64% of Homebuyers or Sellers Who Asked Their Real Estate Agent for a Lower Commission Rate Were Successful

For more than 100 years, property sales have taken place with the guidance of real estate agents. (The National Association of Realtors was founded in 1908, then called the National Association of Real Estate Exchanges.) Buyers and sellers alike have benefited from the advocacy and knowledge of a professional third party, but that service isn’t free. Still, unbeknownst to many, it may be negotiable.

The latest LendingTree survey finds that nearly two-thirds of homebuyers or sellers who asked their real estate agent for a lower commission fee were successful. “Like most things in life, you won’t know if your real estate agent will be willing to lower their commission fee until you ask,” LendingTree senior economist Jacob Channel says. And in some cases, he says, “it can quite literally pay off.”

Below, we dive deep into our findings on all things real estate agents — and their fees.

Key findings

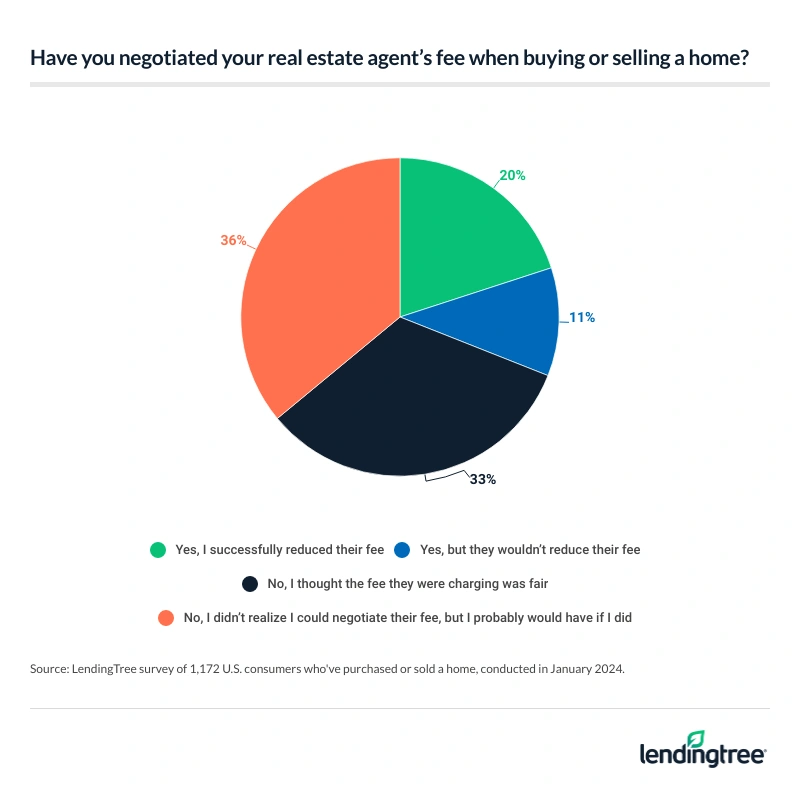

- Lower real estate fees can come to those who ask. While just 31% of homebuyers or sellers have attempted to negotiate real estate agent commission fees when buying or selling, 64% of those who asked successfully reduced theirs. Additionally, 36% say they weren’t aware negotiating was an option but would have tried if they were. Overall, 84% of Americans believe real estate agents should be flexible with their commission.

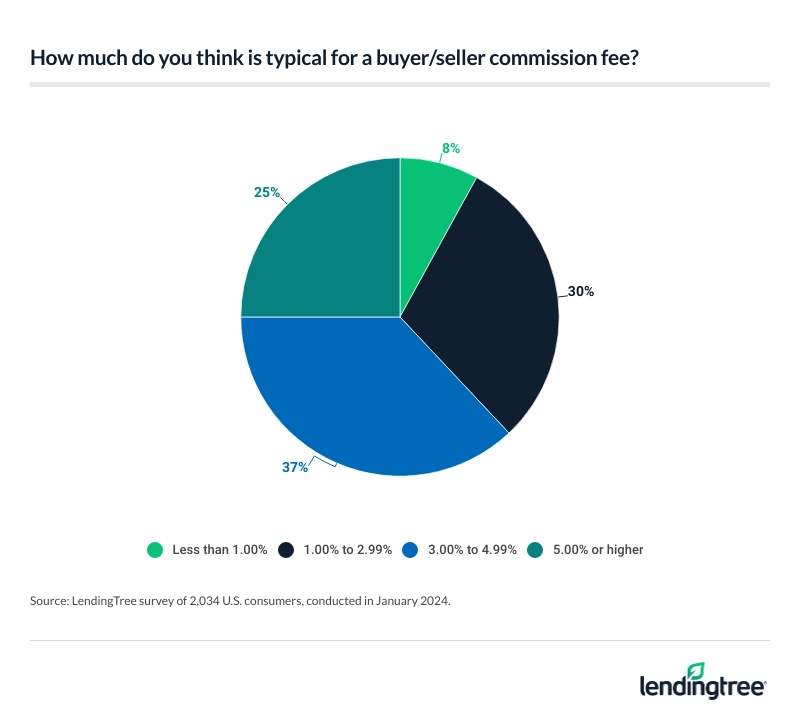

- Many Americans are in the dark on fees. Among homebuyers or sellers, 48% admit they don’t know what percent commission their agent received in their last transaction. 44% of those who know say their agent received between 3.00% to 4.99% in their last transaction, while 30% say it was 5.00% or higher. When asked what they believe a typical commission fee is, 37% of Americans said 3.00% to 4.99%, while 30% said 1.00% to 2.99%.

- Most consumers find real estate agents necessary in the homebuying/selling process, but technology may change that. 64% of Americans believe a real estate agent is at least somewhat necessary when buying or selling. However, 44% say they would attempt a real estate transaction without an agent. When asked if they think online tools and services have made agents less necessary in transactions, 64% agreed.

- Most Americans say they know how agents are compensated, though they may disagree with the practice. 64% of Americans believe they have a general understanding of how agents are paid. However, when asked their opinion, 11% said the buyer should be responsible for the entire commission and 20% said the seller. Over a third (35%) of homebuyers or sellers say they’ve been asked to pay the other party’s real estate agent fees in a transaction — more commonly the buyer than the seller.

Lower real estate fees can come to those who ask

Our survey had 2,034 respondents, more than half — 58% — of whom reported buying or selling a home. (Perhaps unsurprisingly, baby boomers ages 60 to 78 and Gen Xers ages 44 to 59 were more likely to report buying or selling — 86% and 60%, respectively — than millennials ages 28 to 43 at 48% and Gen Zers ages 18 to 27 at 27%.)

Of those who’ve bought or sold a home, 31% attempted to negotiate their agent’s fee — 20% successfully and 11% unsuccessfully. (Put another way, 64% of those who asked successfully reduced theirs.) Meanwhile, another 36% of buyers and sellers say they didn’t know such negotiations were feasible, but they would have tried if they had.

While asking your agent for a fee reduction can be nerve-wracking, Channel says, being successful can save money on both sides of the transaction. Although sellers typically pay an agent’s commission, saved costs might be knocked off a home’s negotiated sale price, saving money for buyers. For the seller, saved costs may mean more money for moving expenses or a down payment on a new home.

Although relatively few respondents tackled the big conversation and attempted to negotiate, the vast majority are on board. In fact, 84% of Americans think real estate agents should be flexible with their fees. A higher percentage of baby boomers (92%), six-figure earners (91%) and parents with children 18 or older (88%) align with this.

Many Americans in dark on commission fees

One dynamic that may exacerbate uneasiness around negotiating real estate agents’ fees is that many Americans don’t know how much they cost. While a slight majority (52%) of homebuyers and sellers say they know the percent commission their agent received in their last real estate transaction, 48% admit they’re in the dark. (Men — 63% — were more likely than women — 43% — to say they were aware.)

The majority of respondents who say they knew (44%) report their agent’s fee was 3.00% to 4.99% of the sale price, while 30% say it was 5.00% or higher.

Most Americans (63%) think real estate agent fees of 3.00% and up are typical, which may be another reason a relatively low number of buyers and sellers are negotiating with their agents.

But what should homebuyers and sellers expect in this realm?

“Commission fees can vary significantly based on factors like who your agent is, what kind of home is being sold, where the home is being sold and how much the home is worth,” Channel says. According to data gathered by LendingTree, the average commission is 5.37% of a sale’s price — which, depending on the price of the home, can add up to “thousands, if not tens of thousands, of dollars,” Channel says.

The good news: This percentage encapsulates the total commission fee owed to both the buyers’ and sellers’ agents. The commission is usually split evenly between those two parties, Channel says. Again, while it’s usually the seller who pays both fees, they may preemptively increase the asking price of the home to cover this expense, so some of the money may come out of the buyer’s pocket in the end.

Despite advances in technology, most consumers find real estate agents necessary

With a slew of online tools at the disposal of homebuyers and sellers, it may seem that getting a go-between involved is less necessary — but surprisingly (and encouragingly, for those in the industry), most consumers don’t agree.

Overall, 64% of Americans agree real estate agents are necessary in the homebuying or selling process, with 24% saying they’re “very necessary.” While 28% of respondents are neutral, only 9% think real estate agents aren’t very necessary or aren’t at all necessary.

In keeping with those findings, more than half of respondents (56%) say they wouldn’t attempt to buy or sell a home without getting an agent involved, though 44% say they would.

While the majority of consumers still think agents are necessary, many are willing to admit the tides may be turning. When asked if the online tools, information and services available today have made real estate agents less necessary in a real estate transaction, 64% of respondents said yes. This is led by parents with children younger than 18 (73%), those who make $100,000 or more a year (71%) and men (69%).

“In the past, you may have been able to advertise your home in places like your local newspaper,” Channel says, “but the amount of space you had for that advertisement was very limited compared to what you can now do online. On top of that, the internet also makes it easier for sellers to get in touch with people who can help them buy a new house or navigate the sale of their current one like mortgage lenders or attorneys.”

Still, agents can help ease the process by assisting with paperwork, offering staging advice, facilitating showings and more. Selling a home can be a lot more work than it seems — which is why Channel adds: “While selling a house on your own can save you money in commission costs, it still might not be worth it in the end.”

Most Americans say they know how agents are compensated

Even though, as we’ve seen above, many Americans admit some level of confusion about agents’ fees, most — 64% — say they generally understand how real estate agents are compensated. This is most common among those who earn $100,000 or more a year (79%), baby boomers (77%) and parents with children 18 or older (72%).

Still, only 20% think the seller should cover both agents’ fees, as is standard practice. The largest group of respondents, 37%, say both the buyer and seller should be responsible for the agents’ fees. (Of course, again, because of how commissions impact home pricing, both parties are responsible in some ways.)

The majority of homebuyers or sellers (65%) say they’ve never been asked to pay the other party’s real estate agent fees, but 21% have as the buyer and 14% have as the seller. A far higher rate of millennial buyers (38%) report being asked to cover the seller’s agent’s fee, compared with 13% of Gen X and 9% of baby boomer buyers.

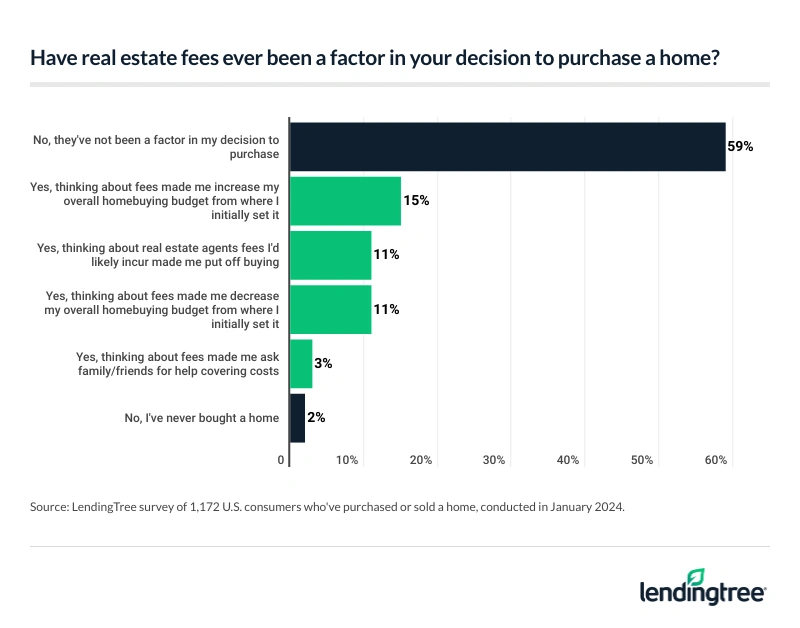

While, as discussed, agents’ fees can stack up substantially, most buyers or sellers (59%) don’t allow this cost to influence their decision to purchase a home. But 15% say considering these fees ahead of time caused them to increase their overall home budget from what they’d originally intended, and 11% say agents’ fees influenced their decision to put off buying.

3 benefits of using a real estate agent

While technology has the power to turn the tides and simplify transactions — perhaps one day to the exclusion of needing a living, breathing real estate agent — bringing a human third party into your home purchase or sale transaction can be a boon. Here are three benefits of using a real estate agent that computers can’t compete with.

- Simplification of a wealth of knowledge. There’s a lot to know about real estate. As much information as is available online, it’s a whole lot easier sometimes to have someone to tell you in a way you can understand and relate to. “Google is nice,” Channel says. “But having a real, flesh-and-blood person to ask questions or bounce ideas off can be even better.”

- Advocacy in the wild world of real estate purchases. A home sale may seem like a fairly straightforward transaction: The seller wants to sell, the buyer wants to buy, and voila, a deal is struck. But things are seldom so simple. For example, what do you do as a buyer when the seller cancels the contract at the last minute? This is only one of a host of scenarios an agent can help with — on either side of the table.

- Agents make the real estate transaction process their full-time job so you don’t have to. For buyers and sellers alike, a property’s process of changing hands is time- and energy-consuming — from staging to showing to signing the necessary paperwork. Real estate agents can take pressure off consumers by taking care of hidden footwork that would otherwise make buyers’ and sellers’ lives more complicated during an admittedly complicated time. (Even just shopping around for the right mortgage can be a lot of work!)

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,034 U.S. consumers ages 18 to 78 from Jan. 17 to 19, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

View mortgage loan offers from up to 5 lenders in minutes