The Cost of a White Christmas: Home Values in the Nation’s Snowiest States

Though a white Christmas may be on some people’s wish lists this year, it’s not on everyone’s. Some might be willing to pay a premium to live in an area that gets plenty of snow during the holiday season, while others might be open to paying a premium for the opposite.

With that in mind, LendingTree analyzed U.S. Census Bureau and National Centers for Environmental Information data to look at home values on both sides of the snow globe. Specifically, we analyzed the median value of owner-occupied housing units in the states that got the most (and least) snow in December 2022.

While there are plenty of expensive snowy and not-so-snowy states for homebuyers to consider, relatively affordable options exist on both sides of the snowfall spectrum.

Key findings

- There’s a slight positive correlation between home values and the amount of snowfall — but that doesn’t mean expensive real estate is exclusive to snowy parts of the country. Plenty of states with minimal or no snowfall, like Hawaii, boast high median home values.

- With an average of 19.47 inches of snow reported last December, Alaska is the nation’s snowiest state. The median home value of $336,900 in the Land of the Midnight Sun is $16,000 higher than the median home value in the U.S. of $320,900.

- North Dakota, Idaho and Vermont are the next snowiest states in the U.S. The average amount of snow reported in these states in December 2022 was, respectively, 17.49, 16.91 and 16.18 inches, making them and Alaska the only states where the average amount of reported snowfall last December was above 16 inches. At $243,100, $432,500 and $304,700, median home values in these three states vary quite a bit.

- Six states — Alabama, Florida, Hawaii, Louisiana, South Carolina and Texas — reported no snow in December 2022. At $200,900, $209,200, $254,600 and $275,400, Alabama, Louisiana, South Carolina and Texas have median home values lower than the national median. In Florida, meanwhile, the median home value ($354,100) is $33,200 higher than the median home value in the U.S. However, at $820,100, the median value of a home is higher in Hawaii than in any other state, snowy or otherwise.

- Relative to incomes, affordable housing can be found in states both snowy and not. For example, with a median home value to median household income ratio of 3.82, homes in Alaska are relatively affordable compared to the national median home value to median household income ratio of 4.29. Despite its significantly different climate, Texas’ median home value to median household income ratio of 3.81 is nearly identical to Alaska’s.

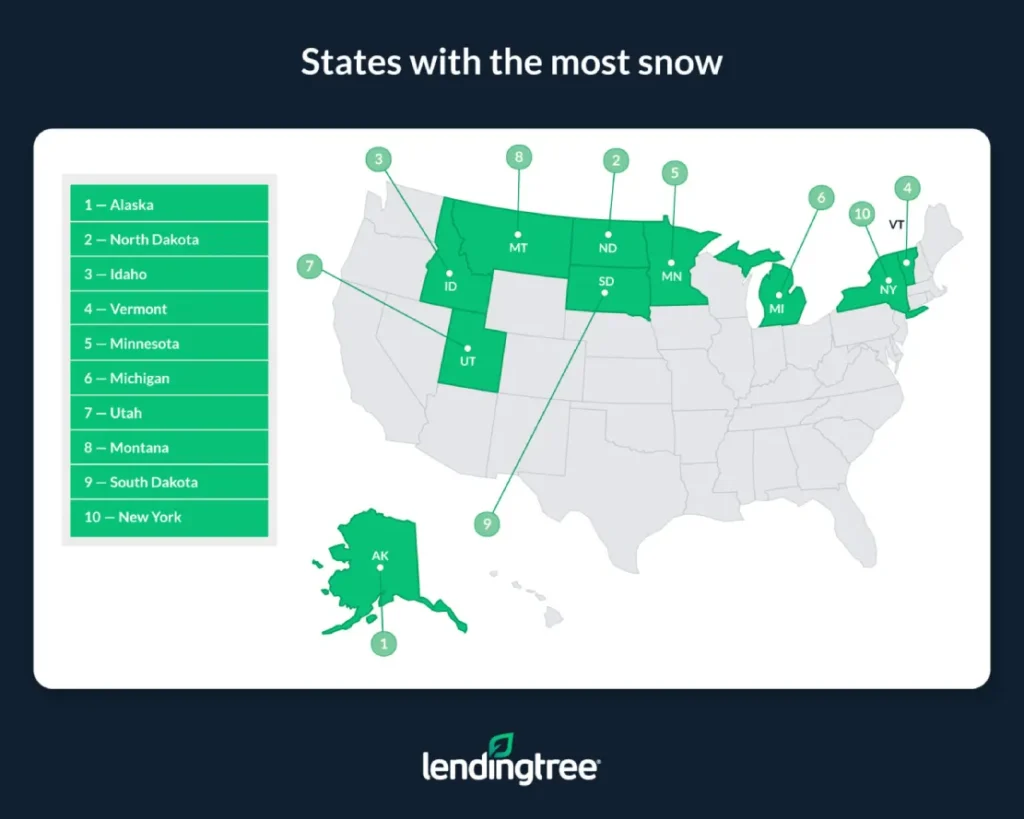

States with the most snow

No. 1: Alaska

- Average reported snowfall in December 2022: 19.47 inches

- Median home value: $336,900

- Median household income: $88,121

- Median home value to median household income ratio: 3.82

No. 2: North Dakota

- Average reported snowfall in December 2022: 17.49 inches

- Median home value: $243,100

- Median household income: $71,970

- Median home value to median household income ratio: 3.38

No. 3: Idaho

- Average reported snowfall in December 2022: 16.91 inches

- Median home value: $432,500

- Median household income: $72,785

- Median home value to median household income ratio: 5.94

No. 4: Vermont

- Average reported snowfall total in December 2022: 16.18 inches

- Median home value: $304,700

- Median household income: $73,991

- Median home value to median household income ratio: 4.12

No. 5: Minnesota

- Average reported snowfall total in December 2022: 14.20 inches

- Median home value: $314,600

- Median household income: $82,338

- Median home value to median household income ratio: 3.82

Homebuyers should consider snow-related costs

Regardless of how expensive a house is, certain factors can make living in a state that sees a lot of snow each year logistically challenging and costly.

For example, not only can severe cold and snow cause major home damage like burst pipes and flooding, but intense snowfall can also render travel virtually impossible. In extreme cases, being snowed in can prevent someone from important tasks like going to the grocery store or even getting to a hospital for medical attention.

Due to the challenges that cold weather can bring, those who live in snowy climates should plan to spend extra to ensure their homes are sufficiently weatherproofed. This can include paying for items like more expensive insulated thermal windows or purchasing backup generators in case of power outages. Residents who live in areas with snowy seasons should also own a vehicle capable of safely driving through heavy snowfall and ice buildup.

Of course, while those who live in snowier areas will likely need to spend more money on dealing with snow, it doesn’t mean that those living in warmer areas will never see snowfall or face the challenges it can bring. As a result, regardless of where you live, you should be sure your home is equipped to deal with winter weather.

Tips for buying a home in a snowy state

If you can’t imagine living somewhere without an ample snow season each year, consider the following tips to make buying and owning a home in a snowy state more affordable:

- Shop around: No matter where you’re buying, shopping around for a mortgage before purchasing a home can help you get a lower rate and save tens of thousands of dollars over the life of the loan.

- Ensure that you’ve got the right insurance: Having the proper home insurance for your living situation is especially important in snowy areas, where bad weather can easily cause damage to your house. In the same way shopping around for a mortgage can help save you money, shopping around for insurance can do the same.

- Consider weather-related costs: Those who live in snowy areas may incur numerous costs related to the weather, from needing to spend extra on snow tires for their cars to shelling out cash to better insulate their houses. By calculating how much you can afford to spend on a home each month, you can better budget for snow-related expenses.

Methodology

LendingTree analyzed the U.S. Census Bureau 2022 American Community Survey with one-year estimates — the latest available — for housing and income data.

Snowfall data, via the National Centers for Environmental Information, is based on the snowfall reported by Global Historical Climatology Network (GHCN) stations across a state. LendingTree calculated the total snowfall reported from Dec. 1 through Dec. 31, 2022, at each weather observation station that reported snowfall data in a given state. We then calculated the average of those totals to determine which states got the most — and least — snow.

View mortgage loan offers from up to 5 lenders in minutes