Cheapest Car Insurance in Iowa (2026)

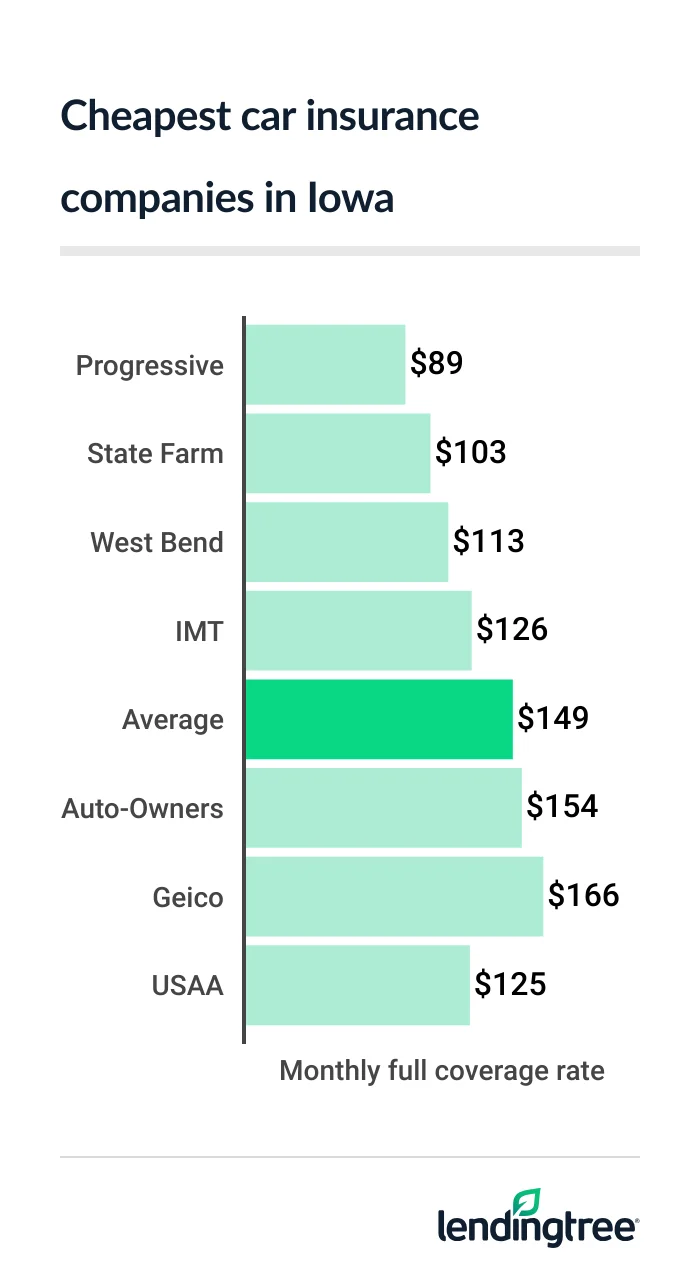

Progressive has Iowa’s cheapest full coverage car insurance, with an average rate of $89 a month. That’s $60 less than the state average of $149 a month.

Best cheap Iowa car insurance

Cheapest full coverage car insurance in Iowa: Progressive

Progressive has the cheapest full coverage car insurance for most Iowa drivers at $89 a month. Progressive is 14% less than the next-cheapest rate of $103 a month from State Farm.

Of these two companies, State Farm has a better satisfaction rating from J.D. Power, or happier customers.

Full coverage

Each company views these factors differently and offers different car insurance discounts. This makes it good to compare car insurance quotes from a few companies to find a cheap rate.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Progressive | $89 | |

| State Farm | $103 | |

| West Bend | $113 | |

| IMT | $126 | |

| Auto-Owners | $154 | |

| Geico | $166 | |

| Nationwide | $185 | |

| Farm Bureau | $191 | |

| Allstate | $234 | |

| USAA* | $125 | |

Cheap Iowa liability insurance: Progressive

At $15 a month, Progressive has Iowa’s cheapest liability insurance, or minimum coverage

Progressive and IMT are available through independent insurance agents. Some independent agents can get you quotes from both companies. You have to contact State Farm separately for its quotes.

Cheap auto liability insurance

| Company | Monthly rate |

|---|---|

| Progressive | $15 |

| State Farm | $20 |

| IMT | $21 |

| Farm Bureau | $30 |

| West Bend | $30 |

| Auto-Owners | $36 |

| Nationwide | $56 |

| Geico | $56 |

| Allstate | $70 |

| USAA* | $25 |

Iowa’s cheapest car insurance for teen drivers: IMT

You can often get Iowa’s cheapest car insurance for teens from IMT. The company’s liability-only rates for young drivers average $59 a month. Progressive and State Farm have the next-cheapest teen liability rates. Both charge less than $70 a month.

IMT also has the cheapest full coverage for teens at $218 a month. This is 16% less than the next-cheapest rate of $261 a month from State Farm.

Monthly teen car insurance rates

| Company | Liability only | Full |

|---|---|---|

| IMT | $59 | $218 |

| Progressive | $65 | $326 |

| State Farm | $68 | $261 |

| Farm Bureau | $86 | $402 |

| Geico | $108 | $330 |

| West Bend | $124 | $335 |

| Auto-Owners | $130 | $376 |

| Nationwide | $170 | $524 |

| Allstate | $186 | $449 |

| USAA* | $73 | $303 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This is the main reason why their insurance rates are so high. Teens usually get cheaper car insurance when added to a parent’s policy than they do on their own.

Discounts can also make car insurance more affordable for teens.

- Progressive and IMT give Iowa teens a discount for getting good grades.

- Progressive also has a discount for parents who add a teen under 18 to their policy.

Other companies have these and other discounts for young drivers. It’s good to ask about them when you get your quotes.

Best Iowa car insurance rates after a speeding ticket: State Farm

State Farm has the cheapest car insurance for Iowa drivers with a speeding ticket at $109 a month. This is 46% less than the state average of $198 a month after a ticket. Progressive is the next-cheapest company at $129 a month.

Insurance rates after a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $107 |

| Progressive | $129 |

| IMT | $174 |

| Geico | $212 |

| West Bend | $226 |

| Nationwide | $231 |

| Farm Bureau | $234 |

| Auto-Owners | $256 |

| Allstate | $257 |

| USAA* | $155 |

A speeding ticket raises the average price of car insurance in Iowa by an average of 33%. However, some companies increase their rates after an incident by lower amounts. Comparing quotes helps you find cheap car insurance for a bad driving record.

Cheapest Iowa car insurance after an accident: State Farm

Iowa drivers with an at-fault accident can get the cheapest car insurance from State Farm. The company’s rates average $103 a month after an accident. This is 29% less than the next-cheapest rate of $145 a month from Progressive.

Insurance rates after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $103 |

| Progressive | $145 |

| West Bend | $191 |

| IMT | $193 |

| Auto-Owners | $197 |

| Geico | $288 |

| Nationwide | $293 |

| Farm Bureau | $311 |

| Allstate | $344 |

| USAA* | $177 |

Best insurance for Iowa teens with a bad driving record: Progressive and State Farm

Progressive and State Farm have Iowa’s cheapest car insurance for teens with a bad driving record. Progressive has the cheapest liability rates for teens with a ticket at $73 a month. However, State Farm is only slightly more expensive at $75 a month.

State Farm is the cheapest company for teens with an at-fault accident at $68 a month. This only beats Progressive’s rate by $10 a month. When rates are this close, it’s good to compare car insurance quotes from both companies when you shop.

Insurance rates for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Progressive | $73 | $78 |

| State Farm | $75 | $68 |

| IMT | $83 | $105 |

| Farm Bureau | $106 | $140 |

| Geico | $146 | $186 |

| Nationwide | $182 | $187 |

| Allstate | $212 | $309 |

| West Bend | $269 | $183 |

| Auto-Owners | $279 | $182 |

| USAA* | $115 | $128 |

Cheapest Iowa car insurance after an OWI: Progressive

At $119 a month, Progressive has Iowa’s cheapest OWI insurance. State Farm has the next-cheapest rate for drivers with an OWI (operating while intoxicated) at $171 a month.

An OWI raises the average price of Iowa car insurance by 80% to $268 a month.

Insurance rates with a OWI

| Company | Monthly rate |

|---|---|

| Progressive | $119 |

| State Farm | $171 |

| West Bend | $213 |

| IMT | $223 |

| Geico | $262 |

| Allstate | $307 |

| Auto-Owners | $342 |

| Nationwide | $367 |

| Farm Bureau | $418 |

| USAA* | $257 |

Iowa’s cheapest bad credit car insurance: Progressive

Progressive has Iowa’s cheapest bad credit car insurance at $144 a month. IMT has the next-cheapest rates at $168 a month. Both companies charge far less than the average of $282 a month for drivers with bad credit.

Insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Progressive | $144 |

| IMT | $168 |

| West Bend | $202 |

| Geico | $240 |

| Nationwide | $264 |

| Farm Bureau | $328 |

| Allstate | $353 |

| Auto-Owners | $395 |

| State Farm | $512 |

| USAA* | $216 |

Best Iowa car insurance companies

Progressive and State Farm are Iowa’s best car insurance companies for slightly different reasons.

Progressive stands out for its low rates and flexible coverage options. It offers accident forgiveness and gap insurance

State Farm has low rates and a better customer satisfaction rating than Progressive. State Farm’s high score from J.D. Power means its customers like its prices, coverage options and service. It’s often the best choice if you don’t need the extra coverages that Progressive offers.

IMT is Iowa’s best regional car insurance company for auto insurance quotes. Its low rates for teens make it a good choice for young drivers and families. IMT also offers:

-

New car replacement

, which you can’t get from Progressive or State Farm.If you total your car while it’s still relatively new, new car replacement pays for a new one, with no deduction for depreciation.

- Gap coverage, which you can also get from Progressive, but not State Farm.

Insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Auto-Owners | 638 | A+ | |

| Farm Bureau | 645 | A | |

| Geico | 645 | A++ | |

| IMT | Not rated | A- | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ | |

| West Bend | Not rated | A |

Iowa car insurance rates by city

Ames has the cheapest car insurance among Iowa’s cities and towns at $122 a month. Coralville, Iowa City and University Heights tie for the next-cheapest rate of $123 a month.

Drivers in Bedford and Gravity have Iowa’s most expensive car insurance at $177 a month. This is 19% higher than the state average. Redding drivers have the next-highest rate at $176 a month.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Ackley | $139 | -6% |

| Ackworth | $147 | -1% |

| Adair | $159 | 7% |

| Adel | $141 | -5% |

| Afton | $161 | 9% |

| Agency | $145 | -2% |

| Ainsworth | $144 | -3% |

| Akron | $146 | -1% |

| Albert City | $138 | -7% |

| Albia | $156 | 5% |

| Albion | $144 | -3% |

| Alburnett | $141 | -5% |

| Alexander | $136 | -8% |

| Algona | $135 | -9% |

| Alleman | $137 | -8% |

| Allerton | $164 | 10% |

| Allison | $148 | -1% |

| Alta | $138 | -7% |

| Alta Vista | $148 | -1% |

| Alton | $136 | -9% |

| Altoona | $133 | -11% |

| Alvord | $139 | -7% |

| Amana | $146 | -2% |

| Ames | $122 | -18% |

| Anamosa | $151 | 2% |

| Andover | $141 | -5% |

| Andrew | $144 | -3% |

| Anita | $161 | 8% |

| Ankeny | $127 | -15% |

| Anthon | $148 | -1% |

| Aplington | $144 | -3% |

| Archer | $140 | -6% |

| Aredale | $144 | -3% |

| Argyle | $147 | -1% |

| Arion | $147 | -1% |

| Arispe | $158 | 7% |

| Arlington | $155 | 4% |

| Armstrong | $135 | -9% |

| Arnolds Park | $135 | -9% |

| Arthur | $142 | -5% |

| Asbury | $135 | -10% |

| Ashton | $138 | -7% |

| Aspinwall | $141 | -5% |

| Atalissa | $138 | -7% |

| Atkins | $142 | -4% |

| Atlantic | $158 | 7% |

| Auburn | $139 | -7% |

| Audubon | $149 | 0% |

| Aurelia | $143 | -4% |

| Aurora | $147 | -1% |

| Austinville | $145 | -3% |

| Avoca | $161 | 8% |

| Ayrshire | $140 | -6% |

| Badger | $141 | -5% |

| Bagley | $149 | 0% |

| Baldwin | $148 | 0% |

| Bancroft | $137 | -8% |

| Barnes City | $148 | -1% |

| Barnum | $143 | -4% |

| Batavia | $152 | 2% |

| Battle Creek | $143 | -4% |

| Baxter | $139 | -6% |

| Bayard | $153 | 3% |

| Beacon | $143 | -4% |

| Beaman | $141 | -5% |

| Bedford | $177 | 19% |

| Belle Plaine | $148 | -1% |

| Bellevue | $146 | -2% |

| Belmond | $136 | -8% |

| Bennett | $141 | -5% |

| Benton | $169 | 14% |

| Bernard | $145 | -2% |

| Berwick | $133 | -10% |

| Bettendorf | $135 | -9% |

| Bevington | $150 | 1% |

| Birmingham | $155 | 4% |

| Blairsburg | $137 | -8% |

| Blairstown | $143 | -4% |

| Blakesburg | $153 | 3% |

| Blanchard | $162 | 9% |

| Blencoe | $152 | 2% |

| Blockton | $173 | 16% |

| Bloomfield | $159 | 7% |

| Bode | $138 | -7% |

| Bondurant | $135 | -9% |

| Boone | $138 | -7% |

| Booneville | $138 | -7% |

| Bouton | $140 | -6% |

| Boxholm | $141 | -5% |

| Boyden | $137 | -8% |

| Braddyville | $168 | 13% |

| Bradgate | $140 | -6% |

| Brandon | $140 | -6% |

| Brayton | $153 | 3% |

| Breda | $137 | -8% |

| Bridgewater | $161 | 9% |

| Brighton | $149 | 0% |

| Bristow | $147 | -1% |

| Britt | $135 | -9% |

| Bronson | $141 | -5% |

| Brooklyn | $146 | -1% |

| Brunsville | $139 | -6% |

| Bryant | $139 | -7% |

| Buckingham | $144 | -3% |

| Buffalo Center | $137 | -8% |

| Burlington | $131 | -12% |

| Burnside | $142 | -4% |

| Bussey | $148 | -1% |

| Calamus | $137 | -8% |

| Callender | $143 | -4% |

| Calumet | $142 | -4% |

| Camanche | $134 | -10% |

| Cambridge | $133 | -10% |

| Cantril | $156 | 5% |

| Carbon | $169 | 14% |

| Carlisle | $143 | -4% |

| Carpenter | $144 | -3% |

| Carroll | $133 | -11% |

| Carson | $167 | 13% |

| Carter Lake | $172 | 16% |

| Cascade | $148 | -1% |

| Casey | $160 | 8% |

| Castalia | $156 | 5% |

| Castana | $147 | -1% |

| Cedar | $145 | -3% |

| Cedar Falls | $139 | -7% |

| Cedar Rapids | $137 | -8% |

| Center Junction | $150 | 1% |

| Center Point | $142 | -5% |

| Centerville | $158 | 7% |

| Central City | $146 | -2% |

| Chapin | $139 | -6% |

| Chariton | $157 | 6% |

| Charles City | $145 | -2% |

| Charlotte | $137 | -8% |

| Charter Oak | $144 | -3% |

| Chatsworth | $143 | -3% |

| Chelsea | $151 | 2% |

| Cherokee | $143 | -4% |

| Chester | $154 | 3% |

| Chillicothe | $145 | -2% |

| Churdan | $142 | -5% |

| Cincinnati | $161 | 8% |

| Clare | $143 | -4% |

| Clarence | $144 | -3% |

| Clarinda | $165 | 11% |

| Clarion | $134 | -10% |

| Clarksville | $145 | -2% |

| Clear Lake | $134 | -10% |

| Clearfield | $175 | 17% |

| Cleghorn | $143 | -4% |

| Clemons | $143 | -4% |

| Clermont | $155 | 4% |

| Climbing Hill | $145 | -3% |

| Clinton | $136 | -8% |

| Clio | $161 | 8% |

| Clive | $130 | -12% |

| Clutier | $148 | 0% |

| Coggon | $146 | -2% |

| Coin | $165 | 11% |

| Colesburg | $151 | 1% |

| Colfax | $138 | -7% |

| College Springs | $164 | 10% |

| Collins | $139 | -7% |

| Colo | $135 | -10% |

| Columbia | $149 | 0% |

| Columbus City | $147 | -1% |

| Columbus Junction | $146 | -2% |

| Colwell | $147 | -1% |

| Conesville | $140 | -6% |

| Conrad | $140 | -6% |

| Conroy | $146 | -2% |

| Coon Rapids | $144 | -3% |

| Cooper | $143 | -4% |

| Coralville | $123 | -17% |

| Corning | $173 | 16% |

| Correctionville | $146 | -2% |

| Corwith | $137 | -8% |

| Corydon | $162 | 9% |

| Coulter | $138 | -7% |

| Council Bluffs | $167 | 12% |

| Crawfordsville | $144 | -3% |

| Crescent | $170 | 14% |

| Cresco | $153 | 3% |

| Creston | $157 | 5% |

| Cromwell | $156 | 5% |

| Crystal Lake | $139 | -7% |

| Cumberland | $167 | 12% |

| Cumming | $142 | -4% |

| Curlew | $138 | -7% |

| Cushing | $144 | -3% |

| Cylinder | $135 | -9% |

| Dakota City | $141 | -5% |

| Dallas Center | $139 | -7% |

| Dana | $142 | -4% |

| Danbury | $147 | -1% |

| Davenport | $139 | -6% |

| Davis City | $165 | 11% |

| Dawson | $143 | -4% |

| Dayton | $140 | -6% |

| De Soto | $148 | -1% |

| De Witt | $134 | -10% |

| Decatur | $161 | 8% |

| Decorah | $153 | 3% |

| Dedham | $142 | -5% |

| Defiance | $147 | -1% |

| Delaware | $148 | 0% |

| Delmar | $139 | -7% |

| Deloit | $142 | -4% |

| Delta | $150 | 1% |

| Denison | $144 | -3% |

| Denmark | $143 | -4% |

| Denver | $145 | -3% |

| Derby | $158 | 6% |

| Des Moines | $141 | -5% |

| Dewar | $147 | -1% |

| Dexter | $156 | 5% |

| Diagonal | $168 | 13% |

| Dickens | $137 | -8% |

| Dike | $141 | -5% |

| Dixon | $134 | -10% |

| Dolliver | $137 | -8% |

| Donahue | $133 | -11% |

| Donnellson | $148 | -1% |

| Dorchester | $160 | 8% |

| Douds | $158 | 6% |

| Dougherty | $142 | -5% |

| Dow City | $147 | -1% |

| Dows | $136 | -9% |

| Drakesville | $154 | 4% |

| Dubuque | $137 | -8% |

| Dumont | $144 | -3% |

| Duncombe | $141 | -5% |

| Dundee | $151 | 2% |

| Dunkerton | $146 | -2% |

| Dunlap | $155 | 4% |

| Durango | $141 | -5% |

| Durant | $135 | -9% |

| Dyersville | $140 | -6% |

| Dysart | $145 | -2% |

| Eagle Grove | $135 | -9% |

| Earlham | $154 | 4% |

| Earling | $151 | 2% |

| Earlville | $147 | -1% |

| Early | $139 | -6% |

| East Peru | $158 | 6% |

| Eddyville | $147 | -1% |

| Edgewood | $152 | 2% |

| Elberon | $147 | -1% |

| Eldon | $152 | 2% |

| Eldora | $141 | -5% |

| Eldridge | $132 | -11% |

| Elgin | $158 | 6% |

| Elk Horn | $156 | 5% |

| Elk Run Heights | $143 | -4% |

| Elkader | $158 | 6% |

| Elkport | $154 | 4% |

| Elliott | $168 | 13% |

| Ellston | $166 | 11% |

| Ellsworth | $135 | -9% |

| Elma | $152 | 2% |

| Ely | $139 | -7% |

| Emerson | $168 | 13% |

| Emmetsburg | $135 | -9% |

| Epworth | $140 | -6% |

| Essex | $166 | 11% |

| Estherville | $135 | -9% |

| Evansdale | $141 | -5% |

| Everly | $139 | -6% |

| Exira | $152 | 2% |

| Exline | $161 | 8% |

| Fairfax | $137 | -8% |

| Fairfield | $147 | -1% |

| Farley | $140 | -6% |

| Farnhamville | $142 | -5% |

| Farragut | $165 | 11% |

| Fayette | $154 | 3% |

| Ferguson | $143 | -4% |

| Fertile | $142 | -4% |

| Floris | $161 | 8% |

| Floyd | $146 | -2% |

| Fonda | $142 | -5% |

| Fontanelle | $164 | 10% |

| Forest City | $135 | -9% |

| Fort Atkinson | $155 | 4% |

| Fort Dodge | $141 | -5% |

| Fort Madison | $143 | -4% |

| Fostoria | $141 | -5% |

| Fredericksburg | $149 | 0% |

| Fremont | $146 | -2% |

| Fruitland | $139 | -7% |

| Galt | $139 | -7% |

| Galva | $141 | -5% |

| Garber | $157 | 6% |

| Garden City | $139 | -7% |

| Garden Grove | $167 | 12% |

| Garnavillo | $158 | 6% |

| Garner | $134 | -10% |

| Garrison | $142 | -4% |

| Garwin | $143 | -4% |

| George | $139 | -7% |

| Gibson | $149 | 0% |

| Gifford | $146 | -2% |

| Gilbert | $127 | -14% |

| Gilbertville | $142 | -4% |

| Gilman | $142 | -4% |

| Gilmore City | $140 | -6% |

| Gladbrook | $143 | -4% |

| Glenwood | $169 | 14% |

| Glidden | $137 | -8% |

| Goldfield | $136 | -9% |

| Goodell | $138 | -7% |

| Goose Lake | $136 | -9% |

| Gowrie | $142 | -4% |

| Graettinger | $137 | -8% |

| Grafton | $143 | -4% |

| Grand Junction | $143 | -4% |

| Grand Mound | $138 | -7% |

| Granger | $137 | -8% |

| Granville | $140 | -6% |

| Gravity | $177 | 19% |

| Gray | $148 | 0% |

| Greeley | $151 | 1% |

| Greene | $149 | 0% |

| Greenfield | $161 | 8% |

| Greenville | $139 | -7% |

| Grimes | $127 | -15% |

| Grinnell | $144 | -3% |

| Griswold | $166 | 11% |

| Grundy Center | $140 | -6% |

| Guernsey | $144 | -3% |

| Guthrie Center | $157 | 6% |

| Guttenberg | $154 | 4% |

| Halbur | $138 | -7% |

| Hamburg | $167 | 12% |

| Hamilton | $148 | -1% |

| Hamlin | $150 | 1% |

| Hampton | $137 | -8% |

| Hancock | $163 | 10% |

| Hanlontown | $141 | -5% |

| Harcourt | $142 | -4% |

| Hardy | $137 | -8% |

| Harlan | $152 | 2% |

| Harper | $149 | 0% |

| Harpers Ferry | $162 | 9% |

| Harris | $139 | -6% |

| Hartford | $147 | -1% |

| Hartley | $139 | -6% |

| Hartwick | $148 | 0% |

| Harvey | $144 | -3% |

| Hastings | $170 | 14% |

| Havelock | $138 | -7% |

| Haverhill | $144 | -3% |

| Hawarden | $140 | -6% |

| Hawkeye | $152 | 2% |

| Hayesville | $149 | 0% |

| Hazleton | $144 | -3% |

| Hedrick | $151 | 1% |

| Henderson | $170 | 14% |

| Hiawatha | $136 | -8% |

| Highlandville | $152 | 2% |

| Hills | $138 | -7% |

| Hillsboro | $150 | 1% |

| Hinton | $145 | -2% |

| Holland | $141 | -5% |

| Holstein | $143 | -4% |

| Holy Cross | $144 | -3% |

| Homestead | $146 | -2% |

| Honey Creek | $164 | 10% |

| Hopkinton | $150 | 1% |

| Hornick | $146 | -2% |

| Hospers | $138 | -7% |

| Houghton | $147 | -1% |

| Hubbard | $136 | -9% |

| Hudson | $139 | -6% |

| Hull | $135 | -9% |

| Humboldt | $141 | -5% |

| Humeston | $160 | 8% |

| Huxley | $134 | -10% |

| Ida Grove | $141 | -5% |

| Imogene | $165 | 11% |

| Independence | $139 | -6% |

| Indianola | $148 | 0% |

| Inwood | $140 | -6% |

| Ionia | $146 | -2% |

| Iowa City | $123 | -17% |

| Iowa Falls | $134 | -10% |

| Ira | $140 | -6% |

| Ireton | $137 | -8% |

| Irwin | $147 | -1% |

| Jamaica | $149 | 0% |

| Janesville | $142 | -4% |

| Jefferson | $143 | -4% |

| Jesup | $139 | -6% |

| Jewell | $135 | -9% |

| Johnston | $127 | -15% |

| Joice | $143 | -4% |

| Jolley | $139 | -6% |

| Kalona | $143 | -4% |

| Kamrar | $139 | -6% |

| Kanawha | $136 | -9% |

| Kellerton | $170 | 15% |

| Kelley | $135 | -9% |

| Kensett | $145 | -2% |

| Keokuk | $144 | -3% |

| Keosauqua | $161 | 8% |

| Keota | $150 | 1% |

| Kesley | $145 | -2% |

| Keswick | $152 | 2% |

| Keystone | $146 | -2% |

| Killduff | $139 | -7% |

| Kimballton | $151 | 1% |

| Kingsley | $141 | -5% |

| Kinross | $150 | 1% |

| Kirkman | $150 | 1% |

| Kirkville | $145 | -2% |

| Kiron | $142 | -4% |

| Klemme | $136 | -9% |

| Knierim | $144 | -3% |

| Knoxville | $147 | -1% |

| La Motte | $147 | -1% |

| La Porte City | $143 | -4% |

| Lacona | $156 | 5% |

| Ladora | $149 | 0% |

| Lake City | $138 | -7% |

| Lake Mills | $137 | -8% |

| Lake Park | $137 | -8% |

| Lake View | $139 | -6% |

| Lakota | $137 | -8% |

| Lamoni | $166 | 12% |

| Lamont | $149 | 0% |

| Lanesboro | $138 | -7% |

| Langworthy | $150 | 1% |

| Lansing | $163 | 10% |

| Larchwood | $140 | -6% |

| Larrabee | $145 | -2% |

| Latimer | $137 | -8% |

| Laurel | $144 | -3% |

| Laurens | $138 | -7% |

| Lawler | $151 | 2% |

| Lawton | $140 | -5% |

| Le Claire | $131 | -12% |

| Le Grand | $143 | -4% |

| Le Mars | $136 | -9% |

| Ledyard | $136 | -8% |

| Lehigh | $141 | -5% |

| Leighton | $141 | -5% |

| Leland | $138 | -7% |

| Lenox | $171 | 15% |

| Leon | $169 | 14% |

| Letts | $140 | -6% |

| Lewis | $160 | 8% |

| Liberty Center | $149 | 0% |

| Libertyville | $152 | 2% |

| Lidderdale | $137 | -8% |

| Lime Springs | $155 | 4% |

| Linden | $146 | -2% |

| Lineville | $163 | 10% |

| Linn Grove | $141 | -5% |

| Lisbon | $145 | -2% |

| Little Cedar | $148 | -1% |

| Little Rock | $139 | -7% |

| Little Sioux | $156 | 5% |

| Livermore | $137 | -8% |

| Logan | $161 | 8% |

| Lohrville | $141 | -5% |

| Lone Rock | $138 | -7% |

| Lone Tree | $136 | -9% |

| Long Grove | $132 | -11% |

| Lorimor | $167 | 12% |

| Lost Nation | $142 | -5% |

| Lovilia | $156 | 5% |

| Low Moor | $136 | -8% |

| Lowden | $143 | -4% |

| Lu Verne | $136 | -8% |

| Luana | $156 | 5% |

| Lucas | $160 | 8% |

| Luther | $138 | -7% |

| Luxemburg | $147 | -1% |

| Luzerne | $146 | -2% |

| Lynnville | $139 | -6% |

| Lytton | $139 | -6% |

| Macksburg | $157 | 5% |

| Madrid | $139 | -6% |

| Magnolia | $159 | 7% |

| Malcom | $144 | -3% |

| Mallard | $139 | -7% |

| Malvern | $170 | 14% |

| Manchester | $147 | -1% |

| Manilla | $141 | -5% |

| Manly | $142 | -4% |

| Manning | $139 | -6% |

| Manson | $142 | -5% |

| Mapleton | $147 | -1% |

| Maquoketa | $141 | -5% |

| Marathon | $137 | -8% |

| Marble Rock | $147 | -1% |

| Marcus | $142 | -4% |

| Marengo | $149 | 0% |

| Marion | $136 | -8% |

| Marne | $160 | 8% |

| Marquette | $156 | 5% |

| Marshalltown | $138 | -7% |

| Martelle | $149 | 0% |

| Martensdale | $149 | 0% |

| Martinsburg | $149 | 0% |

| Mason City | $131 | -12% |

| Masonville | $147 | -1% |

| Massena | $165 | 11% |

| Matlock | $140 | -6% |

| Maurice | $136 | -9% |

| Maxwell | $139 | -6% |

| Maynard | $149 | 0% |

| Mc Callsburg | $136 | -9% |

| Mc Causland | $133 | -11% |

| Mc Clelland | $163 | 10% |

| Mc Gregor | $156 | 5% |

| Mc Intire | $147 | -1% |

| Mechanicsville | $148 | -1% |

| Mediapolis | $144 | -3% |

| Melbourne | $143 | -4% |

| Melcher-Dallas | $151 | 2% |

| Melrose | $162 | 9% |

| Melvin | $139 | -6% |

| Menlo | $160 | 8% |

| Meriden | $145 | -2% |

| Merrill | $141 | -5% |

| Meservey | $138 | -7% |

| Middle | $147 | -1% |

| Middle Amana | $147 | -1% |

| Middletown | $140 | -6% |

| Miles | $141 | -5% |

| Milford | $137 | -8% |

| Millersburg | $148 | 0% |

| Millerton | $157 | 5% |

| Milo | $152 | 2% |

| Milton | $161 | 8% |

| Minburn | $143 | -4% |

| Minden | $164 | 10% |

| Mineola | $166 | 12% |

| Mingo | $141 | -5% |

| Missouri Valley | $160 | 8% |

| Mitchellville | $141 | -5% |

| Modale | $158 | 6% |

| Mondamin | $162 | 9% |

| Monmouth | $149 | 1% |

| Monona | $157 | 6% |

| Monroe | $137 | -8% |

| Montezuma | $146 | -2% |

| Monticello | $153 | 3% |

| Montour | $144 | -3% |

| Montpelier | $136 | -9% |

| Montrose | $147 | -1% |

| Moorhead | $151 | 1% |

| Moorland | $143 | -4% |

| Moravia | $161 | 8% |

| Morley | $147 | -1% |

| Morning Sun | $144 | -3% |

| Morrison | $142 | -4% |

| Moscow | $138 | -7% |

| Moulton | $162 | 9% |

| Mount Auburn | $142 | -4% |

| Mount Ayr | $171 | 15% |

| Mount Pleasant | $143 | -4% |

| Mount Sterling | $162 | 9% |

| Mount Union | $143 | -4% |

| Mount Vernon | $146 | -2% |

| Moville | $143 | -4% |

| Murray | $164 | 10% |

| Muscatine | $133 | -10% |

| Mystic | $161 | 8% |

| Nashua | $148 | -1% |

| Nemaha | $139 | -6% |

| Nevada | $133 | -10% |

| New Albin | $164 | 10% |

| New Hampton | $147 | -1% |

| New Hartford | $143 | -3% |

| New Liberty | $135 | -9% |

| New London | $144 | -3% |

| New Market | $170 | 14% |

| New Providence | $140 | -6% |

| New Sharon | $144 | -3% |

| New Vienna | $144 | -3% |

| New Virginia | $161 | 8% |

| Newell | $139 | -7% |

| Newhall | $143 | -4% |

| Newton | $136 | -9% |

| Nichols | $138 | -7% |

| Nodaway | $169 | 13% |

| Nora Springs | $143 | -4% |

| North Buena Vista | $149 | 0% |

| North English | $150 | 1% |

| North Liberty | $129 | -13% |

| North Washington | $146 | -2% |

| Northboro | $164 | 10% |

| Northwood | $143 | -4% |

| Norwalk | $144 | -3% |

| Norway | $142 | -5% |

| Oakland | $165 | 11% |

| Oakville | $148 | 0% |

| Odebolt | $140 | -6% |

| Oelwein | $147 | -1% |

| Ogden | $140 | -6% |

| Okoboji | $135 | -9% |

| Olds | $145 | -2% |

| Olin | $151 | 2% |

| Ollie | $150 | 1% |

| Onawa | $146 | -2% |

| Onslow | $151 | 2% |

| Oran | $149 | 0% |

| Orange City | $135 | -9% |

| Orchard | $147 | -1% |

| Orient | $164 | 10% |

| Osage | $145 | -2% |

| Osceola | $162 | 9% |

| Oskaloosa | $140 | -6% |

| Ossian | $157 | 5% |

| Otley | $141 | -5% |

| Oto | $145 | -2% |

| Ottosen | $139 | -6% |

| Ottumwa | $142 | -5% |

| Oxford | $138 | -7% |

| Oxford Junction | $150 | 1% |

| Oyens | $138 | -7% |

| Pacific Junction | $169 | 14% |

| Packwood | $151 | 2% |

| Palmer | $140 | -6% |

| Palo | $139 | -7% |

| Panama | $155 | 4% |

| Panora | $156 | 5% |

| Park View | $132 | -11% |

| Parkersburg | $144 | -3% |

| Parnell | $146 | -2% |

| Patterson | $155 | 4% |

| Paullina | $140 | -6% |

| Pella | $137 | -8% |

| Peosta | $139 | -7% |

| Percival | $166 | 12% |

| Perry | $142 | -4% |

| Persia | $160 | 8% |

| Peru | $158 | 6% |

| Pierson | $145 | -3% |

| Pilot Grove | $144 | -3% |

| Pilot Mound | $141 | -5% |

| Pisgah | $163 | 9% |

| Plainfield | $144 | -3% |

| Plano | $158 | 7% |

| Pleasant Hill | $136 | -9% |

| Pleasant Valley | $134 | -10% |

| Pleasantville | $147 | -1% |

| Plover | $140 | -6% |

| Plymouth | $138 | -7% |

| Pocahontas | $138 | -7% |

| Polk City | $137 | -8% |

| Pomeroy | $139 | -6% |

| Popejoy | $138 | -7% |

| Portsmouth | $157 | 6% |

| Postville | $158 | 6% |

| Prairie City | $141 | -5% |

| Prairieburg | $146 | -2% |

| Prescott | $166 | 12% |

| Preston | $141 | -5% |

| Primghar | $139 | -6% |

| Princeton | $132 | -11% |

| Prole | $149 | 0% |

| Promise City | $163 | 9% |

| Protivin | $151 | 1% |

| Pulaski | $156 | 5% |

| Quasqueton | $142 | -4% |

| Quimby | $145 | -2% |

| Radcliffe | $135 | -9% |

| Rake | $138 | -7% |

| Ralston | $140 | -6% |

| Randalia | $149 | 0% |

| Randall | $137 | -8% |

| Randolph | $167 | 12% |

| Raymond | $142 | -4% |

| Readlyn | $147 | -1% |

| Reasnor | $139 | -7% |

| Red Oak | $164 | 11% |

| Redding | $176 | 18% |

| Redfield | $152 | 2% |

| Reinbeck | $142 | -4% |

| Rembrandt | $140 | -6% |

| Remsen | $139 | -7% |

| Renwick | $138 | -7% |

| Rhodes | $143 | -4% |

| Riceville | $150 | 1% |

| Ricketts | $147 | -1% |

| Ridgeway | $156 | 5% |

| Ringsted | $135 | -9% |

| Rippey | $145 | -3% |

| Riverside | $138 | -7% |

| Riverton | $164 | 11% |

| Robins | $134 | -10% |

| Rock Falls | $138 | -7% |

| Rock Rapids | $138 | -7% |

| Rock Valley | $138 | -7% |

| Rockford | $146 | -2% |

| Rockwell | $138 | -7% |

| Rockwell City | $140 | -6% |

| Rodney | $147 | -1% |

| Roland | $131 | -12% |

| Rolfe | $139 | -7% |

| Rose Hill | $144 | -3% |

| Rowan | $139 | -6% |

| Rowley | $140 | -6% |

| Royal | $141 | -5% |

| Rudd | $145 | -2% |

| Runnells | $144 | -3% |

| Russell | $163 | 10% |

| Ruthven | $137 | -8% |

| Rutland | $141 | -5% |

| Ryan | $148 | -1% |

| Sabula | $142 | -4% |

| Sac City | $138 | -7% |

| Salem | $146 | -2% |

| Salix | $143 | -4% |

| Sanborn | $140 | -6% |

| Saylorville | $133 | -11% |

| Scarville | $139 | -6% |

| Schaller | $139 | -7% |

| Schleswig | $143 | -4% |

| Searsboro | $143 | -4% |

| Selma | $154 | 4% |

| Sergeant Bluff | $143 | -4% |

| Seymour | $165 | 11% |

| Shambaugh | $164 | 10% |

| Shannon City | $162 | 9% |

| Sharpsburg | $171 | 15% |

| Sheffield | $139 | -6% |

| Sheldahl | $139 | -7% |

| Sheldon | $139 | -6% |

| Shell Rock | $143 | -4% |

| Shellsburg | $145 | -3% |

| Shenandoah | $160 | 8% |

| Sherrill | $142 | -4% |

| Sibley | $140 | -6% |

| Sidney | $168 | 13% |

| Sigourney | $149 | 0% |

| Silver City | $169 | 13% |

| Sioux Center | $135 | -9% |

| Sioux City | $152 | 3% |

| Sioux Rapids | $139 | -6% |

| Slater | $135 | -9% |

| Smithland | $146 | -2% |

| Soldier | $148 | 0% |

| Solon | $138 | -7% |

| Somers | $142 | -4% |

| South Amana | $146 | -2% |

| South English | $150 | 1% |

| Spencer | $137 | -8% |

| Sperry | $143 | -4% |

| Spillville | $151 | 2% |

| Spirit Lake | $135 | -9% |

| Spragueville | $144 | -3% |

| Springbrook | $145 | -2% |

| Springville | $145 | -3% |

| St. Ansgar | $143 | -4% |

| St. Anthony | $143 | -4% |

| St. Charles | $160 | 7% |

| St. Donatus | $145 | -2% |

| St. Lucas | $152 | 2% |

| St. Marys | $153 | 3% |

| St. Olaf | $156 | 5% |

| St. Paul | $144 | -3% |

| Stanhope | $137 | -8% |

| Stanley | $147 | -1% |

| Stanton | $167 | 13% |

| Stanwood | $147 | -1% |

| Steamboat Rock | $140 | -6% |

| Stockport | $151 | 2% |

| Stockton | $135 | -9% |

| Storm Lake | $137 | -8% |

| Story City | $130 | -13% |

| Stout | $141 | -5% |

| Stratford | $141 | -5% |

| Strawberry Point | $155 | 5% |

| Stuart | $159 | 7% |

| Sully | $139 | -7% |

| Sumner | $148 | -1% |

| Superior | $138 | -7% |

| Sutherland | $142 | -4% |

| Swaledale | $138 | -7% |

| Swan | $145 | -2% |

| Swea City | $137 | -8% |

| Swedesburg | $144 | -3% |

| Swisher | $136 | -9% |

| Tabor | $167 | 12% |

| Tama | $145 | -2% |

| Teeds Grove | $139 | -7% |

| Templeton | $141 | -5% |

| Terril | $137 | -8% |

| Thayer | $163 | 9% |

| Thompson | $136 | -9% |

| Thor | $140 | -6% |

| Thornburg | $150 | 1% |

| Thornton | $137 | -8% |

| Thurman | $169 | 14% |

| Tiffin | $133 | -11% |

| Tingley | $165 | 11% |

| Tipton | $142 | -5% |

| Titonka | $138 | -7% |

| Toddville | $138 | -7% |

| Toeterville | $143 | -3% |

| Toledo | $145 | -2% |

| Tracy | $145 | -3% |

| Traer | $143 | -4% |

| Treynor | $163 | 10% |

| Tripoli | $146 | -2% |

| Troy Mills | $143 | -4% |

| Truesdale | $139 | -6% |

| Truro | $161 | 9% |

| Udell | $157 | 6% |

| Underwood | $164 | 10% |

| Unionville | $157 | 5% |

| University Heights | $123 | -17% |

| University Park | $142 | -4% |

| Urbana | $144 | -3% |

| Urbandale | $130 | -12% |

| Ute | $147 | -1% |

| Vail | $140 | -6% |

| Van Horne | $145 | -3% |

| Van Meter | $147 | -1% |

| Van Wert | $168 | 13% |

| Varina | $143 | -4% |

| Ventura | $135 | -9% |

| Victor | $150 | 1% |

| Villisca | $173 | 16% |

| Vincent | $141 | -5% |

| Vining | $147 | -1% |

| Vinton | $144 | -3% |

| Volga | $153 | 3% |

| Wadena | $157 | 6% |

| Walcott | $133 | -11% |

| Walford | $141 | -5% |

| Walker | $143 | -4% |

| Wall Lake | $141 | -5% |

| Wallingford | $137 | -8% |

| Walnut | $160 | 8% |

| Wapello | $144 | -3% |

| Washington | $142 | -4% |

| Washta | $145 | -2% |

| Waterloo | $142 | -5% |

| Waterville | $157 | 6% |

| Watkins | $142 | -5% |

| Waucoma | $154 | 4% |

| Waukee | $133 | -11% |

| Waukon | $157 | 5% |

| Waverly | $141 | -5% |

| Wayland | $146 | -2% |

| Webb | $142 | -4% |

| Webster | $153 | 3% |

| Webster City | $139 | -7% |

| Weldon | $164 | 10% |

| Wellman | $145 | -2% |

| Wellsburg | $140 | -6% |

| Welton | $138 | -7% |

| West Bend | $135 | -9% |

| West Branch | $139 | -7% |

| West Burlington | $131 | -12% |

| West Chester | $147 | -1% |

| West Des Moines | $132 | -11% |

| West Liberty | $137 | -8% |

| West Point | $144 | -3% |

| West Union | $153 | 3% |

| Westfield | $148 | 0% |

| Westgate | $149 | 0% |

| Westside | $140 | -6% |

| Wever | $143 | -4% |

| What Cheer | $150 | 1% |

| Wheatland | $140 | -6% |

| Whiting | $145 | -2% |

| Whittemore | $137 | -8% |

| Whitten | $144 | -3% |

| Williams | $139 | -6% |

| Williamsburg | $145 | -3% |

| Williamson | $155 | 4% |

| Wilton | $135 | -9% |

| Windsor Heights | $132 | -11% |

| Winfield | $143 | -3% |

| Winterset | $163 | 10% |

| Winthrop | $143 | -4% |

| Wiota | $159 | 7% |

| Woden | $137 | -8% |

| Woodbine | $160 | 7% |

| Woodburn | $161 | 9% |

| Woodward | $141 | -5% |

| Woolstock | $138 | -7% |

| Worthington | $144 | -3% |

| Yale | $154 | 4% |

| Yarmouth | $143 | -4% |

| Yorktown | $161 | 9% |

| Zearing | $136 | -8% |

| Zwingle | $146 | -2% |

Car insurance costs $141 a month in Des Moines, or 5% less than the state average.

Several factors affect car insurance rates in different parts of the state. High accident rates and more car thefts make car insurance more expensive in some areas. High medical and car repair costs can also drive up rates.

Car insurance requirements in Iowa

You need car insurance to drive legally in Iowa. The state’s minimum auto insurance requirements include:

-

Bodily injury liability

: $20,000 per person, $40,000 per accidentBodily injury liability helps cover the medical bills of other people you injure in a car accident.

-

Property damage liability

: $15,000Property damage liability covers damage you cause to property like fences, toll booths and light posts.

You usually also need collision

Iowa SR-22 insurance requirements

You may need SR-22 car insurance after certain violations, including OWI. An SR-22 is a form that shows you have car insurance. Your insurance company files it for you when you buy your policy.

The state only requires minimum liability coverage for an SR-22. If you have a car loan or lease, you also need collision and comprehensive.

Some companies don’t offer SR-22 insurance, but most do. Many add an SR-22 filing fee of about $25 to your rate.

The actual cost of SR-22 insurance depends largely on your driving record. SR-22 rates average about $270 a month after a major offense like OWI. The average quote is closer to $200 a month for a less severe offense.

Shopping around can often help you find rates that are cheaper than these averages.

How we selected the cheapest car insurance companies in Iowa

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Iowa

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.