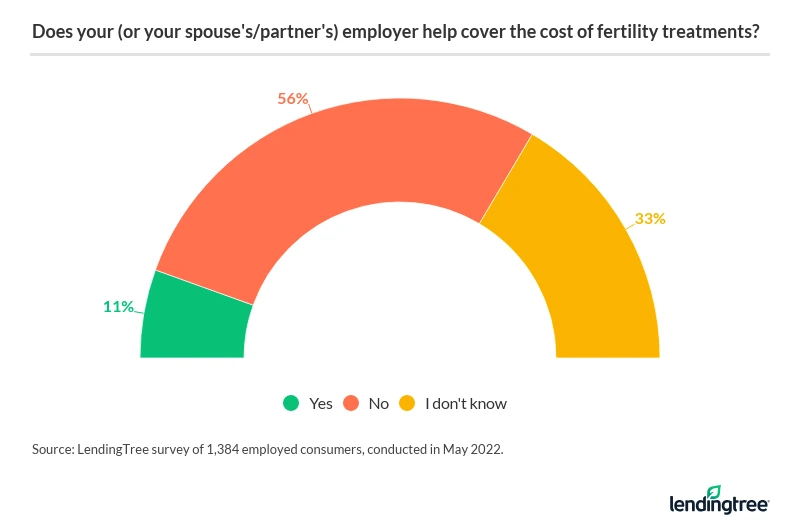

33% of Americans Don’t Know If Their Employer Covers Fertility Benefits

Fertility treatments can open the door to parenthood for some Americans, but treatment may feel out of reach for many because of high costs. One avenue of financial support could be your employer: Fertility benefits are becoming increasingly common at workplaces, but some consumers aren’t sure what their (or their spouse’s or partner’s) job offers.

In the latest LendingTree survey, we asked nearly 2,100 U.S. consumers about their experiences with fertility treatments and the toll they can take on finances. Keep reading to learn which fertility treatments are most common among Americans and how many consumers have gone into debt to offset the costs of having kids.

Key findings

- Your employer may offer better fertility benefits than you think. A third of employed Americans have no idea if their (or their spouse’s or partner’s) employer provides financial assistance for fertility treatments. However, a 2021 Mercer survey found that 61% of employers with 500-plus employees offer fertility benefits.

- 15% of Americans have undergone a fertility treatment. High earners are consistently more likely to pursue fertility treatments than those who make less.

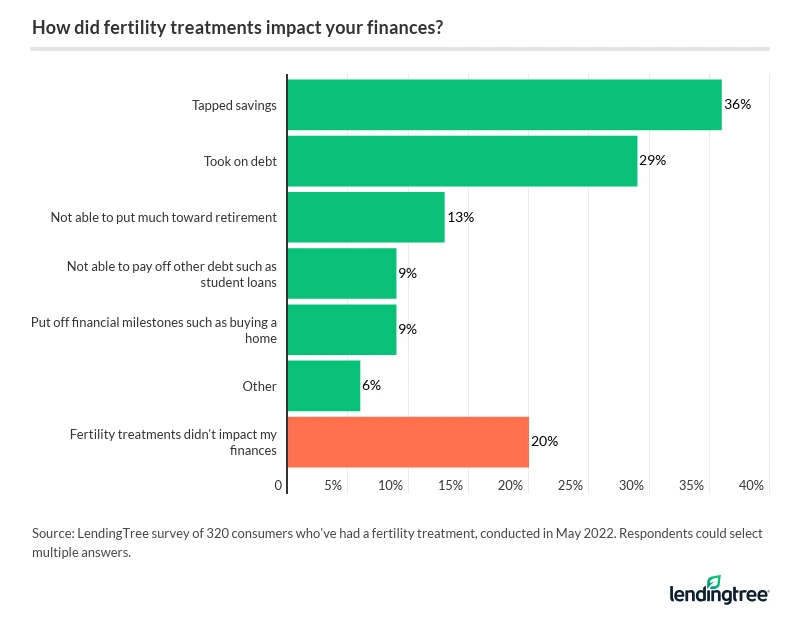

- 80% of those who’ve had a fertility treatment say their finances were negatively impacted — primarily from tapping savings (36%), taking on debt (29%) and not being able to save as much for retirement (13%). Less than 40% of those who’ve had a fertility treatment say insurance covered all or most of the expenses.

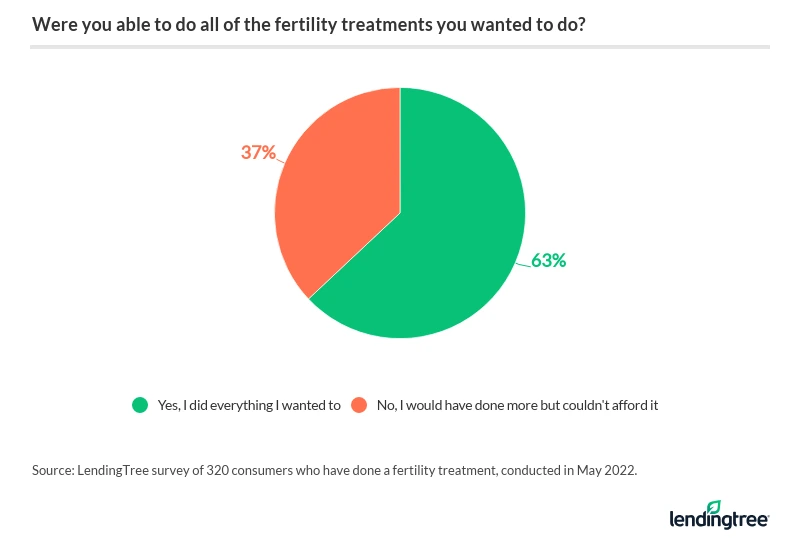

- 37% of those who’ve had a fertility treatment wanted to do more but couldn’t afford the cost. Among all Americans, including those who haven’t had a fertility treatment, 12% say they’ve wanted to pursue fertility treatments but couldn’t afford them.

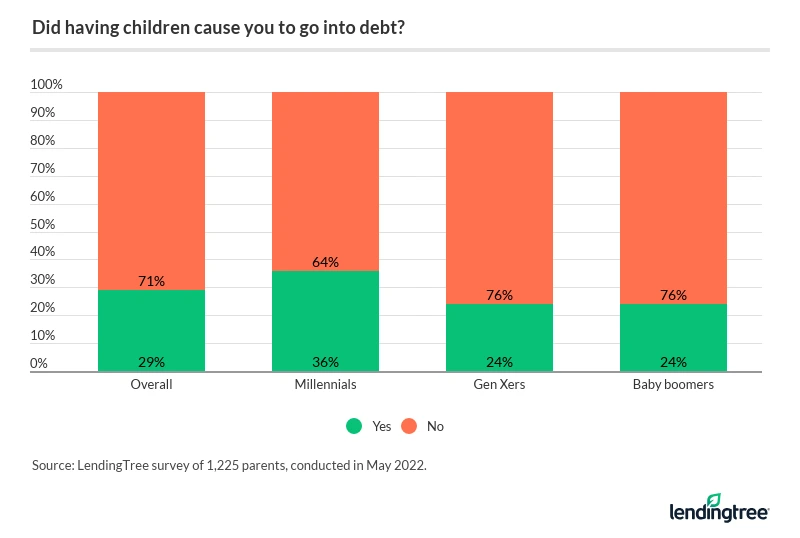

- 29% of parents have gone into debt because they had children, with expenses including prenatal care, the childbirth process, fertility treatments and postpartum care. This jumps to 36% among millennials. Meanwhile, of those who don’t have kids, 31% are worried they’ll never be able to afford children.

Employed Americans don’t know if their job offers fertility benefits

For Americans looking to undergo fertility treatments, double-checking their benefits packages may offer surprising (and welcome) financial support. The survey revealed that 1 in 3 (33%) employed Americans don’t know if their employer — or their spouse’s or partner’s employer — helps cover the cost of fertility treatments. On the other hand, just 11% say their employer offers fertility benefits.

Gen Xers (ages 42 to 56) are the least likely to know whether they have fertility benefits, at 39%. It’s also worth noting that this age group is less likely to successfully conceive through popular treatments like in-vitro fertilization (IVF), according to the Society for Assisted Reproductive Technology. And at many clinics, physicians won’t perform IVF on those with low probabilities of conception.

Generally, most large employers offer support for employees seeking fertility treatment. In fact, 61% of employers with 500 or more employees provide fertility benefits, according to a 2021 survey from Mercer, a New York-based consulting firm.

Fertility treatments negatively impact consumers’ finances

Like many medical expenses, fertility treatments are a costly burden on Americans. Among the 15% of Americans who’ve undergone a fertility treatment, 80% say it impacted their finances, with many tapping into their savings (36%) or taking on debt (29%) to offset the costs.

Medical insurance can help shoulder the burden, as almost 40% of those who’ve undergone a fertility treatment say insurance covered all or most of their expenses. However, according to LendingTree health insurance expert Robin Townsend, getting fertility treatments covered isn’t easy.

“Only 20 states have infertility insurance laws,” Townsend says. “And even with regulations in place, fertility coverage can be limited and the requirements difficult to meet.”

For the more than 60% left with most — or all — of their fertility treatment costs, their copayments may be hefty. According to resource site FertilityIQ, a single IVF cycle averages more than $23,000. Beyond that, FertilityIQ says prices rise 10% to 15% yearly.

Exploratory fertility checks (such as tests to determine egg or sperm counts) are the least likely to impact finances. Among those who’ve had fertility treatments, 21% say seeking exploratory fertility checks didn’t affect their finances. Fertility drugs (20%) are also less likely to impact finances.

As far as insurance coverage goes, however, Americans who receive donor eggs are the most likely to have all or most of their costs covered by insurance (44%). Insurance is also more likely to cover egg freezing and fertility drugs (both 43%), as well as IVF treatments (42%).

Generally, the most popular fertility treatments are the ones least likely to impact finances and most likely to receive insurance coverage. Overall, respondents said they’d undergone or would consider getting:

- Exploratory fertility checks (14%)

- Fertility drugs (12%)

- Natural cycle IVF (11%)

- Artificial insemination (11%)

Costs prevent Americans from pursuing fertility treatments

With high treatment costs and little insurance coverage, some Americans who’ve had fertility treatments aren’t returning for more. Nearly 4 in 10 (37%) of those who’ve had a fertility treatment say that while they want to undergo another treatment, they can’t afford it.

In fact, many Americans feel put off by the high cost of fertility treatments. Overall, 12% of respondents say they’ve wanted to pursue fertility treatments but couldn’t afford to do so — and notably, a majority of respondents (69%) say they wouldn’t be willing to take on debt to pay for fertility treatments.

Matt Schulz, LendingTree chief consumer finance analyst, says he isn’t surprised so many Americans wouldn’t take on debt to pay for fertility treatments — particularly because he believes many Americans don’t think they’ll have fertility issues.

He also says the cost of child care plays a role. With many Americans putting off having children (or choosing not to have kids at all), it’s understandable that many wouldn’t want to take on debt to fund fertility treatments.

“As with most things involving money, this is a question of priorities,” Schulz says. “People are willing to spend big on things that really matter to them. For many folks struggling to have a child, there is no greater priority in life than expanding their family, so they’re willing to take on debt — even sizable debt — to make it happen.”

Among the respondents who would take on debt:

- 15% would take on less than $20,000

- 7% would take on $20,000 to $39,999

- 4% would take on $40,000 to $59,999

- 2% would take on $60,000 to $79,999

- 2% would take on $100,000 or more

- 1% would take on $80,000 to $99,999

Gen Zers (ages 18 to 25) are the most likely to take on debt, at 41%. Millennials (ages 26 to 41) (40%) are also more likely to take on debt, while Gen Xers (28%) trail behind.

The cost of having a child puts parents into debt

Many family-minded Americans may be fortunate enough to forgo fertility treatments entirely, but there are other hefty medical expenses new parents face. From prenatal care to postpartum care, the cost of having a child puts many Americans into debt. In fact, among the 59% of respondents who have children, 29% say they took on debt to have a child.

Millennials are the most likely age group to go into debt from the costs of having a child, at 36%. Notably, they’re also the group most likely to have children younger than 18 (53%), which may play a role — particularly as another LendingTree study found that U.S. workers can spend as much as 29% of their income on child care for children younger than 5.

The costs of having a child affect consumers who aren’t parents, too. Among respondents who don’t have children, 33% say they would like to someday, but 31% are worried they’ll never be able to afford children.

5 tips to offset fertility treatment costs

While fertility treatments are expensive, they don’t have to feel out of reach. Consider these five tips to help offset the costs:

- Look into your employee benefits. Double-check your benefits package to see what fertility benefits your job may offer, and check in with your HR or benefits team to learn how to take advantage of them.

- Understand what your insurance covers. “The first thing is to find out whether you have coverage at all,” Townsend says. “Then, look at how different procedures are covered by your plan, and ask your doctor if a lower-cost treatment option would work for you.”

- Compare clinics. Townsend recommends comparing prices at your local clinics. “And don’t be afraid to negotiate,” Townsend says. “You can do this for fertility drugs, too, as they’re a big part of your overall cost.“

- Seek treatment abroad. Townsend says medical tourism is an option for those seeking fertility treatments, though you should check if your insurance provider covers treatment abroad first. “While it may seem costly to travel abroad for treatment, you may save money in the long run,” Townsend says. “If it’s cheaper than what you would pay with insurance, it’s also worth considering. And wherever you plan to go, research the clinic thoroughly — whether it’s inside or outside the U.S.”

- Consider your financing options. A personal loan can help you manage the expensive out-of-pocket costs of fertility treatments, so long as you consider the interest rates and understand the payment plan. You may not need to rely on a financial institution for a loan, either. Some fertility clinics offer IVF loans for patients who can’t pay upfront.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,071 U.S. consumers, fielded May 6-10, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

While the survey also included consumers from the silent generation (those 77 and older), the sample size was too small to include findings related to that group in the generational breakdowns.

Get personal loan offers from up to 5 lenders in minutes

Recommended Articles

Parents, Caregivers Leaving Their Jobs to Manage Their Kids’ Behavioral Health Needs

Parents With Young Children Spend Average of $731 Annually on Kids’ Extracurriculars, and Majority Believe It’ll Lead to Income or Career

Kids and Credit Cards: Parents Frequently Lend Kids Their Cards But Often Get Burned