PNC Bank Personal Loan Review

- APR (with autopay)

- 7.69% – 26.44%

- Eligibility and access: 2/5

- Cost to borrow: 4.5/5

- Loan terms and options: 3.8/5

- Repayment support and tools: 5/5

As of this writing, PNC Bank is among the top 10 banks in the U.S., based on assets. It offers smaller personal loans between $1,000 to $35,000 in select states.

- Don’t have to be a PNC member: Unlike some banks, PNC doesn’t require you to be a current member to qualify for a personal loan.

- Must be a member to apply online: If you don’t currently bank with PNC, you have to apply over the phone or in person at a branch.

- Current members can save more: PNC offers a 0.25% discount to members who sign up for autopay using their PNC checking account.

- No origination fees: Most brick-and-mortar banks skip origination fees, and PNC is no exception.

- Only available in select states: PNC Bank personal loans are only available in Alabama, Arizona, Colorado, Connecticut, District of Columbia, Delaware, Florida, Georgia, Illinois, Indiana, Kentucky, Massachusetts, Maryland, Michigan, Missouri, North Carolina, New Jersey, New Mexico, New York, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Wisconsin and West Virginia.

- Best for current PNC Bank members: If you bank with PNC and need a small loan, it may be worth your time to check rates. You can save by enrolling in autopay with your PNC checking account. Plus, current members can apply online while nonmembers cannot.

PNC Bank pros and cons

Every bank, credit union and online lender has its own drawbacks and benefits. If you’re thinking about shopping with PNC Bank, here are some points to consider.

Pros

- Cheaper rates than a lot of online-only lenders

- Can apply for a joint loan for cheaper rates or better approval odds

- Personal lines of credit are also available

Cons

- Only available in about half of the country

- Can take days to get an approval decision

- Autopay discount requires a PNC checking account

- Can’t check rates without hurting your credit

PNC Bank offers personal loans with competitive rates. Generally, banks tend to offer lower rates than online lenders. They also typically have fewer fees. PNC doesn’t charge an origination fee, for example.

However, there are often some tradeoffs when going with a traditional bank. In PNC’s case, that tradeoff is convenience.

Nonmembers must call or go into a branch to apply. And member or not, approval decisions can take days. By contrast, many online lenders offer near-instant approvals.

Traditional banks usually offer a suite of products, including PNC. For example, it offers personal lines of credit (PLOCs) as well as personal loans. If you need to borrow money on an ongoing basis, a PLOC makes more sense.

PNC Bank requirements

PNC doesn’t shed light into its personal loan requirements. It will review your credit history, how long you’ve been employed, your citizenship status and more. You must also have a Social Security number and a government-issued photo ID.

Learn more about personal loan requirements and how lenders like PNC make approval decisions.

Additionally, you can only get a PNC loan if you live in one of the below states.

| Alabama | Florida | Michigan | Pennsylvania |

| Arizona | Georgia | Missouri | South Carolina |

| Colorado | Illinois | North Carolina | Tennessee |

| Connecticut | Indiana | New Jersey | Texas |

| District of Columbia | Kentucky | New Mexico | Virginia |

| Delaware | Massachusetts | New York | Wisconsin |

| Florida | Maryland | Ohio | West Virginia |

If PNC Bank’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a personal loan with PNC Bank

Apply for a personal loan online, over the phone or in person

You can’t prequalify for a personal loan with PNC Bank. Prequalification lets you check your eligibility and rates without a hard credit pull. Instead, you have to submit a formal application to see if you qualify. This will probably drop your credit score temporarily by a handful of points.

If you already bank with PNC, you can apply for a loan on PNC’s website. Otherwise, you will have to call or apply in person at a branch location.

When you apply, PNC will ask you for some basic information, like your name, Social Security number and annual income. You’ll also need to know the names of your creditors and the amounts you owe if you’re consolidating debt.

Wait for a decision and if approved, get your money

Expect to wait a few days before hearing back from PNC. If approved, you may be able to sign electronically. Otherwise, you will have to sign at a branch. You will get your funds immediately in both cases.

Start repaying

Your first monthly payment will likely be due about 30 days after you sign your loan agreement. Check your payment schedule to be certain — a missed payment can drastically drop your credit score.

How PNC Bank compares to other personal loan companies

Even if you believe PNC Bank aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare other lenders. Here’s how PNC Bank stacks up against similar personal loan lenders.

| Lender | PNC Bank | Wells Fargo Bank | Upstart |

|---|---|---|---|

| LendingTree’s rating | 3.7/5 | 4.4/5 | 4.4/5 |

| Minimum credit score | Not specified | Not specified | None |

| APRs | 7.69% – 26.44% (with autopay) | 6.74% – 25.99% (with discount) | 6.50% – 35.99% |

| Loan amounts | $1,000 – $35,000 | $3,000 – $100,000 | $1,000 – $75,000 |

| Repayment terms | 6 to 60 months | 12 to 84 months | 36 to 60 months |

| Origination fee | None | None | Varies |

| Funding timeline | May get an approval decision in a few days and same-day funding available after approval | Get money as soon as the same day | Get money as soon as the next business day |

| Bottom line | PNC Bank offers the smallest loans and shortest terms. This isn’t always a bad thing. The less you borrow and the faster you pay it off, the less interest you’ll pay. | Wells Fargo Bank only offers personal loans if you’ve banked with it for at least a year. If you meet this criteria, you could get some of the lowest rates on the market. You could also get a same-day loan. | Upstart is an online lending platform with partners that do business nationwide. However, your loan could come with an origination fee.

You don’t pay origination fees up front on a personal loan. The lender usually rolls them into your loan, where they will accrue interest. You may also need to borrow more money to make up for the fee in order to get the amount you need.

|

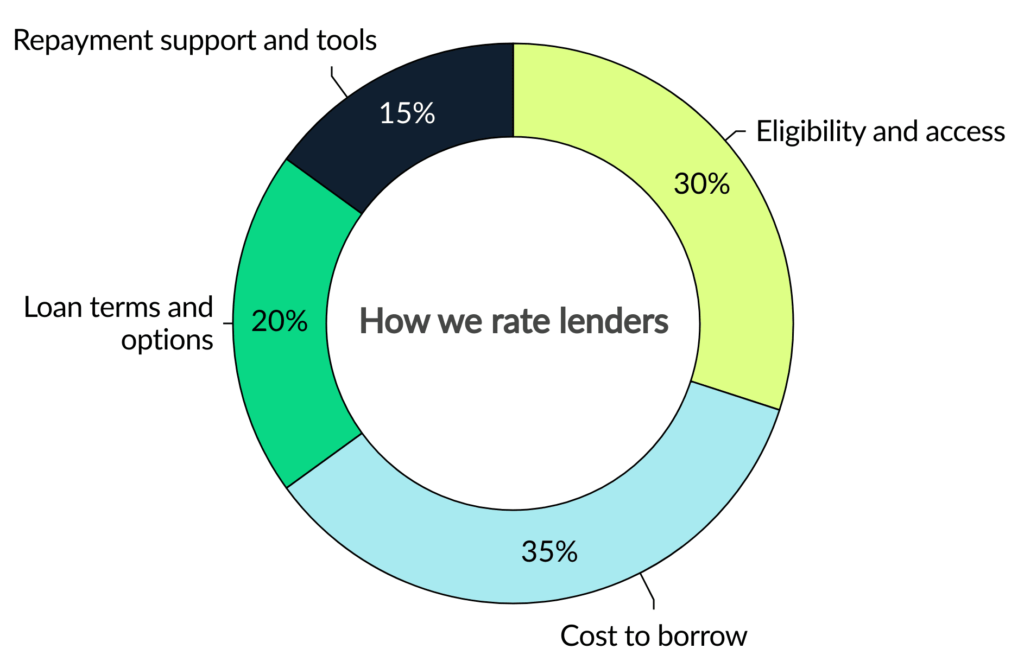

How we rated PNC Bank

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

PNC Bank could be a great option if you qualify and live in a state where it does business. PNC personal loans have low rates, discount opportunities for existing customers and it doesn’t charge origination fees.

It can take a few days to get an approval decision with PNC Bank. If you need an emergency loan, you might want to consider other options. SoFi and LightStream offer same-day loans, for instance.

Every lender has different rates and eligibility requirements, so there’s no one bank that’s best for everyone. If you want to compare top options, read our roundup of the best personal loans from banks to see which lenders consistently offer competitive rates and flexible terms.

Get personal loan offers from up to 5 lenders in minutes