2025 Friends and Money Report: 36% of Americans Have Lost Friendships Over Money

More than 1 in 3 Americans, including nearly 1 in 2 parents of kids under 18, have had a friendship end over money.

That’s just one of the troubling findings in our 2025 Friends and Money Report. We asked 2,000 Americans about the intersection of friendship and finances, and their responses painted a dark picture.

Many told us they’ve lied to their friends about money, been judged about their financial situations, felt pressure to keep up with the spending habits of those closest to them and ultimately lost friendships over money.

Here’s more of what we found.

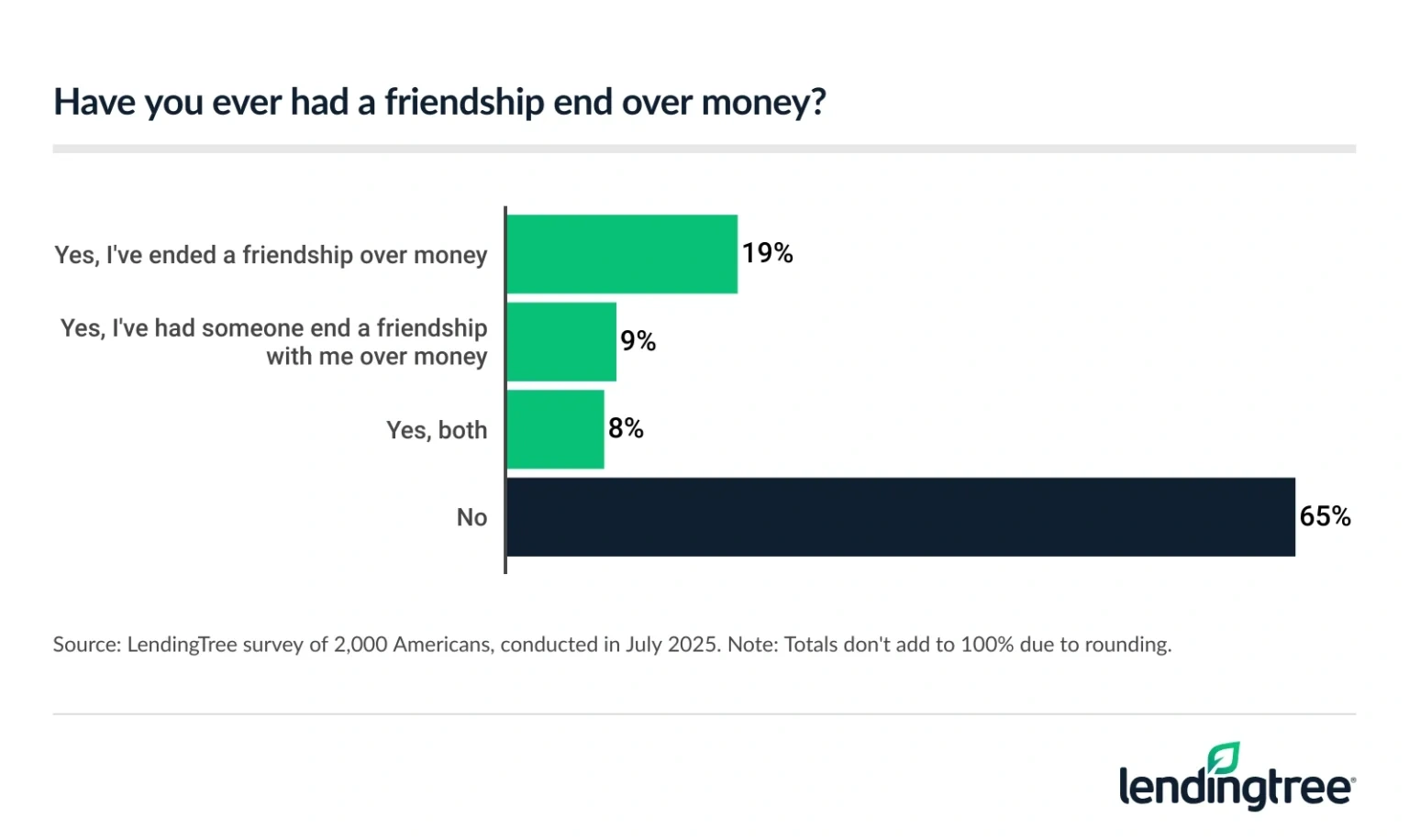

- Money and friendships don’t always mix. 41% of Americans admit they’ve had tension with a friend over money, while 36% have had a friendship end because of it. Nearly half of parents with kids under 18 have seen a friendship end for that reason. Meanwhile, 31% say they’ve felt pressure to keep up with their friends’ spending habits — with millennials at 41%.

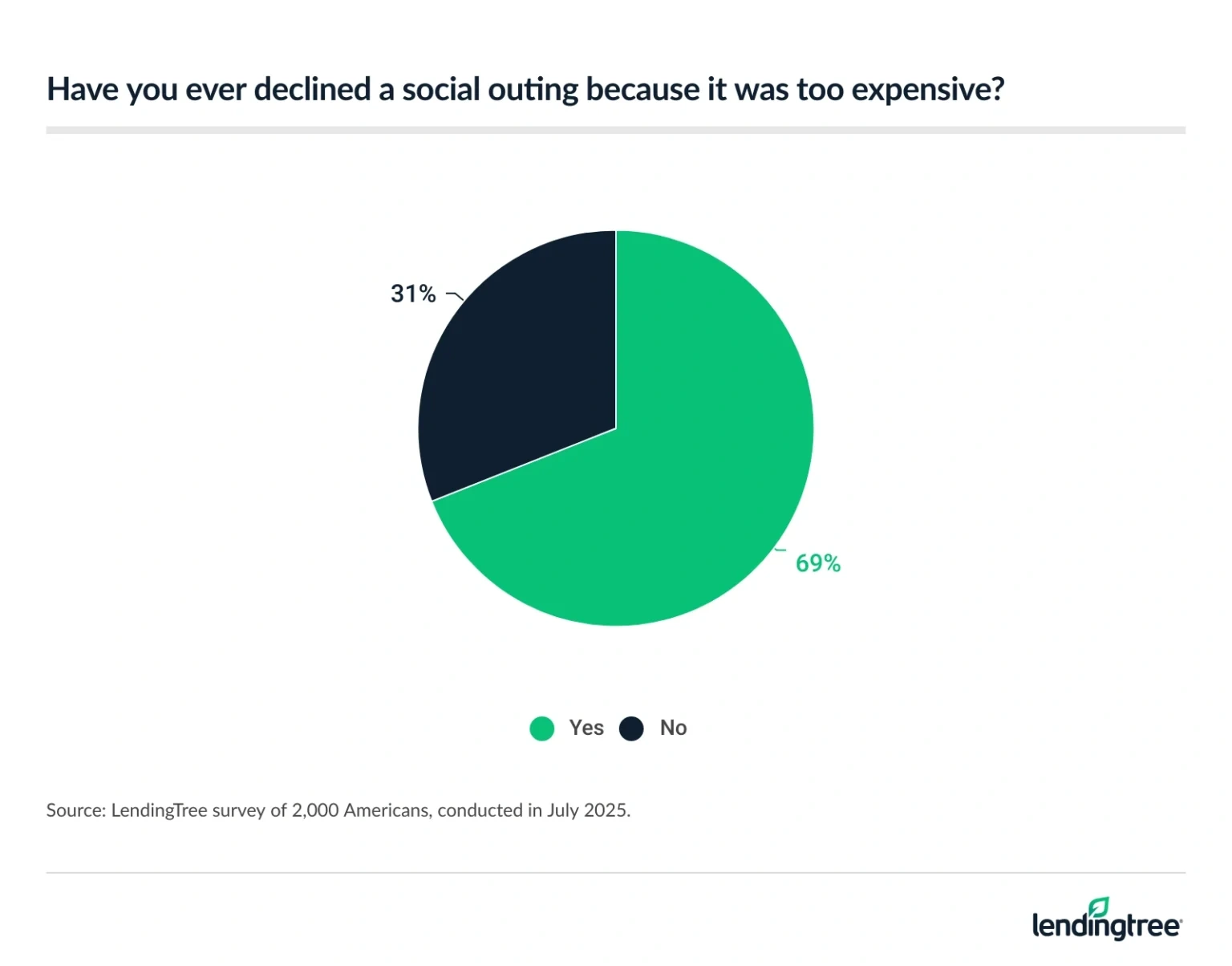

- Most Americans have said no to a social event because of cost, though they didn’t always say why. 69% of Americans have declined a social outing because it was too expensive, including 74% of parents with young kids. However, of those who did, 39% chose not to tell the person who invited them the real reason for skipping.

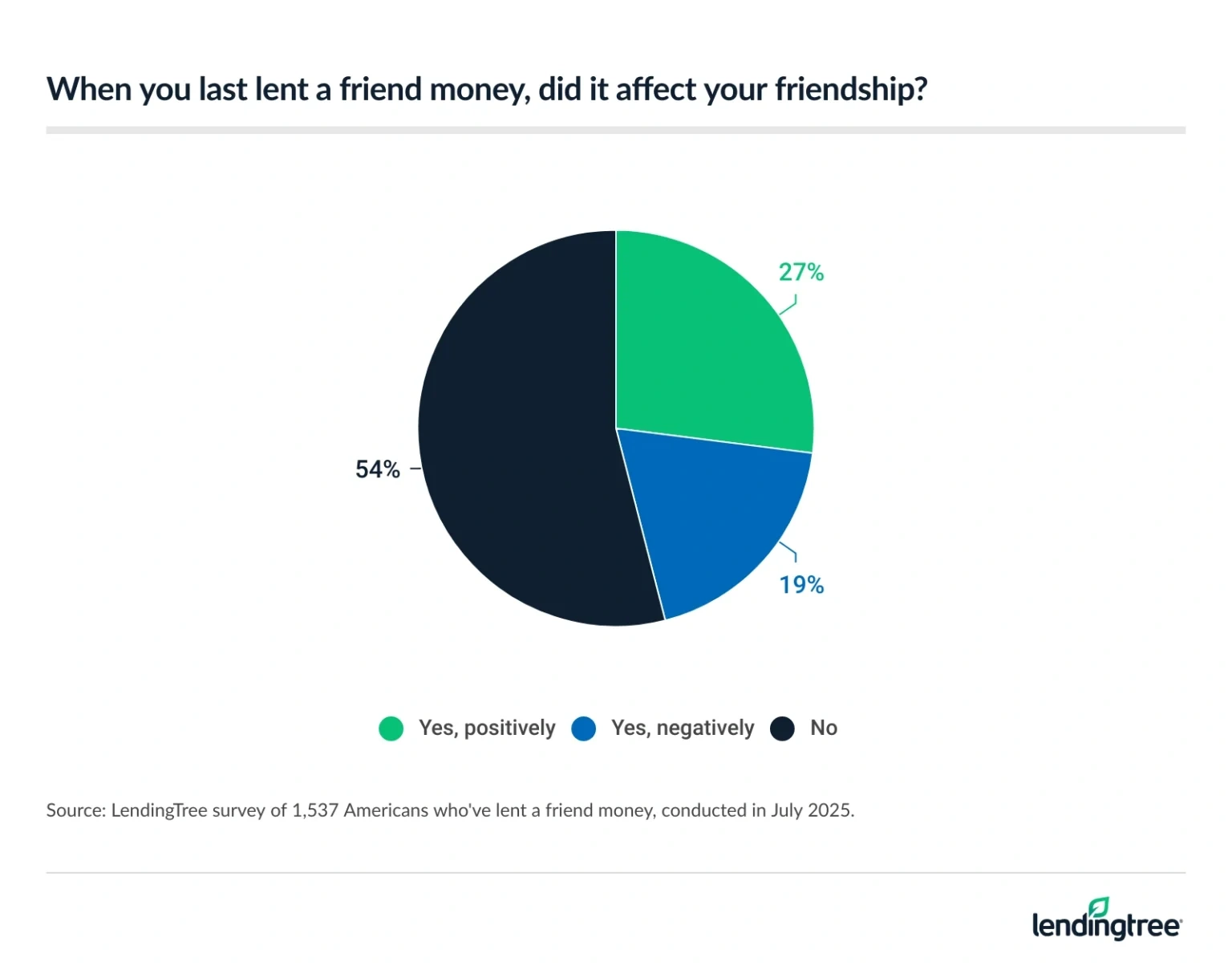

- Beware of loaning money to friends. Of the 77% of Americans who’ve lent money to a friend, 19% say it affected their friendship negatively the last time they did and 32% didn’t get their money back. This may help explain why 47% of Americans say they wouldn’t loan their best friend $500 if they asked.

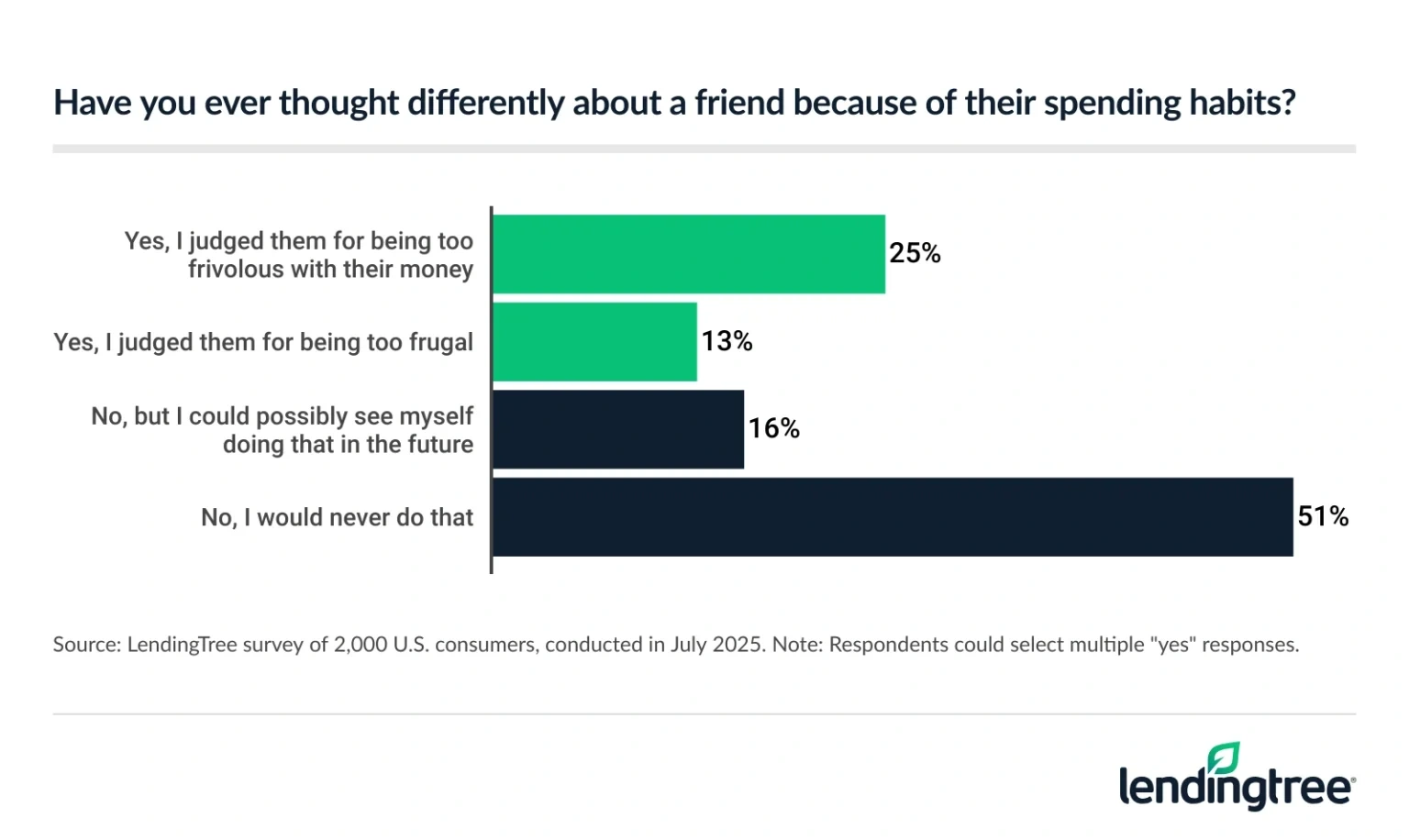

- Lying and judging friends over money is disturbingly common. While nearly 6 in 10 Americans are comfortable discussing their finances with friends, 33% admit to lying to them about being in a better financial situation than they are. Meanwhile, 28% of Americans have felt judged about being in a worse financial situation than their friends, and 33% admit they’ve thought differently of a friend because of their spending habits.

Money and friendships don’t always mix

More than 4 in 10 Americans (41%) say they’ve had tension or a disagreement with friends over money. The more money you make, the more likely you are to say so. Men are more likely than women to say so (46% versus 36%).

For many, however, those disagreements have boiled over, causing friendships to end altogether. More than 1 in 3 Americans (36%) say they’ve lost a friendship because of money, including 27% who say they’ve been the one who ended it.

Parents of young kids are the most likely demographic to have lost a friendship over money, with 48% saying so. Men are more likely than women to say this (41% versus 31%).

There could be as many reasons for those disagreements as there are stars in the sky. However, our report suggests that differing views and approaches toward spending are a prominent source of strife. Nearly 1 in 3 Americans (31%) say they’ve felt pressured to keep up with their friends’ spending habits. Among millennials ages 29 to 44, this soars to 41%.

Most Americans have said no to a social event because of cost, though they didn’t always say why

Nearly 7 in 10 Americans (69%) say they’ve opted out of a social outing because they felt it was too expensive. Again, parents with young kids are the most likely to do so, at 74%. Women are slightly more likely than men to do it (71% versus 67%), and there isn’t much difference among the generations. Gen Zers ages 18 to 28 are the most likely (71% have done so), while baby boomers ages 61 to 79 are the least likely, though still at 67%.

Our survey makes it clear that people aren’t always fully transparent about why they choose to skip the event in question.

Of those who did skip, 39% chose not to tell the person who invited them the real reason for skipping. Perhaps surprisingly, high-income Americans are more likely than any other income bracket to tell someone the truth when they decline an invitation because of money.

Beware of loaning money to friends

While the idea that money and friends don’t mix is anything but new, most of us have put that concept to the test a time or two. For example, more than 3 in 4 Americans (77%) say they’ve loaned money to a friend. Among the most likely groups to have done so: parents of young kids (83%), men (81%) and millennials (80%).

To no one’s surprise, lending money to a friend didn’t always end well. About 1 in 3 lenders (32%) say they didn’t get their money back the last time they loaned money to a friend.

Most lenders (54%) say their friendship was unaffected the last time they loaned money to a friend. However, perhaps surprisingly, lenders are more likely to say it had a positive impact on the friendship (27%) than a negative one (19%).

Still, nearly half of Americans (47%) say that if their best friend asked them to borrow $500, they would not give the loan. The survey reveals a huge gender gap around this question: 62% of men say they’d loan their best friend $500, while just 46% of women say the same.

Lying and judging friends over money is disturbingly common

Our survey reveals that most Americans (59%) are comfortable discussing money with their friends, and 66% believe people should openly share their financial struggles with their friends. However, the numbers also show that not all of us are entirely truthful when discussing money with our buddies.

One in 3 Americans says they’ve lied to their friends about being in a better financial situation than they are. The more money you make, the more likely you are to have done so.

A deeper dive into the data reveals one major reason for these lies: the fear of judgment. Among Americans, 28% have felt judged about being in a worse financial situation than their friends. Women are more likely than men to have felt that way (31% versus 25%), while Gen Zers are more likely than their older counterparts to say so.

Judgment can be a two-way street, however. A third of Americans (33%) have admitted to thinking differently about a friend because of that person’s spending habits. That includes 25% who judged friends for being too frivolous with their money and 13% who judged them for being too frugal. Looks like you just can’t win either way.

Men are significantly more likely than women (37% versus 30%) to have thought differently about a friend because of their spending habits. Also, those earning $100,000 or more a year are more likely than any other income bracket to say they judged someone for being too frivolous (29% had done so) or too frugal (22%).

Have the difficult conversation

The key to any great relationship — romantic, platonic, professional, whatever — is open and honest communication. That becomes even more true when money is involved.

For example, it’s likely that many of the problems people have faced in lending money to friends have sprung from a lack of communication. Maybe the lender didn’t clearly establish expectations or the consequences of failing to meet them. Maybe the borrower wasn’t fully transparent about the depth of their financial struggles. Maybe both sides were nervous about hurting the other’s feelings, so they didn’t feel comfortable pushing back and wound up agreeing to terms they didn’t fully understand or knew they couldn’t live up to.

Also, much of the judgment and lying likely could have been avoided with more open communication. If your friends knew you were struggling financially, they might not have encouraged you to attend the event you skipped because of the cost. If they understood the circumstances that pushed you into debt, perhaps they wouldn’t have judged you so harshly for being frugal. On the flip side, if they knew how hard you had worked to reach that big goal, they might not have judged you so harshly for splurging a bit to celebrate.

This doesn’t mean you have to share every minute detail of your financial situation with those close to you. Nor does it mean you have to be 100% honest, forgoing all tact in all situations. It does, however, mean that sometimes you can defuse a volatile situation before it escalates simply by discussing it.

Of course, talking doesn’t solve every problem, and there are cases in which a friendship should end because of a dispute. It can be sad to discover that someone you thought was a friend isn’t, but it does happen, and it can be better to cut that cord now than to let that person take advantage of you again.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from July 14 to 15, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Recommended Articles