Nearly 1 in 5 Americans Ended 2025 Worse Off; Groceries, Essentials Hit Hardest

The new year means new goals. While some may focus on hitting the gym or reading more, setting financial goals is also common.

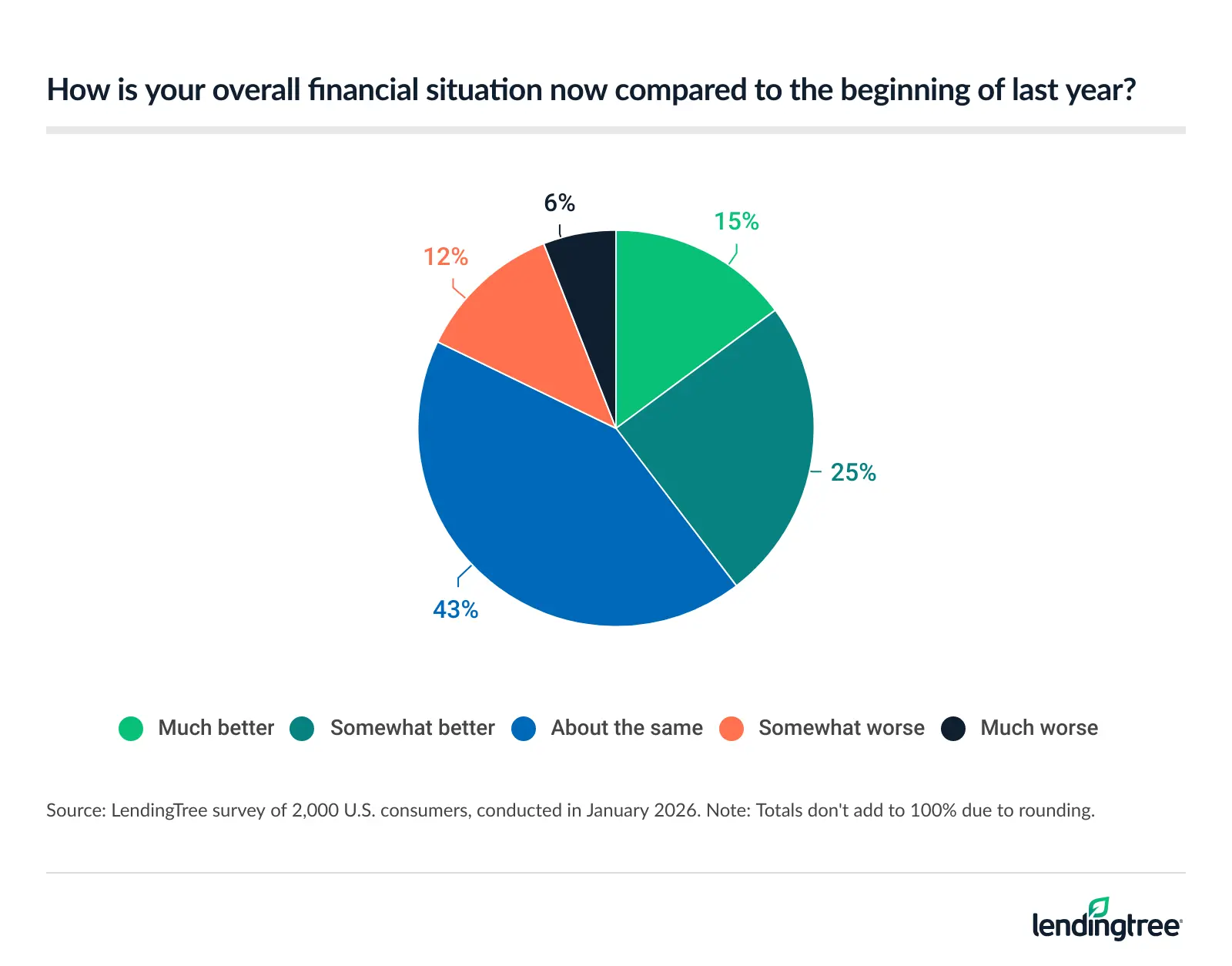

According to a LendingTree survey of 2,000 U.S. consumers, 60% say their financial situation at the start of 2026 is the same or worse compared to the beginning of 2025. But nearly half (48%) plan to save more in the new year, while 35% aim to reduce debt and 34% hope to boost their income.

Here’s a closer look at what else we found.

Key findings

- Many Americans didn’t make the financial progress they hoped for in 2025. 60% say their financial situation at the start of 2026 is the same or worse than it was at the beginning of 2025, including nearly 1 in 5 (17%) who report being worse off. When asked what made managing finances most difficult in 2025, 26% cited rising prices and inflation, 15% pointed to unexpected expenses and 11% blamed changes in their income or job situation.

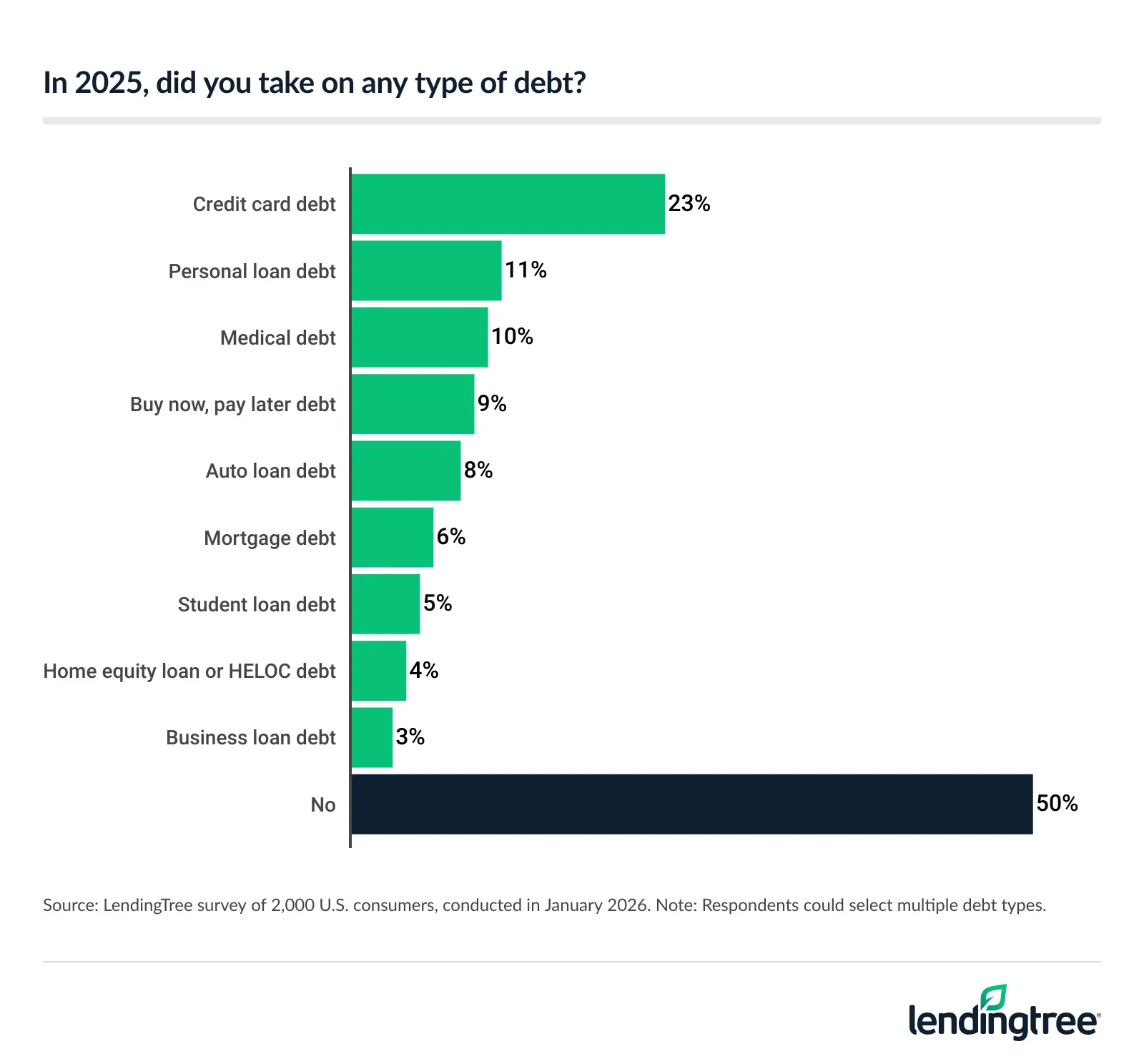

- Half of Americans took on some form of debt in 2025. Credit cards were the most common source (23%), followed by personal loans (11%) and medical debt (10%). Notably, groceries and household essentials was the spending category Americans struggled to manage most.

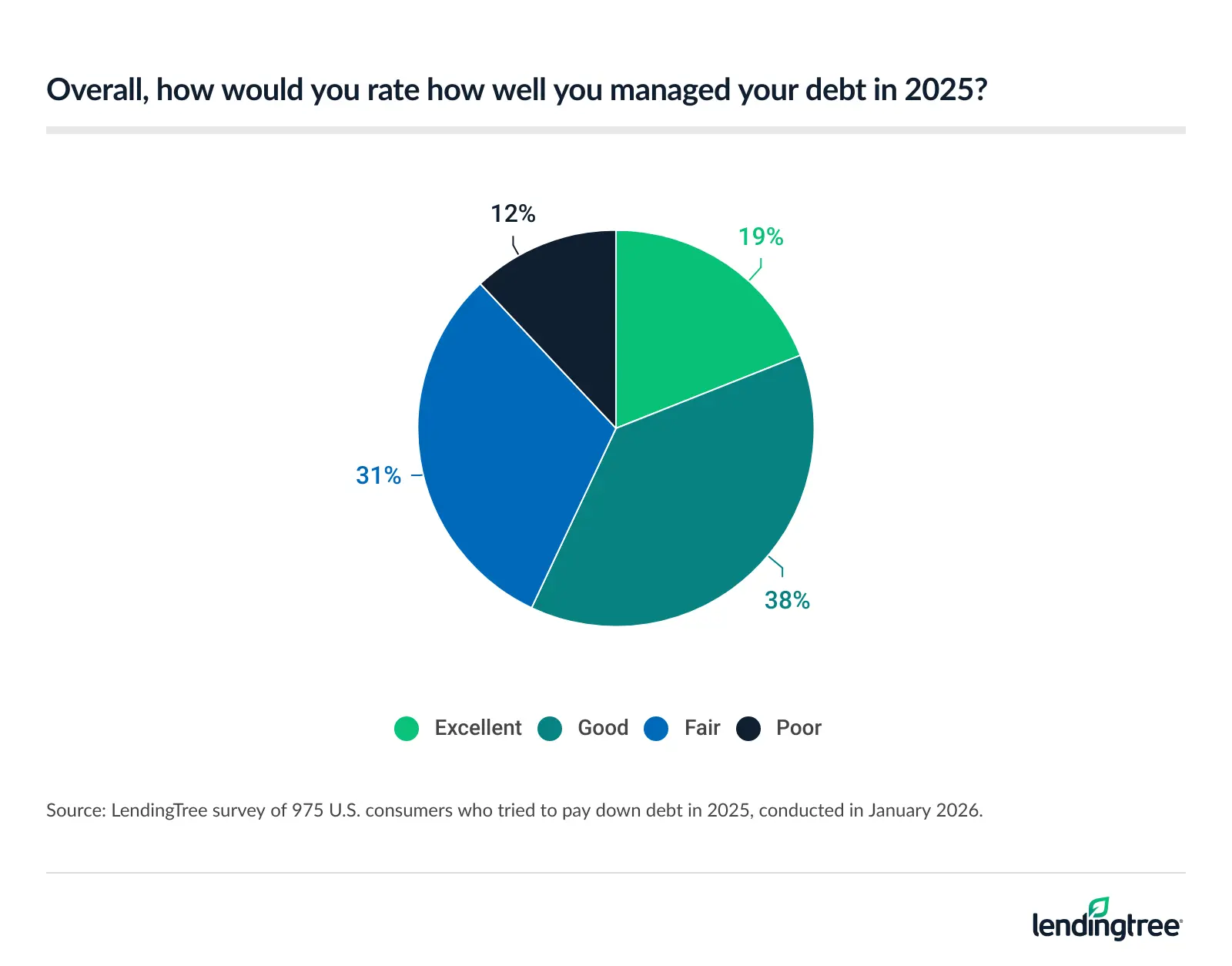

- Still, many made progress in reducing their debt. Nearly half (49%) of Americans had debt they were actively trying to pay down in 2025, though 43% of that group say they managed it only fairly or poorly. Even so, most were successful: 58% reduced their balance last year. Credit card debt led the list of balances Americans worked to pay down, but — as highlighted — it was also the top category in which Americans overall added to their debt.

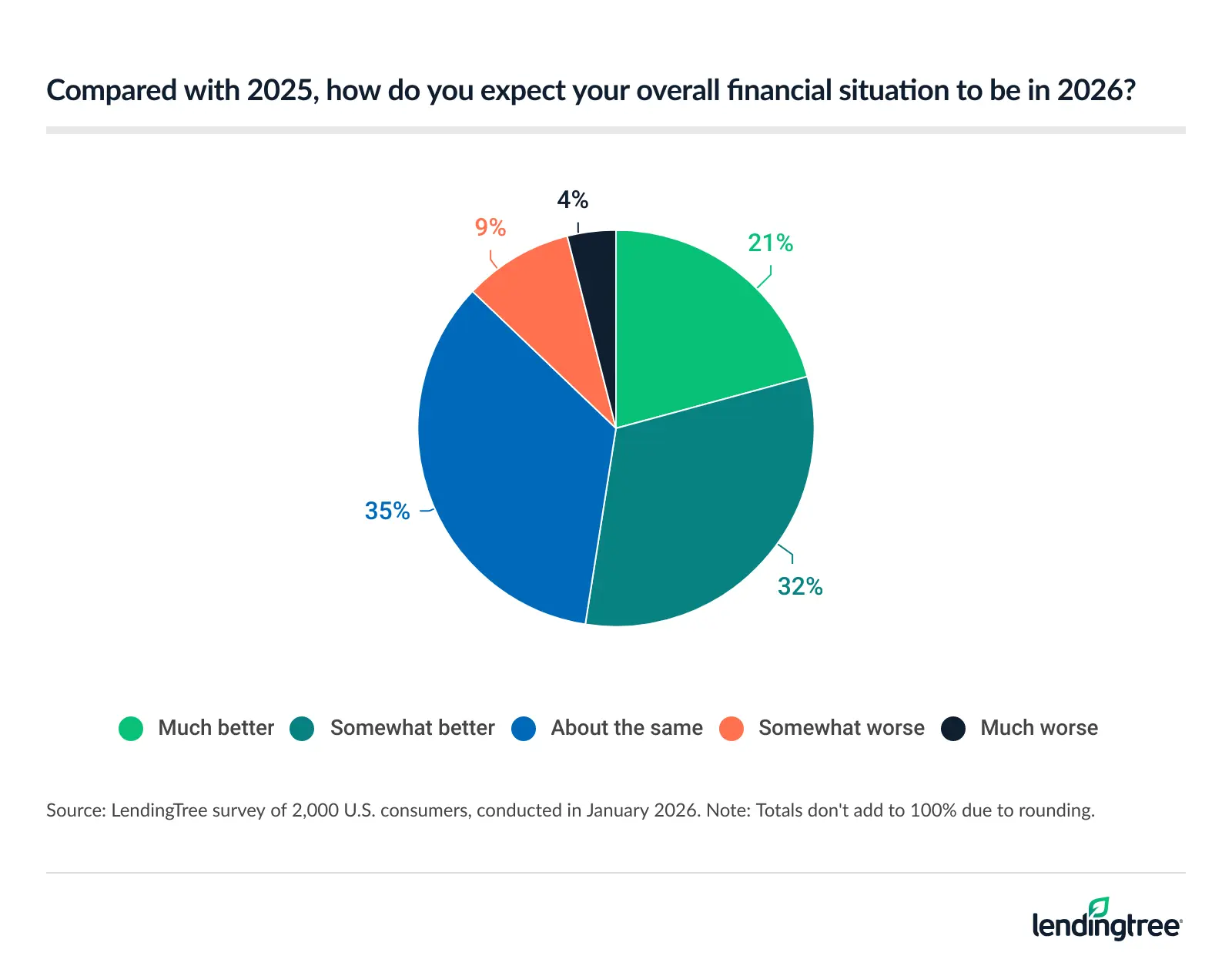

- Americans are optimistic about 2026. More than half (52%) expect their overall financial situation to improve, including 44% of those earning less than $30,000 annually. Looking ahead, nearly half (48%) plan to save more, while 35% aim to reduce debt and 34% hope to boost their income.

60% say their financial situation is the same or worse than last year

With 2025 in the rearview window, 60% say their financial situation at the start of 2026 is the same or worse compared to the beginning of last year. That includes nearly 1 in 5 (17%) who report being worse off. That’s highest among those earning less than $30,000 (26%), Gen Xers ages 46 to 61 (23%), those earning $30,000 to $49,999 (20%) and women (20%).

When asked what made managing finances most difficult in 2025, 26% of Americans cited rising prices and inflation — by far the top response. Following that, 15% blamed unexpected expenses and 11% cited changes in their income or job situation. Other hurdles included:

- Changes in government or economic policies like tariffs or trade policies (8%)

- Housing costs (7%)

- Medical or health care costs (7%)

- Overall debt burden (7%)

- Family obligations (7%)

- Interest rates on credit cards and loans (5%)

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — believes there are signs that many Americans remain resilient in challenging and uncertain situations.

“However, while many people feel that their finances are better entering 2026, many remain one job loss, income reduction, medical emergency or other big unexpected financial hit away from being in a pretty precarious place,” he says. “That’s unlikely to change anytime soon.”

When it comes to their financial discipline, 59% say they were at least somewhat consistent with following a budget in 2025, though lower earners are less likely to budget. In fact, 19% of those earning less than $30,000 didn’t budget, versus just 6% of those earning $100,000 or more.

Credit card debt was most common in 2025

Debt was no stranger to Americans last year, as half of them took on some form of it in 2025. Credit cards led the way here, at 23%. Americans were also likely to take on personal loan debt (11%) and medical debt (10%).

With that in mind, 87% of Americans say they struggled with managing spending. Across all spending categories, Americans are most likely to struggle with spending on groceries and household essentials (22%).

Schulz says groceries are pushing households into the red because they’re not something people can cancel like a Netflix subscription.

“Yes, you can do things to keep your costs down, including couponing, shopping around, leaning on generics or store brands and so on, but you can’t just cut groceries out of your budget,” he says. “When those prices rise, you have to adjust accordingly. With so many people on a tight budget, that’s a major challenge.”

Debt payments (11%) and utilities (10%) are the next top categories Americans struggled with. Other categories include:

- Housing (9%)

- Online shopping/impulse purchases (8%)

- Entertainment (8%)

- Health care (7%)

- Transportation (5%)

- Clothing (3%)

- Education (2%)

- Child care (1%)

Half with debt focused on paying it down

Americans may not look back fondly at their financial progress in 2025, but many with debt have something to feel good about. Overall, 49% of Americans had debt they were actively trying to pay down in 2025, while 38% didn’t have debt and 13% had debt but weren’t actively paying it down.

Of those trying to pay down their debt, 43% say they managed it only fairly or poorly. That’s especially high among those earning less than $30,000 (63%) and women (50%).

Despite some pessimism, 58% of those trying to pay down debt reduced their balance last year. Most worked on paying off credit cards, at 61%. That’s followed by auto loans (26%), personal loans (24%) and mortgages (24%).

Financial optimism is high

Despite having a rocky 2025 financially, Americans remain hopeful for 2026. Overall, 52% expect their personal financial situation to improve in 2026, led by those with children under 18 (68%) and Gen Zers ages 18 to 29 (66%).

Schulz believes there’s good reason for optimism.

“Interest rates have fallen and may keep heading in that direction,” he says. “The unemployment rate is still low, though the job market is sluggish. Inflation is stubborn but isn’t the raging fire it once was. Those are all reasons to be hopeful that 2026 will be better than previous years. However, that’s anything but guaranteed. We live in uncertain times, and your best move is to get your financial foundation as firm as possible to deal with whatever comes next.”

When it comes to their goals for 2026, 48% plan to save more — the most common response. Meanwhile, 35% aim to reduce debt and 34% hope to increase their income.

That’s similar to the breakdown of financial goals Americans focused on in 2025, and 47% would rate their progress toward them as good or excellent.

Starting off 2026 on right path: Top expert tips

If you’ve ended 2025 with higher debt, there are a few things you can do to regain control in 2026. Here are our top recommendations:

- Lower your interest rates. “High interest rates are murder on those with credit card debt,” Schulz says. “However, you can potentially lower them by consolidating debts with a 0% balance transfer credit card or a personal loan. You can even call your credit card issuer and ask them for a lower rate. It works way more often than you’d believe. Regardless of how you get there, reducing your interest rate is one of the best things you can do in the fight against debt.”

- Get your credit in order. “There are few things in life that are more expensive than crummy credit,” Schulz says. “It can cost you tens of thousands of dollars over the years in the form of higher interest rates, bigger fees and other subpar loan terms. Start by checking your credit report from the three major credit bureaus to make sure everything is accurate. Also, arrange for automatic payments to make sure you don’t pay any bills late. A single 30-day-late payment can wreak havoc on your credit.”

- Make sure your spending is in line with your priorities. “If you haven’t reviewed your spending in a while, now would be a great time to do so,” he says. “In doing so, you might find places that you can cut back on to free up cash to go toward other priorities such as paying down high-interest debt.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 80 on Jan. 2, 2026. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2026:

- Generation Z: 18 to 29

- Millennials: 30 to 45

- Generation X: 46 to 61

- Baby boomers: 62 to 80

Get debt consolidation loan offers from up to 5 lenders in minutes