Economic Squeeze: 72% Struggle With Bills As 48% Pay Late in Past Year

Nearly 3 in 4 Americans say the current economy makes it more difficult for them to pay their bills, and about half say they’ve paid a bill late in the past year.

However, while 30% of Americans say they’re less able to afford their monthly bills than a year ago, another 31% feel they’re more able to do so.

LendingTree surveyed 2,000 American adults about their bill-paying behaviors and beliefs. While the results show that many Americans continue to struggle, they also highlight a divide in how they feel about paying their bills.

Here’s more of what we found.

Key findings

- Many Americans struggle to keep up with bills in the current financial climate, but a divide has developed. 72% say the current economy makes it more difficult to afford their bills, with 30% saying they’re less able to afford monthly bills than a year ago. Still, a nearly identical rate — 31% — say they’re more able to afford bills than a year ago, while 39% say their ability to pay hasn’t changed during that time.

- Late payments are common — and usually recent. Nearly half (48%) have paid a bill late in the past 12 months, including 35% within the past six months. Nearly half of the late payers in the past year (47%) were late on just one or two bills. And when late, 68% say their bills were typically overdue by a few days, while 24% were overdue by a week or more. The bills most often paid late are utilities (32%), phones (30%), credit cards (28%), cable/internet (27%) and rent/mortgage (19%).

- Affordability is the top driver of late payments but is far from the only reason. Among those who paid late in the past year, the leading causes were not having enough money (46%), mixing up the due date (31%), forgetting (25%) and autopay issues (19%). Most who’ve asked for relief have got it: 69% have requested that their late fee be waived, and 79% of them were granted it.

- Rent or mortgage is the clear priority to pay on time. For the most important bill to pay on time, if forced to choose one, rent/mortgage (35%) leads by a wide margin, followed by utilities (18%). Rent/mortgage payments are also the bills Americans most struggle to afford when they’re due (15%), followed by utilities (13%) and credit cards (12%).

Many Americans struggle to keep up with bills in current financial climate, but divide develops

Nearly 3 in 4 Americans (72%) say that current economic conditions are making it harder for them to afford their bills. While women are more likely than men to agree with that sentiment (77% versus 67%), both figures are significant. Gen Xers ages 45 to 60 (77%) are the most likely age group to agree, but there’s widespread consensus, with 73% of millennials ages 29 to 44, 71% of Gen Zers ages 18 to 28 and 65% of baby boomers ages 61 to 79 saying so as well.

However, when you ask people to compare their ability to pay their bills to how they felt a year ago, that agreement disappears — and a divide emerges.

Three in 10 Americans (30%) say they’re less able to afford their bills than a year ago, while 31% say they’re more able to afford them than a year ago. (The other 39% say their ability hasn’t changed in the past year.)

Men are more likely to say they’re more able to pay than a year ago (37%) than to say they’re less able (24%), while women are the opposite (37% are less able to pay, versus 25% more able).

There’s also a significant generation gap, with more Gen Zers and millennials saying they’re more able to pay and older generations saying they’re less able to pay. For example, 45% of Gen Zers say they’re more able to pay, versus just 26% who say they’re less able. Compare that to 30% of boomers who are less able to pay and just 14% who say they’re more able.

Late payments are common — and usually recent

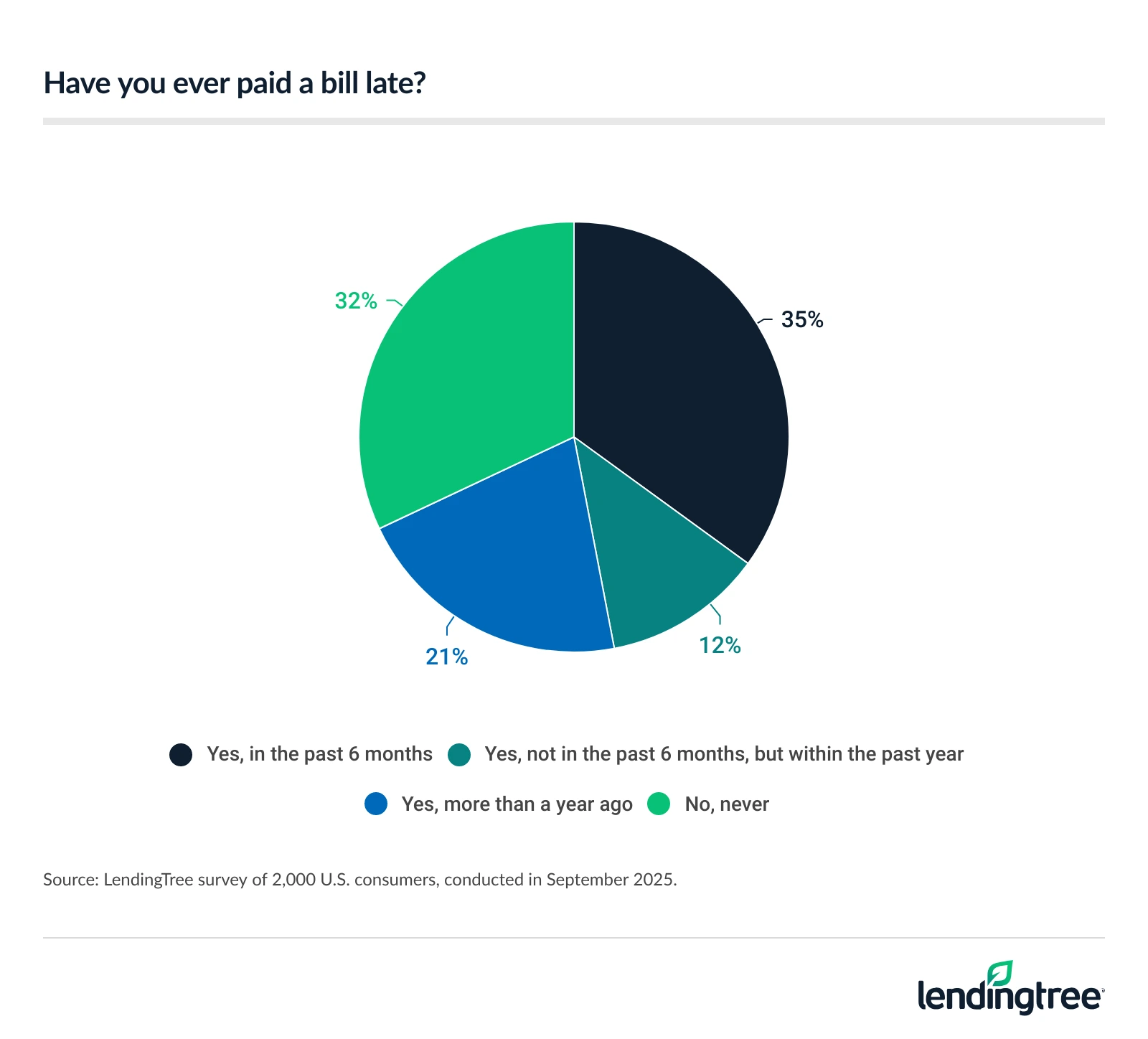

Almost half of Americans say they’ve paid a bill late in the past year, with 35% saying they’ve done so in the past six months.

Surprisingly, the highest earners are the most likely income bracket to say they’ve paid late in the past six months, with 41% of those earning $100,000 or more a year saying so. Compare that with:

- 32% of those making less than $30,000

- 40% of those making $30,000 to $49,999

- 32% of those making $50,000 to $99,999

Millennials (58% late in the past year, 44% in the past six months) and Gen Xers (55% and 43%) are far more likely than Gen Zers (47% and 33%) and baby boomers (26% and 17%) to say they’ve paid late in the past year.

Just about half (47%) of those who paid late in the past year did so two times or fewer, while 15% did so six times or more. About two-thirds say they’re typically late only by days, though 24% say weeks and 8% say months.

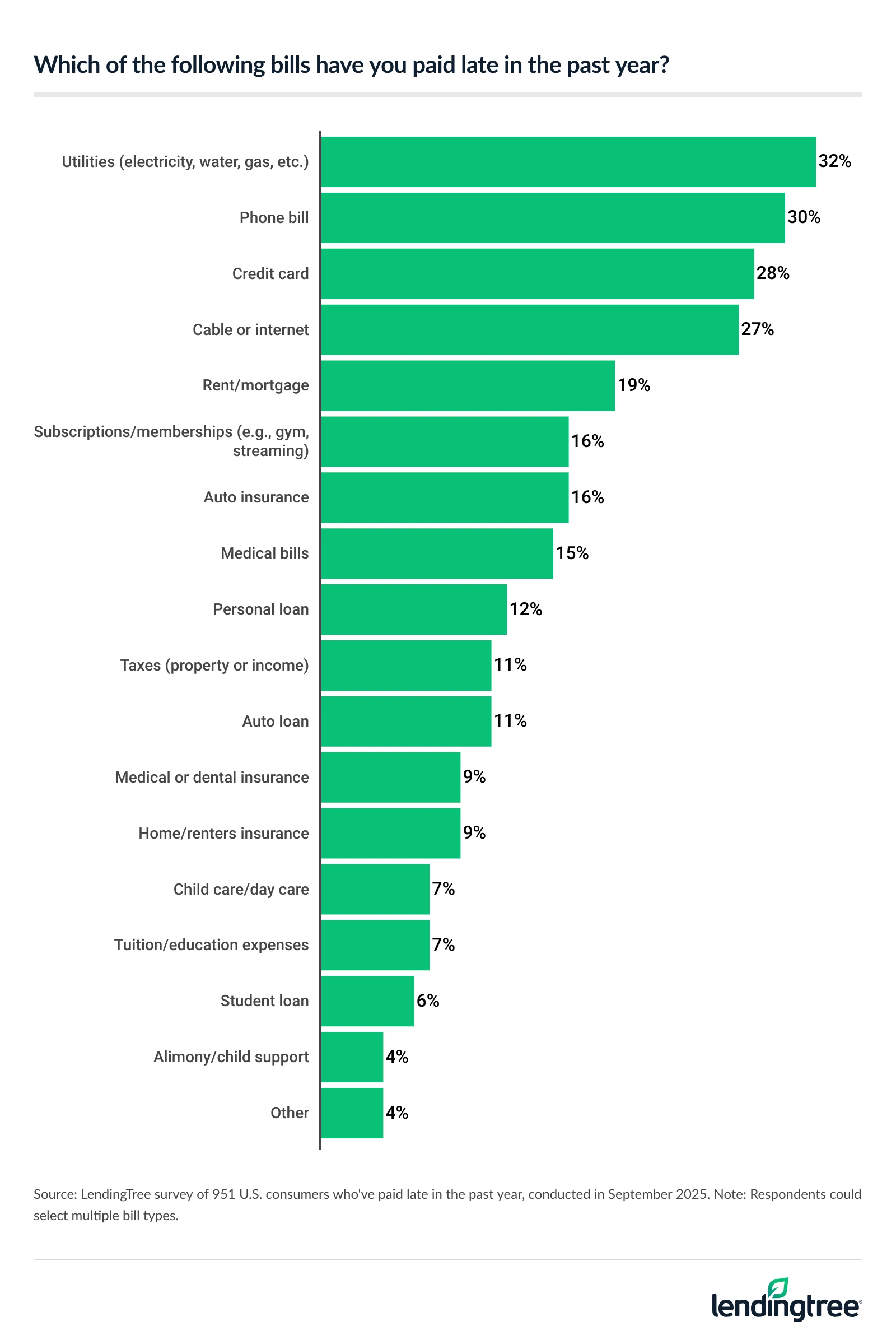

Utility bills are the most commonly paid late (32%), with phone bills (30%), credit card bills (28%) and cable/internet bills (27%) not far behind. Nearly 1 in 5 say they were late with rent or mortgage payments (19%).

There’s a gender split when it comes to the bills most often paid late. Among men who paid late in the past year, credit card bills were most often paid late, at 33%. For women, utilities were the top, at 38%.

Affordability is top driver of late payments, but it’s far from only reason

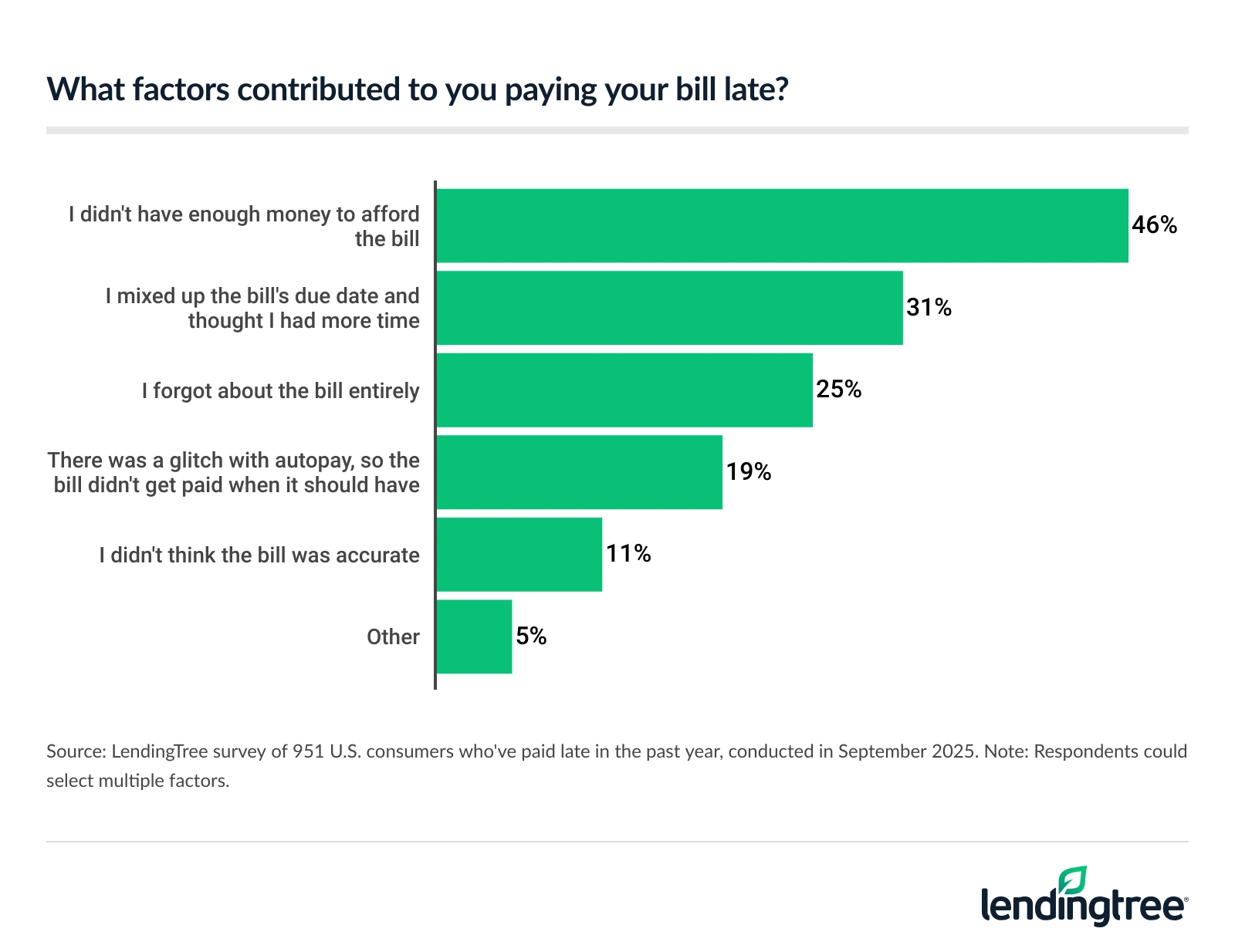

No shocker here: The most commonly given reason for paying bills late was not having enough money. Nearly half (46%) of those who paid late in the past year say that. Baby boomers (61%) and women (57%) are among the most likely to say so.

Still, these late payers provided numerous other reasons for their slipups. Nearly 1 in 3 (31%) say they mixed up the due date and thought they had more time, 25% just forgot about the bill and 19% blamed a glitch with autopay. Another 11% say they paid late because they didn’t think the bill was accurate.

These other reasons shed some light on why high-income earners often pay late. At 24%, not having enough money was only the fourth most commonly offered reason given by those earning $100,000 or more a year. Mixing up the due date was first at 39%, followed by autopay glitches and simply forgetting, both at 34%.

The younger you are, the more likely you are to blame due-date mix-ups and autopay glitches. The older you are, the more likely you are to blame simply not having enough money.

Women are far more likely than men to say they paid late because they didn’t have enough money (57% versus 35%), while men are far more likely to blame autopay glitches (29% versus 10%).

There’s good news, however: Most of these late payers are asking for late fees to be waived, and most people who’ve asked have gotten their way. Nearly 7 in 10 who paid late in the past year (69%) have requested their late fee be waived, and nearly 8 in 10 of them (79%) were successful.

Rent or mortgage is clear priority to pay on time

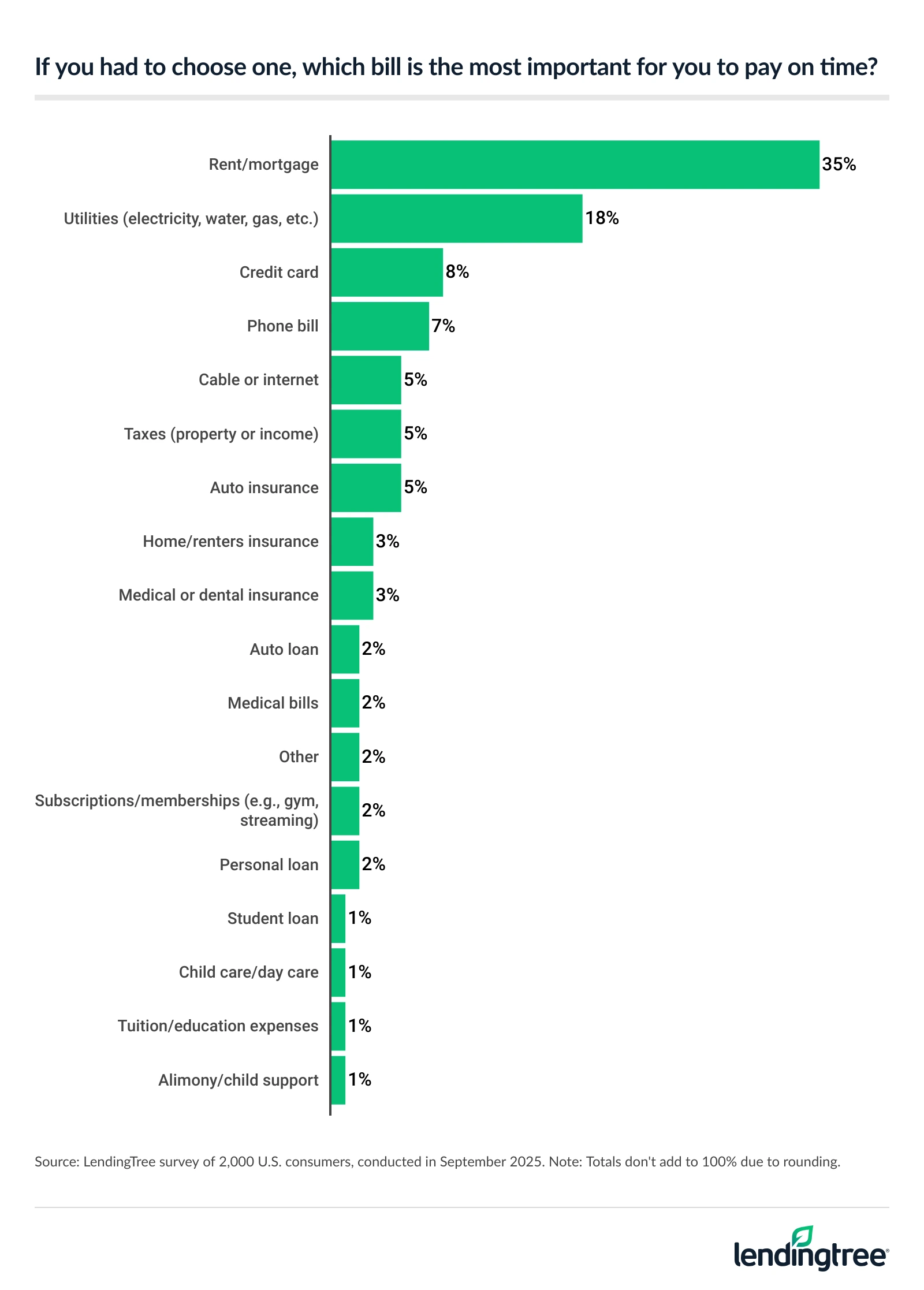

When it comes to prioritizing which bills to pay, there’s no place like home. Not surprisingly, rent or mortgage payments are considered the most important to pay, with 35% saying so. Utility bills are second, at 18%.

Every demographic — from gender to age to parental status to income level — indicates that rent is the most important and utilities are the second most important.

As far as which bill they struggle the most to afford when it comes due, the top responses are the same, though it isn’t a landslide: 15% say rent or mortgage payments and 13% say utilities, while credit cards are close behind at 12%.

There’s less agreement among genders, income levels and age groups as to which bill they struggle most to pay. For example, credit cards are the top answer for men and high-income earners, while utility bills top the list for Gen Xers.

To ensure on-time payments, trust but verify

Late payments can be a big deal. One bill paid 30 days or more late can knock 50 points or more off your credit score, and often that drop can be enough to change your great credit into merely good credit or your good credit into not-so-good credit.

Here’s the truth: There’s little in life that is more expensive than having crummy credit. It can cost you tens of thousands of dollars in interest and fees on loans over your lifetime. It can make it harder for you to get a loan, an apartment or a cellphone. It can even cause your insurance premiums to soar.

Setting up automatic payments is perhaps the most effective way to ensure that your bills are paid on time. Our report suggests that Americans are aware of this, as 68% report using autopay for at least some of their bills.

However, our report also makes it clear that people have seen the downside of autopay as well. Simply put, it doesn’t always work. Almost 1 in 5 who paid late in the past year blamed an autopay glitch.

I’ve been there myself. Earlier this year, I was late on payments for two credit cards from the same bank in the same month due to an autopay glitch. I was able to get both late fees waived, but it was still annoying. Who doesn’t have better things to do than cleaning up their bank’s mess?

Although we may not like it, the unfortunate reality is that we are ultimately responsible for ensuring our bills are paid on time. Here are a few ways we can do that:

- Ensure you have the necessary funds available in your account. This one is obvious and easier said than done, but nothing stops an automatic payment from working faster than insufficient funds.

- Build autopay checks into your regular financial routine. This is one of the best ways to ensure that a slightly late payment doesn’t turn into a significantly late payment. Devote some time each month (or ideally, a few times a month) to ensuring that all your bills are up to date. It shouldn’t take long and typically won’t reveal anything, but you’ll be glad you took the time in those rare cases when you catch a mistake.

- Use bank notifications to your advantage. Whether you prefer email, text or app-based notifications, your bank likely offers various options. For example, you can be notified about a bill’s due date, told when a bill has been paid or even informed about unusual account activity. Again, technology is imperfect, but these notifications can act as an extra set of eyes watching out over your account.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from Sept. 12 to 15, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Get debt consolidation loan offers from up to 5 lenders in minutes