Nearly 2 in 3 Americans Believe a Recession Is Coming, and Most Aren’t Financially Ready for It

Most Americans think the economy is heading for a recession and that they’re not financially prepared to deal with it, according to a LendingTree survey.

We also found that Americans are skeptical about whether tariffs are necessary to secure the country’s long-term financial future.

Here’s more about what we found.

- Nearly 2 in 3 Americans think a recession is coming. Most say they aren’t ready for it, especially women. 63% of Americans believe we’ll face a recession, and 59% admit they’re not financially prepared for it. Women are far more likely than men to say they feel unprepared (69% versus 48%). If hit by a recession, 48% of Americans are worried about being able to afford their monthly bills and 34% are worried about paying debts.

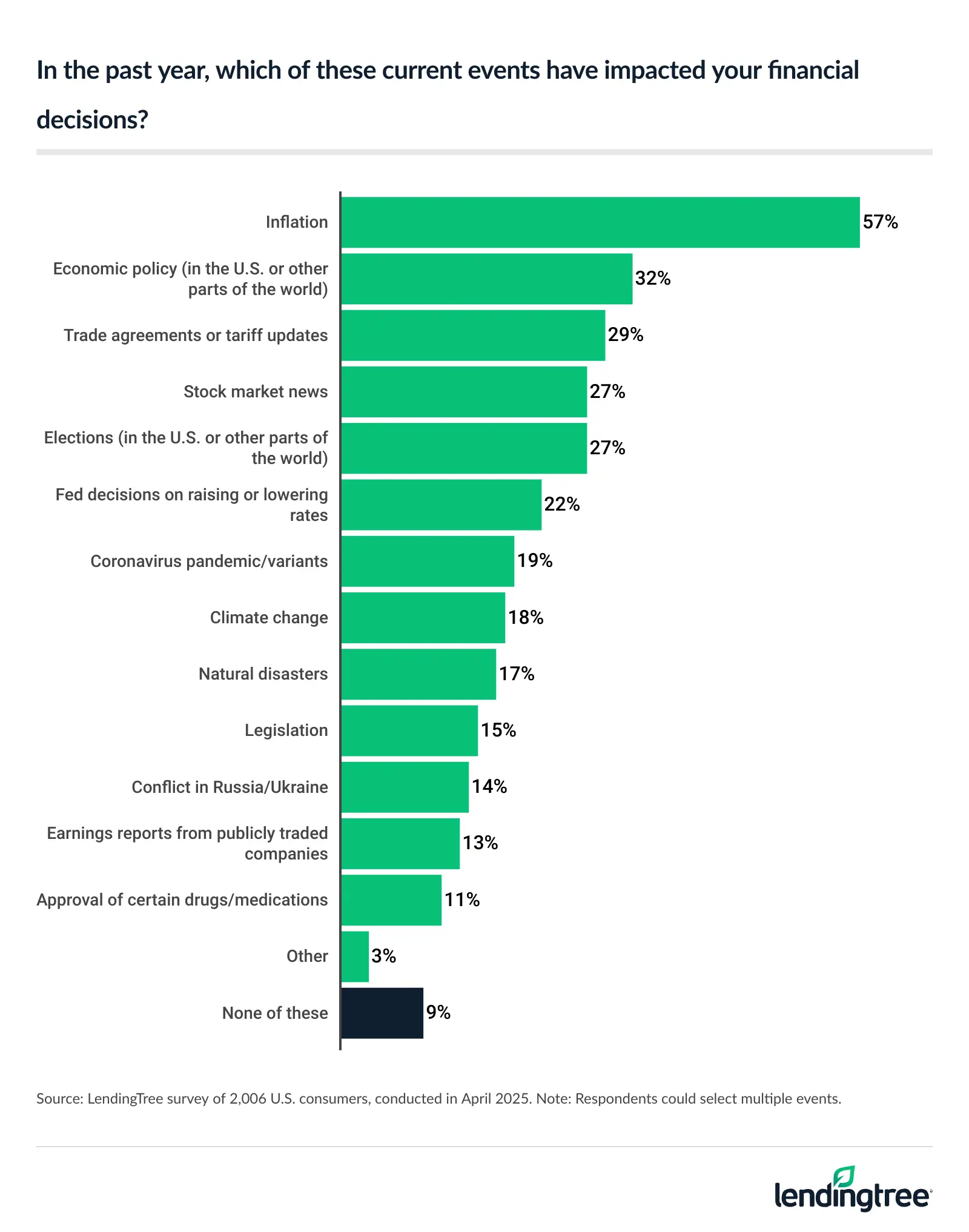

- 74% of Americans admit that world news and/or current events affect their financial decisions. Inflation (57%), economic policy (32%) and tariffs (29%) have the biggest impact. 33% took money out of the stock market in the past year because of current events. This includes 15% who regret doing so (26% among Gen Zers).

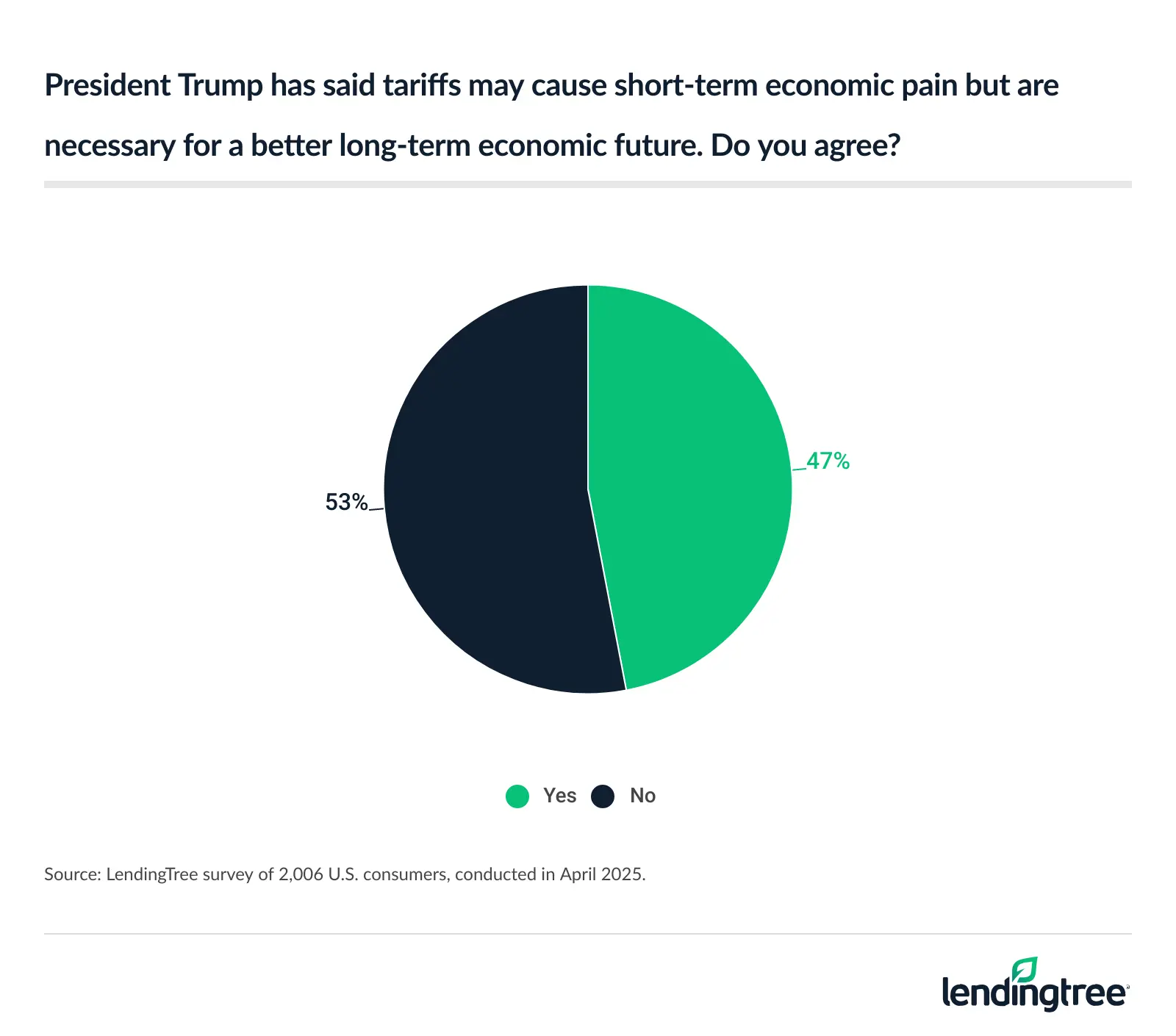

- Most Americans don’t think tariffs will make the economy better. More than half of Americans (53%) disagree with President Trump’s belief that implementing tariffs will bring a better economic future. In fact, 64% believe the Trump administration’s actions will make a recession more likely.

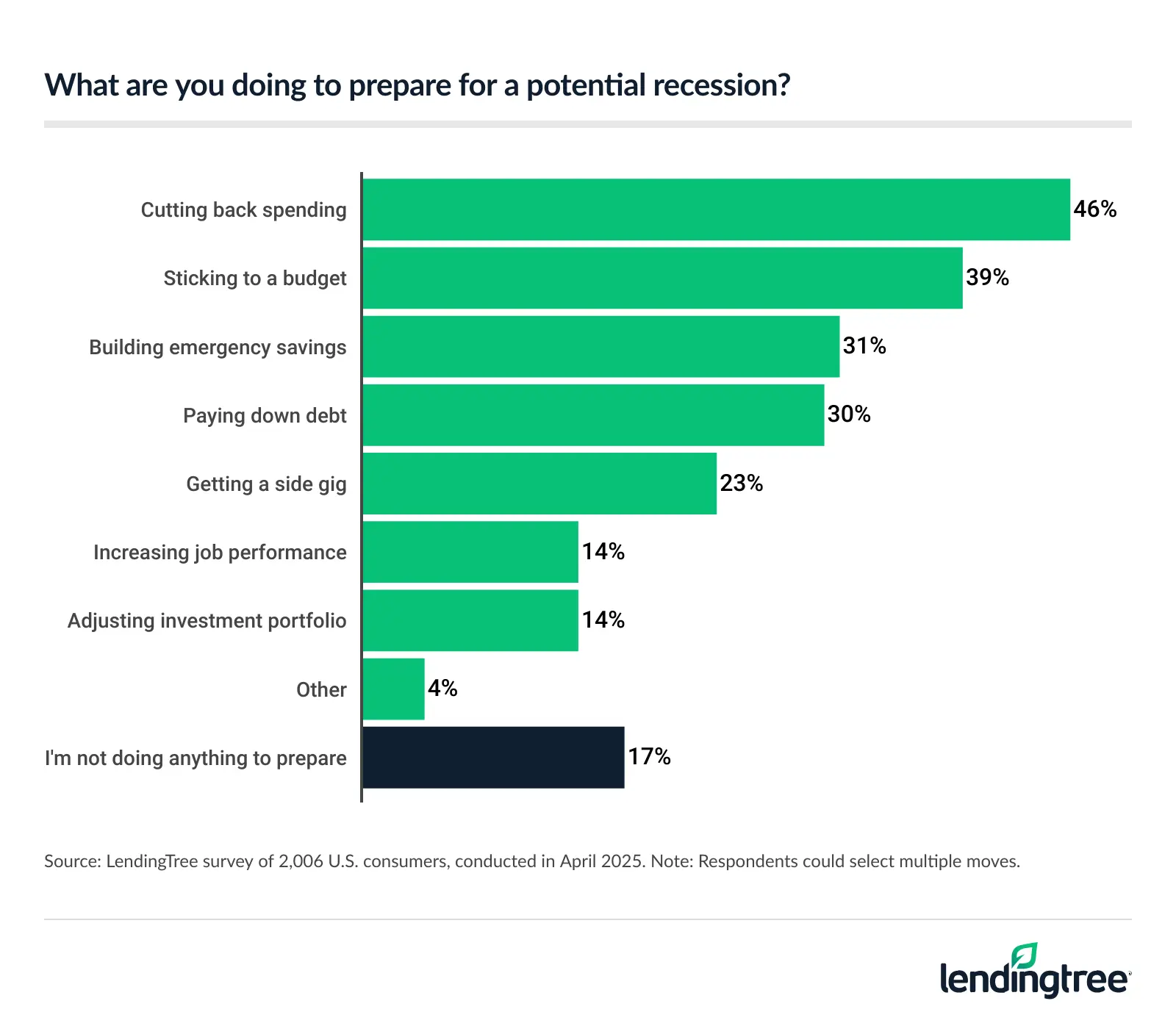

- Many are closing their wallets to brace for impact. To prepare for a potential recession, 46% of Americans are cutting back their spending and 39% are sticking to a budget. There’s a slight partisan gap here, as 48% of independents and Democrats say they’re cutting back on spending, while 42% of Republicans say the same.

Most Americans say a recession is coming, but they’re not prepared

No one has a crystal ball to know what’s ahead for our nation’s economy. However, our survey makes it clear Americans are nervous.

We asked respondents, “Do you think a recession is coming?” About 47% say they expect one in the next six months. Another 15% expect one but not within the next six months, 14% don’t expect one and 24% aren’t sure. There’s one thing with widespread agreement: Nearly 9 in 10 (88%) say they don’t want a recession to happen.

To be clear, a recession is almost certainly coming someday. By one estimate, we’ve had six since 1980 — an average of every seven to eight years — with the last in 2020, so it would be almost silly to think we’ll never have another. The point of this survey, however, is to see whether people think one is coming soon, and nearly two-thirds of Americans do.

Perhaps the most troubling data point in this survey is that nearly 6 in 10 Americans feel they’re not prepared financially for a recession. Women are far more likely than men to say they feel unprepared (69% versus 48%). Gen Xers ages 45 to 60 (67% unprepared) are the most likely age group to say so. Republicans are the least likely political party to say so, but still 49% of them say they’re not financially prepared.

Should a recession come, Americans’ biggest concerns are what you might expect: not being able to pay monthly bills (48%) or debts (34%), losing their job (26%) and losing money in the stock market (25%).

About 3 in 4 admit that current events impact their financial decisions

As much as we might wish they didn’t, world news and current events often play a major role in people’s financial decisions. Our survey makes that crystal clear.

Inflation is the biggest news story that Americans say impacted their financial decisions, with 57% saying so. While it’s certainly no surprise inflation took the top spot by a wide margin, I was surprised the total percentage wasn’t higher.

The older you are, the more likely you are to say inflation has influenced your financial decisions in the past year. Women are more likely than men to say so, and independent voters are more likely than either Republicans or Democrats.

The next most commonly mentioned events or news stories — all of them 25 to 30 points lower — are economic policy (32%), tariffs (29%), elections and the stock market (both at 27%).

The survey found that 33% of respondents took money out of the stock market in the past year because of current events. That 33% includes 18% who are glad to have done so and 15% who regret pulling their money. Gen Zers ages 18 to 28 (26%) and millennials ages 29 to 44 (24%) are the most likely age groups to express regret.

Most are skeptical about tariffs

Our survey showed that tariffs are one of the primary news events or stories impacting people’s financial decisions.

To gauge people’s views on this topic, we asked the following question: “President Trump has said that while the implementation of tariffs may cause some short-term economic pain, they are a necessary step for a better long-term economic future. Do you agree with this?”

A slim majority of respondents — 53% — say no.

Sixty percent of women say no, compared with 45% of men. Nearly 6 in 10 baby boomers ages 61 to 79 (58%) say no, while just 48% of millennials do. The lower your household income, the more likely you are to say no (67% of those making less than $30,000, versus 48% of those making $100,000 or more or $50,000 to $99,999). Plus, there was a massive partisan gap: 78% of Democrats and 60% of independents say no, compared with 22% of Republicans.

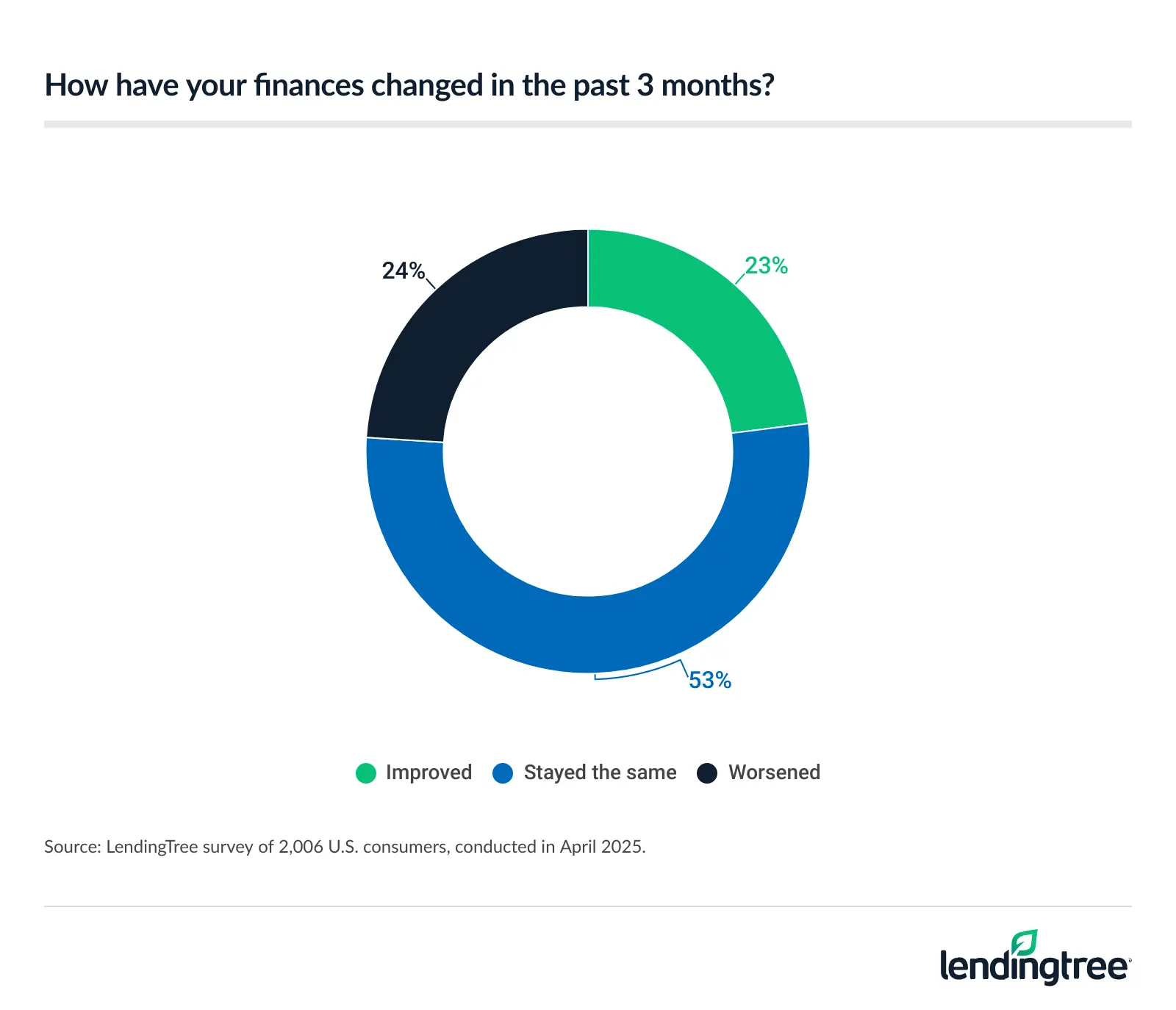

Meanwhile, nearly 2 in 3 Americans (64%) believe the Trump administration’s actions make a recession more likely. When looking at their finances over the past three months, however, views are far more divided. More than half say their finances have stayed the same (53%), while 24% say they’ve worsened and 23% say they’ve improved.

Many are closing their wallets to brace for impact

Given that negative view of the near future, it shouldn’t be surprising that Americans are taking steps to prepare for a possible recession. Nearly half of respondents (46%) say they’re cutting back on spending in preparation for a potential recession.

The partisan gap apparent in other parts of the survey is less pronounced here, though it’s still prevalent. While 48% of independents and Democrats say they’re cutting back on spending in preparation for a recession, 42% of Republicans say so.

Other commonly mentioned moves include sticking to a budget (39%), building emergency savings (31%) and paying down debt (30%).

The older you are, the more likely you are to say you’re cutting back spending. Nearly 6 in 10 boomers say so (59%), versus 33% of Gen Zers. Perhaps surprisingly, there was little difference between the lowest and highest income earners: 45% of those making $100,000 or more are cutting back, versus 43% of those making less than $30,000.

When preparing for a recession, paying down debt should be a top priority

Economic downturns can be unnerving, especially given that we’ve been through some real doozies in the past 15 to 20 years with the Great Recession and the onset of the pandemic. However, the good news from the survey is that people generally do the right things when preparing.

While it’s only the fourth-most common step people take, perhaps none is more important than paying down debt. That’s especially true with high-interest debt such as credit cards. Money that has to go to that debt is money that can’t go toward building an emergency fund or making other important financial moves.

If possible, it’s wise to still build up that emergency fund while paying down your card debt. Yes, it’ll mean it may take you a little longer and cost you a little more to pay off that card debt. However, having savings to fall back on once your card balance gets to $0 means the next big unexpected expense may not have to go on a credit card. That’s a big deal because it can help break the cycle of debt that traps so many people today.

To help knock down card debt while building your emergency fund, consider these tools:

- A 0% balance transfer credit card: It may be the best weapon for the battle against credit card debt. It can allow you to go a year or more without accruing any interest on the transferred balance, potentially saving you a small fortune and dramatically reducing the time it takes to pay off your balance.

- A personal loan: You’ll need good credit to get a 0% card. If you don’t qualify, a personal loan can be a good alternative. These loans don’t come with 0% offers, but you may be able to find one with rates significantly lower than what you’re paying on your credit card.

- A high-yield savings account: If you still have a regular savings account with one of the big megabanks, you’re likely leaving money on the table. Online high-yield savings accounts (HYSAs) can have yields of 4% or higher. The returns aren’t as high as last year before the Federal Reserve started cutting rates, and today’s high returns won’t last forever, but there’s still time to shop for an HYSA if you haven’t yet.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,006 U.S. consumers ages 18 to 79 from April 8 to 14, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79