About 3 in 4 Cardholders Don’t Understand How 0% Balance Transfers Work

According to a new report from LendingTree, about 3 in 4 credit cardholders have a fundamental misunderstanding about how introductory 0% balance transfer credit cards work, despite the fact that half of all surveyed cardholders have had a balance transfer card in the past.

LendingTree reviewed the terms and conditions of 167 credit cards that allow balance transfers as part of our 2019 Balance Transfer Credit Card Report. This research showed 0% introductory offers are still easy to find, and while most of those cards charge a one-time fee on that transferred balance, you can find cards that don’t impose a fee if you shop around.

Unfortunately, the news wasn’t all good. In creating the report, we also commissioned a survey to ask cardholders about their own history with balance transfer cards to gauge their understanding of these cards, which are popular with both consumers and issuers alike. What we found was fewer cardholders said they paid their transferred balances in full during the introductory 0% period in 2019 than in 2018. Furthermore, many were confused about just how these cards even worked.

Click below to learn more:

There is a silver lining, however. It turns out that 0% balance transfer offers aren’t as tricky as people think they are. Yes, there are deadlines, fees and some nuances that consumers should understand before applying for a balance transfer card, but these cards are a better deal than most people realize.

Key findings

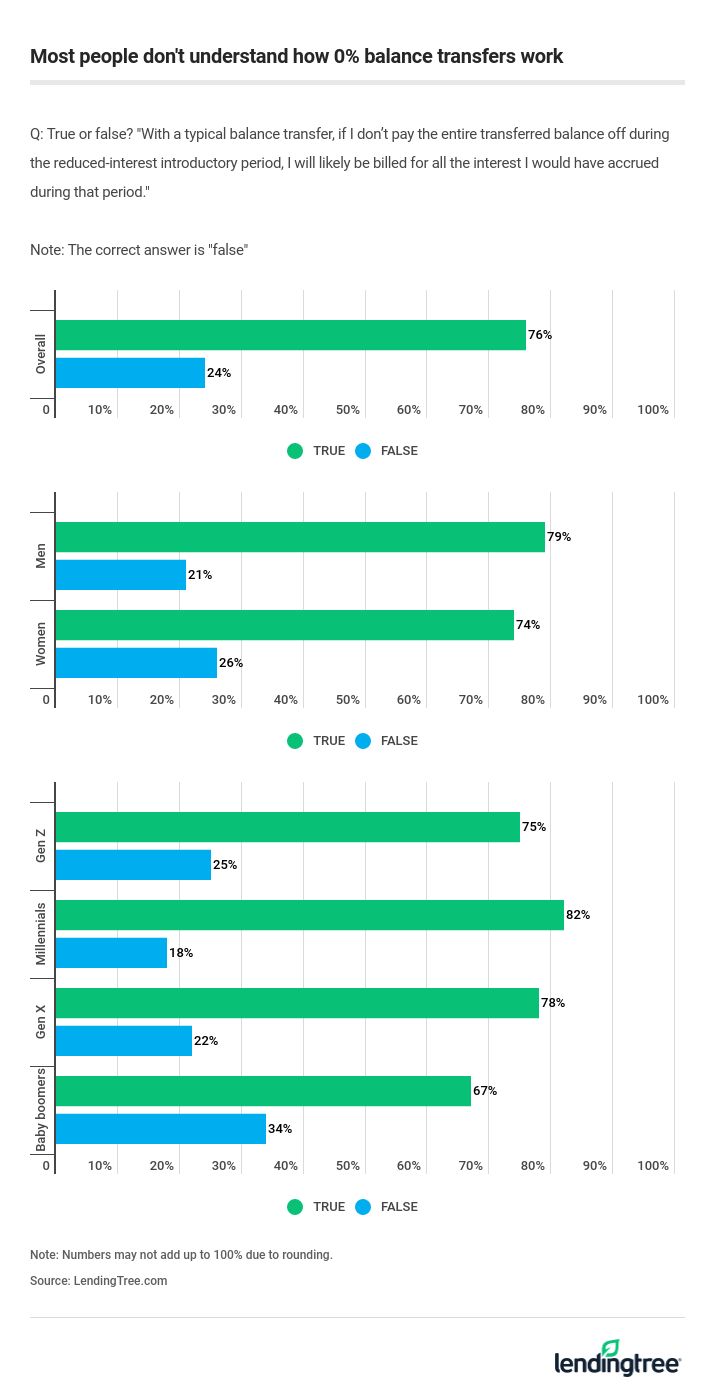

- 76% of cardholders are misinformed about a key balance transfer benefit. More than 3 in 4 respondents inaccurately believe that if they don’t pay off the entire transferred balance during the reduced-interest introductory period, they’ll be billed for all of the interest they would have otherwise accrued during that time frame.

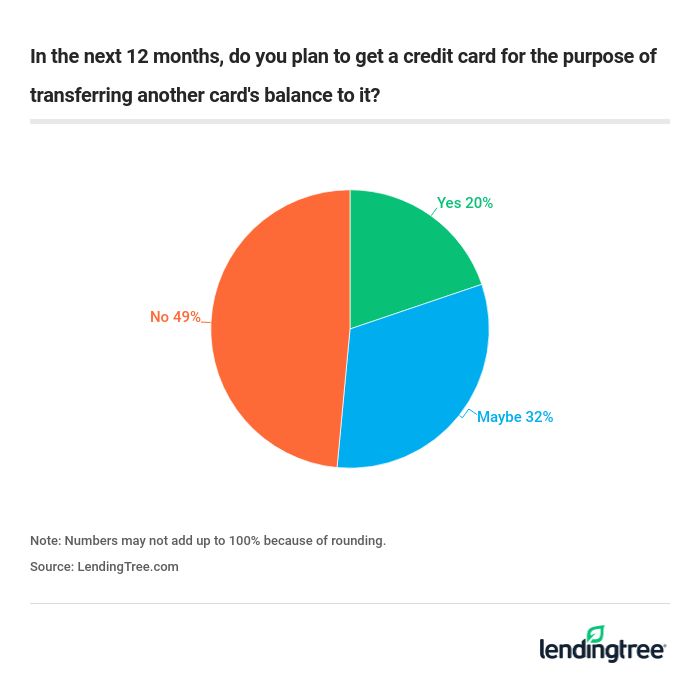

- Nearly 20% of credit cardholders plan to get a new credit card in order to transfer to another card’s balance next year. Another 32% are considering doing so. Men are twice as likely than women to plan on opening a balance transfer card in 2020. Nearly one-third of millennials plan on opening a balance transfer card in 2020.

- Half of all credit cardholders have opened a new credit card specifically to transfer another card’s balance. That number includes almost 18% who have done so more than once.

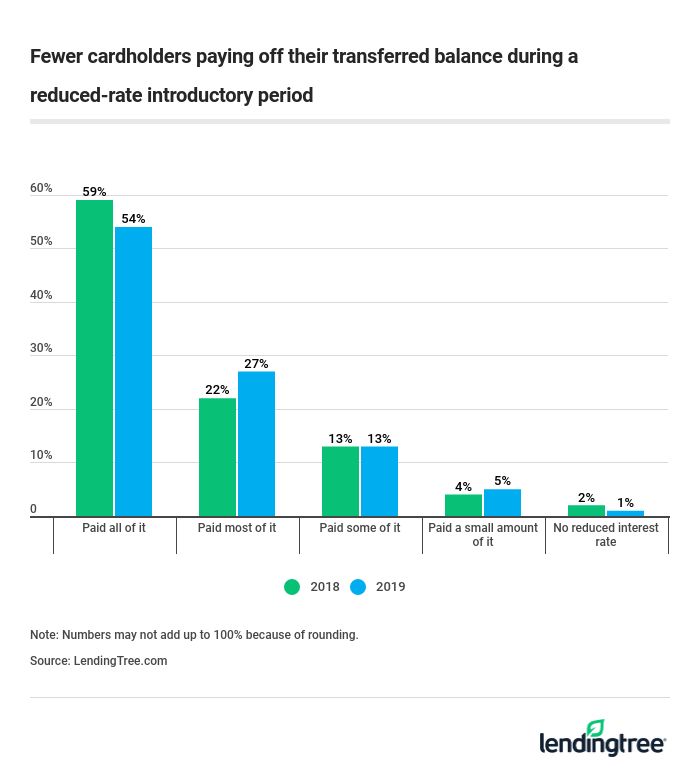

- Fewer people said they paid their most recent transferred balance in full during the reduced-rate introductory period this year than last year. Of those cardholders who transferred a balance, 54% said they paid off the entire transferred balance during the introductory reduced-interest rate period. That’s down from 59% last year.

- Nearly half of the balance transfer cards we reviewed came with a 0% APR on transferred balances for at least some period of time. The average length of that 0% offer is 14 months, though offers ranged from six to 36 months.

- Our report found 18 balance transfer cards that do not ever charge a balance transfer fee, while four cards came with short-term introductory offers in which the fee was waived. The most common fee was 3% of the transferred balance.

- Nearly two-thirds of cards with an introductory 0% APR on balance transfers came with a “use it or lose it” deadline to get that APR. The most common deadline was 60 days after opening the card.

The misunderstanding: reduced interest vs. deferred interest

There’s so much jargon around credit cards that it is very easy to get confused. Balance transfer credit cards are no exception, and our survey shows that the terminology around the 0% introductory offer on balance transfer cards is a major source of confusion for consumers.

A 0% introductory offer on balance transfers generally works like this:

- You successfully apply for the card.

- You transfer a balance from another card to the new card.

- You’re charged no interest on that balance for a set amount of time, typically 15 months, but durations can vary.

- Once that introductory period is over, you begin to accrue interest on the remaining transferred balance at the card’s regular APR. (The average is about 20%.) You continue to accrue interest until your entire balance is paid off.

That’s it. Even if you don’t pay the transferred balance off in full during the 0% promotional period, you won’t be billed retroactively for interest you would’ve accrued during that time.

Contrary to the facts of how a balance transfer card works, most of our survey respondents – 3 in 4 cardholders, including 82% of millennials – think they will get hit with a bill for that retroactive interest. It’s a concept called “deferred interest,” and while it is typically not seen with balance transfer offers, most cardholders believe that it is.

Deferred interest is most commonly seen in so-called special financing deals with retail credit cards. Under these deals, you pay on a purchase for six months or more with no interest. If you pay the entire purchase off during the no-interest period, you never pay any interest. However, if you don’t pay the balance in full during the promotional time frame, you will be hit with a bill for all of the interest that you would have accrued on the purchase going back to the day you bought it. That’s true even if you paid $999 of a $1,000 purchase, and it can come as a real shock to an unsuspecting cardholder.

Those “special financing” deals simply aren’t found with introductory 0% balance transfer offers. If you make regular, on-time payments, that 12-month, no-interest period means just that. And that’s very good news.

Balance transfer cards still popular

Despite any confusion surrounding them, balance transfer cards remain popular. More than half of cardholders said they’re at least considering getting a new credit card in order to transfer a balance next year.

Perhaps surprisingly, six-figure earners are more likely than any other income bracket to have done a transfer. Among cardholders, men (55%), Gen Xers (57%) and parents of young children (62%) are also likely to have used a balance transfer card.

The state of balance transfer credit cards today

For our annual study, we reviewed the terms and conditions of 167 cards that allow balance transfers. Here’s what we found:

- Introductory balance transfer APRs: 84 of the 167 cards surveyed came with an introductory APR offer for balance transfers, and 77 of those 84 offers were at 0%.

- Duration of introductory balance transfer APRs: The average length of the introductory period was 14 months, though the durations ranged from six to 36 months.

- Ongoing balance transfer APRs: For cards that come with an introductory offer, the average post-introductory-period APR was 19.37%, about a point lower than the overall average for all credit cards. For those cards without an introductory offer, the APR was higher, coming in at 20.57%.

- Annual fees on balance transfer cards: 128 of the cards reviewed came with no annual fee, at least for some period, though 11 of the cards waived it only for the first year. Among cards that charged an annual fee, the median fee was $95.

- No-fee balance transfers: 18 reviewed cards never charge a balance transfer fee, while four others came with an introductory period in which the fee was waived.

- Balance transfer fees: The most common fee was 3% of the transferred balance, with a minimum of either $5 or $10.

- “Use it or lose it” deadlines: 54 out of 84 cards with an introductory balance transfer APR required cardholders to transfer the balance within a certain window in order to take advantage of the introductory offer. The most common timeframe was 60 days, though the window varied from 45 to 120 days.

The bottom line: 2019 didn’t bring huge changes, and 2020 probably won’t either

While we looked at a slightly different sampling of credit cards – a few cards added from last year’s list, a few removed for various reasons – for this year’s survey than for the 2018 report, it is clear that 2019 was not a year of seismic change in the balance transfer space. For example, the average duration of an introductory 0% APR offer (14 months) was unchanged, as was the most common balance transfer fee (3%). That means plenty of good balance transfer credit card offers are out there, and barring a sudden, sharp downturn in the economy, they’re probably not going anywhere anytime soon.

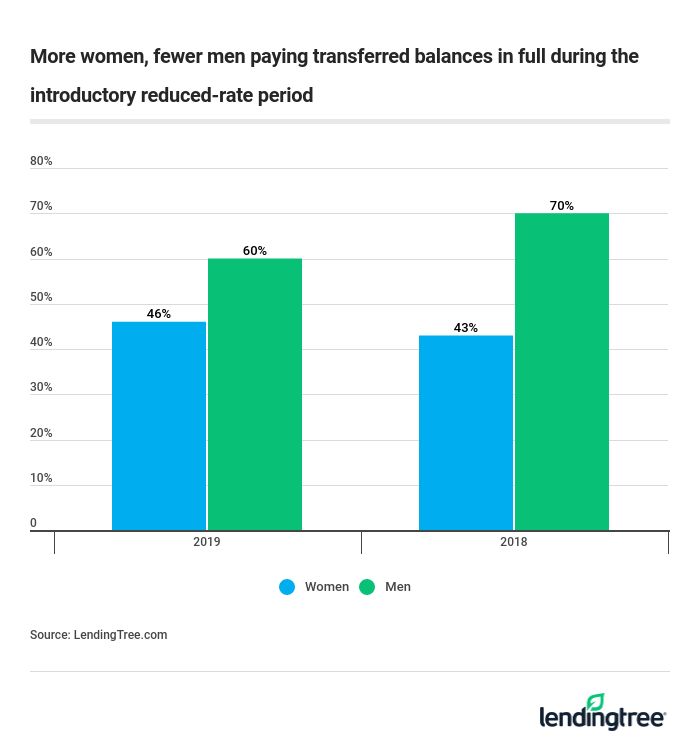

What did change was the percentage of cardholders paying off their transferred balances during the 0% APR introductory period. In 2018, 59% of cardholders say they did that with their most recent balance transfer. That’s down to 54% in 2019, powered mostly by a significant drop in men paying their balances in full. In the 2018 survey, 70% of men said they did so, while just 60% did in 2019. (The percentage of women saying the same actually went up, growing from 43% to 46%.)

If you’re struggling to pay off your balances, introductory 0% APR balance transfer cards should absolutely be one of the weapons you use to attack that debt. Getting a yearlong (or longer) reprieve from accruing interest can be a godsend, and these cards can bring you that, when used wisely. That last part is key, though. These cards can be a great tool to help you conquer your debt, but if you don’t make a commitment to pay off as much of the balance as possible during the interest-free period, that hole you’re standing in is only going to get deeper.

Methodology

LendingTree reviewed credit card offers for 167 credit cards that allow balance transfers. Cards from more than 40 different issuers – including banks and credit unions – were included. We reviewed basic terms and conditions, including APRs and annual fees, as well as evaluating the cards’ balance transfer programs. All offers were reviewed online. Credit card offer data is accurate as of Dec. 1, 2019.

In addition, LendingTree commissioned Qualtrics to conduct an online survey of 791 credit cardholders, with the sample base proportioned to represent the overall population. The survey was fielded Nov. 1-4, 2019. The overall margin of error for all respondents is +/-3%.