Tariffs Threaten to Push $28.6 Billion in Extra Holiday Expenses Onto Consumers

With the holidays approaching, the grinch is taking a new form: tariffs.

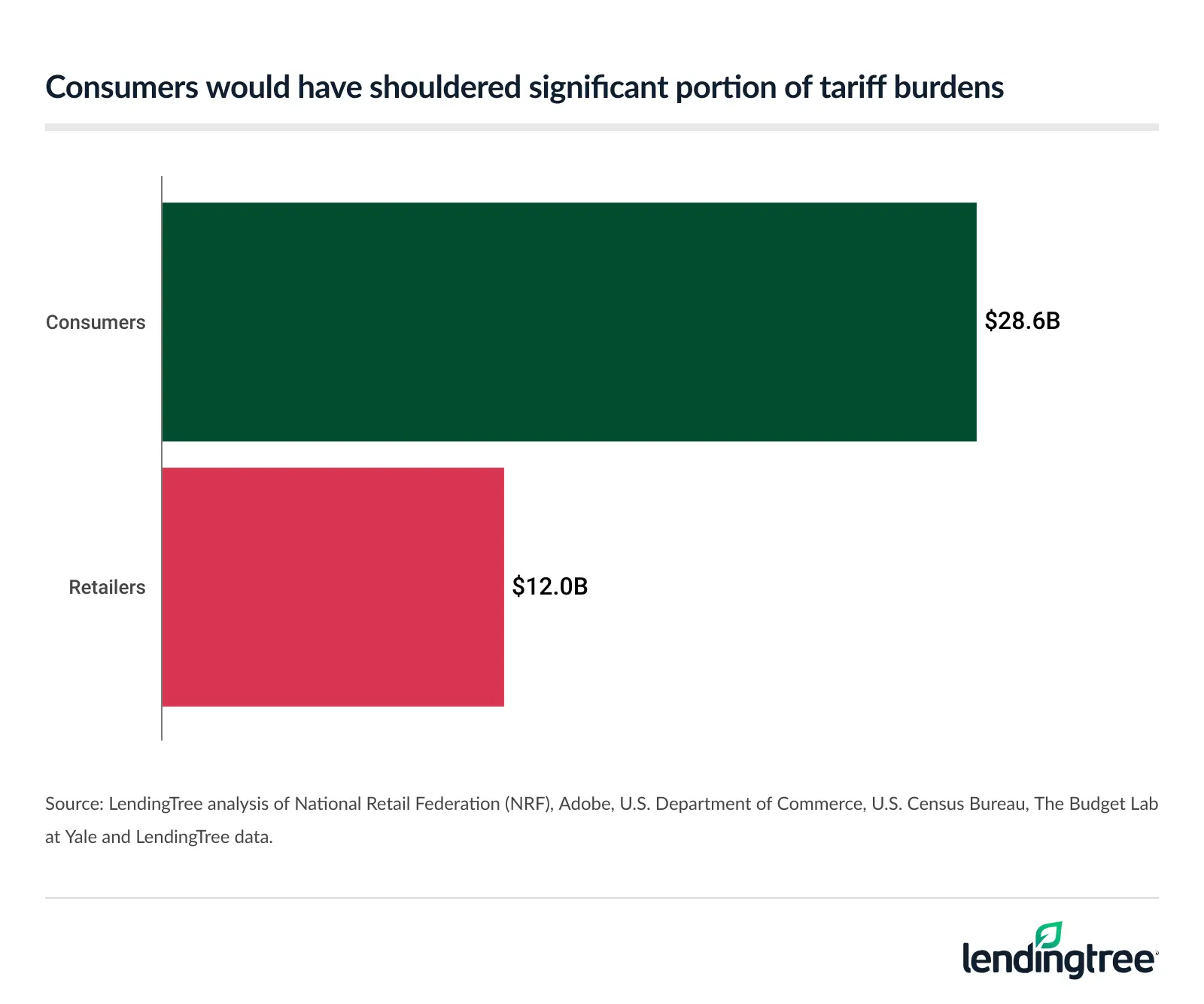

In fact, according to a LendingTree analysis, consumers and retailers would have faced an estimated extra $40.6 billion burden on gifts during the 2024 winter holidays if current tariffs had been in place.

Here’s a closer look at how that breaks down.

Key findings

- If current tariffs had been in place during the 2024 winter holidays, we estimate consumers and retailers would have faced an extra $40.6 billion burden from gift purchases. Consumers would have shouldered an estimated $28.6 billion, while retailers would have absorbed $12.0 billion.

- For shoppers, the $28.6 billion burden translates to $132 each. The biggest per-shopper burden would have come from electronics at $186, with clothing or accessories next at $82. These two categories would have accounted for an estimated 60.7% of the winter holiday gifts consumer tariff burden.

- Consumers spent hundreds of billions of dollars on imported goods during the holiday shopping season. We estimate consumers spent $377.7 billion on imported goods during winter holiday shopping in 2024. A massive 88.0% of clothing and accessories were imported, totaling $117.5 billion in holiday spending, ahead of electronics at 69.0% and $111.6 billion.

LendingTree researchers utilized National Retail Federation (NRF) 2024 holiday surveys and Adobe’s holiday shopping report to determine the amount spent on gifts in November and December 2024 — defined as the winter holidays — as well as the categories in which consumers made their purchases.

We then analyzed U.S. Department of Commerce and U.S. Census Bureau data to estimate the wholesale value of 2024 holiday gift buying and the ratio of those purchases that were imported. After, researchers applied an estimated 17.8% effective tariff rate and assumed a 70.5% pass-through rate from retailers to consumers, as estimated in a September 2025 report by The Budget Lab at Yale.

Finally, we used LendingTree research to calculate the per-shopper burden of tariffs.

Current tariffs would have added estimated $40.6B burden to winter holiday gift shopping

Using NRF, Adobe, U.S. Department of Commerce, U.S. Census Bureau, The Budget Lab at Yale and LendingTree data, we estimate that consumers and retailers would have faced an additional $40.6 billion in winter holiday shopping costs for gifts in 2024.

Based on The Budget Lab’s estimate that 70.5% of new tariffs were passed onto consumers in June 2025 — with retailers paying the other 29.5% — our estimates show that consumers would have shouldered an estimated $28.6 billion of that total winter holiday shopping burden, while retailers would have absorbed $12.0 billion.

Anything that makes holiday shopping more expensive creates real challenges for consumers, says Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.”

“That means that even more Americans would have had to fall back on credit cards and personal loans to help cover gift-buying expenses,” he says. “That’s the unfortunate reality that many people would have faced” if current tariffs were in place during last year’s winter holidays.

Shoppers would have paid an extra $132 each

That $28.6 billion consumer burden breaks down to $132 per shopper, according to LendingTree estimates.

“For most Americans, spending an extra $132 at the holidays is significant,” Schulz says. “While it may not be earth-shattering, it can have a real impact on many families. It could prompt people to cut back on gift-giving this year or lead to them taking on extra debt. That’s a choice no one wants to have to make.”

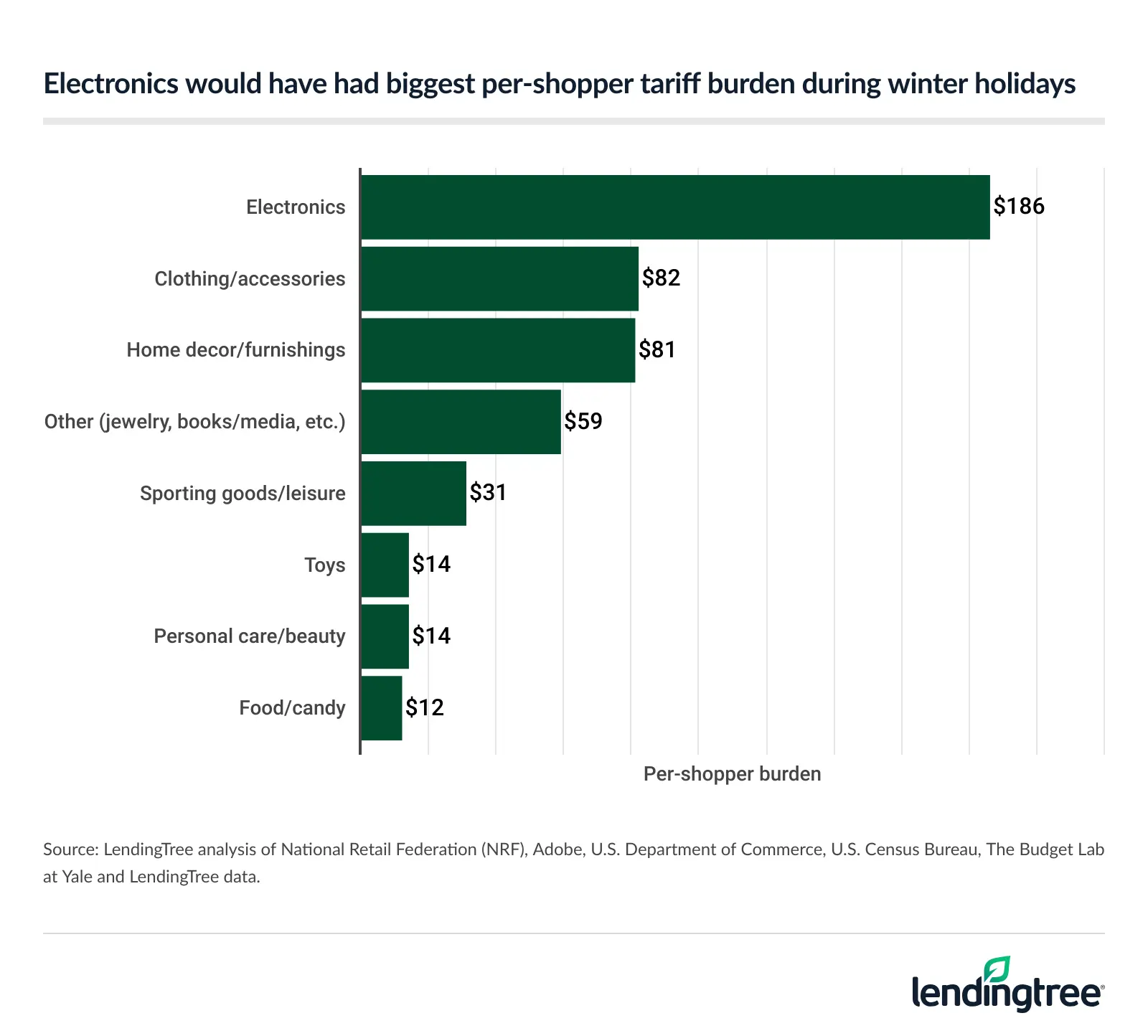

Examining our analyzed spending categories, which combine NRF and Adobe data, electronics would have the largest per-shopper burden at $186, followed by clothing or accessories at $82. Conversely, food or candy would have the smallest per-shopper burden, at just $12. Personal care or beauty and toys were next closest, with both at $14.

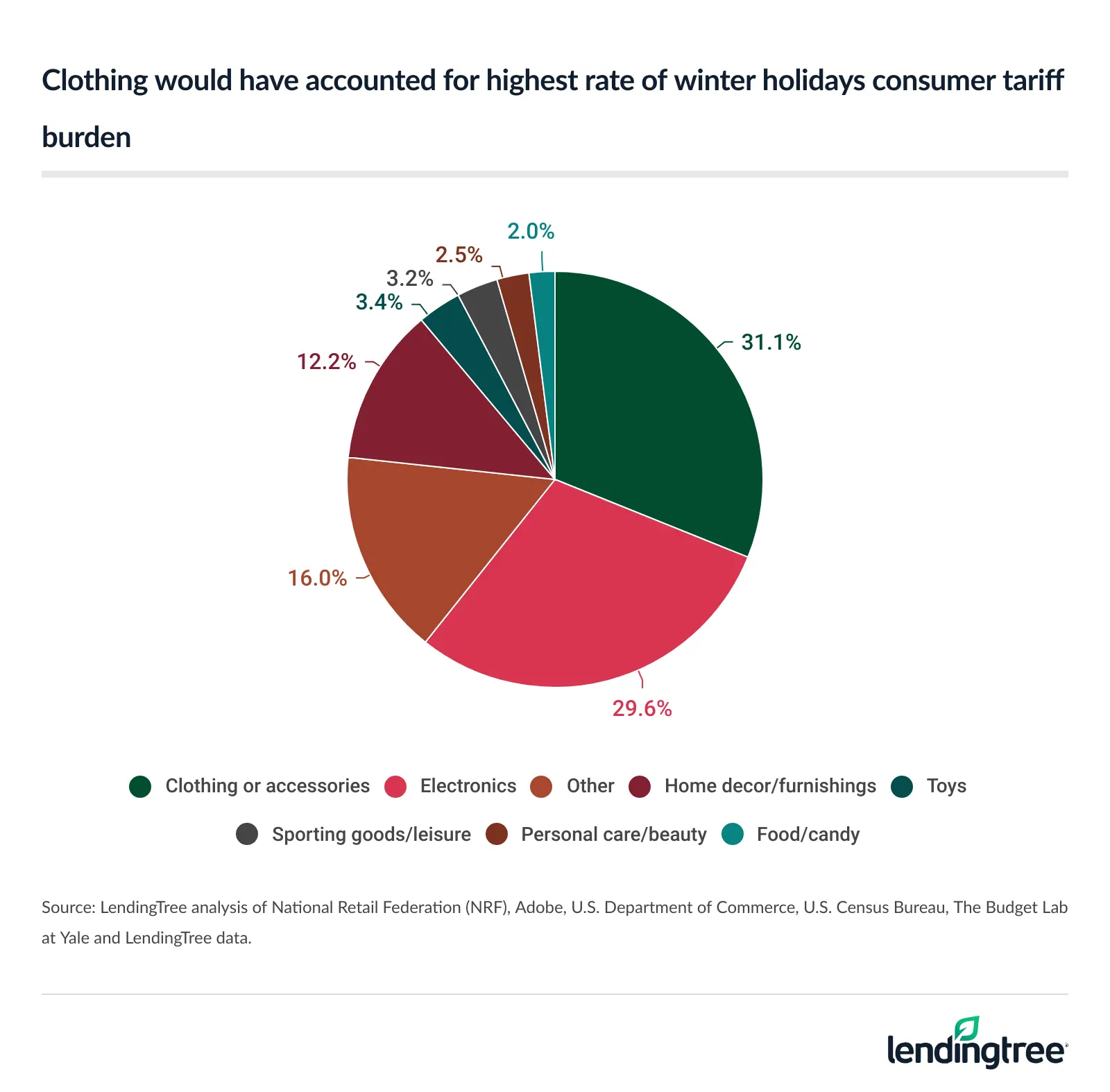

Based on our analysis of Americans’ winter holiday gift shopping and our grouping of the spending categories, here’s how each would have contributed to the $28.6 billion consumer burden:

Estimated consumer tariff burden by spending category, 2024 winter holidays

| Rank | Spending category | Consumer tariff burden | % of total consumer tariff burden |

|---|---|---|---|

| 1 | Clothing or accessories | $8.9B | 31.1% |

| 2 | Electronics | $8.5B | 29.6% |

| 3 | Other | $4.6B | 16.0% |

| 4 | Home decor/furnishings | $3.5B | 12.2% |

| 5 | Toys | $983.1M | 3.4% |

| 6 | Sporting goods/leisure | $925.3M | 3.2% |

| 7 | Personal care/beauty | $702.5M | 2.5% |

| 8 | Food/candy | $571.9M | 2.0% |

That means clothing or accessories and electronics would have accounted for an estimated 60.7% of the winter holiday consumer tariff burden.

Schulz believes that a spike in the cost of electronics and clothing would likely force some families to think twice about what they give this holiday season if tariffs have a similar winter holiday impact in 2025.

“That might mean giving fewer of those items as gifts, or it could mean having to suck up the higher costs to give your loved ones what they want,” he says. “I doubt that we’ll see a huge drop-off in the amount of electronics and clothes that are gifted this year, simply because they’re what so many people want. However, for some, higher prices may leave them no choice.”

Holiday gift shopping involves significant amount of imported goods

Unsurprisingly, consumers spend hundreds of billions on imported goods. By doing so, tariffs on imported goods play a significant role.

Adding in U.S. Department of Commerce and U.S. Census Bureau data, we estimate that consumers spent $377.7 billion on imported goods while winter holiday gift shopping in November and December 2024. By category, 88.0% of clothing and accessories were imported, totaling $117.5 billion in holiday spending on imported goods — the highest overall.

Estimated imported spend by category, 2024 winter holiday gifts

| Rank | Category | % imported | Imported spend |

|---|---|---|---|

| 1 | Clothing or accessories | 88.0% | $117.5B |

| 2 | Electronics | 69.0% | $111.6B |

| 3 | Other | 31.3% | $60.6B |

| 4 | Home decor/furnishings | 53.8% | $46.0B |

| 5 | Toys | 54.0% | $13.0B |

| 6 | Sporting goods/leisure | 54.0% | $12.2B |

| 7 | Personal care/beauty | 41.0% | $9.3B |

| 8 | Food/candy | 12.0% | $7.5B |

Schulz says that poses a real challenge, even for those trying to avoid tariffs by shopping domestically.

“Doing your homework to find domestic alternatives to imported goods can help, but information can be unreliable,” he says. “Often, your time may be better spent shopping around and taking other steps to save instead. Although it may not be ideal for holiday shopping, used and secondhand items could be a good alternative for those seeking to avoid tariffs. These items typically aren’t subject to tariffs when resold in the country in which they were initially bought.”

All in all, Americans’ winter holiday spending totaled $706.5 billion. Electronics accounted for $161.8 billion (from 45.4 million shoppers), while 108.2 million shoppers spent a combined $133.5 billion on clothing or accessories.

Number of shoppers by spending category, 2024 winter holidays

| Rank | Category | % of spending | Total spend | # of shoppers |

|---|---|---|---|---|

| 1 | Clothing or accessories | 18.9% | $133.5B | 108.2M |

| 2 | Other | 27.4% | $193.6B | 78.3M |

| 3 | Toys | 3.4% | $24.0B | 69.3M |

| 4 | Personal care/beauty | 3.2% | $22.6B | 51.9M |

| 5 | Food/candy | 8.9% | $62.9B | 47.6M |

| 6 | Electronics | 22.9% | $161.8B | 45.4M |

| 7 | Home decor/furnishings | 12.1% | $85.5B | 43.3M |

| 8 | Sporting goods/leisure | 3.2% | $22.6B | 30.3M |

Holiday shopping on a budget: Top tips for dealing with tariffs

Budgets may be especially tight this holiday season, and tariffs make it more difficult to spread holiday cheer. To help manage costs, we offer the following advice:

- Shop around. “It’s perhaps the oldest personal finance advice and might just be the best,” Schulz says. “It’s always important, but never more so than during tough economic times. The savings you can realize from taking the time to comparison shop can help you extend your holiday budget.”

- Leverage 0% credit card offers. “A 0% balance transfer credit card can be your best friend if you overspend this holiday season,” he says. This type of card can allow you to go a year or longer without accruing any interest on that transferred balance. That can lead to huge savings. However, a card that offers 0% on new purchases can help you avoid getting into that debt hole in the first place. “Just know that you’ll likely need good credit to get either of these types of deals,” Schulz says.

- Make a list and check it twice. “Again, this is simple, old advice, but it can have a huge impact,” he says. “Impulse buys crush holiday budgets, and one great way to avoid that is to always have a list when you shop. Instead of looking for inspiration, you’re on the hunt for specific items. That change of focus can help you steer clear of falling for those impulse purchases.”

Methodology

LendingTree researchers began by analyzing the National Retail Federation (NRF) 2024 holiday surveys to estimate total winter spending on holiday gifts, category-level spending and the share of shoppers in each category. (The NRF defines winter holidays as November and December.) Adobe’s 2024 holiday shopping report — which covers the same period — was then used to fill in the percentage of spending by category, except for books, video games and jewelry, which weren’t available.

Next, researchers used the U.S. Department of Commerce’s Purchased in America 2023 report to estimate the portion of each category that was imported. They multiplied each category’s holiday spend by this percentage to find imported values.

Then, U.S. Census Bureau retail margin data was applied to imported spending to estimate wholesale costs. This provided a more accurate baseline for calculating tariffs.

To assess tariff impacts, researchers used a 17.8% consumer goods effective tariff rate calculated by The Budget Lab at Yale through May 12. They then applied The Budget Lab’s September findings that 70.5% of tariff costs are passed onto consumers.

Finally, LendingTree researchers estimated the number of shoppers by adjusting the 2024 U.S. adult population for the 81% who reported buying holiday gifts to LendingTree. They applied NRF’s category-level shopping percentages and divided each category’s consumer tariff burden by its shoppers to calculate the burden per shopper.

Get debt consolidation loan offers from up to 5 lenders in minutes