Nearly 3 in 5 Parents Have Given Kids Access to Their Cards, but 31% Regret It

Teaching children financial literacy, including how to use credit responsibly, is an important life lesson. But parents who’ve given their kids credit or debit card access say this can come with regret, according to the newest LendingTree survey.

Further, about 1 in 5 parents admit their child made an unauthorized purchase with their card. Our survey explores the complicated relationship between money and family dynamics and offers strategies for cultivating healthy spending habits without financial quarrels.

- The majority of parents have given kids access to their money, but some have regrets. 59% of parents have given their child permission to use their credit or debit card, with dads more likely to do so than moms (64% versus 54%). However, 31% of them regret letting their child borrow their card.

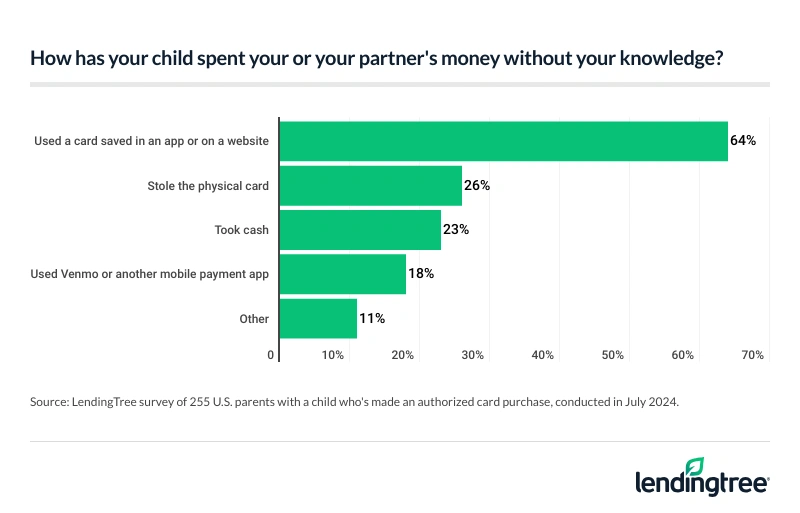

- Some children spend without permission, and it’s not always for minor purchases. 22% of parents say their child has made an unauthorized purchase with their card. When asked how sneaky spending has happened, 64% said a card was saved on an app or website, 26% said their child has stolen a physical card and 23% said they have taken cash. Parents say the largest unauthorized card purchase averaged $620.

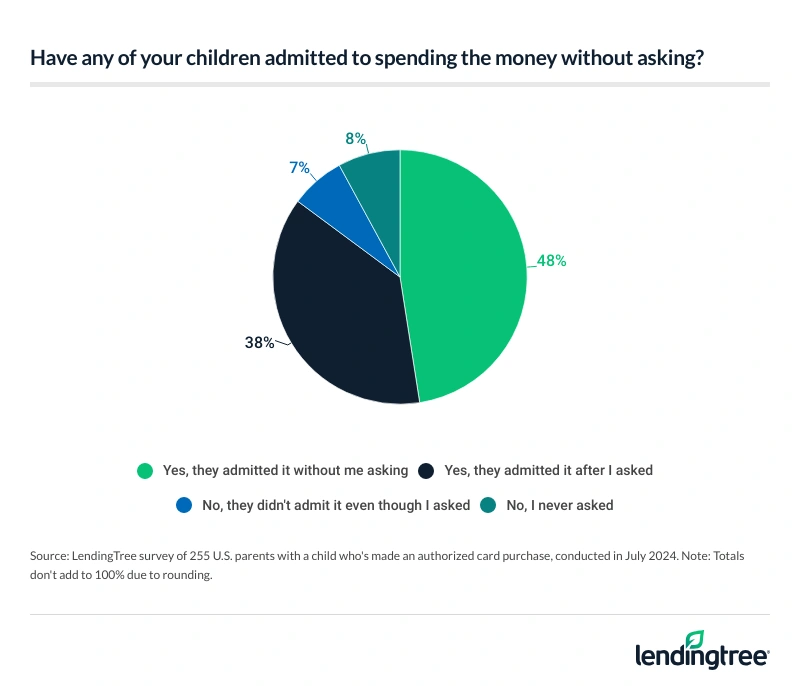

- Kids are coming clean, but not without repercussions. 86% of parents of kids who made an unauthorized purchase say their child admitted to spending without permission, and 48% say the kid confessed without the parent asking. Consequently, 53% asked their child to get their own source of income.

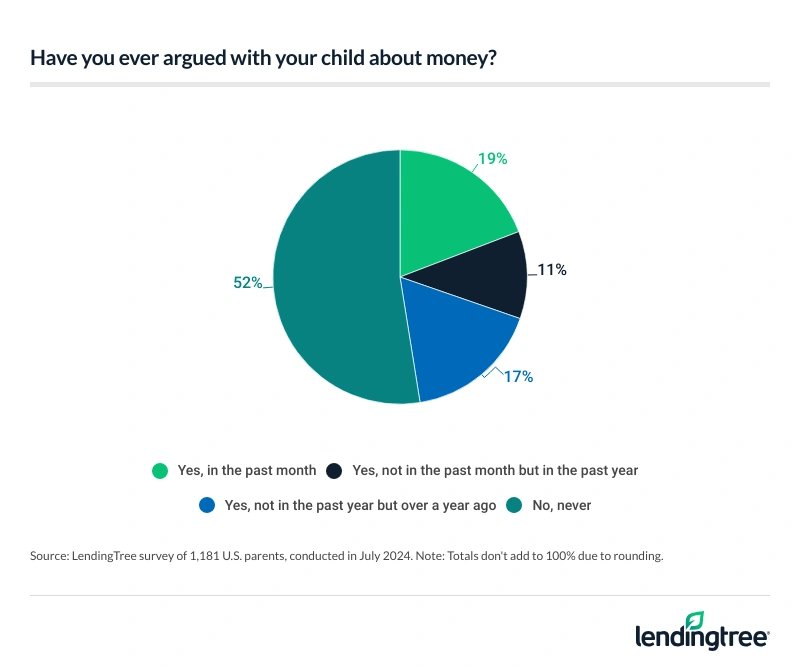

- Money can be a sensitive topic for families, leading to arguments. Almost half (48%) of parents have argued with their child about money, with 31% doing so in the past year. When asked what they argued about in the past year, 44% said their child wanted something the parent wouldn’t buy, 31% argued about their allowance amount and 25% quarreled over spending habits.

Majority of parents have given kids access to credit/debit card

Whether their child needs a card number to make an in-app purchase or a physical card to shop at the mall, 59% of parents say they’ve allowed them to use their credit or debit card. Dads are more willing to hand over plastic power to kids than moms — 64% versus 54%.

Among parents who’ve let their children use their credit or debit card, only 10% have given unlimited access. Most (54%) have allowed card usage less than five times.

The survey also asked about the aftermath of parents allowing kids to use their credit or debit cards, with 31% having regrets. The most regretful were millennials ages 28 to 43 (42%), those earning $100,000 or more annually (41%) and parents with children younger than 18 (39%).

Avoiding parental remorse over card access starts with good communication, says Matt Schulz, LendingTree chief consumer finance analyst. “You have to be crystal clear about your expectations and boundaries around usage of the card, as well as the consequences if things go awry,” he says. While it could lead to awkward conversations around the dinner table, it’s better to talk about those things in advance instead of doing it once an unexpected bill arrives.

Despite so many people letting their kids test the plastic waters early, 83% of parents agree that children should be at least 15 years old before they have access to a card in their own name or as an authorized user. The ideal age range is 18 to 20, according to 35% of respondents. Millennial parents are most likely to believe children younger than 14 should have a card in their name or be an authorized user, at 21%.

Tip: There are specialized credit cards for teens that help young adults build credit.

3 in 4 parents have given children an allowance

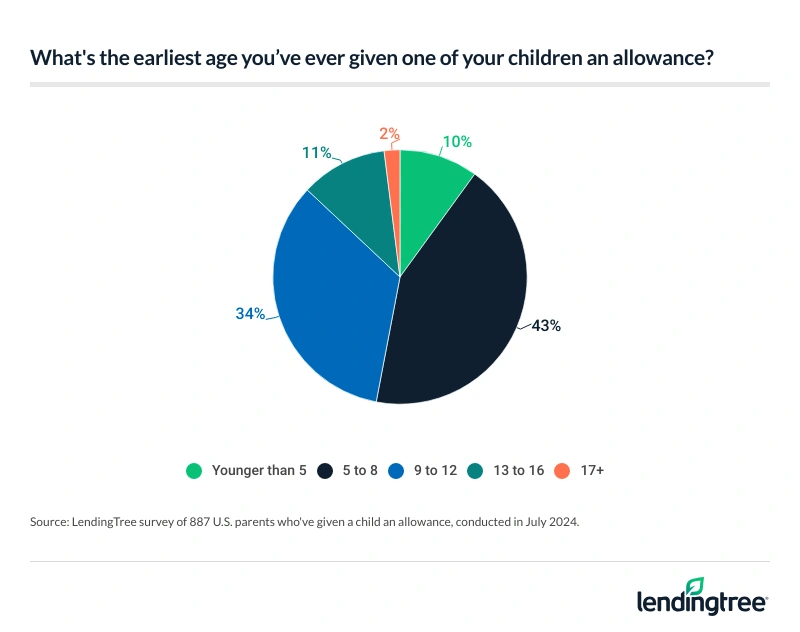

Most parents (75%) have given their children an allowance, though there’s disagreement about the appropriate age to start.

Ages 5 to 8 is the most popular choice (43%) among parents who have given an allowance, followed by 9 to 12 (34%), then 13 to 16 (11%). Just 10% have started their kids off with an allowance before they turned 5.

There’s no one-size-fits-all answer to the best age for an allowance, says Schulz, the author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.” “It depends on the kid, the parents’ financial situations and about a thousand other things. Some parents won’t ever give their kid an allowance, and that can be OK, too.”

What matters most is finding some way to give your kid experience handling money and talking about money while they’re young. “If they never get that experience when they’re little when the stakes are low, it’ll be that much harder for them to deal with it as they get older and things start to matter more,” he says.

One thing that’s clear: Among parents who give an allowance, more than 9 in 10 (91%) prefer to tie it to performing tasks or chores. By generation, millennials are the most generous allowance-givers, with their highest amount ever averaging $82.35 per month. Compare that to:

- Gen Xers (ages 44 to 59): $63.23

- Baby boomers (ages 60 to 78): $30.44

Some children spend without permission (and sometimes a lot)

For the most part, children have used their parents’ cards responsibly, but 22% of parents say their kids have spent without permission. And it’s more prevalent among higher-income families:

- $100,000 or more: 28%

- $50,000 to $99,999: 24%

- $30,000 to $49,999: 20%

- Less than $30,000: 17%

As for what type of purchases those children made using their parents’ cards without permission, the most popular was gaming console or app purchases (e.g., App Store, PlayStation or Xbox) at 68%. Other top spending categories:

- Streaming and media platforms (e.g., Netflix or YouTube): 44%

- Retail apps (e.g., Amazon or eBay): 33%

- Food delivery apps (e.g., DoorDash or Grubhub): 33%

Among parents whose kids used a card without permission, just 17% cite in-person purchases. That’s because digital spending often allows for one-click shopping opportunities in which kids can use a saved payment method, which 64% of these parents cite as a way children were able to spend without permission. This is especially a problem for parents with kids younger than 18, with 69% of that group blaming unauthorized charges on saved payment methods.

Of course, parents report “old school” unauthorized purchases, too. Of parents with kids who used a card without permission, 26% say their child has swiped their physical card, while another 23% say their kid has taken cash.

Unfortunately, many of these transgressions come with triple-digit consequences, with parents reporting $620 as the highest average amount spent using a card without permission.

Kids coming clean, but not without repercussions

Among parents who discovered that their children made card purchases without permission, 86% say the kids fessed up, including 48% who say they admitted it without being asked.

While those situations could be used to impart money lessons, Schulz recommends finding ways to have those chats before you’re on the hook to pay for unauthorized purchases.

“Find teachable moments in everyday life,” Schulz says. “If you keep your eyes open for them, they can be magical.” For instance, you can give your kids a “cash advance” when they ask for something at the store and agree to pay you back from their piggy bank when you get home. Then if they forget to pay their debt, you can offer a gentle reminder, warning that you’ll charge a little extra if they don’t make their payment by a certain date.

“Find teachable moments in everyday life,” Schulz says. “If you keep your eyes open for them, they can be magical.” For instance, you can give your kids a “cash advance” when they ask for something at the store and agree to pay you back from their piggy bank when you get home. Then if they forget to pay their debt, you can offer a gentle reminder, warning that you’ll charge a little extra if they don’t make their payment by a certain date.

“You shouldn’t give a 12-year-old an economics lecture because they’ll tune you out immediately,” Schulz says. “Keep it simple, relatable and maybe even fun, if possible. If you can do that, they’ll listen.”

For one-third of parents who cited an unauthorized card purchase, a successful remedy has been encouraging their children to find and use their own source of income. However, another 30% of parents say their children were too young for this approach.

Money can be sensitive topic for families, leading to arguments

Money is the root of at least some family tension, with almost half (48%) of parents saying they’ve argued with their child about money; for 19%, a fight took place in the past month. Among Gen Z parents ages 18 to 27, 35% had one of these arguments in the past month.

Quibbles over money matters occur for various reasons, but fighting over a child using a card or cash without permission was a common theme — cited by 44% of parents who’ve argued with kids about money in the past year. Other arguments in the past year stem from:

- The child getting angry when a parent wouldn’t purchase something they wanted: 44%

- Allowance amount: 31%

- The child’s spending habits: 25%

- The child not getting money to do something they wanted to do: 25%

To help avoid some of these familiar family fights, Schulz says to try the following strategies:

- Set ground rules, including consequences for unauthorized spending. “Most parenting experts will tell you kids crave boundaries,” Schulz says. “What’s most important is to be clear and direct about those boundaries.” For example, you might allow purchases under $10 but require permission for anything above that.

- Loop kids into the family budget. You don’t have to open your books entirely to your kid, but explaining the math behind your decisions can be a great way to take the emotion out of these situations. “With back-to-school shopping, if money is tight and you need to prioritize your spending to make your budget work, ask your kid what matters most to them,” Schulz says. “Maybe they want an awesome new backpack but don’t care much about lunch boxes and shoes. That can help you decide what to spend your money on while keeping kids as happy as possible.”

- Have them put some “skin in the game” when they want to buy something. It can be very satisfying to successfully earn enough or save enough to buy something you want, so try to help your kids have that experience early, Schulz says. “You can start small by having the child pitch in toward buying something,” he says. “That way, even if they didn’t do it all themselves, they can take pride in having a bit of ownership of the item and feel like part of a successful team.”

- Don’t store payment methods inside apps your kids use. “Having to enter card numbers every time you buy may be inconvenient, but it can help you avoid your card being used without your permission,” Schulz says. For younger kids, it’ll also help you avoid accidental in-app purchases, too.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey from July 15 to 17, 2024, of 1,181 U.S. consumers ages 18 to 78 who are parents. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78