2025 LendingTree Concert Spending Report: 23% of Americans Have Used BNPL to Pay for Concerts

Nearly 1 in 4 Americans — including more than 1 in 3 Gen Zers and millennials — say they’ve used a buy now, pay later loan to pay costs associated with attending a concert or festival.

Scroll for more findings from the 2025 LendingTree Concert Spending Report.

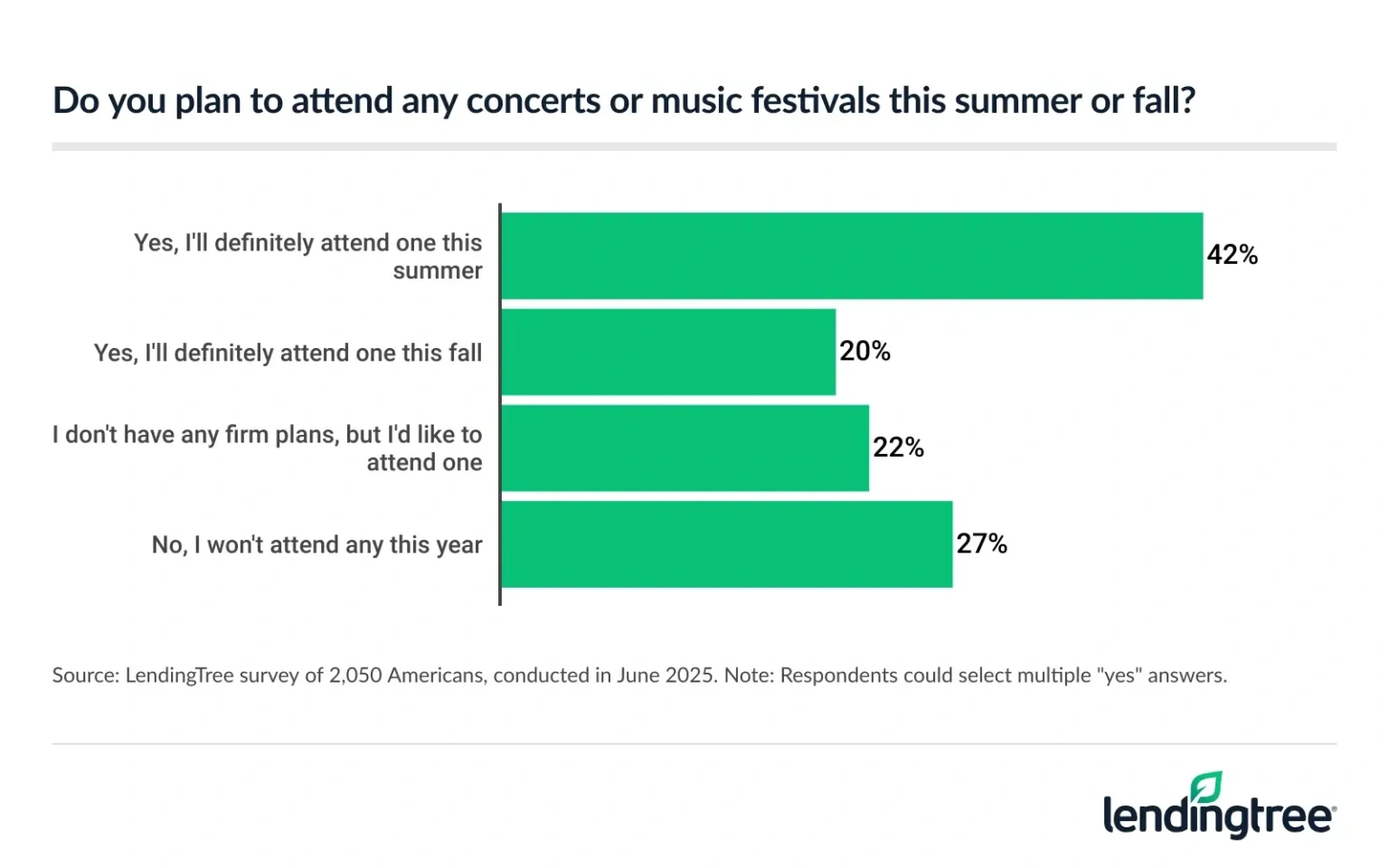

- Some of the biggest artists are touring this year, and fans from all over are willing to spend big to sing along in person. 51% of Americans plan to attend a concert or festival this summer or fall, estimating they’ll spend almost $1,000 on shows over the course of 2025.

- Many concertgoers are taking on debt, including BNPL loans, to pay for their experiences. About 1 in 3 concertgoers think they’ll go into debt over concert or festival spending this year. Additionally, 23% of Americans have used buy now, pay later loans for concerts or festivals, led generationally by Gen Zers (37%) and millennials (35%).

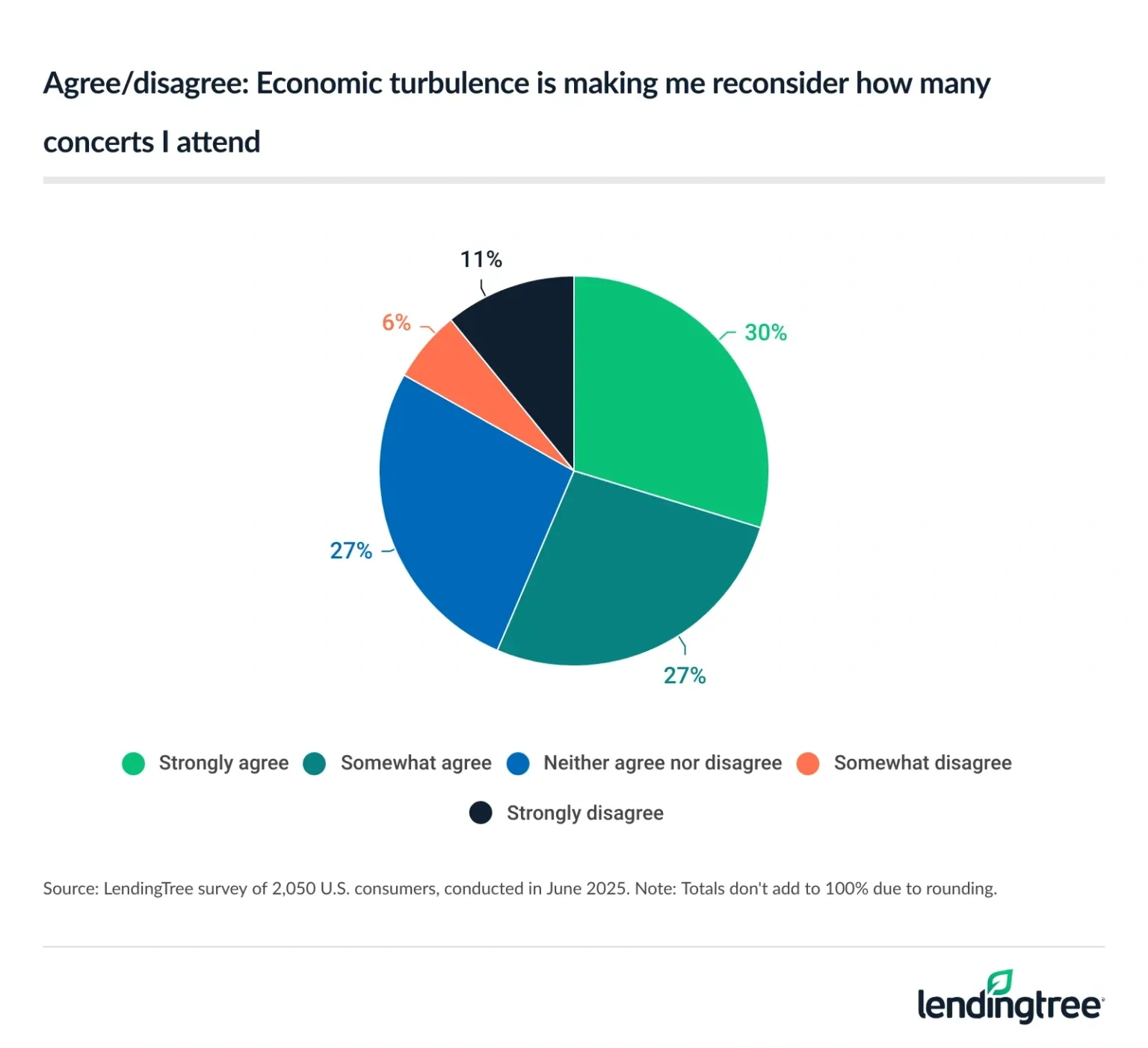

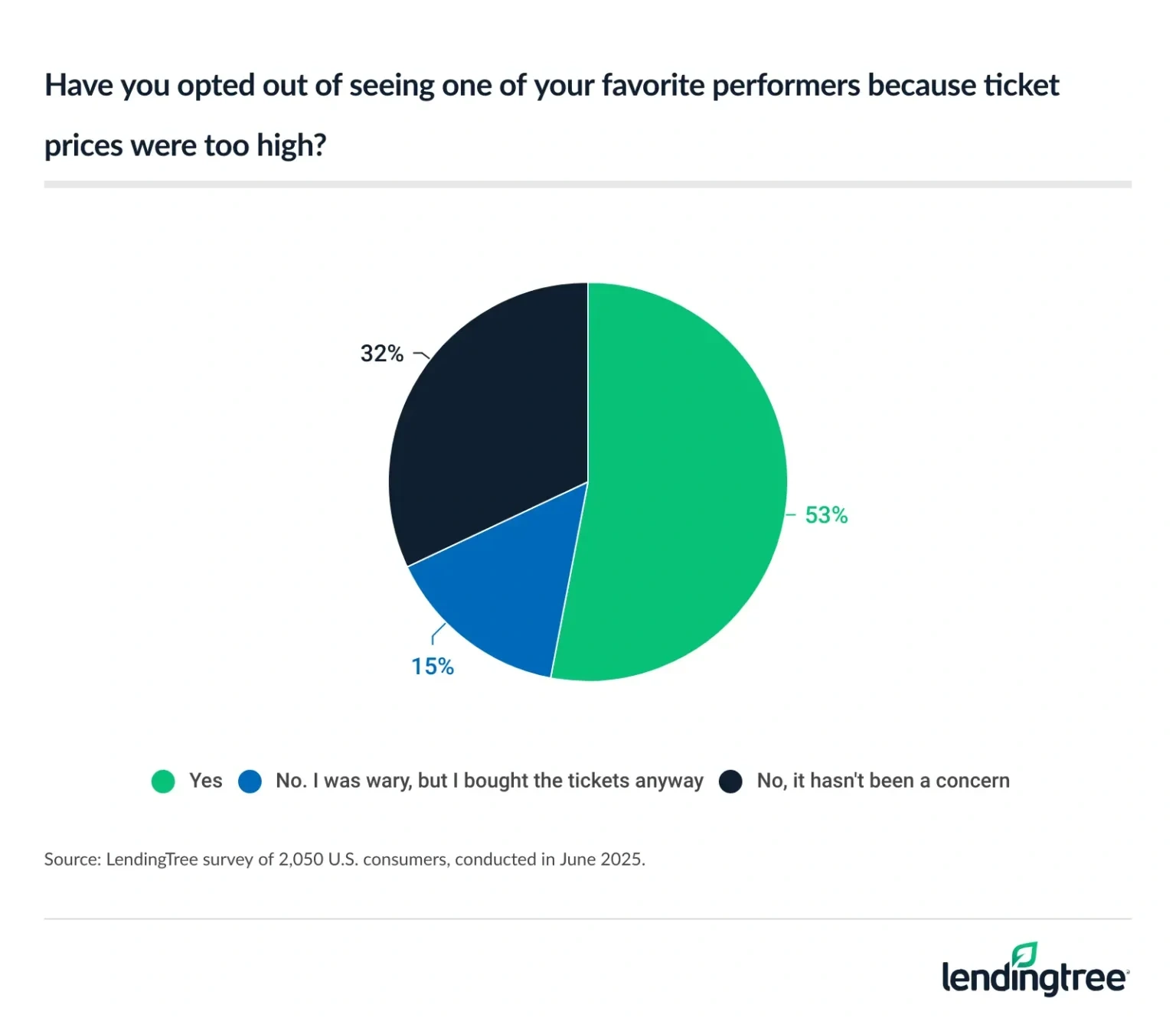

- Some fans opt out altogether because of high prices. 57% of Americans are reconsidering how many concerts they’ll attend due to economic turbulence, and 53% have missed out on seeing their favorite performers due to high prices.

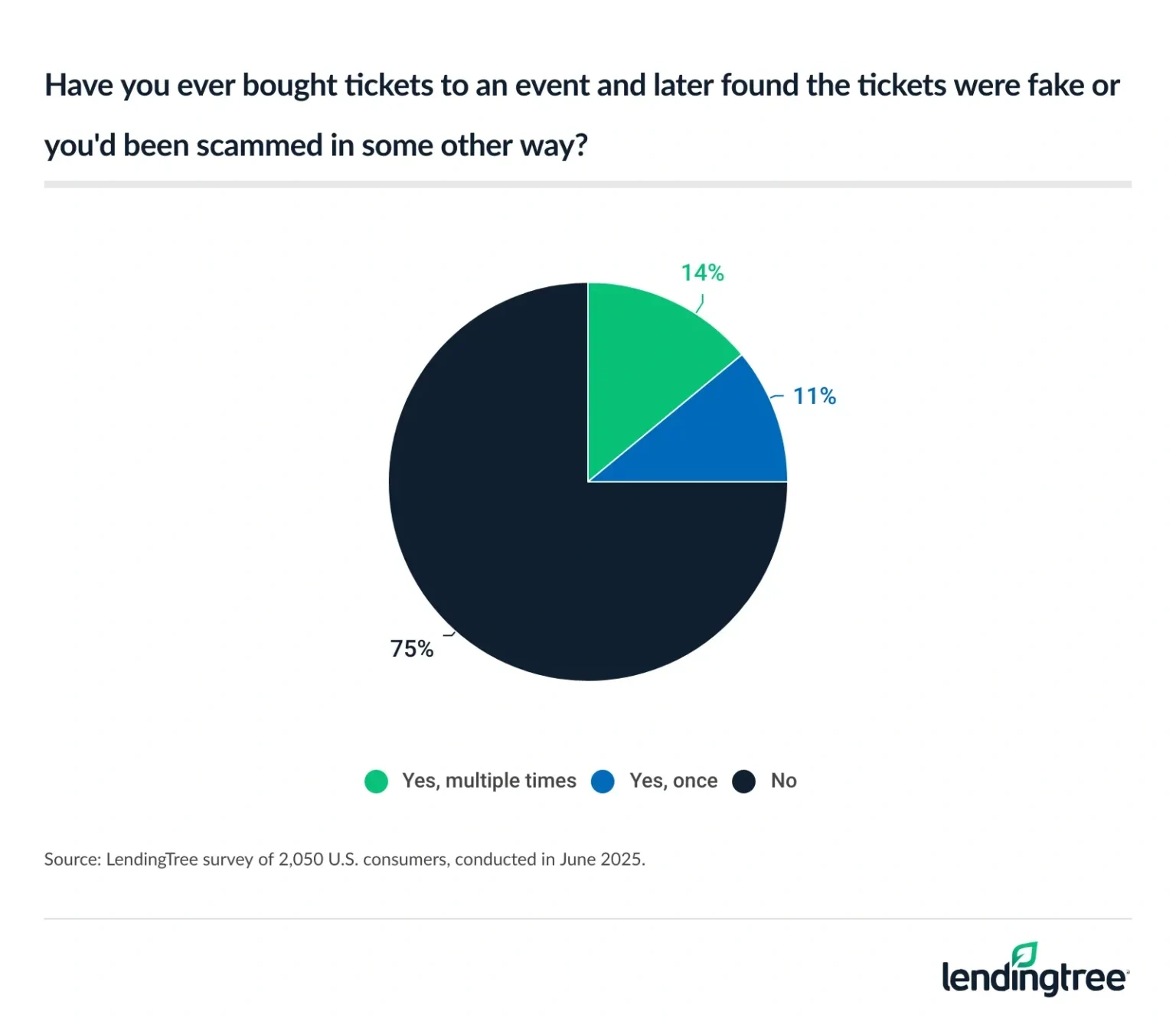

- Big tickets can be hard to get, and some fans get stung. 3 in 10 Americans have snagged tickets from a secondary market, and 1 in 4 say they’ve purchased show tickets and later found out they were scammed. More than 4 in 10 parents of young kids say they’ve been victimized (45%), as do 39% of those earning $100,000 or more a year.

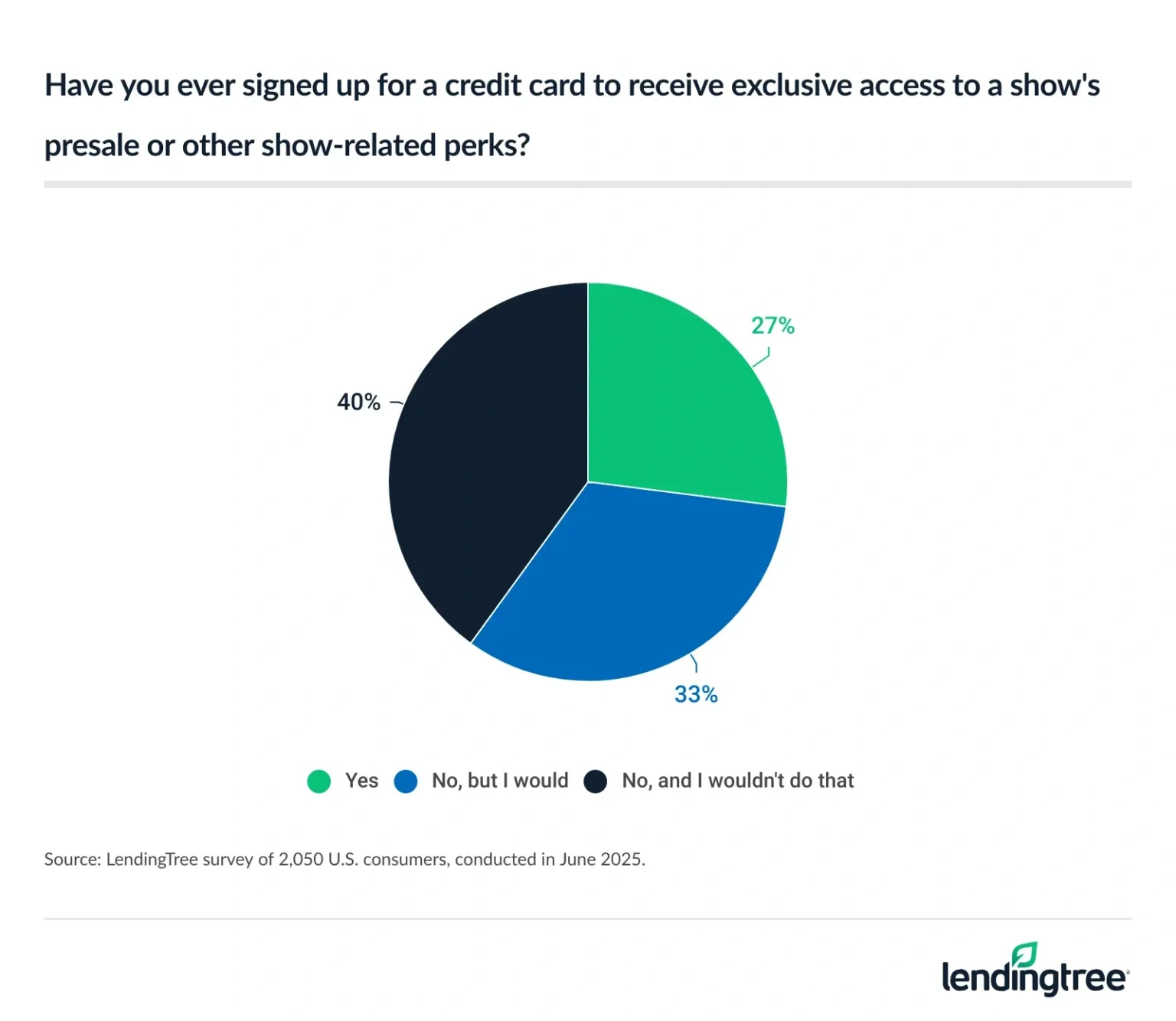

- Many utilize credit card perks to see their favorite artists. 65% of concertgoers plan to use rewards, points or miles to help fund their concert experience. Meanwhile, more than 1 in 4 Americans say they’ve signed up for a credit card to receive exclusive show perks.

Fans pay big to see their favorite artists

We Americans love a good concert. More than half of Americans told us they’re planning to attend a concert or festival this summer or fall.

The younger you are and the higher your income, the more likely you are to say you plan to check out a concert or festival this summer or fall. Also, parents with kids under 18 are the most likely demographic to say they’ll attend — 67% of them say they’ll attend a concert or music festival in the summer, while 25% say they’ll attend one in the fall.

Concertgoers will drop big bucks to see their favorite artists. Those who’ll attend a concert or festival this summer or fall estimate they’ll spend nearly $1,000 ($992, to be exact) on shows over the course of 2025 — and many of them will take on debt in the process.

When survey-takers were asked the most they had spent on a single concert ticket, the response averaged $237. When asked the most they’d be willing to spend on a ticket to see their favorite musician, the answer averaged $287.

Many concertgoers take on debt, including BNPL loans

About a third (31%) of those who’ll attend a concert or festival this year say they think they’ll go into debt as a result, and another 8% say they might. Parents of young kids (44%) are the most likely group to say they’ll go into debt over a concert or festival. Men are significantly more likely than women (39% versus 22%) to say so. More than 1 in 3 millennials ages 29 to 44 (36%) and Gen Zers ages 18 to 28 (35%) say the same, compared with just 6% of baby boomers ages 61 to 79.

For many concertgoers, especially younger ones, that debt will come in the form of a buy now, pay later (BNPL) loan. Nearly 1 in 4 Americans (23%) say they’ve used BNPL loans to pay for concert and festival expenses. The younger you are and the higher your income, the likelier you are to say so.

Parents of young kids are the most likely group to say they’ve used BNPL for these purposes, with 44% saying so. More than 1 in 3 Gen Zers (37%) and millennials (35%) say the same, versus 19% of Gen Xers ages 45 to 60 and just 3% of boomers.

Some fans opt out of concerts because of high prices

For some Americans, though, it’s all too much. When asked if they agreed that “economic turbulence” was making them reconsider how many concerts they attend, 57% said yes.

As you might expect, the groups most likely to say they’re reconsidering their concert attendance are similar to those taking on debt. Nearly 3 in 4 parents of young kids (72%) are reconsidering their plans. And the younger you are and the more income you make, the more likely you are to say the same.

Many people aren’t willing to make an exception for their most loved performers. More than half (53%) of Americans say they’ve skipped going to see one of their favorite artists because the price was too high.

Gen Xers (58%) and boomers (57%) are the most likely generations to say so, though millennials (48%) and Gen Zers (46%) aren’t too far behind. Parents with young kids and higher-income Americans are also more likely to opt out because of high prices.

Big tickets can be hard to get, and some fans get stung

Anyone who has ever tried to get tickets to an in-demand concert or festival knows how quickly tickets can sell out. However, concertgoers also know that because of secondary-market sellers like StubHub and SeatGeek, tickets are almost always available — if you’re willing to pay enough for them.

Three in 10 Americans have snagged tickets through one of these ticket resellers. Parents of young kids (47%), six-figure earners (45%), millennials (40%), Gen Zers (39%) and men (39%) are among the most likely to say they’ve done so.

There’s a risk with those purchases, however. Despite their best efforts, these secondary market sites aren’t able to keep all bad actors and fraudsters at bay. With that in mind, we asked Americans the following: “Have you ever bought tickets to an event and later found the tickets were fake or you were scammed in some other way?” A quarter of Americans (25%) said yes, including 14% who said it happened to them multiple times.

Men are nearly twice as likely as women to say they’ve been scammed (34% versus 17%). Millennials and Gen Zers (both at 38%) are far more likely than Gen Xers (22%) and boomers (4%). And higher-earning Americans are likelier than lower-income Americans to say so: 39% of those earning $100,000 or more, versus no more than 30% for anyone earning less.

Many use credit card perks to see their favorite artists

Credit cards can be a double-edged sword for ticket buyers. Yes, they make it easier to overspend in search of tickets to that big show. However, they can also open doors to experiences that may not be possible another way.

For example, rewards cardholders may be able to redeem points or miles to help fund their concert experience. There are also ticket presales and other events only available as perks to certain cardholders.

Our survey found that about two-thirds of concertgoers (65%) say they’ll use rewards to help pay for their concert and festival costs, and 27% of Americans overall say they’ve signed up for a credit card primarily to get access to a ticket presale or other perks.

More than half of parents with young kids (53%) and 44% of the highest-income earners say they’ve signed up for a card for those perks. On the other hand, just 5% of baby boomers and 21% of women say they’ve done the same.

Tips for keeping your concert-going debt under control

Crazy-expensive concert and festival tickets seem to be a simple fact of life these days, I’m sad to say. Whether your tastes lean more toward Taylor Swift, Kendrick Lamar, Bad Bunny, Beyonce or Morgan Wallen, it’s likely to be expensive — often prohibitively so — to see your favorite artists perform.

I’m different from many other personal finance experts in that I firmly believe it can be OK to take on a little debt to see your favorite musical artists. Good debt, by definition, is debt that gives you a strong return on investment, and that return doesn’t have to be financial. It can come in the form of lifelong memories and bonds with friends and family, too. Those sorts of things, as they say, are priceless.

The key, of course, is to keep that debt to a minimum. Having to pay off an unforgettable concert experience for a couple of months every once in a while is probably not a big deal. Regularly having to do it for six months to a year or more is a different story.

Here are some tips for making sure your concert debt doesn’t get out of control.

- Budget for it. Everyone has their thing they love to spend money on. Whatever yours is, make sure you make room for it in your budget regularly. That way, you’re more able to indulge in that passion without wrecking your finances.

- Start saving early. Stashing money away in a high-yield savings account, even if only a few dollars, can make a real difference next year when festival season comes around.

- Consider a credit card with a 0% introductory rate for new purchases. When it comes to 0% credit card offers, we tend to talk about balance transfers most often. However, plenty of cards come with no-interest offers for new purchases, too. The ability to go a year or more without paying interest on a new purchase can be a big deal.

- Be flexible. There can be a shocking amount of difference in ticket costs from city to city, especially on the secondary market. You may have heard stories, for example, of Taylor Swift fans opting to see her perform in Europe or South America because of high ticket prices in the U.S. Amazingly enough, fans found they could take an overseas trip — hotel, airfare, concert tickets and all — for about the same as what they would have spent on tickets for a U.S. performance. Those are extreme cases, but depending on where you live, a short road trip or flight may allow you to save real money on the overall cost of seeing your favorite artist.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,050 U.S. consumers ages 18 to 79 from June 12 to 14, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79