Most Guests Feel Weddings Are Too Expensive, and 31% Have Taken on Debt to Attend

As the months grow warmer, so do hearts — wedding season is approaching.

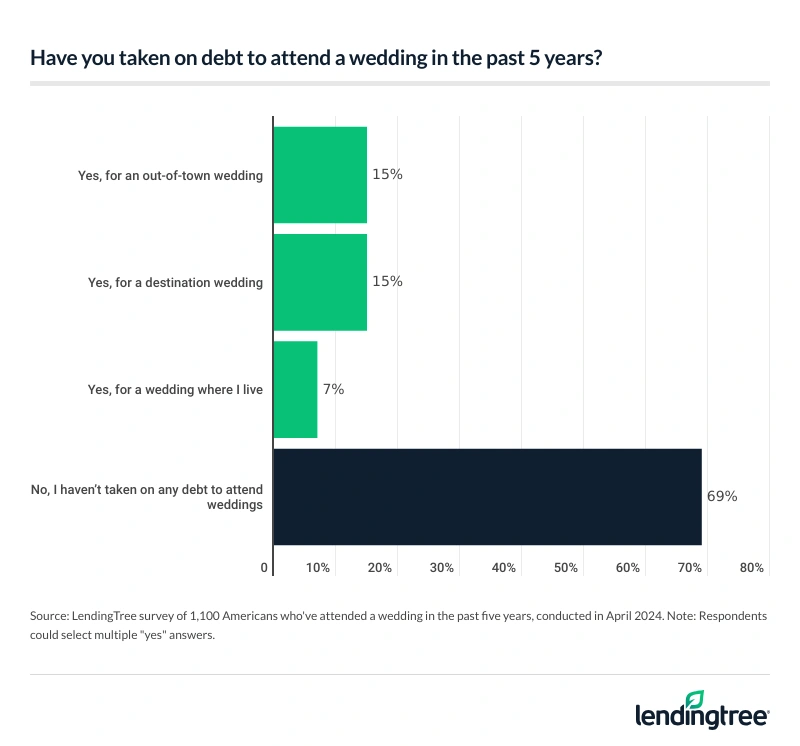

But it’s not just love that’s in the air during holy matrimony; debt is, too. Of the 54% of Americans who’ve attended a wedding in the past five years, 31% have taken on debt to do so, according to this LendingTree survey of over 2,000 Americans. And what’s more, 23% of that group took on $2,500 or more.

Read on for more in-depth findings about America’s financial relationship with the ceremony we use to celebrate relationships.

- Some wedding attendees say “I do” to overspending. Among the 54% of Americans who’ve attended a wedding in the past five years, 31% have taken on debt to attend one. And 23% that took on debt went into the hole $2,500 or more for their most expensive wedding.

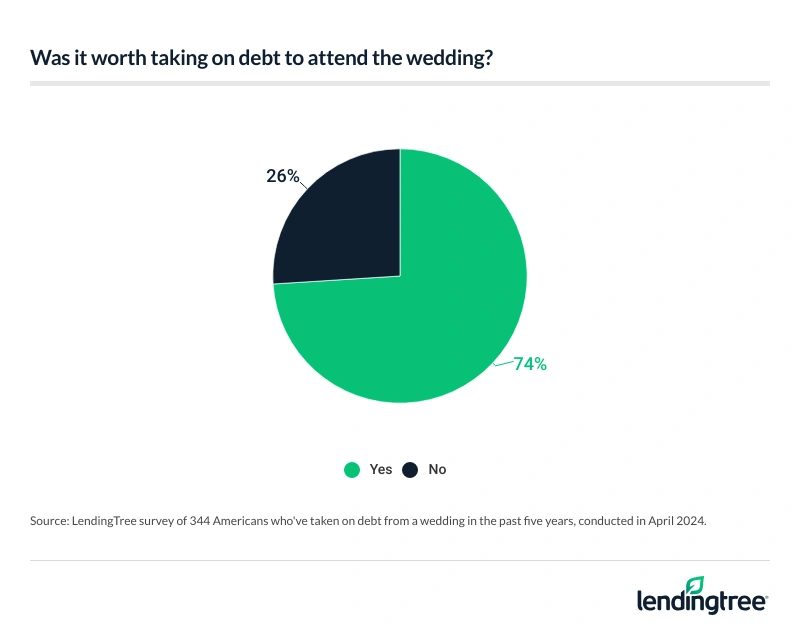

- Many feel pressured to overspend by outside influences. Among wedding guests who’ve gone into debt, 37% felt pressured to overspend by family, as well as 28% by friends and 26% by the happy couple themselves. However, most don’t have regrets, as 74% of those who went into debt say it was worth it.

- High-cost weddings affect budgets … and friendships. About a third (34%) of wedding guests have declined a wedding invitation due to costs, with 12% saying it ruined their relationship with the couple. However, over half (54%) of guests would be uncomfortable knowing their attendees took on debt for their wedding.

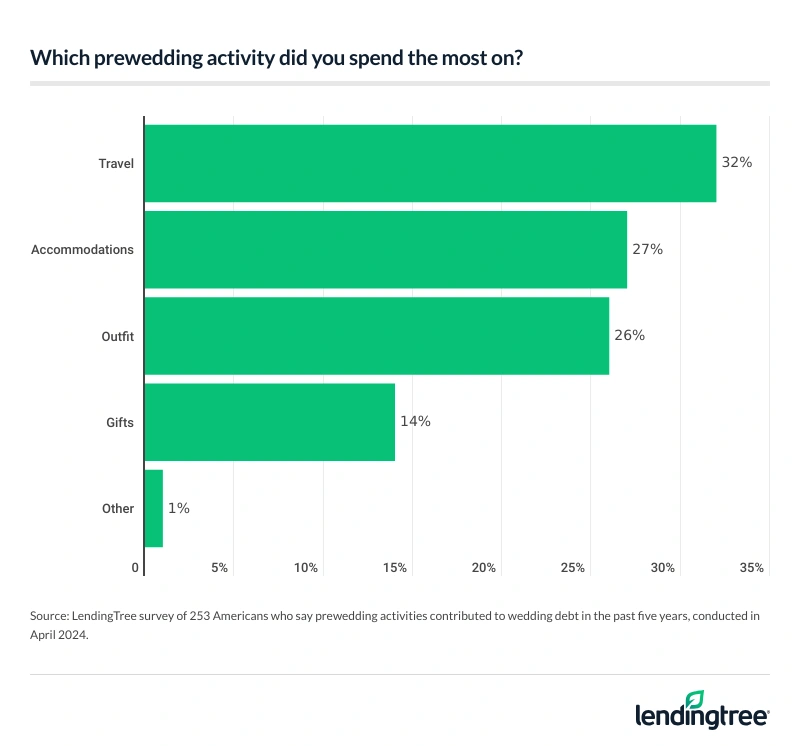

- For wedding party members, overspending goes beyond the big day. 74% of those who took on debt say prewedding activities such as bachelor parties or bridal showers contributed to their overspending, with travel (32%), accommodations (27%) and outfits (26%) being the top expenses. Considering those costs, it may not be surprising that 27% of guests have declined to be in a wedding party due to cost.

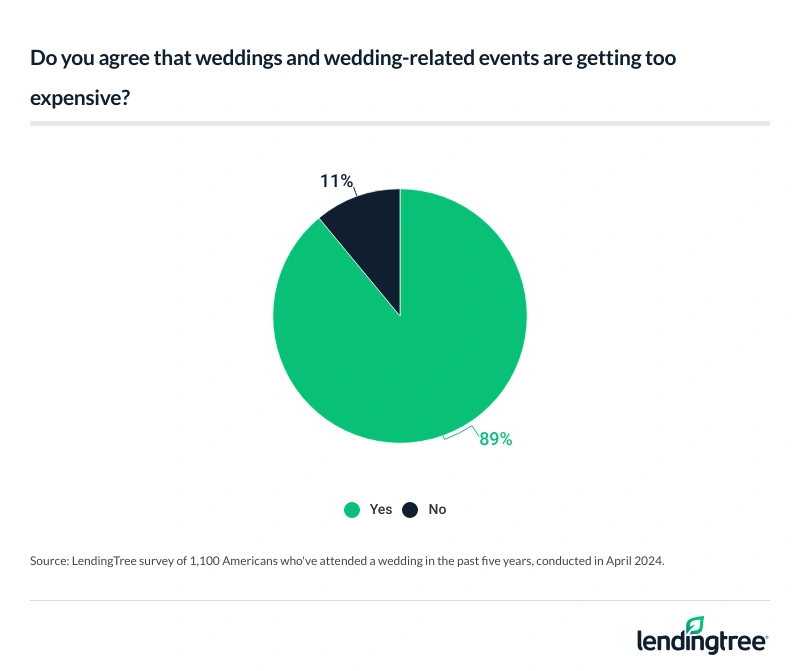

- One thing the majority of Americans can agree on is that the big day equals big pay. Almost all guests (nearly 9 in 10) agree that weddings and wedding-related events are getting too expensive, especially among baby boomers (95%) and Gen Xers (94%).

’Til debt do us part: 31% of recent wedding guests have taken on debt

More than half (54%) of Americans have attended at least one wedding in the past five years — with millennials ages 28 to 43 and Gen Zers ages 18 to 27 leading the generational charge. Among those age groups, 62% have attended at least one wedding, while 6% and 5%, respectively, have attended at least six weddings in that time frame.

Among wedding guests, 43% have spent an average of $100 to $499 to attend each blessed event. Another 29% spent an average of at least $500 a wedding, while 12% spent an average of at least $1,000.

That’s a lot of cash, contributing to why 31% of guests say they’ve gone into debt to attend a wedding.

Gen Z guests (47%) are the most likely generation to have done so, and men (40%) are almost twice as likely as women (22%) to go into debt to go to a wedding. Families with children younger than 18 (49%) are far more likely to go into debt in this way than those without children (27%) or those whose children are adults (13%) — which may not come as a surprise to parents, given the increasing cost of raising a child.

Many weddings require guests to travel, an expense they’re usually expected to shoulder. But most guests think their presence isn’t enough to count as a present: 91% of such wedding attendees say they felt pressure to give the couple a wedding gift, and 67% did.

Such gifts could be one more reason respondents have gone into debt to attend weddings — and some have gone into substantial debt. Of those who have taken on this kind of debt, 23% took on $2,500 or more. Fortunately, many guests (43%) took on less than $1,000.

How much is reasonable to expect to pay to attend a wedding? According to LendingTree chief consumer finance analyst Matt Schulz — the author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — “There’s no-one-size-fits-all answer. What’s reasonable for one person is outrageous and maddening for another.”

He does, however, think “the onus should be on the bride(s) and groom(s) to take their prospective guests’ financial circumstances into consideration when planning their big day” — whether it takes place close to home or further afield.

“If you’re close enough to these people to invite them to your wedding,” Schulz goes on, “give them the respect they deserve by not making them pay a fortune to see you say I do.”

87% of those with wedding guest debt feel pressured to overspend

The reality is that many wedding guests feel pressured to spend more than they can afford to celebrate love with their loved ones. Those who’ve taken on debt to attend a wedding say they’ve felt pressured by their family (37%), friends (28%) and the couple themselves (26%). Overall, 87% felt pressure to overspend regardless of the source.

Although unfortunate, Schulz says it’s not a surprise. “Practically every aspect of a wedding can create pressure to overspend: gifts, airfares, hotels, clothing, parties, rehearsals and more.”

How can you tackle the problem? “The best way to avoid such pressure is to honestly and openly communicate with those involved,” Schulz says. “If you’re willing to have that difficult conversation about money up front, you might be surprised with the response you get.”

Still, almost three-quarters (74%) of wedding attendees who took on debt say it was worth it. This is one financial area where the sexes agree: Men and women are equally likely to agree that taking on such debt is worthwhile. (Related, a recent LendingTree survey examined male and female financial approaches.)

As for which weddings are worth taking on such debt, however, not all nuptials are created equally. Guests are more likely to say they’d take on debt to attend the wedding of an immediate family member (56%), for example, than that of an extended family member (20%). About a third (31%) would be willing to take on debt to attend a close friend’s wedding.

Wedding expenses may strain guests’ relationships with the couple

Given the often-debt-inducing expense of attending weddings, some would-be guests decline for financial reasons, which can cause tension in their relationship with the bride(s) and groom(s). Among surveyed wedding guests, 34% admit they’ve RSVP’d “no” because of the cost of attendance. For 12% of wedding guests, the decision ruined their relationship with the couple.

Even in these awkward situations, however, most people are willing to be honest: Among respondents who declined an invite due to the cost of attendance, the majority — 69% — told the couple the reason they were bowing out.

Whatever they decide, most wedding guests stay true to their original RSVP: Only 26% have accepted a wedding invitation and later didn’t attend. Understandably, though, for those who did renege on their “yes,” the decision often — 57% of the time — negatively impacted their relationship with the couple.

Still, most guests (54%) say they’d be uncomfortable if they knew their wedding guests took on debt to be there — and 31% say they’d be very uncomfortable. (Baby boomers ages 60 to 78 are the generation least comfortable with the taking-on-debt-to-go-to-a-wedding phenomenon: 76% say they’d be uncomfortable, compared with only 35% of Gen Zers.)

Despite their discomfort, though, people aren’t checking in with their guests to get a sense of the financial strain their nuptials may be causing: 67% of wedding guests say a bride or groom has never asked them to offer their opinion about the cost of attending.

All this data suggests that, as Schulz mentioned, open and forthright communication might be in order, which may help lower tensions and costs.

From bouquets to bills: Wedding party members also feel a financial strain

As expensive as it can be to attend a wedding, it’s even costlier to be part of the wedding party — as 45% of guests have been in the past five years.

Of those who’ve taken on debt to attend a wedding, 74% say peripheral, prewedding activities, like bachelor/ette parties and bridal showers, contributed to their overall cost and debt burden. Specifically, the costs of travel (32%), accommodations (27%) and outfits (26%) for each event racked up the highest bills.

Despite costs, most respondents who’ve been wedding guests — 73% — have never declined an invitation to be in a wedding party. Still, that means more than a quarter (27%) of guests have turned down a wedding party invitation due to costs. For 10% of guests, the decision wreaked havoc on their relationship with the betrothed couple.

Of those who declined an invitation to participate in a wedding party on financial grounds, 73% told the person who invited them why. (Men — 75% — are slightly more likely to be up front about their reasons than women — 69%.)

Once again, an upfront conversation about costs could help clear the way for would-be wedding party members to say yes without blowing their budgets, but Schulz says such negotiations take tact. “It can be tricky,” he says. “The key is flexibility. Go into the conversation looking for a compromise that can work for everyone rather than putting your foot down.”

For example, Schulz says: “One great way to do that is to ask about the bride or groom’s priorities and let that drive the conversation. If the bachelorette party is a big deal to the bride but the rehearsal dinner isn’t, offer to rework your travels with that in mind. That way, you’re present for the things that matter most but still mindful of costs.”

Majority of Americans believe weddings are getting too expensive

Open conversations or not, most Americans are on the same page about one thing: The costs of weddings and wedding-related events are getting too expensive. Nearly 9 in 10 (89%) wedding guests agree with that sentiment, though Gen Zers are the most likely demographic to disagree, at 22%. (Perhaps this is because they’ve never known another way.)

Still, there are ways couples can mitigate the financial and energetic burden of attending a wedding for their guests and party members. For example, 30% of wedding guests say they enjoy weddings on holiday weekends since they already have time off — even if 28% don’t like such weddings since they take up free time that might otherwise be spent differently. (Another 43% say it makes no difference to them whether the weekend is a holiday.)

Further, more wedding guests (31%) don’t like weekday weddings than like them (26%), likely due to the logistics and scheduling of work, school and other commitments. And while the majority of wedding guests (57%) say formal attire is their preferred dress code for a wedding, a large contingent — 32% — would be happy in more casual attire.

Schulz suggests that brides and grooms give their wedding guests options as part of the planning process. “Provide different choices for hotels or rentals,” he says. “Give them multiple choices at different price levels for bridesmaid dresses. Connect those in your wedding party so they can work together to keep costs down through carpooling and other things.”

Obviously, some weddings — like a destination bash in Hawaii — are going to be costlier for guests than others, but even a little bit of agency might help guests feel a lot less salty about what they’re being asked to spend.

3 expert tips to celebrate love on a budget

A wedding should be a celebration of love — not a cause for financial alarm. Fortunately, there are ways to help lower the cost of attending and participating in weddings so you can be there for your besties without breaking the bank. Here are some tips from our chief credit analyst.

- Let credit card rewards help. “Whether you’re cashing in rewards for free airfares and hotel nights, saving a few cents per gallon on gas or getting a couple percentage points on everything you buy, credit card rewards can help you extend your wedding budget,” Schulz says. For destination weddings, a travel rewards credit card could make a big difference — and help you save on other trips, too. Of course, credit card rewards only work in your favor if you pay off your entire statement balance in full on time each month (to avoid accruing interest), so it’s still important not to spend more than you can afford or max out your card.

- Work with other guests. “Chances are that you’re not the only one struggling with the costs of the wedding,” he says. “Consider reaching out to other guests about sharing some of those costs. Maybe you’re sharing a room or a rental car with another bridesmaid. Maybe you split the cost of a wedding gift. There are many ways to save if you’re willing to ask.”

- Don’t be afraid to be vulnerable. “If you’re struggling financially and can’t afford to go even though you’d love to, share that with your friend or relative,” Schulz says. “Good people want to help their friends, but they can’t if they don’t know there’s a problem.” It might not always work out in your favor. But transparency likely is your best shot at strengthening your relationship with the couple.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,025 U.S. consumers ages 18 to 78 from April 1 to 4, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78