55% Would Spend More on Eco-Friendly Products While Willing to Boycott Less-Green Companies

More consumers are showing how much they care about the environment with their wallets.

In a recent LendingTree survey of 1,048 Americans, 55% said they are willing to spend more on sustainable and eco-friendly products, while 4 in 10 are willing to go a step further and boycott companies that aren’t so keen on going green.

With Earth Day approaching, find out more about how consumer sentiment around climate change is driving a shift in spending habits, especially among younger shoppers.

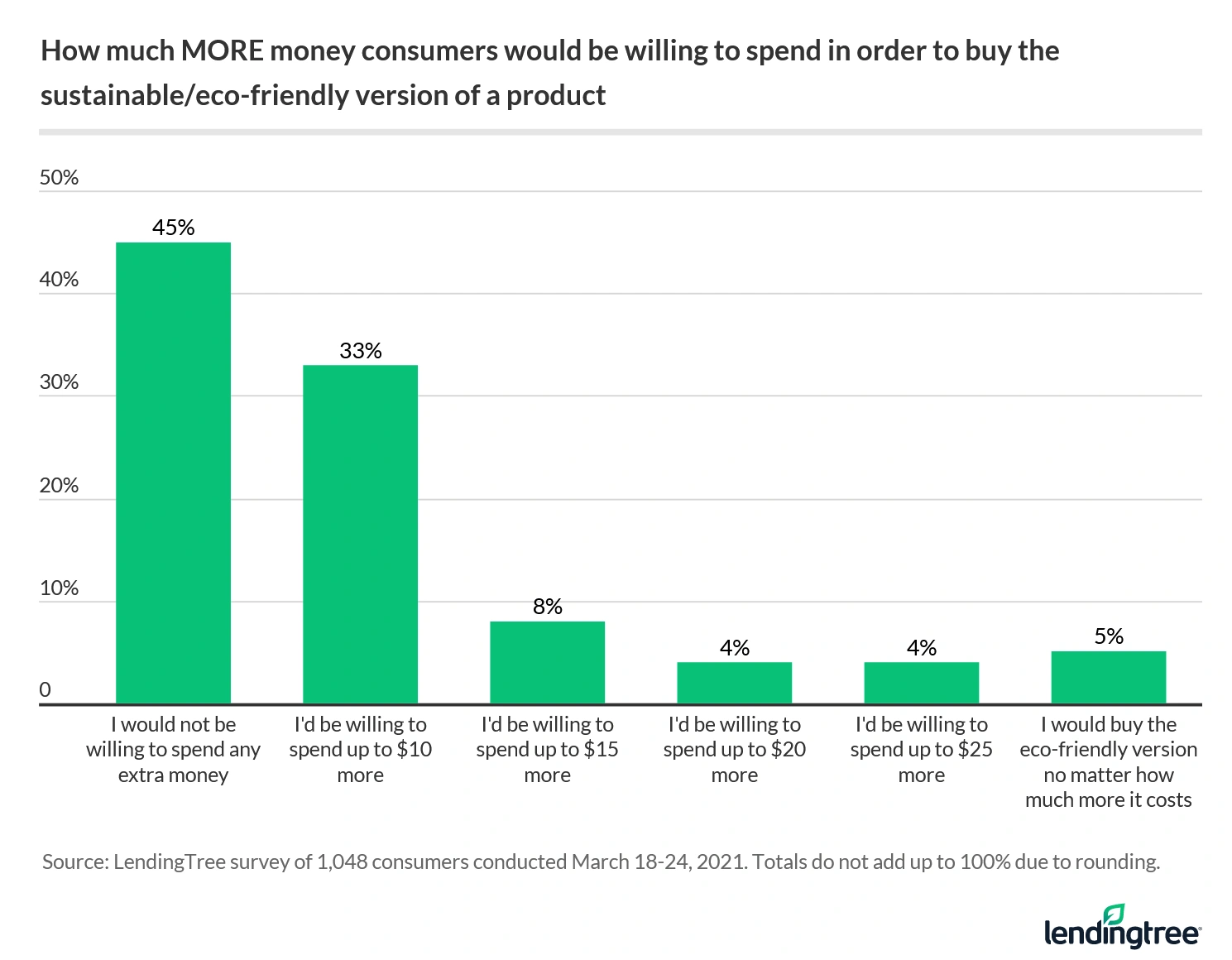

- A majority (55%) of consumers are willing to spend extra money in order to purchase environmentally friendly products, though at differing amounts. Younger shoppers are the most willing to spend more to go “green,” while women are more on board with sustainable spending than men (61% versus 49%).

- Nearly 40% of consumers would boycott a company for not being eco-conscious; and of that group, 18% have done so. Gen Z and millennials are most willing to boycott, at 58% and 50%, respectively, compared to 29% of Gen X and 27% of baby boomers.

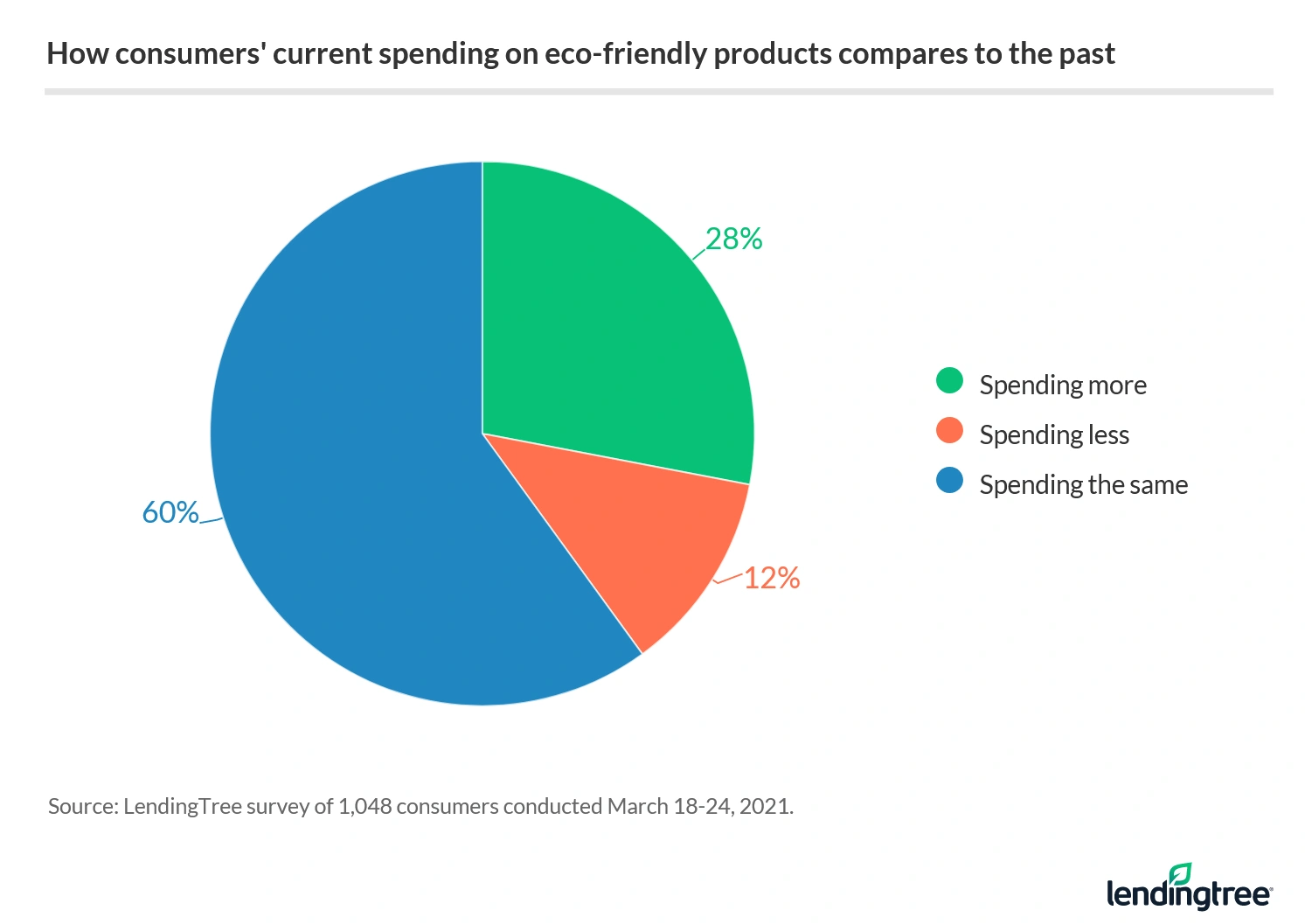

- More than a quarter (28%) of consumers said they’re spending more on environmentally friendly products than ever before. For millennials, the percentage is even higher at 41%. The same goes for consumers with household incomes of $100,000+ (40%).

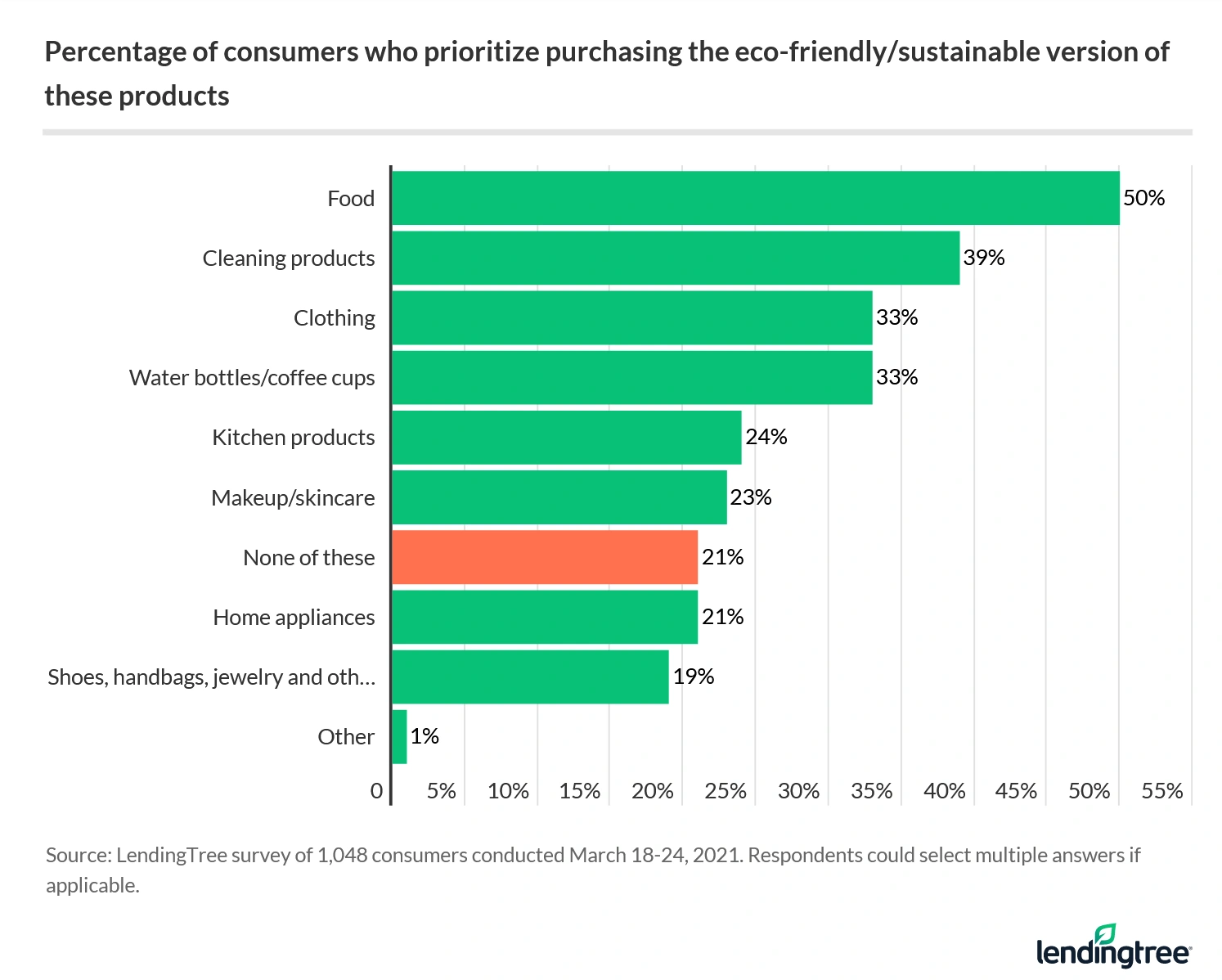

- Consumers are most focused on food (50%), cleaning products (39%), clothing (33%) and water bottles/coffee cups (33%) when it comes to seeking out eco-friendly options. “Clean” cosmetics were also a priority for more than a third (34%) of women.

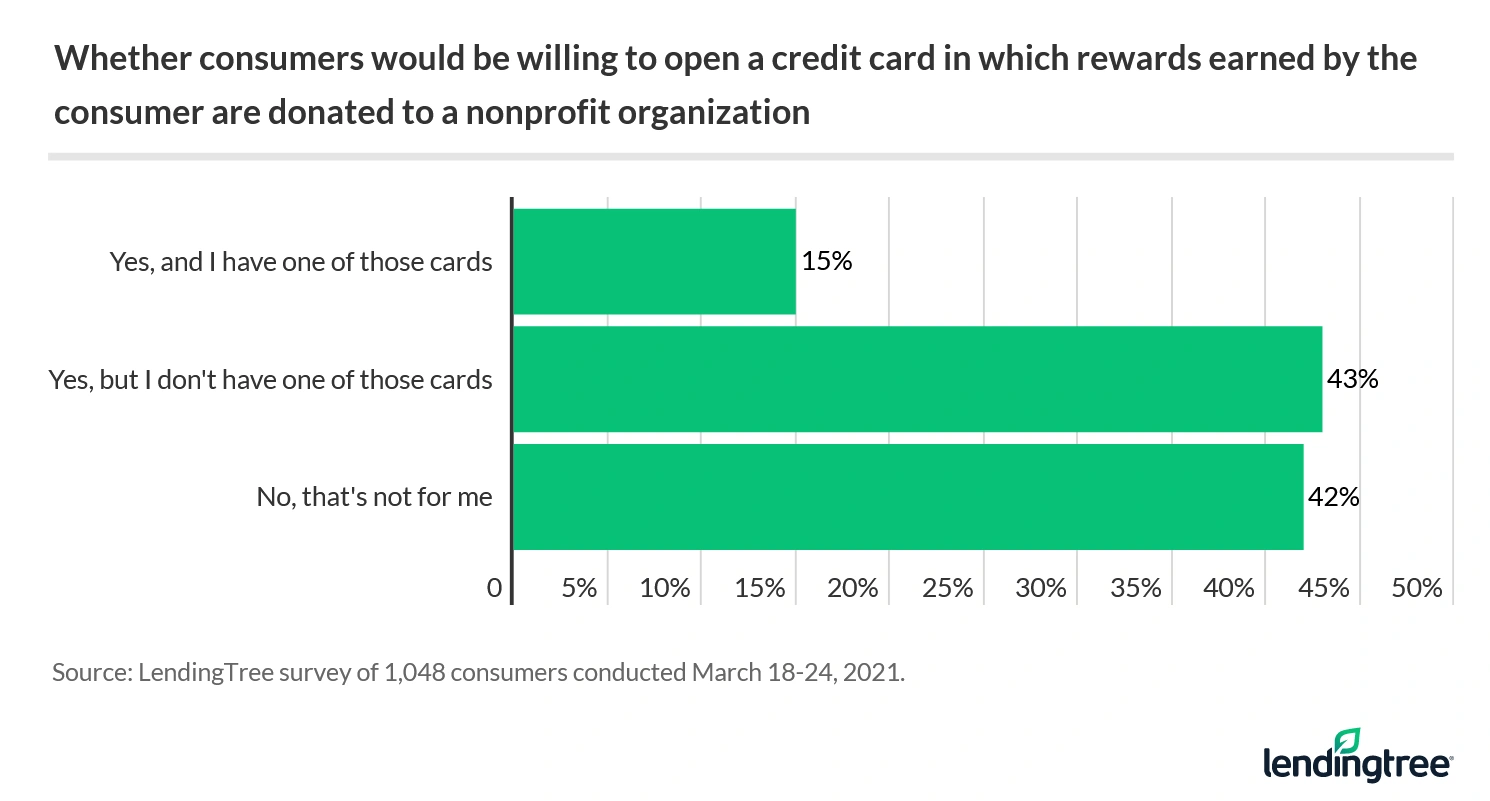

- About 1 in 7 Americans have a credit card in which rewards earned are donated to nonprofit organizations, including those that protect the environment. A further 43% said they’d consider opening such a card.

- When shopping for new credit cards, 62% of consumers would rather choose an issuer that’s pledged to fight climate change versus one that hasn’t made environmental issues a priority.

As environmental concerns grow, shopping sustainably becomes a priority

With millennials (41%) and those with household incomes more than $100,000 (40%) leading the charge, consumers are willing to dish out extra green for environmentally friendly products. It may also be a political choice, as 38% of Democrats are spending more on sustainable products compared to 19% of Republicans. Overall, 28% of consumers are showing their commitment to fighting climate change via their shopping preferences.

“I’m not surprised that younger spenders are more open to spending on green products,” said Matt Schulz, chief consumer finance analyst for LendingTree. “We’ve seen in recent years that many Gen Z and millennials see protecting the environment as perhaps the most important challenge facing our nation today.” He also points out that Democrats and women are typically far more likely to back efforts to protect the environment, as survey responses seem to indicate.

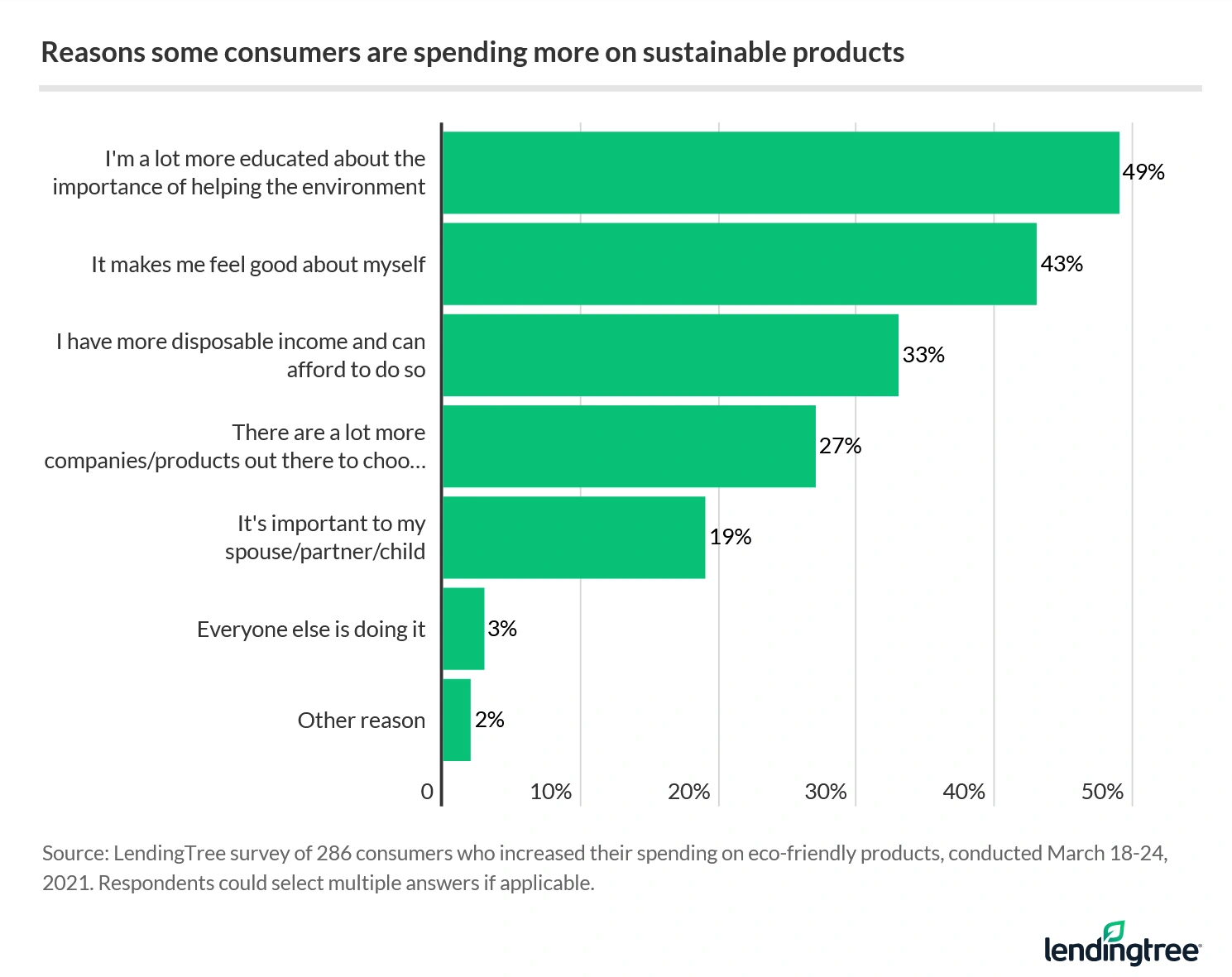

Top reasons for showing activism at the registers include getting educated about climate change, being able to afford sustainable choices, having a range of options available, and to support a cause that’s important to a partner or child.

On the flip side, there is a subset of people who say they are spending less (12%) on sustainable items. For a good portion of those respondents, it comes down to budget: 35% citing they have less income due to the pandemic, and 29% noting that “green” products tend to be more expensive. Another 19% say it’s because they don’t have the time to go search the aisles or read labels.

About 1 in 5 shoppers (and 35% of baby boomers) say they do not trust the effectiveness of products labeled as sustainable or eco-conscious. In fact, 8% of overall shoppers are concerned that eco-friendly cleaning products can’t effectively kill the coronavirus.

Schulz said he has noticed skepticism about the effectiveness of eco-conscious products. “For example, with things like cleaning products, many may question how effective the greener, more natural option is as compared to the more traditional, less eco-friendly product,” he said, adding that it’s typically the non-green chemicals (like bleach) that are the best disinfectants.

“Seeing [these products] as less effective can help someone rationalize making the less-green choice,” said Schulz.

But for many, price may be the underlying decision driver, as eco-conscious products do tend to be more expensive.

Many willing to pay more for eco-friendly products

Though the majority (55%) of consumers said they’d spend more if it meant helping the planet, there are limits to how much more. One-third of that group said they would spend just up to $10 extra for the sustainable version of a product, while just 5% noted that they’d pay any amount more.

Younger consumers show a greater willingness to spend extra, and the percentage declines with age: 73% of Gen Z, 67% of millennials, 51% of Gen X and 34% of baby boomers.

As for which categories of green products consumers are selecting most: food (chosen by 6 in 10 millennials), cleaning products, clothing (especially among Gen Z, at 56%), and water bottles/coffee cups topped the list. About 1 in 5 also said they shop for eco-conscious appliances, while more than third of women (34%) choose makeup/skincare with sustainability in mind.

Nearly 1 in 5 boycotted a company for not being eco-friendly, and even more would do so in the future

In addition to spending more on green products, 39% of consumers also said they would be willing to withhold dollars from companies that aren’t showing a commitment to climate change, with 18% already having done so.

“That should be an eye-opener for companies,” said Schulz. “Your potential customers are watching what you do and say when it comes to the environment, and if you’re not eco-friendly, you may risk losing some business.”

Companies targeting younger generations should be especially concerned, as Gen Z and millennials at 58% and 50%, respectively, are the most likely boycotters. The same goes for more than half (56%) of high earners (incomes of $100,000+), including 27% of whom say they have already stopped buying certain products.

“The last thing any business wants to do is alienate the people who might spend the most money with them,” said Schulz.

Peer pressure may also play a role, with 22% of consumers saying they have felt shamed by others for not purchasing sustainable products. Again, this is more a trend among the younger shoppers (41% of Gen Z, 34% of millennials, 14% of Gen X and 5% of baby boomers).

Some respondents have also been the ones to call out others who were buying items that are bad for the environment — 1 in 5 overall, led by 38% of Gen Z and 25% of millennials.

Some donate credit card rewards to help fight climate change

There’s at least one type of plastic that is helping to protect the environment – credit cards.

About 1 in 7 Americans have a credit card that allows for earned rewards to be donated to nonprofit organizations, including those with climate-focused causes. In the survey, 43% said they’d consider opening such a card.

Schulz isn’t sure if this finding plays out in reality, however.

“Charity credit cards have existed for years. They’ve never really taken off, and I don’t expect that to change in the near future,” he said. That’s because other types of rewards cards will often provide better returns, he added. For consumers who wish to donate to environmental causes, they’d be better off leveraging their rewards from higher-earning cards and then using those amounts toward donations.

That said, consumers are also paying attention to the climate change initiatives of the card issuers themselves when deciding which to do business with. In fact, 62% said they would rather open a credit card with an institution dedicated to protecting the environment over an issuer that has not made climate change a priority. The percentage jumps higher for Gen Z (79%) and millennials (72%).

The bottom line

Today’s consumers are leveraging their buying power to support eco-conscious products and the companies that make them — and in many cases, they are willing to spend more on sustainable goods. In addition, consumers are paying closer attention to which companies are stepping up with climate change commitments to decide which ones are worthy of their brand loyalty.

Methodology

LendingTree commissioned Qualtrics to field an online survey of 1,048 Americans, conducted March 18-24, 2021. The survey was administered using a non-probability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby boomer: 56 to 75

While the survey also included consumers from the silent generation (defined as those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.