Cheapest Car Insurance in Vermont (2026)

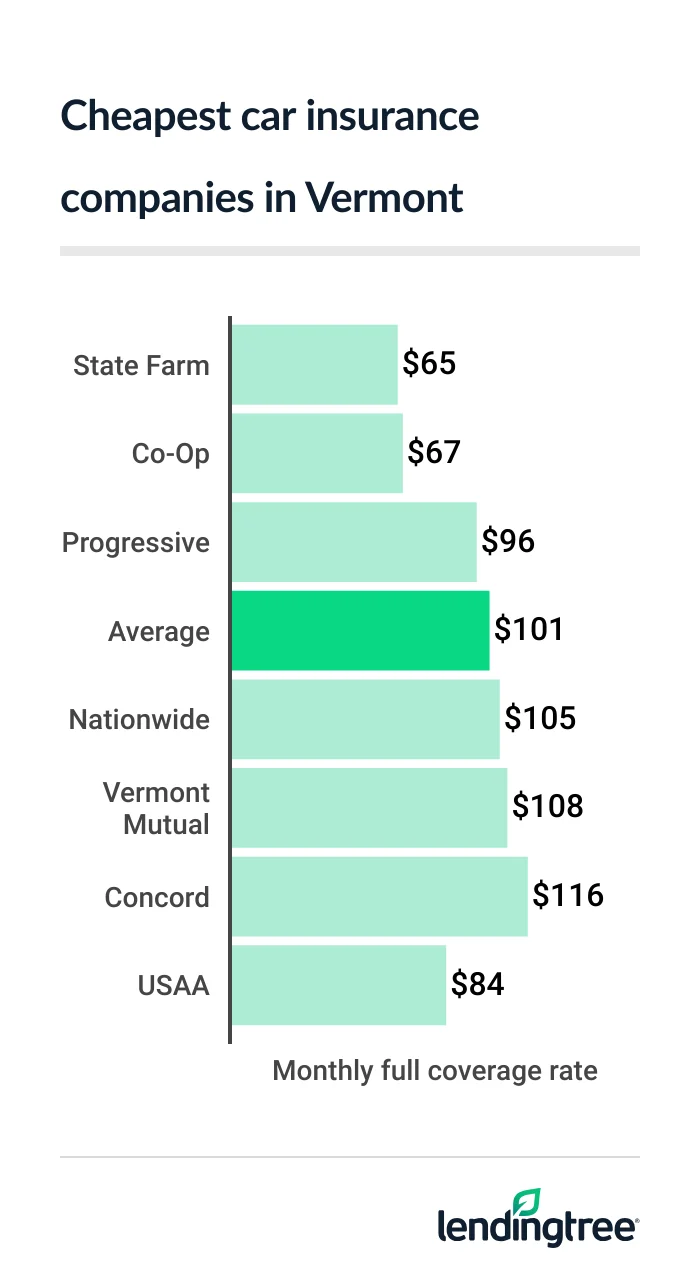

State Farm and Co-Op have the cheapest car insurance in Vermont. State Farm has the cheapest full coverage policies, at $65 a month.

Cheapest Vermont auto insurance quotes

Cheapest full coverage car insurance quotes in Vermont: State Farmī

State Farm has the cheapest full coverage car insurance in Vermont, with an average rate of $65 a month. Co-Op is only $2 more, however, at $67 a month.

The average cost of full coverage

VT full coverage insurance quotes by company

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $65 | |

| Co-Op | $67 | Not rated |

| Progressive | $96 | |

| Nationwide | $105 | |

| Vermont Mutual | $108 | |

| Concord | $116 | |

| Geico | $130 | |

| Allstate | $136 | |

| USAA* | $84 | |

To find out which of these companies is the best and cheapest for you, compare car insurance quotes from each of them before you buy or renew a policy.

Vermont’s cheapest liability insurance: Co-Op

With an average rate of $19 a month, Co-Op offers the cheapest liability insurance for Vermont drivers. State Farm is just $1 more, though, at $20 a month.

VT liability insurance quotes by company

| Company | Monthly rate |

|---|---|

| Co-Op | $19 |

| State Farm | $20 |

| Allstate | $35 |

| Concord | $38 |

| Progressive | $41 |

| Vermont Mutual | $42 |

| Geico | $48 |

| Nationwide | $49 |

| USAA* | $22 |

If you or a close relative are active-duty or retired military, compare quotes from USAA as well. Its average rate for liability

State Farm and USAA offer several car insurance discounts that could make them the cheapest for you. Both companies have discounts for insuring multiple vehicles or buying more than one policy from them.

Some of State Farm’s other discounts are for low-mileage drivers, loyal customers and those who pay for their policies up front. USAA customers can also save on newer vehicles, cars with anti-theft devices and more.

The average cost of liability car insurance is $35 a month in Vermont.

Best cheap car insurance in Vermont for teen drivers: Co-Op

To get Vermont’s cheapest teen car insurance, make sure you get a quote from Co-Op when you shop for a policy.

Co-Op has the lowest teen liability rates of $40 a month in Vermont. It also has the cheapest full coverage rates for teen drivers, at $128 a month.

Teen car insurance quotes in VT

| Company | Liability only | Full coverage |

|---|---|---|

| Co-Op | $40 | $128 |

| State Farm | $62 | $192 |

| Allstate | $70 | $347 |

| Concord | $78 | $208 |

| Vermont Mutual | $95 | $252 |

| Progressive | $104 | $270 |

| Nationwide | $144 | $296 |

| Geico | $175 | $478 |

| USAA* | $56 | $199 |

State Farm has the second-cheapest teen car insurance quotes in Vermont. It charges $62 a month for teen liability coverage, on average, and $192 a month for full coverage.

Many companies, including State Farm, offer car insurance discounts for teens and young adults who:

- Complete a driver’s education or training program

- Get good grades

- Go to college without a vehicle

Cheap car insurance in Vermont after a speeding ticket: State Farm

At $69 a month, State Farm is Vermont’s cheapest auto insurance company for drivers with a speeding ticket on their records.

Co-Op comes in second for drivers with a ticket, at $80 per month. The state average is $122 a month.

VT auto insurance quotes after a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $69 |

| Co-Op | $80 |

| Nationwide | $121 |

| Progressive | $123 |

| Vermont Mutual | $134 |

| Concord | $150 |

| Allstate | $154 |

| Geico | $168 |

| USAA* | $96 |

A typical driver in Vermont pays about $20 a month more for car insurance after getting a speeding ticket.

Vermont’s cheapest auto insurance after an accident: State Farm

Drivers in Vermont get the cheapest car insurance after an accident from State Farm, at an average rate of $74 a month.

This is $16 less than the second-cheapest company, Co-Op. And it’s around half the state average of $152 a month.

VT auto insurance quotes after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $74 |

| Co-Op | $90 |

| Vermont Mutual | $134 |

| Progressive | $142 |

| Concord | $175 |

| Nationwide | $177 |

| Allstate | $219 |

| Geico | $246 |

| USAA* | $117 |

On average, Vermont drivers pay around $50 a month more for auto insurance after an at-fault accident.

Accident forgiveness

Cheapest car insurance for Vermont teens with a bad driving record: Co-Op

Vermont teens with tickets or accidents on their driving records can find the cheapest auto insurance with Co-Op.

The company has the state’s lowest quotes for teens with a speeding ticket, at $48 a month. It also has the most affordable quotes for teen drivers with an accident, at $59 a month.

Auto insurance for VT teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Co-Op | $48 | $59 |

| State Farm | $66 | $72 |

| Allstate | $79 | $130 |

| Concord | $100 | $116 |

| Vermont Mutual | $105 | $105 |

| Progressive | $112 | $120 |

| Nationwide | $144 | $157 |

| Geico | $204 | $214 |

| USAA* | $81 | $105 |

Compare quotes from State Farm as well if you’re looking for cheap teen car insurance after a ticket or accident in Vermont. Its average quotes in these situations are close enough to Co-Op’s that discounts could make State Farm your best and cheapest option.

Best cheap car insurance companies after a DUI in Vermont: Co-Op

At $97 a month, Co-Op has the cheapest DUI insurance quotes for Vermont drivers. That’s less than half the state average of $205 a month for drivers with a DUI (driving under the influence) conviction.

VT car insurance quotes with a DUI

| Company | Monthly rate |

|---|---|

| Co-Op | $97 |

| Progressive | $108 |

| State Farm | $131 |

| Allstate | $183 |

| Concord | $196 |

| Nationwide | $231 |

| Vermont Mutual | $322 |

| Geico | $404 |

| USAA* | $171 |

The average driver in Vermont sees their car insurance costs more than double after getting a DUI. You may see a smaller increase depending on your insurer, however. Co-Op only raises the rates of its customers 45% after a DUI, on average, or about $30 a month.

Cheapest car insurance in Vermont for bad credit: Co-Op

Co-Op has Vermont’s cheapest car insurance for drivers with bad credit, with an average quote of $135 a month.

Nationwide, Progressive and Geico are also cheaper than the state average rate of $188 a month.

VT car insurance quotes with poor credit

| Company | Monthly rate |

|---|---|

| Co-Op | $135 |

| Nationwide | $155 |

| Progressive | $164 |

| Geico | $186 |

| Allstate | $190 |

| Concord | $206 |

| State Farm | $232 |

| Vermont Mutual | $257 |

| USAA* | $166 |

Geico, Nationwide and Progressive each offer several car insurance discounts that could save you money and even make them your cheapest option.

Geico has the most discounts of these three companies. You may get a discount from Geico for having a car with air bags, anti-lock brakes, an anti-theft system or daytime running lights. Some of the company’s other discounts are for federal employees, military personnel and members of certain groups.

Find out your credit score for free with LendingTree Spring before you shop for car insurance.

Best car insurance companies in Vermont

Co-Op and State Farm are the best car insurance companies in Vermont, according to our research.

Co-Op has the cheapest car insurance rates for many coverage and driver types, including those with bad credit or a DUI. It only offers basic coverage options, however, and it doesn’t have as many discounts as most large companies.

State Farm has Vermont’s cheapest insurance rates for full coverage and drivers with a ticket or accident on their records. And it’s the second-cheapest company for many other drivers. It also has the best J.D. Power customer satisfaction score

Vermont car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Co-Op | Not rated | Not rated | Not rated |

| Concord | Not rated | A+ | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ | |

| Vermont Mutual | Not rated | A |

Vermont car insurance rates by city

South Burlington is Vermont’s cheapest city for car insurance, with an average rate of $93 a month.

The state’s most expensive city for car insurance is Jeffersonville, where rates average $102 a month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Adamant | $99 | -1% |

| Albany | $99 | -1% |

| Alburgh | $96 | -4% |

| Arlington | $99 | -2% |

| Ascutney | $98 | -3% |

| Averill | $99 | -1% |

| Bakersfield | $98 | -3% |

| Barnet | $100 | -1% |

| Barre | $93 | -7% |

| Barton | $100 | -1% |

| Beebe Plain | $99 | -1% |

| Beecher Falls | $99 | -2% |

| Bellows Falls | $97 | -4% |

| Belmont | $101 | 0% |

| Belvidere Center | $101 | 0% |

| Bennington | $99 | -1% |

| Benson | $98 | -3% |

| Bethel | $99 | -2% |

| Bomoseen | $100 | -1% |

| Bondville | $100 | -1% |

| Bradford | $99 | -2% |

| Brandon | $98 | -3% |

| Brattleboro | $96 | -4% |

| Bridgewater | $100 | -1% |

| Bridgewater Corners | $99 | -2% |

| Bridport | $97 | -4% |

| Bristol | $98 | -2% |

| Brookfield | $99 | -2% |

| Brownsville | $96 | -5% |

| Burlington | $94 | -6% |

| Cabot | $100 | -1% |

| Calais | $100 | -1% |

| Cambridge | $98 | -2% |

| Cambridgeport | $96 | -4% |

| Canaan | $100 | 0% |

| Castleton | $98 | -3% |

| Cavendish | $98 | -3% |

| Center Rutland | $97 | -3% |

| Charlotte | $98 | -3% |

| Chelsea | $96 | -5% |

| Chester | $96 | -5% |

| Chittenden | $99 | -1% |

| Colchester | $95 | -5% |

| Concord | $99 | -2% |

| Corinth | $99 | -2% |

| Craftsbury | $99 | -2% |

| Craftsbury Common | $99 | -2% |

| Cuttingsville | $101 | 0% |

| Danby | $100 | -1% |

| Danville | $98 | -3% |

| Derby | $99 | -2% |

| Derby Line | $99 | -1% |

| Dorset | $99 | -2% |

| East Arlington | $99 | -2% |

| East Barre | $95 | -6% |

| East Berkshire | $98 | -3% |

| East Burke | $99 | -1% |

| East Calais | $100 | -1% |

| East Charleston | $99 | -1% |

| East Corinth | $99 | -2% |

| East Dorset | $100 | -1% |

| East Dover | $97 | -4% |

| East Fairfield | $97 | -3% |

| East Hardwick | $99 | -2% |

| East Haven | $99 | -2% |

| East Middlebury | $97 | -4% |

| East Montpelier | $94 | -6% |

| East Poultney | $100 | -1% |

| East Randolph | $101 | 0% |

| East Ryegate | $99 | -2% |

| East St.Johnsbury | $98 | -3% |

| East Thetford | $97 | -3% |

| East Wallingford | $100 | -1% |

| Eden | $101 | 0% |

| Eden Mills | $101 | 0% |

| Enosburg Falls | $98 | -3% |

| Essex Junction | $94 | -6% |

| Fair Haven | $98 | -3% |

| Fairfax | $97 | -4% |

| Fairfield | $97 | -4% |

| Fairlee | $100 | -1% |

| Ferrisburgh | $99 | -2% |

| Florence | $99 | -2% |

| Forest Dale | $99 | -2% |

| Franklin | $97 | -3% |

| Gaysville | $100 | -1% |

| Gilman | $99 | -2% |

| Glover | $99 | -1% |

| Grafton | $97 | -4% |

| Grand Isle | $96 | -5% |

| Graniteville | $95 | -6% |

| Granville | $99 | -1% |

| Greensboro | $99 | -2% |

| Greensboro Bend | $100 | -1% |

| Groton | $99 | -1% |

| Guildhall | $99 | -2% |

| Hancock | $97 | -3% |

| Hardwick | $99 | -2% |

| Hartland | $97 | -4% |

| Hartland Four Corners | $97 | -4% |

| Highgate Center | $97 | -4% |

| Highgate Springs | $97 | -4% |

| Hinesburg | $98 | -3% |

| Huntington | $97 | -4% |

| Hyde Park | $101 | 0% |

| Hydeville | $98 | -3% |

| Irasburg | $100 | -1% |

| Island Pond | $99 | -1% |

| Isle La Motte | $97 | -4% |

| Jacksonville | $98 | -3% |

| Jamaica | $99 | -2% |

| Jeffersonville | $102 | 1% |

| Jericho | $96 | -5% |

| Johnson | $101 | 0% |

| Jonesville | $98 | -3% |

| Killington | $101 | 0% |

| Lake Elmore | $100 | 0% |

| Londonderry | $99 | -2% |

| Lowell | $100 | -1% |

| Lower Waterford | $98 | -2% |

| Ludlow | $98 | -3% |

| Lunenburg | $99 | -2% |

| Lyndon Center | $99 | -2% |

| Lyndonville | $99 | -2% |

| Manchester | $100 | -1% |

| Manchester Center | $100 | -1% |

| Marshfield | $100 | -1% |

| McIndoe Falls | $99 | -1% |

| Middlebury | $97 | -4% |

| Middletown Springs | $100 | -1% |

| Milton | $97 | -4% |

| Montgomery Center | $98 | -3% |

| Montpelier | $94 | -7% |

| Moretown | $100 | -1% |

| Morgan | $100 | -1% |

| Morrisville | $100 | -1% |

| Moscow | $101 | 0% |

| Mount Holly | $100 | -1% |

| New Haven | $96 | -4% |

| Newbury | $99 | -2% |

| Newfane | $97 | -4% |

| Newport | $99 | -2% |

| Newport Center | $99 | -1% |

| North Bennington | $99 | -2% |

| North Clarendon | $99 | -2% |

| North Concord | $99 | -2% |

| North Ferrisburgh | $97 | -4% |

| North Hartland | $97 | -4% |

| North Hero | $97 | -4% |

| North Hyde Park | $100 | 0% |

| North Montpelier | $97 | -3% |

| North Pomfret | $99 | -1% |

| North Pownal | $99 | -2% |

| North Springfield | $95 | -5% |

| North Thetford | $98 | -3% |

| North Troy | $100 | 0% |

| Northfield | $100 | -1% |

| Northfield Falls | $100 | -1% |

| Norton | $99 | -1% |

| Norwich | $97 | -4% |

| Orleans | $100 | -1% |

| Orwell | $96 | -4% |

| Passumpsic | $98 | -2% |

| Pawlet | $100 | -1% |

| Peacham | $99 | -2% |

| Perkinsville | $95 | -5% |

| Peru | $100 | -1% |

| Pittsfield | $99 | -2% |

| Pittsford | $99 | -2% |

| Plainfield | $100 | -1% |

| Plymouth | $99 | -2% |

| Post Mills | $100 | 0% |

| Poultney | $100 | -1% |

| Pownal | $99 | -1% |

| Proctor | $96 | -5% |

| Proctorsville | $98 | -2% |

| Putney | $96 | -4% |

| Quechee | $97 | -4% |

| Randolph | $100 | 0% |

| Randolph Center | $100 | 0% |

| Reading | $96 | -5% |

| Readsboro | $99 | -1% |

| Richford | $98 | -3% |

| Richmond | $98 | -3% |

| Ripton | $97 | -4% |

| Rochester | $100 | -1% |

| Roxbury | $100 | -1% |

| Rutland | $96 | -5% |

| Salisbury | $98 | -3% |

| Saxtons River | $96 | -4% |

| Shaftsbury | $99 | -1% |

| Sharon | $99 | -1% |

| Sheffield | $99 | -2% |

| Shelburne | $96 | -5% |

| Sheldon | $97 | -3% |

| Sheldon Springs | $97 | -3% |

| Shoreham | $97 | -4% |

| South Barre | $96 | -5% |

| South Burlington | $93 | -8% |

| South Hero | $96 | -4% |

| South Londonderry | $99 | -2% |

| South Newfane | $98 | -3% |

| South Pomfret | $99 | -2% |

| South Royalton | $99 | -2% |

| South Ryegate | $100 | 0% |

| South Strafford | $101 | 0% |

| South Woodstock | $99 | -1% |

| Springfield | $96 | -5% |

| St. Albans | $97 | -4% |

| St. Albans Bay | $97 | -4% |

| St. Johnsbury | $98 | -3% |

| St. Johnsbury Center | $98 | -2% |

| Stamford | $99 | -1% |

| Starksboro | $99 | -2% |

| Stockbridge | $100 | -1% |

| Stowe | $101 | 0% |

| Strafford | $101 | 0% |

| Sutton | $99 | -1% |

| Swanton | $97 | -4% |

| Taftsville | $101 | 1% |

| Thetford Center | $100 | -1% |

| Topsham | $99 | -2% |

| Townshend | $96 | -4% |

| Troy | $100 | -1% |

| Tunbridge | $98 | -2% |

| Underhill | $98 | -2% |

| Underhill Center | $98 | -3% |

| Vergennes | $98 | -3% |

| Vernon | $97 | -4% |

| Vershire | $101 | 0% |

| Waitsfield | $100 | -1% |

| Wallingford | $100 | 0% |

| Wardsboro | $99 | -2% |

| Warren | $100 | 0% |

| Washington | $96 | -4% |

| Waterbury | $100 | -1% |

| Waterbury Center | $100 | -1% |

| Waterville | $101 | 0% |

| Websterville | $96 | -5% |

| Wells | $100 | -1% |

| Wells River | $100 | -1% |

| West Brattleboro | $96 | -4% |

| West Burke | $99 | -1% |

| West Charleston | $100 | -1% |

| West Danville | $99 | -2% |

| West Dover | $99 | -2% |

| West Dummerston | $96 | -4% |

| West Fairlee | $101 | 0% |

| West Halifax | $98 | -3% |

| West Hartford | $99 | -1% |

| West Newbury | $99 | -2% |

| West Pawlet | $100 | -1% |

| West Rupert | $99 | -2% |

| West Rutland | $97 | -4% |

| West Topsham | $99 | -2% |

| West Townshend | $97 | -4% |

| West Wardsboro | $99 | -2% |

| Westfield | $100 | -1% |

| Westford | $98 | -3% |

| Westminster | $97 | -4% |

| Westminster Station | $96 | -4% |

| Weston | $98 | -3% |

| White River Junction | $96 | -5% |

| Whiting | $97 | -3% |

| Whitingham | $98 | -3% |

| Wilder | $96 | -5% |

| Williamstown | $96 | -5% |

| Williamsville | $96 | -4% |

| Williston | $96 | -5% |

| Wilmington | $98 | -3% |

| Windsor | $95 | -5% |

| Winooski | $94 | -7% |

| Wolcott | $101 | 0% |

| Woodbury | $100 | -1% |

| Woodstock | $97 | -4% |

| Worcester | $99 | -1% |

The average cost of car insurance in Vermont’s other largest cities:

- Burlington, $94 a month

- Colchester, $95 a month

- Rutland City, $96 a month

- Bennington, $99 a month

Minimum coverage for car insurance in Vermont

Vermont state law requires drivers to buy at least a minimum amount of liability, uninsured motorist (UM) and underinsured motorist (UIM) car insurance.

| Coverage type | Minimum amount needed |

|---|---|

| Liability bodily injury | $25,000 per person $50,000 per accident |

| Liability property damage | $10,000 per accident |

| UM/UIM bodily injury | $50,000 per person $100,000 per accident |

| UM/UIM property damage | $10,000 per accident |

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

Uninsured motorist covers you and your passengers for injuries and damage caused by a driver with no insurance.

Underinsured motorist protects you from drivers who have insurance, but not enough to cover your damages.

Vermont law doesn’t require full coverage car insurance, which usually includes collision

SR-22 insurance in Vermont

Vermont drivers convicted of violations like DUI or driving without insurance may need to file an SR-22 form with the state.

Vermont drivers who are required to file an SR-22 must do so for three years. If your insurance lapses or is canceled during that time, your insurance company will notify the state — after which your license may be suspended.

Frequently asked questions

Car insurance in Vermont costs $101 a month, on average, if you buy full coverage. If you only buy liability coverage, the state average cost is $35 a month.

You can get the cheapest car insurance in Vermont from State Farm and Co-Op. State Farm has the state’s lowest average rate for full coverage, at $65 a month. Co-Op has the lowest average rate for liability coverage, at $19 a month.

How we selected the cheapest car insurance companies in Vermont

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured/underinsured motorist property damage: $10,000 ($150 deductible)

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Vermont

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.