Apple Credit Card Review: A Stylish Option With Smart Features and Some Trade-Offs

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

Key takeaway

Pros and Cons

Pros

- Very few fees

- Unlimited daily cash back

- See if you’re approved without impacting your credit score

- Financing offers on Apple products

- Advanced security features

- Share your card with co-owners and family members

- Access to Apple’s high-yield savings account

Cons

- Must use Apple ID to apply

- Not all businesses accept Apple Pay

- No sign-up bonus

- No intro APR

- Physical card is sent by request only

- No travel or purchase protections

Is the Apple Credit Card worth it?

If your iPhone is barely holding a charge or your old MacBook finally gave out after years of loyal service, you may be pondering how to fund your next big Apple purchase. Apple products don’t come cheap. So how do you make a big purchase feel a little less painful?

In a situation like this, the Apple Credit Card might stand out. This tech-savvy credit card option lets you split your Apple purchases into interest-free monthly payments, all managed from your Wallet app. Plus, you’ll earn a high rate of Daily Cash back on all purchases made directly with Apple.

However, it lacks many of the features found with other top cash back credit cards, including a sign-up bonus, higher everyday rewards and travel or purchase protections. If you’re looking to maximize rewards or need robust benefits, other credit cards may offer better overall value.

Quick facts

Recommended credit: Credit scores ranges may vary. Your individual chance at approval may vary due to factors such as creditors using a particular variation at their discretion Good / Excellent

Rewards Rate: 1% - 3% Daily Cash

- 2% Daily Cash every time you use Apple Card with Apple Pay

- 3% Daily Cash on all purchases made directly with Apple and select merchants

- 1% on other purchases made with your physical Apple Card

Welcome offer: N/A

Rates

- Intro purchase APR: N/A

- Regular purchase APR: 18.24% to 28.49% variable

- Intro balance transfer APR: N/A

- Regular balance transfer APR: N/A

- Regular cash advance APR: N/A

Fees

- Annual fee: $0

- Balance transfer fee: N/A

- Cash advance fee: N/A

- Foreign exchange fee: $0

- Late fee: $0

Compare the Apple Credit Card to similar cards

| Credit Cards | Our Ratings | Annual Fee | Welcome Offer | Rewards Rate | |

|---|---|---|---|---|---|

Apple Credit Card*

|

$0 | N/A | 1% - 3% Daily Cash

| ||

Capital One Savor Cash Rewards Credit Card

|

$0 | $200 Cash Back

Earn $200 Cash Back after you spend $500 on purchases within 3 months from account opening

| 1% - 8% cash back

| ||

Wells Fargo Active Cash® Card*

|

$0 | $200 cash rewards

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months

| 2% cash rewards on purchases

Earn unlimited 2% cash rewards on purchases.

| ||

Chase Freedom Unlimited®

on Chase's secure site Rates & Fees |

$0 | $200 cash back

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

| 1.5% - 5% cash back

|

on Chase's secure site Rates & Fees |

Apple Credit Card benefits

-

Very few fees

The Apple Credit Card comes with very few credit card fees including a $0 annual fee, $0 foreign transaction fee, $0 late fee and no over-the-limit fee — which means more cash in your pocket. You don’t have to worry about incurring costly fees in case you forget to pay your bill on time or go over your credit limit (though you’ll still owe interest). And you won’t accumulate a 3% fee on your charges when making purchases outside of the United States.

→ See LendingTree’s picks for top no-annual-fee credit cards and top credit cards with no foreign transaction fees.

-

Unlimited daily cash back

With the Apple Credit Card you earn 2% Daily Cash every time you use Apple Card with Apple Pay, 3% Daily Cash on all purchases made directly with Apple and select merchants and 1% on other purchases made with your physical Apple Card. Merchant offers may change at any time, but currently include:

- Apple

- Ace Hardware

- Booking.com

- ChargePoint

- Duane Reade

- Exxon Mobil

- Nike

- Uber

- Uber Eats

- Walgreens

You can find the most up-to-date offers on the Apple website.

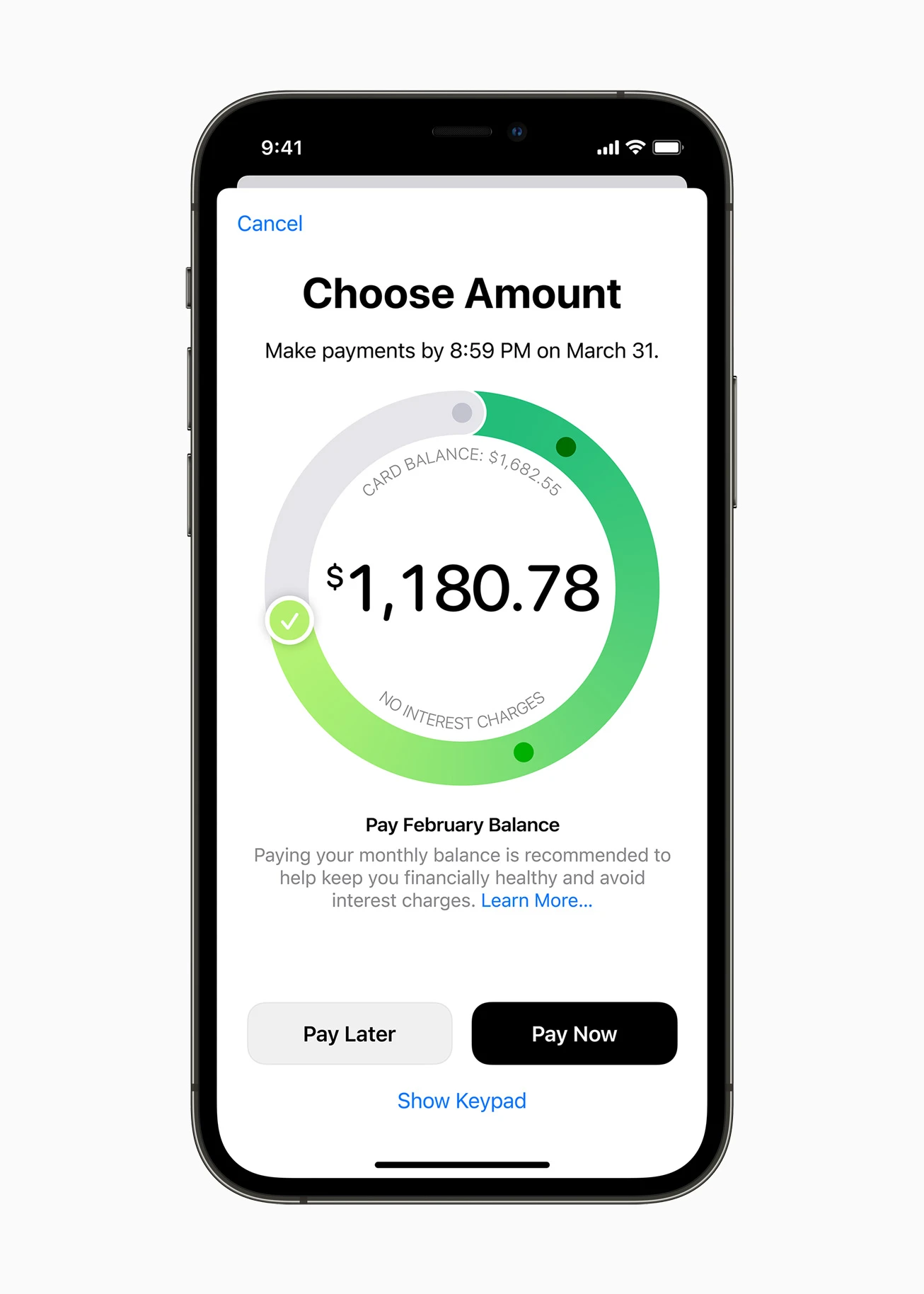

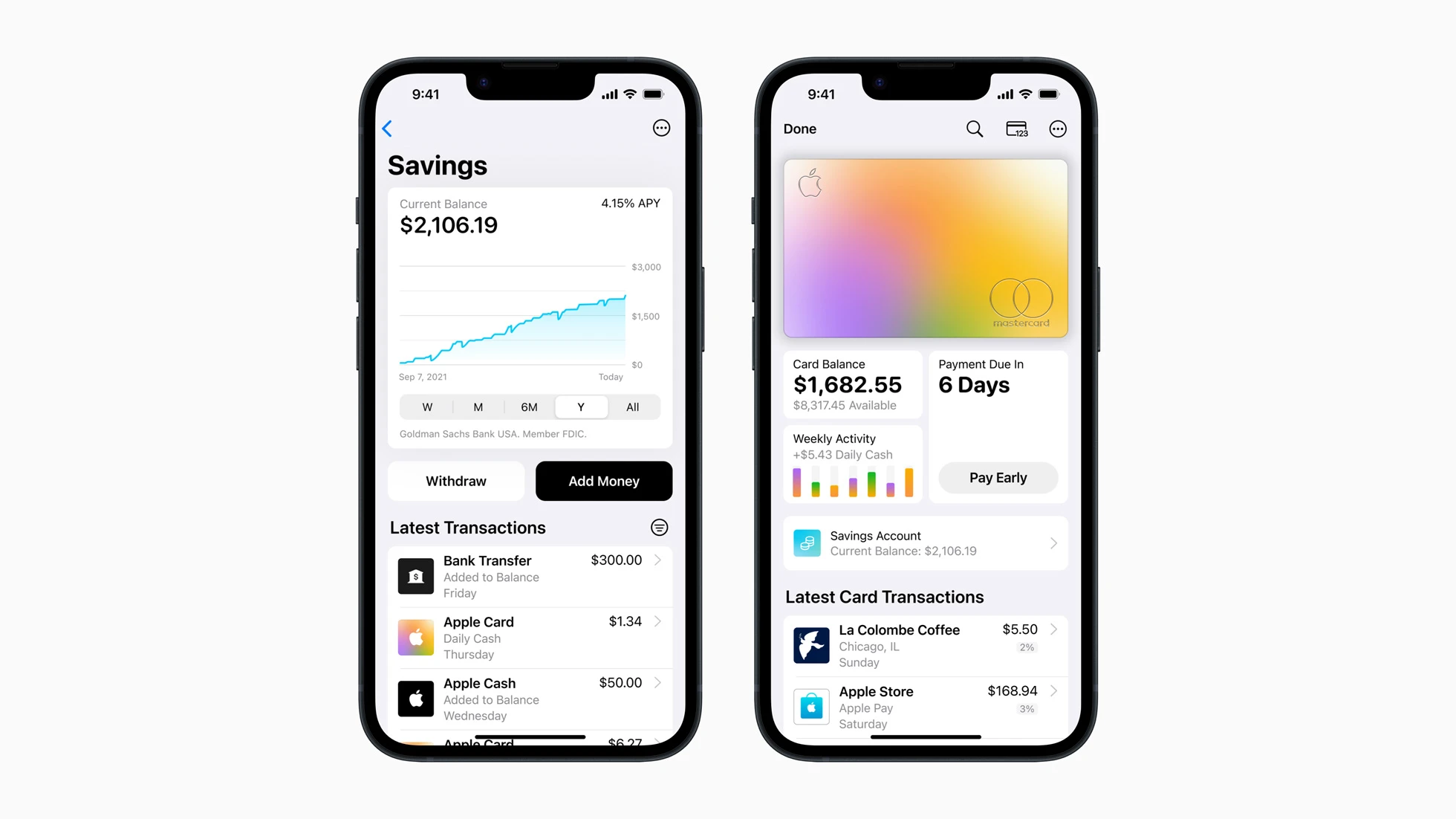

Most credit cards issue cash back rewards on a monthly basis, but the Apple Credit Card offers daily cash back. You can have your rewards automatically added to your Apple Cash card in the Wallet app, where they’re ready to use right away. Or you can open a savings account with Apple and route daily cash into the account where it can earn interest. There’s no limit to how much daily cash you can earn and it never expires or loses its value.

→ See all of LendingTree’s picks for top cash back credit cards.

-

See if you’re approved without impacting your credit score

You can apply for the Apple Credit Card in as little as a minute to see if you’re approved without impacting your credit score. If you’re approved, you’ll receive an offer that includes details like your credit limit, APR and fees. If you accept the offer, a hard pull of your credit report will be done.

-

Financing offers on Apple products

When you use your Apple Credit Card to buy a new iPhone, iPad, Mac, Apple Watch, AirPods, Apple Vision Pro or other Apple product, you can receive special interest-free financing through Apple Card Monthly Installments. To save even more, you can trade in an eligible device. And of course, you’ll earn 3% Daily Cash back on your purchase. Here’s how it works:

- Choose Apple Card Monthly Installments at checkout on apple.com, the Apple Store app or at the Apple Store.

- View your installments in the Wallet app.

- Track and pay your balance, which is automatically added to the minimum payment due on your Apple Credit Card.

- Get daily cash back on Apple purchases that you can use right away.

If you share your card with a co-owner, you’re both responsible for the payment. And if you or your Apple Card Family members have purchased multiple products, you’ll still only have one balance to pay.

-

Advanced security features

Once you’re approved for an Apple Credit Card, you’ll receive a digital card inside your Apple Wallet. This virtual card is protected by advanced security features like Face ID, Touch ID and unique transaction codes, so you’re the only one who can use it.

You can also request a physical card to use where Apple Pay isn’t available. You’ll notice there are no numbers on the card — front or back. This means that your number can’t be copied down by an unscrupulous server or cashier.

A few taps on your device or a call to customer support should stop unauthorized charges if your card falls in the wrong hands. Apple also says that your data isn’t sold to third parties for marketing or advertising.

-

Share card with co-owners or members of your Apple Family Sharing group

A neat feature of the Apple Credit Card is that you can share its cash back and credit-building benefits with co-owners or your entire Apple Family.

- Co-Owners: You can add your partner, spouse or another adult from your Family Sharing group as a Co‑Owner of your Apple Credit Card. Note, you’ll both be liable for the full balance and the account history will show up on both credit reports.

- Participants: You can add anyone 13 or older in your Family Sharing group as a participant to your Apple Credit Card. A participant can make purchases and manage spending across multiple devices. The Owner’s credit limit — or the combined credit limit of Co‑Owners — is shared with all participants and everyone gets access to their 3% Daily Cash back on their own purchases.

For participants who are 18 or older, this can be a great way to start building credit — if the account owner manages the account responsibly — since account activity and payment history are reported to credit bureaus.→ Learn more about the pros and cons of being an authorized user on a credit card.

-

Access to Apple’s high-yield savings account

As an Apple Credit Card owner or co-owner, you can open a high-yield savings account in just a few steps and manage it from your Apple Wallet. There’s no minimum deposit or balance required and no additional fees. This account is powered by Apple’s financial partner, Goldman Sachs.

You automatically direct your Daily Cash into your high-yield savings to grow your balance. You can also add funds from your Apple Cash balance, your linked Apple Credit Card bank account or any external bank account. You’re free to move money in or out whenever you like and can pause the Daily Cash transfers at any time.

Why it’s in my wallet

“I use the Apple Credit Card for most of my non-grocery purchases. It’s convenient since it’s built into my phone, so I always have it with me. I get a high rate of cash back on all Apple Pay purchases and at places like Walgreens and Mobil gas stations, which adds up over time. Redeeming the Daily Cash is simple — I usually just apply it to my monthly balance. I’ve never used the physical card since it only earns 1% and if I need to use a physical card, I can use my Wells Fargo Active Cash® Card which lets you earn unlimited 2% cash rewards on purchases.”

– Charlotte Zhang, credit cards writer at LendingTree

Apple Credit Card drawbacks

-

Must use Apple ID to apply

You must have (or create) an Apple ID to apply for the Apple Credit Card. Applying on your iPhone or mobile device is likely the most convenient way, but you can also apply via your computer.

If you’re not already in the Apple ecosystem, you’re not missing out on much since you need to make Apple-related purchases to earn the highest level of Daily Cash. Plenty of cash back credit cards offer the same, or better, levels of rewards without having to jump through additional requirements to obtain the card.

-

Not all businesses accept Apple Pay

More than 85% of businesses accept Apple Pay, but chances are there are a few places you shop that don’t accept it. You can request your own physical Apple Credit Card (which is a Mastercard) and use it to make purchases at these places, but you’ll only earn 1% cash back.

You can check in advance whether a store, website or app accepts Apple Pay. Look for the Apple Pay or contactless payment icons at checkout, or use the Maps app to find local businesses that support it. For online purchases, a site may list Apple Pay as a payment option during checkout.

→ Learn more about how credit cards work with Apple Pay.

-

No sign-up bonus or intro APR

There’s no sign-up bonus with the Apple Credit Card, which means no extra points or cash back rewards for meeting an initial spending requirement. The lack of an intro APR also makes it a poor choice for financing a large purchase outside of the Apple brand.

Most other cash back credit cards come with a sign-up bonus. For example, with the Capital One Savor Cash Rewards Credit Card, you can earn $200 Cash Back after you spend $500 on purchases within 3 months from account opening. Plus, there’s a 0% intro on purchases for 12 months (followed by a 18.49% - 28.49% (Variable) APR).

-

Physical card is sent by request only

If you prefer a physical card, this isn’t the card for you, since most of the benefits come from using it with Apple pay. You can request a sleek and shiny physical card, made of titanium, for those instances when Apple Pay isn’t available. However, since you’re going to only earn 1% cash back on those purchases, it doesn’t make sense to use the physical Apple Credit Card.

If you prefer using a physical card, there are plenty of options with a better rate on all purchases including the Wells Fargo Active Cash® Card, which allows you to earn unlimited 2% cash rewards on purchases.

-

No travel or purchase protections

While the Apple Credit Card offers strong security for purchases, it falls short in terms of travel and purchase protections. By comparison, some cash back cards like the Chase Freedom Unlimited® offer protections including purchase protection, extended warranty protection, auto rental coverage and trip cancellation and interruption insurance.

→ See all of LendingTree’s picks for best credit cards with travel insurance.

Consumers often don’t realize that you need to opt in to the Apple Credit Card‘s interest-free financing before making an Apple purchase. In October 2024, the CFPB fined Apple and Goldman Sachs for misleading customers about these interest-free payments.

“We had bought my husband’s phone from an Apple store in 2023 and paid with the Apple Credit Card, but were not given an option for financing. In the whirlwind of shopping (we went in for a repair but given the cost versus age of phone, we ended up trading it in for a new one), I forgot to ask how financing worked. After getting home, I saw there was no option to pay in installments. The ability to finance it over a few months had influenced our decision to buy a new phone rather than repair his current one that day.”

– Charlotte Zhang, credit cards writer at LendingTree

Tip: If you decide to take advantage of this feature, get additional clarity on how it works before committing to the product.

Alternate cash back credit cards

Apple Credit Card vs. Capital One Savor Cash Rewards Credit Card

The Apple Credit Card and Capital One Savor Cash Rewards Credit Card both offer cash back, but they cater to different spending styles. While the Apple Credit Card is focused on Apple purchases and Apple Pay, the Capital One Savor Cash Rewards Credit Card provides more earning potential across a wider range of everyday categories. That includes dining, entertainment and groceries. It also has the chance to earn a sign-up bonus and an introductory APR on purchases and balance transfers, unlike the Apple Credit Card.

Additionally, the Capital One Savor Cash Rewards Credit Card is our top pick for the best cash back credit card.

Apple Credit Card vs. Wells Fargo Active Cash® Card

While the Apple Credit Card requires you to use Apple Pay to earn at least 2% cash back, the Wells Fargo Active Cash® Card lets you earn unlimited 2% cash rewards on purchases. You can also earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months and get additional benefits like an intro APR on purchases and balance transfers and cellphone protection. For broader rewards and flexibility, the Wells Fargo Active Cash® Card provides stronger overall value.

Apple Credit Card vs. Chase Freedom Unlimited®

Although the Apple Credit Card is a good fit for loyal Apple users, the Chase Freedom Unlimited® offers broader earning potential in categories like travel, dining and drugstores. It also comes with a sign-up bonus and a competitive intro APR on purchases and balance transfers.

It also has better additional benefits, including purchase protection, extended warranty, trip cancellation/interruption insurance and rental car insurance.

Is the Apple Credit Card right for you?

The Apple Credit Card is a good card for avid Apple fans — you’ll earn a high rate of cash back on your tech purchases, which is a rare category for cash back cards. You’ll also get the convenience of paying with your phone through Apple Pay, which most businesses accept, and earning bonus cash back on your purchases. Plus, being able to see all of your data with a few taps of your screen is a nice feature.

However, it’s less rewarding for those who don’t regularly use Apple Pay, and it lacks features like a sign-up bonus, intro APR on purchases and benefits like travel and purchase protections. If you’re looking to maximize rewards, there are cash back credit cards that offer much more value like the Capital One Savor Cash Rewards Credit Card, Wells Fargo Active Cash® Card and Chase Freedom Unlimited®.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Apple Credit Card and Wells Fargo Active Cash® Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.