Cheap Car Insurance in Denver

Best cheap car insurance companies in Denver

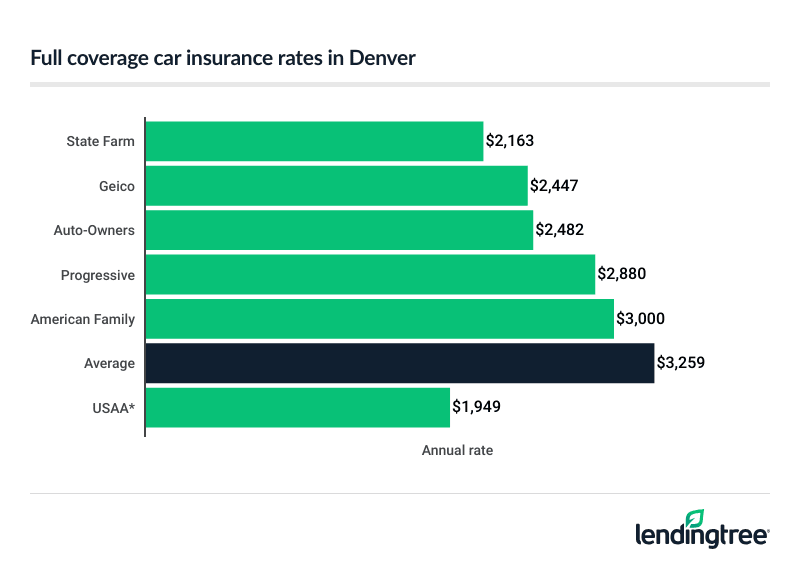

Denver’s cheapest full coverage car insurance: State Farm

State Farm has the cheapest full coverage car insurance in Denver at $2,163 a year, or $180 a month. State Farm’s rate is 34% cheaper than the city average of $3,259 a year.

USAA has the overall cheapest rate for full coverage

Geico and Auto-Owners are also worth a look because of their low rates. Both companies, along with State Farm, offer several discounts that could decide which one is cheapest for you.

Denver full coverage car insurance quotes

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| State Farm | $2,163 | |

| Geico | $2,447 | |

| Auto-Owners | $2,482 | |

| Progressive | $2,880 | |

| American Family | $3,000 | |

| Allstate | $3,968 | |

| Nationwide | $4,647 | |

| Farmers | $5,796 | |

| USAA* | $1,949 |

Cheap liability-only car insurance in Denver: State Farm

Denver drivers get the cheapest liability car insurance with State Farm at $801 a year, or $67 a month. Progressive is the next-cheapest company for liability coverage

Even if Progressive’s rate isn’t the cheapest for you, it offers more coverage options than State Farm does. One example is GAP coverage, which pays off the remainder of your loan amount if your vehicle is totaled. State Farm doesn’t offer this.

Liability car insurance rates

| Company | Annual rate |

|---|---|

| State Farm | $801 |

| Progressive | $815 |

| Geico | $870 |

| Auto-Owners | $919 |

| American Family | $932 |

| Nationwide | $1,561 |

| Allstate | $1,697 |

| Farmers | $2,031 |

| USAA* | $516 |

Best cheap car insurance for Denver teens: State Farm

State Farm has the cheapest car insurance for young drivers in Denver. Its liability car insurance rates for young drivers average $2,762 a year, while its full coverage rates average $6,331.

Geico is the next-cheapest for most teens, at $2,830 a year for liability coverage and $6,826 for full coverage. Consider American Family for liability, too, due to its discounts.

Car insurance for teen driver

| Company | Liability | Full coverage |

|---|---|---|

| State Farm | $2,762 | $6,331 |

| Geico | $2,830 | $6,826 |

| American Family | $2,968 | $8,462 |

| Auto-Owners | $3,542 | $8,243 |

| Progressive | $4,072 | $12,563 |

| Allstate | $4,537 | $8,106 |

| Nationwide | $6,590 | $15,284 |

| Farmers | $7,762 | $19,601 |

| USAA* | $1,506 | $4,835 |

Teens pay the highest car insurance rates of any age demographic. This is mostly because of their inexperience behind the wheel, which makes it more likely they’ll get into accidents.

If you’re the parent of a young driver, consider adding them to your car insurance policy. While this will raise your rate, it should still be cheaper than if both of you had separate policies.

Denver’s cheapest insurance rates after a speeding ticket: State Farm

Denver drivers with a speeding ticket on their records get the cheapest insurance with State Farm. Its rates average $2,323 a year, or $194 a month. Auto-Owners is the city’s second-cheapest option after a ticket, at $2,591 a year.

State Farm and Auto-Owners both offer a number of discounts that could make them the cheapest for you. Auto-Owners does offer some interesting add-on coverages, however. For example, if you get its At-Fault Accident Forgiveness coverage, Auto-Owners will waive the accident surcharge for your first at-fault accident.

Car insurance after a ticket

| Company | Annual rate |

|---|---|

| State Farm | $2,323 |

| Auto-Owners | $2,591 |

| Geico | $3,270 |

| American Family | $3,524 |

| Allstate | $4,405 |

| Progressive | $4,681 |

| Nationwide | $6,725 |

| Farmers | $7,935 |

| USAA* | $2,432 |

Cheap Denver car insurance after an accident: State Farm

At $2,497 a year, or $208 a month, State Farm has the cheapest car insurance rates after an accident in Denver. Auto-Owners is second-cheapest, with rates of around $4,173 a year.

Both companies offer a car and home insurance bundle discount, but State Farm’s bundle can save you up to $1,273 a year on your auto and home insurance costs, while Auto-Owners’ site doesn’t give a discount estimate.

Car insurance after an accident

| Company | Annual rate |

|---|---|

| State Farm | $2,497 |

| Auto-Owners | $4,173 |

| American Family | $4,381 |

| Geico | $4,693 |

| Progressive | $5,240 |

| Allstate | $6,173 |

| Farmers | $8,009 |

| Nationwide | $8,172 |

| USAA* | $2,765 |

Cheapest insurance for young Denver drivers with bad driving records: State Farm

Young Denver teens with poor driving records find the lowest car insurance rates with State Farm. With State Farm, these drivers pay $3,042 a year after a ticket and $3,346 a year after an accident.

American Family has the next-cheapest rates of $3,215 a year and $4,289 a year, respectively. Both companies offer enough discounts that it’s worth your time to compare.

Cheapest rates for teens with bad driving records

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $3,042 | $3,346 |

| American Family | $3,215 | $4,289 |

| Geico | $3,344 | $4,594 |

| Auto-Owners | $3,720 | $6,305 |

| Allstate | $5,240 | $8,273 |

| Progressive | $5,488 | $5,825 |

| Nationwide | $7,163 | $7,250 |

| Farmers | $9,600 | $9,600 |

| USAA* | $1,695 | $1,761 |

Best cheap car insurance in Denver with a DUI: Progressive

Progressive has the cheapest DUI car insurance rate in Denver at $4,420 a year, or $368 a month. Geico is second at $4,641 a year.

Given the number of discounts that Progressive, Geico, State Farm and Auto-Owners offer and the closeness of their rates, comparing quotes from these four companies should help you find the most affordable coverage.

Cheapest car insurance with a DUI

| Company | Annual rate |

|---|---|

| Progressive | $4,420 |

| Geico | $4,641 |

| State Farm | $5,111 |

| Auto-Owners | $5,192 |

| American Family | $5,228 |

| Allstate | $5,303 |

| Farmers | $7,786 |

| Nationwide | $11,008 |

| USAA* | $4,096 |

Cheapest insurance rates for Denver drivers with bad credit: Geico

Drivers in Denver with poor credit get the cheapest auto insurance with Geico at an average of $3,626 a year, or $302 a month. American Family comes in second for bad-credit car insurance, with rates of around $5,090 a year.

Despite the rate gap between the two companies, American Family offers many discounts that could make it better for you. That includes a bundling discount that could save you up to 23% on your insurance costs.

Cheap car insurance with poor credit

| Company | Annual rate |

|---|---|

| Geico | $3,626 |

| American Family | $5,090 |

| Progressive | $5,195 |

| Allstate | $6,736 |

| Nationwide | $7,082 |

| Auto-Owners | $7,579 |

| State Farm | $8,637 |

| Farmers | $9,560 |

| USAA* | $3,927 |

Best car insurance companies in Denver

State Farm is the best car insurance company in Denver. It offers the cheapest average rates for most drivers in the city and good financial strength. The company’s good J.D. Power

State Farm is the next-best option in terms of cost and customer satisfaction. American Family and Auto-Owners also have strong customer satisfaction ratings that are above average, and rates between the two are often competitive.

Denver’s best-rated car insurance companies

| Company | J.D. Power** | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| American Family | 660 | A | |

| Auto-Owners | 654 | A++ | |

| Farmers | 619 | A | |

| Geico | 637 | A++ | |

| Nationwide | 641 | A | |

| Progressive | 622 | A+ | |

| State Farm | 657 | A++ | |

| USAA* | 739 | A++ |

Denver auto insurance rates by neighborhood

Denver drivers living in the 80234 ZIP code pay the city’s cheapest car insurance rates, which average $2,814 a year. Drivers in the 80219 ZIP code have the most expensive average rate of $3,467 a year.

Car insurance rates near you

| ZIP code | Annual rate | % from average |

|---|---|---|

| 80014 | $3,269 | 5% |

| 80110 | $3,035 | -3% |

| 80123 | $2,846 | -9% |

| 80202 | $3,150 | 1% |

| 80203 | $3,199 | 3% |

| 80204 | $3,318 | 7% |

| 80205 | $3,199 | 3% |

| 80206 | $3,174 | 2% |

| 80207 | $3,191 | 2% |

| 80208 | $3,059 | -2% |

| 80209 | $3,108 | 0% |

| 80210 | $3,089 | -1% |

| 80211 | $3,150 | 1% |

| 80212 | $3,089 | -1% |

| 80214 | $3,079 | -1% |

| 80215 | $2,918 | -6% |

| 80216 | $3,154 | 1% |

| 80218 | $3,199 | 3% |

| 80219 | $3,467 | 11% |

| 80220 | $3,246 | 4% |

| 80221 | $2,980 | -4% |

| 80222 | $3,136 | 1% |

| 80223 | $3,398 | 9% |

| 80224 | $3,124 | 0% |

| 80225 | $2,961 | -5% |

| 80226 | $3,048 | -2% |

| 80227 | $3,027 | -3% |

| 80228 | $2,901 | -7% |

| 80229 | $2,950 | -5% |

| 80230 | $3,249 | 4% |

| 80231 | $3,142 | 1% |

| 80232 | $3,067 | -2% |

| 80233 | $2,909 | -7% |

| 80234 | $2,814 | -10% |

| 80235 | $2,989 | -4% |

| 80236 | $3,147 | 1% |

| 80237 | $3,087 | -1% |

| 80238 | $3,133 | 1% |

| 80239 | $3,222 | 3% |

| 80246 | $3,214 | 3% |

| 80247 | $3,269 | 5% |

| 80249 | $3,072 | -1% |

| 80260 | $2,959 | -5% |

| 80262 | $3,142 | 1% |

| 80264 | $3,155 | 1% |

| 80265 | $3,147 | 1% |

| 80266 | $3,099 | 0% |

| 80290 | $3,134 | 1% |

| 80293 | $3,125 | 0% |

| 80294 | $3,133 | 1% |

| 80295 | $3,131 | 1% |

| 80299 | $3,108 | 0% |

Insurers look at several factors besides where you live when calculating your quote. These include:

- Make and model of your car

- Your age

- Driving history

- Claims history

- Coverage limits needed

Denver’s minimum car insurance requirements

Colorado law requires drivers to have at least the state minimum car insurance limits of 25/50/15. This means:

- $25,000 of bodily injury liability coverage for one person

- $50,000 of bodily injury liability coverage for two or more people

- $15,000 of property damage liability coverage

Bodily injury coverage helps cover medical bills for others injured in an accident you cause. Property damage liability handles repair or replacement costs for non-injury costs after an accident.

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: minimum limits, where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.