Cheapest Car Insurance in West Virginia (2026)

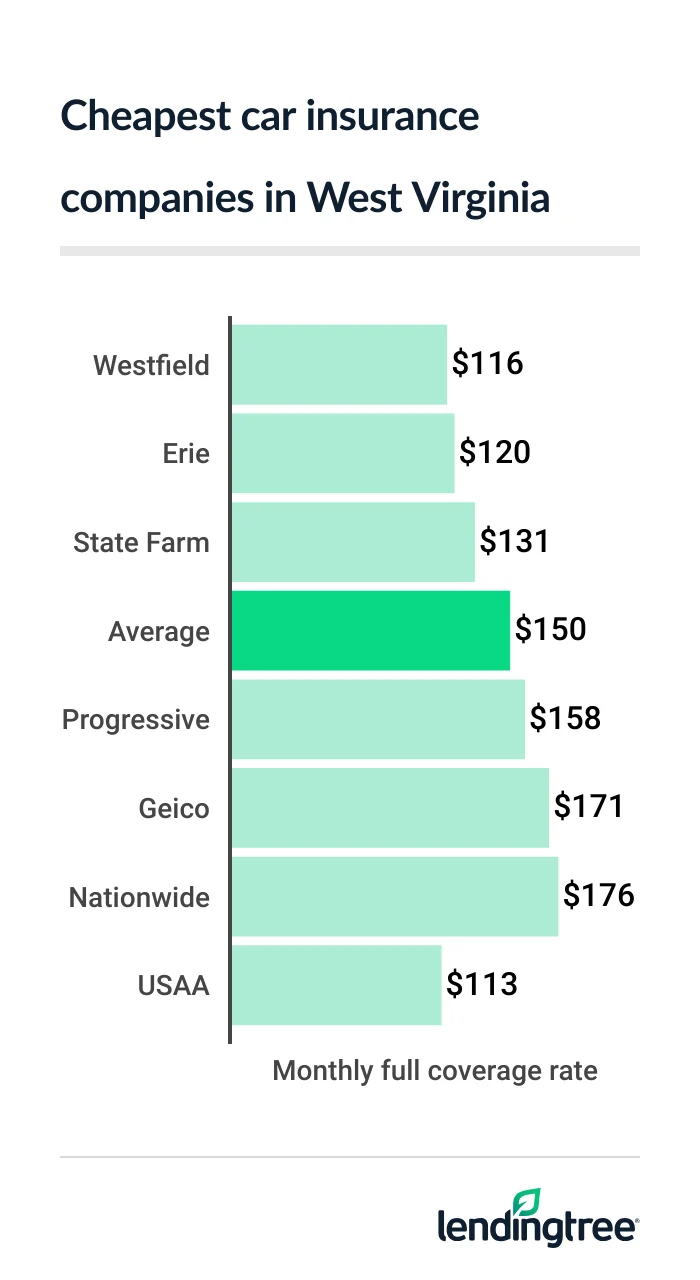

Westfield has the cheapest full coverage car insurance for most drivers in West Virginia, with an average rate of $116 per month. This is $34 less than the state average.

Best cheap car insurance in West Virginia

Cheapest full coverage car insurance in West Virginia: Westfield

Westfield has the cheapest full coverage car insurance for most drivers in West Virginia, with an average rate of $116 per month. The state average for full coverage is $150 per month.

USAA is $3 cheaper than Westfield, at $113 per month for a full coverage

Erie and State Farm also offer full coverage car insurance to West Virginia drivers that’s less than the state average rate.

Both companies have better customer satisfaction ratings than Westfield. They also offer more car insurance discounts, which could make them cheaper.

Cheapest companies for full coverage

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Westfield | $116 | |

| Erie | $120 | |

| State Farm | $131 | |

| Progressive | $158 | |

| Geico | $171 | |

| Nationwide | $176 | |

| Allstate | $219 | |

| USAA* | $113 | |

Both Erie and State Farm have discounts for insuring more than one vehicle or bundling multiple policies with them. You can also earn savings for having a car with certain safety features or paying for your entire policy period up front.

One of the best ways to find out which of these companies is the best for you is to compare car insurance quotes from each of them before you buy or renew your policy.

West Virginia’s best liability insurance rates: Westfield

At $29 per month, Westfield also has the cheapest liability insurance for most West Virginia drivers. This is $27 less than the state average of $56 per month.

Erie is nearly as cheap as Westfield, however, with an average rate of $31 per month for liability

Cheapest companies for liability coverage

| Company | Monthly rate |

|---|---|

| Westfield | $29 |

| Erie | $31 |

| State Farm | $40 |

| Geico | $74 |

| Nationwide | $75 |

| Progressive | $82 |

| Allstate | $85 |

| USAA* | $32 |

Another reason to consider Erie over Westfield is that all Erie car insurance policies come with some perks you have to pay extra for with other companies. Erie Rate Lock is one example. With it, your rates won’t go up until you make certain changes to your policy — even if you file a claim.

All Erie policies also come with first accident forgiveness

Cheapest auto insurance for West Virginia teens: Erie

To get the cheapest teen car insurance in West Virginia, make sure you get a quote from Erie while you shop for a policy.

Erie has the state’s lowest teen liability rates of $68 per month. It also has the cheapest full coverage rates for teen drivers, at $269 per month.

Cheapest companies for teen drivers

| Company | Liability only | Full coverage |

|---|---|---|

| Erie | $68 | $269 |

| Westfield | $90 | $358 |

| State Farm | $134 | $356 |

| Geico | $164 | $379 |

| Progressive | $192 | $410 |

| Nationwide | $235 | $635 |

| Allstate | $291 | $795 |

| USAA* | $88 | $297 |

Westfield has the second-cheapest liability rates for most West Virginia teens, at $90 per month. State Farm is the second-cheapest for teen full coverage, at $356 per month.

If you or a family member have ties to the military, consider getting a quote from USAA. It comes in second in both categories for those who qualify.

Most car insurance companies have discounts that can make teen car insurance more affordable. Erie and State Farm offer some of the most common ones.

- Erie offers discounts for unmarried drivers under 21 who live with their parents as well as unmarried young drivers whose parents used to insure them.

- Both Erie and State Farm give discounts to students who get good grades.

- They also have discounts for students who go away to school and don’t take a car with them, or who complete an approved driver training course.

Another way for teen drivers to save money on car insurance is to get added to a parent’s policy. The parent’s rate will go up, but the total price will still be cheaper than if you get your own coverage.

Best cheap car insurance in West Virginia after a speeding ticket: Westfield

Westfield is West Virginia’s cheapest car insurance company for most drivers with a speeding ticket on their records. Its average rate for these drivers is $116 per month.

Cheapest companies after a ticket

| Company | Monthly rate |

|---|---|

| Westfield | $116 |

| Erie | $132 |

| State Farm | $138 |

| Progressive | $205 |

| Geico | $216 |

| Nationwide | $228 |

| Allstate | $281 |

| USAA* | $131 |

Erie and State Farm are the next-cheapest companies for most of the state’s drivers after a ticket. The average quote from Erie is $132 per month, and from State Farm it’s $138 per month.

The state average cost of car insurance after a speeding ticket is $181 per month in West Virginia. This is $31 more than what drivers with clean records pay for the same amount of coverage.

Cheap car insurance quotes in West Virginia after an accident: State Farm

With an average quote of $131 per month, State Farm is West Virginia’s cheapest company for car insurance after an accident.

Erie’s average quote is only $11 more, though, at $142 per month. Westfield and Progressive are next, with each coming in well under the state average of $212 per month.

Cheapest companies after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $131 |

| Erie | $142 |

| Westfield | $165 |

| Progressive | $191 |

| Nationwide | $279 |

| Geico | $280 |

| Allstate | $351 |

| USAA* | $159 |

The average driver in West Virginia sees their car insurance go up about $60 per month after an accident.

Best insurance for West Virginia teens with bad driving records: Erie

West Virginia teens with a speeding ticket or accident on their driving records usually get the cheapest car insurance from Erie.

Erie’s average rate for teens with a speeding ticket is $79 per month. For teens with an accident, the company’s rates average $80 per month.

Cheapest companies for teens after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Erie | $79 | $80 |

| Westfield | $90 | $102 |

| State Farm | $145 | $134 |

| Geico | $198 | $252 |

| Progressive | $212 | $204 |

| Nationwide | $249 | $256 |

| Allstate | $405 | $428 |

| USAA* | $124 | $156 |

Westfield has the second-cheapest car insurance rates for young drivers in West Virginia with a ticket, at $90 per month. It also comes in second for young drivers after an accident, at $102 per month.

Cheapest car insurance in West Virginia with a DUI: Erie

Erie has the cheapest DUI insurance quotes for West Virginia drivers, at $181 per month. That’s around $75 less than the state average of $258 per month for drivers with a DUI (driving under the influence) conviction.

Cheapest companies after a DUI

| Company | Monthly rate |

|---|---|

| Erie | $181 |

| Progressive | $221 |

| State Farm | $255 |

| Westfield | $265 |

| Allstate | $292 |

| Geico | $300 |

| Nationwide | $346 |

| USAA* | $204 |

You should expect your car insurance premium

West Virginia’s cheapest car insurance with bad credit: Westfield

At $166 per month, Westfield has the cheapest car insurance for drivers with bad credit in West Virginia.

Nationwide is the next-cheapest company for most of the state’s drivers, with an average rate of $240 per month. Geico comes in third for most West Virginia drivers with poor credit, at $253 per month.

Cheapest companies for drivers with poor credit

| Company | Monthly rate |

|---|---|

| Westfield | $166 |

| Nationwide | $240 |

| Geico | $253 |

| Progressive | $270 |

| Erie | $276 |

| Allstate | $366 |

| State Farm | $545 |

| USAA* | $213 |

The state average rate for car insurance with poor credit is $291 per month. This is nearly double what a typical West Virginia driver with good credit pays.

Find out your credit score for free with LendingTree Spring before you shop for car insurance.

Best car insurance companies in West Virginia

Erie and Westfield are the best car insurance companies for most drivers in West Virginia.

Westfield usually has cheaper rates than Erie for drivers with clean records, but only by a few dollars per month. Also, Erie offers more discounts than Westfield, which means it could be cheaper for you if you can get some of them.

West Virginia car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Erie | 703 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ | |

| Westfield | 647 | A |

If all you want is basic car insurance at a low price, Westfield may be the best company for you. It doesn’t offer many coverage options that let you customize your policy.

Erie also offers fewer optional coverages than many large insurance companies, but still has more than Westfield. With Erie, you can pay extra for roadside assistance

West Virginia car insurance rates by city

Falling Waters is the cheapest city in West Virginia for car insurance, with an average rate of $132 per month.

The state’s most expensive city for car insurance is Kermit, where rates average $185 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Accoville | $169 | 12% |

| Adrian | $159 | 6% |

| Advent | $155 | 3% |

| Albright | $156 | 4% |

| Alderson | $144 | -4% |

| Alkol | $170 | 13% |

| Allen Junction | $160 | 6% |

| Alloy | $143 | -5% |

| Alma | $149 | -1% |

| Alum Bridge | $157 | 4% |

| Alum Creek | $158 | 5% |

| Amherstdale | $168 | 12% |

| Amigo | $160 | 6% |

| Amma | $162 | 8% |

| Anawalt | $159 | 6% |

| Anmoore | $142 | -6% |

| Annamoriah | $162 | 8% |

| Ansted | $143 | -5% |

| Apple Grove | $153 | 1% |

| Arbovale | $157 | 4% |

| Arnett | $150 | 0% |

| Arnoldsburg | $165 | 10% |

| Arthurdale | $156 | 4% |

| Artie | $147 | -2% |

| Asbury | $143 | -5% |

| Ashford | $154 | 2% |

| Ashton | $153 | 2% |

| Athens | $139 | -7% |

| Auburn | $163 | 9% |

| Augusta | $142 | -5% |

| Aurora | $159 | 6% |

| Avondale | $160 | 6% |

| Baisden | $176 | 17% |

| Baker | $144 | -5% |

| Bakerton | $136 | -10% |

| Ballard | $147 | -2% |

| Ballengee | $147 | -2% |

| Bancroft | $146 | -3% |

| Bandytown | $160 | 6% |

| Barboursville | $152 | 1% |

| Barrackville | $141 | -6% |

| Bartley | $161 | 7% |

| Bartow | $155 | 3% |

| Baxter | $141 | -6% |

| Bayard | $152 | 1% |

| Beaver | $143 | -5% |

| Beckley | $144 | -4% |

| Beech Bottom | $139 | -8% |

| Beeson | $143 | -5% |

| Belington | $159 | 5% |

| Belle | $147 | -2% |

| Belleville | $148 | -1% |

| Belmont | $156 | 4% |

| Belva | $150 | 0% |

| Benwood | $139 | -7% |

| Berea | $162 | 7% |

| Bergoo | $156 | 4% |

| Berkeley Springs | $136 | -9% |

| Berwind | $161 | 7% |

| Bethany | $140 | -7% |

| Bethlehem | $135 | -10% |

| Bickmore | $162 | 8% |

| Big Bend | $164 | 9% |

| Big Chimney | $146 | -3% |

| Big Creek | $168 | 12% |

| Big Otter | $161 | 7% |

| Big Run | $149 | -1% |

| Big Sandy | $164 | 9% |

| Big Springs | $163 | 8% |

| Bim | $160 | 6% |

| Birch River | $147 | -2% |

| Blacksville | $143 | -5% |

| Blair | $169 | 12% |

| Blennerhassett | $143 | -5% |

| Bloomingrose | $155 | 3% |

| Blount | $149 | -1% |

| Blue Creek | $146 | -3% |

| Bluefield | $139 | -7% |

| Bluewell | $141 | -6% |

| Boaz | $148 | -2% |

| Bob White | $158 | 5% |

| Bolt | $146 | -3% |

| Bomont | $159 | 6% |

| Boomer | $143 | -5% |

| Borderland | $179 | 19% |

| Bowden | $154 | 2% |

| Bradley | $143 | -5% |

| Bradshaw | $161 | 7% |

| Bramwell | $142 | -6% |

| Branchland | $173 | 15% |

| Brandywine | $157 | 5% |

| Breeden | $185 | 23% |

| Brenton | $162 | 8% |

| Bretz | $156 | 4% |

| Bridgeport | $139 | -7% |

| Brohard | $163 | 9% |

| Brookhaven | $140 | -7% |

| Brownsville | $142 | -6% |

| Bruceton Mills | $158 | 5% |

| Bruno | $169 | 12% |

| Buckeye | $153 | 2% |

| Buckhannon | $158 | 5% |

| Bud | $158 | 5% |

| Buffalo | $149 | -1% |

| Bunker Hill | $134 | -11% |

| Burlington | $143 | -5% |

| Burnsville | $159 | 5% |

| Burnt House | $160 | 6% |

| Burnwell | $146 | -3% |

| Burton | $148 | -2% |

| Cabin Creek | $147 | -2% |

| Cabins | $147 | -2% |

| Cairo | $160 | 7% |

| Caldwell | $142 | -5% |

| Calvin | $151 | 0% |

| Camden | $156 | 3% |

| Camden-on-Gauley | $157 | 4% |

| Cameron | $143 | -5% |

| Camp Creek | $142 | -5% |

| Canebrake | $161 | 7% |

| Cannelton | $144 | -4% |

| Canvas | $151 | 0% |

| Capon Bridge | $141 | -6% |

| Capon Springs | $142 | -5% |

| Carolina | $143 | -5% |

| Carpendale | $141 | -6% |

| Cass | $158 | 5% |

| Cassville | $138 | -8% |

| Cedar Grove | $149 | -1% |

| Cedarville | $160 | 7% |

| Center Point | $157 | 4% |

| Ceredo | $150 | 0% |

| Chapmanville | $166 | 10% |

| Charles Town | $135 | -10% |

| Charleston | $145 | -3% |

| Charlton Heights | $143 | -5% |

| Charmco | $143 | -5% |

| Chattaroy | $179 | 19% |

| Chauncey | $167 | 11% |

| Cheat Lake | $140 | -7% |

| Chesapeake | $148 | -2% |

| Chester | $140 | -7% |

| Chloe | $166 | 11% |

| Circleville | $159 | 6% |

| Clarksburg | $142 | -5% |

| Clay | $160 | 7% |

| Clear Creek | $147 | -2% |

| Clear Fork | $162 | 8% |

| Clendenin | $152 | 1% |

| Cleveland | $161 | 7% |

| Clothier | $167 | 11% |

| Coal City | $145 | -4% |

| Coal Mountain | $165 | 10% |

| Coaldale | $141 | -6% |

| Coalton | $156 | 4% |

| Coburn | $148 | -2% |

| Colcord | $147 | -2% |

| Colfax | $141 | -7% |

| Colliers | $137 | -9% |

| Comfort | $151 | 0% |

| Cool Ridge | $145 | -4% |

| Copen | $156 | 4% |

| Cora | $168 | 11% |

| Corinne | $159 | 6% |

| Costa | $155 | 3% |

| Cottageville | $156 | 4% |

| Cove Gap | $176 | 17% |

| Covel | $158 | 5% |

| Cowen | $153 | 2% |

| Coxs Mills | $163 | 9% |

| Crab Orchard | $144 | -4% |

| Craigsville | $148 | -2% |

| Crawford | $161 | 7% |

| Crawley | $142 | -5% |

| Creston | $162 | 8% |

| Crichton | $144 | -4% |

| Cross Lanes | $145 | -4% |

| Crum | $184 | 22% |

| Cucumber | $160 | 6% |

| Culloden | $147 | -2% |

| Cyclone | $166 | 11% |

| Dailey | $155 | 3% |

| Dallas | $141 | -6% |

| Danese | $143 | -5% |

| Daniels | $144 | -4% |

| Danville | $160 | 6% |

| Davin | $167 | 11% |

| Davis | $158 | 5% |

| Davisville | $146 | -3% |

| Davy | $162 | 8% |

| Dawes | $148 | -2% |

| Deep Water | $143 | -5% |

| Dehue | $174 | 15% |

| Delbarton | $178 | 18% |

| Dellslow | $140 | -7% |

| Delray | $143 | -5% |

| Despard | $142 | -6% |

| Diana | $158 | 5% |

| Dille | $159 | 6% |

| Dingess | $181 | 20% |

| Dixie | $150 | 0% |

| Dorothy | $146 | -3% |

| Dothan | $141 | -6% |

| Drennen | $153 | 2% |

| Dry Creek | $149 | -1% |

| Dry Fork | $157 | 4% |

| Drybranch | $145 | -3% |

| Duck | $159 | 5% |

| Dunbar | $143 | -5% |

| Duncan | $157 | 4% |

| Dunlow | $182 | 21% |

| Dunmore | $154 | 2% |

| Durbin | $157 | 4% |

| Earling | $168 | 12% |

| East Bank | $146 | -3% |

| East Lynn | $178 | 19% |

| Eccles | $144 | -4% |

| Eckman | $160 | 6% |

| Edgarton | $179 | 19% |

| Edmond | $142 | -6% |

| Eglon | $160 | 6% |

| Elbert | $160 | 7% |

| Eleanor | $146 | -3% |

| Elizabeth | $163 | 9% |

| Elk Garden | $145 | -4% |

| Elkhorn | $161 | 7% |

| Elkins | $154 | 2% |

| Elkview | $149 | -1% |

| Ellamore | $157 | 4% |

| Ellenboro | $159 | 6% |

| Emmett | $180 | 20% |

| Enterprise | $144 | -4% |

| Erbacon | $157 | 4% |

| Eskdale | $148 | -2% |

| Ethel | $173 | 15% |

| Eureka | $156 | 4% |

| Evans | $155 | 3% |

| Exchange | $157 | 4% |

| Fairdale | $148 | -1% |

| Fairlea | $142 | -6% |

| Fairmont | $140 | -7% |

| Fairview | $142 | -5% |

| Falling Rock | $147 | -2% |

| Falling Waters | $132 | -12% |

| Falls Mill | $159 | 6% |

| Fanrock | $161 | 7% |

| Farmington | $144 | -4% |

| Fayetteville | $141 | -6% |

| Fenwick | $148 | -2% |

| Filbert | $160 | 7% |

| Fisher | $144 | -4% |

| Flat Top | $143 | -5% |

| Flatwoods | $157 | 5% |

| Flemington | $155 | 3% |

| Floe | $166 | 11% |

| Follansbee | $137 | -9% |

| Folsom | $149 | -1% |

| Forest Hill | $149 | -1% |

| Fort Ashby | $141 | -6% |

| Fort Gay | $179 | 19% |

| Foster | $158 | 5% |

| Four States | $143 | -5% |

| Frametown | $156 | 4% |

| Frankford | $141 | -6% |

| Franklin | $156 | 4% |

| Fraziers Bottom | $150 | 0% |

| Freeman | $141 | -6% |

| French Creek | $160 | 6% |

| Frenchton | $158 | 5% |

| Friendly | $149 | -1% |

| Gallagher | $146 | -3% |

| Gallipolis Ferry | $152 | 1% |

| Galloway | $160 | 6% |

| Gandeeville | $162 | 8% |

| Gap Mills | $149 | -1% |

| Gary | $159 | 6% |

| Gassaway | $154 | 2% |

| Gauley Bridge | $142 | -6% |

| Gauley Mills | $157 | 4% |

| Gay | $156 | 4% |

| Genoa | $180 | 20% |

| Gerrardstown | $133 | -11% |

| Ghent | $144 | -4% |

| Gilbert | $176 | 17% |

| Gilboa | $151 | 0% |

| Given | $155 | 3% |

| Glady | $154 | 2% |

| Glasgow | $147 | -2% |

| Glen | $163 | 8% |

| Glen Dale | $139 | -7% |

| Glen Daniel | $149 | -1% |

| Glen Easton | $141 | -6% |

| Glen Ferris | $143 | -5% |

| Glen Fork | $162 | 8% |

| Glen Jean | $143 | -5% |

| Glen Rogers | $164 | 9% |

| Glen White | $145 | -3% |

| Glengary | $133 | -12% |

| Glenville | $162 | 8% |

| Glenwood | $150 | 0% |

| Gordon | $159 | 5% |

| Gormania | $148 | -2% |

| Grafton | $156 | 4% |

| Grant Town | $142 | -5% |

| Grantsville | $163 | 9% |

| Granville | $138 | -8% |

| Grassy Meadows | $145 | -4% |

| Great Cacapon | $138 | -8% |

| Green Bank | $154 | 3% |

| Green Spring | $144 | -4% |

| Green Sulphur Springs | $147 | -2% |

| Greenville | $149 | -1% |

| Griffithsville | $173 | 15% |

| Gypsy | $146 | -3% |

| Hacker Valley | $160 | 6% |

| Halltown | $136 | -10% |

| Hambleton | $162 | 8% |

| Hamlin | $172 | 15% |

| Handley | $146 | -3% |

| Hanover | $163 | 9% |

| Hansford | $147 | -2% |

| Harman | $157 | 4% |

| Harper | $144 | -4% |

| Harrisville | $160 | 6% |

| Hartford | $151 | 0% |

| Hartford City | $151 | 0% |

| Harts | $172 | 14% |

| Haywood | $142 | -6% |

| Heaters | $158 | 5% |

| Hedgesville | $134 | -11% |

| Helen | $145 | -3% |

| Helvetia | $158 | 5% |

| Henderson | $154 | 2% |

| Hendricks | $159 | 6% |

| Henlawson | $167 | 11% |

| Hensley | $165 | 10% |

| Hepzibah | $142 | -6% |

| Herndon | $160 | 6% |

| Hernshaw | $148 | -2% |

| Hewett | $160 | 6% |

| Hiawatha | $144 | -4% |

| Hico | $144 | -5% |

| High View | $141 | -6% |

| Hillsboro | $152 | 1% |

| Hilltop | $140 | -7% |

| Hinton | $150 | 0% |

| Holden | $170 | 13% |

| Hometown | $146 | -3% |

| Hooverson Heights | $138 | -8% |

| Horner | $156 | 4% |

| Hugheston | $147 | -2% |

| Hundred | $151 | 1% |

| Huntington | $149 | -1% |

| Hurricane | $147 | -2% |

| Iaeger | $161 | 7% |

| Idamay | $142 | -5% |

| Ikes Fork | $165 | 10% |

| Independence | $156 | 4% |

| Indian Mills | $149 | -1% |

| Indore | $161 | 7% |

| Institute | $144 | -4% |

| Inwood | $134 | -11% |

| Ireland | $155 | 3% |

| Isaban | $169 | 12% |

| Itmann | $159 | 6% |

| Ivydale | $161 | 7% |

| Jacksonburg | $150 | 0% |

| Jane Lew | $155 | 3% |

| Jeffrey | $160 | 6% |

| Jenkinjones | $160 | 7% |

| Jesse | $163 | 8% |

| Job | $155 | 3% |

| Jolo | $163 | 9% |

| Josephine | $148 | -2% |

| Julian | $157 | 5% |

| Jumping Branch | $149 | -1% |

| Junior | $159 | 6% |

| Justice | $179 | 19% |

| Kanawha Falls | $143 | -5% |

| Kanawha Head | $159 | 6% |

| Kearneysville | $135 | -10% |

| Kegley | $140 | -7% |

| Kellysville | $141 | -6% |

| Kenna | $157 | 5% |

| Kenova | $150 | 0% |

| Kerens | $155 | 3% |

| Kermit | $185 | 23% |

| Keslers Cross Lanes | $151 | 0% |

| Keyser | $142 | -6% |

| Kiahsville | $176 | 17% |

| Kimball | $160 | 7% |

| Kimberly | $143 | -5% |

| Kincaid | $143 | -5% |

| Kingmont | $141 | -7% |

| Kingwood | $154 | 3% |

| Kirby | $142 | -5% |

| Kistler | $167 | 11% |

| Kopperston | $164 | 9% |

| Kyle | $158 | 5% |

| Lahmansville | $149 | -1% |

| Lake | $167 | 11% |

| Lanark | $144 | -4% |

| Lansing | $143 | -5% |

| Lashmeet | $140 | -7% |

| Lavalette | $165 | 10% |

| Layland | $144 | -5% |

| Le Roy | $157 | 4% |

| Left Hand | $164 | 9% |

| Lehew | $143 | -5% |

| Leivasy | $150 | 0% |

| Lenore | $180 | 20% |

| Leon | $153 | 2% |

| Lerona | $140 | -7% |

| Lesage | $149 | -1% |

| Leslie | $144 | -4% |

| Lester | $146 | -3% |

| Letart | $152 | 1% |

| Levels | $142 | -5% |

| Lewisburg | $143 | -5% |

| Liberty | $146 | -3% |

| Lindside | $149 | -1% |

| Linn | $164 | 9% |

| Little Birch | $158 | 5% |

| Littleton | $150 | 0% |

| Liverpool | $157 | 4% |

| Livingston | $146 | -3% |

| Lizemores | $162 | 8% |

| Lochgelly | $141 | -6% |

| Logan | $167 | 11% |

| London | $146 | -3% |

| Lookout | $145 | -4% |

| Looneyville | $162 | 8% |

| Lorado | $169 | 12% |

| Lorentz | $158 | 5% |

| Lost City | $144 | -4% |

| Lost Creek | $149 | -1% |

| Lost River | $144 | -4% |

| Lubeck | $143 | -5% |

| Lumberport | $145 | -4% |

| Lundale | $169 | 12% |

| Lyburn | $168 | 12% |

| Lynco | $163 | 8% |

| Maben | $162 | 8% |

| Mabie | $155 | 3% |

| Mabscott | $144 | -4% |

| MacArthur | $144 | -4% |

| Macfarlan | $161 | 7% |

| Madison | $160 | 7% |

| Mahan | $146 | -3% |

| Maidsville | $140 | -7% |

| Mallory | $167 | 11% |

| Mammoth | $146 | -3% |

| Man | $167 | 11% |

| Mannington | $144 | -4% |

| Marfrance | $144 | -4% |

| Marianna | $164 | 9% |

| Marlinton | $155 | 3% |

| Marmet | $147 | -2% |

| Martinsburg | $132 | -12% |

| Mason | $151 | 0% |

| Masontown | $156 | 4% |

| Matewan | $177 | 18% |

| Matheny | $163 | 9% |

| Mathias | $142 | -5% |

| Matoaka | $143 | -5% |

| Maxwelton | $142 | -5% |

| Maybeury | $159 | 6% |

| Maysel | $162 | 8% |

| Maysville | $149 | -1% |

| McGraws | $163 | 8% |

| McMechen | $140 | -7% |

| Meadow Bluff | $144 | -4% |

| Meadow Bridge | $145 | -3% |

| Meadow Creek | $147 | -2% |

| Meadowbrook | $142 | -5% |

| Metz | $145 | -4% |

| Miami | $147 | -2% |

| Middlebourne | $148 | -1% |

| Midkiff | $172 | 14% |

| Midway | $144 | -4% |

| Milam | $147 | -2% |

| Mill Creek | $158 | 5% |

| Millstone | $164 | 9% |

| Millville | $136 | -10% |

| Millwood | $156 | 4% |

| Milton | $149 | -1% |

| Minden | $140 | -7% |

| Mineral Wells | $146 | -3% |

| Moatsville | $161 | 7% |

| Mohawk | $167 | 11% |

| Monongah | $139 | -7% |

| Montana Mines | $142 | -5% |

| Montcalm | $139 | -7% |

| Monterville | $156 | 4% |

| Montgomery | $144 | -4% |

| Montrose | $156 | 4% |

| Moorefield | $144 | -4% |

| Morgantown | $137 | -9% |

| Moundsville | $139 | -7% |

| Mount Alto | $155 | 3% |

| Mount Carbon | $142 | -5% |

| Mount Clare | $144 | -4% |

| Mount Gay | $168 | 11% |

| Mount Gay-Shamrock | $168 | 12% |

| Mount Hope | $142 | -6% |

| Mount Lookout | $149 | -1% |

| Mount Nebo | $147 | -2% |

| Mount Storm | $150 | 0% |

| Mount Zion | $164 | 9% |

| Mullens | $160 | 6% |

| Munday | $161 | 7% |

| Myra | $169 | 12% |

| Nallen | $143 | -5% |

| Naoma | $152 | 1% |

| Napier | $159 | 6% |

| Naugatuck | $181 | 20% |

| Nebo | $160 | 7% |

| Nellis | $155 | 3% |

| Nemours | $139 | -7% |

| Nettie | $147 | -2% |

| New Creek | $143 | -5% |

| New Cumberland | $140 | -7% |

| New Haven | $150 | 0% |

| New Manchester | $140 | -7% |

| New Martinsville | $145 | -3% |

| New Milton | $158 | 5% |

| New Richmond | $162 | 7% |

| Newburg | $157 | 5% |

| Newell | $140 | -7% |

| Newhall | $161 | 7% |

| Newton | $166 | 10% |

| Newtown | $179 | 19% |

| Nicut | $161 | 7% |

| Nimitz | $147 | -2% |

| Nitro | $145 | -4% |

| Nobe | $163 | 8% |

| Normantown | $162 | 8% |

| North Hills | $144 | -4% |

| North Matewan | $179 | 19% |

| North Spring | $165 | 10% |

| Northfork | $161 | 7% |

| Norton | $154 | 2% |

| Nutter Fort | $142 | -5% |

| Oak Hill | $140 | -7% |

| Oakvale | $140 | -7% |

| Oceana | $162 | 8% |

| Odd | $146 | -3% |

| Old Fields | $144 | -4% |

| Omar | $170 | 13% |

| Ona | $149 | -1% |

| Onego | $156 | 4% |

| Orgas | $156 | 4% |

| Orlando | $156 | 4% |

| Orma | $166 | 10% |

| Osage | $140 | -7% |

| Ottawa | $160 | 6% |

| Paden City | $146 | -3% |

| Page | $143 | -5% |

| Pageton | $160 | 7% |

| Palestine | $164 | 9% |

| Panther | $161 | 7% |

| Parkersburg | $143 | -5% |

| Parsons | $161 | 7% |

| Paw Paw | $137 | -9% |

| Pax | $141 | -6% |

| Paynesville | $162 | 8% |

| Pea Ridge | $149 | -1% |

| Peach Creek | $168 | 11% |

| Pecks Mill | $168 | 12% |

| Pence Springs | $146 | -3% |

| Pennsboro | $159 | 6% |

| Pentress | $140 | -7% |

| Perkins | $161 | 7% |

| Petersburg | $149 | -1% |

| Peterstown | $148 | -2% |

| Petroleum | $161 | 7% |

| Peytona | $154 | 2% |

| Philippi | $161 | 7% |

| Pickens | $156 | 4% |

| Piedmont | $142 | -6% |

| Pinch | $148 | -1% |

| Pine Grove | $150 | 0% |

| Pineville | $161 | 7% |

| Piney View | $144 | -4% |

| Pipestem | $148 | -2% |

| Pleasant Valley | $139 | -8% |

| Poca | $148 | -2% |

| Point Pleasant | $151 | 1% |

| Points | $143 | -5% |

| Pond Gap | $148 | -1% |

| Pool | $150 | 0% |

| Porters Falls | $147 | -2% |

| Powellton | $143 | -5% |

| Pratt | $146 | -3% |

| Premier | $159 | 6% |

| Prichard | $170 | 13% |

| Prince | $143 | -5% |

| Princeton | $140 | -7% |

| Princewick | $144 | -4% |

| Procious | $160 | 7% |

| Proctor | $142 | -6% |

| Prosperity | $144 | -4% |

| Pullman | $163 | 8% |

| Purgitsville | $143 | -5% |

| Pursglove | $140 | -7% |

| Quinwood | $144 | -4% |

| Rachel | $144 | -4% |

| Racine | $153 | 2% |

| Ragland | $179 | 19% |

| Rainelle | $146 | -3% |

| Raleigh | $144 | -4% |

| Ranger | $174 | 16% |

| Ranson | $135 | -10% |

| Ravencliff | $164 | 9% |

| Ravenswood | $155 | 3% |

| Rawl | $179 | 19% |

| Raysal | $163 | 8% |

| Reader | $147 | -2% |

| Red Creek | $157 | 4% |

| Red House | $147 | -2% |

| Red Jacket | $177 | 17% |

| Reedsville | $154 | 3% |

| Reedy | $165 | 10% |

| Renick | $141 | -6% |

| Reynoldsville | $144 | -4% |

| Rhodell | $145 | -3% |

| Richwood | $148 | -2% |

| Ridgeley | $141 | -6% |

| Ridgeview | $153 | 2% |

| Ridgeway | $134 | -11% |

| Rio | $142 | -5% |

| Ripley | $154 | 2% |

| Rippon | $135 | -10% |

| Riverton | $156 | 4% |

| Rivesville | $141 | -6% |

| Robinette | $168 | 12% |

| Robson | $143 | -5% |

| Rock | $139 | -7% |

| Rock Castle | $155 | 3% |

| Rock Cave | $161 | 7% |

| Rock Creek | $148 | -2% |

| Rock View | $161 | 7% |

| Rockport | $150 | 0% |

| Roderfield | $163 | 8% |

| Romney | $143 | -5% |

| Ronceverte | $142 | -6% |

| Rosedale | $161 | 7% |

| Rosemont | $157 | 5% |

| Rossmore | $167 | 11% |

| Rowlesburg | $159 | 6% |

| Rupert | $144 | -4% |

| Russelville | $144 | -4% |

| Sabine | $161 | 7% |

| Salem | $149 | -1% |

| Salt Rock | $153 | 2% |

| Sand Fork | $160 | 6% |

| Sand Ridge | $165 | 10% |

| Sandstone | $149 | -1% |

| Sandyville | $158 | 5% |

| Sarah Ann | $170 | 13% |

| Saulsville | $163 | 8% |

| Saxon | $149 | -1% |

| Scarbro | $141 | -6% |

| Scott Depot | $146 | -3% |

| Second Creek | $148 | -2% |

| Selbyville | $159 | 6% |

| Seneca Rocks | $157 | 5% |

| Seth | $154 | 3% |

| Shady Spring | $144 | -4% |

| Shanks | $142 | -6% |

| Shannondale | $136 | -10% |

| Sharples | $173 | 15% |

| Shenandoah Junction | $133 | -11% |

| Shepherdstown | $133 | -11% |

| Shinnston | $142 | -5% |

| Shirley | $154 | 2% |

| Shoals | $159 | 6% |

| Shock | $161 | 7% |

| Short Creek | $139 | -8% |

| Simon | $164 | 9% |

| Simpson | $157 | 5% |

| Sinks Grove | $146 | -3% |

| Sissonville | $150 | 0% |

| Sistersville | $148 | -1% |

| Skelton | $144 | -4% |

| Slab Fork | $145 | -3% |

| Slanesville | $142 | -6% |

| Slatyfork | $155 | 3% |

| Smithburg | $156 | 4% |

| Smithers | $144 | -4% |

| Smithfield | $153 | 2% |

| Smithville | $160 | 6% |

| Smoot | $144 | -4% |

| Snowshoe | $155 | 3% |

| Sod | $169 | 13% |

| Sophia | $145 | -4% |

| South Charleston | $143 | -5% |

| Southside | $153 | 2% |

| Spanishburg | $142 | -6% |

| Spelter | $142 | -5% |

| Spencer | $161 | 7% |

| Spring Dale | $143 | -5% |

| Spurlockville | $165 | 10% |

| Squire | $163 | 8% |

| St. Albans | $145 | -3% |

| St. Marys | $155 | 3% |

| Stanaford | $144 | -4% |

| Standard | $146 | -3% |

| Star City | $137 | -9% |

| Stephenson | $161 | 7% |

| Stollings | $169 | 12% |

| Stonewood | $142 | -5% |

| Stouts Mills | $160 | 6% |

| Sugar Grove | $158 | 5% |

| Sumerco | $169 | 12% |

| Summersville | $149 | -1% |

| Summit Point | $136 | -9% |

| Surveyor | $143 | -5% |

| Sutton | $155 | 3% |

| Swiss | $149 | -1% |

| Switchback | $159 | 6% |

| Switzer | $167 | 11% |

| Sylvester | $156 | 4% |

| Tad | $147 | -2% |

| Talcott | $147 | -2% |

| Tallmansville | $159 | 6% |

| Tanner | $163 | 8% |

| Taplin | $168 | 12% |

| Teays Valley | $147 | -2% |

| Terra Alta | $157 | 4% |

| Tesla | $158 | 5% |

| Thacker | $179 | 19% |

| Thomas | $161 | 7% |

| Thornton | $159 | 6% |

| Thorpe | $160 | 6% |

| Thurmond | $142 | -5% |

| Tioga | $151 | 0% |

| Tornado | $149 | -1% |

| Triadelphia | $135 | -11% |

| Trout | $143 | -5% |

| Troy | $162 | 8% |

| Tunnelton | $157 | 4% |

| Turtle Creek | $159 | 6% |

| Twilight | $160 | 6% |

| Uneeda | $159 | 6% |

| Union | $148 | -2% |

| Upper Falls | $148 | -1% |

| Upper Tract | $157 | 4% |

| Upperglade | $156 | 4% |

| Valley Bend | $155 | 3% |

| Valley Fork | $161 | 7% |

| Valley Grove | $135 | -10% |

| Valley Head | $156 | 4% |

| Vallscreek | $161 | 7% |

| Van | $159 | 6% |

| Varney | $179 | 19% |

| Verdunville | $166 | 11% |

| Verner | $180 | 20% |

| Victor | $143 | -5% |

| Vienna | $146 | -3% |

| Vivian | $160 | 7% |

| Volga | $158 | 5% |

| Vulcan | $179 | 19% |

| Waiteville | $146 | -3% |

| Walkersville | $159 | 6% |

| Wallace | $148 | -2% |

| Wallback | $161 | 7% |

| Walton | $164 | 9% |

| Wana | $144 | -4% |

| War | $160 | 6% |

| Wardensville | $144 | -4% |

| Warriormine | $160 | 7% |

| Washington | $143 | -5% |

| Waverly | $147 | -2% |

| Wayne | $172 | 14% |

| Wayside | $147 | -2% |

| Webster Springs | $155 | 3% |

| Weirton | $138 | -8% |

| Welch | $160 | 6% |

| Wellsburg | $139 | -7% |

| West Columbia | $151 | 0% |

| West Hamlin | $172 | 15% |

| West Liberty | $136 | -9% |

| West Milford | $148 | -2% |

| West Union | $155 | 3% |

| Weston | $156 | 3% |

| Westover | $138 | -8% |

| Wharncliffe | $176 | 17% |

| Wharton | $160 | 6% |

| Wheeling | $135 | -10% |

| White Oak | $144 | -4% |

| White Sulphur Springs | $142 | -6% |

| Whitesville | $149 | -1% |

| Whitman | $167 | 11% |

| Whitmer | $155 | 3% |

| Whittaker | $146 | -3% |

| Widen | $160 | 6% |

| Wilcoe | $160 | 7% |

| Wildcat | $155 | 3% |

| Wiley Ford | $142 | -6% |

| Wilkinson | $168 | 11% |

| Williamsburg | $143 | -5% |

| Williamson | $179 | 19% |

| Williamstown | $148 | -2% |

| Willow Island | $156 | 4% |

| Wilsondale | $178 | 18% |

| Winding Gulf | $144 | -4% |

| Windsor Heights | $139 | -7% |

| Winfield | $147 | -2% |

| Winifrede | $148 | -1% |

| Winona | $144 | -4% |

| Wolf Creek | $146 | -3% |

| Wolfe | $139 | -7% |

| Woodville | $164 | 9% |

| Worthington | $142 | -6% |

| Wyatt | $146 | -3% |

| Wyco | $159 | 6% |

| Wyoming | $162 | 7% |

| Yawkey | $169 | 12% |

| Yellow Spring | $143 | -5% |

| Yolyn | $174 | 15% |

The average cost of car insurance in West Virginia’s largest cities:

- Charleston, $145 per month

- Huntington, $149 per month

- Morgantown, $137 per month

- Parkersburg, $143 per month

- Wheeling, $135 per month

Minimum coverage for car insurance in West Virginia

You need to meet West Virginia’s car insurance requirements to drive legally. These requirements include:

- Bodily injury liability coverage: $25,000 per person, $50,000 per accident

- Property damage coverage: $25,000

- Uninsured motorist bodily injury coverage: $25,000 per person, $50,000 per accident

- Uninsured motorist property damage coverage: $25,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

Uninsured motorist covers you and your passengers for injuries and damage caused by a driver with no insurance.

West Virginia state law doesn’t require full coverage car insurance, which typically includes collision

How to save on car insurance in West Virginia

Compare car insurance quotes

Comparing car insurance quotes from several companies is an easy way to save money on car insurance.

Insurance companies don’t all look at the factors that impact your rate in the same way. This is why you may get different quotes from insurance companies.

Comparing insurance quotes could save you as much as 24% on your annual premium in West Virginia.

Take advantage of discounts

Bundling multiple insurance policies with one company is another good way to save money on car insurance. Many insurance companies give you a discount if you buy more than one policy from them, such as auto and renters insurance or auto and home insurance.

Insurers offer tons of other discounts, too, including ones for:

- Automatic payments

- Good students

- Multiple vehicles

- New vehicles

- Safe drivers

- Safety features and equipment

- Usage-based insurance programs

Raise your deductible

You may also save on car insurance costs by raising your deductible.

The lower your deductible, the less you have to pay out of your own pocket for repairs if you’re in an accident. A low deductible also means a high premium, though.

Because of this, if you want to lower your auto insurance costs, raise your policy’s deductible. Just make sure you can afford to spend that amount if your car is in an accident.

Drop coverage you don’t need

If you want to pay less for car insurance, look at your current coverage types and amounts and see if you still need them.

You may not need collision and comprehensive coverage if you drive an older car that is paid off

Frequently asked questions

West Virginia car insurance costs $150 a month, on average, if you buy full coverage. If you only buy minimum coverage, the state average cost is $56 a month.

The cheapest car insurance in West Virginia comes from Westfield. The company has the lowest average rate for liability coverage, at $29 per month. It also has the state’s lowest full coverage rate of $116 per month.

West Virginia is an at-fault state for car insurance. This means the driver that causes the accident is required to pay for the injuries and repairs of others involved in the accident.

How we selected the cheapest car insurance companies in West Virginia

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured motorist property damage: $25,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in West Virginia

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.