Over Half of Homeowners Fear Effects of Climate Change, Including Impact on Home Insurance Costs

As temperatures rise, so do financial concerns for homeowners.

According to the latest LendingTree survey of nearly 2,000 U.S. consumers, 51% of homeowners are worried climate change-related hazards will affect their homes, while others worry about property values and insurance prices as the climate becomes increasingly volatile.

Here’s what else we found.

Key findings

- Most homeowners fear climate change effects — and the youngest are most concerned. Over half (51%) of homeowners are worried climate change-related hazards will affect their homes, with that figure rising to 63% among millennial homeowners. When asked what hazards they’re most concerned about, severe storms (24%), hurricanes (14%) and flooding (14%) topped the list among homeowners.

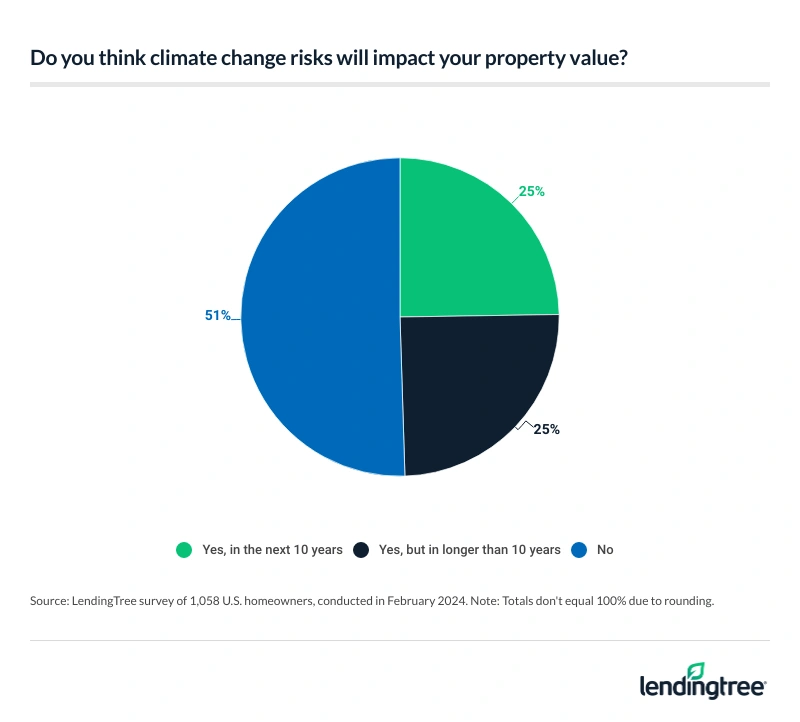

- Some are planning to move away from places at high risk of climate change hazards, and many believe those risks should be disclosed. A quarter (25%) of homeowners worry climate change will impact their property values in the next 10 years. Among those in at-risk locations, 34% are considering moving, while 13% have already relocated. Additionally, 72% of homeowners think climate change risks should be disclosed by the seller or real estate agent during the homebuying process, and 57% believe there isn’t enough public awareness and education about homebuying climate change risks.

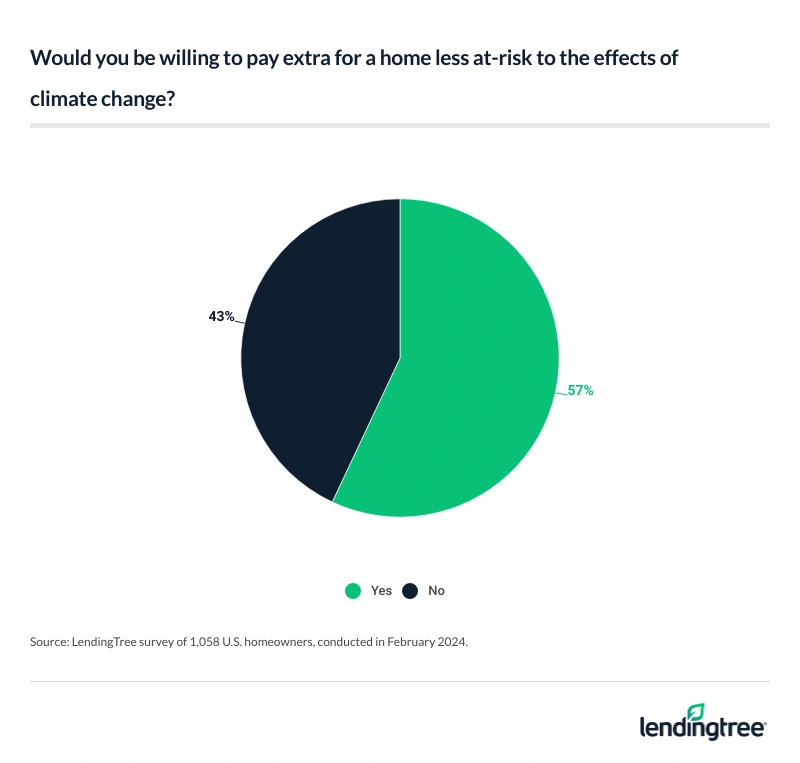

- Many will pay a premium for peace of mind. 57% of homeowners say they’d be willing to pay extra for a home less at risk of climate change through upgrades or location. In fact, 17% of homeowners say risks associated with climate change have kept them from purchasing a home in the past. When buying their next home, 42% are more likely to prioritize climate change risks over other factors.

- Homeowners think climate change will impact their wallets — whether via rate hikes or the need for additional coverage. Seven in 10 (70%) homeowners say they think climate change risks will make home insurance more expensive. Separately, 21% say their home insurance costs have already risen due to climate change risks. To account for climate risks, 38% have purchased additional coverage, like flood insurance or fire coverage. Meanwhile, 36% are worried they’ll be dropped by their home insurer because of their home’s risk.

Homeowners are worried about climate change

Concerns are brewing over climate change, particularly for homeowners. In fact, 51% of homeowners are at least somewhat worried climate change-related hazards will affect their homes, though that’s especially true among homeowners with children younger than 18 (64%) and millennial homeowners ages 28 to 43 (63%).

According to LendingTree home insurance expert and licensed insurance agent Rob Bhatt, younger homeowners may be concerned over climate change because they’ve had more exposure to climate issues.

“Millennials and Gen Zers have grown up with climate change as a regular topic of discussion in classrooms, when they watch the news, chat over the dinner table or at family gatherings,” he says. “Millennials are also reaching the homebuying age at a time when many of the climate change risks they learned about growing up appear to be coming to fruition. Ice caps are melting, devastating coastal storms are becoming more frequent and wildfires are raging at greater sizes than before. Ash-filled skies are becoming a summer tradition in many major West Coast cities.”

Millennials and Gen Zers have grown up with climate change as a regular topic of discussion in classrooms, when they watch the news, chat over the dinner table or at family gatherings.

Also worth noting, a higher rate of male homeowners (56%) are concerned than female homeowners (45%).

When it comes to the hazards homeowners are most concerned about, severe storms (24%) rank first, followed by:

- Hurricanes (14%)

- Flooding (14%)

- Rising temperatures (10%)

- Heat waves (10%)

- Wildfires (10%)

- Drought (8%)

- Rising sea levels (3%)

As coastal flooding poses concerns, most homeowners think coastal properties aren’t viable

When asked about the long-term viability of coastal properties in the face of rising sea levels and increased storm activity, 47% of homeowners think they’ll still be livable but less valuable. Meanwhile, 38% believe they’ll be uninhabitable. That means just 15% believe coastal properties will be unaffected by these climate risks.

Those concerns are well-founded. In a LendingTree study on coastal flood risks, we found that flood events have doubled or more at 21 of 33 coastal weather sites analyzed between 1990-2009 and 2010-2022.

25% worry climate change will impact their property value in next 10 years

Property values are also a concern. Across all homeowners, 25% worry climate change will impact their property values in the next 10 years. That’s especially true among millennials (38%), those with children younger than 18 (36%) and men (32%). Meanwhile, another 25% think it’ll take longer than 10 years for their property values to feel the impact.

According to Bhatt, homeowners are right to be worried.

“If an area experiences multiple disasters in a relatively short amount of time, insurance becomes more expensive and often harder to get,” he says. “We’re seeing this in certain areas in California, Texas and Florida, which are the largest states by population, as well as in disaster-prone areas such as Oklahoma and Colorado. If home insurance rates get too high, they can reduce the amounts people can afford for properties, because your home insurance payments are usually folded into the monthly escrow payments you make for a mortgage.”

Notably, 40% of homeowners live in a location they consider to be at risk of climate change. Of this group, 34% are considering moving and 13% have already relocated. As concerns mount for these potential climate refugees, a First Street Foundation report found that around 3.2 million Americans have moved between 2000 and 2020 due to flooding risks.

“Everyone has a different comfort level with risk,” Bhatt says. “No one can predict the future, but you can take steps to minimize the damage a natural disaster may cause. For example, wind- and hail-resistant roofs and windows can make a difference. But if having enough insurance and taking steps to minimize damage aren’t enough to alleviate your concerns, you may be better off relocating to a different area in your community, or a different community altogether.”

With so many homeowners considering their homes to be at risk, the majority think those risks should be disclosed. Across all homeowners, 72% think climate change risks should be disclosed by the seller or real estate agent during the homebuying process.

Meanwhile, 57% believe there isn’t enough public awareness and education about homebuying climate change risks. Those who are least concerned about climate change are the most likely to believe there isn’t enough public awareness, leading with women (67%), baby boomers ages 60 to 78 (67%) and those with children 18 or older (66%).

Majority would pay more to ease climate concerns

As homeowners everywhere begin preparing for increased climate risks, 57% say they’d be willing to pay extra for a home less at risk of climate change — whether through upgrades (like hurricane shutters or earthquake retrofitting) or moving to an area with lower climate risks.

Those with children younger than 18 (72%) are the most likely to share this sentiment. That’s followed by millennials (69%) and men (62%).

Climate risks have stopped some from purchasing a home before. In fact, 17% of homeowners say these risks have kept them from a purchase in the past. As far as their next home goes, a significantly higher 42% say they’ll prioritize climate risks over other factors.

Bhatt says it’s generally a good idea to be aware of the potential risks for a home you want to buy.

“As climate disasters become more frequent, you should account for things such as a home’s potential flood, windstorm and wildfire risks,” he says. “If you buy a home in an area where these types of risks are prevalent, you may pay more for insurance than expected. Or you may not have enough insurance to rebuild after a natural disaster strikes, which can be financially devastating.”

In addition to insuring your home, you also want to make plans to keep yourself and your family safe during a disaster. Have go bags and disaster kits ready, know where to meet and who to call if a disaster strikes, and have an evacuation plan.

Homeowners aren’t only trying to mitigate their climate risks; they’re attempting to lessen their environmental impact. In fact, 68% say environmental sustainability is at least somewhat important in their decision-making process when buying a home. This figure rises to 79% among parents with kids younger than 18 and 78% among millennials.

Meanwhile, 65% have invested in renewable energy systems to mitigate climate change risks and reduce their home’s environmental impact. The most common investments are energy-efficient appliances (32%) and energy-efficient HVAC systems (26%). That’s followed by:

- Smart thermostats (24%)

- Weatherproofing home (23%)

- Solar panels (21%)

- Rainwater harvesting systems (9%)

- Green roofs (3%)

Homeowners expect higher insurance costs due to climate change

Insurance is a particular pain point for homeowners — and one that most expect to worsen as climate risks grow. Across all homeowners, 70% think insurance will become more expensive due to climate change risks. In fact, 21% say their home insurance costs have already risen due to climate change risks, particularly those with children younger than 18 (32%), millennials (31%) and men (28%).

It’s not just rate hikes affecting homeowners — many may need extra coverage to protect them from growing climate risks. In fact, 38% have purchased additional coverage, with the most common add-ons being:

- Flood insurance (17%)

- Additional fire coverage (9%)

- Additional dwelling coverage (6%)

- Additional wind coverage (6%)

Meanwhile, 36% are worried they’ll be dropped by their home insurance because of their home’s risk, with 23% worrying they’ll be dropped in the next 10 years.

Mitigating climate risks: Top expert tips

If you plan to move soon, Bhatt says climate risks should certainly play a role in your decision-making — if not through picking the location, then at least through your budget. In particular, he recommends the following:

- Factor insurance costs into your budget. “In many parts of the country, insurance is taking up a greater share of homeownership costs than in the past,” he says. “You should account for this when you budget.”

- Consider getting a home insurance quote before you submit a purchase offer. “People usually wait until after their offer is accepted before shopping for home insurance,” Bhatt says. “However, in areas prone to wildfires, hurricanes or extreme thunderstorms, it often makes more sense to see if you can afford insurance for a home you want to buy before you put in an offer.”

- Look into prior insurance claims to determine a property’s risk — and your financial risk. “You can also ask a seller or their real estate agent for a copy of their home’s CLUE (Comprehensive Loss Underwriting Exchange) report,” he says. “This is an industry database that shows prior insurance claims at a home. If the home has had multiple weather- or wildfire-related claims in the past few years, it may be too risky to insure.”

1 in 5 properties in Mississippi, Louisiana and New Mexico don’t have disaster insurance

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,964 U.S. consumers ages 18 to 78 from Feb. 13 to 19, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78