The Most (and Least) Financially Responsible Metros

Being financially responsible — spending no more than you earn — is essential for financial wellness, though it’s often easier said than done. Naturally, it helps if you have a higher income, but where you live can also make a big difference.

In this study, we looked at the 100 largest U.S. metros to rank where it’s easiest — and hardest — for people to spend within their means. To rank each metro, we looked at debt-to-income (DTI) ratios, credit inquiries, maxed-out credit cards, spending on housing costs and low credit utilization rates.

Here’s what we found.

Key findings

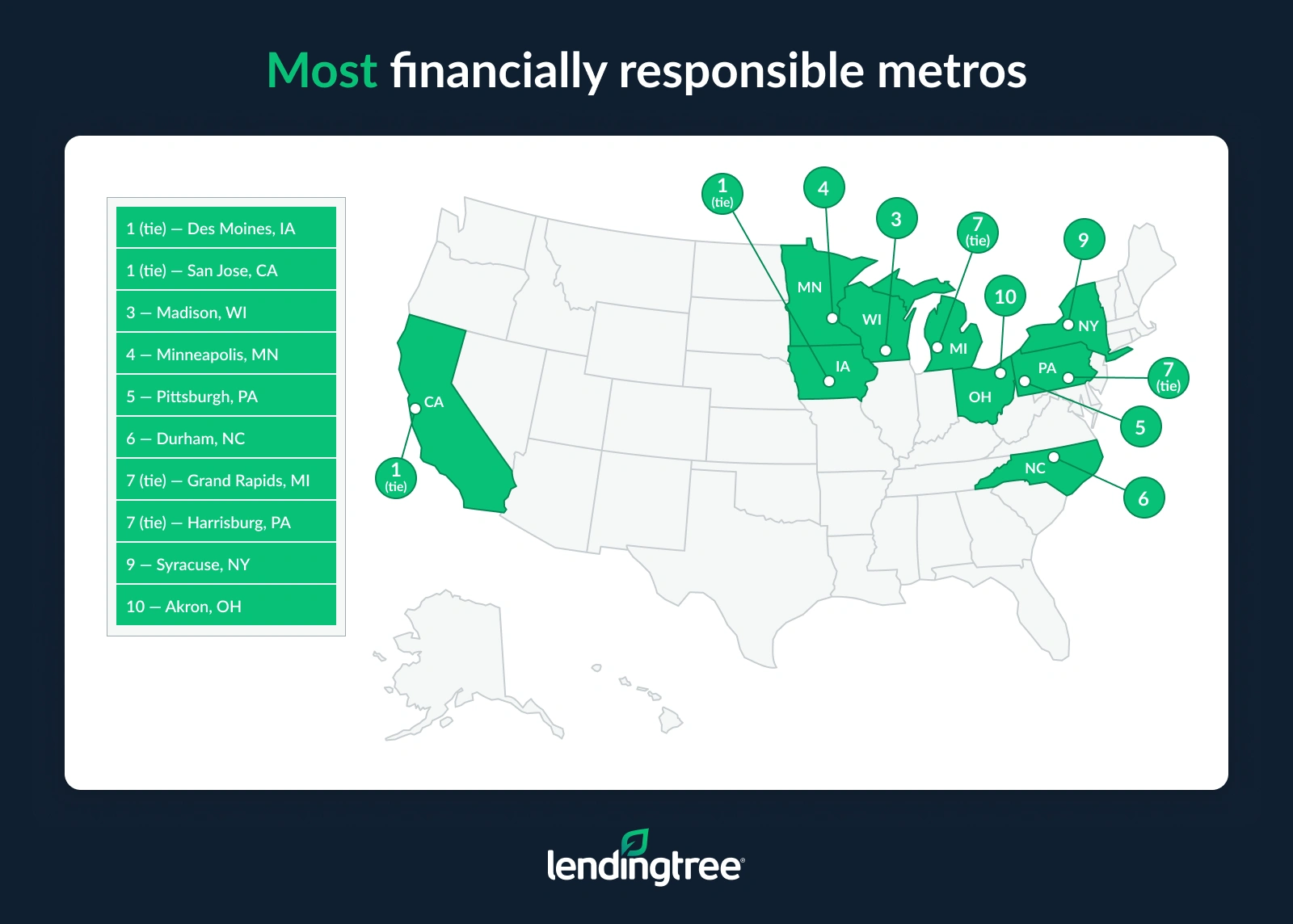

- Des Moines, Iowa, and San Jose, Calif., tie as the most financially responsible metros. Des Moines stands out for its overall consistency, with only 18.9% of households spending 35% or more of their income on housing — the fourth-lowest across the 100 largest metros. Meanwhile, San Jose stands out with the lowest debt-to-income ratio (51%) — tying with Syracuse, N.Y., and Harrisburg, Pa. — and leads with 76.6% of cardholders keeping their utilization below 30%.

- Madison, Wis., ranks third overall but leads in a key area. Just 16.3% of its cardholders have at least one maxed-out card — the lowest among the 100 metros. The top 10 metros are spread across the U.S.

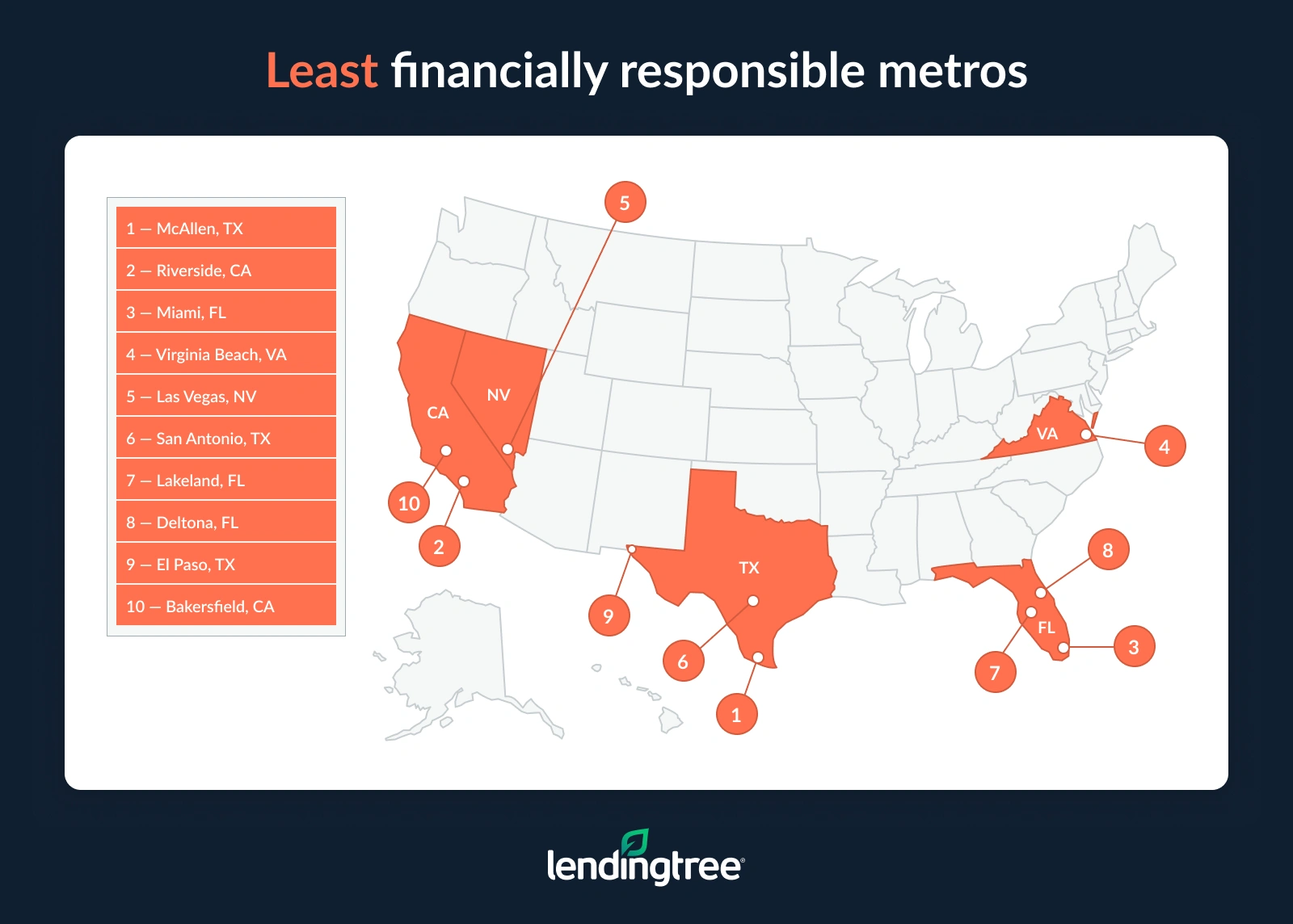

- The least financially responsible metro is McAllen, Texas. McAllen has the highest average number of credit inquiries over the past two years (6.7), the largest share of cardholders with at least one maxed-out card (35.8%) and the lowest rate of cardholders with a utilization below 30% (43.0%).

- Riverside, Calif., and Miami also land in the bottom three. Riverside’s debt-to-income ratio ties for the worst, at a staggering 251%. In Miami, 37.6% of households spend 35% or more of their income on housing — the highest share among all metros. Miami also ties with Las Vegas for the second-highest rate of cardholders with a maxed-out card, at 33.4%.

2 metros tie as the most financially responsible

If you want long-lasting financial security, it’s important to live within your means. In our analysis — which ranks the largest 100 metros by creating a score from five metrics — we found that Des Moines, Iowa, and San Jose, Calif., tie as the most financially responsible metros.

Des Moines scores consistently well across all the metrics analyzed. Notably, only 18.9% of households spend 35% or more of their income on housing — the fourth-lowest across the 100 largest metros. The metro also has the third-lowest rate of cardholders with at least one maxed-out card (16.9%) and the fourth-highest rate of cardholders with credit utilization ratios below 30% (73.0%).

While residents in San Jose struggle with housing costs, the metro still boasts the lowest debt-to-income ratio (51%) — a title it shares with Syracuse, N.Y., and Harrisburg, Pa. — and the highest rate of cardholders with low credit utilization (76.6%). Also noteworthy: San Jose residents have an average of 1.6 credit inquiries in the past two years — the third-lowest by metro.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says it’s a little surprising that two metros with extremely different costs of living are at the top, but it shows that there are multiple ways to live within your means.

“You can do so by making a lot of money, which allows you to live comfortably even in an expensive place like San Jose, or you can do so by living in a place with a reasonable cost of living, where your money goes a little further like it does in Des Moines,” he says.

“Obviously, there’s discipline required to live within your means no matter how much you make or where you live, but it shouldn’t surprise anyone that making more money or living in a lower-cost area would make that easier.”

There’s discipline required to live within your means no matter how much you make or where you live.

Madison, Wis., ranks third in this regard. It also has the lowest rate of cardholders with at least one maxed-out card, at just 16.3%.

Interestingly, the top 10 metros are spread across the U.S. — a reminder that financial discipline isn’t limited to any specific region.

The most financially responsible metros: Changes over time

How do these rankings compare to when we conducted this study four years ago? Last time:

- San Jose ranked first

- Des Moines ranked ninth

- Madison ranked fifth

At that time, Grand Rapids, Mich., and Minneapolis ranked second and third, respectively, for the most financially responsible metros. In this year’s analysis, they rank seventh (tying with Harrisburg) and fourth, respectively.

This time around, we added an additional metric to better capture responsible credit behavior — the share of cardholders in each metro with low credit utilization (under 30%).

Nearly a quarter of cardholders have at least one maxed-out credit card

An alarming percentage of consumers with an active credit card have maxed one out. Across the 100 largest U.S. metros, an average of 24.7% of cardholders have at least one maxed-out credit card.

Also worth noting, 24.9% of Americans across these metros spend 35% or more of their income on housing. Meanwhile, 63.4% of cardholders maintain a credit utilization rate below 30%, and the average number of credit inquiries over the past two years is 3.2.

“Having that much money tied up in housing means that there’s much less to put toward other basic costs of life,” Schulz says. “It makes it harder to build emergency funds, pay down high-interest debt or work toward other financial goals.”

Additionally, he says having a maxed-out credit card is tough because it means that you have fewer options in a short-term financial pinch. “Like it or not, millions of Americans use their credit card as a de facto emergency fund, but that’s impossible when the card is maxed out,” Schulz says.

“Also, maxing out a credit card hurts your credit score because it sends your credit utilization soaring.”

Texas metro is the least financially responsible

On the other end of the list, McAllen, Texas, is the least financially responsible of the studied metros.

McAllen has the highest average number of credit inquiries over the past two years at 6.7, the largest share of cardholders with at least one maxed-out card (35.8%) and the lowest rate of cardholders with a utilization below 30% (43.0%).

Schulz says those figures are concerning.

“It certainly hints that McAllen residents are struggling with managing their credit cards,” he says.

“That struggle is almost certainly made worse by the fact that McAllen residents tend to have lower incomes and lower credit scores than people in other big cities around the country. Lower credit scores make it harder to get credit, and lower income means that if you do qualify for a credit card, your credit limit probably won’t be very high. That makes for a challenging situation for McAllen residents, leaving them precious little wiggle room financially.”

According to the U.S. Census Bureau, 86.5% of McAllen residents are Hispanic or Latino. This population faces several financial challenges, including poor access to credit and lower incomes, according to the UnidosUS Latino Banking and Financial Health Survey.

Riverside, Calif., follows. Here, the debt-to-income ratio ties for the worst, at a staggering 251%. (Note: Debt-to-income figures are based on Federal Reserve estimates using sampled credit and income data, so ties at specific percentages may reflect rounding or methodological overlaps.)

Riverside also ties for the seventh-lowest rate of cardholders with utilization rates below 30%, at 55.1%.

Miami rounds out the bottom three, with the highest percentage of households spending 35% or more of their income on housing (37.6%). Miami also ties for the second-highest rate of cardholders with a maxed-out card, at 33.4%.

Full rankings: The most/least financially responsible metros

| Rank | Metro | % of households spending 35% or more on housing | Debt-to-income ratio | Credit inquiries in past 2 years | % with maxed-out card(s) | % with utilization below 30% |

|---|---|---|---|---|---|---|

| 1 | Des Moines, IA | 18.9% | 114.0% | 2.8 | 16.9% | 73.0% |

| 1 | San Jose, CA | 27.4% | 51.0% | 1.6 | 21.0% | 76.6% |

| 3 | Madison, WI | 22.4% | 114.0% | 2.3 | 16.3% | 74.2% |

| 4 | Minneapolis, MN | 20.8% | 125.0% | 2.4 | 16.4% | 71.9% |

| 5 | Pittsburgh, PA | 18.7% | 102.0% | 2.8 | 20.2% | 66.2% |

| 6 | Durham, NC | 22.9% | 102.0% | 2.8 | 22.4% | 74.7% |

| 7 | Grand Rapids, MI | 18.6% | 114.0% | 3.0 | 20.6% | 66.1% |

| 7 | Harrisburg, PA | 20.1% | 51.0% | 3.5 | 21.2% | 62.1% |

| 9 | Syracuse, NY | 22.2% | 51.0% | 2.9 | 22.4% | 64.0% |

| 10 | Akron, OH | 21.0% | 114.0% | 3.2 | 19.7% | 69.2% |

| 11 | Omaha, NE | 21.4% | 125.0% | 2.8 | 20.7% | 69.6% |

| 12 | Knoxville, TN | 19.4% | 135.0% | 3.9 | 18.1% | 69.1% |

| 13 | Kansas City, MO | 20.9% | 125.0% | 3.0 | 20.9% | 69.2% |

| 14 | Cincinnati, OH | 20.3% | 114.0% | 3.4 | 20.1% | 67.1% |

| 15 | Boise, ID | 20.5% | 206.0% | 2.4 | 17.5% | 70.0% |

| 16 | Rochester, NY | 22.9% | 102.0% | 3.2 | 19.7% | 65.1% |

| 17 | Buffalo, NY | 22.5% | 102.0% | 2.9 | 20.8% | 64.3% |

| 18 | Columbus, OH | 21.8% | 114.0% | 3.4 | 21.6% | 67.8% |

| 19 | Albany, NY | 21.7% | 102.0% | 2.4 | 23.9% | 63.3% |

| 20 | St. Louis, MO | 20.0% | 125.0% | 3.6 | 21.9% | 68.0% |

| 21 | Ogden, UT | 18.0% | 206.0% | 2.1 | 20.2% | 65.8% |

| 22 | Salt Lake City, UT | 21.8% | 135.0% | 2.1 | 23.3% | 65.5% |

| 22 | Hartford, CT | 25.3% | 102.0% | 2.4 | 21.9% | 65.4% |

| 24 | Seattle, WA | 26.4% | 135.0% | 2.3 | 22.0% | 70.9% |

| 25 | Indianapolis, IN | 20.8% | 114.0% | 3.4 | 22.7% | 64.9% |

| 25 | Portland, OR | 27.0% | 161.0% | 2.4 | 17.5% | 68.2% |

| 27 | Milwaukee, WI | 24.2% | 114.0% | 3.5 | 20.8% | 67.9% |

| 28 | Wichita, KS | 19.9% | 114.0% | 3.6 | 22.5% | 62.8% |

| 28 | Denver, CO | 25.9% | 161.0% | 1.3 | 22.4% | 66.6% |

| 30 | Boston, MA | 28.0% | 114.0% | 2.0 | 22.8% | 67.0% |

| 31 | Provo, UT | 20.9% | 251.0% | 2.0 | 18.3% | 69.2% |

| 32 | Detroit, MI | 22.7% | 125.0% | 2.9 | 23.5% | 64.6% |

| 33 | Chattanooga, TN | 20.5% | 135.0% | 3.8 | 23.2% | 66.2% |

| 34 | Louisville, KY | 20.6% | 114.0% | 3.9 | 24.7% | 65.6% |

| 35 | Nashville, TN | 22.8% | 147.0% | 3.9 | 21.9% | 69.9% |

| 36 | San Francisco, CA | 30.0% | 135.0% | 1.8 | 24.8% | 71.6% |

| 37 | Raleigh, NC | 20.6% | 161.0% | 3.3 | 24.1% | 67.6% |

| 38 | Dayton, OH | 20.0% | 114.0% | 3.8 | 24.8% | 62.6% |

| 39 | Chicago, IL | 25.8% | 114.0% | 3.1 | 23.4% | 65.2% |

| 40 | Worcester, MA | 25.5% | 161.0% | 2.5 | 20.9% | 63.3% |

| 41 | Allentown, PA | 23.7% | 135.0% | 3.2 | 22.6% | 60.8% |

| 42 | Greenville, SC | 20.2% | 147.0% | 4.0 | 24.4% | 63.5% |

| 42 | Philadelphia, PA | 25.6% | 135.0% | 2.8 | 25.2% | 64.8% |

| 44 | Austin, TX | 26.0% | 135.0% | 3.2 | 24.5% | 66.6% |

| 45 | Toledo, OH | 21.0% | 102.0% | 3.8 | 25.9% | 58.4% |

| 46 | Palm Bay, FL | 24.0% | 179.0% | 3.7 | 21.0% | 66.7% |

| 47 | North Port, FL | 26.0% | 206.0% | 2.9 | 21.9% | 70.7% |

| 48 | Winston-Salem, NC | 20.1% | 147.0% | 4.1 | 25.1% | 63.3% |

| 49 | Tulsa, OK | 20.9% | 125.0% | 4.2 | 25.3% | 61.6% |

| 49 | Baltimore, MD | 24.6% | 161.0% | 3.0 | 23.4% | 63.2% |

| 51 | Tucson, AZ | 25.2% | 179.0% | 2.8 | 22.5% | 64.0% |

| 52 | Albuquerque, NM | 25.0% | 161.0% | 3.2 | 21.2% | 60.2% |

| 52 | Washington, DC | 24.1% | 161.0% | 2.6 | 28.1% | 66.8% |

| 54 | Providence, RI | 26.3% | 179.0% | 2.5 | 22.4% | 62.3% |

| 55 | Richmond, VA | 23.1% | 147.0% | 3.4 | 26.2% | 62.7% |

| 56 | Cleveland, OH | 22.3% | 206.0% | 3.8 | 21.9% | 65.8% |

| 57 | Baton Rouge, LA | 22.8% | 125.0% | 4.3 | 24.9% | 59.6% |

| 58 | Oklahoma City, OK | 22.2% | 125.0% | 4.0 | 26.2% | 58.5% |

| 58 | Sacramento, CA | 30.0% | 179.0% | 2.7 | 21.8% | 65.3% |

| 60 | Colorado Springs, CO | 26.4% | 206.0% | 1.5 | 25.6% | 62.5% |

| 61 | Phoenix, AZ | 24.4% | 179.0% | 2.9 | 25.7% | 63.1% |

| 62 | Dallas, TX | 26.8% | 114.0% | 3.5 | 27.0% | 61.2% |

| 62 | Charlotte, NC | 22.3% | 147.0% | 3.8 | 28.0% | 62.6% |

| 64 | Little Rock, AR | 21.5% | 125.0% | 4.3 | 28.4% | 61.1% |

| 65 | Scranton, PA | 22.5% | 102.0% | 3.7 | 28.1% | 54.6% |

| 66 | New Haven, CT | 29.7% | 125.0% | 2.9 | 25.3% | 60.0% |

| 67 | Spokane, WA | 24.8% | 179.0% | 3.0 | 23.0% | 55.4% |

| 68 | Birmingham, AL | 21.8% | 125.0% | 4.5 | 29.6% | 61.3% |

| 69 | Greensboro, NC | 22.9% | 125.0% | 4.1 | 28.9% | 58.9% |

| 70 | Cape Coral, FL | 28.0% | 206.0% | 3.2 | 24.3% | 66.8% |

| 71 | Tampa, FL | 28.0% | 161.0% | 3.4 | 25.8% | 61.9% |

| 72 | New York, NY | 33.7% | 114.0% | 2.1 | 31.6% | 63.4% |

| 73 | Honolulu, HI | 33.4% | 206.0% | 2.3 | 23.6% | 65.0% |

| 73 | San Diego, CA | 35.2% | 179.0% | 2.2 | 24.7% | 64.9% |

| 75 | Kiryas Joel, NY | 29.7% | 179.0% | 2.7 | 26.3% | 61.0% |

| 76 | Atlanta, GA | 25.2% | 147.0% | 3.5 | 31.2% | 60.3% |

| 77 | New Orleans, LA | 29.8% | 135.0% | 3.9 | 27.1% | 60.5% |

| 77 | Jacksonville, FL | 25.4% | 179.0% | 4.0 | 26.6% | 60.1% |

| 79 | Houston, TX | 27.0% | 114.0% | 4.0 | 30.3% | 58.2% |

| 80 | Columbia, SC | 23.3% | 161.0% | 4.2 | 29.3% | 59.1% |

| 81 | Fresno, CA | 31.3% | 147.0% | 2.8 | 25.3% | 53.5% |

| 82 | Bridgeport, CT | 31.5% | 161.0% | 2.1 | 32.4% | 63.6% |

| 83 | Orlando, FL | 30.2% | 147.0% | 3.6 | 27.9% | 59.3% |

| 84 | Memphis, TN | 26.6% | 114.0% | 4.9 | 30.2% | 58.7% |

| 84 | Augusta, GA | 22.1% | 161.0% | 4.4 | 31.4% | 57.9% |

| 86 | Jackson, MS | 23.1% | 135.0% | 5.2 | 30.9% | 59.0% |

| 87 | Oxnard, CA | 32.4% | 251.0% | 2.2 | 24.9% | 64.9% |

| 88 | Stockton, CA | 30.2% | 206.0% | 2.7 | 25.5% | 56.1% |

| 89 | Los Angeles, CA | 37.4% | 179.0% | 2.2 | 27.3% | 63.5% |

| 90 | Charleston, SC | 24.6% | 206.0% | 3.9 | 30.5% | 61.2% |

| 91 | Bakersfield, CA | 32.3% | 161.0% | 3.0 | 28.7% | 54.4% |

| 92 | El Paso, TX | 27.2% | 147.0% | 4.1 | 30.4% | 52.9% |

| 93 | Deltona, FL | 27.3% | 251.0% | 4.0 | 25.9% | 61.5% |

| 94 | Lakeland, FL | 26.2% | 206.0% | 4.0 | 28.0% | 55.1% |

| 95 | San Antonio, TX | 26.2% | 161.0% | 4.5 | 30.9% | 54.9% |

| 96 | Las Vegas, NV | 31.0% | 179.0% | 2.9 | 33.4% | 60.3% |

| 97 | Virginia Beach, VA | 27.3% | 179.0% | 3.8 | 31.1% | 55.3% |

| 98 | Miami, FL | 37.6% | 147.0% | 3.4 | 33.4% | 60.5% |

| 99 | Riverside, CA | 32.7% | 251.0% | 3.0 | 30.0% | 55.1% |

| 100 | McAllen, TX | 24.4% | 147.0% | 6.7 | 35.8% | 43.0% |

Living within your means: Top expert tips

While it can be difficult to live within your means (particularly if you’re a low earner living in a high-cost metro), there are a few things worth keeping in mind. Schulz recommends the following:

- Lower your interest, if at all possible. “High interest rates are just a killer for those with credit card debt,” he says. “However, you may have options to rein them in a bit. A 0% balance transfer credit card can be about the best weapon in your battle against credit card debt, though you’ll likely need good credit to get one. If you don’t qualify, consolidating your debts with a low-interest personal loan can be a great option, too. You can even call your credit card issuer and ask them for a lower rate on your credit card, even just temporarily. This works way more often than you’d think.”

- Save while paying down debt. “That’s easier said than done, especially if you have big debts,” he says. “However, having savings is a huge key to breaking the cycle of debt so many people find themselves trapped in. That’s because when you get your card debt to $0, having savings means that the next big unexpected expense may not have to go entirely on to your credit card. That’s a big deal. Even just a few dollars a paycheck put into a high-yield savings account can turn into significant money when done consistently over time.”

- Track your spending — every dollar. Awareness is the first step toward control. It’s easy to underestimate how much you’re spending, especially on small, frequent purchases like takeout or streaming subscriptions. Use a budgeting app or even a simple spreadsheet to track where your money goes each month.

Methodology

LendingTree analysts scored the 100 largest U.S. metros according to five metrics:

- Percentage of households spending 35% or more of their income on housing costs (U.S. Census Bureau 2023 American Community Survey with five-year estimates)

- Household debt-to-income (DTI) ratio (Federal Reserve data from fourth-quarter 2023 — the latest available for all metros)

- Credit inquiries in the past two years (sample of about 260,000 anonymized LendingTree users from Jan. 1 to March 31, 2025 — the first quarter)

- Percentage of cardholders with at least one maxed-out card (sample of about 260,000 anonymized LendingTree users from Jan. 1 to March 31, 2025 — the first quarter)

- Percentage of cardholders with a low credit utilization under 30% (sample of about 260,000 anonymized LendingTree users from Jan. 1 to March 31, 2025 — the first quarter)

All metrics were evenly weighted to create a final score.

Researchers used the U.S. Census Bureau 2023 American Community Survey with five-year estimates to identify the 100 largest metros.

Note: All consumers with active credit are included in credit inquiry averages. However, for maxed-out cards and credit utilization, we only considered consumers with active credit cards.

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles