48% of Halloween Celebrators Are Planning Spooky Splurges, With Average Holiday Spending Expected to Reach $162

As Halloween approaches, it’s not just ghouls and ghosts sending shivers down your spine. In fact, 50% of Americans who plan to spend on Halloween say inflation will impact their related expenses. But it’s not just holding consumers back from buying: Around half (48%) of celebrators say they’ll make some Halloween splurges.

The latest LendingTree survey asks 2,000 U.S. consumers about their Halloween plans and purchases. Here’s what we found.

- Spooky season is approaching — but what’s scarier than inflation?! Most Americans (88%) plan to make Halloween-related purchases this year. Although 50% of this group says inflation will impact their spending, 48% of those planning Halloween purchases expect to make some spooky splurges that’ll haunt their wallets. The most common splurges are costumes (20%), themed activities (18%) and decorations (17%). Overall, those celebrating Halloween expect to spend an average of $162, with parents of young children planning to spend substantially more at $245, on average.

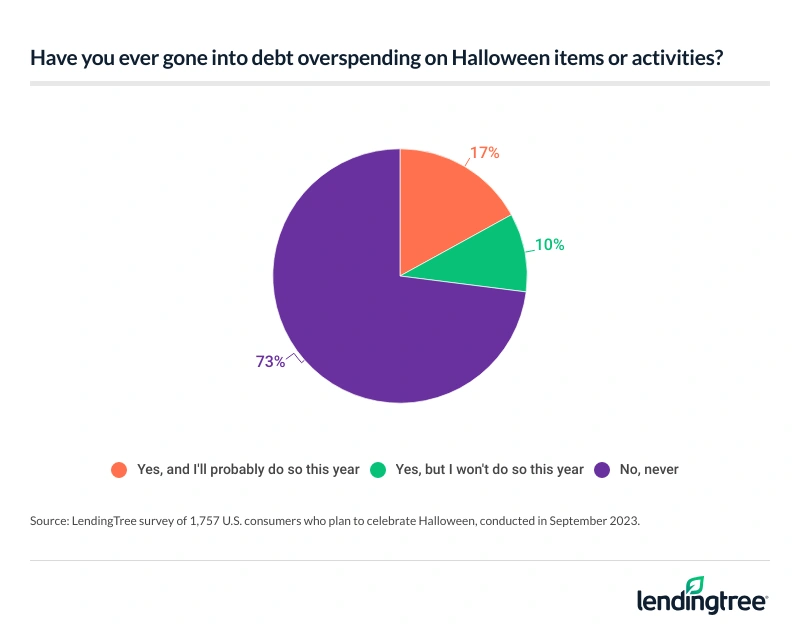

- Tricks, treats … and debt? Over a quarter (27%) of celebrators have taken on debt due to Halloween splurges in the past, with parents of children younger than 18 among the most guilty (40%). When asked why they overspent, more than half (51%) of these parents say they wanted to make their kids happy — but 48% regret sacrificing their finances for short-term Halloween thrills.

- Social media is to blame for some — but not all — Halloween spending. Almost a third (30%) of celebrators say they’re planning to purchase items specifically for social media posts. Unsurprisingly, younger generations lead here, with 41% of Gen Zers and 40% of millennials saying so.

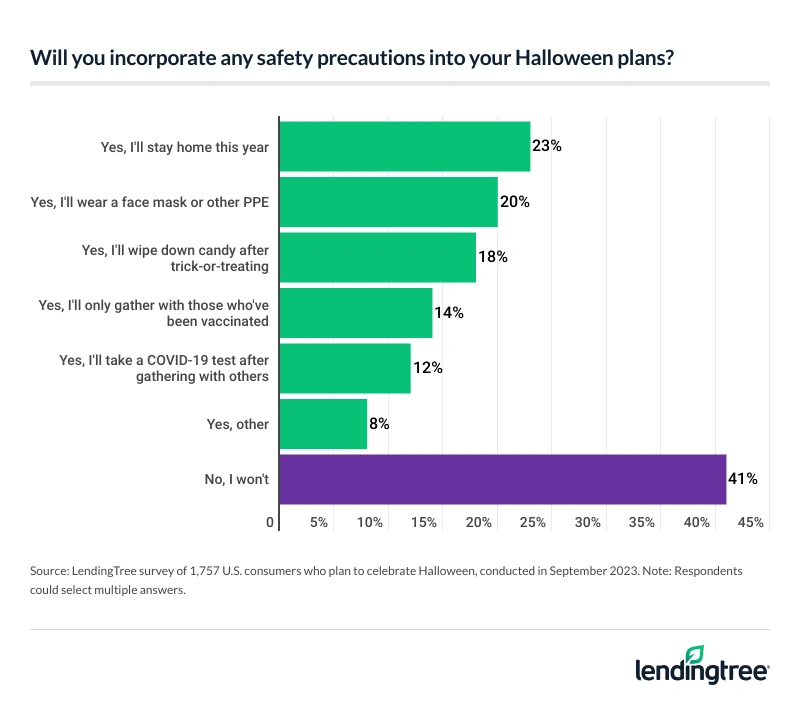

- Safety concerns haunt some parents. Almost three-quarters (73%) of parents with young children say they’ll thoroughly check their kids’ candy after trick-or-treating, while 19% say they’ll at least glance at it. Among all Halloween celebrators, 59% will incorporate some safety precautions this year. Of this group, 23% will stay home this year and 20% will wear a mask or other personal protective equipment (PPE).

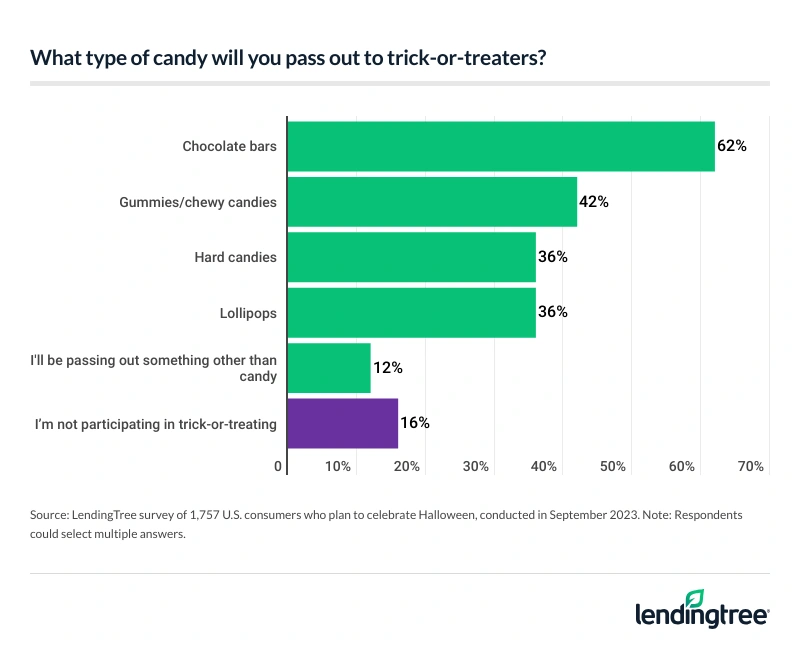

- Sweet treats and frightful flicks are in demand this Halloween. Among the 84% of Halloween celebrators who plan to pass out goodies to little ghosts and goblins this year, most will offer sugary confections — but trick-or-treaters may feel tricked by the 12% who plan to give out something other than candy. For 43% of Halloween celebrators, the spooky day will be celebrated in front of the TV. As further evidence that Americans enjoy a scary flick, almost a third (31%) of celebrators say they’ve subscribed to a new streaming service to enjoy Halloween-related movies and TV shows, while another 28% are considering doing so.

Americans are haunted by inflation as Halloween spending ramps up

The spooky season is approaching, and Americans are preparing for it. In fact, 88% of consumers plan to make Halloween-related purchases this year. By age group, millennials (ages 27 to 42) (94%) are the most likely to spend on Halloween, though Gen Zers (ages 18 to 26) (93%) aren’t far behind. Following that, 87% of Gen Zers (ages 43 to 58) and 76% of baby boomers (ages 59 to 77) plan to make spooky purchases this year.

Unsurprisingly, parents with children younger than 18 (96%) are much more likely to spend than those with no children (84%) and those with children older than 18 (82%). Meanwhile, six-figure earners are the most likely income group to shell out for Halloween, at 95%. On the other hand, those earning less than $35,000 a year (83%) are the least likely.

What, exactly, are consumers buying? Candy tops the expected Halloween purchases this year at 62%, with pumpkins and/or carving supplies (34%) as the next most popular purchase. Following that, Americans plan to buy:

- Outdoor decorations (31%)

- Indoor decorations (31%)

- Halloween-related food items (not including candy) (26%)

- Costumes for themselves (24%)

- Costumes for their kids (23%)

- Halloween-related accessories (not part of a costume) (21%)

- Arts and crafts (19%)

- Halloween-related beverages, including alcohol (19%)

- Halloween-related clothing (not part of a costume) (18%)

- Costumes for their pets (16%)

- Greeting cards (12%)

- Other (1%)

As Halloween spending ramps up, Americans won’t have to look for monsters under the bed — their wallets will be scary enough this year. Of those planning Halloween purchases, 50% say inflation will impact their spending. Still, that won’t stop the 48% of spenders planning to make spooky splurges.

When it comes to their splurges, freaky fits top the list — 20% plan to spend extensively on costumes. That’s followed by:

- Themed activities (18%)

- Decorations (17%)

- Full-sized candy to hand out (15%)

- Expenses for hosting a Halloween party (14%)

- Travel expenses to a Halloween-themed destination (10%)

- Something else (5%)

LendingTree chief consumer finance analyst Matt Schulz believes there’s a good chance that those splurges may not be as big as they’ve been in the past.

“There’s a general sense of financial unease that a lot of people are feeling right now,” he says. “After a few years of holiday splurging to make up for the lost time of the pandemic years, people may play Halloween a little more cautiously when it comes to spending.”

Overall, Halloween spenders plan to shell out an average of $162 for the holiday. Six-figure earners and parents of young children plan to spend the most, at an average of $253 and $245, respectively. By age group, millennials ($220) plan to spend the most, while men ($188) plan to spend much more than women ($138).

While that’s a substantial amount, it’s slightly less than the $169 Americans planned to spend when we conducted this survey last year. (Note: We asked this question across all Americans last year, while this year focused solely on Halloween spenders.) By demographic last year, six-figure earners ($340) and parents with young children ($309) again planned to shell out the most — though they’ve dropped their spending significantly this year.

Parents are the most likely to take on Halloween debt

Debt is a frequent visitor on Halloween, and it haunts many a celebrator. In fact, 27% of them have taken on debt due to Halloween splurges in the past, with 17% of this group planning to do so this year. Among those who’ve taken on debt, parents of children younger than 18 are the most likely to have done so at 40%.

Six-figure earners (37%) also top the list here. By age group, millennials and Gen Zers are the most likely to spend more than they could afford on Halloween, at 37% for both. Also worth noting, men (33%) are significantly more likely to take on Halloween debt than women (21%).

Schulz says it’s understandably easy to get swept up in all the costumes, candies, decorations and fun, especially when you have kids.

“You don’t have to go into debt to have a festive Halloween, though,” he says. “One of the best things you can do is budget for the holiday. It may be too late this year, but you can start doing that today for Halloween 2024. It may seem odd initially to stash money aside for Halloween, but budgets are about prioritizing. We’d think nothing of saving for travel or Taylor Swift tickets. It should be the same with Halloween. If it’s a passion and priority of yours, it should have a space in your budget.”

When asked why they overspent, 37% said they wanted to make their kids happy — the most common response. Unsurprisingly, parents of children younger than 18 (51%) are the most likely to cite this reason. Following that, overspenders shelled out because:

- They didn’t intend to spend so much, but it all added up (33%)

- They wanted their decorations to look as good as their neighbors’ (31%)

- They were hosting a party and wanted to impress their guests (29%)

- They were influenced by social media or advertisements (29%)

- They wanted to look good on social media (27%)

- They didn’t want to miss out on what their friends/family were doing (24%)

- They felt pressured to spend money on so many different items (24%)

- They had to repair damages from a prank or out-of-control party (22%)

- Other reasons (5%)

Still, half (50%) of overspenders regret doing so. Parents with young children are slightly less likely to feel regret, at 48%. And perhaps because they have more wiggle room in their budgets, six-figure earners (42%) are also among the least likely to regret overspending. For comparison, 58% of those earning less than $35,000 share similar regrets.

TikTok or treat? 30% of celebrators are spending specifically for social media

Americans aren’t exactly creepin’ it real on their socials. Almost a third (30%) of celebrators say they’re planning to purchase items specifically for social media posts, while just over a quarter (26%) say they’ve done so in the past. Parents with young children (45%) and six-figure earners (43%) are particularly likely to trade cash for likes this year.

Further, it may come as no surprise that Gen Zers (41%) are the most likely age group to spend for a social media post this year, though millennials (40%) aren’t far behind.

While most users are keen to show off their costumes on social media, it’s worth noting that many consumers plan to DIY their fits this year. In fact, 46% of those who plan to dress themselves, their child or their pet up for the holiday say they’ll make their costumes to save money.

Safety concerns plague some parents

While kids are almost certainly looking forward to trick-or-treating, parents understandably have some concerns about the candy. In fact, 73% of parents with young children plan to thoroughly check their kids’ candy and remove all items that are homemade, unwrapped or in packaging that’s discolored or torn — even if they otherwise appear fresh and/or edible. Meanwhile, 19% say they’ll at least glance at it to remove any obviously spoiled or inedible items.

That isn’t the only safety precaution consumers are taking. Among all Halloween celebrators, 59% will incorporate some safety precautions this year, with 23% planning to stay home and 20% planning to wear a mask or other personal protective equipment (PPE).

Of course, trick-or-treating wouldn’t be possible without consumers offering candy — whether it’s checked by parents or not. And this year, 84% of Halloween celebrators plan to pass out some goodies. Among the top candy choices, 62% will offer chocolate bars, 42% will provide gummies or chewy candy and 36% each will go with hard candy and lollipops. Still, trick-or-treaters may be surprised by the 12% who plan to give out something other than candy. (While some kids may feel jaded, those with allergies or who otherwise would be unable to have candy may be grateful for the inclusion.)

Netflix and chills, Hulu-ween and Amazon Scream: Streaming services are in demand this spooky season

Whether they’re offering candy to kids or not, buying Halloween treats (52%) is the most common way consumers plan to celebrate the holiday. That’s followed by decorating (45%) and watching a scary movie (43%).

While Hollywood has a long lineup of new Halloween releases this year, Americans also plan to cozy up to a scary movie at home — and they’re willing to pay a little extra to make that happen. In fact, 31% of celebrators say they’ve subscribed to a new streaming service to enjoy Halloween-related movies and TV shows, with parents of young children (47%), six-figure earners (43%) and Gen Zers (43%) the most likely to do so. Meanwhile, another 28% of celebrators are considering subscribing for some scary flicks.

While Schulz is surprised so many have (or might) subscribed to a streaming service for Halloween, he believes the ease of adding and canceling a subscription may play a role.

“This might show that people are comfortable with subscribing to streaming services and then canceling them when they’re done,” he says. “They may even just use that streaming service for an evening and cancel it the next day. It speaks well to how easy these services have made it to stop and start subscriptions, but it also speaks to what a bargain some of those services can be. Watching a movie with friends and family can be a pretty low-cost way to have a great Halloween even if you have to pay for one month of a streaming service to make it happen.”

Beyond treats, decorations and movies, Americans plan to celebrate by doing the following:

- Going to a Halloween-related activity (33%)

- Dressing up in a costume (28%)

- Going trick-or-treating (25%)

- Going to a Halloween party (25%)

- Dressing up their kids in a costume (24%)

- Making Halloween crafts (23%)

- Dressing up their pets in a costume (18%)

- Hosting a Halloween party (14%)

- Sending a greeting card (11%)

Spooktacular savings: Expert trips to curb overspending this Halloween

While Halloween is all about the treats, you don’t want to find any tricks in your bank statement come Nov. 1. To help reduce costs while celebrating the spooky holiday, Schulz recommends the following:

- Shop around. “Even around Halloween, taking the time to shop around and compare prices can make a big difference,” Schulz says. “And don’t be afraid to look in the bargain bin and the clearance section.” You should also utilize a rewards credit card to get back money on your shopping.

- Get creative. “Some of the best costumes and decorations each Halloween are the ones that come from people’s creative minds rather than from the Halloween store,” Schulz says. “Use stuff that you already have around the house. Make it a family project. Have some fun with it.”

- Reuse last year’s supplies. “Having Little Sister wear Big Sister’s old costume can save you some money,” he says. “Reusing last year’s decorations rather than getting all new stuff can, too. Making Halloween a group celebration can also help, especially if you turn it into a potluck and have people bring food and drinks and pitch in in other ways.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 77 from Sept. 5-11, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77