What is a Credit-Builder Loan and Where Can You Get One?

Boost your credit and your savings

Best: Overall credit-builder loan – Intuit Credit Karma

APR range: Doesn’t charge interest

Loan terms: No specific terms

Loan amounts: Starting at $500

Fees: None

Pros

- No fees or interest charges

- No credit check

- Doesn’t require monthly payments

- Reports to all three credit bureaus

Cons

- Savings account doesn’t earn interest

- If you don’t make monthly payments, you won’t see the same credit boost

- Must transfer money to the account at least once every three months

The best credit-building loan is the Credit Karma Credit Builder because it’s free and gives borrowers the flexibility to save as much and as frequently as they want.

Credit Builder doesn’t require monthly payments, and you can start with payments as small as $10. Each time you save up $500, Credit Karma will release $500 to you.

It may be tempting to skip monthly payments without facing a penalty, but you’ll build your credit much faster if you choose to make regular payments.

To get a Credit Builder loan with Credit Karma, you’ll need:

- A credit score of 619 or lower

- A Credit Karma Money Spend account

Best: Credit-builder loan from a bank – BMO

APR range: 10.80% to 19.12%

Loan terms: 24 to 60 months

Loan amounts: Starting at $1,000

Fees: $75 loan processing fee

Pros

- Loan money earns interest

- Can qualify even with no or low credit

- Low, one-time fee

- Autopay discount

Cons

- Loans start at $1,000 (compared to $500 from competitors)

- High starting rates

- Must pay with an eligible BMO checking account for autopay discount

BMO gives a generous rate discount if you enroll in autopay with an eligible BMO checking account. If you already have one or don’t mind opening a new one, BMO is worth considering. When you take out a credit-builder loan with BMO, your money will go into a certificate of deposit (CD), where it will earn interest.

BMO credit-builder loans come with high annual percentage rates (APRs), meaning that you’ll have to pay more to take out the loan. While your loan will earn interest in a CD account, it likely won’t be enough to offset the cost of the interest payments you make.

BMO doesn’t have a minimum credit score requirement for the credit-builder loan. To evaluate your eligibility, BMO will review how you pay off any current debts and assess whether you can afford the monthly payment for your credit-builder loan.

Best: Credit-builder loan from a credit union – DCU

APR range: 5.00%

Loan terms: 12 to 24 months

Loan amounts: $500 - $3,000

Fees: None listed

Pros

- Low APR

- Offers both small and large loans

- Loan funds earn interest

Cons

- Must become a member of DCU to get loan

- Charges interest

Digital Federal Credit Union (DCU) offers a low-cost credit-builder loan to its members. While you will need to pay a 5.00% APR, your money will earn interest in a savings account as you pay off your loan. This will help offset the (already competitively low) cost of your loan.

You will need to become a member of DCU to get a loan, but you can easily qualify by joining one of their partner organizations.

DCU doesn’t specify its eligibility requirements, but you’ll need to become a member to get a credit-builder loan. You can qualify for DCU membership by being related to a current member, working at a partner company, living in a qualifying community or joining a partner organization.

Best: Up-front funds, in some cases – MoneyLion

APR range: 5.99% to 29.99%

Loan terms: Up to 12 months

Loan amounts: Up to $1,000

Fees: $19.99/month membership fee

Pros

- Good credit could mean getting some of your loan up front

- Loan money earns interest

- No credit check

- Reports to all three credit bureaus

Cons

- High maximum APR

- Monthly membership fee

In most cases, you won’t get any cash up front when you get a credit-builder loan. Instead, you’ll give the lender a deposit, and once you’ve paid back that amount and any applicable interest and fees, they’ll return your money. Fintech company MoneyLion doesn’t always work that way. If you have good credit, it may give you part of your loan up front.

Be sure to shop around before accepting a MoneyLion loan, since its interest rates can be steep. You should also budget for the monthly membership fee, which is currently $19.99. That means if you keep your loan for the full 12 months, you’ll pay almost $240 in fees alone.

MoneyLion but it only runs a soft credit hit when you apply. Soft credit hits don’t hurt your credit score.

Read more about how we chose the best credit-builder loans.

What are credit-builder loans?

- A credit builder loan is a way to boost your credit score.

- You send money to a lender in monthly installments and usually get it all back at the end of the loan term.

- Credit-builder loans have fixed monthly payments until you hit your loan amount — usually $300 to $1,000.

- A credit-builder loan is best if you can easily afford the monthly payments and don’t already have debt.

How do credit-builder loans work?

Credit-builder loans work differently from traditional loans. Instead of borrowing money that you can use right away, you’ll make fixed monthly payments into an account that the lender holds for you. When your loan term ends, you’ll get your money back — minus any interest or fees.

The real benefit of credit-builder loans? You’ll build a payment history (worth 35% of your credit score). Your lender reports each on-time payment to the credit bureaus, proving to future lenders that you can manage debt responsibly.

If your credit (or lack of credit) has been keeping you from qualifying for credit cards or loans, a credit-builder loan could be a smart first step.

But be aware, you’re not borrowing money you can spend. You won’t find credit-builder loans that give you money upfront. If that’s what you need, then you’ll probably want to look for a bad credit personal loan instead.

Are credit-builder loans worth it?

Yes, credit-builder loans could be worth it if you need to build credit from scratch and can easily afford the monthly payments.

The Consumer Finance Protection Bureau (CFPB) conducted a study and found that credit-builder loans tend to work best for people who don’t already have debt.

Borrowers with no existing debt saw their credit scores rise by about 60 points after using a credit-builder loan.

For borrowers who already had debt, scores dropped slightly, by around 3 points. So, if you already have credit card or loan debt, look into other ways to improve your credit score.

Credit-builder loans pros and cons

Consider these points before jumping into a credit-builder loan contract.

Pros

-

Create a credit score and history

Payment history makes up 35% of your FICO Score. Credit-builder loans can help you start and build your credit history through consistent, on-time payments. -

Diversify your credit mix

Credit mix makes up 10% of your FICO Score. If you don’t have any other installment loans (like a personal or auto loan), then a credit-builder loan will diversify your mix. -

Lower APRs

Credit-builder loans usually have lower interest rates than credit-builder credit cards.

Cons

-

Can be risky

If you miss a payment, your credit score will likely drop, so be certain you can afford your payments. -

Can cost money

You’ll often pay interest or other fees on your credit-builder loan. Check with your lender to see if these are refundable. -

Ties up money

Since your money will be locked until the loan ends, make sure you won’t need it for emergencies.

How to build credit with a credit-builder loan

-

Compare offers

Every credit-builder loan has different costs and features, so check out more than one lender to find the best deal. -

Evaluate your budget

Use a loan calculator to make sure you can afford the monthly payments along with any additional fees. -

Make your payments on time

Credit-builder loans don’t automatically improve your credit — it’s up to you to build your score by making regular on-time payments. A late or missed payment can leave you worse off than when you started. -

Check your credit score and credit report

Track your progress as you build your credit. You can check your credit and get credit alerts for free with LendingTree Spring. -

Bonus: Bulk up your emergency fund

When the loan term is up and you receive the loan money, consider transferring it to a high-yield savings account to earn interest. The next time you face an emergency expense, you can dip into this account without taking on more debt or damaging your credit.

Should you get a credit-builder loan?

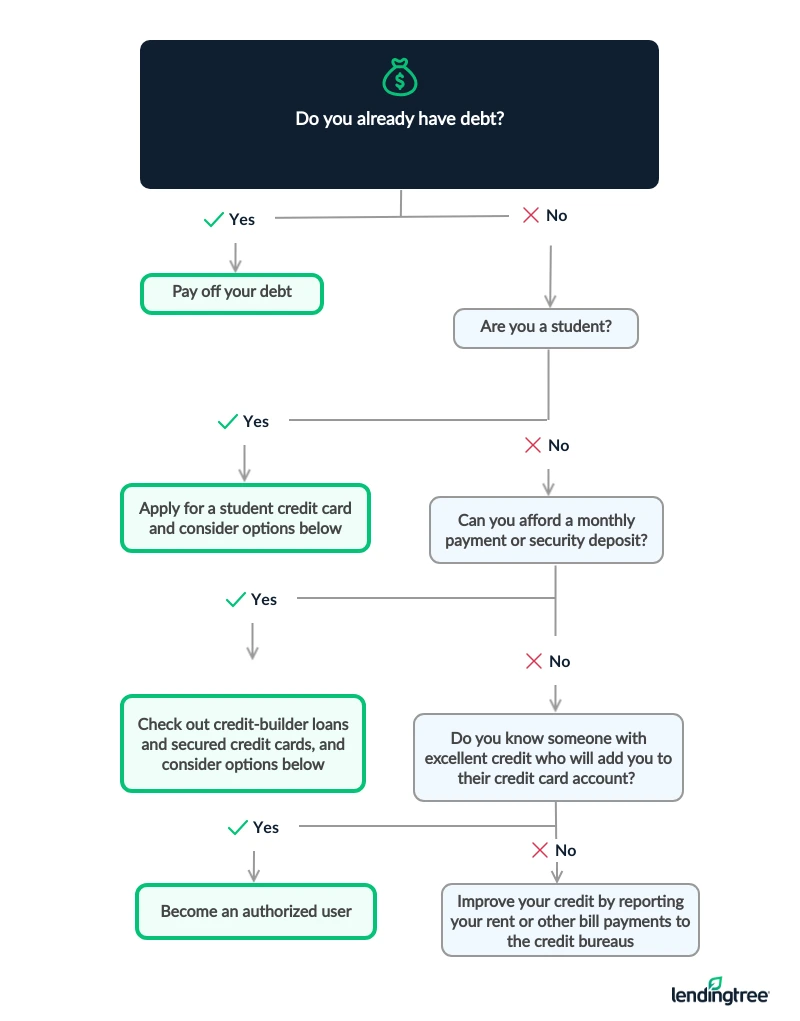

Use our flowchart to decide if you should apply for a credit-builder loan or choose an alternative.

Alternatives to credit-builder loans

| What it is | How it builds credit | Pros and cons | |

|---|---|---|---|

| Secured credit card | A credit card with a security deposit that acts as your credit limit | Reports payments to credit bureaus | Pros: Low credit requirements, can graduate to a regular card with responsible use Cons: Requires a security deposit |

| Become an authorized user | Being added to a trusted family member or friend’s credit card account | Card payment activity appears on your credit account | Pros: Free, no credit requirement Cons: Only works if your relative/friend makes payments on time and keeps the balance low |

| Pay off current debt | Paying off any credit cards or loans with balances | Improves your credit utilization ratio, which is part of “amounts owed” (worth 30% of your FICO Score) | Pros: One of the best long-term ways to improve your credit Cons: Takes time and discipline |

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

How we chose the best credit-builder loans

To choose the top four credit-builder loans available to consumers across the United States, we systematically reviewed and evaluated the top credit-builder loans currently on the market. We rated lenders across fifteen data points in three categories.

Based on our comprehensive rating system, the best credit-builder loans come from Credit Karma, BMO, DCU and MoneyLion.

We gave lenders points for making their loans available to consumers nationwide, for not requiring membership to get a loan and for skipping a hard credit pull when evaluating loan eligibility.

To receive top marks, lenders must offer competitive interest rates, low fees and flexible repayment terms.

We used trusted third-party sources to assess the customer experience with each lender, awarding points to lenders who refund interest and put funds into an account that earns dividends.

Why trust our methodology?

Our writers and editors dig through the facts, contact lenders directly and even go through the application process ourselves if it helps better explain what you can expect. As a Certified Financial Education Instructor℠, I’m committed to breaking down complex financial details so people can make confident, informed decisions with their money.

Jessica’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.

Frequently asked questions

Yes. Although credit-builder loans are easier to get than traditional loans, the lender will deny you if you don’t meet its minimum requirements.

In short, yes. Paying off a credit-builder loan early defeats the purpose of getting a loan to establish a positive payment history. The more on-time payments you make, the more you extend your credit history and demonstrate that you’re a responsible borrower.

Borrow as much as you can comfortably pay back. If you can’t make your loan payments on time every time, your credit will take a hit, defeating the purpose of the loan.

Yes, although you may need to have at least fair credit in order to get a personal loan, and even better credit to get the cheapest rates. You can shop online for personal loan lenders to see if you qualify, as well as check with your own bank or credit union.