States With Most Reported Credit Card Identity Theft

Identity theft reports involving a credit card grew by 7.8% in 2024, according to a LendingTree analysis of government data, with Florida residents the most likely to file.

LendingTree analyzed Federal Trade Commission (FTC) Consumer Sentinel Network Data Book data to learn more about the state of credit card identity theft in America. The data makes it clear that ID theft remains a massive problem in the U.S., and there can be a wide variance among states regarding reporting.

Here’s more of what we found.

The FTC defines credit card identity theft as using a person’s identifying information to open a new credit card account or make changes to an existing credit card account without permission. Unless otherwise noted, this study’s data refers to consumer filings.

- Credit card fraud is the most commonly reported form of identity theft, and it grew significantly in 2024. There were 449,032 reports of identity theft involving credit cards in 2024, up 7.8% from 2023. In 2024, this fraud accounted for 39.6% of ID theft reports, similar to 40.2% in 2023. In 88.6% of 2024 credit card fraud cases, stolen identities were used to open a new credit card, while 11.4% involved changes to an existing account.

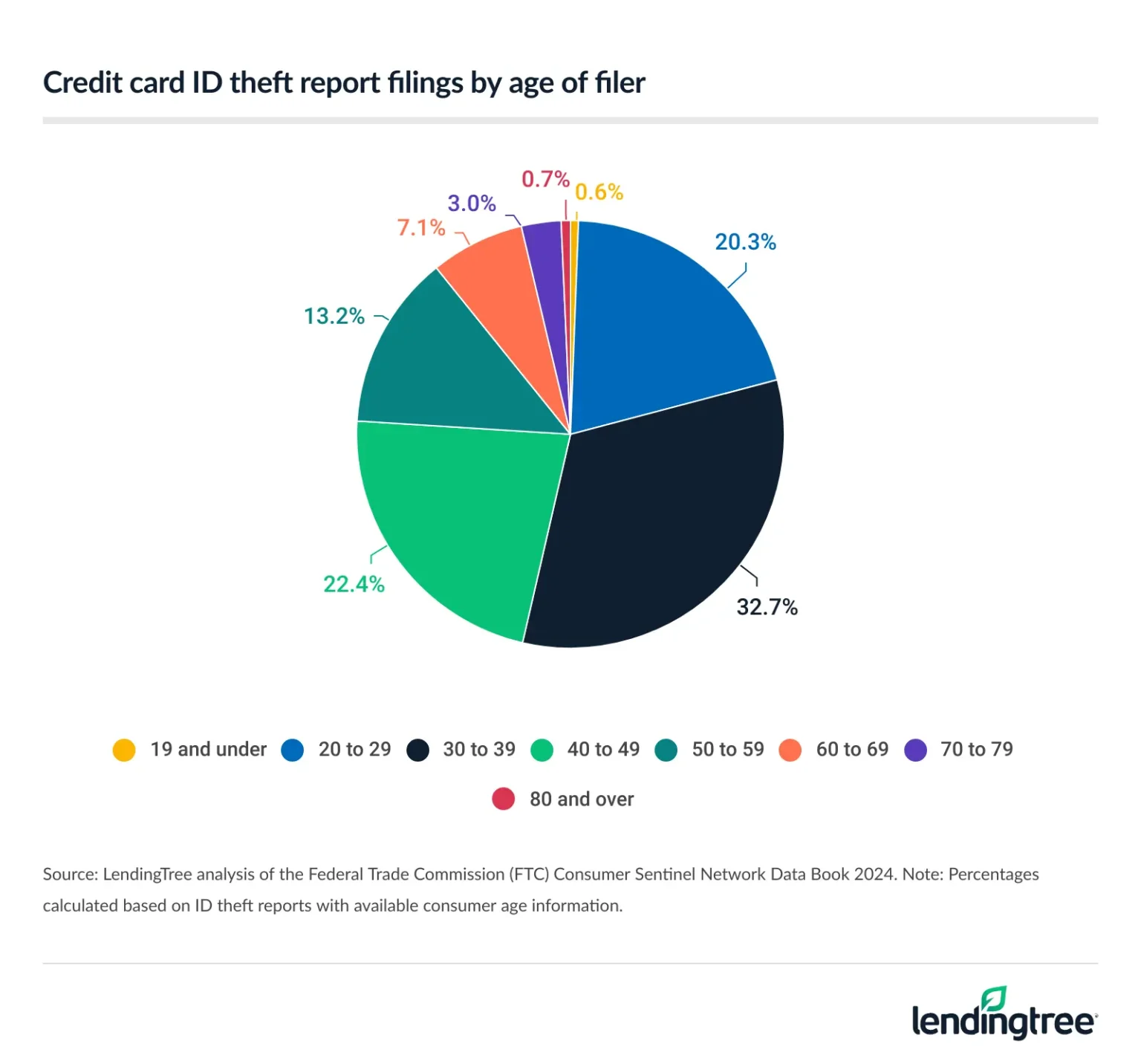

- 30-somethings are the most likely age group to report credit card-related ID theft. 3 in 4 credit card fraud reports in the U.S. were made by people ages 20 to 49, with those 30 to 39 making up the largest share (32.7%). Americans 60 or older account for just 10.8%.

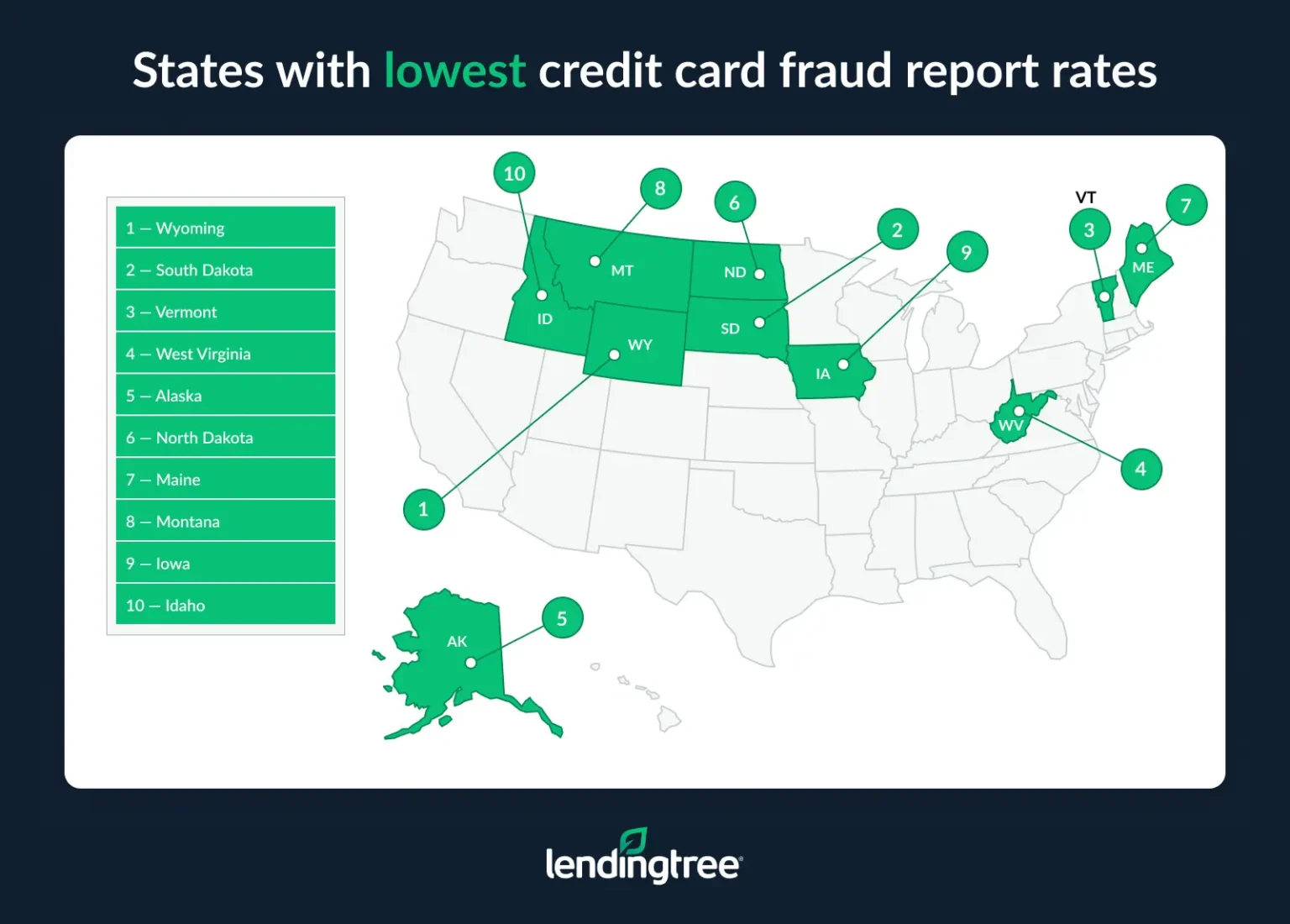

- Florida’s rate of credit card-related ID theft reporting was nearly double the national average. The Sunshine State’s rate was 264.5 per 100,000 residents in 2024, ahead of Georgia (241.8) and the District of Columbia (233.9). The lowest rates were in Wyoming (32.1 per 100,000), South Dakota (33.0) and Vermont (33.9). Nationwide, there were 135.1 reports per 100,000 population.

- Massachusetts had the largest year-over-year jump in credit card ID theft reports. Reports in the state rose by 64.1%, followed by Georgia (22.4%) and Louisiana (21.3%). In contrast, 23 states saw declines, with the largest in Nebraska (29.9%), Kansas (19.4%) and Wyoming (16.2%).

Credit card fraud is most commonly reported ID theft, and it’s growing

In 2024, there were nearly 450,000 reports of credit card-related identity theft in the U.S. — a 7.8% increase from 2023.

Nearly 9 in 10 (88.6%) reported credit card fraud cases in 2024 were about someone’s stolen identity being used to open a new credit card. Just 11.4% involved changes to an existing account.

Credit card fraud accounted for nearly 4 in every 10 (39.6%) ID theft reports in the U.S. in 2024. That’s largely unchanged from 40.2% in 2023 and 39.8% in 2022, but up significantly from 2021’s 27.2% and 2020’s 28.4%. (Reports of government benefits fraud spiked in those years, at the height of the coronavirus pandemic.)

Credit card identity theft reports, 2020-24

| Year | Credit card ID theft reports | % change YoY | Total ID theft reports | % of ID theft reports that are credit card ID theft |

|---|---|---|---|---|

| 2024 | 449,032 | 7.8% | 1,135,291 | 39.6% |

| 2023 | 416,579 | -5.5% | 1,036,903 | 40.2% |

| 2022 | 440,675 | 13.1% | 1,108,609 | 39.8% |

| 2021 | 389,790 | -0.9% | 1,434,676 | 27.2% |

| 2020 | 393,446 | – | 1,387,615 | 28.4% |

| 2020-24 | 2,089,522 | – | 6,103,094 | 34.2% |

For the five years from 2020 to 2024, Americans filed more than 2 million credit card ID theft reports. That’s an average of 1,144 every day or 48 every hour. Those numbers are staggering, especially when you consider not every incident of identity theft gets reported.

30-somethings were most likely age group to file

Three in 4 credit card fraud reports in the U.S. in 2024 were made by people ages 20 to 49. Thirty-somethings (32.7%) were significantly more likely than any other age group to file, but 40-somethings (22.4%) and 20-somethings (20.3%) each made up more than one-fifth of all reports filed. Americans 60 or older accounted for just 10.8%.

Credit card ID theft report filings by age of filer, 2024

| Age | Credit card ID theft reports | % of credit card ID theft reports |

|---|---|---|

| 19 and under | 2,447 | 0.6% |

| 20 to 29 | 81,362 | 20.3% |

| 30 to 39 | 131,297 | 32.7% |

| 40 to 49 | 89,864 | 22.4% |

| 50 to 59 | 52,940 | 13.2% |

| 60 to 69 | 28,281 | 7.1% |

| 70 to 79 | 11,861 | 3.0% |

| 80 and over | 2,987 | 0.7% |

It’s important to remember that these numbers only reflect reports, not incidents. It’s possible that if all unreported credit card fraud incidents were factored in as well, those involving older Americans would make up a larger piece of the pie. However, the data clearly shows that younger Americans are providing the vast majority of credit card fraud reports.

Florida residents most likely to report credit card fraud; Wyoming least likely

When examining the raw numbers, California (68,323), Florida (57,997) and Texas (44,480) had the most credit card fraud reports in 2024. That’s no surprise, given they’re the most populous states, albeit not in that order. However, a deeper look reveals that those aren’t the three states whose residents are most likely to file a credit card fraud report.

To determine this, we compared the number of reports to the state’s population. Through that lens, Florida topped the list. In the Sunshine State, there were 264.5 reports for every 100,000 residents. That’s nearly double the national average of 135.1 reports per 100,000 residents and well ahead of Georgia (241.8) and the District of Columbia (233.9).

Despite their massive aggregate numbers, California and Texas ranked sixth and ninth, respectively.

Conversely, Wyoming (186 total reports), Vermont (219) and Alaska (252) had the fewest reports of credit card fraud in aggregate. Perhaps this is not surprising, given that those are the three least populous states in the U.S.

However, when viewed as a percentage of the population, the list shifts a bit. Wyoming (32.1 per 100,000) remained the lowest, followed closely by South Dakota (33.0) and Vermont (33.9). West Virginia (34.2) and Alaska (34.3) were next.

Full rankings: Credit card ID theft report rates by state

| Rank | State | Credit card ID theft reports | Reports per 100,000 population | Top ID theft type |

|---|---|---|---|---|

| 1 | Florida | 57,997 | 264.5 | Credit card |

| 2 | Georgia | 26,174 | 241.8 | Credit card |

| 3 | District of Columbia | 1,572 | 233.9 | Credit card |

| 4 | Nevada | 6,667 | 212.3 | Credit card |

| 5 | Delaware | 1,785 | 177.5 | Credit card |

| 6 | California | 68,323 | 174.1 | Credit card |

| 7 | Massachusetts | 11,469 | 164.0 | Credit card |

| 8 | Louisiana | 6,970 | 150.8 | Credit card |

| 9 | Texas | 44,480 | 150.1 | Credit card |

| 10 | Maryland | 8,958 | 145.2 | Credit card |

| 11 | Illinois | 17,685 | 139.3 | Credit card |

| 12 | New Jersey | 12,569 | 135.6 | Credit card |

| 13 | New York | 26,736 | 134.5 | Credit card |

| 14 | Pennsylvania | 16,639 | 128.1 | Credit card |

| 15 | South Carolina | 6,451 | 123.8 | Credit card |

| 16 | Arizona | 8,097 | 111.4 | Credit card |

| 17 | North Carolina | 11,172 | 105.6 | Credit card |

| 18 | Connecticut | 3,786 | 105.2 | Credit card |

| 19 | Mississippi | 3,066 | 103.9 | Credit card |

| 20 | Alabama | 5,245 | 103.8 | Credit card |

| 21 | Michigan | 9,383 | 93.3 | Credit card |

| 22 | Rhode Island | 996 | 90.9 | Credit card |

| 23 | Ohio | 10,311 | 87.5 | Credit card |

| 24 | Virginia | 7,245 | 83.7 | Credit card |

| 25 | Tennessee | 5,445 | 77.9 | Credit card |

| 26 | Colorado | 4,191 | 72.1 | Credit card |

| 27 | Indiana | 4,860 | 71.3 | Other ID theft |

| 28 | Arkansas | 1,979 | 65.3 | Other ID theft |

| 29 | Missouri | 3,740 | 60.6 | Credit card |

| 30 | New Hampshire | 797 | 57.4 | Credit card |

| 31 | Washington | 4,420 | 57.1 | Credit card |

| 32 | Hawaii | 805 | 55.7 | Credit card |

| 33 | Oregon | 2,217 | 52.3 | Credit card |

| 34 | Oklahoma | 2,079 | 52.0 | Other ID theft |

| 35 | Utah | 1,730 | 51.9 | Credit card |

| 36 | Wisconsin | 3,050 | 51.8 | Credit card |

| 37 | Minnesota | 2,799 | 49.0 | Credit card |

| 38 | Kansas | 1,429 | 48.6 | Credit card |

| 39 | Kentucky | 2,101 | 46.6 | Credit card |

| 40 | Nebraska | 840 | 42.7 | Credit card |

| 41 | New Mexico | 891 | 42.1 | Other ID theft |

| 42 | Idaho | 787 | 41.6 | Credit card |

| 43 | Iowa | 1,321 | 41.3 | Credit card |

| 44 | Montana | 440 | 39.8 | Credit card |

| 45 | Maine | 520 | 37.8 | Credit card |

| 46 | North Dakota | 289 | 37.1 | Credit card |

| 47 | Alaska | 252 | 34.3 | Credit card |

| 48 | West Virginia | 610 | 34.2 | Other ID theft |

| 49 | Vermont | 219 | 33.9 | Credit card |

| 50 | South Dakota | 297 | 33.0 | Credit card |

| 51 | Wyoming | 186 | 32.1 | Other ID theft |

Per the FTC, it’s the “use of a person’s identifying information in other ways to commit fraud or theft, such as to create or use another person’s email or social media account, to create or use a person’s online shopping or payment account, to break the law or avoid the police, to get insurance, to get medical care, to open or use a person’s securities or investment account without their permission.”

Massachusetts sees credit card fraud reports spike; Nebraska sees declines

Credit card fraud is the most commonly reported type of identity theft in all but six states (Indiana, Arkansas, Oklahoma, New Mexico, West Virginia and Wyoming).

In 2024, many states saw major shifts in their overall credit card fraud report numbers. Florida (up 18.5%), Texas (10.8%) and California (8.9%) all saw significantly higher total reports than in 2023. However, only Florida among those three made the list of the 10 biggest increases, and all three paled in comparison to the state at the top.

Credit card fraud reports in Massachusetts jumped 64.1%, by far the biggest increase in the nation. Georgia (22.4%) and Louisiana (21.3%) saw the next largest increases.

However, nearly half of the nation — 23 states — saw credit card ID theft reports fall in 2024. Nebraska (29.9%) had the biggest drop, while its neighbors in Kansas (19.4%) and Wyoming (16.2%) were next on the list.

It’s worth noting again that the above numbers are about reports that were filed, rather than individual incidents. Given that, increases or decreases in these numbers, especially small movements, don’t necessarily indicate a change in fraud incidents.

States with biggest credit card ID theft report increases/decreases, 2023 to 2024

| Rank | State | Credit card ID theft reports, 2024 | Credit card ID theft reports, 2023 | % change |

|---|---|---|---|---|

| 1 | Massachusetts | 11,469 | 6,988 | 64.1% |

| 2 | Georgia | 26,174 | 21,376 | 22.4% |

| 3 | Louisiana | 6,970 | 5,744 | 21.3% |

| 4 | Florida | 57,997 | 48,962 | 18.5% |

| 5 | Rhode Island | 996 | 850 | 17.2% |

| 6 | Hawaii | 805 | 692 | 16.3% |

| 7 | Mississippi | 3,066 | 2,639 | 16.2% |

| 8 | Tennessee | 5,445 | 4,708 | 15.7% |

| 9 | Nevada | 6,667 | 5,816 | 14.6% |

| 10 | Arkansas | 1,979 | 1,750 | 13.1% |

| 11 | Illinois | 17,685 | 15,647 | 13.0% |

| 12 | Maryland | 8,958 | 8,044 | 11.4% |

| 13 | Connecticut | 3,786 | 3,414 | 10.9% |

| 14 | Texas | 44,480 | 40,154 | 10.8% |

| 15 | Delaware | 1,785 | 1,624 | 9.9% |

| 16 | North Carolina | 11,172 | 10,185 | 9.7% |

| 17 | California | 68,323 | 62,758 | 8.9% |

| 17 | New Jersey | 12,569 | 11,538 | 8.9% |

| 19 | Kentucky | 2,101 | 1,939 | 8.4% |

| 20 | District of Columbia | 1,572 | 1,462 | 7.5% |

| 21 | New York | 26,736 | 24,899 | 7.4% |

| 22 | Missouri | 3,740 | 3,495 | 7.0% |

| 23 | Oklahoma | 2,079 | 1,965 | 5.8% |

| 24 | Montana | 440 | 422 | 4.3% |

| 25 | New Hampshire | 797 | 765 | 4.2% |

| 26 | Indiana | 4,860 | 4,751 | 2.3% |

| 27 | Idaho | 787 | 780 | 0.9% |

| 28 | Utah | 1,730 | 1,716 | 0.8% |

| 29 | Maine | 520 | 524 | -0.8% |

| 30 | Ohio | 10,311 | 10,419 | -1.0% |

| 31 | Arizona | 8,097 | 8,248 | -1.8% |

| 31 | Michigan | 9,383 | 9,557 | -1.8% |

| 31 | New Mexico | 891 | 907 | -1.8% |

| 34 | South Dakota | 297 | 303 | -2.0% |

| 35 | Washington | 4,420 | 4,516 | -2.1% |

| 35 | Minnesota | 2,799 | 2,860 | -2.1% |

| 37 | Alabama | 5,245 | 5,390 | -2.7% |

| 38 | Vermont | 219 | 226 | -3.1% |

| 39 | Wisconsin | 3,050 | 3,187 | -4.3% |

| 40 | South Carolina | 6,451 | 6,756 | -4.5% |

| 41 | West Virginia | 610 | 645 | -5.4% |

| 42 | Oregon | 2,217 | 2,345 | -5.5% |

| 43 | Alaska | 252 | 267 | -5.6% |

| 44 | Virginia | 7,245 | 7,768 | -6.7% |

| 45 | Colorado | 4,191 | 4,543 | -7.7% |

| 46 | Iowa | 1,321 | 1,502 | -12.1% |

| 47 | North Dakota | 289 | 329 | -12.2% |

| 48 | Pennsylvania | 16,639 | 19,537 | -14.8% |

| 49 | Wyoming | 186 | 222 | -16.2% |

| 50 | Kansas | 1,429 | 1,773 | -19.4% |

| 51 | Nebraska | 840 | 1,198 | -29.9% |

Your not-so-secret weapon against identity theft

This report makes crystal clear that identity theft is a major problem in the U.S., and there’s no reason to believe that’s going to change anytime soon. It’s on all of us to do what we can to protect ourselves:

- You can do it by using tools like authenticators, password managers and VPNs

- You can do it by reviewing your credit card and checking account transaction histories frequently to make sure nothing looks amiss

- You can do it by being diligent about not clicking on questionable links or replying to iffy social media messages, emails, texts and calls

However, perhaps the most powerful weapon in your battle against identity theft is your credit report. If someone uses your personal information to open an account in your name — which our report shows is disturbingly common — there may be no better way to find out than to check your credit report. Your credit report is an exhaustive list of your currently open (and recently closed) loan accounts. If a loan is listed on your report that you don’t remember opening, it could be a sign you were a victim of fraud.

You can view your credit reports from all three major credit bureaus for free at AnnualCreditReport.com, which is a no-strings-attached website run by the credit bureaus and mandated by the federal government. Be sure to get reports from all three credit bureaus — Equifax, Experian and TransUnion. That’s important because all three reports can have significant differences among them, but you won’t know unless you check.

If you find something amiss in your report, use the credit bureau’s online dispute tool to report the issue. You can also reach out over the phone or via snail mail. Still, it’s important that you do something to correct the issue because errors on credit reports can lead to your credit score being lowered unnecessarily.

After your initial check, you can leverage tools like LendingTree’s Spring app to help you monitor your credit. Spring gives you ongoing access to your TransUnion credit report and your VantageScore credit score for free when you log in. This is important because if your credit score suddenly drops and you’re unsure why, it could be a sign that you’ve been a victim of identity theft.

Methodology

LendingTree researchers analyzed the Federal Trade Commission (FTC) Consumer Sentinel Network Data Book 2024 for 2020-to-2024 data.

The analysis focused on credit card-related identity theft, which the FTC defines as the use of a person’s identifying information to either open a new credit card account or make unauthorized charges on an existing account.

To determine the per-capita reports for each state, researchers used the U.S. Census Bureau 2023 American Community Survey (ACS) with five-year estimates.

Recommended Articles