Even in the Face of Rising Home Prices, Multigenerational Households Haven’t Spiked in Popularity

It’s no secret that home prices have been on the rise over the past several years. So it may be tempting to assume that a larger share of people are moving in with family to cut housing costs.

However, according to the latest LendingTree analysis of the U.S. Census Bureau American Community Survey, these rising home prices may not be causing an increase in the share of multigenerational households — in which three or more generations live in the same home.

Instead, our findings suggest that even though some parts of the U.S. are seeing significant increases in both home prices and multigenerational households, there’s no strong growth correlation. Our findings also indicate that even in the face of more expensive housing, the share of multigenerational households declined in most states from 2014 to 2019.

TABLE OF CONTENTS

Key findings

- Arizona, Nevada and Colorado saw the largest increases in multigenerational households. In the five years between 2014 and 2019, multigenerational households increased by an average of 12.34% across the three states.

- North Dakota, Vermont and South Dakota saw the largest declines in the share of multigenerational households. Across these three states, the share of multigenerational households fell by an average of 24.80%.

- Across all 50 states, there isn’t a strong correlation between home price growth and multigenerational household growth. As evidenced by a weak positive correlation coefficient of 0.23, there are many instances where a state can experience high home price growth but little — or even negative — multigenerational household growth.

- Though multigenerational households became more prevalent in many states, they became less common in the majority. The rate of multigenerational households decreased in 27 states from 2014 to 2019. In that same period, every state saw home prices increase, providing further evidence that home price growth may not be a major factor in why people decide to live in multigenerational homes.

- In general, multigenerational households aren’t very common. Across all 50 states, an average of only 3.32% of households are multigenerational. Even in the state with the highest share of multigenerational households — Hawaii — that figure is only 7.26%.

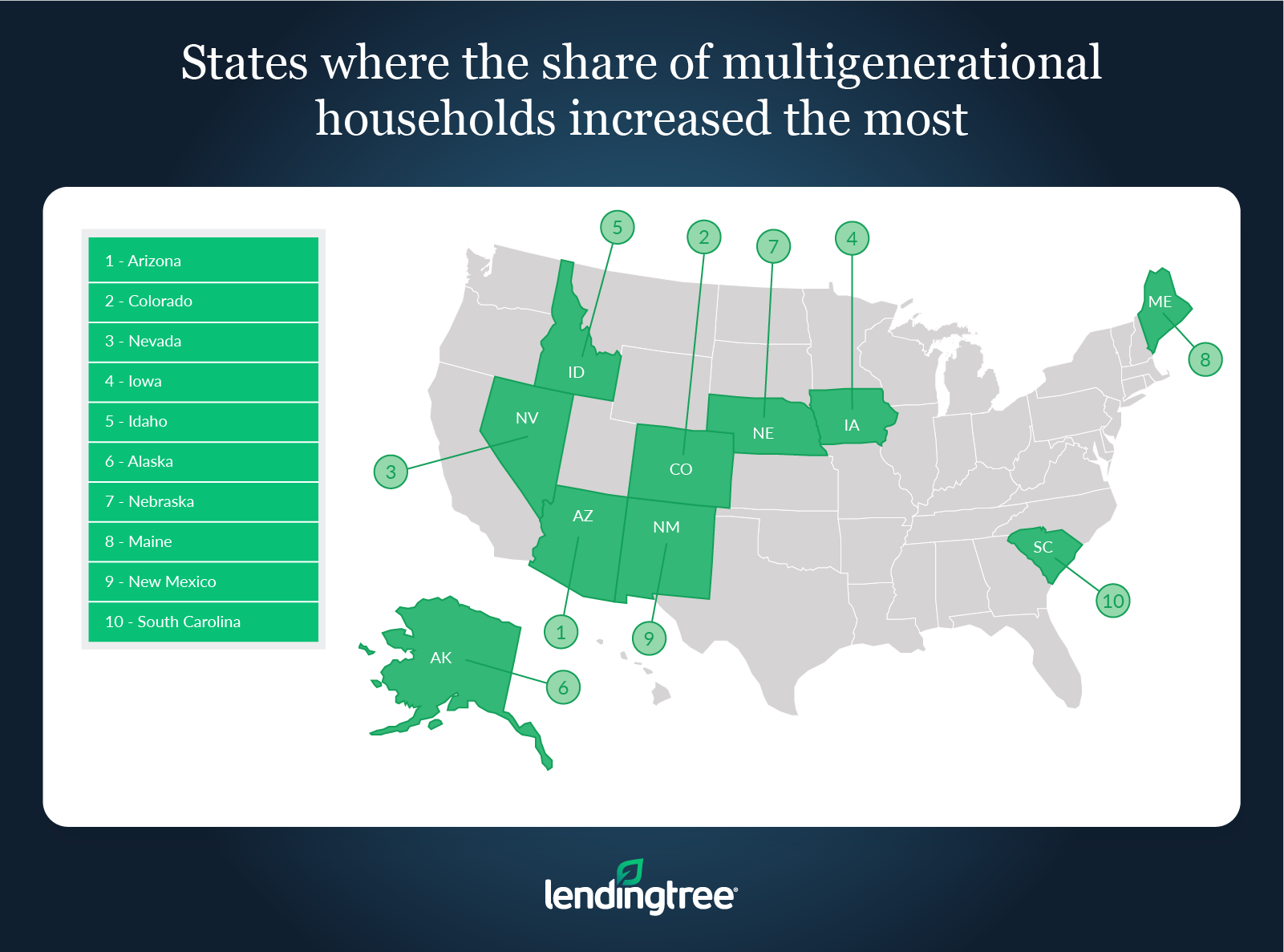

States where the share of multigenerational households increased the most

No. 1: Arizona

- 5-year growth in the share of multigenerational households: 13.71%

- 5-year growth in home prices: 44.82%

- Share of multigenerational households: 4.48%

No. 2: Colorado

- 5-year growth in the share of multigenerational households: 11.74%

- 5-year growth in home prices: 54.62%

- Share of multigenerational households: 3.14%

No. 3: Nevada

- 5-year growth in the share of multigenerational households: 11.56%

- 5-year growth in home prices: 65.43%

- Share of multigenerational households: 4.44%

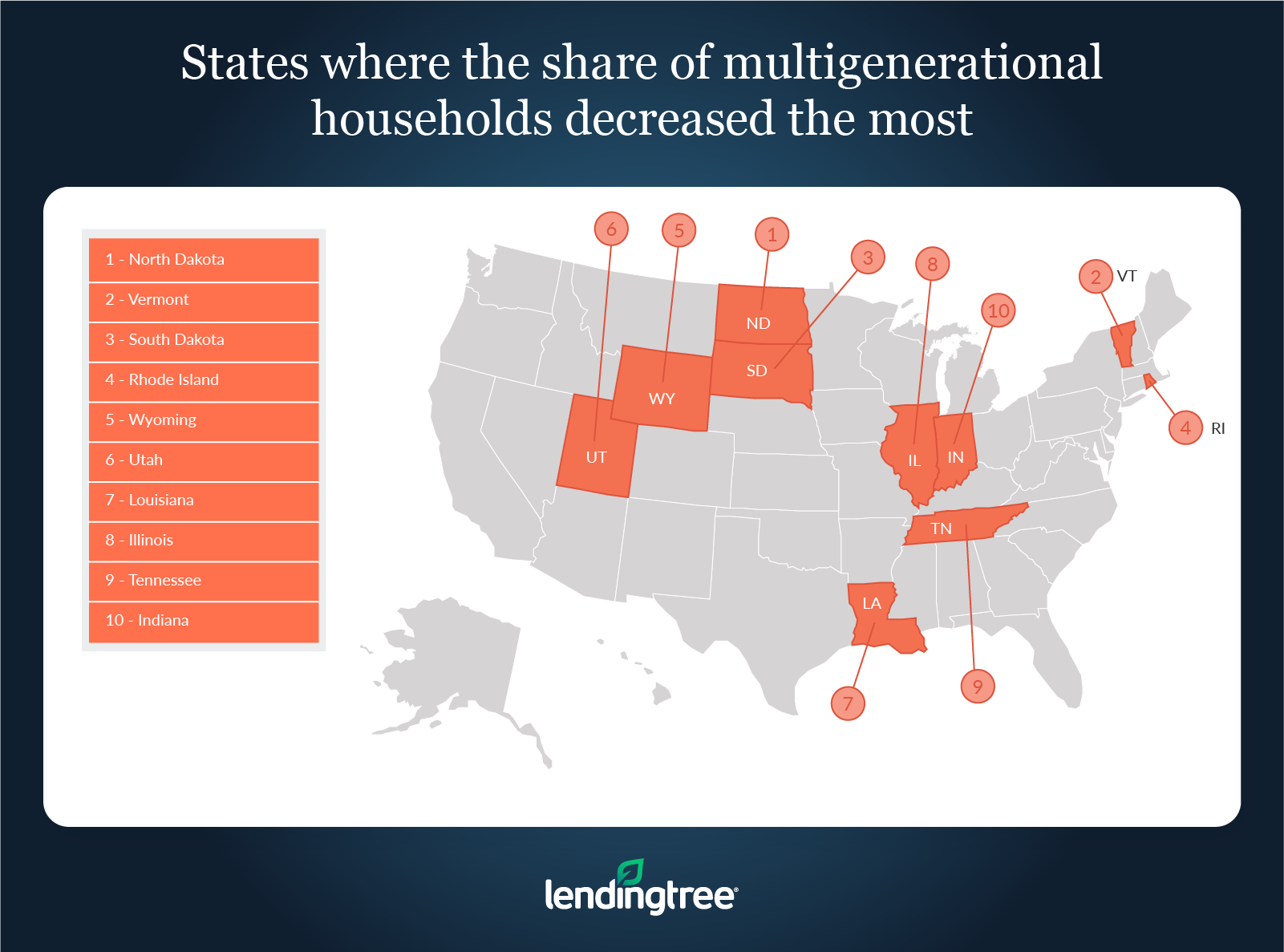

States where the share of multigenerational households decreased the most

No. 1: North Dakota

- 5-year decline in the share of multigenerational households: 31.18%

- 5-year growth in home prices: 26.95%

- Share of multigenerational households: 1.17%

No. 2: Vermont

- 5-year decline in the share of multigenerational households: 26.77%

- 5-year growth in home prices: 8.67%

- Share of multigenerational households: 1.86%

No. 3: South Dakota

- 5-year decline in the share of multigenerational households: 16.46%

- 5-year growth in home prices: 30.01%

- Share of multigenerational households: 1.98%

Are multigenerational households becoming more popular?

When discussing demographic changes, nuance is crucial. This is because a glance at population changes over time can be misleading without context.

This is because the total number of households in the U.S. also increased from 2014 to 2019. As a result, proportionally speaking, multigenerational households remained about as popular as they were in 2014.

More specifically, the number of multigenerational households increased from 4,494,733 units in 2014 to 4,688,869 units in 2019. At the same time, the total number of households increased from 117,259,427 to 122,802,852 units. This means that while raw numbers increased, the share of multigenerational households stayed virtually the same at about 3.8% from 2014 to 2019.

Ultimately, this nuance is important for two key reasons. Not only does it shed more light on how popular multigenerational households are relative to the overall number of households in the country, but it also indicates that multigenerational households are unlikely to become the norm anytime soon, even if numbers do increase.

Tips for making a home more affordable

If you’re struggling to find an affordable place to live in today’s hot housing market, you may not need to move in with family to make ends meet. Here are a few tips on how to make housing more affordable:

- Shop around for the lowest rate. Though mortgage interest rates increased in January and February, you can still secure a relatively low rate on a mortgage. Keep in mind that the offer you receive from the first lender may not be the best you can get. You may be able to increase your chances of finding your lowest possible rate by shopping around for a lender on a platform like LendingTree.

- Refinance your current loan to a lower rate. If you’re having difficulty keeping up with your housing payments, you could potentially lower them by refinancing your mortgage to get a lower interest rate. Refinancing can be a good option for those who want to reduce housing costs while still keeping their home.

- Think about alternative types of housing. Though a single-family home may be what most people picture when they think about buying a place to live, they aren’t the only options available. Buying a low-cost alternative, like a mobile home or condo, can help you maintain your independence while keeping your monthly housing costs in check.

Methodology

Data in this study comes from the U.S. Census Bureau 2019 American Community Survey with one-year estimates — the latest full survey available — and the 2014 American Community Survey with one-year estimates.

The Census Bureau defines multigenerational households as “family households consisting of three or more generations.” This definition means that households consisting of only parents and their children aren’t considered multigenerational.