Cheapest Car Insurance in South Dakota (2026)

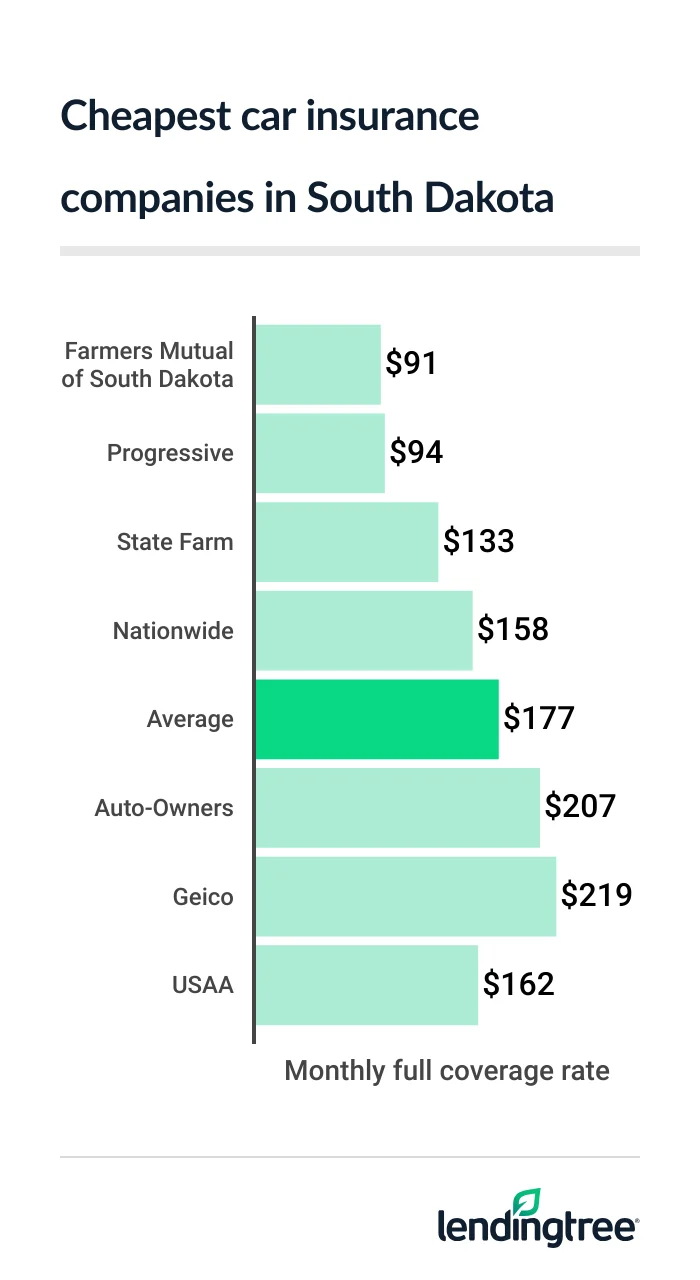

FMNE has the cheapest car insurance quotes in South Dakota, at $91 a month for full coverage. That’s $86 less than the state average.

Best cheap car insurance in South Dakota

South Dakota’s cheapest full coverage car insurance: FMNE

FMNE

The state average for full coverage

Along with FMNE and Progressive, State Farm, Nationwide and USAA also offer full coverage insurance that’s cheaper than this amount.

Cheapest company for full coverage

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| FMNE | $91 | |

| Progressive | $94 | |

| State Farm | $133 | |

| Nationwide | $158 | |

| Auto-Owners | $207 | |

| Geico | $219 | |

| North Star Mutual | $233 | |

| Farm Bureau | $298 | |

| USAA* | $162 | |

Progressive might be the cheapest company for you if you can get a few of its many car insurance discounts.

Progressive has discounts for insuring multiple vehicles, buying more than one policy and owning a home. It also offers savings for getting an online quote, signing documents online, setting up automatic payments and paying for your entire policy period up front.

Cheapest liability insurance in South Dakota: FMNE

At $14 a month, FMNE also has the cheapest liability insurance for South Dakota drivers. Progressive is just $1 more, though, with an average rate of $15 a month.

Cheapest company for liability coverage

| Company | Monthly rate |

|---|---|

| FMNE | $14 |

| Progressive | $15 |

| State Farm | $21 |

| North Star Mutual | $35 |

| Farm Bureau | $40 |

| Auto-Owners | $41 |

| Geico | $43 |

| Nationwide | $46 |

| USAA* | $25 |

State Farm is worth a look as well if you want affordable liability

The average cost of liability car insurance in South Dakota is $31 a month.

Best cheap car insurance in South Dakota for teen drivers: FMNE

For the cheapest teen car insurance in South Dakota, compare quotes from FMNE when you shop for a policy.

FMNE has the state’s cheapest teen liability rate of $38 a month. It also has the cheapest full coverage rate for teen drivers, at $153 a month.

Cheapest companies for teen drivers

| Company | Liability only | Full coverage |

|---|---|---|

| FMNE | $38 | $153 |

| North Star Mutual | $50 | $294 |

| State Farm | $69 | $308 |

| Progressive | $77 | $355 |

| Farm Bureau | $110 | $559 |

| Auto-Owners | $131 | $494 |

| Nationwide | $140 | $385 |

| Geico | $161 | $666 |

| USAA* | $64 | $312 |

North Star Mutual has the second-cheapest liability rates for South Dakota teens, at $50 a month. It’s also the second-cheapest for teen full coverage, at $294 a month.

Discounts are one of the best ways to save money on car insurance for teen drivers. The good news is that many companies offer discounts for teens and young adults who:

- Complete a driver’s education or training program

- Get good grades

- Go to college without a vehicle

Cheap car insurance quotes in South Dakota after a speeding ticket: FMNE

FMNE is South Dakota’s cheapest auto insurance company for drivers with a speeding ticket on their records. Its average rate is $106 a month.

Progressive and State Farm are next. Progressive’s average rate after a ticket is $126 a month, while State Farm’s is $138 a month.

Cheapest companies after a ticket

| Company | Monthly rate |

|---|---|

| FMNE | $106 |

| Progressive | $126 |

| State Farm | $138 |

| Nationwide | $225 |

| North Star Mutual | $233 |

| Auto-Owners | $249 |

| Geico | $283 |

| Farm Bureau | $367 |

| USAA* | $198 |

A typical driver in South Dakota pays $214 a month for car insurance after getting a speeding ticket. This is $37 more than what drivers with a clean record pay for the same coverage.

One of the best ways to get the most affordable rate with a clean or bad driving record is to compare car insurance quotes from several companies before you buy or renew a policy.

South Dakota’s cheapest car insurance after an accident: FMNE

With an average rate of $118 a month, FMNE has the cheapest car insurance after an accident for South Dakota drivers.

State Farm and Progressive aren’t too much more expensive for these drivers. State Farm’s average rate after an accident is $133 a month, while Progressive’s is $145. The state average is $270 a month.

Cheapest companies after an accident

| Company | Monthly rate |

|---|---|

| FMNE | $118 |

| State Farm | $133 |

| Progressive | $145 |

| Nationwide | $271 |

| Auto-Owners | $282 |

| North Star Mutual | $401 |

| Geico | $414 |

| Farm Bureau | $455 |

| USAA* | $209 |

Although Progressive’s average rate is higher than those for State Farm and FMNE, its many discounts could help make it the most affordable for you.

Something else that could help Progressive stand out for you is that it offers more coverage options than most other car insurance companies.

For an extra cost, you can get accident forgiveness

Best cheap insurance in South Dakota for teens with bad driving records: FMNE

Teens in South Dakota with a speeding ticket or accident on their driving records usually get the cheapest auto insurance from FMNE.

FMNE’s average rate for teens with a speeding ticket is $50 a month. For teens with an accident, the company’s rates average $63 a month.

Cheapest companies for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| FMNE | $50 | $63 |

| North Star Mutual | $58 | $79 |

| State Farm | $75 | $69 |

| Progressive | $80 | $84 |

| Auto-Owners | $131 | $179 |

| Farm Bureau | $145 | $183 |

| Nationwide | $151 | $153 |

| Geico | $188 | $209 |

| USAA* | $87 | $91 |

Compare quotes from North Star Mutual, State Farm and Progressive as well if you’re looking for cheap teen car insurance with incidents on your record. Their average quotes are close enough to FMNE’s that discounts could make any of them your cheapest option.

Cheap car insurance quotes after a DUI in South Dakota: Progressive

Progressive has the cheapest DUI insurance in South Dakota, at $114 a month.

FMNE is the state’s second-cheapest company for drivers with a DUI (driving under the influence) conviction. Its average rate is $166 a month.

Cheapest companies after a DUI

| Company | Monthly rate |

|---|---|

| Progressive | $114 |

| FMNE | $166 |

| State Farm | $220 |

| Auto-Owners | $358 |

| Nationwide | $361 |

| Farm Bureau | $627 |

| North Star Mutual | $670 |

| Geico | $766 |

| USAA* | $327 |

An average driver sees their car insurance costs more than double after getting a DUI in South Dakota. You may see a smaller increase depending on where you bought your policy, however. Progressive only raises the rates of its customers an average of 21% after a DUI, for example.

Cheapest South Dakota auto insurance for bad credit: FMNE

At $135 a month, FMNE has South Dakota’s cheapest car insurance for drivers with bad credit.

Progressive is nearly as cheap, however, with an average rate that is just $11 more than FMNE’s.

Cheapest companies for drivers with poor credit

| Company | Monthly rate |

|---|---|

| FMNE | $135 |

| Progressive | $146 |

| Nationwide | $269 |

| Geico | $314 |

| North Star Mutual | $386 |

| Farm Bureau | $556 |

| Auto-Owners | $639 |

| State Farm | $716 |

| USAA* | $301 |

The state average rate for car insurance with bad credit is $385 a month. This is more than twice what a typical driver with good credit pays in South Dakota.

Find out your credit score for free with LendingTree Spring before you shop for car insurance.

Best car insurance companies in South Dakota

FMNE and Progressive are the best car insurance companies in South Dakota, based on our data and research.

FMNE has the cheapest car insurance rates for most of the state’s drivers. It only offers basic coverage options, however, and it doesn’t have as many discounts as most large companies.

Progressive often has rates that are a bit higher than FMNE’s, but it offers many discounts that may make it the most affordable option for some drivers. It’s also great for people who like to customize their policies with additional coverage types.

South Dakota car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| Auto-Owners | 638 | A+ | |

| FMNE | Not rated | Not rated | |

| Farm Bureau | 645 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| North Star Mutual | Not rated | A+ | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

South Dakota insurance rates by city

The cheapest city for car insurance in South Dakota is Shindler, where rates average $142 a month.

Allen is the state’s most expensive city for car insurance. Rates there average $235 a month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Aberdeen | $148 | -16% |

| Agar | $184 | 4% |

| Agency Village | $160 | -10% |

| Akaska | $180 | 1% |

| Alcester | $152 | -14% |

| Alexandria | $158 | -11% |

| Allen | $235 | 33% |

| Alpena | $163 | -8% |

| Amherst | $159 | -10% |

| Andover | $162 | -9% |

| Antelope | $225 | 27% |

| Arlington | $153 | -13% |

| Armour | $163 | -8% |

| Artesian | $162 | -8% |

| Ashland Heights | $179 | 1% |

| Ashton | $163 | -8% |

| Astoria | $153 | -14% |

| Athol | $161 | -9% |

| Aurora | $145 | -18% |

| Avon | $165 | -7% |

| Badger | $156 | -12% |

| Baltic | $158 | -11% |

| Barnard | $155 | -12% |

| Batesland | $225 | 27% |

| Bath | $155 | -13% |

| Belle Fourche | $191 | 8% |

| Belvidere | $224 | 26% |

| Bemis | $154 | -13% |

| Beresford | $152 | -14% |

| Big Stone City | $158 | -11% |

| Bison | $229 | 29% |

| Blackhawk | $187 | 6% |

| Blunt | $182 | 3% |

| Bonesteel | $185 | 5% |

| Bowdle | $173 | -3% |

| Box Elder | $180 | 2% |

| Bradley | $162 | -9% |

| Brandon | $146 | -18% |

| Brandt | $153 | -14% |

| Brentford | $157 | -11% |

| Bridgewater | $156 | -12% |

| Bristol | $158 | -11% |

| Britton | $160 | -10% |

| Brookings | $144 | -19% |

| Bruce | $149 | -16% |

| Bryant | $158 | -11% |

| Buffalo | $222 | 25% |

| Buffalo Gap | $206 | 16% |

| Bullhead | $221 | 25% |

| Burbank | $151 | -15% |

| Burke | $189 | 6% |

| Butler | $158 | -11% |

| Camp Crook | $224 | 26% |

| Canistota | $157 | -11% |

| Canova | $159 | -10% |

| Canton | $152 | -14% |

| Caputa | $190 | 7% |

| Carpenter | $159 | -10% |

| Carthage | $160 | -10% |

| Cavour | $162 | -9% |

| Chamberlain | $187 | 5% |

| Chancellor | $155 | -13% |

| Chelsea | $163 | -8% |

| Cherry Creek | $223 | 26% |

| Claire City | $156 | -12% |

| Clark | $162 | -9% |

| Clear Lake | $153 | -14% |

| Colome | $192 | 8% |

| Colonial Pine Hills | $183 | 3% |

| Colton | $156 | -12% |

| Columbia | $156 | -12% |

| Conde | $161 | -9% |

| Corona | $158 | -11% |

| Corsica | $166 | -6% |

| Cottonwood | $192 | 8% |

| Cresbard | $167 | -6% |

| Crooks | $150 | -15% |

| Custer | $203 | 14% |

| Dakota Dunes | $149 | -16% |

| Dallas | $190 | 7% |

| Dante | $165 | -7% |

| Davis | $156 | -12% |

| De Smet | $161 | -9% |

| Deadwood | $191 | 8% |

| Dell Rapids | $156 | -12% |

| Delmont | $163 | -8% |

| Denby | $225 | 27% |

| Dimock | $161 | -9% |

| Dixon | $190 | 7% |

| Doland | $167 | -6% |

| Draper | $222 | 25% |

| Dupree | $223 | 26% |

| Eagle Butte | $222 | 25% |

| Eden | $158 | -11% |

| Edgemont | $196 | 10% |

| Egan | $151 | -15% |

| Elk Point | $147 | -17% |

| Elkton | $148 | -17% |

| Ellsworth AFB | $183 | 3% |

| Elm Springs | $189 | 6% |

| Emery | $159 | -10% |

| Enning | $190 | 7% |

| Erwin | $156 | -12% |

| Ethan | $159 | -10% |

| Eureka | $172 | -3% |

| Fairburn | $197 | 11% |

| Fairfax | $184 | 4% |

| Fairview | $152 | -14% |

| Faith | $191 | 8% |

| Faulkton | $176 | -1% |

| Fedora | $160 | -10% |

| Ferney | $154 | -13% |

| Firesteel | $223 | 26% |

| Flandreau | $149 | -16% |

| Florence | $151 | -15% |

| Fort Meade | $191 | 8% |

| Fort Pierre | $184 | 4% |

| Fort Thompson | $188 | 6% |

| Frankfort | $161 | -9% |

| Frederick | $158 | -11% |

| Freeman | $160 | -10% |

| Fulton | $158 | -11% |

| Gann Valley | $181 | 2% |

| Garden City | $159 | -10% |

| Garretson | $153 | -14% |

| Gary | $155 | -12% |

| Geddes | $166 | -6% |

| Gettysburg | $185 | 4% |

| Glad Valley | $224 | 26% |

| Glencross | $220 | 24% |

| Glenham | $181 | 2% |

| Goodwin | $154 | -13% |

| Green Valley | $179 | 1% |

| Gregory | $189 | 7% |

| Grenville | $160 | -10% |

| Groton | $156 | -12% |

| Hamill | $190 | 7% |

| Harrisburg | $147 | -17% |

| Harrison | $165 | -7% |

| Harrold | $186 | 5% |

| Hartford | $154 | -13% |

| Hayes | $203 | 14% |

| Hayti | $153 | -14% |

| Hazel | $155 | -13% |

| Hecla | $160 | -10% |

| Henry | $152 | -14% |

| Hermosa | $196 | 11% |

| Herreid | $186 | 5% |

| Herrick | $187 | 5% |

| Highmore | $189 | 7% |

| Hill City | $196 | 10% |

| Hitchcock | $161 | -9% |

| Holabird | $186 | 5% |

| Hosmer | $166 | -7% |

| Hot Springs | $194 | 9% |

| Houghton | $157 | -11% |

| Hoven | $180 | 2% |

| Howard | $161 | -9% |

| Howes | $192 | 9% |

| Hudson | $152 | -14% |

| Hurley | $156 | -12% |

| Huron | $160 | -10% |

| Ideal | $190 | 7% |

| Interior | $229 | 29% |

| Ipswich | $163 | -8% |

| Irene | $158 | -11% |

| Iroquois | $161 | -9% |

| Isabel | $223 | 26% |

| Java | $180 | 2% |

| Johnson Siding | $186 | 5% |

| Kadoka | $226 | 27% |

| Kaylor | $159 | -10% |

| Keldron | $221 | 25% |

| Kennebec | $188 | 6% |

| Keystone | $189 | 6% |

| Kimball | $178 | 0% |

| Kranzburg | $151 | -15% |

| Kyle | $225 | 27% |

| Labolt | $155 | -13% |

| Lake Andes | $169 | -5% |

| Lake City | $158 | -11% |

| Lake Norden | $156 | -12% |

| Lake Preston | $160 | -10% |

| Lane | $163 | -8% |

| Langford | $158 | -11% |

| Lantry | $224 | 26% |

| Lead | $191 | 8% |

| Lebanon | $179 | 1% |

| Lemmon | $221 | 25% |

| Lennox | $151 | -15% |

| Leola | $166 | -6% |

| Lesterville | $158 | -11% |

| Letcher | $162 | -9% |

| Little Eagle | $223 | 26% |

| Lodgepole | $225 | 27% |

| Long Lake | $164 | -8% |

| Long Valley | $225 | 27% |

| Ludlow | $225 | 27% |

| Lyons | $151 | -15% |

| Madison | $156 | -12% |

| Manderson | $228 | 29% |

| Mansfield | $157 | -12% |

| Marion | $157 | -11% |

| Martin | $230 | 30% |

| Marty | $162 | -9% |

| Marvin | $156 | -12% |

| McIntosh | $222 | 25% |

| McLaughlin | $220 | 24% |

| Meadow | $224 | 26% |

| Menno | $159 | -10% |

| Midland | $223 | 26% |

| Milbank | $155 | -13% |

| Milesville | $224 | 26% |

| Miller | $173 | -2% |

| Mission | $226 | 27% |

| Mission Hill | $156 | -12% |

| Mitchell | $156 | -12% |

| Mobridge | $183 | 3% |

| Monroe | $158 | -11% |

| Morristown | $219 | 23% |

| Mound City | $181 | 2% |

| Mud Butte | $192 | 8% |

| Murdo | $220 | 24% |

| Nemo | $191 | 8% |

| New Effington | $158 | -11% |

| New Holland | $164 | -7% |

| New Underwood | $186 | 5% |

| Newell | $195 | 10% |

| Nisland | $191 | 8% |

| Norris | $225 | 27% |

| North Eagle Butte | $222 | 25% |

| North Sioux City | $149 | -16% |

| North Spearfish | $187 | 6% |

| Northville | $163 | -8% |

| Nunda | $152 | -14% |

| Oelrichs | $196 | 10% |

| Oglala | $228 | 29% |

| Okaton | $222 | 25% |

| Okreek | $212 | 20% |

| Oldham | $155 | -13% |

| Olivet | $160 | -10% |

| Onaka | $167 | -6% |

| Onida | $184 | 4% |

| Opal | $192 | 8% |

| Oral | $197 | 11% |

| Orient | $169 | -5% |

| Ortley | $156 | -12% |

| Ottumwa | $223 | 26% |

| Parkston | $160 | -10% |

| Parmelee | $226 | 28% |

| Peever | $158 | -11% |

| Philip | $228 | 29% |

| Pickstown | $165 | -7% |

| Piedmont | $185 | 4% |

| Pierpont | $160 | -10% |

| Pierre | $175 | -1% |

| Pine Ridge | $229 | 29% |

| Plainview | $192 | 9% |

| Plankinton | $163 | -8% |

| Platte | $170 | -4% |

| Pollock | $185 | 4% |

| Porcupine | $230 | 30% |

| Prairie City | $225 | 27% |

| Presho | $195 | 10% |

| Pringle | $196 | 11% |

| Pukwana | $184 | 4% |

| Quinn | $192 | 8% |

| Ralph | $227 | 28% |

| Ramona | $155 | -13% |

| Rapid City | $182 | 3% |

| Rapid Valley | $179 | 1% |

| Raymond | $161 | -9% |

| Redfield | $172 | -3% |

| Redig | $223 | 26% |

| Ree Heights | $168 | -5% |

| Reliance | $190 | 7% |

| Renner | $152 | -14% |

| Reva | $224 | 26% |

| Revillo | $156 | -12% |

| Ridgeview | $223 | 26% |

| Rockham | $166 | -6% |

| Roscoe | $172 | -3% |

| Rosebud | $226 | 27% |

| Rosholt | $158 | -11% |

| Roslyn | $160 | -10% |

| Rutland | $152 | -14% |

| Salem | $159 | -10% |

| Scenic | $191 | 8% |

| Scotland | $159 | -10% |

| Selby | $183 | 3% |

| Seneca | $167 | -6% |

| Shindler | $142 | -20% |

| Sinai | $152 | -14% |

| Sioux Falls | $150 | -16% |

| Sisseton | $159 | -10% |

| Sky Ranch | $224 | 26% |

| Smithwick | $197 | 11% |

| South Shore | $155 | -13% |

| Spearfish | $189 | 7% |

| Spencer | $159 | -10% |

| Springfield | $164 | -7% |

| St. Charles | $187 | 5% |

| St. Francis | $228 | 29% |

| St. Lawrence | $167 | -6% |

| St. Onge | $189 | 6% |

| Stephan | $186 | 5% |

| Stickney | $165 | -7% |

| Strandburg | $156 | -12% |

| Stratford | $156 | -12% |

| Sturgis | $188 | 6% |

| Summerset | $187 | 6% |

| Tabor | $161 | -9% |

| Tea | $144 | -19% |

| Timber Lake | $218 | 23% |

| Tolstoy | $179 | 1% |

| Toronto | $153 | -13% |

| Trail City | $220 | 24% |

| Trent | $155 | -12% |

| Tripp | $162 | -9% |

| Turton | $160 | -10% |

| Tuthill | $229 | 29% |

| Twin Brooks | $157 | -12% |

| Tyndall | $161 | -9% |

| Union Center | $196 | 11% |

| Utica | $157 | -11% |

| Vale | $191 | 8% |

| Valley Springs | $146 | -18% |

| Veblen | $161 | -9% |

| Vermillion | $148 | -16% |

| Viborg | $157 | -11% |

| Vienna | $158 | -11% |

| Virgil | $160 | -9% |

| Vivian | $190 | 7% |

| Volga | $147 | -17% |

| Volin | $157 | -11% |

| Wagner | $168 | -5% |

| Wakonda | $157 | -12% |

| Wakpala | $215 | 22% |

| Walker | $216 | 22% |

| Wall | $196 | 10% |

| Wallace | $156 | -12% |

| Wanblee | $229 | 29% |

| Wasta | $189 | 6% |

| Watauga | $219 | 24% |

| Watertown | $144 | -19% |

| Webster | $161 | -9% |

| Wessington | $162 | -8% |

| Wessington Springs | $168 | -5% |

| Westport | $157 | -12% |

| Wetonka | $157 | -12% |

| White | $148 | -17% |

| White Owl | $189 | 6% |

| White River | $225 | 27% |

| Whitehorse | $223 | 26% |

| Whitewood | $190 | 7% |

| Willow Lake | $163 | -8% |

| Wilmot | $159 | -10% |

| Winfred | $157 | -11% |

| Winner | $191 | 8% |

| Witten | $189 | 7% |

| Wolsey | $165 | -7% |

| Wood | $224 | 26% |

| Woonsocket | $164 | -8% |

| Worthing | $151 | -15% |

| Wounded Knee | $225 | 27% |

| Yale | $159 | -10% |

| Yankton | $157 | -11% |

| Zeona | $192 | 8% |

The average cost of car insurance in South Dakota’s largest cities:

- Sioux Falls, $150 a month

- Rapid City, $182 a month

- Aberdeen, $148 a month

- Brookings, $144 a month

Minimum coverage for car insurance in South Dakota

You must meet South Dakota’s auto insurance requirements to drive legally in the state. This means you need to have at least:

- $25,000 of bodily injury liability coverage per person

- $50,000 of bodily injury liability coverage per accident

- $25,000 of property damage coverage

- $25,000 of uninsured/underinsured motorist coverage per person

- $50,000 of uninsured/underinsured motorist coverage per accident

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

Uninsured motorist covers you and your passengers for injuries and damage caused by a driver with no insurance.

Underinsured motorist protects you from drivers who have insurance, but not enough to cover your damages.

South Dakota law doesn’t require full coverage car insurance, which usually includes collision

Frequently asked questions

The average cost of car insurance in South Dakota is $31 a month if you only get liability coverage. If you get full coverage, the state average cost is $177 a month.

FMNE has the cheapest car insurance in South Dakota for most drivers. It has the state’s cheapest average rates for both full coverage ($91 a month) and liability-only coverage ($14 a month).

South Dakota is an at-fault car insurance state, which means the driver who causes the accident pays for injuries and damages they caused.

How we selected the cheapest car insurance companies in South Dakota

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in South Dakota

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.