US Gas Prices Decrease By As Much As 8% — See Where Your State Stacks Up

- The average U.S. gas price on March 3, 2026, was $3.11 per gallon — up 0.4% from $3.10 one year earlier.

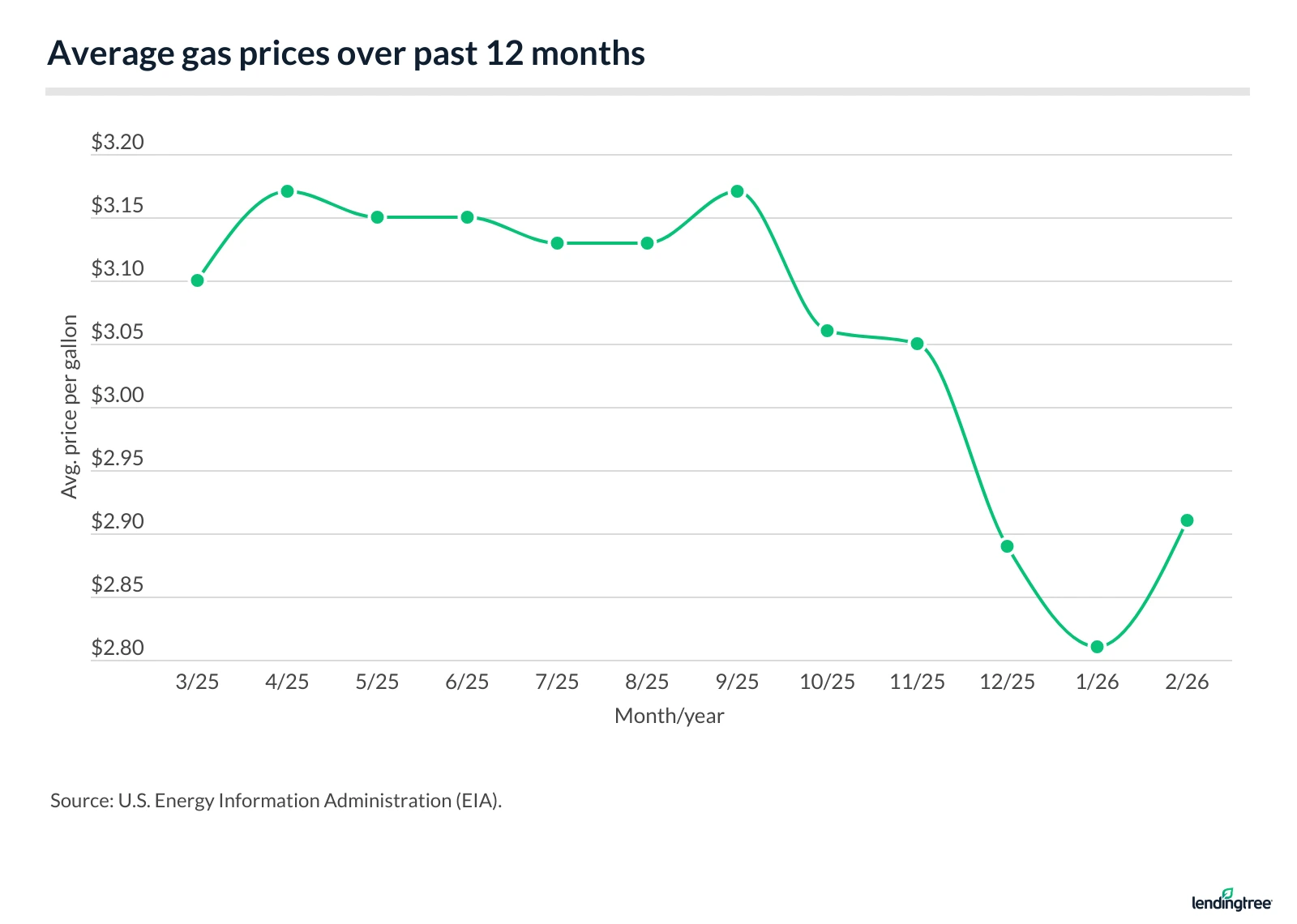

- The highest average monthly gas price per gallon in 2025 was $3.17 in September and April, while the lowest was $2.89 in December. It further decreased to $2.81 in January 2026 before rising to $2.91 in February 2026.

- The average gas price per gallon in 2025 was $3.10, down 6.3% from $3.30 in 2024 and 12.0% from $3.52 in 2023.

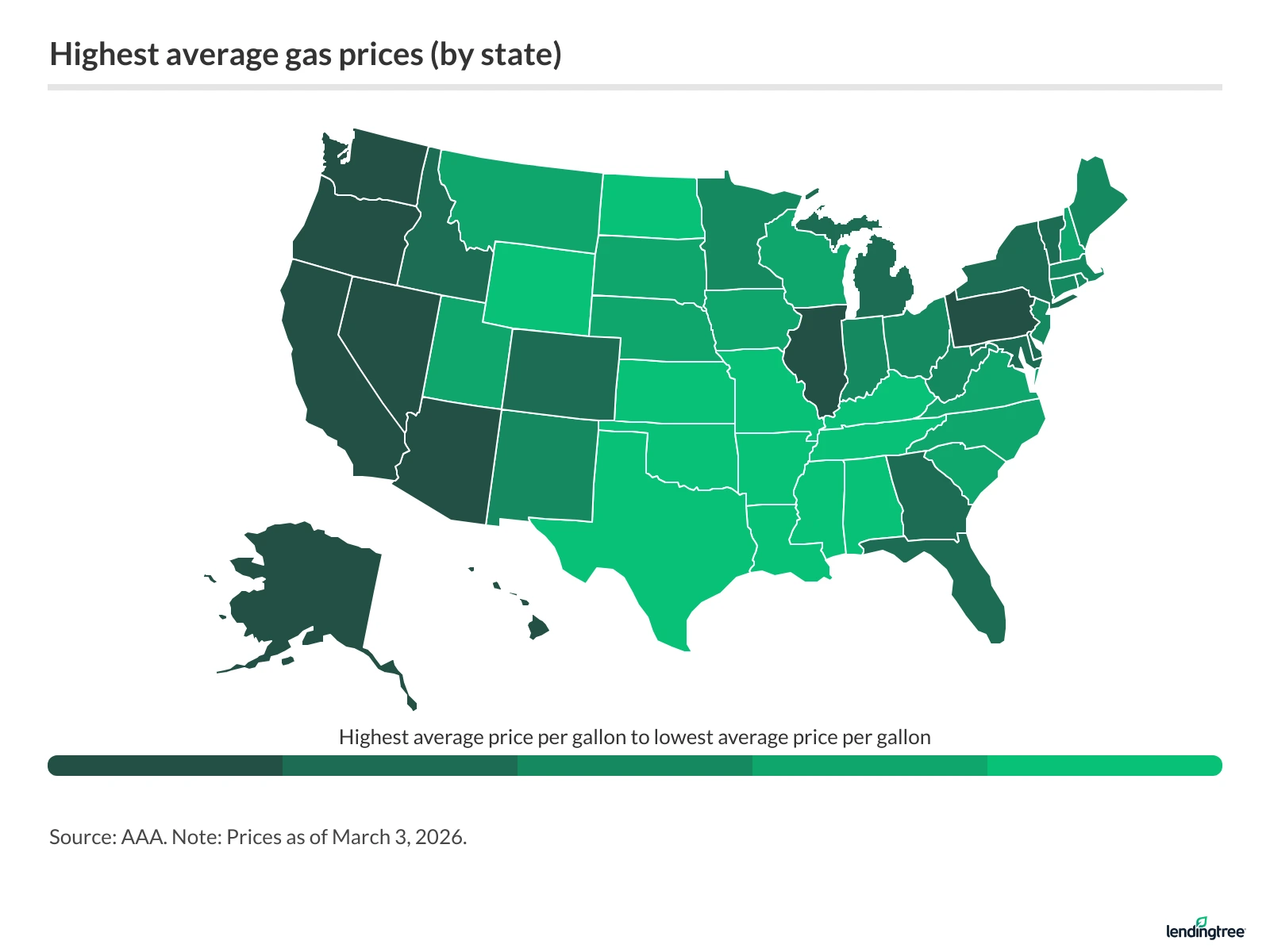

- The highest average gas prices are in California ($4.67 per gallon), Hawaii ($4.40) and Washington ($4.38).

- Oklahoma has the lowest average gas price ($2.62 per gallon), ahead of Mississippi ($2.64) and Kansas and Arkansas (both at $2.70).

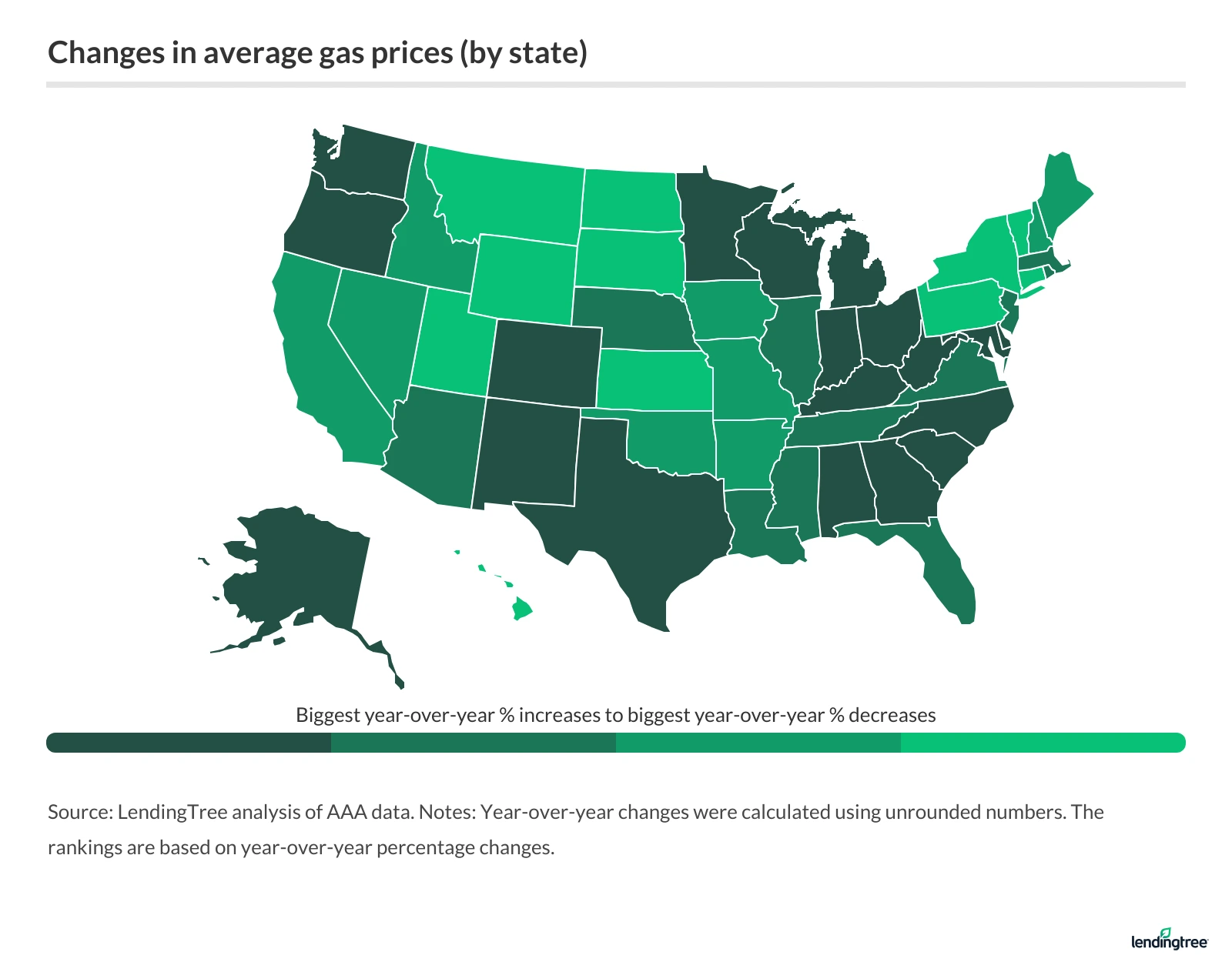

- Average gas prices increased the most between March 3, 2025, and March 3, 2026, in Ohio (8.3%), Alaska (6.1%) and Washington (5.9%).

- Average gas prices decreased the most between March 3, 2025, and March 3, 2026, in North Dakota (8.3%), Montana (7.1%) and Wyoming (6.9%).

- By metro, average gas prices jumped the most in Dayton, Ohio (14.9%), followed by two Texas metros: McAllen-Edinburg-Mission (14.4%) and San Angelo (14.0%).

- By metro, average gas prices decreased the most in Dubuque, Iowa (10.6%), Franklin, Idaho (9.2%), and Manhattan, Kan. (9.1%).

Average monthly gas prices are down $2.02 per gallon from their peak in June 2022, according to a LendingTree analysis.

Meanwhile, average daily gas prices are up 0.4% year over year as of March 3. At the state level, prices decreased by as much as 8.3% in North Dakota and increased by as much as 8.3% in Ohio.

We examined the largest fluctuations in gas prices between March 3, 2025, and March 3, 2026. Along with identifying which states and metros saw the biggest changes, we’ll explain how you can use credit card rewards to earn cash back at the pump.

Average gas prices increased 0.4% nationwide — here’s how they fluctuated

On March 3, 2026, the average U.S. gas price was $3.11 per gallon. That’s up 0.4% from $3.10 on March 3, 2025. In December 2025, the national average dipped below $3.00 for the first time since May 2021.

The average gas price per gallon in 2025 was $3.10, down from $3.30 in 2024. In 2025, the average gas price was lowest in December at $2.89 per gallon and highest in September and April at $3.17. In January 2026, the average price dropped further to $2.81 per gallon, but then it rose to $2.91 in February 2026. (Because the following chart and table are based on the average price over a full month, March 2026 will be added in April.)

Average gas prices over past 12 months

| Month | Avg. price per gallon |

|---|---|

| February 2026 | $2.91 |

| January 2026 | $2.81 |

| December 2025 | $2.89 |

| November 2025 | $3.05 |

| October 2025 | $3.06 |

| September 2025 | $3.17 |

| August 2025 | $3.13 |

| July 2025 | $3.13 |

| June 2025 | $3.15 |

| May 2025 | $3.15 |

| April 2025 | $3.17 |

| March 2025 | $3.10 |

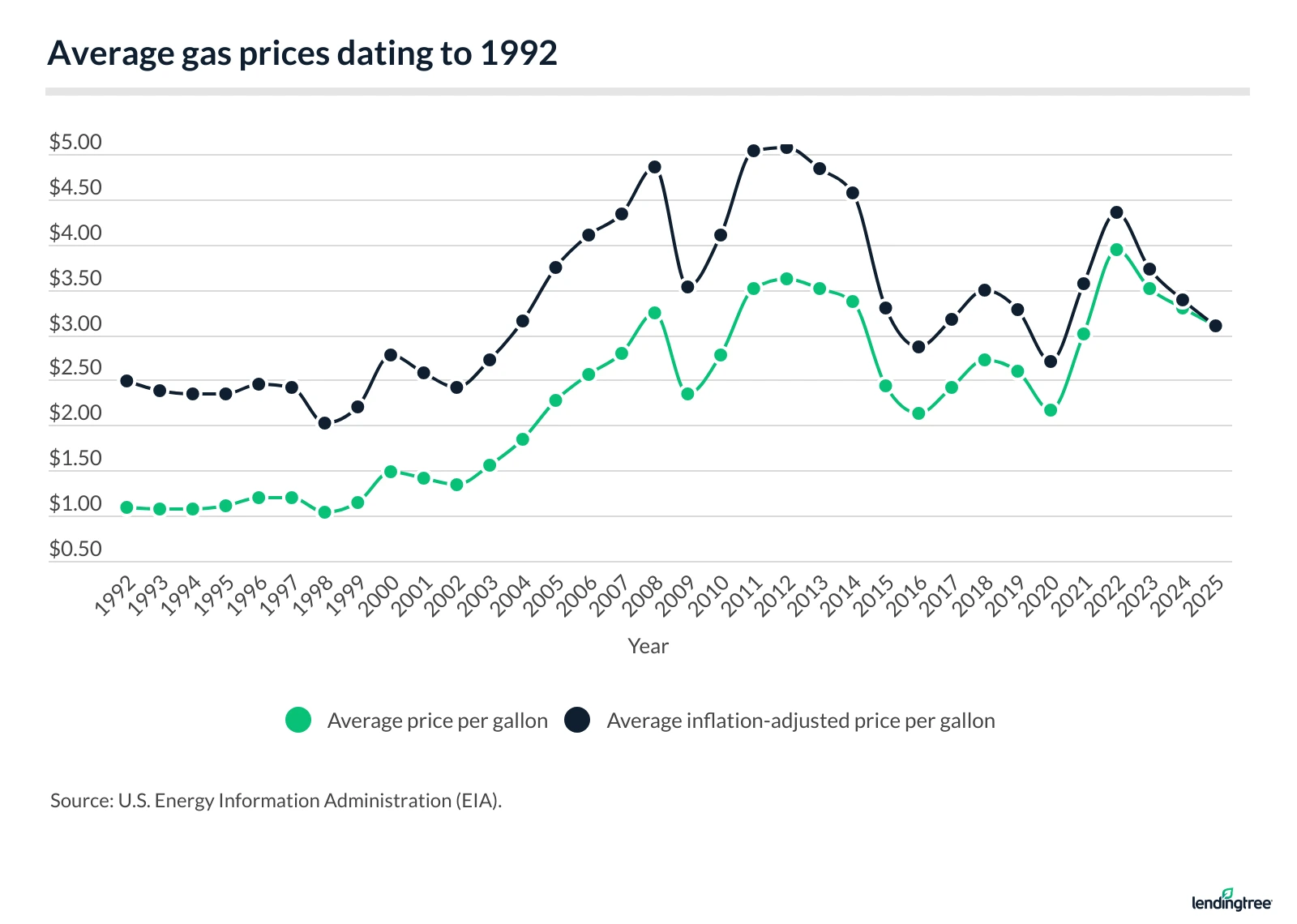

It’s worth noting that gas prices have decreased in 2025 and 2026 compared to their 2022 highs. To put it into perspective, six of the 10 months with the highest average gas prices, dating back to 1992, occurred in 2022 — including the top five. Notably, the only other months where average gas prices reached over $4.00 a gallon were June and July 2008, when demand was high but global oil production was low.

Highest gas prices (historical)

| Rank | Month | Avg. price per gallon |

|---|---|---|

| 1 | June 2022 | $4.93 |

| 2 | July 2022 | $4.56 |

| 3 | May 2022 | $4.44 |

| 4 | March 2022 | $4.22 |

| 5 | April 2022 | $4.11 |

| 6 | July 2008 | $4.06 |

| 7 | June 2008 | $4.05 |

| 8 | August 2022 | $3.98 |

| 9 | May 2011 | $3.91 |

| 10 | April 2012 | $3.90 |

Still, 2022 wasn’t the worst year for gas prices. After adjusting for inflation, 2012 had the highest average gas price at $5.07 per gallon. Before adjusting for inflation, it was $3.62 per gallon.

Avg. gas prices dating to 1992

| Year | Avg. price per gallon | Avg. inflation-adjusted price per gallon |

|---|---|---|

| 2025 | $3.10 | $3.10 |

| 2024 | $3.30 | $3.39 |

| 2023 | $3.52 | $3.72 |

| 2022 | $3.95 | $4.35 |

| 2021 | $3.01 | $3.57 |

| 2020 | $2.17 | $2.70 |

| 2019 | $2.60 | $3.28 |

| 2018 | $2.72 | $3.49 |

| 2017 | $2.42 | $3.17 |

| 2016 | $2.14 | $2.87 |

| 2015 | $2.43 | $3.30 |

| 2014 | $3.36 | $4.57 |

| 2013 | $3.51 | $4.84 |

| 2012 | $3.62 | $5.07 |

| 2011 | $3.52 | $5.04 |

| 2010 | $2.78 | $4.11 |

| 2009 | $2.35 | $3.53 |

| 2008 | $3.25 | $4.85 |

| 2007 | $2.80 | $4.34 |

| 2006 | $2.57 | $4.11 |

| 2005 | $2.27 | $3.74 |

| 2004 | $1.85 | $3.16 |

| 2003 | $1.56 | $2.73 |

| 2002 | $1.35 | $2.41 |

| 2001 | $1.42 | $2.58 |

| 2000 | $1.48 | $2.77 |

| 1999 | $1.14 | $2.20 |

| 1998 | $1.03 | $2.03 |

| 1997 | $1.20 | $2.41 |

| 1996 | $1.20 | $2.46 |

| 1995 | $1.11 | $2.35 |

| 1994 | $1.08 | $2.34 |

| 1993 | $1.07 | $2.38 |

| 1992 | $1.09 | $2.49 |

Average gas prices highest in California, lowest in Oklahoma

As of March 3, 2026, the highest average gas price nationwide is in California ($4.67 per gallon). Hawaii ($4.40) and Washington ($4.38) follow.

States with highest average gas prices

| Rank | State | Avg. price per gallon |

|---|---|---|

| 1 | California | $4.67 |

| 2 | Hawaii | $4.40 |

| 3 | Washington | $4.38 |

| 4 | Oregon | $3.95 |

| 5 | Nevada | $3.73 |

Conversely, Oklahoma has the lowest average gas price at $2.62 per gallon, followed by Mississippi ($2.64) and Kansas and Arkansas (both at $2.70).

States with lowest average gas prices

| Rank | State | Avg. price per gallon |

|---|---|---|

| 1 | Oklahoma | $2.62 |

| 2 | Mississippi | $2.64 |

| 3 | Kansas | $2.70 |

| 3 | Arkansas | $2.70 |

| 5 | Tennessee | $2.72 |

| 5 | Louisiana | $2.72 |

Full rankings

Highest average gas prices (by state)

| Rank | State | Avg. price per gallon | % difference from avg. U.S. gas price |

|---|---|---|---|

| 1 | California | $4.67 | 50.2% |

| 2 | Hawaii | $4.40 | 41.5% |

| 3 | Washington | $4.38 | 40.9% |

| 4 | Oregon | $3.95 | 27.1% |

| 5 | Nevada | $3.73 | 20.0% |

| 6 | Alaska | $3.64 | 17.1% |

| 7 | Arizona | $3.39 | 9.0% |

| 8 | Pennsylvania | $3.21 | 3.2% |

| 9 | Illinois | $3.20 | 2.9% |

| 10 | District of Columbia | $3.15 | 1.3% |

| 11 | Michigan | $3.13 | 0.7% |

| 12 | Idaho | $3.08 | -0.9% |

| 13 | Florida | $3.07 | -1.3% |

| 14 | Maryland | $3.06 | -1.6% |

| 15 | Vermont | $3.05 | -1.9% |

| 16 | New York | $3.04 | -2.2% |

| 17 | Delaware | $3.02 | -2.9% |

| 17 | Colorado | $3.02 | -2.9% |

| 19 | Georgia | $3.01 | -3.2% |

| 20 | Maine | $3.00 | -3.5% |

| 20 | Ohio | $3.00 | -3.5% |

| 20 | West Virginia | $3.00 | -3.5% |

| 20 | Indiana | $3.00 | -3.5% |

| 20 | Minnesota | $3.00 | -3.5% |

| 25 | New Jersey | $2.99 | -3.8% |

| 26 | Massachusetts | $2.98 | -4.1% |

| 27 | Connecticut | $2.96 | -4.8% |

| 27 | Rhode Island | $2.96 | -4.8% |

| 27 | New Mexico | $2.96 | -4.8% |

| 30 | Virginia | $2.94 | -5.4% |

| 31 | New Hampshire | $2.93 | -5.8% |

| 32 | North Carolina | $2.91 | -6.4% |

| 33 | Utah | $2.89 | -7.0% |

| 33 | Montana | $2.89 | -7.0% |

| 35 | Nebraska | $2.88 | -7.4% |

| 36 | South Dakota | $2.86 | -8.0% |

| 36 | Wisconsin | $2.86 | -8.0% |

| 38 | South Carolina | $2.83 | -9.0% |

| 39 | Iowa | $2.81 | -9.6% |

| 40 | Wyoming | $2.79 | -10.3% |

| 40 | Missouri | $2.79 | -10.3% |

| 42 | Alabama | $2.77 | -10.9% |

| 43 | North Dakota | $2.75 | -11.5% |

| 44 | Texas | $2.74 | -11.9% |

| 45 | Kentucky | $2.73 | -12.2% |

| 46 | Tennessee | $2.72 | -12.5% |

| 46 | Louisiana | $2.72 | -12.5% |

| 48 | Kansas | $2.70 | -13.2% |

| 48 | Arkansas | $2.70 | -13.2% |

| 50 | Mississippi | $2.64 | -15.1% |

| 51 | Oklahoma | $2.62 | -15.7% |

Where average gas prices increased (or fell) the most

It’s also worth noting which states saw the biggest year-over-year changes. Average gas prices rose in 21 states between March 3, 2025, and March 3, 2026.

The average gas price increased in Ohio by 8.3% from $2.77 to $3.00 per gallon, followed by Alaska by 6.1% from $3.44 to $3.64 and Washington by 5.9% from $4.14 to $4.38.

States with biggest increases in average gas prices

| Rank | State | Avg. gas price, March 3, 2026 | Avg. gas price, March 3, 2025 | YoY % change | YoY $ change |

|---|---|---|---|---|---|

| 1 | Ohio | $3.00 | $2.77 | 8.3% | $0.23 |

| 2 | Alaska | $3.64 | $3.44 | 6.1% | $0.21 |

| 3 | Washington | $4.38 | $4.14 | 5.9% | $0.24 |

| 4 | Michigan | $3.13 | $2.96 | 5.8% | $0.17 |

| 5 | Indiana | $3.00 | $2.84 | 5.6% | $0.16 |

Meanwhile, average gas prices decreased the most in North Dakota between March 3, 2025, and March 3, 2026. There, gas prices fell 8.3% from $3.00 to $2.75. Montana, where prices fell 7.1% from $3.11 to $2.89, and Wyoming, where prices fell 6.9% from $2.99 to $2.79, followed.

States with biggest decreases in average gas prices

| Rank | State | Avg. gas price, March 3, 2026 | Avg. gas price, March 3, 2025 | YoY % change | YoY $ change |

|---|---|---|---|---|---|

| 1 | North Dakota | $2.75 | $3.00 | -8.3% | -$0.25 |

| 2 | Montana | $2.89 | $3.11 | -7.1% | -$0.22 |

| 3 | Wyoming | $2.79 | $2.99 | -6.9% | -$0.21 |

| 4 | Utah | $2.89 | $3.02 | -4.3% | -$0.13 |

| 5 | Kansas | $2.70 | $2.81 | -4.1% | -$0.12 |

Full rankings

Changes in average gas prices (by state)

| Rank | State | Avg. gas price, March 3, 2026 | Avg. gas price, March 3, 2025 | YoY % change | YoY $ change |

|---|---|---|---|---|---|

| 1 | Ohio | $3.00 | $2.77 | 8.3% | $0.23 |

| 2 | Alaska | $3.64 | $3.44 | 6.1% | $0.21 |

| 3 | Washington | $4.38 | $4.14 | 5.9% | $0.24 |

| 4 | Michigan | $3.13 | $2.96 | 5.8% | $0.17 |

| 5 | Indiana | $3.00 | $2.84 | 5.6% | $0.16 |

| 6 | Oregon | $3.95 | $3.74 | 5.4% | $0.20 |

| 7 | North Carolina | $2.91 | $2.77 | 5.1% | $0.14 |

| 7 | Delaware | $3.02 | $2.87 | 5.1% | $0.15 |

| 9 | South Carolina | $2.83 | $2.72 | 4.2% | $0.11 |

| 10 | Texas | $2.74 | $2.66 | 2.9% | $0.08 |

| 11 | West Virginia | $3.00 | $2.92 | 2.6% | $0.08 |

| 11 | Maryland | $3.06 | $2.98 | 2.6% | $0.08 |

| 11 | Georgia | $3.01 | $2.93 | 2.6% | $0.08 |

| 14 | New Mexico | $2.96 | $2.88 | 2.5% | $0.07 |

| 15 | Wisconsin | $2.86 | $2.82 | 1.6% | $0.05 |

| 16 | Minnesota | $3.00 | $2.96 | 1.4% | $0.04 |

| 17 | Kentucky | $2.73 | $2.71 | 0.8% | $0.02 |

| 18 | Colorado | $3.02 | $3.01 | 0.4% | $0.01 |

| 18 | Alabama | $2.77 | $2.76 | 0.4% | $0.01 |

| 20 | Florida | $3.07 | $3.06 | 0.3% | $0.01 |

| 21 | Arizona | $3.39 | $3.39 | 0.1% | $0.00 |

| 22 | Virginia | $2.94 | $2.94 | -0.1% | $0.00 |

| 23 | Mississippi | $2.64 | $2.66 | -0.5% | -$0.01 |

| 24 | Rhode Island | $2.96 | $2.97 | -0.6% | -$0.02 |

| 24 | New Jersey | $2.99 | $3.01 | -0.6% | -$0.02 |

| 24 | Nebraska | $2.88 | $2.89 | -0.6% | -$0.02 |

| 27 | Illinois | $3.20 | $3.22 | -0.7% | -$0.02 |

| 28 | Louisiana | $2.72 | $2.74 | -0.8% | -$0.02 |

| 29 | Massachusetts | $2.98 | $3.01 | -1.2% | -$0.04 |

| 29 | Tennessee | $2.72 | $2.75 | -1.2% | -$0.03 |

| 31 | Missouri | $2.79 | $2.83 | -1.3% | -$0.04 |

| 32 | New Hampshire | $2.93 | $2.98 | -1.5% | -$0.05 |

| 33 | Arkansas | $2.70 | $2.76 | -2.0% | -$0.06 |

| 34 | California | $4.67 | $4.79 | -2.3% | -$0.11 |

| 35 | District of Columbia | $3.15 | $3.23 | -2.4% | -$0.08 |

| 35 | Maine | $3.00 | $3.07 | -2.4% | -$0.07 |

| 35 | Nevada | $3.73 | $3.82 | -2.4% | -$0.09 |

| 38 | Oklahoma | $2.62 | $2.69 | -2.6% | -$0.07 |

| 39 | Idaho | $3.08 | $3.17 | -2.7% | -$0.09 |

| 39 | Iowa | $2.81 | $2.89 | -2.7% | -$0.08 |

| 41 | Pennsylvania | $3.21 | $3.31 | -3.0% | -$0.10 |

| 42 | Hawaii | $4.40 | $4.55 | -3.2% | -$0.14 |

| 42 | Vermont | $3.05 | $3.15 | -3.2% | -$0.10 |

| 44 | Connecticut | $2.96 | $3.06 | -3.3% | -$0.10 |

| 45 | New York | $3.04 | $3.15 | -3.6% | -$0.11 |

| 46 | South Dakota | $2.86 | $2.98 | -4.0% | -$0.12 |

| 47 | Kansas | $2.70 | $2.81 | -4.1% | -$0.12 |

| 48 | Utah | $2.89 | $3.02 | -4.3% | -$0.13 |

| 49 | Wyoming | $2.79 | $2.99 | -6.9% | -$0.21 |

| 50 | Montana | $2.89 | $3.11 | -7.1% | -$0.22 |

| 51 | North Dakota | $2.75 | $3.00 | -8.3% | -$0.25 |

Biggest metro increases in Ohio and Texas

Metros (as designated by AAA) in Ohio and Texas saw the largest average gas price increases. In fact, of the 10 metros with the highest gas price increases, five are in Texas and four are in Ohio.

Dayton, Ohio, saw the largest increase, with gas prices rising by 14.9% from $2.54 to $2.92. This was followed by two Texas metros: McAllen-Edinburg-Mission, where prices increased 14.4%, from $2.50 to $2.86, and San Angelo with a 14.0% increase from $2.54 to $2.89.

Metros with biggest increases in average gas prices

| Rank | Metro | Avg. gas price, March 3, 2026 | Avg. gas price, March 3, 2025 | YoY % change | YoY $ change |

|---|---|---|---|---|---|

| 1 | Dayton, OH | $2.92 | $2.54 | 14.9% | $0.38 |

| 2 | McAllen-Edinburg-Mission, TX | $2.86 | $2.50 | 14.4% | $0.36 |

| 3 | San Angelo, TX | $2.89 | $2.54 | 14.0% | $0.35 |

| 4 | Brownsville-Harlingen, TX | $2.87 | $2.52 | 13.8% | $0.35 |

| 5 | Lima, OH | $2.99 | $2.64 | 13.4% | $0.35 |

| 6 | Toledo, OH | $3.05 | $2.70 | 12.9% | $0.35 |

| 7 | Laredo, TX | $2.90 | $2.58 | 12.5% | $0.32 |

| 8 | Wilmington, NC | $2.99 | $2.69 | 11.3% | $0.30 |

| 9 | Corpus Christi, TX | $2.86 | $2.57 | 11.1% | $0.29 |

| 9 | Canton-Massillon, OH | $3.07 | $2.77 | 11.1% | $0.30 |

Meanwhile, average gas prices decreased the most in Dubuque, Iowa, falling by 10.6% from $3.17 to $2.84. Rounding out the top three are Franklin, Idaho, where prices declined by 9.2% from $3.00 to $2.72, and Manhattan, Kan., where prices dropped by 9.1% from $2.84 to $2.58.

Metros with biggest decreases in average gas prices

| Rank | Metro | Avg. gas price, March 3, 2026 | Avg. gas price, March 3, 2025 | YoY % change | YoY $ change |

|---|---|---|---|---|---|

| 1 | Dubuque, IA | $2.84 | $3.17 | -10.6% | -$0.33 |

| 2 | Franklin, ID | $2.72 | $3.00 | -9.2% | -$0.28 |

| 3 | Manhattan, KS | $2.58 | $2.84 | -9.1% | -$0.26 |

| 4 | Alexander County, IL | $3.20 | $3.50 | -8.6% | -$0.30 |

| 5 | Iowa City, IA | $2.77 | $3.02 | -8.4% | -$0.25 |

| 5 | Minot, ND | $2.79 | $3.05 | -8.4% | -$0.26 |

| 7 | Missoula, MT | $2.89 | $3.15 | -8.3% | -$0.26 |

| 8 | Moorhead, MN | $2.75 | $2.99 | -8.2% | -$0.24 |

| 9 | Bismarck, ND | $2.80 | $3.04 | -8.0% | -$0.24 |

| 10 | Le Flore-Sequoyah, OK | $2.52 | $2.73 | -7.9% | -$0.21 |

Utilizing credit cards for cash back at the gas station: Expert tips

The U.S. Energy Information Administration (EIA) forecasts gas prices to be $2.91 per gallon in 2026 and $2.93 per gallon in 2027.

LendingTree chief consumer finance analyst Matt Schulz says drivers can take a few steps to save on gas at the pump. First, he recommends shopping around.

“It doesn’t make sense to drive across town to save 3 cents a gallon, but gas prices can vary quite a bit even in a small area,” he says. “Driving an extra few blocks for a lower gas price can add up over a year, especially for drivers who fill up frequently.”

Next, Schulz advises leveraging credit cards with the best gas station rewards.

“Whether you’re loyal to one specific gas station chain or just looking to save on gas prices no matter where you fill up, plenty of credit cards can help you,” he says. “Just know that gas station-specific cards tend to have higher-than-average APRs, so make sure you pay them off in full every month if you’re going to use them. Otherwise, the amount you save on gas can quickly be outweighed by how much you accrue in interest.”

Methodology

LendingTree researchers analyzed AAA data on average regular gas prices in states and metros. Prices are as of March 3, 2026, and are compared to those on March 3, 2025.

U.S. Energy Information Administration (EIA) data was used to calculate average historical prices of regular gas per gallon.