Employer Identification Number (EIN): Who Needs It and How to Find It

An employer identification number (EIN) is like a personal Social Security number for a business, helping the IRS track its activity. It’s essential for business owners to have. If you don’t know your EIN, there are a few ways to find out what it is.

What is an EIN?

An employer identification number is a nine-digit number assigned by the IRS that identifies your business. An EIN is required for certain businesses, and can be helpful even when it’s not required.

You can use an EIN to open a business bank account, apply for business licenses and business loans and file tax returns. It also allows business owners to give out a federal tax ID number that’s different from their Social Security number. Apply online to get an EIN immediately

When you apply for an EIN online, you’ll generally receive your number immediately and you can use it right away, including for opening a bank account or applying for a business license.

You can also apply by mail, fax or phone — jump ahead to learn more about the application process, or keep reading if you’re not sure if you need an EIN.

Who needs an EIN?

Businesses of all types are welcome to apply for an EIN. However, the IRS requires businesses to get an EIN if you:

- Pay at least one employee

- Operate a business as a corporation or partnership

-

File the following tax returns:

- Employment

- Excise

- Alcohol, tobacco and firearms

- Withhold taxes on income, other than wages, paid to a nonresident immigrant

- Have a tax-deferred Keogh plan for employee pensions

- Are involved with any of the following types of organizations: Trusts (excluding certain revocable trusts, IRAs and for Exempt Organization Business Income Tax Returns), estates, real estate mortgage investment conduits, nonprofit organizations, farmers’ cooperatives and plan administrators

If the IRS considers you to be an employer, you’ll need an EIN

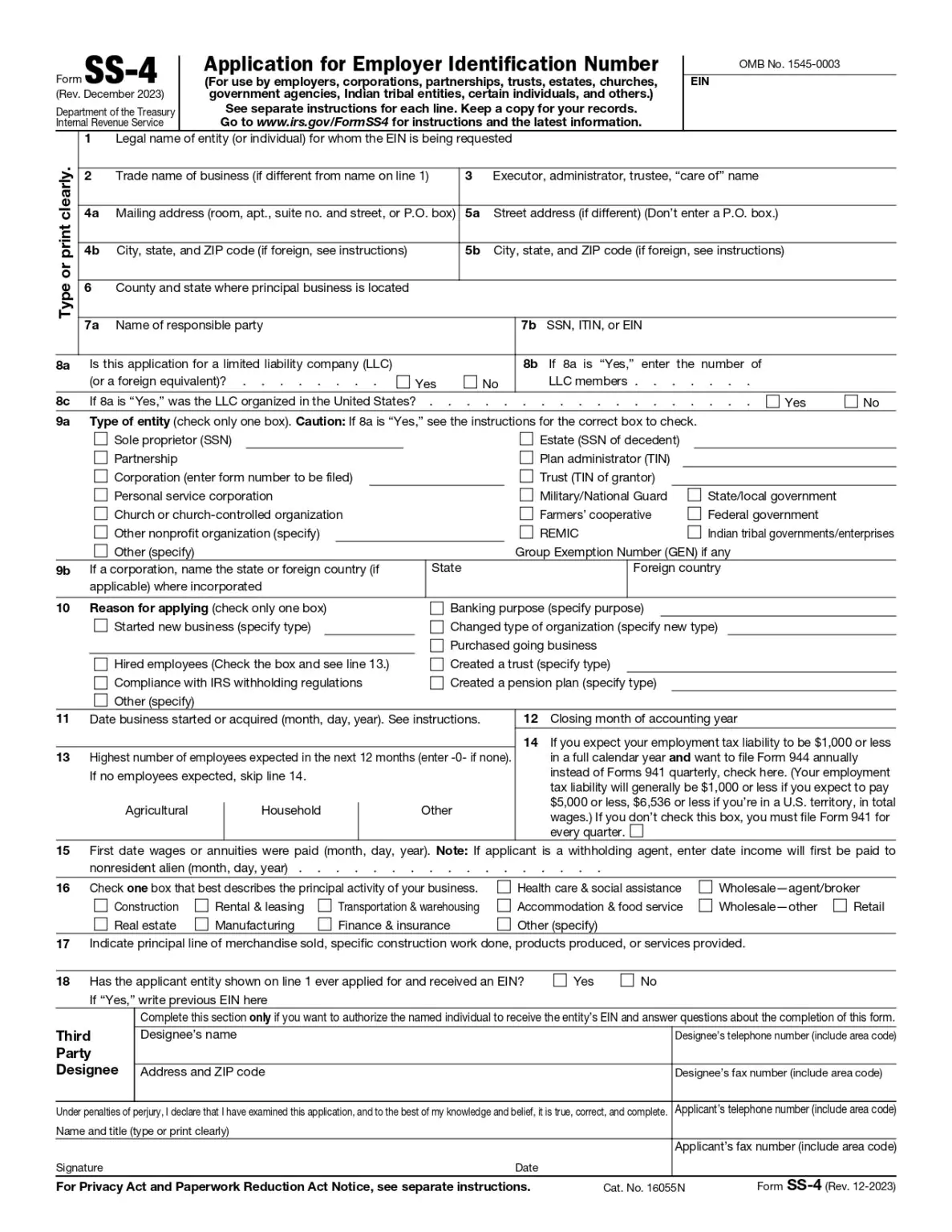

How to apply for an EIN

Applying online is the simplest and quickest way to get an EIN. The EIN’s online application is available to anyone whose business or legal residence is in the United States. To get an EIN online:

- Go to the EIN assistant on the IRS website

- Answer the questions on the screen

- Your EIN will be issued immediately online

The online EIN application system is available through the IRS Monday through Friday from 7 a.m. to 10 p.m, Eastern time.

To get an EIN, you’ll need to know:

- The established name of your business. This could be your own name if you run a sole proprietorship.

- Your Taxpayer Identification Number, which is your own Social Security number

- What type of entity you operate

- The principal activity of your business, or what your business does

- Your reason for needing an EIN

- The length of time you’ve been in business

- The number of employees you expect to have in the next 12 months

If you operate your business as an LLC, you’ll also need to indicate how you’re taxed by the IRS. By default, a domestic single-member LLC is considered a “disregarded entity,” while a domestic LLC with two or more members is treated as a partnership. You’ll need to fill out additional paperwork if you want to be classified differently.

Read the SS-4 instructions carefully to make sure you fill out this section correctly or follow the prompts online.

Other ways to apply

If you don’t have a legal residence or a principal place of business or agency in the U.S., you can apply over the phone. This option isn’t available to U.S. residents. You can reach the IRS at 267-941-1099 from 6 a.m. to 11 p.m. Eastern time, Monday through Friday.

You can also submit form SS-4 by mail or fax.

How long does it take to get an EIN?

How long it takes depends on how you submit your application:

- If you apply online, the application is a series of prompts and must be completed in one sitting; you’ll receive your EIN immediately after submitting the form.

- If you apply by fax, you’ll be faxed your EIN within four business days of submitting Form SS-4.

- If you apply by mail, expect the form to be processed within four weeks.

- International applicants who apply by calling can get an EIN immediately over the phone.

When a business needs to reapply for an EIN

Businesses may need a new EIN when the business changes hands or changes its structure. Each type of business entity has to apply for a new EIN under the following circumstances:

Sole proprietors, if you:

- Are subject to a bankruptcy proceeding

- Incorporate

- Become a partnership

- Purchase or inherit an existing business that will operate as a sole proprietorship going forward

Sole proprietors don’t need a new EIN if they change their business name or location or if they operate multiple businesses under one name.

Corporations, if you:

- Receive a new corporate charter from the secretary of state

- Are a subsidiary of a parent corporation and have been using the parent’s EIN

- Change from a partnership to a sole proprietorship

- Are part of a new corporation that was created after a merger

Businesses that are a division of a corporation don’t need a new EIN, nor do existing corporations that survived a merger. Corporations that declare bankruptcy, change names or locations or choose to file taxes as an S corporation also won’t need to apply for a new EIN. If a corporate reorganization changes only the name or the place of business, then the corporation doesn’t need a new EIN.

Partnerships, if you:

- Incorporate

- Leave the partnership and it becomes a sole proprietorship

- Terminate an old partnership and start a new one

Partnerships that declare bankruptcy, change names or add or change locations aren’t required to get a new EIN. If 50% or more of the ownership of the partnership, measured in capital and profits, changes hands within a 12-month period, the business also won’t need a new EIN.

Benefits of having an EIN, even if you don’t need it

The U.S. Small Business Administration recommends applying for an EIN immediately after you register your business entity with your state or local government. An employer identification number:

Protects your Social Security number

Setting up an EIN can help protect your Social Security number from overexposure or falling into the wrong hands. For freelancers, using an EIN on your tax forms allows you to avoid sharing your Social Security number with every client who pays you.

If you’re a sole proprietor, you can use an EIN rather than your Social Security number when sending 1099 forms to any contractors or freelancers that you pay.Makes it easier to open a business bank account

As discussed earlier, many banks require an EIN for business accounts — they want to make sure you have a legitimate business and the right to sign checks as the legal, declared owner of that business. Banks don’t want to set up business accounts for anyone who could expose the institution to dangerous or illegitimate business practices.

A business bank account helps maintain a clear distinction between your business and personal finances. It’s always a good idea to keep your personal and professional expenses separate.

Helps you build business credit

An EIN separates you from your business and can be connected to your business credit score. If you want to help protect your personal credit and establish a business credit profile, having an EIN is an important step.

EIN lookup: How to find your business tax ID

If you previously received an EIN but misplaced your number, the IRS recommends the following steps to find or verify your EIN.

Find your original confirmation letter from the IRS.

As we mentioned earlier, when you apply for an EIN online, the number is immediately available to you. After applying, you get an EIN letter that you can print from your browser, and the IRS also sends you a copy in the mail. If you kept screenshots or paper copies of that letter, your EIN will be on it.

Call any organization where you used your EIN.

Since you’d likely need an EIN to open a business bank account or get a business license, the bank or license agency should have your EIN on file. Any other organization that required you to provide your EIN would keep the number on file as well.

Check old tax returns.

Previously filed tax returns for your business will be notated with your EIN. You should keep copies of tax returns and the accompanying records for two to three years, or longer depending on the details of your return.

Contact the IRS.

You can call the Business and Specialty Tax Line at 800-829-4933 Monday through Friday between 7 a.m. and 7 p.m. local time. You’ll need to provide identifying information to help an IRS representative find your number — you won’t need to pay to talk to an IRS agent.

To receive your EIN over the phone, you must be either a sole proprietor, a partner in a partnership, a corporate officer, a trustee of a trust or an executor of an estate.

How to look up another business’s EIN

You can look up another business’s EIN for free using the SEC’s Edgar system, as long as it’s a public company. Start by typing the company’s name or ticker symbol into the search box. Once you click on the business’s name, you’ll be directed to a page with details about the company, including its latest company filings and reports. From there, expand the “company information” box, and you should find the EIN.

To find a charitable organization’s EIN, the IRS Tax Exempt Organization Search page is also free to use. In the main search menu, select “search by organization name.” You can also enter the organization’s city and state, if you know it, to help narrow down the results.

Finding the EIN for a private company can be a little trickier, since there isn’t a central database. In this case, your best bet is to contact the company’s accounting or finance department directly to ask for the EIN. You could also consider using a paid service or pay-to-search database to locate a company’s EIN — but it’s important to check if the service is legitimate before spending any money.

Frequently asked questions

You can call the IRS at 800-829-4933 to request your EIN. However, the IRS will only share an EIN over the phone with someone who is authorized to receive it, such as a sole proprietor, a partner in a partnership or a corporate officer, among others.

Generally, you’ll need an EIN if your business pays at least one employee, unless you’re a sole proprietor. You may also need an EIN if your business is a partnership or a corporation, or if you meet other IRS criteria. But even if an EIN isn’t required for your business by the IRS, applying is still a good idea for other reasons, like setting up business banking.

An EIN is a type of taxpayer identification number used for businesses in the U.S. You’ll need it to report your business income to the government, similar to how an individual uses their Social Security number to report employment income on their tax return.