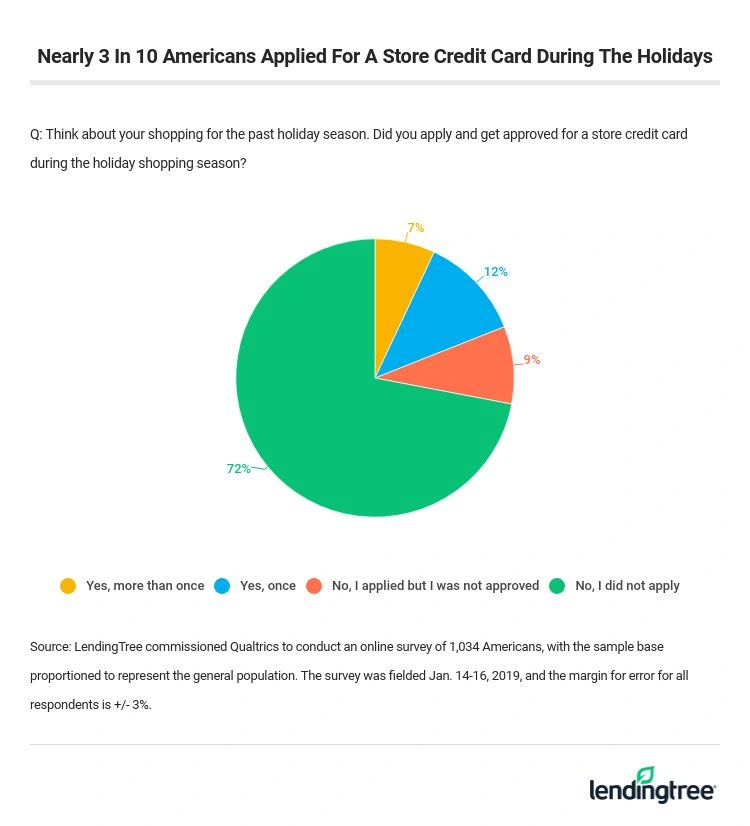

Nearly 3 in 10 Americans Applied For A Store Credit Card During The Holidays

Nearly 3 in 10 American adults applied for a store credit card during the 2018 holiday season, according to a new report from LendingTree, and millennials led the way.

With the holidays still fresh in our memories, LendingTree asked Americans to look back at some of their spending behaviors. We asked whether consumers had applied and been approved for a store credit card, how long they expected it would take to pay off their first purchase with the card and whether they spent more than they expected on shopping this holiday season.

We found that many Americans just couldn’t resist the lure of a new store credit card. That’s despite the fact that these cards come with an average APR of about 25% — far higher than other credit cards – less lucrative rewards than general-purpose credit cards and fine print that can turn a good deal into a not-so-great one. (Check out our 2018 Store Card Study to learn more.) We also learned that many Americans were a little more spendy this holiday season than they thought they’d be.

- Nearly 3 in 10 Americans applied for a store credit card during the holiday season. Of that, nearly 1 in 3 (32%) were not approved.

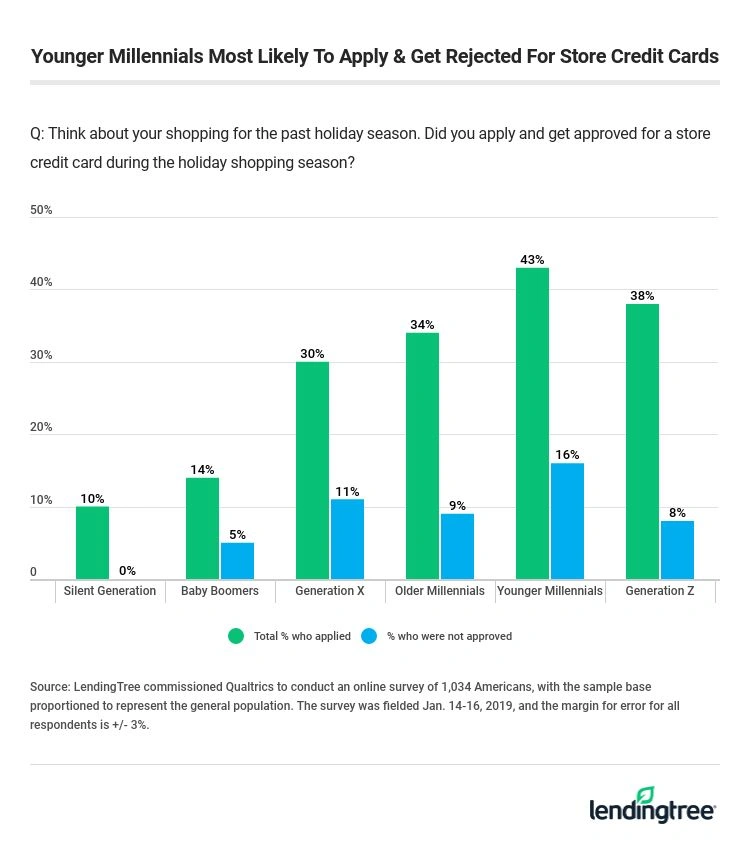

- 43% of younger millennials (those aged 22 to 29) applied – the most of any age group — but they were also more likely than others to not be approved. Men and parents with young kids were also among the most likely to have applied.

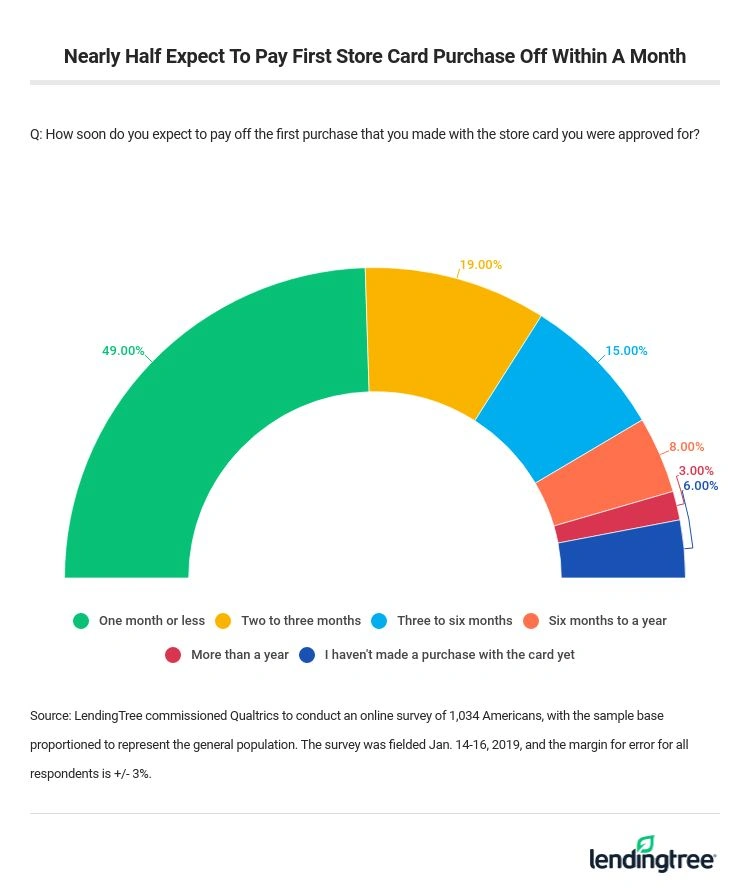

- Of those who were approved, about half said they would pay off their first purchase with the card in one month or less.

- About 1 in 3 people said they spent more money than they expected to on holiday shopping, while about 1 in 5 said they spent less. Parents with young kids and millennials were most likely to say they spent more than they expected.

The bottom line: When it comes to store credit cards, buyer beware

It’s no great secret why Americans embrace store credit cards: They can save you real money if you use them wisely. That 15% or 20% discount that many retailers offer on your first purchase can be a big deal and can help extend your family budget, assuming you can pay that purchase off at the end of the month. On the flip side, however, if you carry a balance, these cards can be seriously costly.

Ultimately, it comes down to this: If you can’t pay your balance in full each month, you shouldn’t get a store credit card. It’s as simple as that. The main reason is that the interest rates are too high. You don’t have to be an accountant to understand that it doesn’t make sense to pay 25% in interest to save 15% on a purchase. The math just doesn’t work in your favor.

Many people simply don’t think this through before applying for a card, and that’s how the retailers want it to be. They offer you the card at the checkout counter, assume that you won’t take the time to ask too many questions and know that a significant number of people will still say yes. That’s not a recipe for good decision making.

Here’s what you should do instead the next time a store credit card offer piques your interest: Politely say no, but ask for a brochure. When you get home, read the brochure, making sure that you understand the main fees and other details associated with the offer. If the offer still sounds good after you’ve read up on it, go ahead and apply for the card the next time you visit. Chances are all of the things you liked about it will still apply, and you’ll be making a much more informed decision.