How to Do a Cash Flow Analysis with Examples

Cash flow analysis puts your cash flow statement under the microscope to understand what causes money to flow into and out of your business.

The expression “cash is king” means a business needs cash to stay healthy and reward shareholders. Cash flow analysis tells you if you’re generating cash or burning cash, and why.

What is a cash flow statement?

A cash flow statement is an accounting report that lists every category of transaction that either brought cash into or took cash out of your business during a given period — that period may be a month, quarter or full year. Incoming cash appears as a positive number and is called “positive cash flow.” Outgoing cash appears as a negative number and is called “negative cash flow.”

“Net cash flow” is the sum of all the positive and negative flows on the report. Positive net cash flow means you’re accumulating cash. Negative net cash flow means you’re depleting cash reserves. Negative net cash flow may be unavoidable for short periods with unusual expenditures, but must turn positive before you run out of money.

Prepare your cash flow analysis: Step by step

To prepare a business cash flow analysis, follow these few steps, which start with gathering financial information about your business.

Step 1. Identify your net income for the period you’re analyzing

The first step to understanding cash flow is identifying your net income. You find this number on your income statement, which itemizes your revenue from products and services you offer, minus your operating expenses, taxes and interest payments. Use an income statement that matches the period you want to analyze.

Step 2. Identify other sources and uses of cash during the period

Net income isn’t the only item that affects cash. Things like getting a loan, putting down a security deposit, collecting receivables from customers, stockpiling inventory and buying equipment don’t appear on your income statement.

To calculate the amount of cash these activities are generating or depleting, compare the balance sheet at the beginning of the period you’re analyzing with the balance sheet at the end of the period.

For example, if your beginning balance sheet says you had $1 million in debt, but the end-of-period balance sheet shows a balance of only $750,000, you can calculate that you paid off $250,000 in debt during the period.

Step 3. Create your cash flow statement

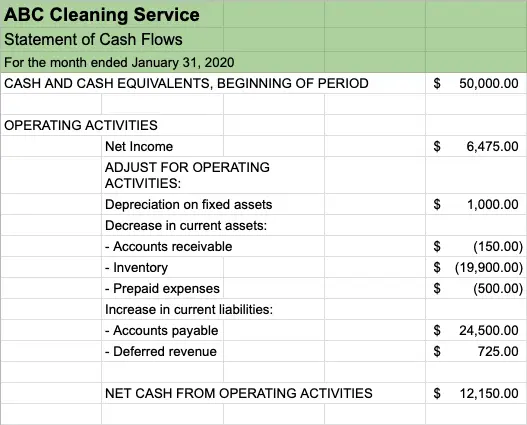

After you’ve gathered information regarding your net income and other sources and uses of cash, you can create a cash flow statement. A standard cash flow statement has three sections:

Operating activities

This section summarizes cash flows caused by your company’s core business activities. It begins with net income from your income statement. Then depreciation and any other non-cash expenses are added back. Finally, using the balance sheet changes you calculated in Step 2, you list the other cash movements that are directly related to your daily operations. This typically includes changes in the accounts receivable, accounts payable and inventory.

The sum of all the inflows and outflows in this section should be a positive number; if not, it’s a serious red flag that you’re operating at a deficit

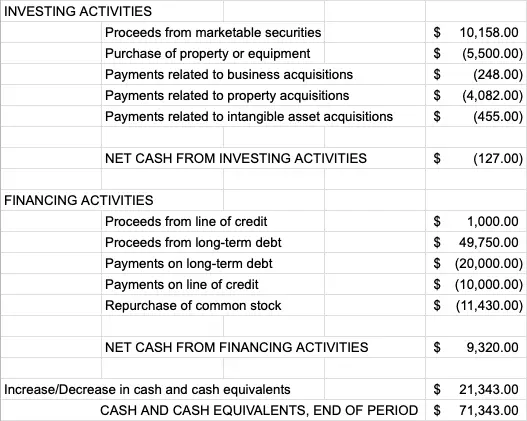

Investing activities

This section lists cash inflows and outflows for investments, including the purchase of property and equipment as well as investments in other companies and in marketable securities like stocks and bonds. You get these numbers by comparing the balance sheets for the beginning and ending of the period you’re analyzing.

It’s normal for the sum of the investing activities section to be a negative number because healthy companies often make investments to grow their business.

Financing activities

This section describes how you’re financing your business with debt and equity. It records changes between the beginning and ending balance sheets for items like short- and long-term debt and common and preferred stock.

The sum of the cash inflows and outflows in this section is usually a positive number because it’s normal for businesses to obtain additional financing as they grow.

Step 4. Analyze your cash flow statement

The cash flow statement tells the story of how much cash you started the period with, how that was increased or decreased by each activity and how much you ended up with. Now that you’ve done the hard work of plugging in the numbers — see the example worksheet below — it’s time to analyze the cash flow patterns.

Your first priority: free cash flow

While positive net cash flow from operations is a good start, it’s important to continue making investments in facilities and equipment to maintain and improve your operations. That’s why analysts focus on “free cash flow,” which is generally defined as cash flow from operations minus capital expenditures. Free cash flow shows how much cash is left over after you’ve made necessary investments to maintain your business activities. If free cash flow is negative, it means you’re unable to afford the required upkeep of your infrastructure.

The good news is that standard accounting software can automatically produce a cash flow statement for any period you want to analyze. For general management purposes, running a cash flow analysis once a quarter is usually adequate. However, if you’re close to the limit of your cash reserves, a monthly or even weekly analysis may be advisable.

Make sure you stay up to date on inputting all transactions into your accounting system, because the report will only be as accurate as the data that’s in it.

Cash flow analysis examples

The standard format used in preparing cash flow statements in the U.S.is called the “indirect method,” which is shown in the example below. If you don’t have accounting software, you can create a cash flow statement manually using free Excel templates from sites such as Vertex42.

Small businesses without accounting software or a bookkeeping service sometimes use the “direct method.” This is a time-consuming approach that requires listing every item that provided or used any cash during the period. A “direct method” cash flow statement can be error prone and difficult to analyze due to the large number of individual line items it contains. Most businesses will benefit from using accounting software to save time while staying accurate.

Remember, the specific information in your cash flow statement will match your company’s individual circumstances. For instance, if your business did not buy an existing business, property or intangible assets, your cash flow statement won’t include those lines.

If you’d like to see real-world examples, you can find the cash flow statements of public companies online. For instance, you can view Amazon’s annual report to see how a major corporation organizes its financial information; their cash flow statement is on page 37 of this report.

Interpreting a cash flow statement

Interpreting a cash flow statement means analyzing where money came from and where it was spent so you can identify where improvements are needed. Remember, net income is only one element of cash flow, so your income statement doesn’t give you the full picture of your company’s financial health: You need to understand the other cash movements as well.

Better time your expenses

Since the cash flow statement tells you when your business actually receives money, it can help you better time your expenses. Try to schedule major cash expenditures, such as purchases of equipment, insurance renewals or employee bonuses, to coincide with your periods of strongest cash flow: This will save you the cost of borrowing money to cover your obligations.

Look for patterns of deficits

If you detect a pattern of negative cash flows occurring repeatedly, analyze what’s causing it.

In operating activities, recurring negative net cash flow is an alarm signal that your core business may be heading toward disaster. If it’s due to weak net income, you must find a way to either raise prices or reduce costs. If net income is fine but total operating cash flow is negative, then you likely are having a problem collecting money or are overstocking inventory.

For investing activities, negative net cash flow is acceptable if the investments you’re making are productive for your business, and you have enough money to pay for them from operating cash flow or prudent financing strategies like equipment loans.

Make financing and expansion decisions

Cash flow statement analysis gives you a roadmap for financing and expansion strategy. For example, if your net operating cash flow and free cash flow are positive, it’s a sign your business is healthy and it may be a good time to consider raising money for expansion by getting a loan or issuing stock.

On the other hand, if your free cash flow is negative, you’re already relying on debt and equity financing just to stay afloat, so it may be advisable to delay expansion until it’s positive.

Tips for small business cash flow management

Now that you’ve completed your corporate cash flow statement analysis, you can focus on areas for improvement. Here are some tips for small business cash flow management:

1. Plan for upcoming expenses

Now that you know what causes money to move in and out of the business, you can plan for periods when you anticipate a cash crunch. Establishing a business line of credit with no maintenance or annual fee can be one way to ensure access to quick funding if needed.

2. Increase your income

Net income is a key element of cash flow: How can you increase it? Options to consider include charging more for your products and services (although not so much that you lose customers) or reducing your expenses by finding lower cost providers of materials and services.

You can also explore growing your business by hiring more employees to increase production, expanding your product line or adding retail locations.

3. Re-examine your payment schedules

Are you paying your bills before they’re due, or giving your customers better credit terms than you’re getting from your own suppliers? These common mistakes can significantly hurt your cash flow.

Try to negotiate 90-day payment plans with your vendors (without interest or penalties). Also consider offering customers incentives to pay faster, or look into factoring your invoices.

4. Be cautious with your investment

It’s tempting to invest in the most elegant decor, the latest technology and lots of inventory. But all these things eat up cash. Be cautious with your investment dollars to avoid falling into a cash flow hole you may not get out of.

Compare business loan offers

Recommended Articles