 49 | Arkansas | 25.4% | 29.0% | -3.6 | 45.8% |

| 50 | Mississippi | 23.5% | 20.0% | 3.5 | 39.4% |

| 51 | West Virginia | 21.3% | 27.1% | -5.8 | 33.6% |

Balancing rising costs and raising prices: Tips for small businesses

It can be difficult to juggle an increase in operating costs with raising prices — particularly when consumers are already feeling pinched. Here are a few tips to consider:

- Don’t be afraid to negotiate. “Yes, prices are rising all over the place, but that doesn’t mean you’re getting the best possible deal from the suppliers, vendors and other businesses you work with,” Schulz says. “Depending on your business’s particular circumstances, it may make a lot of sense to reach out to those companies to talk about your arrangement.”

- Improve your efficiency. “When costs are rising, businesses must be ruthless about efficiency,” he says. “If extra dollars are being spent carelessly in one less-important aspect of the business, it means they can’t be spent on things that matter more. It can take some time and tough questions to find out where the waste is, but if doing so helps offset rising costs and avoid price increases, it can absolutely be worth the effort.”

- Explore financing options strategically. Rising costs can put serious pressure on cash flow, especially for small businesses. A well-timed small business loan or line of credit can offer breathing room, letting you cover short-term expenses or invest in cost-saving improvements without immediately passing costs onto your customers. Just make sure the loan terms work for the long-term health of your business — not just its immediate survival.

Methodology

LendingTree researchers analyzed U.S. Census Bureau Business Trends and Outlook Survey (BTOS) data. This survey asks: “Six months from now, how do you think the prices this business charges for its own goods or services will have changed?” States were ranked from highest to lowest based on the percentage of businesses that said they expect to increase prices.

We also ranked states from highest to lowest based on the percentage that responded with increases to: “Six months from now, how do you think the prices this business pays for goods or services will have changed?”

We analyzed the survey that was fielded from June 2 to June 15, 2025. We also compared this to the survey six months earlier from Dec. 2 to Dec. 15, 2024.

Recommended Articles