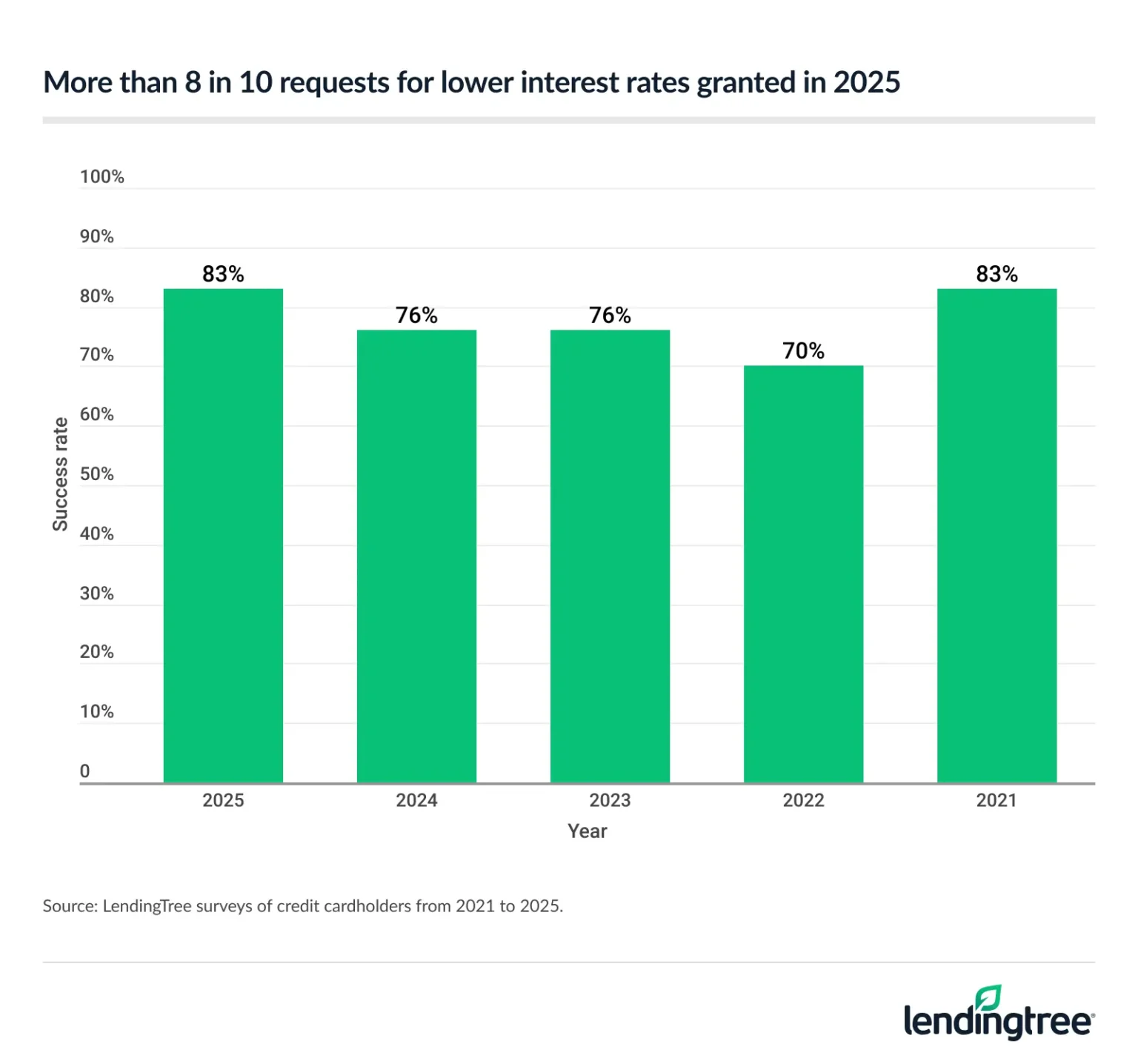

83% of People Who Asked for Lower Credit Card Interest Rate in Past Year Got One — Highest Since Pandemic

More than 4 in every 5 cardholders who asked for a lower interest rate on a credit card in the past year got their request granted, according to a LendingTree survey.

The 83% success rate is the highest since 2021 and is welcome news for cardholders who’ve been struggling with record debt and sky-high interest rates amid ongoing economic uncertainty. The survey also revealed that many other important requests cardholders can make are even more likely to be granted, including increasing a credit limit or waiving an annual fee or late fee.

Perhaps the best news of all, however, is that these rates have remained sky-high even as more cardholders ask for them.

Here’s what we found.

- 83% of those who asked for a lower interest rate on a credit card in the past year got one, matching pandemic-era highs. That’s a seven-point increase from last year. That 83% is the highest success rate seen since 2021, which also saw an 83% success rate. The average reduction was 6.7 points, which could result in more than $1,600 in interest savings over the life of a balance.

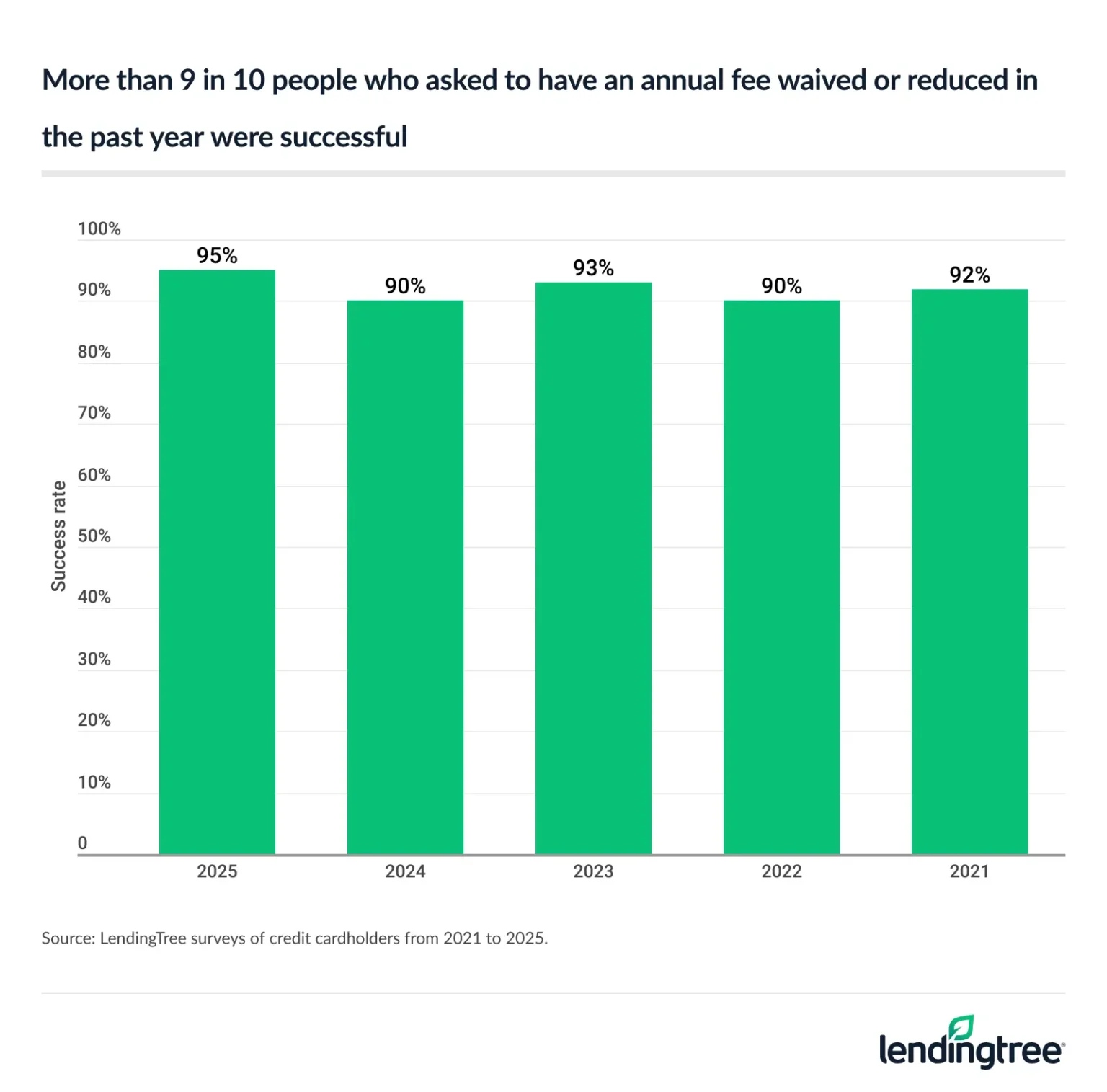

- 95% of those asking to have an annual fee waived or reduced in the past year were successful, the highest since tracking began. 74% of those who asked got their fees waived entirely, while another 20% got them reduced.

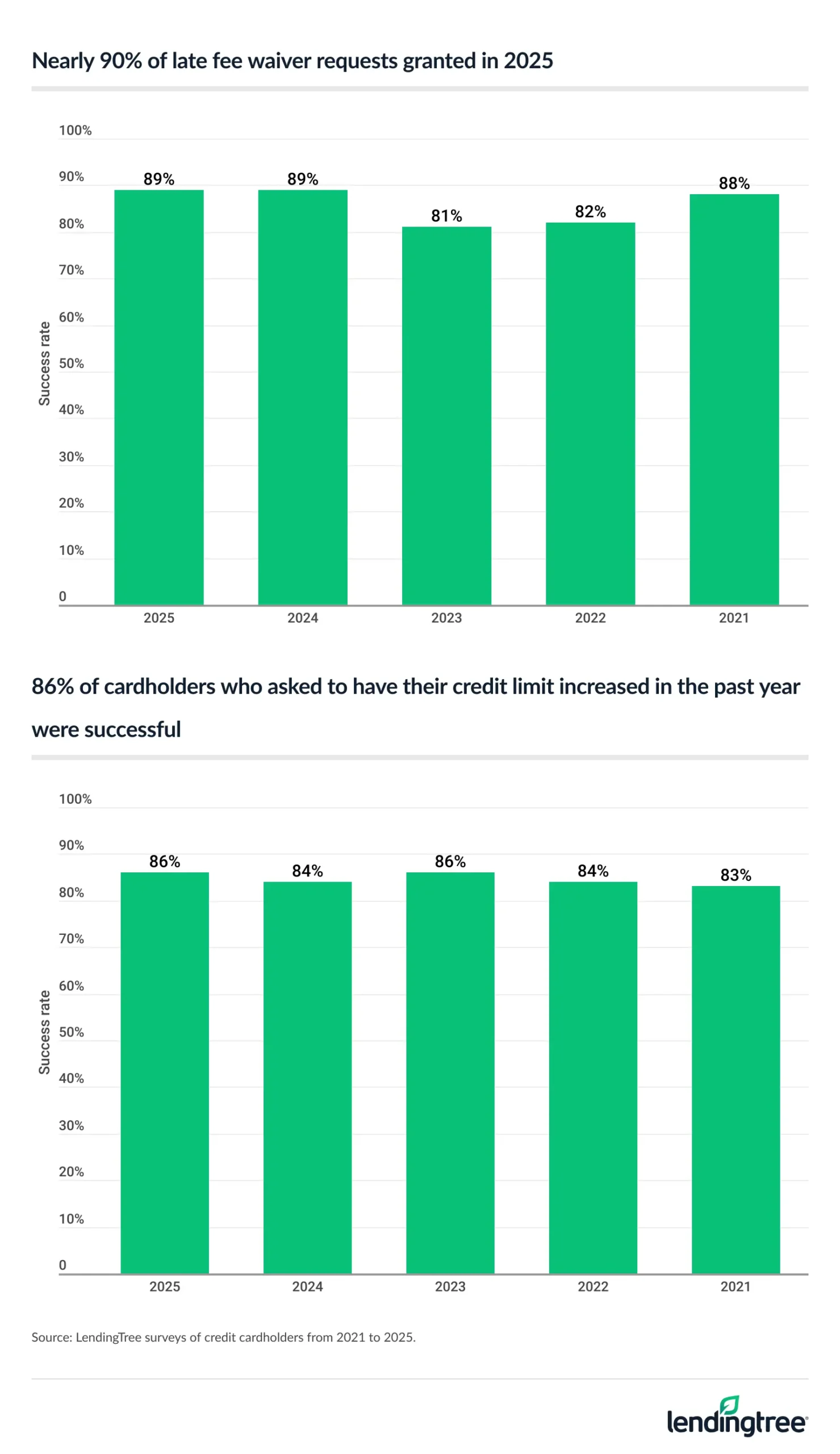

- Requests for waived late fees and higher credit limits remain highly likely to be granted. 89% of those who asked for a late fee to be waived in the past year got their way, which was unchanged from last year. Meanwhile, 86% of those asking for a higher credit limit in the past year had their request granted, matching the highest since tracking began. The average increase was $2,670, also a series high.

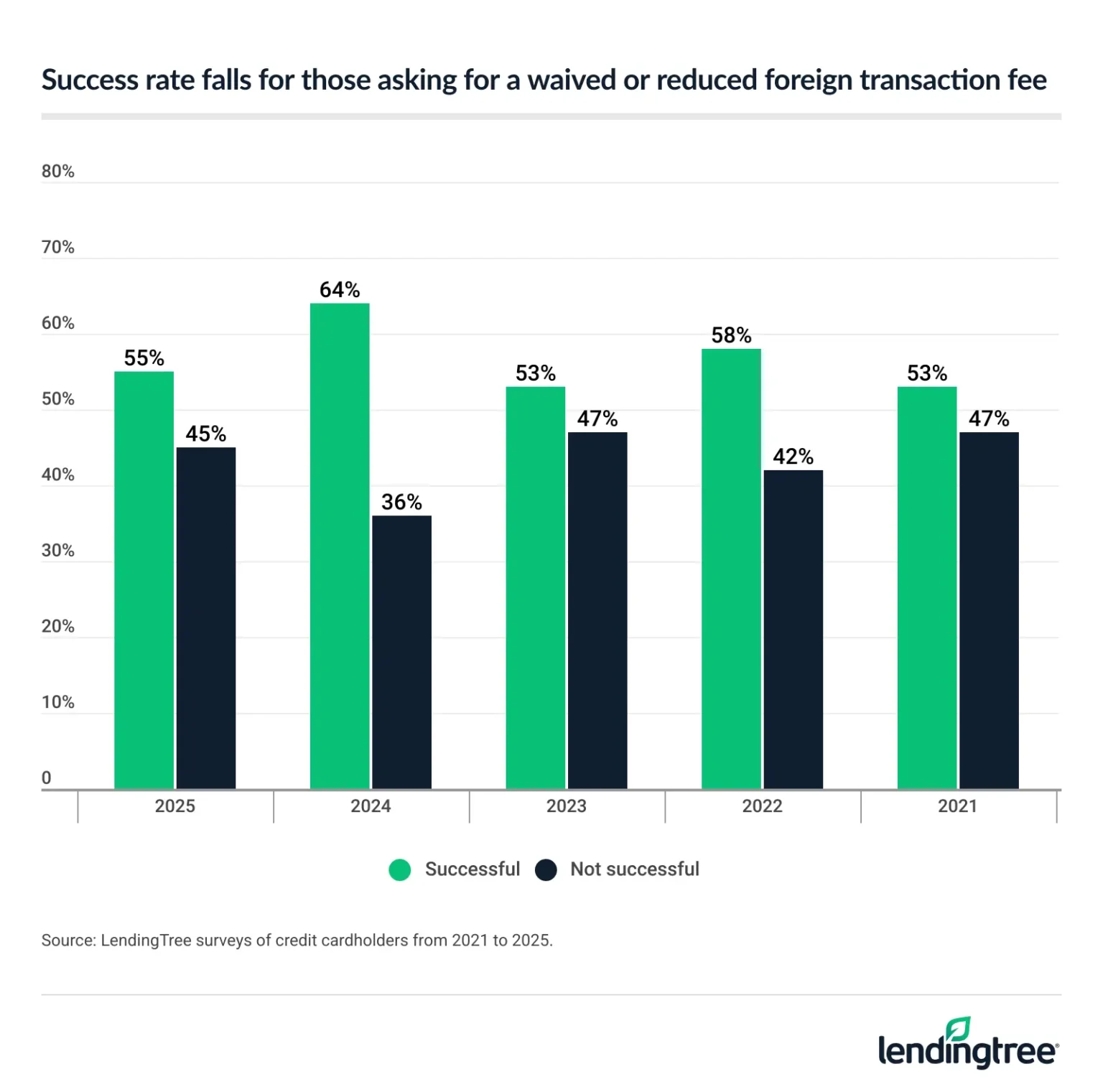

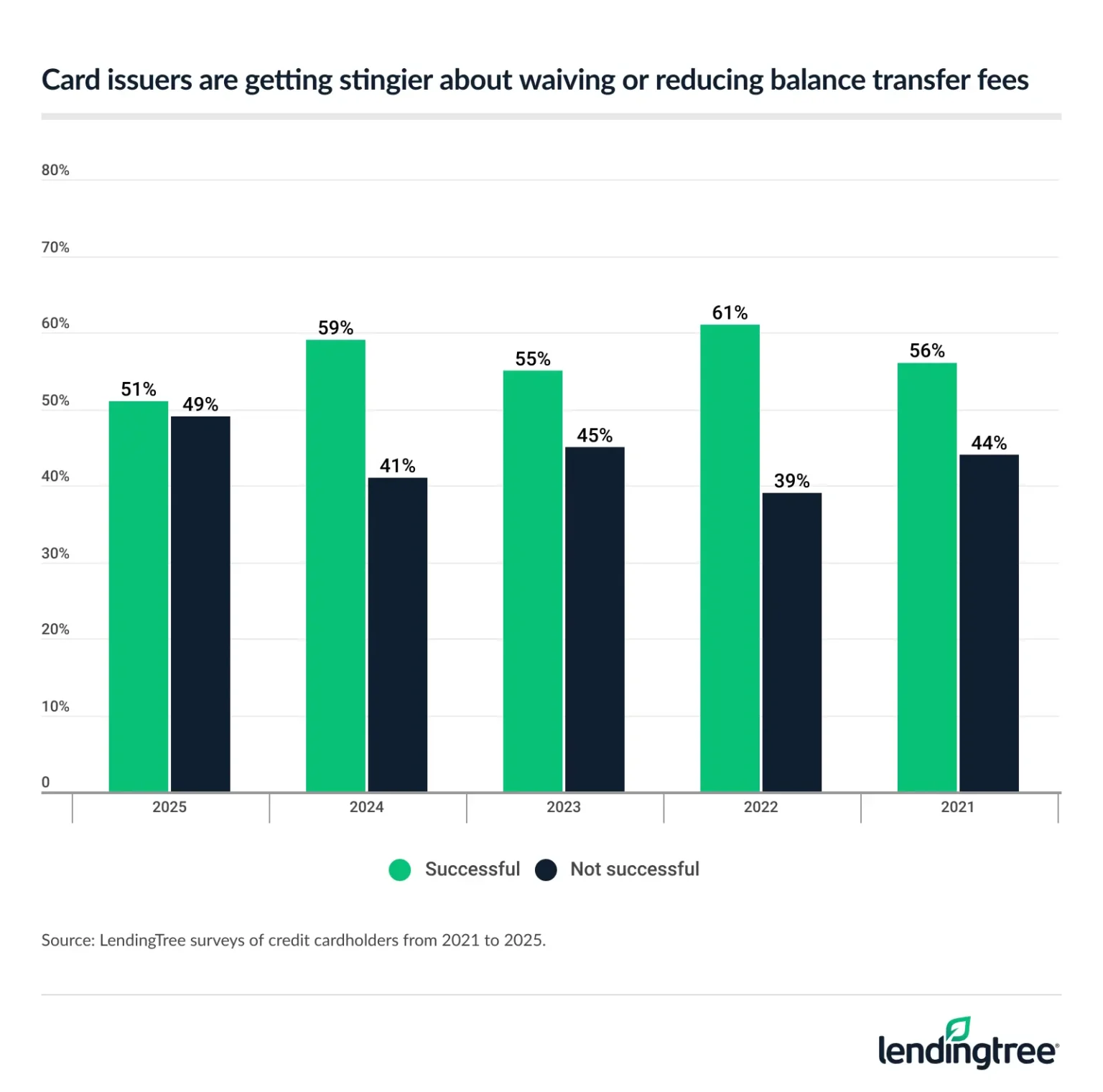

- Issuers are getting stingier about waiving or reducing balance transfer fees and foreign transaction fees. While both still have success rates of more than 50%, the percentage of those who successfully ask for both of these requests has fallen sharply in the past year. 55% of foreign transaction fee requests were granted (down nine points from 64% a year ago) and 51% of balance transfer fee requests were granted (down eight points from 59%).

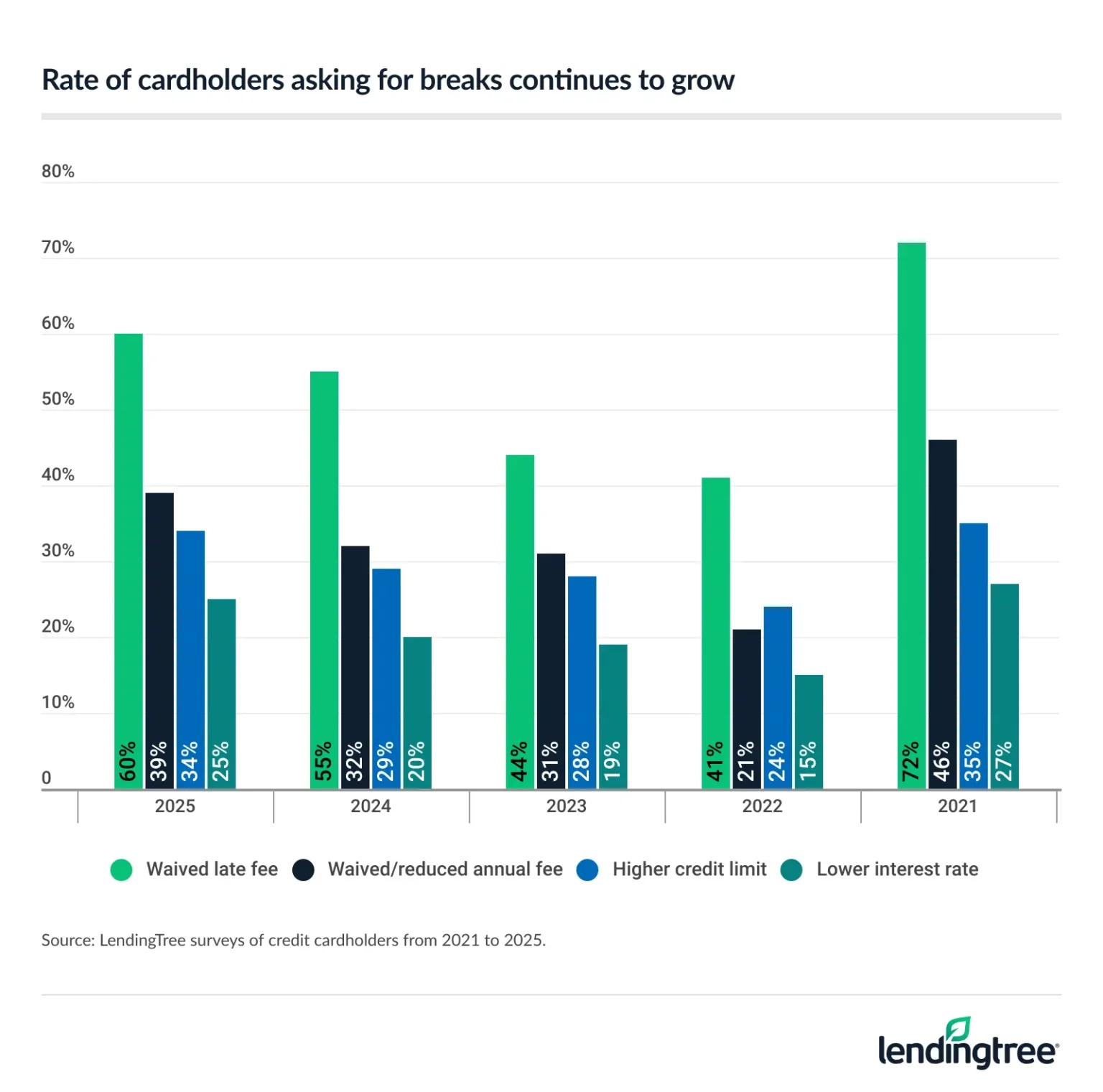

- More cardholders are asking for breaks, though many still don’t know they can. Although still well below pandemic-era peaks seen in 2021, the percentage of cardholders asking their card issuers for waived annual fees, waived late fees, higher credit limits and lower APRs all rose for the third straight year. However, many cardholders still don’t know they can ask. When we asked those who hadn’t requested a higher credit limit or a lower APR why they hadn’t, the most common reason was they didn’t know they could.

83% of lower interest rate requests in past year were granted

If you have credit card debt, lowering your interest rate can be an absolute game-changer. A 0% balance transfer credit card is the ultimate weapon, though you generally need good credit to get one. A low-interest personal loan can work well, too. However, many people don’t realize that another impactful option exists: simply asking your card issuer to lower your rate.

You can do that? Yes, our latest report found that 83% of cardholders who asked got their way, and the average reduction was 6.7 points.

That’s a big deal. Here’s why:

- If you have $7,000 in card debt, an APR of 27.00% and you pay $250 per month, you’ll pay $4,171 in interest and take 45 months to pay it off.

- If you lower that APR by 6.7 points to 20.30% and keep everything else equal, you’ll pay $2,565 in interest over 38 months.

More than $1,600 in savings for making a phone call? Sounds like a pretty good use of your time.

This isn’t a new thing, either. For years, LendingTree has asked cardholders whether they’ve asked their cards’ issuers for breaks like this, and success rates have remained consistently high. (Note: We first did this survey in 2019, but we only show historical data dating to 2021 because of methodology changes made that year.)

At least some of these reductions are likely only temporary. For example, issuers have so-called hardship programs in which they offer short-term relief to cardholders experiencing financial difficulties. A temporarily reduced APR may be one of the breaks offered, as might a deferred payment or waived fee, among other things. However, even a temporary break is well worth pursuing.

95% of those asking to have annual fee waived or reduced in past year were successful

You’re even more likely to get an annual fee waived or reduced than you are to get your interest rate lowered. Sure, the savings may not be as impactful — the average annual fee among large credit card issuers was $157 in 2023, according to the Consumer Financial Protection Bureau (CFPB) — but it’s still significant. Who couldn’t use an extra $157 to put toward groceries or pay down debt?

A stunning 95% of those who asked got their fee waived or reduced, including 74% whose fees were waived entirely and another 20% whose fees were reduced. (Note: The numbers don’t add to 95% due to rounding.)

Again, this isn’t a one-year phenomenon. This year’s success rate is the highest we’ve seen. But as you can see, they’ve never been anything short of sky-high.

It’s also important to understand that card issuers probably aren’t waiving or reducing these fees permanently. It’s more likely that these are one-year reprieves. However, given the sky-high success rates, it’s reasonable to conclude that at least some cardholders are successfully making these requests multiple years in a row.

Requests for waived late fees, higher credit limits remain highly likely to be granted

Nearly 9 in 10 cardholders (89%) who asked to have a late fee waived in the past year got their way, unchanged from last year’s series high.

Many card issuers have policies, written or otherwise, that they’ll waive a first-time offender’s late fee upon request, no questions asked. I’ve seen this myself firsthand more times than I’d care to admit. However, it’s reasonable to assume that the more frequently you ask, the less likely you are to get your way. The bank may be happy to help someone who slips up once in a blue moon. They’ll be far less forgiving of someone who messes up regularly.

Meanwhile, a slightly smaller percentage of cardholders (86%) who asked for a higher credit limit in the past year got their way. That matches the highest percentage since tracking began. The average increase — $2,670 — was also a series high.

While a higher credit limit can be dangerous if used carelessly, it can boost your credit score if managed wisely. Here’s why:

- Credit utilization, how much debt you have versus how much total available credit you have, is one of the most important factors in credit scoring. It’s typically recommended that your debt totals less than 30% of your available credit, but the lower it is, the better.

- Say you have $1,500 in debt and $5,000 in available credit. That gives you a utilization rate of 30%, right at the maximum recommended amount. ($1,500/$5,000=30%)

- If you add $2,670 to your available credit, pushing your total to $7,670 without adding any debt, your utilization falls to 20%. ($1,500/$7,670=20%).

- That’s a significant drop that could improve your credit score.

The key to all of that, though, is to not run up any extra debt with that newfound available credit. Otherwise, you’re just making things worse for yourself.

Issuers getting stingier about waiving balance transfer, foreign transaction fees

Not all the news from this survey is great, however. We found lower success rates among those asking for either a foreign transaction fee or a balance transfer fee to be waived or reduced.

With these two requests, we asked if cardholders had ever been successful. With the other requests in this report, we asked if they had been successful in the past year.

Most people asking for these requests still get their way, but the success rates for each have fallen:

- 55% of foreign transaction fee requests were granted, versus 64% a year ago

- 51% of balance transfer fee requests were granted, versus 59% a year ago

The success rate for balance transfer fee waivers is the lowest since we began tracking. That’s bad news for those struggling with credit card debt because the typical balance transfer fee is 3% to 5% of the transferred balance. (If you transfer $5,000, the fee would be $150 to $250, for example.) That fee pales in comparison to what you can save by using a balance transfer card wisely, but it’s still significant.

The success rate for foreign transaction fee waivers isn’t the lowest we’ve seen, but it’s down nine points from last year. These are the fees you pay when you buy something in a foreign currency with your American credit card, typically while traveling or shopping online with a foreign-based retailer. They usually amount to 1% to 3% of the purchase price, lower than a typical balance transfer fee but still a big deal to travelers.

More cardholders asking for breaks, but there’s plenty of room for improvement

Perhaps the best news in all of this is that more people are taking the time to ask for these breaks — and the success rates have remained sky-high.

For the third straight year, the percentage of cardholders asking their card issuers for waived annual fees, waived late fees, higher credit limits and lower APRs rose. The percentages are lower than the record numbers seen in 2021 as the pandemic raged, but the growth is noteworthy.

Men, millennials, Republicans and high-income Americans were among the most likely to have asked for waived annual fees and late fees, higher credit limits and lower APRs in the past year.

There’s plenty of room for improvement, though. Many cardholders still don’t know they can ask for these things. We asked cardholders who hadn’t asked for a higher credit limit or a lower APR why they hadn’t done so, and by far, the most common reason given was they didn’t know they could. The next most common answers: Neither of those requests matters to them (which could happen if a person doesn’t carry a balance, thus making the APR a moot point, and is happy with their credit limit) and they didn’t think they’d be successful.

This report, however, provides clear evidence that most people are successful when they make these requests. Here are some tips for how to do it.

- Research competitive offers. If you’re asking for a lower interest rate, one of the best things you can do is come into the conversation with other offers you’ve seen. Maybe you’ve gotten offers in your snail mail or email. Maybe you’ve seen them on sites like LendingTree. Maybe you’ve gone to your card issuer’s website and seen the rates offered to new applicants. You can use all that information to frame the negotiation. Just make sure that these are offers for which you’d qualify. If you have a 550 credit score and you’re asking for the lowest available rate, you’re setting yourself up for failure.

- Script out what you’ll say. I literally wrote the book on this. In my book, “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” I offer word-for-word scripts for how to ask for a lower APR, waived late fee and higher credit limit on your credit card, along with many other helpful requests. While you can’t predict everything that’ll happen in a conversation, taking a moment to think ahead and write down what you want to say, even if only to begin the conversation, can be immensely helpful.

- Know you can sometimes get a break without talking to anyone. Some of these requests can happen without having to speak with another person. Earlier this year, I got two late fees waived by following prompts in a phone tree. The issuer’s automated system knew who I was and that I was late with a payment, so the recorded prompts asked if I wanted to waive the fees. Of course, I said yes. I’ve had many late fees waived over the years, but that was the first time it had worked that way. For other asks, such as a higher credit limit, you may be able to do them via the issuer’s website or mobile app.

- Keep trying, and be nice. Don’t accept that first no as a final answer. Maybe you caught someone on a bad day, you were under the weather or your kids were distracting from your focus. Whatever the reason, calling back the next day or just a few hours later can lead to completely different results. Don’t be afraid to give it a second try. Make sure to be nice and polite when you do. That doesn’t mean you should be a pushover — kindness doesn’t equal weakness — but people want to help people they like, so a little niceness can go a long way.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,050 U.S. consumers ages 18 to 79 from May 14 to 16, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Recommended Articles

You Miss 100% of the Shots You Don’t Take — Here Are Topics You Should Talk to Your Credit Card Issuers About

Despite Federal Reserve Rate Hikes, 76% of Lower Credit Card APR Requests Were Granted in Past Year

Although Odds Dipped, LendingTree Survey Finds 70% of Requests for Lower Credit Card APRs Are Still Granted