Fewer Americans Think They’ll Be Wealthy One Day

Americans are taking a hard look at their wallets, and they don’t like what they see. Just 21% consider themselves wealthy, according to a LendingTree survey of 2,000 consumers. Only 38% of Americans who don’t currently see themselves as wealthy believe they ever will be, down from 41% in 2023.

These numbers are more telling when you consider how Americans now define wealth. Dreams of mansions and luxury cars have fallen by the wayside. Today, over half of Americans equate wealth with feeling financially secure or living without financial worry.

- Optimism for future wealth dwindles. Only 38% of Americans who don’t consider themselves wealthy think they ever will be — down from 41% in 2023. Gen Zers are the most hopeful (62%), but even their optimism has dropped 7 points in two years.

- Americans lower the bar for wealth. Most respondents define “wealthy” as feeling financially secure or living comfortably without financial concerns — a shift from the traditional view of wealth as excess. Despite these more modest definitions, only 21% of respondents consider themselves wealthy.

- Most expect to outearn their parents despite economic headwinds. An overwhelming majority (80%) of Americans think it’s becoming harder to build wealth, but more than half (57%) believe they’ll be wealthier than their parents.

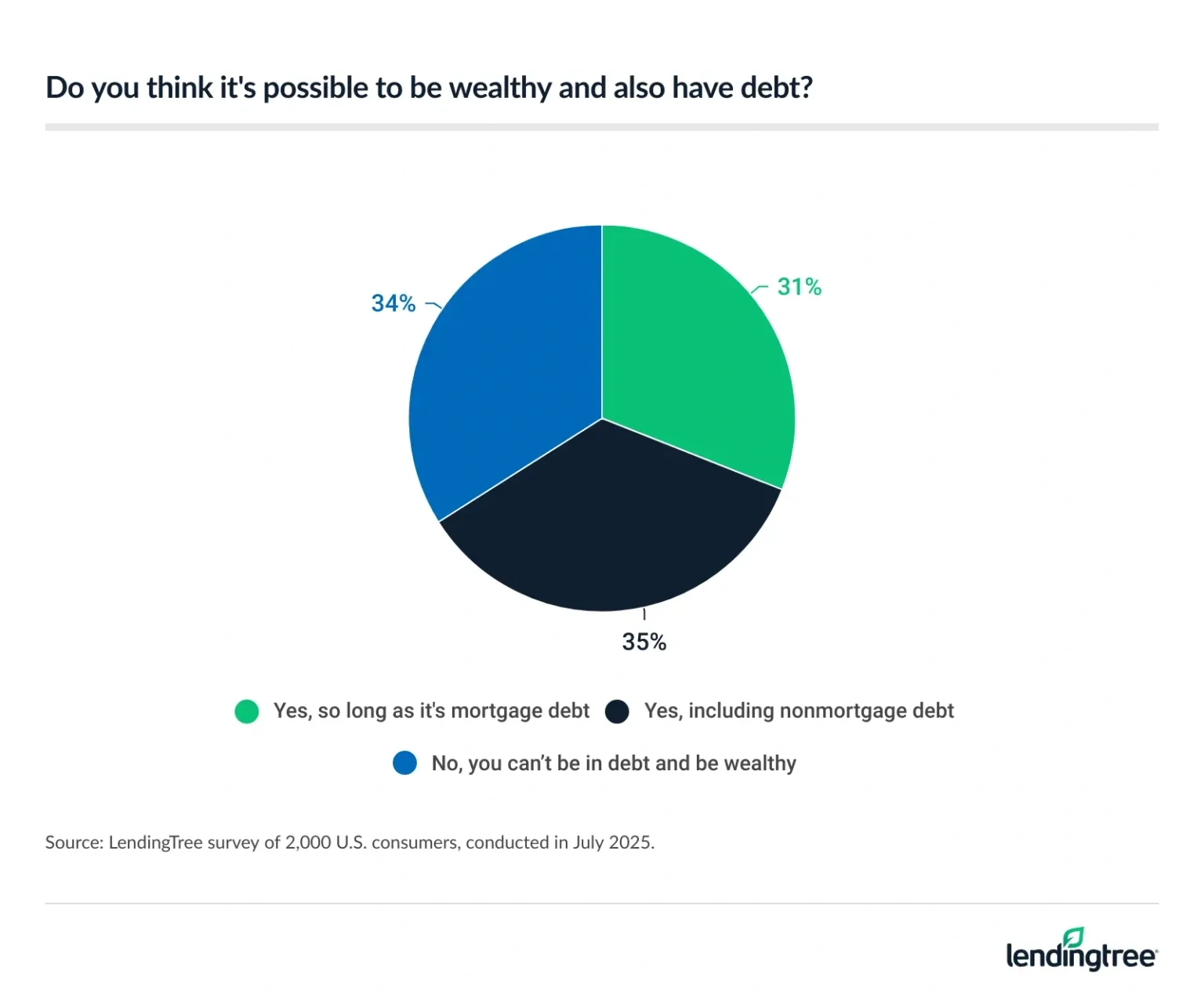

- Can you be wealthy with debt? It’s complicated, say Americans. Two-thirds (66%) think it’s possible to have debt and be wealthy, but 31% say only if it’s mortgage debt.

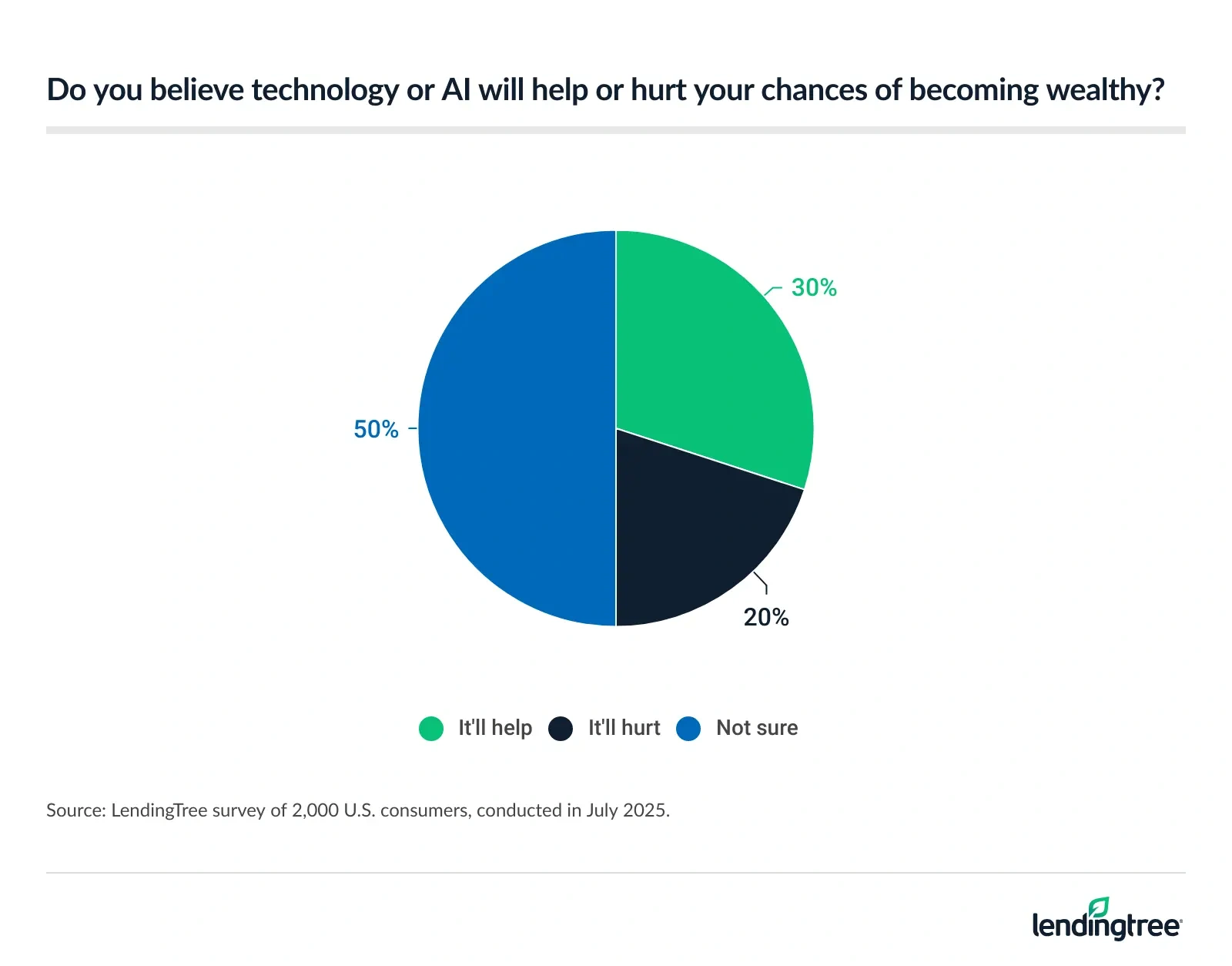

- Men are more likely to think they’ll get rich using tech and AI. Half of respondents aren’t sure how AI and technology will affect wealth, but 39% of men think it’ll improve their chances of striking it rich, compared with just 22% of women.

Optimism for future wealth dwindles

Americans who don’t consider themselves rich are losing confidence in their ability to build wealth. Since 2023, overall confidence has dropped by 3 points, and every demographic we polled — except for child-free respondents — is now less optimistic about their chances of striking it rich than they were two years ago.

Gen Zers’ (ages 18 to 28) confidence tumbled by 7 percentage points. They’re followed closely by baby boomers (ages 61 to 79) at 5 percentage points.

The group most affected in the past two years? Parents. Parents of kids 18 and over are 8 percentage points less confident in their odds of becoming wealthy now than they were two years ago, and parents of kids under 18 haven’t fared much better, with a 5 percentage point drop.

So who thinks they’ll become wealthy? Here’s a look at respondents by demographics like gender, generation, income and parental status.

Parents, Gen Zers and baby boomers are losing confidence in generating wealth, and each of these demographics has been hit with some serious economic headwinds in the past couple of years.

For parents, annual costs of raising a child have risen 35.7% in that same two-year span. Gen Zers are starting their careers in an uncertain economy, and almost half of baby boomers still in the workforce (48%) are afraid they won’t get Social Security, according to a DepositAccounts survey.

Americans lower the bar for wealth

Americans remain grim when asked to describe their current finances. Four in 5 (80%) don’t consider themselves wealthy. Among those making six figures, more than half (58%) say they’re not wealthy.

While wealth has traditionally been associated with abundance or luxury, many now see it as simply being comfortable.

When asked what “wealth” means to them, Americans’ top answers are:

- Living comfortably without financial concerns (54%)

- Feeling financially secure (51%)

- Being debt-free (48%)

These are the top three answers in every demographic we polled, regardless of gender, parental status, income bracket and generation.

Americans are more than twice as likely to equate wealth with having no financial concerns than with making six figures (23%) or having a net worth of at least $1 million (26%). Comfort and security — not indulgence — have become the new markers of wealth.

Most expect to outearn their parents despite economic headwinds

Americans at large may be laying aside dreams of striking it rich, but they haven’t forsaken their bootstraps just yet. While the vast majority (80%) agree that it’s getting harder to build wealth, most (57%) believe they’ll be wealthier than their parents.

What explains this apparent contradiction? The answer may lie in what people think drives wealth: 42% of respondents cite discipline and habits as the most important factor, followed by education (22%).

It’s the American dream writ small: “Maybe I won’t be wealthy, but if I work hard enough, I can have a better life than my parents did.”

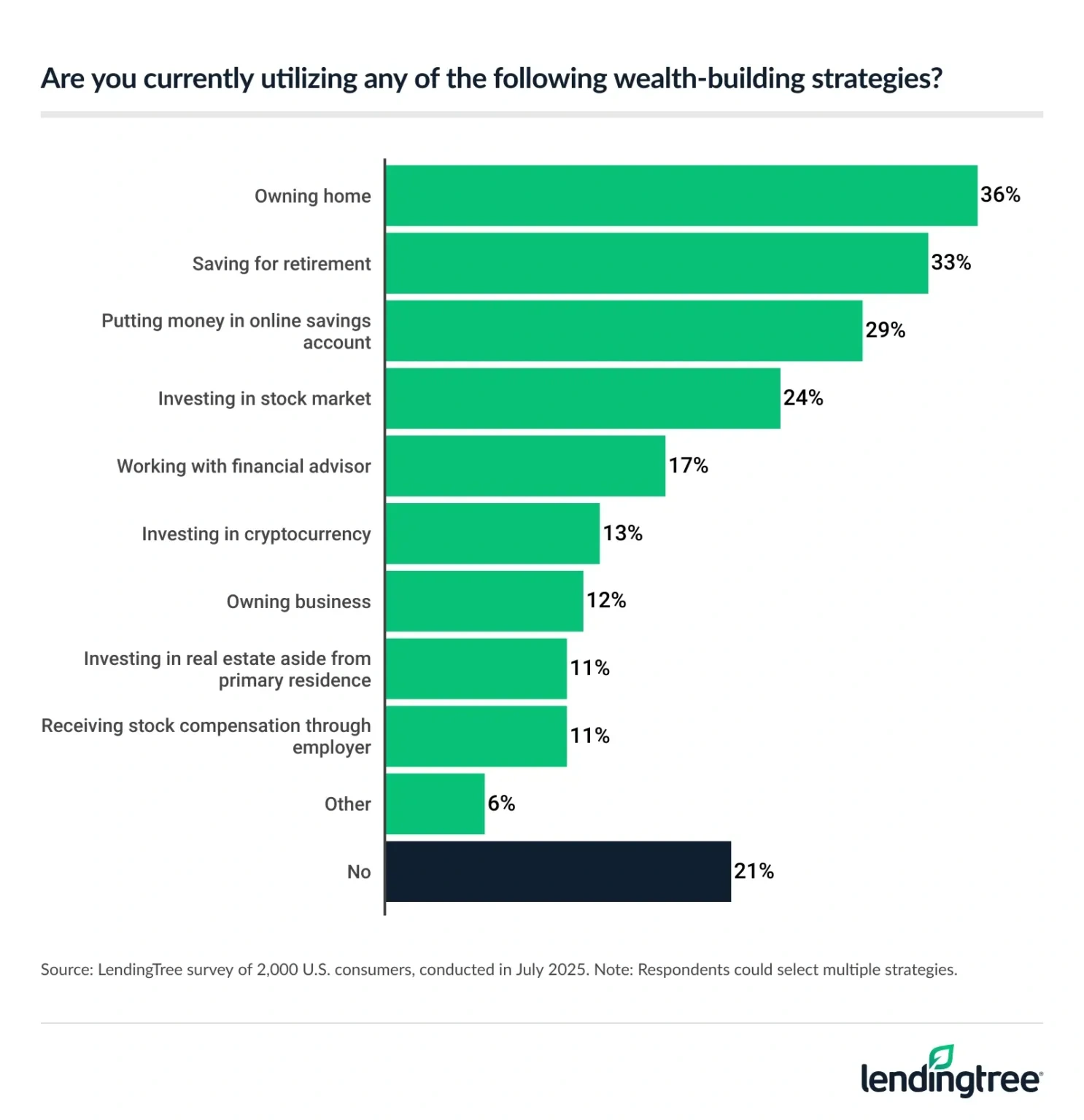

So how do they plan to overcome the odds? Respondents’ most popular wealth-building strategies are homeownership (36%), followed by saving for retirement (33%) and using online savings accounts (29%).

If these strategies feel out of reach, you’re not alone — 21% of respondents aren’t using any wealth-building strategies.

So where should you start? “Slow and steady investment in the stock market is a powerful wealth-building strategy,” says Matt Schulz, LendingTree chief consumer finance analyst. “This isn’t about day trading, crypto or meme stocks. Simply put away money consistently over time and give the magic of compounding a chance to work.”

Can you be wealthy with debt?

Americans are split three ways on the topic of debt and wealth. Just over a third (34%) think that you can’t have any debt and be considered wealthy, while 66% think you can but disagree about what type of debt is acceptable.

While a third of Americans don’t think you can be wealthy with a mortgage, nearly half (48%) think homeownership is a solid strategy to build wealth.

So why do so few respondents (36%) own homes? “Homeownership has long been one of the best wealth-building tools for Americans, but the truth is that many people feel that door is closed for them right now,” says Schulz, also the author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.”

“This is especially true for younger Americans. High home prices and high interest rates combined with the fact that so many people are living on tight budgets today means that it’s as challenging as it has ever been to buy a home.”

Men are more likely to think they’ll get rich using tech and AI

Half (50%) of Americans aren’t ready to weigh in on whether they think tech and AI will help or hurt their odds of becoming wealthy.

Opinions differ significantly across income brackets and gender.

High earners ($100,000+) are three times more likely to say that AI and tech would help their chances (48%) than hurt (16%). In fact, the less respondents earn, the less likely they are to think that AI and tech will help them.

Men are almost twice as likely to think that AI will help their chances of becoming wealthy (39%) as women (22%). They’re also significantly more likely to invest in cryptocurrency (18%) than women (8%).

So, where should you go for financial advice when there are so many new tools? It’s hard to know, says Schulz, but “long-established websites like LendingTree can provide useful, practical advice. For specific guidance, working with a certified financial planner can make sense.”

Schulz cautions against making risky moves with your money. “A lot of people out there make big promises and declarations. Trust your gut. If something seems too good to be true or just doesn’t quite feel right, walk away.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from July 1 to 3, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Recommended Articles