Cheapest Car Insurance in Virginia (2026)

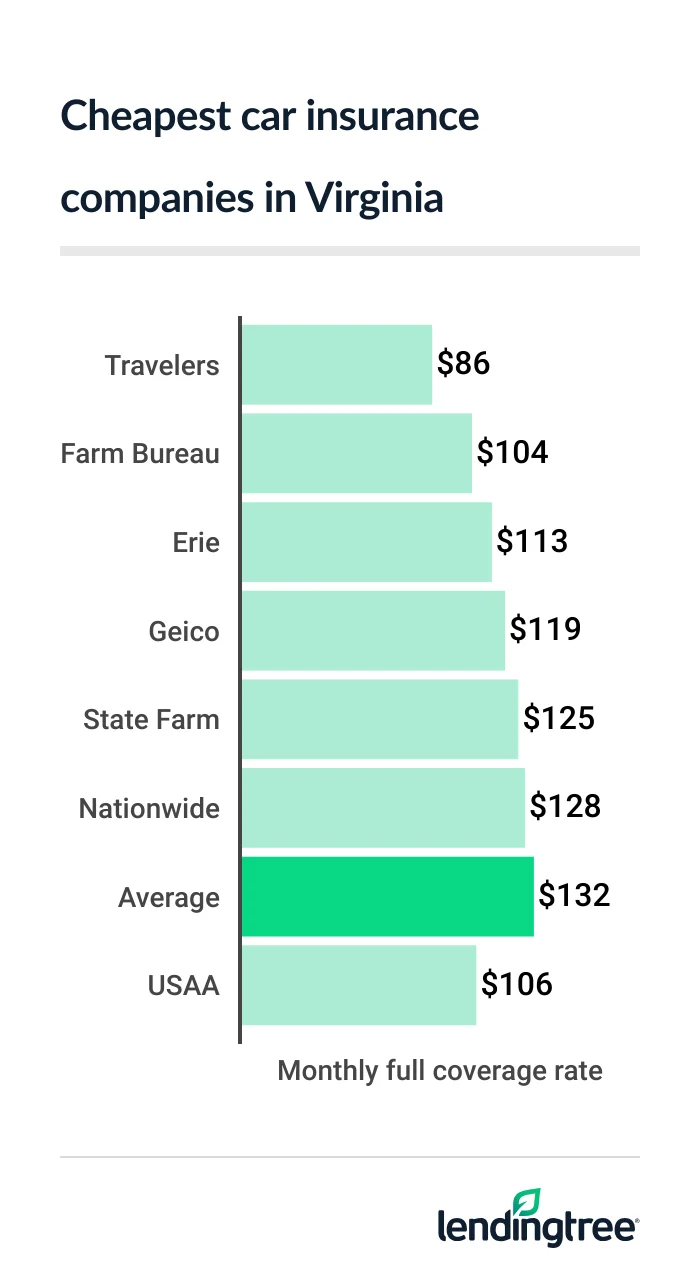

Travelers has Virginia’s cheapest full coverage car insurance, at $86 a month. This is $46 less than the state average of $132 a month.

Best cheap VA car insurance

Virginia’s cheapest full coverage car insurance: Travelers

Travelers has Virginia’s cheapest full coverage car insurance, at $86 a month. This is 17% less than the next-cheapest rate of $104 a month from Virginia Farm Bureau.

Travelers also has more discounts than the Farm Bureau, which could make it even more affordable for you.

The average cost of full coverage in Virginia is $132 a month for a typical driver. Your actual price depends on factors like your driving record, credit history and vehicle.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $86 | |

| Farm Bureau | $104 | |

| Erie | $113 | |

| Geico | $119 | |

| State Farm | $125 | |

| Nationwide | $128 | |

| Progressive | $175 | |

| Allstate | $228 | |

| USAA* | $106 | |

Companies treat these factors differently and have different car insurance discounts. Comparing car insurance quotes is a good way to find the cheapest company for you.

Cheap Virginia liability insurance: Farm Bureau

At $37 a month, Farm Bureau has Virginia’s cheapest liability insurance, or minimum coverage. Travelers is only slightly more expensive, at $43 a month. Minimum coverage includes liability

Cheapest liability car insurance

| Company | Monthly rate |

|---|---|

| Farm Bureau | $37 |

| Travelers | $43 |

| Erie | $49 |

| Geico | $59 |

| State Farm | $59 |

| Nationwide | $88 |

| Progressive | $107 |

| Allstate | $112 |

| USAA* | $45 |

You need to join the Farm Bureau to get its insurance. After the $40 annual fee, Farm Bureau only costs $32 less a year than Travelers, before discounts.

Farm Bureau has fewer insurance discounts than Travelers. However a Farm Bureau membership gets you discounts on a variety of other products and services. These range from hotel stays to medical prescriptions.

Member fees also support the state’s agricultural industry. If these benefits are important to you, Farm Bureau may be the best car insurance company for you.

Cheapest car insurance for Virginia teens: Farm Bureau

Farm Bureau has Virginia’s cheapest car insurance for teens. Its minimum coverage rates for young drivers average $94 a month. Erie is the next-cheapest company, at $109 a month. Erie also has a better satisfaction rating from J.D. Power

Farm Bureau also has the cheapest full coverage for young drivers at $218 a month. This is only 4% less than Travelers’ rate of $226 a month.

Teen auto insurance rates

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Farm Bureau | $94 | $218 |

| Erie | $109 | $265 |

| Travelers | $113 | $226 |

| Geico | $152 | $287 |

| State Farm | $195 | $375 |

| Allstate | $240 | $535 |

| Nationwide | $309 | $463 |

| Progressive | $472 | $815 |

| USAA* | $118 | $270 |

Teens’ lack of driving experience make them more likely to get into accidents. This is the main reason why their insurance rates are so high. Young drivers usually get cheaper rates on a parent’s policy than they do on their own.

Usage-based insurance (UBI) programs can also help make car insurance more affordable for teens. Most of these programs use an app to monitor your driving.

- Farm Bureau and Travelers give you insurance discounts for driving safely with their UBI apps.

- Erie’s UBI program gives you gift cards from retailers instead of insurance discounts.

Several other car insurance companies also have UBI. It’s important to read the fine print for any program you choose. Some raise your rates for unsafe driving, unless you opt out of the program in time.

Best VA auto insurance rates after a speeding ticket: Travelers

Virginia drivers with a speeding ticket can get the cheapest auto insurance quotes from Travelers. Its full coverage rates average $86 a month after a ticket. Erie is the next-cheapest company, at $127 a month. Travelers also has a few more discounts than Erie, which may help you save more.

Auto insurance rates with a ticket

| Company | Monthly rate |

|---|---|

| Travelers | $86 |

| Erie | $127 |

| Farm Bureau | $130 |

| State Farm | $134 |

| Nationwide | $167 |

| Geico | $172 |

| Progressive | $227 |

| Allstate | $293 |

| USAA* | $129 |

A speeding ticket raises the average cost of car insurance in Virginia by 24% to $163 a month.

Your rate increase usually shows up on your next renewal notice after a ticket or accident.

It’s good to start shopping around after you see your new rate. A different company may be cheaper for a bad driving record.

Cheapest VA car insurance after an accident: Travelers and State Farm

Travelers and State Farm have Virginia’s cheapest car insurance after an accident. Both companies charge an average of $125 a month for full coverage. Of the two, State Farm has a better satisfaction score, which usually means better customer service.

Insurance rates after an accident

| Company | Monthly rate |

|---|---|

| Travelers | $125 |

| State Farm | $125 |

| Farm Bureau | $131 |

| Erie | $172 |

| Nationwide | $201 |

| Geico | $228 |

| Progressive | $269 |

| Allstate | $559 |

| USAA* | $152 |

An at-fault accident raises Virginia car insurance rates by an average of 66% to $218 a month. You can protect yourself from a potential rate hike like this by getting accident forgiveness. You have to add it to your policy before an accident.

Travelers, Farm Bureau and Erie are among the companies that offer accident forgiveness. State Farm does not. It usually costs extra, but Erie gives it to you for free after three years of not filing a claim.

Best for VA teens with bad driving records: Travelers

Travelers and Farm Bureau have Virginia’s best car insurance rates for bad teen drivers. Travelers has the cheapest liability rate for teens with a ticket, at $113 a month. This is 8% less than the Farm Bureau’s rate of $122 a month.

At $107 a month, Farm Bureau is the cheapest company for teens with an at-fault accident. Erie has the next-cheapest rate at $159 a month.

Insurance rates for bad teen drivers

| Company | Ticket | Accident |

|---|---|---|

| Travelers | $113 | $173 |

| Farm Bureau | $122 | $107 |

| Erie | $134 | $159 |

| Geico | $200 | $272 |

| State Farm | $213 | $195 |

| Allstate | $317 | $657 |

| Nationwide | $329 | $338 |

| Progressive | $488 | $498 |

| USAA* | $176 | $211 |

Virginia’s cheapest DUI insurance: Travelers

At $139 a month, Travelers has Virginia’s cheapest car insurance after a DUI (driving under the influence). Farm Bureau also has cheap DUI insurance at $145 a month.

A DUI raises car insurance rates in Virginia by an average of 85% to $243 a month. Comparing quotes can help you find a cheaper rate.

Cheap DUI insurance

| Company | Monthly rate |

|---|---|

| Travelers | $139 |

| Farm Bureau | $145 |

| Erie | $232 |

| Progressive | $240 |

| Nationwide | $259 |

| Geico | $308 |

| State Farm | $313 |

| Allstate | $341 |

| USAA* | $208 |

VA’s best bad-credit car insurance rates: Travelers

Virginia drivers with bad credit get the cheapest car insurance quotes from Travelers. The company’s bad-credit car insurance rates average $152 a month. Nationwide and Geico are the next-cheapest companies at about $180 a month each.

Insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Travelers | $152 |

| Nationwide | $181 |

| Geico | $184 |

| Farm Bureau | $201 |

| Erie | $260 |

| Allstate | $277 |

| Progressive | $278 |

| State Farm | $490 |

| USAA* | $189 |

Insurance companies check your credit for things like your payment history and borrowing habits. Avoiding late payments and paying down debts can help make your car insurance more affordable.

Best car insurance in Virginia

Travelers, Farm Bureau and Erie are Virginia’s best car insurance companies for slightly different reasons. All three companies have cheap rates for most drivers. Each one also has features that cater to different types of drivers.

-

Travelers is a particularly good choice if you have a new car. Its new car replacement

program lasts up to five years. Farm Bureau and Erie also offer new car replacement, but their programs end after two years. State Farm and Geico don’t have it at all.If your car is totaled while it’s relatively new, new car replacement pays for a new one.

- Virginia Farm Bureau is a good choice if your car has custom features. The company has add-on coverage for custom electronics, parts and accessories.

- Erie is the best choice if you value customer service over price. The company has a higher satisfaction rating than most other companies. This means it makes its customers happier over things like price, coverage and service.

Each of these companies can be good choices for other drivers, too. It’s worth getting quotes from all three when it’s time to buy or renew your policy.

Car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree score |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Erie | 703 | A | |

| Farm Bureau | 645 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA* | 735 | A++ |

Virginia car insurance Rates by city

At $108 a month, Merrimac has the cheapest car insurance among Virginia’s cities and towns. Dayton drivers only pay slightly more, at $109 a month.

Lincolnia has the state’s most expensive car insurance at $159 a month. This is 21% higher than the state average. Bailey’s Crossroads has the next-highest rate, at $157 a month.

Car insurance costs $139 a month in Virginia Beach, or 6% more than the state average. Richmond drivers pay $143 a month.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Abingdon | $115 | -13% |

| Accomac | $129 | -2% |

| Achilles | $127 | -3% |

| Adwolf | $118 | -10% |

| Afton | $131 | 0% |

| Alberta | $136 | 3% |

| Aldie | $145 | 10% |

| Alexandria | $148 | 13% |

| Altavista | $124 | -6% |

| Alton | $136 | 3% |

| Amelia Court House | $145 | 10% |

| Amherst | $127 | -4% |

| Amissville | $138 | 5% |

| Ammon | $136 | 4% |

| Amonate | $125 | -5% |

| Andover | $120 | -8% |

| Annandale | $155 | 18% |

| Appalachia | $120 | -9% |

| Appomattox | $127 | -4% |

| Aquia Harbour | $139 | 6% |

| Ararat | $126 | -4% |

| Ark | $128 | -3% |

| Arlington | $138 | 5% |

| Aroda | $137 | 4% |

| Arrington | $131 | 0% |

| Arvonia | $143 | 9% |

| Ashburn | $134 | 2% |

| Ashland | $131 | 0% |

| Assawoman | $129 | -2% |

| Atkins | $118 | -10% |

| Atlantic | $129 | -2% |

| Augusta Springs | $122 | -8% |

| Austinville | $121 | -8% |

| Axton | $134 | 2% |

| Aylett | $135 | 2% |

| Bacova | $118 | -10% |

| Bailey’s Crossroads | $157 | 19% |

| Banco | $134 | 2% |

| Bandy | $124 | -6% |

| Barboursville | $135 | 3% |

| Barhamsville | $129 | -2% |

| Barren Springs | $125 | -5% |

| Baskerville | $130 | -1% |

| Bassett | $128 | -3% |

| Bastian | $127 | -4% |

| Basye | $116 | -12% |

| Batesville | $129 | -2% |

| Battery Park | $133 | 1% |

| Bealeton | $137 | 4% |

| Beaumont | $138 | 5% |

| Beaverdam | $135 | 3% |

| Bedford | $129 | -2% |

| Bee | $127 | -4% |

| Belle Haven | $146 | 11% |

| Bellwood | $140 | 6% |

| Belmont | $134 | 2% |

| Belspring | $118 | -10% |

| Belview | $113 | -14% |

| Ben Hur | $125 | -5% |

| Bena | $128 | -3% |

| Benns Church | $133 | 1% |

| Bensley | $144 | 10% |

| Bent Mountain | $122 | -7% |

| Bentonville | $128 | -3% |

| Bergton | $112 | -15% |

| Berryville | $125 | -5% |

| Bethel Manor | $131 | 0% |

| Big Island | $132 | 0% |

| Big Rock | $130 | -1% |

| Big Stone Gap | $121 | -8% |

| Birchleaf | $129 | -2% |

| Birdsnest | $126 | -4% |

| Bishop | $125 | -5% |

| Blacksburg | $110 | -17% |

| Blackstone | $137 | 5% |

| Blackwater | $126 | -5% |

| Blairs | $135 | 3% |

| Bland | $122 | -7% |

| Bloxom | $128 | -3% |

| Blue Grass | $121 | -8% |

| Blue Ridge | $122 | -7% |

| Bluefield | $127 | -4% |

| Bluemont | $132 | 1% |

| Bohannon | $126 | -4% |

| Boissevain | $127 | -4% |

| Bon Air | $136 | 4% |

| Boones Mill | $127 | -3% |

| Boonesville | $133 | 1% |

| Boston | $134 | 2% |

| Bowling Green | $133 | 1% |

| Boyce | $125 | -5% |

| Boydton | $131 | -1% |

| Boykins | $134 | 2% |

| Bracey | $129 | -2% |

| Brambleton | $135 | 3% |

| Branchville | $133 | 1% |

| Brandermill | $136 | 4% |

| Brandy Station | $136 | 4% |

| Breaks | $128 | -2% |

| Bremo Bluff | $138 | 5% |

| Bridgewater | $111 | -16% |

| Brightwood | $135 | 3% |

| Bristol | $116 | -12% |

| Bristow | $138 | 5% |

| Broad Run | $139 | 6% |

| Broadford | $122 | -7% |

| Broadlands | $135 | 3% |

| Broadway | $111 | -16% |

| Brodnax | $131 | 0% |

| Brooke | $136 | 4% |

| Brookneal | $132 | 1% |

| Brownsburg | $121 | -8% |

| Brucetown | $123 | -6% |

| Bruington | $132 | 0% |

| Buchanan | $124 | -5% |

| Buckhall | $142 | 8% |

| Buckingham | $140 | 7% |

| Buena Vista | $118 | -10% |

| Buffalo Junction | $131 | -1% |

| Bull Run | $141 | 7% |

| Bumpass | $137 | 5% |

| Burgess | $124 | -6% |

| Burke | $150 | 14% |

| Burke Centre | $151 | 15% |

| Burkes Garden | $126 | -4% |

| Burkeville | $138 | 5% |

| Burnsville | $118 | -10% |

| Burr Hill | $136 | 3% |

| Callands | $138 | 5% |

| Callao | $125 | -5% |

| Callaway | $133 | 1% |

| Calverton | $139 | 6% |

| Camptown | $131 | 0% |

| Cana | $121 | -8% |

| Cape Charles | $129 | -2% |

| Capeville | $128 | -2% |

| Capron | $134 | 2% |

| Cardinal | $126 | -4% |

| Caret | $130 | -1% |

| Carrollton | $133 | 1% |

| Carrsville | $132 | 0% |

| Carson | $135 | 2% |

| Cartersville | $147 | 12% |

| Casanova | $140 | 6% |

| Cascade | $136 | 3% |

| Cascades | $137 | 4% |

| Castleton | $138 | 5% |

| Castlewood | $124 | -6% |

| Catawba | $118 | -10% |

| Catharpin | $143 | 9% |

| Catlett | $140 | 6% |

| Cave Spring | $121 | -8% |

| Cedar Bluff | $122 | -7% |

| Center Cross | $127 | -3% |

| Centreville | $146 | 11% |

| Ceres | $122 | -7% |

| Chamberlayne | $140 | 6% |

| Champlain | $126 | -4% |

| Chantilly | $145 | 10% |

| Charles City | $133 | 1% |

| Charlotte Court House | $136 | 3% |

| Charlottesville | $127 | -4% |

| Chase City | $131 | 0% |

| Chatham | $134 | 2% |

| Chatmoss | $129 | -2% |

| Check | $133 | 1% |

| Cheriton | $128 | -2% |

| Cherry Hill | $150 | 14% |

| Chesapeake | $138 | 5% |

| Chester | $137 | 4% |

| Chester Gap | $136 | 4% |

| Chesterfield | $137 | 4% |

| Chilhowie | $117 | -11% |

| Chincoteague | $128 | -3% |

| Chincoteague Island | $129 | -2% |

| Christchurch | $129 | -2% |

| Christiansburg | $111 | -15% |

| Church Road | $137 | 4% |

| Church View | $128 | -3% |

| Churchville | $118 | -10% |

| Claremont | $134 | 2% |

| Clarksville | $132 | 0% |

| Claudville | $125 | -5% |

| Claypool Hill | $123 | -6% |

| Clear Brook | $123 | -7% |

| Cleveland | $126 | -4% |

| Clifford | $127 | -4% |

| Clifton | $147 | 12% |

| Clifton Forge | $115 | -13% |

| Clinchco | $127 | -4% |

| Clintwood | $126 | -4% |

| Clover | $135 | 2% |

| Cloverdale | $120 | -9% |

| Cluster Springs | $134 | 2% |

| Cobbs Creek | $126 | -4% |

| Coeburn | $123 | -7% |

| Coleman Falls | $130 | -1% |

| Coles Point | $131 | -1% |

| Collinsville | $128 | -2% |

| Colonial Beach | $134 | 2% |

| Colonial Heights | $135 | 3% |

| Columbia | $142 | 8% |

| Concord | $127 | -4% |

| Copper Hill | $133 | 1% |

| Corbin | $132 | 0% |

| Countryside | $137 | 4% |

| County Center | $149 | 14% |

| Courtland | $133 | 1% |

| Covesville | $129 | -2% |

| Covington | $117 | -11% |

| Craddockville | $131 | -1% |

| Craigsville | $122 | -8% |

| Crewe | $139 | 6% |

| Criders | $113 | -14% |

| Crimora | $116 | -12% |

| Cripple Creek | $122 | -7% |

| Critz | $127 | -3% |

| Crockett | $120 | -9% |

| Cross Junction | $123 | -6% |

| Crosspointe | $150 | 14% |

| Crozet | $131 | -1% |

| Crozier | $139 | 6% |

| Crystal Hill | $135 | 3% |

| Cullen | $133 | 1% |

| Culpeper | $133 | 1% |

| Cumberland | $146 | 11% |

| Dahlgren | $132 | 0% |

| Dahlgren Center | $133 | 1% |

| Dale City | $149 | 14% |

| Daleville | $122 | -7% |

| Damascus | $116 | -12% |

| Dante | $127 | -3% |

| Danville | $133 | 1% |

| Davenport | $128 | -3% |

| Davis Wharf | $131 | 0% |

| Dayton | $109 | -17% |

| Deerfield | $119 | -9% |

| Delaplane | $137 | 4% |

| Deltaville | $125 | -5% |

| Dendron | $137 | 4% |

| DeWitt | $136 | 4% |

| Diggs | $125 | -5% |

| Dillwyn | $142 | 8% |

| Dinwiddie | $135 | 3% |

| Disputanta | $134 | 2% |

| Doe Hill | $121 | -8% |

| Dogue | $133 | 1% |

| Dolphin | $136 | 3% |

| Dooms | $116 | -12% |

| Doran | $125 | -5% |

| Doswell | $134 | 2% |

| Drakes Branch | $135 | 2% |

| Dranesville | $138 | 5% |

| Draper | $122 | -7% |

| Drewryville | $135 | 2% |

| Dry Fork | $136 | 3% |

| Dryden | $124 | -5% |

| Dublin | $118 | -10% |

| Duffield | $125 | -5% |

| Dugspur | $125 | -5% |

| Dulles | $138 | 5% |

| Dulles Town Center | $138 | 5% |

| Dumbarton | $137 | 4% |

| Dumfries | $148 | 12% |

| Dundas | $135 | 3% |

| Dungannon | $125 | -5% |

| Dunn Loring | $142 | 8% |

| Dunnsville | $129 | -2% |

| Dutton | $127 | -3% |

| Dyke | $133 | 1% |

| Eagle Rock | $122 | -7% |

| Earlysville | $131 | -1% |

| East Highland Park | $151 | 15% |

| East Lexington | $120 | -9% |

| East Stone Gap | $123 | -7% |

| Eastville | $129 | -2% |

| Ebony | $132 | 0% |

| Edinburg | $113 | -14% |

| Edwardsville | $125 | -5% |

| Eggleston | $123 | -7% |

| Elberon | $137 | 4% |

| Elk Creek | $123 | -6% |

| Elkton | $115 | -12% |

| Elkwood | $136 | 3% |

| Elliston | $118 | -10% |

| Emory | $116 | -12% |

| Emporia | $135 | 2% |

| Enon | $138 | 5% |

| Esmont | $134 | 2% |

| Etlan | $134 | 2% |

| Ettrick | $137 | 4% |

| Evergreen | $128 | -3% |

| Evington | $125 | -5% |

| Ewing | $129 | -2% |

| Exmore | $128 | -2% |

| Faber | $132 | 0% |

| Fair Lakes | $144 | 10% |

| Fair Oaks | $143 | 9% |

| Fairfax | $146 | 11% |

| Fairfax Station | $149 | 13% |

| Fairfield | $119 | -9% |

| Fairlawn | $113 | -14% |

| Falls Church | $144 | 9% |

| Falls Mills | $126 | -4% |

| Falmouth | $131 | 0% |

| Fancy Gap | $121 | -8% |

| Farmville | $134 | 2% |

| Farnham | $125 | -5% |

| Ferrum | $131 | 0% |

| Fieldale | $127 | -3% |

| Fincastle | $123 | -6% |

| Fishers Hill | $117 | -11% |

| Fishersville | $114 | -13% |

| Fleet | $154 | 17% |

| Flint Hill | $139 | 6% |

| Floris | $141 | 8% |

| Floyd | $129 | -2% |

| Ford | $137 | 4% |

| Forest | $126 | -5% |

| Fork Union | $136 | 4% |

| Fort Belvoir | $154 | 17% |

| Fort Blackmore | $124 | -5% |

| Fort Defiance | $115 | -13% |

| Fort Eustis | $136 | 3% |

| Fort Gregg Adams | $135 | 3% |

| Fort Hunt | $149 | 13% |

| Fort Lee | $135 | 3% |

| Fort Mitchell | $137 | 4% |

| Fort Monroe | $140 | 6% |

| Fort Myer | $139 | 6% |

| Fort Valley | $117 | -11% |

| Foster | $126 | -4% |

| Franconia | $151 | 15% |

| Franklin | $133 | 1% |

| Franklin Farm | $142 | 8% |

| Franktown | $129 | -2% |

| Fredericksburg | $131 | 0% |

| Free Union | $129 | -2% |

| Freeman | $134 | 2% |

| Fries | $120 | -9% |

| Front Royal | $125 | -5% |

| Fulks Run | $112 | -15% |

| Gainesville | $137 | 4% |

| Galax | $119 | -9% |

| Gargatha | $127 | -3% |

| Gasburg | $132 | 0% |

| Gate City | $126 | -4% |

| George Mason | $148 | 12% |

| Glade Hill | $132 | 1% |

| Glade Spring | $117 | -11% |

| Gladstone | $128 | -3% |

| Gladys | $126 | -4% |

| Glasgow | $119 | -9% |

| Glen Allen | $134 | 2% |

| Glen Lyn | $123 | -6% |

| Glen Wilton | $122 | -7% |

| Gloucester | $128 | -3% |

| Gloucester Courthouse | $128 | -3% |

| Gloucester Point | $127 | -3% |

| Goldvein | $139 | 6% |

| Goochland | $144 | 9% |

| Goode | $127 | -3% |

| Goodview | $131 | 0% |

| Gordonsville | $138 | 5% |

| Gore | $124 | -6% |

| Goshen | $121 | -8% |

| Great Falls | $146 | 11% |

| Green Bay | $138 | 5% |

| Greenbackville | $127 | -4% |

| Greenbriar | $143 | 9% |

| Greenbush | $130 | -1% |

| Greenville | $119 | -10% |

| Greenway | $144 | 9% |

| Greenwood | $129 | -2% |

| Gretna | $131 | 0% |

| Grimstead | $125 | -5% |

| Grottoes | $114 | -13% |

| Groveton | $151 | 15% |

| Grundy | $130 | -1% |

| Gum Spring | $137 | 4% |

| Gwynn | $125 | -5% |

| Hacksneck | $130 | -1% |

| Hadensville | $138 | 5% |

| Hague | $128 | -2% |

| Halifax | $135 | 2% |

| Hallieford | $126 | -4% |

| Hallwood | $129 | -2% |

| Hamilton | $132 | 0% |

| Hampden Sydney | $135 | 3% |

| Hampton | $139 | 5% |

| Hanover | $133 | 1% |

| Harborton | $131 | -1% |

| Hardy | $129 | -2% |

| Hardyville | $126 | -4% |

| Harrisonburg | $111 | -16% |

| Harriston | $115 | -12% |

| Hartfield | $126 | -4% |

| Hayes | $127 | -4% |

| Hayfield | $151 | 15% |

| Haymarket | $139 | 6% |

| Haynesville | $126 | -4% |

| Haysi | $128 | -2% |

| Haywood | $138 | 5% |

| Head Waters | $119 | -9% |

| Heathsville | $123 | -7% |

| Henrico | $137 | 4% |

| Henry | $130 | -1% |

| Herndon | $138 | 5% |

| Highland Springs | $144 | 10% |

| Hillsville | $122 | -7% |

| Hiltons | $126 | -4% |

| Hinton | $110 | -16% |

| Hiwassee | $122 | -7% |

| Hollins | $119 | -9% |

| Hollymead | $129 | -2% |

| Honaker | $124 | -6% |

| Hood | $135 | 3% |

| Hopewell | $136 | 4% |

| Horntown | $128 | -3% |

| Horse Pasture | $128 | -3% |

| Horsepen | $125 | -5% |

| Hot Springs | $117 | -11% |

| Howardsville | $140 | 7% |

| Huddleston | $131 | 0% |

| Hudgins | $125 | -5% |

| Hume | $138 | 5% |

| Huntington | $151 | 15% |

| Huntly | $137 | 4% |

| Hurley | $130 | -1% |

| Hurt | $128 | -3% |

| Hustle | $129 | -2% |

| Hybla Valley | $154 | 17% |

| Idylwood | $141 | 7% |

| Independence | $122 | -8% |

| Independent Hill | $145 | 10% |

| Indian Valley | $128 | -3% |

| Innsbrook | $135 | 2% |

| Iron Gate | $116 | -12% |

| Irvington | $124 | -6% |

| Isle of Wight | $132 | 0% |

| Ivanhoe | $119 | -9% |

| Ivor | $135 | 3% |

| Ivy | $128 | -3% |

| Jamaica | $126 | -4% |

| James Store | $126 | -4% |

| Jamesville | $130 | -1% |

| Jarratt | $135 | 2% |

| Java | $135 | 3% |

| Jeffersonton | $136 | 3% |

| Jenkins Bridge | $130 | -1% |

| Jersey | $133 | 1% |

| Jetersville | $142 | 8% |

| Jewell Ridge | $124 | -6% |

| Jolivue | $114 | -14% |

| Jonesville | $125 | -5% |

| Keeling | $134 | 2% |

| Keen Mountain | $130 | -1% |

| Keene | $129 | -2% |

| Keezletown | $114 | -13% |

| Keller | $131 | -1% |

| Kenbridge | $136 | 3% |

| Kents Store | $134 | 2% |

| Keokee | $124 | -6% |

| Keswick | $131 | -1% |

| Keysville | $137 | 4% |

| Kilmarnock | $123 | -6% |

| King and Queen Court House | $131 | 0% |

| King George | $135 | 3% |

| King William | $132 | 1% |

| Kings Park | $152 | 15% |

| Kings Park West | $149 | 13% |

| Kingstowne | $150 | 14% |

| Kinsale | $127 | -3% |

| La Crosse | $128 | -2% |

| Lacey Spring | $113 | -14% |

| Lackey | $126 | -5% |

| Ladysmith | $133 | 1% |

| Lake Barcroft | $154 | 17% |

| Lake Caroline | $133 | 1% |

| Lake Holiday | $123 | -6% |

| Lake Land’Or | $132 | 1% |

| Lake Monticello | $135 | 2% |

| Lake Ridge | $150 | 14% |

| Lake Wilderness | $133 | 1% |

| Lake of the Woods | $136 | 3% |

| Lakeside | $137 | 5% |

| Lambsburg | $122 | -7% |

| Lancaster | $123 | -6% |

| Laneview | $126 | -4% |

| Lanexa | $127 | -3% |

| Lansdowne | $131 | 0% |

| Laurel | $136 | 3% |

| Laurel Fork | $124 | -6% |

| Laurel Hill | $151 | 15% |

| Lawrenceville | $135 | 2% |

| Lebanon | $123 | -6% |

| Lebanon Church | $116 | -12% |

| Leesburg | $131 | 0% |

| Leon | $137 | 4% |

| Lexington | $120 | -9% |

| Lightfoot | $124 | -5% |

| Lignum | $136 | 3% |

| Lincoln | $134 | 2% |

| Lincolnia | $159 | 21% |

| Linden | $129 | -2% |

| Linton Hall | $138 | 5% |

| Linville | $111 | -15% |

| Little Plymouth | $131 | 0% |

| Lively | $124 | -5% |

| Loch Lomond | $145 | 10% |

| Locust Dale | $136 | 4% |

| Locust Grove | $136 | 4% |

| Locust Hill | $127 | -3% |

| Locustville | $129 | -2% |

| Long Branch | $149 | 13% |

| Long Island | $132 | 0% |

| Loretto | $129 | -2% |

| Lorton | $152 | 15% |

| Lottsburg | $122 | -7% |

| Loudoun Valley Estates | $135 | 3% |

| Louisa | $138 | 5% |

| Lovettsville | $139 | 6% |

| Lovingston | $133 | 1% |

| Low Moor | $117 | -11% |

| Lowes Island | $141 | 7% |

| Lowry | $133 | 1% |

| Lunenburg | $137 | 4% |

| Luray | $119 | -9% |

| Lynch Station | $124 | -6% |

| Lynchburg | $124 | -6% |

| Lyndhurst | $116 | -12% |

| Machipongo | $128 | -3% |

| Madison | $135 | 3% |

| Madison Heights | $124 | -6% |

| Maidens | $142 | 8% |

| Manakin Sabot | $137 | 5% |

| Manassas | $142 | 8% |

| Manassas Park | $145 | 10% |

| Manchester | $141 | 7% |

| Mannboro | $144 | 9% |

| Manquin | $135 | 3% |

| Mantua | $149 | 14% |

| Mappsville | $127 | -3% |

| Marion | $118 | -11% |

| Marionville | $130 | -2% |

| Markham | $138 | 5% |

| Marshall | $139 | 5% |

| Martinsville | $128 | -2% |

| Marumsco | $152 | 16% |

| Maryus | $129 | -2% |

| Mascot | $131 | 0% |

| Mason Neck | $154 | 17% |

| Massanetta Springs | $110 | -16% |

| Massanutten | $114 | -14% |

| Mathews | $126 | -4% |

| Matoaca | $137 | 4% |

| Mattaponi | $129 | -2% |

| Maurertown | $115 | -13% |

| Mavisdale | $128 | -3% |

| Max Meadows | $121 | -8% |

| Maxie | $131 | 0% |

| McClure | $127 | -3% |

| McCoy | $114 | -13% |

| McDowell | $123 | -6% |

| McGaheysville | $114 | -13% |

| McKenney | $137 | 4% |

| McLean | $142 | 8% |

| McNair | $142 | 8% |

| Meadow View | $116 | -12% |

| Meadowbrook | $142 | 8% |

| Meadows of Dan | $126 | -4% |

| Meadowview | $116 | -12% |

| Mears | $129 | -2% |

| Mechanicsville | $132 | 0% |

| Meherrin | $138 | 5% |

| Melfa | $128 | -2% |

| Mendota | $118 | -10% |

| Meredithville | $134 | 2% |

| Merrifield | $148 | 12% |

| Merrimac | $108 | -18% |

| Merry Point | $126 | -4% |

| Middlebrook | $120 | -9% |

| Middleburg | $140 | 7% |

| Middletown | $121 | -8% |

| Midland | $138 | 5% |

| Midlothian | $135 | 2% |

| Milford | $132 | 1% |

| Millboro | $122 | -7% |

| Millers Tavern | $128 | -3% |

| Millwood | $124 | -6% |

| Mineral | $137 | 4% |

| Mint Spring | $116 | -12% |

| Mitchells | $134 | 2% |

| Modest Town | $128 | -2% |

| Mollusk | $125 | -5% |

| Moneta | $132 | 0% |

| Monroe | $127 | -4% |

| Montclair | $148 | 13% |

| Montebello | $130 | -1% |

| Monterey | $124 | -6% |

| Montpelier | $136 | 3% |

| Montpelier Station | $133 | 1% |

| Montrose | $145 | 10% |

| Montross | $128 | -2% |

| Montvale | $129 | -2% |

| Moon | $125 | -5% |

| Morattico | $124 | -5% |

| Moseley | $138 | 5% |

| Motley | $127 | -3% |

| Mount Crawford | $111 | -16% |

| Mount Holly | $130 | -1% |

| Mount Jackson | $116 | -12% |

| Mount Sidney | $115 | -13% |

| Mount Solon | $114 | -14% |

| Mount Vernon | $153 | 16% |

| Mouth Of Wilson | $127 | -3% |

| Mustoe | $121 | -8% |

| Narrows | $123 | -7% |

| Naruna | $129 | -2% |

| Nassawadox | $128 | -2% |

| Nathalie | $136 | 4% |

| Natural Bridge | $121 | -8% |

| Natural Bridge Station | $122 | -7% |

| Naval Weapons Station | $126 | -4% |

| Neabsco | $150 | 14% |

| Nellysford | $131 | 0% |

| Nelson | $132 | 0% |

| Nelsonia | $129 | -2% |

| New Baltimore | $139 | 6% |

| New Canton | $145 | 10% |

| New Castle | $126 | -4% |

| New Church | $128 | -2% |

| New Hope | $115 | -13% |

| New Kent | $135 | 3% |

| New Market | $115 | -13% |

| New Point | $125 | -5% |

| New River | $119 | -9% |

| Newbern | $121 | -8% |

| Newington | $151 | 15% |

| Newington Forest | $151 | 15% |

| Newport | $120 | -9% |

| Newport News | $136 | 3% |

| Newsoms | $132 | 1% |

| Newtown | $133 | 2% |

| Nickelsville | $125 | -5% |

| Ninde | $131 | 0% |

| Nokesville | $140 | 6% |

| Nora | $126 | -4% |

| Norfolk | $152 | 16% |

| Norge | $124 | -6% |

| North | $126 | -4% |

| North Garden | $131 | 0% |

| North Shore | $131 | -1% |

| North Springfield | $154 | 17% |

| North Tazewell | $124 | -5% |

| Norton | $120 | -8% |

| Norwood | $134 | 2% |

| Nottoway | $141 | 7% |

| Nuttsville | $125 | -5% |

| Oak Grove | $138 | 5% |

| Oak Hall | $128 | -2% |

| Oakpark | $136 | 4% |

| Oakton | $142 | 8% |

| Oakwood | $129 | -2% |

| Oilville | $141 | 7% |

| Oldhams | $128 | -2% |

| Onancock | $130 | -1% |

| Onemo | $125 | -5% |

| Onley | $130 | -1% |

| Ophelia | $125 | -5% |

| Orange | $139 | 6% |

| Ordinary | $127 | -3% |

| Oriskany | $122 | -7% |

| Orkney Springs | $115 | -12% |

| Orlean | $140 | 7% |

| Oyster | $128 | -2% |

| Paeonian Springs | $133 | 1% |

| Paint Bank | $121 | -8% |

| Painter | $128 | -3% |

| Palmyra | $136 | 3% |

| Pamplin | $127 | -3% |

| Pantops | $128 | -2% |

| Paris | $130 | -1% |

| Parksley | $128 | -3% |

| Parrott | $119 | -10% |

| Partlow | $132 | 1% |

| Patrick Springs | $123 | -6% |

| Pearisburg | $120 | -8% |

| Pembroke | $121 | -8% |

| Penhook | $135 | 2% |

| Penn Laird | $112 | -15% |

| Pennington Gap | $124 | -6% |

| Petersburg | $136 | 3% |

| Phenix | $137 | 4% |

| Philomont | $137 | 4% |

| Pilgrims Knob | $128 | -3% |

| Pilot | $117 | -11% |

| Pimmit Hills | $139 | 6% |

| Piney River | $131 | 0% |

| Pittsville | $135 | 2% |

| Pleasant Valley | $111 | -16% |

| Plum Creek | $111 | -16% |

| Pocahontas | $128 | -3% |

| Poquoson | $130 | -1% |

| Port Haywood | $126 | -4% |

| Port Republic | $112 | -15% |

| Port Royal | $132 | 0% |

| Portsmouth | $146 | 11% |

| Potomac Mills | $150 | 14% |

| Pound | $122 | -7% |

| Pounding Mill | $123 | -6% |

| Powhatan | $147 | 12% |

| Pratts | $135 | 2% |

| Prince George | $136 | 3% |

| Prospect | $133 | 1% |

| Providence Forge | $133 | 1% |

| Pulaski | $121 | -8% |

| Pungoteague | $129 | -2% |

| Purcellville | $135 | 2% |

| Quantico | $146 | 11% |

| Quantico Base | $146 | 11% |

| Quicksburg | $114 | -13% |

| Quinby | $129 | -2% |

| Quinque | $130 | -1% |

| Quinton | $134 | 2% |

| Radford | $114 | -13% |

| Radiant | $137 | 4% |

| Randolph | $133 | 1% |

| Raphine | $115 | -12% |

| Rapidan | $136 | 4% |

| Rappahannock Academy | $131 | 0% |

| Raven | $123 | -6% |

| Ravensworth | $153 | 16% |

| Rawlings | $137 | 4% |

| Rectortown | $138 | 5% |

| Red Ash | $123 | -6% |

| Red House | $135 | 2% |

| Red Oak | $133 | 1% |

| Redwood | $130 | -1% |

| Reedville | $122 | -7% |

| Remington | $137 | 4% |

| Rescue | $133 | 2% |

| Reston | $139 | 6% |

| Reva | $131 | 0% |

| Rhoadesville | $135 | 3% |

| Rice | $137 | 4% |

| Rich Creek | $123 | -7% |

| Richardsville | $137 | 4% |

| Richlands | $123 | -6% |

| Richmond | $143 | 9% |

| Ridgeway | $129 | -2% |

| Rileyville | $122 | -7% |

| Riner | $116 | -12% |

| Ringgold | $134 | 2% |

| Ripplemead | $123 | -6% |

| Rivanna | $131 | -1% |

| Riverview | $122 | -7% |

| Rixeyville | $136 | 3% |

| Roanoke | $120 | -9% |

| Rochelle | $137 | 4% |

| Rockbridge Baths | $120 | -9% |

| Rockville | $134 | 2% |

| Rockwood | $137 | 4% |

| Rocky Gap | $127 | -4% |

| Rocky Mount | $132 | 1% |

| Rollins Fork | $133 | 1% |

| Rose Hill | $138 | 5% |

| Rosedale | $124 | -6% |

| Roseland | $130 | -1% |

| Round Hill | $134 | 2% |

| Rowe | $126 | -4% |

| Ruby | $135 | 3% |

| Ruckersville | $133 | 1% |

| Rural Retreat | $119 | -10% |

| Rushmere | $135 | 3% |

| Rustburg | $126 | -4% |

| Ruther Glen | $132 | 0% |

| Ruthville | $132 | 1% |

| Salem | $116 | -12% |

| Saltville | $116 | -12% |

| Saluda | $127 | -3% |

| Sandston | $137 | 4% |

| Sandy Hook | $141 | 7% |

| Sandy Level | $136 | 3% |

| Sandy Point | $128 | -2% |

| Sanford | $128 | -3% |

| Saxe | $134 | 2% |

| Saxis | $129 | -2% |

| Schley | $127 | -3% |

| Schuyler | $134 | 2% |

| Scottsburg | $132 | 1% |

| Scottsville | $138 | 5% |

| Seaford | $126 | -4% |

| Sealston | $134 | 2% |

| Seaview | $129 | -2% |

| Sedley | $134 | 2% |

| Selma | $117 | -11% |

| Seven Corners | $148 | 13% |

| Severn | $127 | -3% |

| Shacklefords | $129 | -2% |

| Sharps | $127 | -4% |

| Shawneeland | $122 | -7% |

| Shawsville | $117 | -11% |

| Shenandoah | $115 | -13% |

| Shenandoah Farms | $126 | -4% |

| Shipman | $133 | 1% |

| Short Pump | $135 | 3% |

| Shortt Gap | $125 | -5% |

| Singers Glen | $112 | -15% |

| Skippers | $133 | 1% |

| Skipwith | $132 | 0% |

| Skyland Estates | $130 | -1% |

| Smithfield | $134 | 2% |

| Somerset | $136 | 4% |

| Somerville | $139 | 6% |

| South Boston | $133 | 1% |

| South Hill | $128 | -2% |

| South Riding | $144 | 10% |

| South Run | $150 | 14% |

| Southern Gateway | $133 | 1% |

| Sparta | $134 | 2% |

| Speedwell | $120 | -9% |

| Spencer | $128 | -3% |

| Sperryville | $137 | 5% |

| Spotsylvania | $132 | 0% |

| Spotsylvania Courthouse | $133 | 1% |

| Spottswood | $115 | -12% |

| Spout Spring | $127 | -3% |

| Spring Grove | $134 | 2% |

| Springfield | $153 | 17% |

| St. Charles | $125 | -5% |

| St. Paul | $123 | -6% |

| St. Stephens Church | $135 | 3% |

| Stafford | $139 | 5% |

| Stafford Courthouse | $137 | 4% |

| Staffordsville | $122 | -7% |

| Stanardsville | $133 | 1% |

| Stanley | $117 | -11% |

| Stanleytown | $129 | -2% |

| Star Tannery | $120 | -9% |

| State Farm | $144 | 10% |

| Staunton | $114 | -13% |

| Steeles Tavern | $115 | -12% |

| Stephens City | $121 | -8% |

| Stephenson | $122 | -7% |

| Sterling | $138 | 5% |

| Stevensburg | $135 | 3% |

| Stevensville | $132 | 0% |

| Stone Ridge | $145 | 10% |

| Stony Creek | $136 | 4% |

| Strasburg | $118 | -10% |

| Stratford | $134 | 2% |

| Stuart | $123 | -6% |

| Stuarts Draft | $115 | -12% |

| Studley | $133 | 1% |

| Sudley | $142 | 8% |

| Suffolk | $134 | 2% |

| Sugar Grove | $119 | -10% |

| Sugarland Run | $139 | 6% |

| Sumerduck | $140 | 6% |

| Surry | $133 | 1% |

| Susan | $126 | -4% |

| Sussex | $134 | 2% |

| Sutherland | $136 | 3% |

| Sutherlin | $134 | 2% |

| Sweet Briar | $127 | -3% |

| Swoope | $118 | -10% |

| Swords Creek | $123 | -7% |

| Syria | $131 | -1% |

| Tangier | $129 | -2% |

| Tannersville | $125 | -5% |

| Tappahannock | $128 | -2% |

| Tasley | $130 | -1% |

| Tazewell | $123 | -6% |

| Temperanceville | $126 | -4% |

| Thaxton | $126 | -4% |

| The Plains | $141 | 7% |

| Thornburg | $136 | 3% |

| Thynedale | $131 | 0% |

| Timberlake | $124 | -6% |

| Timberville | $111 | -16% |

| Toano | $122 | -7% |

| Toms Brook | $115 | -12% |

| Topping | $126 | -4% |

| Townsend | $129 | -2% |

| Trevilians | $136 | 4% |

| Triangle | $148 | 12% |

| Troutdale | $127 | -3% |

| Troutville | $123 | -6% |

| Troy | $136 | 3% |

| Tuckahoe | $137 | 4% |

| Tyro | $129 | -2% |

| Tysons Corner | $144 | 9% |

| Union Hall | $135 | 3% |

| Unionville | $138 | 5% |

| University Center | $134 | 2% |

| University of Virginia | $129 | -2% |

| Upperville | $138 | 5% |

| Urbanna | $126 | -4% |

| Valentines | $134 | 2% |

| Vansant | $129 | -2% |

| Vernon Hill | $137 | 4% |

| Verona | $116 | -12% |

| Vesta | $128 | -2% |

| Vesuvius | $119 | -10% |

| Victoria | $135 | 3% |

| Vienna | $141 | 8% |

| Viewtown | $134 | 2% |

| Villa Heights | $127 | -3% |

| Village | $129 | -2% |

| Villamont | $127 | -4% |

| Vinton | $121 | -8% |

| Virgilina | $135 | 3% |

| Virginia Beach | $139 | 6% |

| Virginia State University | $139 | 6% |

| Wachapreague | $129 | -2% |

| Wake | $126 | -4% |

| Wakefield | $149 | 14% |

| Walkerton | $133 | 1% |

| Wallops Island | $129 | -2% |

| Wardtown | $130 | -2% |

| Ware Neck | $127 | -3% |

| Warfield | $135 | 3% |

| Warm Springs | $119 | -10% |

| Warrenton | $137 | 4% |

| Warsaw | $125 | -5% |

| Washington | $138 | 5% |

| Water View | $125 | -5% |

| Waterford | $136 | 4% |

| Wattsville | $130 | -2% |

| Waverly | $137 | 4% |

| Waynesboro | $115 | -13% |

| Weber City | $125 | -5% |

| Weems | $124 | -6% |

| West Augusta | $122 | -8% |

| West Falls Church | $149 | 13% |

| West Mclean | $146 | 11% |

| West Point | $129 | -2% |

| West Springfield | $150 | 14% |

| Weyers Cave | $113 | -14% |

| White Marsh | $127 | -4% |

| White Plains | $134 | 2% |

| White Post | $122 | -7% |

| White Stone | $124 | -6% |

| Whitetop | $125 | -5% |

| Whitewood | $129 | -2% |

| Wicomico | $127 | -3% |

| Wicomico Church | $126 | -5% |

| Williamsburg | $122 | -7% |

| Williamsville | $118 | -10% |

| Willis | $130 | -1% |

| Willis Wharf | $129 | -2% |

| Wilsons | $137 | 4% |

| Winchester | $120 | -8% |

| Windsor | $134 | 2% |

| Wingina | $140 | 7% |

| Wintergreen | $130 | -1% |

| Wirtz | $134 | 2% |

| Wise | $121 | -8% |

| Withams | $129 | -2% |

| Wolf Trap | $145 | 10% |

| Wolford | $130 | -1% |

| Wolftown | $135 | 3% |

| Woodberry Forest | $137 | 4% |

| Woodbridge | $152 | 15% |

| Woodburn | $152 | 15% |

| Woodford | $132 | 0% |

| Woodlake | $137 | 4% |

| Woodlawn | $128 | -3% |

| Woods Cross Roads | $126 | -4% |

| Woodstock | $115 | -13% |

| Woodville | $137 | 4% |

| Woolwine | $127 | -4% |

| Wylliesburg | $132 | 1% |

| Wyndham | $134 | 2% |

| Wytheville | $120 | -9% |

| Yale | $137 | 4% |

| Yorkshire | $145 | 11% |

| Yorktown | $128 | -3% |

| Zacata | $132 | 0% |

| Zuni | $135 | 2% |

Minimum coverage for car insurance in Virginia

Car insurance is required by law in Virginia. The minimum amounts of coverage you need to drive legally include:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured motorist bodily injury: $50,000 per person, $100,000 per accident

- Uninsured motorist property damage: $25,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property.

Collision

Car insurance laws in Virginia

You need to provide proof of insurance to register your vehicle in Virginia. The state also monitors your vehicle’s insurance status electronically.

- Insurance companies report new policies and cancellations to the DMV. It’s important to make sure your insurance documents have accurate details about you and your vehicle.

- If the system detects a lapse in your insurance, it sends you a notice. Your license and registration can be suspended if you don’t reply in time.

How do SR-22 and FR-44 insurance work in Virginia?

You may need SR-22 car insurance or an FR-44 after certain violations. SR-22s and FR-44s are certificates that show that you have enough car insurance to drive legally.

Your insurance company sends the form you need to the state when you buy your policy.

- FR-44s are for more serious violations like DUI. You need to get double the state’s minimum liability limits for an FR-44.

- SR-22s are for lesser offenses like driving without insurance. You only need the minimum liability limits for one of these.

Some companies don’t offer SR-22s or FR-44s. Those that do may add a filing fee of about $25 to your rate. The price you pay for SR-22 or FR-44 insurance depends largely on your driving record. It’s good to shop around to find the cheapest rate.

How we selected the cheapest car insurance companies in Virginia

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Virginia

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.