Cheapest Car Insurance in Texas (2026)

State Farm is the best company for cheap auto insurance in Texas, at $101 per month for full coverage and $37 per month for liability coverage.

Best cheap car insurance in Texas

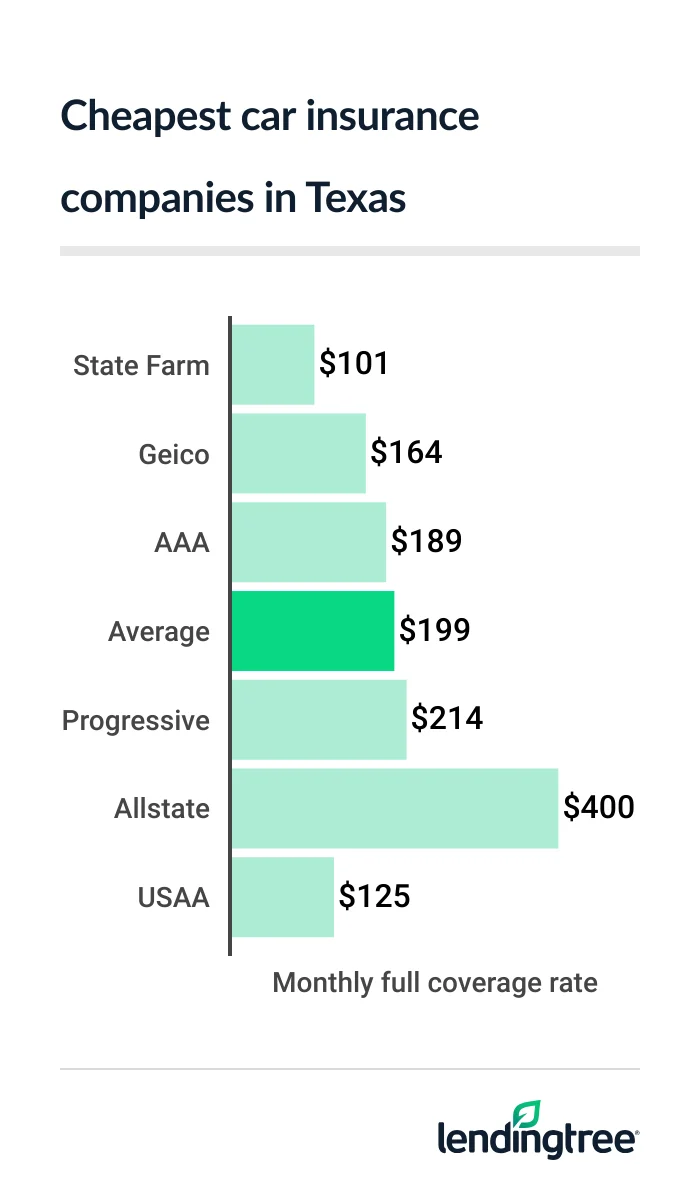

Cheapest full coverage car insurance in Texas: State Farm

State Farm has the cheapest full coverage car insurance in Texas, with an average rate of $101 per month. That’s almost half the state average rate of $199 per month for full coverage

Geico and AAA also offer full coverage insurance to Texas drivers that is cheaper than the state average. Geico’s average rate is $164 per month, while AAA’s is $189.

Cheapest full coverage car insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $101 | |

| Geico | $164 | |

| AAA | $189 | |

| Progressive | $214 | |

| Allstate | $400 | |

| USAA* | $125 | |

Although Geico is $63 per month more than State Farm for full coverage in Texas, discounts could make it more affordable for you. Geico offers more car insurance discounts than State Farm does, including for homeowners, active or retired military, and those with new vehicles.

- Cheapest full coverage: State Farm at $101/month

- Cheapest liability coverage: State Farm at $37/month

- Cheapest for young drivers: State Farm at $125/month

- Cheapest after a ticket: State Farm at $101/month

- Cheapest after an accident: State Farm at $119/month

- Cheapest after a DUI: State Farm at $102/month

- Cheapest for poor credit: Progressive at $298/month

Best cheap liability insurance in Texas: State Farm

With an average rate of $37 per month, State Farm also has the cheapest liability insurance for Texas drivers. That is $42 per month cheaper than the state average of $79 per month.

Geico comes in second for liability insurance

Cheapest liability car insurance rates

| Company | Monthly rate |

|---|---|

| State Farm | $37 |

| Geico | $66 |

| AAA | $77 |

| Progressive | $97 |

| Allstate | $152 |

| USAA* | $43 |

What you pay for car insurance is based on a number of things, such as where you live, your age, the car you drive and your driving record.

Most of our rates are for a 30-year-old driver with a clean record and a typical car. If you are older or younger, have traffic incidents on your record, or drive a sporty vehicle, your rates may be quite different.

This is why it’s important to compare car insurance quotes from at least a few companies before you buy or renew a policy. It’s one of the best ways to see which company will give you the cheapest rate based on your own personal factors.

Cheapest car insurance for Texas teens: State Farm

To get the cheapest teen car insurance in Texas, make sure you compare quotes with State Farm. The company’s average rate for teen liability insurance is $125 per month, or $82 cheaper than the state average of $207 per month.

USAA is even cheaper, with an average rate of $117 per month. But only current or former members of the military and some relatives can buy from USAA.

Cheapest teen car insurance quotes

| Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $125 | $272 |

| Geico | $163 | $361 |

| AAA | $201 | $403 |

| Progressive | $318 | $938 |

| Allstate | $320 | $672 |

| USAA* | $117 | $296 |

Texas teens also get the cheapest full coverage car insurance from State Farm, at around $272 per month. Geico is the second-cheapest company for most of the state’s teens, at $361 per month for full coverage.

Most car insurance companies have discounts that can make teen car insurance more affordable. State Farm and Geico are good examples.

- State Farm and Geico each give discounts to students who get good grades. With Geico, you can save up to 15% on certain coverages. State Farm promises up to 25%.

- Both companies also have discounts for students who go away to school and don’t take a car with them, or who complete an approved driver’s education course.

Best car insurance in Texas after a speeding ticket: State Farm

State Farm is the cheapest car insurance company in Texas for drivers with a speeding ticket on their records. Its average rate is $101 per month, or $142 per month less than the state average.

At $216 per month, Geico also charges Texas drivers with a speeding ticket less than the state average.

Cheapest insurance quotes after a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $101 |

| Geico | $216 |

| Progressive | $276 |

| AAA | $321 |

| Allstate | $400 |

| USAA* | $142 |

It can be hard to choose between State Farm and Geico outside of price. Both companies have good customer satisfaction scores from J.D. Power

State Farm and Geico also have similar optional car insurance coverages. Each one offers roadside assistance

Cheap auto insurance in Texas after an accident: State Farm

For cheap car insurance after an accident in Texas, start by getting a quote from State Farm. Its average rate for drivers with an accident on their records is $119 per month. This is well below the state average of $311 per month.

Geico also comes in under the state average, at $283 per month.

Cheapest insurance quotes after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $119 |

| Geico | $283 |

| Progressive | $318 |

| AAA | $321 |

| Allstate | $634 |

| USAA* | $189 |

The average Texas driver with an at-fault accident on their record pays $112 per month more than what drivers with a clean record pay for car insurance. That’s a difference of 56%.

Accident forgiveness

Cheapest insurance for Texas teens with a bad driving record: State Farm

At $125 per month, State Farm has Texas’s cheapest auto insurance for teens with a speeding ticket on their records. It also has the state’s lowest rates for teens with an accident on their records, at $142 per month.

Cheapest rates for teens with tickets and accidents

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $125 | $142 |

| Geico | $202 | $264 |

| Allstate | $320 | $587 |

| Progressive | $326 | $331 |

| AAA | $342 | $342 |

| USAA* | $160 | $203 |

Consider getting a quote from Geico as well if you want cheap auto insurance in Texas for teen drivers. The company charges about $202 per month for teens with a ticket, and $264 per month for teens with an accident.

Best cheap auto insurance in Texas with a DUI: State Farm

State Farm has the cheapest DUI insurance quotes in Texas, at $102 per month. Progressive is next for drivers with a DUI (driving under the influence) conviction, with rates of around $246 per month.

Cheapest DUI insurance rates

| Company | Monthly rate |

|---|---|

| State Farm | $102 |

| Progressive | $246 |

| Geico | $294 |

| AAA | $486 |

| Allstate | $614 |

| USAA* | $240 |

Progressive’s DUI car insurance rates are a lot higher than State Farm’s, but you may be able to bring them down with discounts.

It should help that some of Progressive’s many discounts are easy to get, like ones for signing your documents online and receiving documents through email. Getting a quote before you buy a policy and paying for your entire policy term at once can also save you money with Progressive.

The average cost of car insurance with a DUI in Texas is $330 per month. That’s $131 per month more than what drivers with a clean record pay for the same amount of coverage.

Cheapest car insurance in Texas with bad credit: Progressive

Most Texas drivers with poor credit can find the cheapest auto insurance with Progressive, where rates average $298 per month.

AAA comes in second for car insurance with bad credit, at $316 per month.

Cheapest insurance for drivers with poor credit

| Company | Monthly rate |

|---|---|

| Progressive | $298 |

| AAA | $316 |

| Geico | $427 |

| Allstate | $571 |

| State Farm | $787 |

| USAA* | $196 |

Both Progressive and AAA are much cheaper than the state average of $433 per month for Texas drivers with poor credit.

AAA has a better J.D. Power customer satisfaction score than Progressive, which means it has happier customers. If customer service is important to you, AAA may be worth a look even if its rates are slightly more expensive.

In Texas, drivers with bad credit pay $234 per month more than drivers with good credit pay for car insurance. That’s more than double.

Find out your credit score for free with LendingTree Spring before you shop for car insurance.

Best car insurance in Texas

State Farm is the best car insurance company in Texas overall because of its low rates for most drivers and its good customer satisfaction rating from J.D. Power. It also offers several discounts that can help you get the cheapest possible rate.

Texas car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| AAA | 652 | A+ | |

| Allstate | 635 | A+ | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

Consider USAA, too, if you or a family member are active duty or retired military. USAA’s rates are usually among the cheapest in Texas, and its reputation for customer service is unmatched by other insurance companies.

Texas insurance rates by city

Redford is the cheapest city for car insurance in Texas, with rates that average $152 per month. Drivers in north Houston pay the state’s most expensive car insurance rates of $234 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Abbott | $165 | -17% |

| Abernathy | $185 | -7% |

| Abilene | $166 | -17% |

| Abram | $190 | -4% |

| Ace | $185 | -7% |

| Ackerly | $168 | -16% |

| Addison | $205 | 3% |

| Adkins | $180 | -10% |

| Adrian | $175 | -12% |

| Afton | $169 | -15% |

| Agua Dulce | $183 | -8% |

| Aiken | $166 | -17% |

| Alamo | $197 | -1% |

| Alamo Heights | $192 | -3% |

| Alanreed | $173 | -13% |

| Alba | $183 | -8% |

| Albany | $166 | -16% |

| Albert | $174 | -13% |

| Aldine | $233 | 17% |

| Aledo | $174 | -13% |

| Alice | $173 | -13% |

| Alief | $223 | 12% |

| Allen | $181 | -9% |

| Alleyton | $168 | -16% |

| Allison | $171 | -14% |

| Alma | $185 | -7% |

| Alpine | $153 | -23% |

| Altair | $172 | -14% |

| Alto | $178 | -11% |

| Alton | $201 | 1% |

| Alvarado | $182 | -9% |

| Alvin | $186 | -7% |

| Alvord | $180 | -10% |

| Amargosa | $172 | -14% |

| Amarillo | $199 | 0% |

| Amherst | $180 | -9% |

| Anahuac | $197 | -1% |

| Anderson | $179 | -10% |

| Andrews | $168 | -15% |

| Angleton | $177 | -11% |

| Anna | $181 | -9% |

| Annetta | $173 | -13% |

| Annetta North | $173 | -13% |

| Annona | $172 | -14% |

| Anson | $166 | -17% |

| Anthony | $180 | -10% |

| Anton | $186 | -7% |

| Apple Springs | $186 | -7% |

| Aquilla | $174 | -13% |

| Aransas Pass | $170 | -14% |

| Archer City | $171 | -14% |

| Argyle | $176 | -11% |

| Arlington | $191 | -4% |

| Armstrong | $181 | -9% |

| Arp | $181 | -9% |

| Art | $169 | -15% |

| Artesia Wells | $173 | -13% |

| Arthur City | $181 | -9% |

| Asherton | $170 | -15% |

| Aspermont | $174 | -13% |

| Atascocita | $204 | 3% |

| Atascosa | $192 | -4% |

| Athens | $176 | -12% |

| Atlanta | $179 | -10% |

| Aubrey | $181 | -9% |

| Austin | $182 | -8% |

| Austwell | $165 | -17% |

| Avalon | $188 | -6% |

| Avery | $179 | -10% |

| Avinger | $182 | -9% |

| Avoca | $164 | -18% |

| Axtell | $169 | -15% |

| Azle | $174 | -13% |

| Bacliff | $190 | -4% |

| Bagwell | $181 | -9% |

| Bailey | $168 | -16% |

| Baird | $162 | -19% |

| Balch Springs | $219 | 10% |

| Balcones Heights | $197 | -1% |

| Ballinger | $165 | -17% |

| Balmorhea | $170 | -15% |

| Bandera | $185 | -7% |

| Bangs | $169 | -15% |

| Banquete | $175 | -12% |

| Bardwell | $189 | -5% |

| Barker | $203 | 2% |

| Barksdale | $170 | -15% |

| Barnhart | $166 | -16% |

| Barrett | $208 | 4% |

| Barry | $166 | -16% |

| Barstow | $166 | -17% |

| Bartlett | $173 | -13% |

| Barton Creek | $186 | -7% |

| Bartonville | $176 | -12% |

| Bastrop | $178 | -11% |

| Batesville | $172 | -13% |

| Batson | $192 | -3% |

| Bay City | $173 | -13% |

| Bayou Vista | $188 | -6% |

| Bayside | $170 | -15% |

| Baytown | $201 | 1% |

| Beasley | $187 | -6% |

| Beaumont | $197 | -1% |

| Bebe | $173 | -13% |

| Beckville | $187 | -6% |

| Bedford | $180 | -9% |

| Bedias | $183 | -8% |

| Bee Cave | $176 | -12% |

| Bee House | $166 | -17% |

| Beeville | $165 | -17% |

| Bellaire | $208 | 4% |

| Bellevue | $168 | -15% |

| Bellmead | $170 | -14% |

| Bells | $167 | -16% |

| Bellville | $171 | -14% |

| Belmont | $172 | -13% |

| Belton | $166 | -17% |

| Ben Arnold | $169 | -15% |

| Ben Bolt | $173 | -13% |

| Ben Franklin | $176 | -12% |

| Ben Wheeler | $183 | -8% |

| Benavides | $167 | -16% |

| Benbrook | $181 | -9% |

| Bend | $173 | -13% |

| Benjamin | $166 | -16% |

| Berclair | $172 | -14% |

| Bergheim | $179 | -10% |

| Bertram | $182 | -8% |

| Beverly Hills | $167 | -16% |

| Bevil Oaks | $196 | -2% |

| Big Bend National Park | $156 | -21% |

| Big Lake | $174 | -12% |

| Big Sandy | $183 | -8% |

| Big Spring | $174 | -13% |

| Big Wells | $170 | -15% |

| Bigfoot | $172 | -13% |

| Biggs Field | $185 | -7% |

| Birome | $165 | -17% |

| Bishop | $172 | -13% |

| Bivins | $182 | -8% |

| Blackwell | $174 | -13% |

| Blanco | $186 | -6% |

| Blanket | $173 | -13% |

| Bledsoe | $167 | -16% |

| Bleiblerville | $172 | -14% |

| Blessing | $167 | -16% |

| Bloomburg | $180 | -9% |

| Blooming Grove | $172 | -14% |

| Bloomington | $170 | -15% |

| Blossom | $180 | -10% |

| Blue Mound | $185 | -7% |

| Blue Ridge | $183 | -8% |

| Bluegrove | $162 | -19% |

| Bluff Dale | $175 | -12% |

| Bluffton | $169 | -15% |

| Blum | $176 | -12% |

| Boerne | $178 | -10% |

| Bogata | $178 | -11% |

| Boling | $181 | -9% |

| Bolivar Peninsula | $193 | -3% |

| Bon Wier | $188 | -5% |

| Bonham | $182 | -9% |

| Booker | $174 | -13% |

| Borger | $178 | -10% |

| Bovina | $176 | -12% |

| Bowie | $169 | -15% |

| Boyd | $176 | -11% |

| Boys Ranch | $183 | -8% |

| Brackettville | $168 | -16% |

| Brady | $179 | -10% |

| Brandon | $164 | -17% |

| Brashear | $172 | -14% |

| Brazoria | $180 | -9% |

| Breckenridge | $173 | -13% |

| Bremond | $173 | -13% |

| Brenham | $168 | -16% |

| Briar | $175 | -12% |

| Briarcliff | $177 | -11% |

| Bridge City | $200 | 0% |

| Bridgeport | $180 | -10% |

| Briggs | $173 | -13% |

| Briscoe | $171 | -14% |

| Broaddus | $180 | -10% |

| Bronson | $179 | -10% |

| Bronte | $168 | -16% |

| Brookeland | $172 | -14% |

| Brookesmith | $166 | -17% |

| Brookshire | $191 | -4% |

| Brookside Village | $188 | -6% |

| Brookston | $177 | -11% |

| Brownfield | $170 | -14% |

| Brownsboro | $183 | -8% |

| Brownsville | $182 | -9% |

| Brownwood | $171 | -14% |

| Bruceville | $166 | -17% |

| Bruni | $190 | -4% |

| Brushy Creek | $177 | -11% |

| Bryan | $163 | -18% |

| Bryson | $165 | -17% |

| Buchanan Dam | $180 | -9% |

| Buchanan Lake Village | $180 | -10% |

| Buckholts | $177 | -11% |

| Buda | $176 | -11% |

| Buffalo | $181 | -9% |

| Buffalo Gap | $161 | -19% |

| Bullard | $183 | -8% |

| Bulverde | $178 | -10% |

| Buna | $189 | -5% |

| Bunker Hill Village | $208 | 5% |

| Burkburnett | $157 | -21% |

| Burkett | $167 | -16% |

| Burkeville | $184 | -8% |

| Burleson | $171 | -14% |

| Burlington | $167 | -16% |

| Burnet | $184 | -8% |

| Burton | $170 | -15% |

| Bushland | $194 | -2% |

| Byers | $162 | -18% |

| Bynum | $171 | -14% |

| Cactus | $177 | -11% |

| Caddo | $169 | -15% |

| Caddo Mills | $183 | -8% |

| Caldwell | $168 | -15% |

| Call | $188 | -5% |

| Calliham | $168 | -16% |

| Calvert | $180 | -10% |

| Camden | $182 | -8% |

| Cameron | $171 | -14% |

| Cameron Park | $184 | -7% |

| Camp Swift | $177 | -11% |

| Camp Wood | $168 | -16% |

| Campbell | $168 | -15% |

| Campbellton | $166 | -16% |

| Canadian | $176 | -11% |

| Canton | $178 | -11% |

| Canutillo | $187 | -6% |

| Canyon | $191 | -4% |

| Canyon Lake | $181 | -9% |

| Carbon | $164 | -18% |

| Carlsbad | $169 | -15% |

| Carlton | $172 | -14% |

| Carmine | $169 | -15% |

| Carrizo Springs | $178 | -11% |

| Carrollton | $194 | -2% |

| Carthage | $185 | -7% |

| Cason | $178 | -11% |

| Castell | $168 | -16% |

| Castle Hills | $196 | -1% |

| Castroville | $182 | -9% |

| Cat Spring | $170 | -15% |

| Catarina | $172 | -14% |

| Cayuga | $171 | -14% |

| Cedar Creek | $186 | -7% |

| Cedar Hill | $207 | 4% |

| Cedar Lane | $172 | -14% |

| Cedar Park | $177 | -11% |

| Cedar Point | $189 | -5% |

| Cee Vee | $168 | -16% |

| Celeste | $182 | -9% |

| Celina | $180 | -10% |

| Center | $184 | -8% |

| Center Point | $178 | -11% |

| Centerville | $186 | -7% |

| Central Gardens | $198 | -1% |

| Centralia | $182 | -8% |

| Chandler | $186 | -7% |

| Channelview | $214 | 7% |

| Channing | $175 | -12% |

| Chapman Ranch | $180 | -9% |

| Chappell Hill | $169 | -15% |

| Charlotte | $170 | -15% |

| Chatfield | $169 | -15% |

| Cherokee | $167 | -16% |

| Chester | $187 | -6% |

| Chico | $178 | -10% |

| Chicota | $177 | -11% |

| Childress | $177 | -11% |

| Chillicothe | $171 | -14% |

| Chilton | $169 | -15% |

| China | $199 | 0% |

| China Spring | $168 | -16% |

| Chireno | $183 | -8% |

| Chriesman | $169 | -15% |

| Christine | $167 | -16% |

| Christoval | $162 | -19% |

| Chula Vista | $187 | -6% |

| Cibolo | $172 | -13% |

| Cienegas Terrace | $166 | -16% |

| Cinco Ranch | $193 | -3% |

| Circle D-KC Estates | $177 | -11% |

| Cisco | $167 | -16% |

| Clarendon | $182 | -9% |

| Clarksville | $178 | -11% |

| Clarksville City | $184 | -8% |

| Claude | $193 | -3% |

| Clayton | $183 | -8% |

| Clear Lake Shores | $189 | -5% |

| Cleburne | $174 | -13% |

| Cleveland | $196 | -1% |

| Clifton | $171 | -14% |

| Clint | $183 | -8% |

| Cloverleaf | $212 | 7% |

| Clute | $179 | -10% |

| Clyde | $164 | -18% |

| Coahoma | $164 | -18% |

| Cockrell Hill | $226 | 13% |

| Coldspring | $184 | -7% |

| Coleman | $172 | -14% |

| College Station | $161 | -19% |

| Collegeport | $170 | -15% |

| Colleyville | $179 | -10% |

| Collinsville | $177 | -11% |

| Colmesneil | $183 | -8% |

| Colorado City | $169 | -15% |

| Columbus | $173 | -13% |

| Comanche | $164 | -17% |

| Combes | $198 | -1% |

| Combine | $200 | 1% |

| Comfort | $182 | -9% |

| Commerce | $171 | -14% |

| Como | $179 | -10% |

| Comstock | $163 | -18% |

| Concan | $169 | -15% |

| Concepcion | $171 | -14% |

| Concord | $175 | -12% |

| Conroe | $183 | -8% |

| Converse | $186 | -7% |

| Cookville | $183 | -8% |

| Coolidge | $174 | -13% |

| Cooper | $176 | -11% |

| Copeville | $193 | -3% |

| Coppell | $192 | -3% |

| Copper Canyon | $178 | -10% |

| Copperas Cove | $168 | -15% |

| Corinth | $178 | -11% |

| Corpus Christi | $176 | -11% |

| Corrigan | $184 | -7% |

| Corsicana | $170 | -15% |

| Cost | $173 | -13% |

| Cotton Center | $171 | -14% |

| Cottonwood Shores | $175 | -12% |

| Cotulla | $173 | -13% |

| Coupland | $175 | -12% |

| Covington | $166 | -16% |

| Coyanosa | $165 | -17% |

| Crandall | $188 | -5% |

| Crane | $176 | -12% |

| Cranfills Gap | $162 | -19% |

| Crawford | $169 | -15% |

| Cresson | $169 | -15% |

| Crockett | $179 | -10% |

| Crosby | $206 | 4% |

| Crosbyton | $177 | -11% |

| Cross Mountain | $190 | -5% |

| Cross Plains | $171 | -14% |

| Cross Roads | $181 | -9% |

| Crowell | $166 | -16% |

| Crowley | $175 | -12% |

| Crystal Beach | $191 | -4% |

| Crystal City | $171 | -14% |

| Cuero | $173 | -13% |

| Cumby | $178 | -11% |

| Cuney | $181 | -9% |

| Cunningham | $174 | -12% |

| Cushing | $183 | -8% |

| Cypress | $197 | -1% |

| Cypress Mill | $182 | -9% |

| D Hanis | $180 | -9% |

| Daingerfield | $179 | -10% |

| Daisetta | $202 | 2% |

| Dale | $185 | -7% |

| Dalhart | $176 | -12% |

| Dallardsville | $185 | -7% |

| Dallas | $219 | 10% |

| Dalworthington Gardens | $178 | -11% |

| Damon | $188 | -6% |

| Danbury | $182 | -9% |

| Danciger | $189 | -5% |

| Danevang | $173 | -13% |

| Darrouzett | $169 | -15% |

| Dawn | $174 | -13% |

| Dawson | $175 | -12% |

| Dayton | $197 | -1% |

| De Berry | $186 | -6% |

| De Kalb | $177 | -11% |

| De Leon | $169 | -15% |

| DeCordova | $170 | -14% |

| DeSoto | $210 | 6% |

| Deanville | $169 | -15% |

| Decatur | $184 | -7% |

| Deer Park | $189 | -5% |

| Del Rio | $168 | -16% |

| Del Valle | $189 | -5% |

| Dell City | $157 | -21% |

| Delmita | $188 | -5% |

| Denison | $176 | -11% |

| Dennis | $169 | -15% |

| Denton | $175 | -12% |

| Denver City | $169 | -15% |

| Deport | $177 | -11% |

| Desdemona | $163 | -18% |

| Detroit | $177 | -11% |

| Devers | $197 | -1% |

| Devine | $180 | -9% |

| Deweyville | $199 | 0% |

| Diana | $188 | -6% |

| Diboll | $182 | -8% |

| Dickens | $179 | -10% |

| Dickinson | $190 | -4% |

| Dike | $175 | -12% |

| Dilley | $175 | -12% |

| Dime Box | $170 | -15% |

| Dimmitt | $180 | -10% |

| Dinero | $187 | -6% |

| Dobbin | $186 | -7% |

| Dodd City | $184 | -8% |

| Dodge | $180 | -9% |

| Dodson | $174 | -13% |

| Doffing | $197 | -1% |

| Donie | $171 | -14% |

| Donna | $194 | -2% |

| Doole | $165 | -17% |

| Doolittle | $200 | 0% |

| Doss | $182 | -9% |

| Double Oak | $180 | -9% |

| Doucette | $188 | -6% |

| Dougherty | $166 | -17% |

| Douglass | $180 | -10% |

| Douglassville | $182 | -9% |

| Driftwood | $182 | -8% |

| Dripping Springs | $180 | -10% |

| Driscoll | $176 | -12% |

| Dryden | $160 | -19% |

| Dublin | $168 | -16% |

| Dumas | $175 | -12% |

| Duncanville | $208 | 5% |

| Dunn | $167 | -16% |

| Dyess AFB | $167 | -16% |

| Eagle Lake | $174 | -12% |

| Eagle Pass | $187 | -6% |

| Early | $171 | -14% |

| Earth | $180 | -10% |

| East Bernard | $176 | -12% |

| Eastland | $168 | -15% |

| Easton | $188 | -5% |

| Ecleto | $163 | -18% |

| Ector | $179 | -10% |

| Edcouch | $199 | 0% |

| Eddy | $165 | -17% |

| Eden | $165 | -17% |

| Edgecliff Village | $190 | -5% |

| Edgewood | $180 | -10% |

| Edinburg | $199 | 0% |

| Edmonson | $168 | -15% |

| Edna | $171 | -14% |

| Edroy | $174 | -12% |

| Egypt | $178 | -11% |

| Eidson Road | $187 | -6% |

| El Campo | $169 | -15% |

| El Cenizo | $192 | -3% |

| El Indio | $186 | -7% |

| El Lago | $189 | -5% |

| El Paso | $184 | -7% |

| Eldorado | $167 | -16% |

| Electra | $162 | -18% |

| Elgin | $179 | -10% |

| Eliasville | $162 | -19% |

| Elkhart | $180 | -9% |

| Ellinger | $163 | -18% |

| Elm Creek | $187 | -6% |

| Elm Mott | $169 | -15% |

| Elmaton | $163 | -18% |

| Elmendorf | $194 | -3% |

| Elmo | $190 | -5% |

| Elsa | $200 | 0% |

| Elysian Fields | $188 | -6% |

| Emerald Bay | $182 | -9% |

| Emory | $169 | -15% |

| Encinal | $168 | -15% |

| Encino | $178 | -11% |

| Energy | $169 | -15% |

| Enloe | $174 | -13% |

| Ennis | $186 | -7% |

| Enochs | $180 | -10% |

| Eola | $162 | -19% |

| Era | $173 | -13% |

| Escobares | $189 | -5% |

| Etoile | $183 | -8% |

| Euless | $185 | -7% |

| Eustace | $179 | -10% |

| Evadale | $188 | -5% |

| Evant | $166 | -17% |

| Everman | $192 | -4% |

| Fabens | $179 | -10% |

| Fair Oaks Ranch | $179 | -10% |

| Fairfield | $169 | -15% |

| Fairview | $186 | -7% |

| Falcon Heights | $201 | 1% |

| Falcon Mesa | $177 | -11% |

| Falfurrias | $174 | -13% |

| Falls City | $173 | -13% |

| Fannett | $197 | -1% |

| Fannin | $169 | -15% |

| Farmers Branch | $201 | 1% |

| Farmersville | $190 | -5% |

| Farnsworth | $168 | -15% |

| Farwell | $176 | -11% |

| Fate | $195 | -2% |

| Fayetteville | $171 | -14% |

| Fentress | $173 | -13% |

| Ferris | $193 | -3% |

| Fieldton | $172 | -14% |

| Fischer | $177 | -11% |

| Flatonia | $173 | -13% |

| Flint | $184 | -7% |

| Flomot | $173 | -13% |

| Florence | $176 | -12% |

| Floresville | $174 | -13% |

| Flower Mound | $173 | -13% |

| Floydada | $176 | -12% |

| Fluvanna | $168 | -16% |

| Flynn | $187 | -6% |

| Follett | $176 | -12% |

| Forest Hill | $194 | -3% |

| Forestburg | $179 | -10% |

| Forney | $195 | -2% |

| Forreston | $186 | -6% |

| Forsan | $167 | -16% |

| Fort Bliss | $185 | -7% |

| Fort Cavazos | $160 | -19% |

| Fort Clark Springs | $168 | -16% |

| Fort Davis | $155 | -22% |

| Fort Hancock | $161 | -19% |

| Fort Hood | $162 | -19% |

| Fort Mc Kavett | $168 | -16% |

| Fort Sam Houston | $189 | -5% |

| Fort Stockton | $162 | -18% |

| Fort Worth | $185 | -7% |

| Four Corners | $211 | 6% |

| Fowlerton | $171 | -14% |

| Francitas | $173 | -13% |

| Franklin | $178 | -11% |

| Frankston | $183 | -8% |

| Fred | $190 | -5% |

| Fredericksburg | $177 | -11% |

| Fredonia | $169 | -15% |

| Freeport | $181 | -9% |

| Freer | $169 | -15% |

| Fresno | $206 | 4% |

| Friendswood | $190 | -4% |

| Friona | $179 | -10% |

| Frisco | $183 | -8% |

| Fritch | $180 | -10% |

| Frost | $166 | -17% |

| Fruitvale | $181 | -9% |

| Fulshear | $190 | -5% |

| Fulton | $172 | -14% |

| Gail | $177 | -11% |

| Gainesville | $173 | -13% |

| Galena Park | $213 | 7% |

| Gallatin | $183 | -8% |

| Galveston | $192 | -4% |

| Ganado | $169 | -15% |

| Garciasville | $201 | 1% |

| Garden City | $177 | -11% |

| Garden Ridge | $176 | -11% |

| Gardendale | $181 | -9% |

| Garfield | $190 | -4% |

| Garland | $211 | 6% |

| Garrison | $185 | -7% |

| Garwood | $178 | -10% |

| Gary | $190 | -4% |

| Gatesville | $178 | -11% |

| Gause | $174 | -13% |

| George West | $166 | -17% |

| Georgetown | $175 | -12% |

| Geronimo | $169 | -15% |

| Gholson | $169 | -15% |

| Giddings | $171 | -14% |

| Gilchrist | $199 | 0% |

| Gillett | $170 | -14% |

| Gilmer | $186 | -6% |

| Girard | $172 | -13% |

| Girvin | $160 | -20% |

| Gladewater | $184 | -8% |

| Glen Flora | $174 | -13% |

| Glen Rose | $171 | -14% |

| Glenn Heights | $200 | 0% |

| Glidden | $167 | -16% |

| Gober | $169 | -15% |

| Godley | $173 | -13% |

| Golden | $181 | -9% |

| Goldsboro | $166 | -16% |

| Goldsmith | $183 | -8% |

| Goldthwaite | $176 | -11% |

| Goliad | $170 | -15% |

| Gonzales | $174 | -13% |

| Goodfellow AFB | $157 | -21% |

| Goodrich | $186 | -6% |

| Gordon | $165 | -17% |

| Gordonville | $173 | -13% |

| Goree | $174 | -13% |

| Gorman | $170 | -15% |

| Gouldbusk | $164 | -18% |

| Graford | $172 | -14% |

| Graham | $166 | -17% |

| Granbury | $171 | -14% |

| Grand Prairie | $205 | 3% |

| Grand Saline | $176 | -11% |

| Grandfalls | $165 | -17% |

| Grandview | $174 | -13% |

| Granger | $171 | -14% |

| Granite Shoals | $175 | -12% |

| Grape Creek | $160 | -20% |

| Grapeland | $178 | -11% |

| Grapevine | $180 | -10% |

| Greatwood | $192 | -3% |

| Green Valley Farms | $177 | -11% |

| Greenville | $181 | -9% |

| Greenwood | $183 | -8% |

| Gregory | $177 | -11% |

| Groesbeck | $170 | -14% |

| Groom | $183 | -8% |

| Groves | $197 | -1% |

| Groveton | $182 | -9% |

| Grulla | $188 | -6% |

| Gruver | $178 | -11% |

| Guerra | $188 | -6% |

| Gun Barrel City | $182 | -9% |

| Gunter | $171 | -14% |

| Gustine | $174 | -13% |

| Guthrie | $171 | -14% |

| Guy | $188 | -5% |

| Hackberry | $185 | -7% |

| Hale Center | $184 | -8% |

| Hallettsville | $178 | -11% |

| Hallsville | $185 | -7% |

| Haltom City | $186 | -7% |

| Hamilton | $173 | -13% |

| Hamlin | $172 | -13% |

| Hamshire | $200 | 0% |

| Hankamer | $195 | -2% |

| Happy | $182 | -8% |

| Hardin | $201 | 1% |

| Hargill | $197 | -1% |

| Harker Heights | $166 | -17% |

| Harleton | $188 | -6% |

| Harlingen | $180 | -10% |

| Harper | $179 | -10% |

| Harrold | $164 | -18% |

| Hart | $179 | -10% |

| Hartley | $177 | -11% |

| Harwood | $176 | -12% |

| Haskell | $165 | -17% |

| Haslet | $177 | -11% |

| Hawk Cove | $186 | -6% |

| Hawkins | $175 | -12% |

| Hawley | $177 | -11% |

| Hearne | $168 | -16% |

| Heath | $194 | -3% |

| Hebbronville | $179 | -10% |

| Hedley | $180 | -9% |

| Hedwig Village | $208 | 5% |

| Heidenheimer | $163 | -18% |

| Helotes | $186 | -7% |

| Hemphill | $186 | -6% |

| Hempstead | $188 | -5% |

| Henderson | $187 | -6% |

| Henrietta | $168 | -16% |

| Hereford | $178 | -11% |

| Hermleigh | $174 | -12% |

| Hewitt | $163 | -18% |

| Hext | $166 | -17% |

| Hickory Creek | $181 | -9% |

| Hico | $169 | -15% |

| Hidalgo | $201 | 1% |

| Hideaway | $180 | -10% |

| Higgins | $172 | -14% |

| High Island | $199 | 0% |

| Highland Park | $214 | 7% |

| Highland Village | $181 | -9% |

| Highlands | $207 | 4% |

| Hill Country Village | $187 | -6% |

| Hillcrest | $183 | -8% |

| Hillister | $185 | -7% |

| Hillsboro | $168 | -16% |

| Hilltop Lakes | $185 | -7% |

| Hilshire Village | $214 | 8% |

| Hitchcock | $188 | -6% |

| Hobson | $162 | -19% |

| Hochheim | $171 | -14% |

| Hockley | $194 | -2% |

| Holiday Lakes | $178 | -11% |

| Holland | $169 | -15% |

| Holliday | $169 | -15% |

| Holly Lake Ranch | $175 | -12% |

| Hollywood Park | $187 | -6% |

| Homestead Meadows North | $188 | -5% |

| Homestead Meadows South | $188 | -6% |

| Hondo | $173 | -13% |

| Honey Grove | $177 | -11% |

| Hooks | $179 | -10% |

| Horizon City | $190 | -5% |

| Horseshoe Bay | $173 | -13% |

| Houston | $217 | 9% |

| Howe | $167 | -16% |

| Hubbard | $169 | -15% |

| Hudson | $185 | -7% |

| Hudson Bend | $178 | -10% |

| Hudson Oaks | $173 | -13% |

| Huffman | $198 | 0% |

| Hufsmith | $220 | 10% |

| Hughes Springs | $185 | -7% |

| Hull | $198 | 0% |

| Humble | $206 | 3% |

| Hungerford | $176 | -12% |

| Hunt | $181 | -9% |

| Hunters Creek Village | $208 | 5% |

| Huntington | $185 | -7% |

| Huntsville | $181 | -9% |

| Hurst | $183 | -8% |

| Hutchins | $217 | 9% |

| Hutto | $177 | -11% |

| Hye | $176 | -11% |

| Idalou | $181 | -9% |

| Iglesia Antigua | $185 | -7% |

| Imperial | $159 | -20% |

| Indian Hills | $191 | -4% |

| Indian Lake | $181 | -9% |

| Indian Springs | $190 | -5% |

| Industry | $168 | -15% |

| Inez | $168 | -16% |

| Ingleside | $170 | -14% |

| Ingram | $178 | -10% |

| Iola | $176 | -12% |

| Iowa Park | $161 | -19% |

| Ira | $167 | -16% |

| Iraan | $173 | -13% |

| Iredell | $169 | -15% |

| Irene | $164 | -17% |

| Irving | $200 | 0% |

| Italy | $182 | -8% |

| Itasca | $176 | -12% |

| Ivanhoe | $181 | -9% |

| Jacinto City | $220 | 10% |

| Jacksboro | $169 | -15% |

| Jacksonville | $182 | -8% |

| Jamaica Beach | $190 | -5% |

| Jarrell | $173 | -13% |

| Jasper | $180 | -9% |

| Jayton | $177 | -11% |

| Jbsa Lackland | $199 | 0% |

| Jbsa Randolph | $186 | -6% |

| Jefferson | $184 | -8% |

| Jermyn | $163 | -18% |

| Jersey Village | $214 | 7% |

| Jewett | $183 | -8% |

| Joaquin | $183 | -8% |

| Johnson City | $178 | -11% |

| Joinerville | $189 | -5% |

| Jollyville | $180 | -10% |

| Jones Creek | $181 | -9% |

| Jonesboro | $165 | -17% |

| Jonesville | $189 | -5% |

| Josephine | $196 | -1% |

| Joshua | $177 | -11% |

| Jourdanton | $168 | -16% |

| Juarez | $179 | -10% |

| Judson | $185 | -7% |

| Junction | $177 | -11% |

| Justiceburg | $174 | -13% |

| Justin | $176 | -12% |

| Kamay | $157 | -21% |

| Karnack | $187 | -6% |

| Karnes City | $168 | -16% |

| Katy | $195 | -2% |

| Kaufman | $186 | -7% |

| Keene | $174 | -13% |

| Keller | $176 | -12% |

| Kemah | $188 | -5% |

| Kemp | $179 | -10% |

| Kempner | $175 | -12% |

| Kendalia | $181 | -9% |

| Kendleton | $189 | -5% |

| Kenedy | $169 | -15% |

| Kennard | $179 | -10% |

| Kennedale | $189 | -5% |

| Kenney | $167 | -16% |

| Kerens | $175 | -12% |

| Kermit | $170 | -15% |

| Kerrick | $170 | -14% |

| Kerrville | $177 | -11% |

| Kildare | $176 | -11% |

| Kilgore | $181 | -9% |

| Killeen | $162 | -18% |

| Kingsbury | $170 | -15% |

| Kingsland | $184 | -8% |

| Kingsville | $166 | -17% |

| Kingwood | $192 | -4% |

| Kirby | $192 | -4% |

| Kirbyville | $183 | -8% |

| Kirvin | $171 | -14% |

| Klondike | $170 | -14% |

| Knickerbocker | $152 | -24% |

| Knippa | $175 | -12% |

| Knott | $163 | -18% |

| Knox City | $174 | -13% |

| Kopperl | $176 | -12% |

| Kosse | $173 | -13% |

| Kountze | $189 | -5% |

| Kress | $180 | -9% |

| Krugerville | $181 | -9% |

| Krum | $170 | -14% |

| Kurten | $162 | -19% |

| Kyle | $180 | -10% |

| La Blanca | $200 | 0% |

| La Coste | $179 | -10% |

| La Feria | $186 | -7% |

| La Grange | $170 | -15% |

| La Grulla | $189 | -5% |

| La Homa | $199 | 0% |

| La Joya | $197 | -1% |

| La Marque | $189 | -5% |

| La Porte | $188 | -5% |

| La Pryor | $171 | -14% |

| La Puerta | $189 | -5% |

| La Salle | $168 | -15% |

| La Vernia | $174 | -12% |

| La Villa | $207 | 4% |

| La Ward | $171 | -14% |

| LaCoste | $181 | -9% |

| Lackland AFB | $197 | -1% |

| Lacy-Lakeview | $170 | -14% |

| Ladonia | $178 | -10% |

| Lago Vista | $179 | -10% |

| Laguna Heights | $177 | -11% |

| Laguna Park | $170 | -14% |

| Laguna Vista | $177 | -11% |

| Laird Hill | $186 | -7% |

| Lake Brownwood | $171 | -14% |

| Lake Bryan | $162 | -19% |

| Lake Cherokee | $186 | -6% |

| Lake Creek | $171 | -14% |

| Lake Dallas | $181 | -9% |

| Lake Dunlap | $169 | -15% |

| Lake Jackson | $175 | -12% |

| Lake Kiowa | $173 | -13% |

| Lake Medina Shores | $185 | -7% |

| Lake Worth | $182 | -8% |

| Lakehills | $185 | -7% |

| Lakeside | $176 | -12% |

| Lakeview | $175 | -12% |

| Lakeway | $178 | -11% |

| Lamar | $170 | -15% |

| Lamesa | $176 | -12% |

| Lampasas | $173 | -13% |

| Lancaster | $220 | 11% |

| Lane City | $183 | -8% |

| Laneville | $179 | -10% |

| Langtry | $163 | -18% |

| Lantana | $176 | -11% |

| Laredo | $190 | -5% |

| Larue | $179 | -10% |

| Las Lomas | $189 | -5% |

| Las Palmas II | $178 | -10% |

| Las Quintas Fronterizas | $187 | -6% |

| Lasara | $186 | -7% |

| Latexo | $177 | -11% |

| Laughlin AFB | $168 | -16% |

| Laureles | $178 | -11% |

| Lavon | $197 | -1% |

| Lawn | $163 | -18% |

| Lazbuddie | $176 | -12% |

| Leaday | $167 | -16% |

| League City | $187 | -6% |

| Leakey | $174 | -12% |

| Leander | $178 | -10% |

| Ledbetter | $166 | -17% |

| Leesburg | $185 | -7% |

| Leesville | $168 | -15% |

| Lefors | $178 | -11% |

| Leggett | $185 | -7% |

| Lelia Lake | $175 | -12% |

| Leming | $176 | -12% |

| Lenorah | $177 | -11% |

| Leon Valley | $199 | 0% |

| Leona | $182 | -9% |

| Leonard | $172 | -14% |

| Leroy | $169 | -15% |

| Levelland | $185 | -7% |

| Lewisville | $186 | -7% |

| Lexington | $178 | -10% |

| Liberty | $196 | -2% |

| Liberty City | $184 | -8% |

| Liberty Hill | $178 | -11% |

| Lillian | $181 | -9% |

| Lincoln | $174 | -12% |

| Lindale | $180 | -10% |

| Linden | $179 | -10% |

| Lindsay | $171 | -14% |

| Lingleville | $164 | -18% |

| Linn | $197 | -1% |

| Lipan | $182 | -9% |

| Lipscomb | $169 | -15% |

| Lissie | $174 | -13% |

| Little Elm | $186 | -6% |

| Little River Academy | $168 | -16% |

| Little River-Academy | $169 | -15% |

| Littlefield | $180 | -10% |

| Live Oak | $186 | -6% |

| Liverpool | $190 | -5% |

| Livingston | $189 | -5% |

| Llano | $178 | -11% |

| Llano Grande | $197 | -1% |

| Lockhart | $178 | -10% |

| Lockney | $175 | -12% |

| Lodi | $181 | -9% |

| Log Cabin | $173 | -13% |

| Lohn | $169 | -15% |

| Lolita | $169 | -15% |

| Lometa | $176 | -11% |

| London | $165 | -17% |

| Lone Oak | $180 | -9% |

| Lone Star | $185 | -7% |

| Long Branch | $191 | -4% |

| Longview | $183 | -8% |

| Loop | $170 | -15% |

| Lopeno | $197 | -1% |

| Lopezville | $196 | -1% |

| Loraine | $173 | -13% |

| Lorena | $167 | -16% |

| Lorenzo | $178 | -11% |

| Los Ebanos | $211 | 6% |

| Los Fresnos | $181 | -9% |

| Los Indios | $197 | -1% |

| Lost Creek | $182 | -9% |

| Lott | $168 | -16% |

| Louise | $173 | -13% |

| Lovelady | $179 | -10% |

| Loving | $162 | -18% |

| Lowake | $161 | -19% |

| Lozano | $198 | 0% |

| Lubbock | $192 | -3% |

| Lucas | $180 | -10% |

| Lueders | $168 | -15% |

| Lufkin | $185 | -7% |

| Luling | $180 | -9% |

| Lumberton | $191 | -4% |

| Lyford | $177 | -11% |

| Lyons | $174 | -12% |

| Lytle | $180 | -10% |

| Mabank | $182 | -8% |

| Macdona | $200 | 0% |

| Madisonville | $183 | -8% |

| Magnolia | $186 | -7% |

| Malakoff | $173 | -13% |

| Malone | $165 | -17% |

| Manchaca | $185 | -7% |

| Manor | $186 | -6% |

| Mansfield | $187 | -6% |

| Manvel | $184 | -7% |

| Maple | $176 | -11% |

| Marathon | $162 | -18% |

| Marble Falls | $174 | -12% |

| Marfa | $152 | -24% |

| Marietta | $185 | -7% |

| Marion | $173 | -13% |

| Markham | $178 | -10% |

| Marlin | $171 | -14% |

| Marquez | $184 | -7% |

| Marshall | $187 | -6% |

| Mart | $168 | -16% |

| Martindale | $175 | -12% |

| Martinsville | $182 | -8% |

| Maryneal | $164 | -18% |

| Mason | $180 | -9% |

| Masterson | $171 | -14% |

| Matador | $180 | -10% |

| Matagorda | $173 | -13% |

| Mathis | $171 | -14% |

| Maud | $181 | -9% |

| Mauriceville | $201 | 1% |

| Maxwell | $176 | -12% |

| May | $171 | -14% |

| Maydelle | $184 | -8% |

| Maypearl | $185 | -7% |

| Mc Camey | $170 | -15% |

| Mc Caulley | $168 | -15% |

| Mc Dade | $182 | -8% |

| Mc Gregor | $169 | -15% |

| Mc Leod | $179 | -10% |

| Mc Neil | $180 | -10% |

| Mc Queeney | $169 | -15% |

| McAllen | $194 | -2% |

| McCamey | $177 | -11% |

| McGregor | $169 | -15% |

| McKinney | $182 | -9% |

| McLean | $184 | -8% |

| McLendon-Chisholm | $194 | -2% |

| McQueeney | $171 | -14% |

| Mcadoo | $176 | -11% |

| Mcfaddin | $169 | -15% |

| Meadow | $172 | -14% |

| Meadowlakes | $174 | -12% |

| Meadows Place | $207 | 4% |

| Medina | $178 | -11% |

| Megargel | $168 | -16% |

| Melissa | $182 | -9% |

| Melvin | $171 | -14% |

| Memphis | $180 | -9% |

| Menard | $173 | -13% |

| Mentone | $169 | -15% |

| Mercedes | $191 | -4% |

| Mereta | $167 | -16% |

| Meridian | $168 | -16% |

| Merit | $179 | -10% |

| Merkel | $166 | -17% |

| Mertens | $165 | -17% |

| Mertzon | $164 | -17% |

| Mesquite | $214 | 8% |

| Mexia | $171 | -14% |

| Meyersville | $161 | -19% |

| Miami | $177 | -11% |

| Mico | $188 | -5% |

| Midfield | $168 | -16% |

| Midkiff | $168 | -15% |

| Midland | $171 | -14% |

| Midlothian | $182 | -9% |

| Midway | $185 | -7% |

| Midway North | $196 | -2% |

| Midway South | $194 | -2% |

| Mila Doce | $191 | -4% |

| Milam | $182 | -8% |

| Milano | $173 | -13% |

| Miles | $171 | -14% |

| Milford | $177 | -11% |

| Millersview | $161 | -19% |

| Millican | $166 | -17% |

| Millsap | $173 | -13% |

| Minden | $186 | -6% |

| Mineola | $172 | -13% |

| Mineral | $165 | -17% |

| Mineral Wells | $171 | -14% |

| Mingus | $164 | -17% |

| Mirando City | $186 | -7% |

| Mission | $195 | -2% |

| Mission Bend | $219 | 10% |

| Missouri City | $203 | 2% |

| Mobeetie | $172 | -13% |

| Monahans | $167 | -16% |

| Mont Belvieu | $198 | -1% |

| Montague | $169 | -15% |

| Montalba | $184 | -7% |

| Monte Alto | $199 | 0% |

| Montgomery | $186 | -6% |

| Moody | $164 | -18% |

| Moore | $175 | -12% |

| Moran | $161 | -19% |

| Morgan | $172 | -13% |

| Morgan Mill | $169 | -15% |

| Morgan’s Point Resort | $166 | -16% |

| Morse | $174 | -13% |

| Morton | $174 | -12% |

| Moscow | $181 | -9% |

| Moulton | $170 | -14% |

| Mound | $172 | -14% |

| Mount Calm | $165 | -17% |

| Mount Enterprise | $186 | -6% |

| Mount Pleasant | $186 | -7% |

| Mount Vernon | $175 | -12% |

| Mountain Home | $176 | -12% |

| Muenster | $172 | -14% |

| Muldoon | $165 | -17% |

| Muleshoe | $184 | -8% |

| Mullin | $176 | -11% |

| Mumford | $169 | -15% |

| Munday | $174 | -13% |

| Murchison | $179 | -10% |

| Murillo | $198 | -1% |

| Murphy | $191 | -4% |

| Myra | $168 | -16% |

| Myrtle Springs | $185 | -7% |

| Nacogdoches | $182 | -8% |

| Nada | $174 | -13% |

| Naples | $185 | -7% |

| Nash | $180 | -10% |

| Nassau Bay | $193 | -3% |

| Natalia | $180 | -10% |

| Naval Air Station Jrb | $185 | -7% |

| Navasota | $177 | -11% |

| Nazareth | $175 | -12% |

| Neches | $176 | -11% |

| Nederland | $198 | -1% |

| Needville | $191 | -4% |

| Nemo | $165 | -17% |

| Nevada | $196 | -1% |

| New Baden | $178 | -11% |

| New Boston | $181 | -9% |

| New Braunfels | $172 | -13% |

| New Caney | $193 | -3% |

| New Deal | $192 | -4% |

| New Fairview | $179 | -10% |

| New Home | $169 | -15% |

| New London | $183 | -8% |

| New Territory | $194 | -3% |

| New Ulm | $171 | -14% |

| New Waverly | $184 | -7% |

| Newark | $170 | -14% |

| Newcastle | $167 | -16% |

| Newton | $180 | -10% |

| Nixon | $175 | -12% |

| Nocona | $168 | -15% |

| Nolan | $165 | -17% |

| Nolanville | $164 | -18% |

| Nome | $202 | 1% |

| Nordheim | $172 | -14% |

| Normangee | $185 | -7% |

| Normanna | $165 | -17% |

| North Alamo | $197 | -1% |

| North Cleveland | $199 | 0% |

| North Houston | $234 | 18% |

| North Richland Hills | $183 | -8% |

| North San Pedro | $175 | -12% |

| North Zulch | $181 | -9% |

| Northlake | $176 | -12% |

| Norton | $161 | -19% |

| Notrees | $176 | -11% |

| Novice | $168 | -16% |

| Nursery | $166 | -17% |

| O Brien | $166 | -16% |

| Oak Grove | $185 | -7% |

| Oak Leaf | $197 | -1% |

| Oak Point | $186 | -7% |

| Oak Ridge North | $183 | -8% |

| Oak Trail Shores | $171 | -14% |

| Oakhurst | $186 | -7% |

| Oakland | $169 | -15% |

| Oakville | $166 | -17% |

| Oakwood | $182 | -8% |

| Odell | $166 | -16% |

| Odem | $173 | -13% |

| Odessa | $183 | -8% |

| Odonnell | $180 | -10% |

| Oglesby | $167 | -16% |

| Oilton | $195 | -2% |

| Oklaunion | $166 | -17% |

| Old Glory | $165 | -17% |

| Old Ocean | $189 | -5% |

| Olden | $167 | -16% |

| Olivarez | $198 | 0% |

| Olmito | $177 | -11% |

| Olmos Park | $198 | -1% |

| Olney | $167 | -16% |

| Olton | $181 | -9% |

| Omaha | $180 | -10% |

| Onalaska | $184 | -8% |

| Orange | $199 | 0% |

| Orange Grove | $171 | -14% |

| Orangefield | $199 | 0% |

| Orchard | $195 | -2% |

| Ore City | $186 | -7% |

| Orla | $162 | -19% |

| Ottine | $172 | -13% |

| Ovalo | $169 | -15% |

| Overton | $183 | -8% |

| Ovilla | $197 | -1% |

| Oyster Creek | $181 | -9% |

| Ozona | $168 | -16% |

| Paducah | $180 | -10% |

| Paige | $178 | -10% |

| Paint Rock | $169 | -15% |

| Palacios | $170 | -14% |

| Palestine | $179 | -10% |

| Palm Valley | $178 | -10% |

| Palmer | $192 | -3% |

| Palmhurst | $200 | 1% |

| Palmview | $195 | -2% |

| Palmview South | $192 | -4% |

| Palo Pinto | $167 | -16% |

| Paloma Creek | $181 | -9% |

| Paloma Creek South | $186 | -6% |

| Paluxy | $175 | -12% |

| Pampa | $178 | -11% |

| Pandora | $176 | -12% |

| Panhandle | $187 | -6% |

| Panna Maria | $169 | -15% |

| Panola | $184 | -7% |

| Panorama Village | $181 | -9% |

| Pantego | $186 | -7% |

| Paradise | $185 | -7% |

| Paris | $176 | -11% |

| Parker | $180 | -10% |

| Pasadena | $197 | -1% |

| Pattison | $192 | -3% |

| Pattonville | $177 | -11% |

| Pawnee | $165 | -17% |

| Pearland | $187 | -6% |

| Pearsall | $171 | -14% |

| Peaster | $172 | -13% |

| Pecan Acres | $178 | -10% |

| Pecan Gap | $176 | -11% |

| Pecan Grove | $192 | -4% |

| Pecan Hill | $197 | -1% |

| Pecan Plantation | $169 | -15% |

| Pecos | $169 | -15% |

| Peggy | $168 | -16% |

| Pelican Bay | $174 | -13% |

| Pendleton | $161 | -19% |

| Penelope | $169 | -15% |

| Penitas | $194 | -2% |

| Pennington | $177 | -11% |

| Penwell | $175 | -12% |

| Pep | $173 | -13% |

| Perezville | $193 | -3% |

| Perrin | $176 | -12% |

| Perryton | $174 | -13% |

| Petersburg | $184 | -8% |

| Petrolia | $166 | -17% |

| Petronila | $172 | -14% |

| Pettus | $165 | -17% |

| Petty | $173 | -13% |

| Pflugerville | $180 | -9% |

| Pharr | $194 | -2% |

| Pickton | $177 | -11% |

| Pierce | $170 | -15% |

| Pilot Point | $179 | -10% |

| Pine Harbor | $183 | -8% |

| Pinehurst | $189 | -5% |

| Pineland | $185 | -7% |

| Pinewood Estates | $191 | -4% |

| Piney Point Village | $209 | 5% |

| Pipe Creek | $185 | -7% |

| Pittsburg | $178 | -10% |

| Placedo | $170 | -15% |

| Plains | $171 | -14% |

| Plainview | $178 | -11% |

| Plano | $189 | -5% |

| Plantersville | $185 | -7% |

| Pleasanton | $176 | -11% |

| Pledger | $172 | -13% |

| Plum | $166 | -17% |

| Point | $180 | -10% |

| Point Comfort | $173 | -13% |

| Pointblank | $185 | -7% |

| Pollok | $182 | -8% |

| Ponder | $169 | -15% |

| Pontotoc | $172 | -13% |

| Poolville | $172 | -14% |

| Port Aransas | $168 | -16% |

| Port Arthur | $199 | 0% |

| Port Bolivar | $191 | -4% |

| Port Isabel | $177 | -11% |

| Port Lavaca | $169 | -15% |

| Port Mansfield | $173 | -13% |

| Port Neches | $193 | -3% |

| Port O Connor | $164 | -17% |

| Port O’Connor | $167 | -16% |

| Porter | $192 | -3% |

| Porter Heights | $191 | -4% |

| Portland | $175 | -12% |

| Post | $180 | -10% |

| Poteet | $178 | -10% |

| Poth | $180 | -10% |

| Potosi | $164 | -18% |

| Pottsboro | $171 | -14% |

| Pottsville | $166 | -17% |

| Powderly | $175 | -12% |

| Powell | $166 | -17% |

| Poynor | $176 | -11% |

| Prairie Hill | $170 | -14% |

| Prairie Lea | $173 | -13% |

| Prairie View | $193 | -3% |

| Premont | $171 | -14% |

| Presidio | $154 | -22% |

| Preston | $171 | -14% |

| Price | $176 | -11% |

| Priddy | $168 | -15% |

| Primera | $178 | -10% |

| Princeton | $181 | -9% |

| Proctor | $168 | -16% |

| Progreso | $205 | 3% |

| Prosper | $183 | -8% |

| Providence | $181 | -9% |

| Purdon | $163 | -18% |

| Purmela | $165 | -17% |

| Putnam | $157 | -21% |

| Pyote | $168 | -15% |

| Quail | $174 | -13% |

| Quail Creek | $171 | -14% |

| Quanah | $174 | -12% |

| Queen City | $187 | -6% |

| Quemado | $182 | -9% |

| Quinlan | $186 | -6% |

| Quitaque | $179 | -10% |

| Quitman | $181 | -9% |

| Rainbow | $162 | -18% |

| Ralls | $178 | -11% |

| Rancho Alegre | $172 | -14% |

| Rancho Chico | $168 | -15% |

| Rancho Viejo | $180 | -9% |

| Randolph | $179 | -10% |

| Randolph AFB | $179 | -10% |

| Ranger | $168 | -16% |

| Rankin | $161 | -19% |

| Ransom Canyon | $190 | -5% |

| Ratcliff | $177 | -11% |

| Ravenna | $179 | -10% |

| Raymondville | $180 | -10% |

| Raywood | $197 | -1% |

| Reagan | $165 | -17% |

| Realitos | $176 | -12% |

| Red Oak | $197 | -1% |

| Red Rock | $186 | -6% |

| Redford | $152 | -24% |

| Redwater | $179 | -10% |

| Redwood | $178 | -11% |

| Refugio | $170 | -15% |

| Reid Hope King | $184 | -8% |

| Reklaw | $177 | -11% |

| Rendon | $183 | -8% |

| Reno | $178 | -11% |

| Rhome | $180 | -10% |

| Ricardo | $166 | -17% |

| Rice | $175 | -12% |

| Richards | $180 | -10% |

| Richardson | $198 | -1% |

| Richland | $170 | -14% |

| Richland Hills | $186 | -7% |

| Richland Springs | $171 | -14% |

| Richmond | $192 | -4% |

| Richwood | $179 | -10% |

| Riesel | $168 | -16% |

| Ringgold | $161 | -19% |

| Rio Bravo | $192 | -3% |

| Rio Frio | $169 | -15% |

| Rio Grande City | $189 | -5% |

| Rio Hondo | $177 | -11% |

| Rio Medina | $180 | -9% |

| Rio Vista | $167 | -16% |

| Rising Star | $166 | -16% |

| River Oaks | $184 | -8% |

| Riviera | $166 | -17% |

| Roanoke | $173 | -13% |

| Roans Prairie | $180 | -10% |

| Roaring Springs | $175 | -12% |

| Robert Lee | $173 | -13% |

| Robinson | $167 | -16% |

| Robstown | $175 | -12% |

| Roby | $173 | -13% |

| Rochelle | $176 | -12% |

| Rochester | $173 | -13% |

| Rock Island | $176 | -11% |

| Rockdale | $170 | -15% |

| Rockport | $170 | -15% |

| Rocksprings | $178 | -11% |

| Rockwall | $194 | -3% |

| Rockwood | $166 | -16% |

| Rogers | $169 | -15% |

| Rollingwood | $180 | -10% |

| Roma | $189 | -5% |

| Roman Forest | $192 | -3% |

| Romayor | $203 | 2% |

| Roosevelt | $168 | -16% |

| Ropesville | $182 | -9% |

| Rosanky | $178 | -10% |

| Roscoe | $170 | -15% |

| Rosebud | $172 | -13% |

| Rosenberg | $187 | -6% |

| Rosharon | $192 | -3% |

| Rosita | $187 | -6% |

| Ross | $170 | -15% |

| Rosser | $189 | -5% |

| Rosston | $172 | -14% |

| Rotan | $174 | -12% |

| Round Mountain | $182 | -9% |

| Round Rock | $177 | -11% |

| Round Top | $173 | -13% |

| Rowena | $166 | -16% |

| Rowlett | $208 | 4% |

| Roxton | $178 | -10% |

| Royse City | $190 | -4% |

| Rule | $169 | -15% |

| Runaway Bay | $180 | -10% |

| Runge | $171 | -14% |

| Rusk | $184 | -8% |

| Rye | $201 | 1% |

| Sabinal | $177 | -11% |

| Sabine Pass | $202 | 2% |

| Sachse | $193 | -3% |

| Sacul | $184 | -8% |

| Sadler | $174 | -12% |

| Saginaw | $183 | -8% |

| Saint Hedwig | $181 | -9% |

| Salado | $165 | -17% |

| Salineno | $202 | 2% |

| Salt Flat | $157 | -21% |

| Saltillo | $173 | -13% |

| Sam Norwood | $175 | -12% |

| Sam Rayburn | $175 | -12% |

| San Angelo | $160 | -20% |

| San Antonio | $194 | -2% |

| San Augustine | $184 | -8% |

| San Benito | $178 | -11% |

| San Carlos I | $188 | -6% |

| San Diego | $169 | -15% |

| San Elizario | $189 | -5% |

| San Felipe | $173 | -13% |

| San Isidro | $186 | -6% |

| San Juan | $195 | -2% |

| San Leon | $192 | -4% |

| San Marcos | $179 | -10% |

| San Patricio | $171 | -14% |

| San Saba | $178 | -10% |

| San Ygnacio | $180 | -9% |

| Sand Springs | $173 | -13% |

| Sanderson | $162 | -18% |

| Sandia | $175 | -12% |

| Sanford | $172 | -13% |

| Sanger | $172 | -14% |

| Sansom Park | $185 | -7% |

| Santa Anna | $174 | -13% |

| Santa Elena | $191 | -4% |

| Santa Fe | $188 | -6% |

| Santa Maria | $198 | 0% |

| Santa Rosa | $186 | -7% |

| Santo | $177 | -11% |

| Saragosa | $162 | -19% |

| Saratoga | $192 | -4% |

| Sarita | $175 | -12% |

| Satin | $167 | -16% |

| Savannah | $181 | -9% |

| Savoy | $169 | -15% |

| Scenic Oaks | $182 | -9% |

| Schertz | $175 | -12% |

| Schulenburg | $172 | -13% |

| Schwertner | $175 | -12% |

| Scotland | $166 | -17% |

| Scottsville | $188 | -6% |

| Scroggins | $176 | -12% |

| Scurry | $186 | -7% |

| Seabrook | $190 | -5% |

| Seadrift | $171 | -14% |

| Seagoville | $204 | 3% |

| Seagraves | $168 | -16% |

| Sealy | $176 | -12% |

| Sebastian | $174 | -13% |

| Seguin | $169 | -15% |

| Selma | $177 | -11% |

| Selman City | $185 | -7% |

| Seminole | $174 | -12% |

| Serenada | $176 | -12% |

| Seth Ward | $178 | -11% |

| Seven Points | $179 | -10% |

| Seymour | $171 | -14% |

| Shady Hollow | $179 | -10% |

| Shady Shores | $179 | -10% |

| Shallowater | $183 | -8% |

| Shamrock | $181 | -9% |

| Shavano Park | $191 | -4% |

| Sheffield | $166 | -16% |

| Shelbyville | $182 | -8% |

| Sheldon | $218 | 9% |

| Shenandoah | $179 | -10% |

| Shepherd | $193 | -3% |

| Sheppard AFB | $157 | -21% |

| Sheridan | $170 | -14% |

| Sherman | $169 | -15% |

| Sherwood Shores | $173 | -13% |

| Shiner | $171 | -14% |

| Shiro | $180 | -9% |

| Shoreacres | $188 | -6% |

| Sidney | $161 | -19% |

| Sienna Plantation | $195 | -2% |

| Sierra Blanca | $166 | -17% |

| Siesta Acres | $187 | -6% |

| Siesta Shores | $177 | -11% |

| Silsbee | $193 | -3% |

| Silver | $164 | -18% |

| Silverton | $182 | -9% |

| Simms | $177 | -11% |

| Simonton | $191 | -4% |

| Sinton | $168 | -15% |

| Skellytown | $181 | -9% |

| Skidmore | $168 | -15% |

| Slaton | $190 | -5% |

| Slidell | $182 | -8% |

| Smiley | $170 | -14% |

| Smithville | $178 | -11% |

| Smyer | $184 | -7% |

| Snook | $173 | -13% |

| Snyder | $168 | -16% |

| Socorro | $184 | -7% |

| Somerset | $184 | -8% |

| Somerville | $171 | -14% |

| Sonora | $163 | -18% |

| Sour Lake | $191 | -4% |

| South Alamo | $197 | -1% |

| South Bend | $162 | -19% |

| South Houston | $211 | 6% |

| South Mountain | $175 | -12% |

| South Padre Island | $175 | -12% |

| South Plains | $166 | -17% |

| Southlake | $179 | -10% |

| Southmayd | $169 | -15% |

| Southside Place | $205 | 3% |

| Spade | $171 | -14% |

| Sparks | $189 | -5% |

| Spearman | $178 | -11% |

| Spicewood | $178 | -11% |

| Splendora | $193 | -3% |

| Spring | $190 | -4% |

| Spring Branch | $181 | -9% |

| Spring Valley Village | $214 | 7% |

| Springlake | $171 | -14% |

| Springtown | $186 | -7% |

| Spur | $183 | -8% |

| Spurger | $180 | -10% |

| St. Hedwig | $181 | -9% |

| St. Jo | $171 | -14% |

| St. Paul | $168 | -15% |

| Stafford | $208 | 4% |

| Stamford | $171 | -14% |

| Stanton | $175 | -12% |

| Staples | $168 | -15% |

| Star | $166 | -17% |

| Stephenville | $168 | -15% |

| Sterling City | $168 | -16% |

| Stinnett | $180 | -10% |

| Stockdale | $174 | -12% |

| Stonewall | $174 | -13% |

| Stowell | $197 | -1% |

| Stratford | $180 | -9% |

| Strawn | $170 | -15% |

| Streetman | $165 | -17% |

| Sublime | $174 | -13% |

| Sudan | $182 | -9% |

| Sugar Land | $194 | -2% |

| Sullivan City | $199 | 0% |

| Sulphur Bluff | $168 | -15% |

| Sulphur Springs | $171 | -14% |

| Summerfield | $180 | -10% |

| Sumner | $180 | -10% |

| Sundown | $181 | -9% |

| Sunnyvale | $208 | 5% |

| Sunray | $181 | -9% |

| Sunrise Beach Village | $177 | -11% |

| Sunset | $178 | -10% |

| Sunset Valley | $179 | -10% |

| Surfside Beach | $181 | -9% |

| Sutherland Springs | $174 | -12% |

| Sweeny | $180 | -9% |

| Sweet Home | $172 | -14% |

| Sweetwater | $169 | -15% |

| Sylvester | $169 | -15% |

| Taft | $176 | -11% |

| Taft Southwest | $176 | -11% |

| Tahoka | $179 | -10% |

| Talco | $177 | -11% |

| Talpa | $168 | -16% |

| Talty | $194 | -2% |

| Tarpley | $170 | -14% |

| Tarzan | $177 | -11% |

| Tatum | $191 | -4% |

| Taylor | $175 | -12% |

| Taylor Lake Village | $189 | -5% |

| Teague | $171 | -14% |

| Tehuacana | $165 | -17% |

| Telegraph | $169 | -15% |

| Telephone | $176 | -12% |

| Telferner | $170 | -15% |

| Tell | $174 | -13% |

| Temple | $161 | -19% |

| Tenaha | $183 | -8% |

| Tennessee Colony | $174 | -13% |

| Tennyson | $159 | -20% |

| Terlingua | $156 | -22% |

| Terrell | $189 | -5% |

| Terrell Hills | $192 | -4% |

| Texarkana | $178 | -10% |

| Texas City | $189 | -5% |

| Texhoma | $195 | -2% |

| Texline | $177 | -11% |

| The Colony | $187 | -6% |

| The Hills | $176 | -11% |

| The Woodlands | $179 | -10% |

| Thicket | $192 | -3% |

| Thomaston | $171 | -14% |

| Thompsons | $196 | -2% |

| Thorndale | $173 | -13% |

| Thornton | $164 | -18% |

| Thrall | $175 | -12% |

| Three Rivers | $172 | -13% |

| Throckmorton | $173 | -13% |

| Tiki Island | $188 | -5% |

| Tilden | $173 | -13% |

| Timberwood Park | $190 | -5% |

| Timpson | $181 | -9% |

| Tioga | $167 | -16% |

| Tivoli | $163 | -18% |

| Tokio | $170 | -15% |

| Tolar | $173 | -13% |

| Tom Bean | $170 | -15% |

| Tomball | $195 | -2% |

| Tool | $179 | -10% |

| Tornillo | $179 | -10% |

| Tow | $173 | -13% |

| Toyah | $162 | -19% |

| Toyahvale | $162 | -19% |

| Trent | $168 | -15% |

| Trenton | $179 | -10% |

| Trinidad | $178 | -10% |

| Trinity | $182 | -9% |

| Trophy Club | $173 | -13% |

| Troup | $181 | -9% |

| Troy | $162 | -18% |

| Tuleta | $168 | -15% |

| Tulia | $179 | -10% |

| Turkey | $182 | -9% |

| Tuscola | $172 | -14% |

| Tye | $170 | -15% |

| Tyler | $182 | -8% |

| Tynan | $166 | -17% |

| Umbarger | $186 | -6% |

| Universal City | $180 | -9% |

| University Park | $211 | 6% |

| Utopia | $176 | -12% |

| Uvalde | $167 | -16% |

| Uvalde Estates | $167 | -16% |

| Val Verde Park | $166 | -16% |

| Valentine | $156 | -21% |

| Valera | $175 | -12% |

| Valley Mills | $174 | -13% |

| Valley Spring | $171 | -14% |

| Valley View | $178 | -11% |

| Van | $184 | -7% |

| Van Alstyne | $174 | -13% |

| Van Horn | $160 | -19% |

| Van Vleck | $178 | -11% |

| Vancourt | $156 | -22% |

| Vanderpool | $171 | -14% |

| Vega | $186 | -6% |

| Venus | $181 | -9% |

| Veribest | $155 | -22% |

| Vernon | $168 | -16% |

| Victoria | $170 | -15% |

| Vidor | $195 | -2% |

| Villa Verde | $197 | -1% |

| Village Mills | $188 | -6% |

| Vinton | $180 | -10% |

| Voca | $177 | -11% |

| Von Ormy | $193 | -3% |

| Voss | $167 | -16% |

| Votaw | $194 | -3% |

| Waco | $169 | -15% |

| Wadsworth | $178 | -10% |

| Waelder | $176 | -11% |

| Waka | $168 | -15% |

| Wake Village | $178 | -11% |

| Walburg | $175 | -12% |

| Wall | $157 | -21% |

| Waller | $190 | -4% |

| Wallis | $177 | -11% |

| Wallisville | $199 | 0% |

| Walnut Springs | $169 | -15% |

| Warda | $166 | -17% |

| Waring | $171 | -14% |

| Warren | $187 | -6% |

| Warrenton | $171 | -14% |

| Washington | $174 | -13% |

| Waskom | $187 | -6% |

| Watauga | $182 | -8% |

| Water Valley | $161 | -19% |

| Waxahachie | $185 | -7% |

| Wayside | $181 | -9% |

| Weatherford | $174 | -13% |

| Webster | $193 | -3% |

| Weesatche | $169 | -15% |

| Weimar | $173 | -13% |

| Weinert | $165 | -17% |

| Weir | $175 | -12% |

| Welch | $176 | -12% |

| Wellborn | $160 | -20% |

| Wellington | $183 | -8% |

| Wellman | $164 | -17% |

| Wells | $185 | -7% |

| Wells Branch | $181 | -9% |

| Weslaco | $201 | 1% |

| West | $171 | -14% |

| West Alto Bonito | $189 | -5% |

| West Columbia | $183 | -8% |

| West Lake Hills | $182 | -9% |

| West Livingston | $189 | -5% |

| West Odessa | $183 | -8% |

| West Orange | $197 | -1% |

| West Point | $174 | -12% |

| West University Place | $206 | 3% |

| Westbrook | $168 | -16% |

| Westdale | $171 | -14% |

| Westhoff | $167 | -16% |

| Westlake | $173 | -13% |

| Westminster | $182 | -9% |

| Weston | $181 | -9% |

| Weston Lakes | $185 | -7% |

| Westover Hills | $183 | -8% |

| Westway | $187 | -6% |

| Westwood Shores | $182 | -9% |

| Westworth Village | $184 | -8% |

| Wharton | $177 | -11% |

| Wheeler | $181 | -9% |

| Wheelock | $166 | -16% |

| White Deer | $184 | -7% |

| White Oak | $183 | -8% |

| White Settlement | $176 | -12% |

| Whiteface | $171 | -14% |

| Whitehouse | $186 | -7% |

| Whitesboro | $179 | -10% |

| Whitewright | $174 | -13% |

| Whitharral | $177 | -11% |

| Whitney | $170 | -15% |

| Whitsett | $166 | -17% |

| Whitt | $173 | -13% |

| Wichita Falls | $159 | -20% |

| Wickett | $162 | -19% |

| Wiergate | $182 | -9% |

| Wild Peach Village | $181 | -9% |

| Wildorado | $177 | -11% |

| Willis | $184 | -7% |

| Willow City | $174 | -12% |

| Willow Park | $173 | -13% |

| Wills Point | $183 | -8% |

| Wilmer | $212 | 7% |

| Wilson | $182 | -8% |

| Wimberley | $182 | -8% |

| Windcrest | $189 | -5% |

| Windom | $175 | -12% |

| Windthorst | $171 | -14% |

| Wingate | $158 | -21% |

| Wink | $169 | -15% |

| Winnie | $197 | -1% |

| Winnsboro | $174 | -13% |

| Winona | $184 | -8% |

| Winters | $165 | -17% |

| Woden | $183 | -8% |

| Wolfe City | $171 | -14% |

| Wolfforth | $185 | -7% |

| Woodbranch | $193 | -3% |

| Woodcreek | $184 | -8% |

| Woodlake | $180 | -9% |

| Woodlawn | $188 | -5% |

| Woodsboro | $169 | -15% |

| Woodson | $171 | -14% |

| Woodville | $184 | -7% |

| Woodway | $167 | -16% |

| Wortham | $174 | -13% |

| Wrightsboro | $174 | -13% |

| Wyldwood | $186 | -7% |

| Wylie | $194 | -3% |

| Yancey | $183 | -8% |

| Yantis | $181 | -9% |

| Yoakum | $173 | -13% |

| Yorktown | $172 | -13% |

| Zapata | $177 | -11% |

| Zavalla | $182 | -9% |

| Zephyr | $173 | -13% |

The average cost of car insurance in Texas’s biggest cities:

- Austin, $182 per month

- Dallas, $219 per month

- El Paso, $184 per month

- Fort Worth, $185 per month

- Houston, $217 per month

- San Antonio, $194 per month

Best and worst drivers in Texas

McKinney and McAllen have the best drivers in Texas due to their low driving incident rates, while Brownsville has the worst drivers.

Gez Z drivers are also far more likely to be involved in traffic incidents compared to older generations.

Driving incident rates are based on the number of speeding tickets, accidents and DUIs from October 2023 to October 2024.

Best drivers by city

McKinney has some of the best drivers in Texas, with only five driving incidents per 1,000 drivers in the city. McAllen has the next-best drivers in Texas.

| City | Incidents per 1,000 drivers |

|---|---|

| McKinney | 4.7 |

| McAllen | 5.3 |

| Amarillo | 5.8 |

| Lubbock | 6.8 |

| Plano | 6.9 |

Drivers in McKinney pay $182 per month, on average, for car insurance. In McAllen, drivers pay around $194 per month. Both cities come in below the state average of $199.

Worst drivers by city

Drivers in Brownsville and Killeen are prone to driving incidents. There were around 15 driving incidents per 1,000 drivers in both cities.

| City | Incidents per 1,000 drivers |

|---|---|

| Brownsville | 15.3 |

| Killeen | 15.0 |

| Corpus Christi | 14.9 |

| Denton | 14.0 |

| Frisco | 12.3 |

Despite the high incident rate, drivers in Killeen pay about $162 per month for car insurance, which is much cheaper than the state average. At $182 per month, drivers in Brownsville also pay less than the state average.

Best and worst drivers by age group

Not surprisingly, the number of traffic incidents goes up with younger, less-experienced drivers.

Gen Z drivers in Texas are more likely to be involved in traffic incidents than any other generation. They have an incident rate of 47 per 1,000 drivers.

Millennial drivers are the second-worst age group in our study, with a 25-incident rate, while baby boomers are the best drivers, at just 21 incidents per 1,000 drivers.

| Generation | Incidents per 1,000 drivers |

|---|---|

| Gen Z | 47.49 |

| Millennial | 25.09 |

| Gen X | 21.72 |

| Boomer | 21.28 |

| Silent Generation | 24.55 |

Best and worst drivers by car brand

On average, some car makes wind up with more accidents or traffic violations than others. In our data, Pontiacs tend to do the best, while Ram trucks do the worst.

Best drivers by car brand

People who drive Pontiacs have the lowest incident rate in Texas. Only about 15 drivers out of 1,000 with a Pontiac were involved in an incident.

| Make | Incidents per 1,000 drivers |

|---|---|

| Pontiac | 15.4 |

| Mercury | 16.0 |

| Chrysler | 18.4 |

| Mitsubishi | 20.0 |

| Buick | 20.3 |

Worst drivers by car brand

Ram vehicles are most likely to be involved in an incident, according to our data. There were 34 driving incidents per 1,000 Ram drivers.

Drivers with Mazda, Subaru, Acura and Lexus round out the worst incident rates.

| Make | Incidents per 1,000 drivers |

|---|---|

| Ram | 34.2 |

| Mazda | 30.1 |

| Subaru | 29.9 |

| Acura | 28.7 |

| Lexus | 28.5 |

Minimum coverage for car insurance in Texas

You must have at least 30/60/25 coverage to meet the Texas auto insurance requirements. This means you need:

- $30,000 of bodily injury liability coverage per person

- $60,000 of bodily injury liability coverage per accident

- $25,000 of property damage coverage

Bodily injury liability coverage helps pay the medical bills of anyone you injure in a car accident. Property damage liability coverage pays for damage you cause to property like fences, toll booths and light posts.

Texas law doesn’t require full coverage car insurance, which usually includes collision

Texas Automobile Insurance Plan Association coverage

Texas drivers who struggle to buy a car insurance policy can get basic coverage through the Texas Automobile Insurance Plan Association (TAIPA).

You can buy TAIPA coverage if you have been turned down by two car insurance companies.

Texas car insurance and flood damage

Recent devastating events have shown that no part of Texas is safe from floods. Here’s how you can protect yourself and your vehicle from flooding in Texas:

- You need comprehensive car insurance to cover flood damage to your vehicle. A policy with only liability coverage won’t pay to repair or replace cars damaged by flooding.

- Contact your insurance company or agent as soon as possible after flooding damages your vehicle.

- Be patient. It might take a while for your insurance company to send out an adjuster to assess the damage, especially if the flooding was widespread.

Frequently asked questions

Car insurance in Texas costs around $199 per month if you buy full coverage. If you only buy liability coverage, the state average cost is $79 per month.

State Farm is the cheapest car insurance company in Texas. It has the state’s lowest rates for adult drivers with clean records as well as for those with a speeding ticket, accident or DUI on their records. It also has the lowest rates for most teen drivers in Texas.

Here are some of the things you can do to get the cheapest car insurance in Texas:

- Look for discounts that are easy to get

- Bundle more than one policy with the same insurance company

- Consider trying a telematics program that tracks good driving habits

- Compare car insurance quotes from several companies while you shop for a policy

The main factors that impact car insurance rates in Texas are your:

- Location (where you live)

- Age

- Gender

- Vehicle make and model

- Driving record

- Insurance history

- Credit score

- Coverage types and amounts

- Deductibles

Texas is an at-fault state for car insurance. This means the driver who causes an accident pays any medical and repair bills tied to it.

How we selected the cheapest car insurance companies in Texas

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Texas

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.