LendingTree Survey: More Eyes on the Super Bowl, Less Money on the Line

Four in 5 Americans plan to watch the Super Bowl in 2026. But while more people say they’ll tune in this year, they don’t expect to open their wallets quite as wide as they did last year.

That’s according to LendingTree’s 2026 Super Bowl Spending Report, which found that enthusiasm for the big game is up, even as expected spending declines.

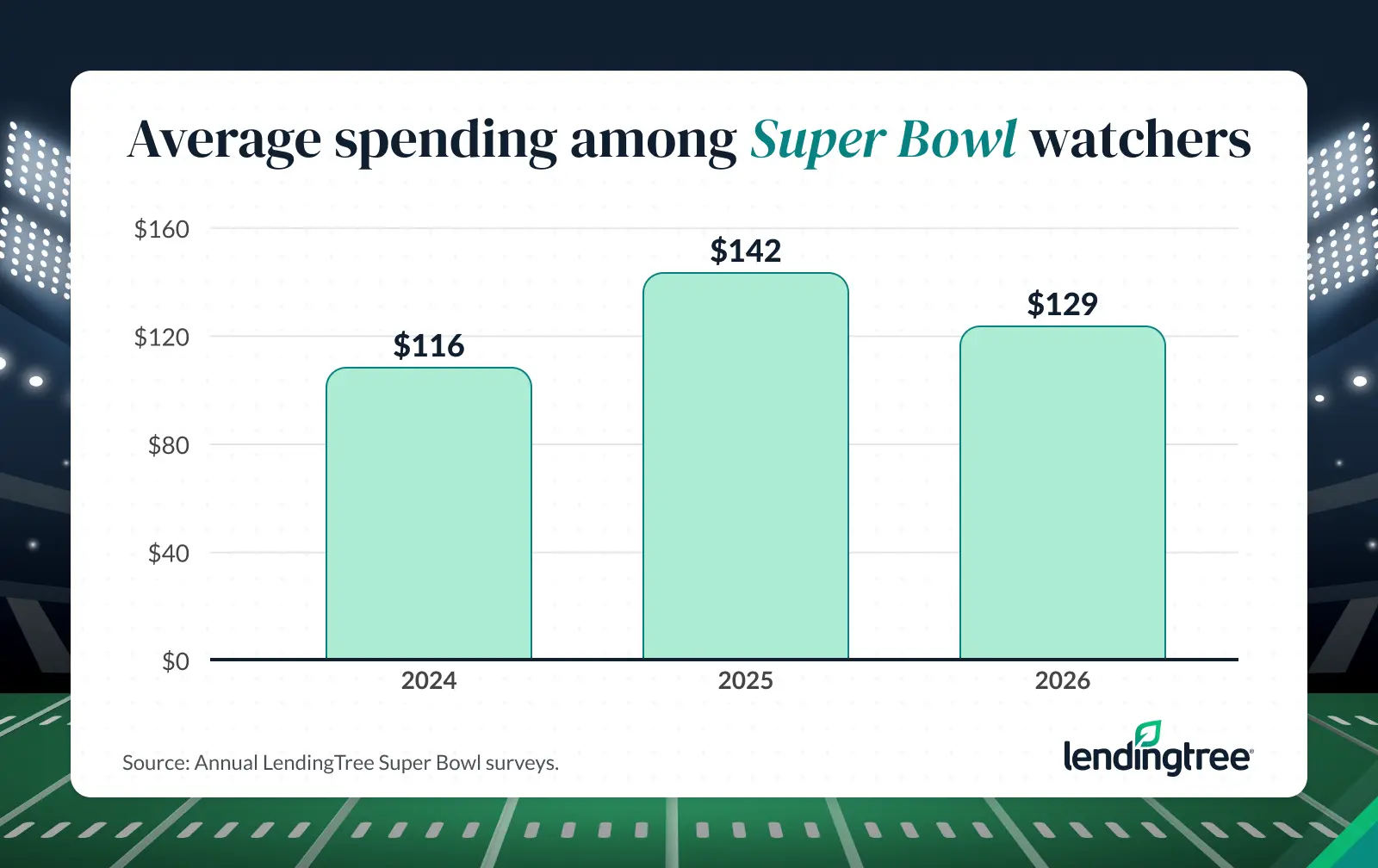

- More Americans plan to tune into the big game this year, but they’ll spend less doing so. 80% of Americans say they plan to watch the Super Bowl this year, up from 75% last year. However, those viewers expect to spend an average of $129, down from $142 last year. Men ($168) expect to spend nearly twice as much as women ($87).

- Amid the overall dip in spending, some Americans are cutting back. 21% say they plan to spend less on the Super Bowl this year than last, while 19% expect to spend more and 61% expect to spend the same. Among those who plan to watch, the most popular purchases include food and beverages (71%), clothing or accessories (20%) and streaming subscriptions (18%).

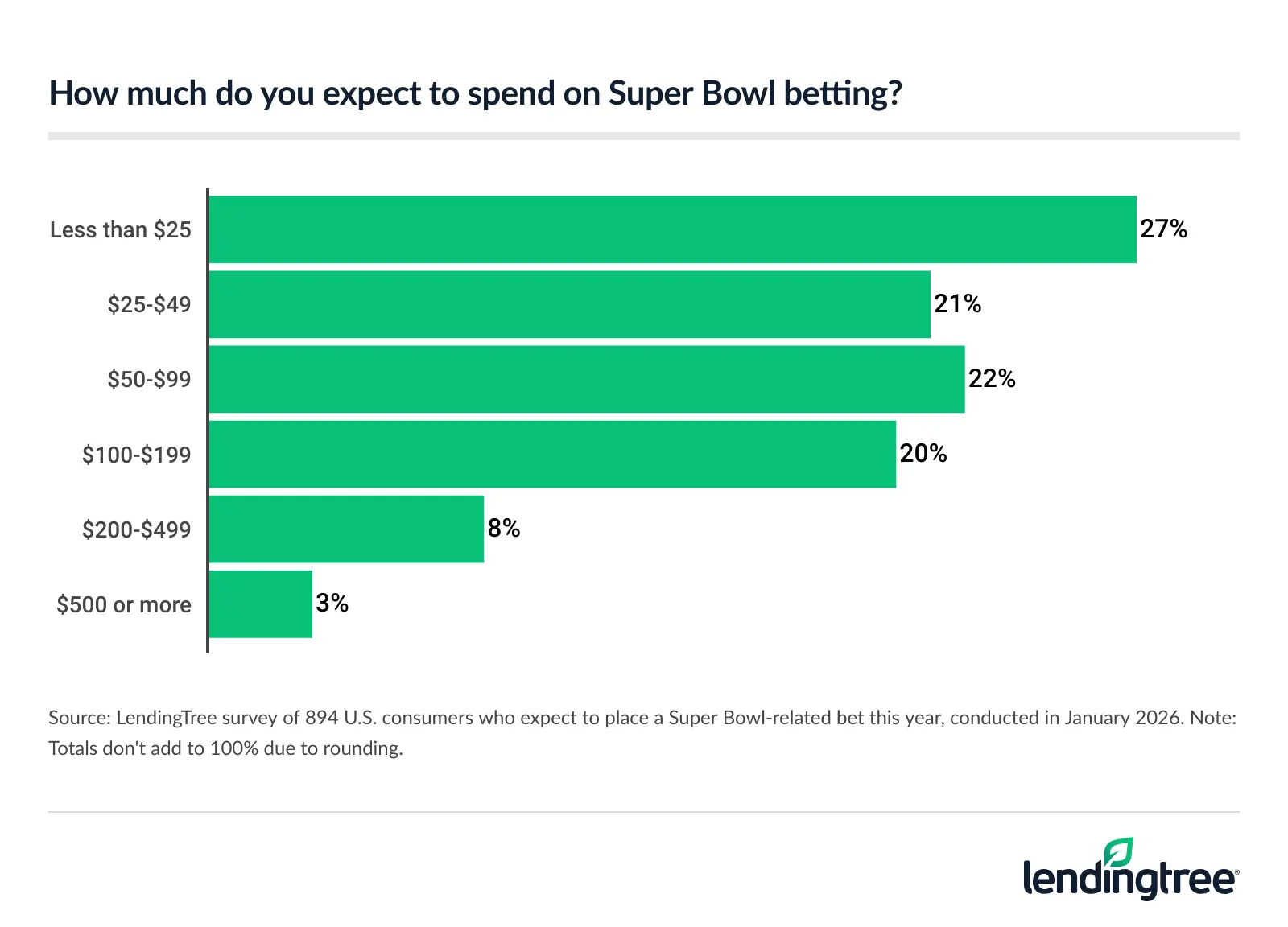

- Gambling interest is on the rise. 54% of Super Bowl viewers plan to place a bet this year, up sharply from 41% last year. Most bettors (69%) expect to spend less than $100, but a notable 42% will use a credit card to place wagers. Legal sportsbook apps and websites are the most popular betting platforms.

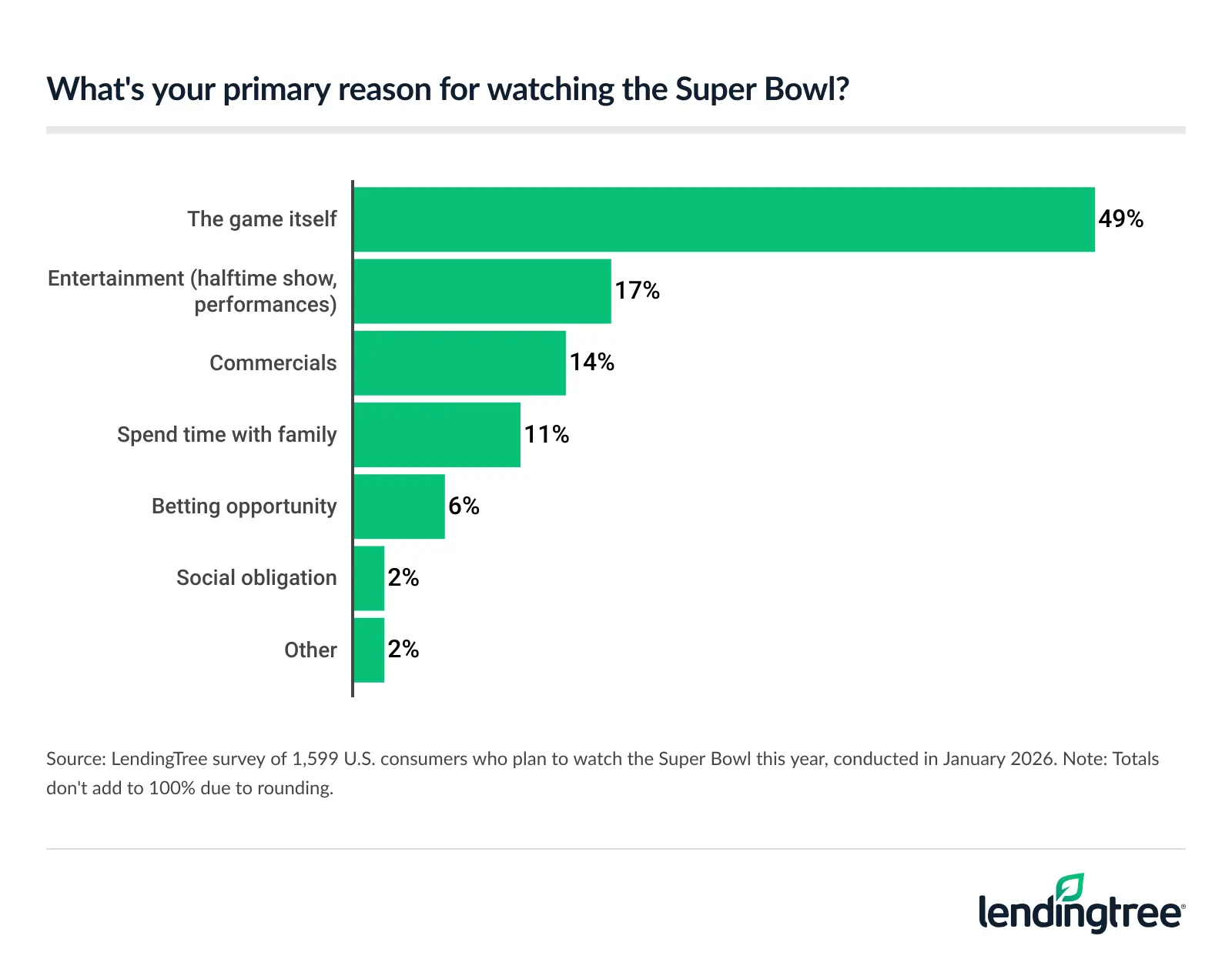

- Just under half of viewers say the game is their primary reason for watching. Among the 51% tuning in for other reasons, top motivations include entertainment such as the halftime show (17% of viewers) and commercials (14%), as well as spending time with family (11%). Interest in this year’s halftime show is mixed: 17% of Americans say the scheduled performer makes them more likely to watch and 10% say it’s the reason they won’t tune in, but 22% say they don’t know who’s scheduled to perform.

More plan to tune into Super Bowl, but they’ll spend less

In an enormously polarized time, few things unite Americans like football.

On Feb. 8, 80% of Americans — or 4 in every 5 adults in the country — say they plan to watch the Seattle Seahawks versus the New England Patriots in the Super Bowl. That’s up from 75% a year ago, when the Philadelphia Eagles beat the Kansas City Chiefs. Men are more likely than women to watch (86% versus 75%), though women still watch in large numbers. The younger you are and the higher your income, the more likely you are to watch.

Those who’ll watch expect to spend $129 on the big game. That’s down from $142 last year but up from $116 in 2024.

Men ($168) expect to spend nearly twice as much as women ($87). The younger you are, the more money you’re likely to spend. (Gen Zers ages 18 to 29 will spend $191 on average, nearly four times the $53 spent by baby boomers ages 62 to 80). And, perhaps unsurprisingly, six-figure earners will spend more than any other income bracket ($172).

LendingTree has asked Americans about the Super Bowl six years in a row. Here’s a key finding from our previous versions:

- 2025: 75% of Americans say they’ll tune in to the Super Bowl, but 31% of those who’ll watch say they’ll spend less on the big game this year.

- 2024: Three-quarters (75%) of Americans plan to watch the Super Bowl this year — and 24% of Gen Zers and 20% of millennials have an increased interest in football this year due to Taylor Swift’s influence.

- 2023: Inflation might be the real winner of Super Bowl LVII as Americans plan to spend an average of $115 on game-related expenses this year — a 31% increase from 2022.

- 2022: Expected consumer spending on the Super Bowl drops by 19%, with fewer Americans planning to watch.

- 2021: 51% of Americans will make some type of Super Bowl-related bet this year.

Amid dip in spending, some Americans cutting back

When we asked people to compare their Super Bowl spending to last year, we found a clear split. While most Americans (61%) expect to spend the same amount they did last year, 21% say they plan to spend less on the game this year, and another 19% expect to spend more.

Those earning less than $30,000 a year (27%), Gen Xers ages 46 to 61 (24%) and women (24%) are among the most likely to say they’re reducing their spending this year. By contrast, Gen Zers (36%), parents of young kids (34%) and six-figure earners (27%) are the most likely to say they’ll spend more.

Among those who plan to watch the big game, food and beverages (71%) are the most common purchases by far. The next most popular items are clothing or accessories (20%), streaming subscriptions (18%) and decorations or supplies (17%).

Gambling interest on rise

Not all Super Bowl spending is about making purchases. Gambling plays a huge role, too. We found that more than half of Super Bowl viewers (54%) plan to place a bet this year, a sharp increase from last year’s 41%.

A deeper dive into the data reveals a significant gender gap among Super Bowl viewers, with 63% of men planning to make a Super Bowl-related bet, versus just 43% of women. Additionally, the younger you are and the higher your income, the more likely you are to say you’ll place a bet. However, most bettors don’t expect to break the bank: 69% expect to spend less than $100.

Nearly half of bettors (49%) will make wagers via legal sportsbook apps and websites, while 41% say they’ll bet informally among friends, 26% say they’ll bet via office pools or Super Bowl squares, and 23% will do it through a sportsbook in-person.

Among those who plan to bet, 42% say they’ll use a credit card to do so. That’s an eye-opening number, especially when you consider that many gambling sites and in-person venues restrict or don’t accept credit cards for betting.

Just under half of viewers say game is primary reason for watching

As popular as it is, gambling is usually far from the primary reason people watch the Super Bowl, though 6% of viewers say it is. That distinction goes to the game itself. However, only 49% of viewers say that’s their primary reason for watching. Baby boomers (61%) and men (60%) are the most likely to say so.

The other most common motivations include entertainment such as the halftime show (17%) and commercials (14%), along with spending time with family (11%). Older Americans are more likely than their younger counterparts to watch the game for the commercials (19% of Gen Xers say so, versus just 7% of Gen Zers). Meanwhile, the younger you are, the more likely you are to say you tune in for the halftime show and other entertainment (24% of Gen Zers say so, while just 9% of boomers say the same).

We also asked Americans the following: “Will this year’s halftime performance artist influence your decision to watch the Super Bowl?” (Note: We didn’t mention the performer, Bad Bunny, by name.)

Responses were mixed: 17% say this year’s halftime performer makes them more likely to watch, while 10% say they plan to avoid watching because of the performer. Meanwhile, 51% say the performer has no impact on their decision, and 22% say they don’t know who is scheduled to perform.

4 tips to avoid going into big debt over big game

It’s easy to overspend on Super Bowl Sunday, especially with hosting, shopping and gambling in the mix. These tips can help you enjoy the game while protecting your budget.

- Crunch the numbers. If you love throwing a great Super Bowl party, that’s awesome. Just make sure you set a budget for it. That way, you and your friends and family can have a great time without worrying about damaging your finances in the process. (This is especially important if you’re planning to gamble — know your limits.)

- Make it a potluck. Super Bowl Sunday is practically a national holiday. Treat it like Thanksgiving and have everyone pitch in to help keep costs down.

- Take advantage of credit card rewards. Whether you’re getting free or reduced-cost airfares and hotel nights or just extending your grocery budget with some extra cash back, the right credit card, used wisely, can make a big difference. Put it to work for you.

- Look for 0% purchase offers. Some credit cards offer zero-interest introductory periods on new purchases, which can be helpful. Just be cautious with “special financing” offers that charge deferred interest if the balance isn’t paid off in full. General-purpose credit cards typically don’t charge deferred interest, but many retail cards do.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 80 on Jan. 2, 2026. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2026:

- Generation Z: 18 to 29

- Millennials: 30 to 45

- Generation X: 46 to 61

- Baby boomers: 62 to 80