10 Things That Can Hurt Your Credit Score

A good credit score can help you get lower interest rates on credit cards and loans, increase your approval odds when applying to rent a house and potentially even lower your insurance premiums.

But to reap the rewards of good credit, you’ll need to build your credit score and avoid common mistakes that can bring it down.

- Several factors impact your credit score, including payment history, credit utilization and the length of your credit history.

- Of the factors that affect your score, payment history and credit utilization (the amount of available credit you’re using) have the biggest impact.

- To protect your credit score, it’s important to regularly check your score and review your credit report.

1. Making late payments

The factor that has the biggest impact on your credit score is payment history, so even one late payment can hurt your score. Lenders typically report late payments to one or more of the three major credit bureaus once the payment is 30 days past due. For this reason, it’s important to pay your bills on time.

This includes not only debt payments, but also rent and utility bills. Setting up automatic payments can help you avoid missing due dates. Or, if you’re worried about being able to make a payment, reach out to your lender to see if you can arrange a payment plan to avoid impacting your score.

2. Using too much credit

Many borrowers don’t realize that using too much of the credit that is available to them can negatively impact their credit scores. Your credit utilization ratio measures the amount of credit you’re using compared to the full amount you were approved for. For example, if your credit card has a $5,000 limit and you’re carrying an account balance of $3,000, your utilization ratio is 60% — assuming this is the only account on your credit report.

Lenders rely on your credit utilization ratio to determine how well you’re managing your debt. In general, using more than 30% of your available credit can have a negative impact on your credit score. This is because of the message it sends lenders: that you’re having trouble repaying what you owe, requiring you to use more of your available credit.

Following closely behind payment history, credit utilization is one of the credit factors that carries the most weight, meaning it can have a serious impact on your scores.

3. Applying for more credit

By applying for a loan or credit card, you’re giving lenders permission to run a hard credit inquiry — also known as a hard credit check — which can negatively impact your score. However, this is a necessary step of the process, as a hard credit check is the only way for lenders to access and review your full credit history.

While one hard inquiry won’t significantly hurt your score, multiple inquiries in a short period of time will. Applying for too much credit at one time tells the credit bureaus that you’re financially overextended, making you more risky as a borrower — which will be reflected in your score.

If you need new credit and want to be able to compare multiple loan or credit card offers, you can shop around without hurting your credit by getting prequalified. You can also rate shop safely within a 14-day period — this means that you can apply with multiple different lenders without significantly hurting your score, as long as you’re applying for the same type of credit. Doing so within a short period of time tells credit bureaus that you’re shopping for the best rates and terms, not trying to open multiple new accounts.

There are two types of credit inquiries: hard and soft. Hard credit checks occur whenever someone accesses your full credit history, like when a lender checks your credit as part of the loan application process. Soft inquiries can occur for many reasons, including during employee background checks, when you apply for insurance and when lenders view your credit score to determine if you prequalify for certain offers.

While hard credit inquiries impact your credit score, soft inquiries do not. However, it’s important to note that soft inquiries are less detailed than hard inquiries, so even if you prequalify for a loan or credit card, you could potentially be denied when you actually apply and a hard credit check is run.

4. Closing credit card accounts

While it might be tempting to close a credit card account once it’s paid off, this can actually hurt your score. This is primarily because closing a credit account will alter your credit utilization ratio.

For instance, let’s say you have two credit cards with a combined credit limit of $6,000 ($3,000 per card.) You’re carrying a balance of $1,500 on one card, and the other has recently been paid off. With both accounts open, you have a credit utilization ratio of 25%. But if you close the paid off account, your total available credit drops to $3,000 and your utilization ratio jumps to 50%.

As we covered previously, a high credit utilization ratio can have a significant impact on your credit score, so closing accounts may not always be the smartest move. Closing accounts can also impact your credit mix and lower the average age of your accounts — both of which can dock your score. In this example, it may be a better choice to keep the second card open and designate it for small purchases you can pay off at the end of each month.

5. Not using credit card accounts

In an effort to avoid overuse, some cardholders may shy away from using their credit cards at all. But if you have available credit, it’s important to make use of it — at least from time to time. Inactive accounts may be closed automatically after a certain amount of time has passed, and this will have a similar impact on your credit score as if you closed the account yourself.

There’s no universal rule for when inactive accounts will be closed. Some creditors may close accounts after a year of inactivity, while others may close inactive accounts after just six months. If you want to designate an account for emergencies — meaning you won’t be using it regularly — consider setting a reminder to check the account every few months. You can also contact your credit card company to understand the policies that may apply.

6. Consolidating debt onto one card

Transferring credit card balances to a single card may sound appealing, especially if the card has a relatively low interest rate. However, like with the last few examples, consolidating your debt onto one credit card will potentially change your credit mix, credit age and utilization ratio, which could negatively impact your score.

Still, a balance transfer could be a good idea if you’re struggling to keep up with payments for multiple cards.

7. Having accounts in collections

Debts that are seriously past due may be sent to a collections agency. Some lenders end delinquent accounts to collections after three months of missed payments, while others may wait as long as six months.

At this point, your credit score will have already been impacted by multiple late or missing payments. But when a debt goes to collections, it can significantly increase the damage to your score. And it’s not just loans and credit cards that can become collection accounts. Other types of unpaid debt, like medical and insurance debt, can also go into collections.

Collection accounts can stay on your credit report for seven years, so do your best to avoid falling behind on your loan payments. If you already have an account in collections, you may be able to work with the collection agency to settle the debt for less than the full account balance. Though this won’t remove the account from your credit report, it may prevent it from continuing to impact your score, depending on the scoring model being used.

8. Cosigning credit applications

By cosigning on a loan or credit card, you’re essentially taking responsibility for the debt and all that comes with it. This means that if the primary account holder fails to make timely payments on their debt, your credit score will be negatively impacted as well.

The same rule applies if the account holder defaults on their loan or rent, so you’ll want to be careful about cosigning for friends or family members.

9. Not paying municipal debts

By now, you understand that late payments on loans and credit cards can significantly hurt your credit scores. But other types of late payments can also end up hurting your score.

For example, failing to pay certain types of municipal debts, like parking tickets, library fines and civil judgments, can potentially lower your score if they’re sent to a collection agency. Most credit scoring models ignore collection accounts if the account balance is less than $100, but higher balances may appear on your credit report and impact your score for several years.

10. Errors on your credit report

While knowing your credit score is important, it’s also important to understand why you have that score — and how you might improve upon it. One of the biggest mistakes people make is ignoring their credit report, which can provide valuable insight you don’t want to overlook.

There could be inaccuracies dragging down your score, such as duplicate accounts. The good news is that you have the right to dispute errors on your credit report. Under the Fair Credit Reporting Act, the credit bureau is required to open an investigation into alleged incorrect or incomplete records.

How to check your credit report

To see where you stand, you can check your credit score for free using LendingTree Spring. Signing up for a LendingTree account gives you access to useful tips and tailored suggestions on how to improve your score.

You can also request a free weekly copy of your credit report from each credit bureau at AnnualCreditReport.com. Be sure to check your reports for any errors or signs of fraudulent activity.

Factors that impact credit scores

There are many things that can affect your credit scores, but the extent of the damage depends on how heavily the activity is weighed by credit scoring systems.

For example, payment history accounts for about 35% of your FICO Score, so late payments will have a serious impact. On the other hand, a hard inquiry that’s the result of applying for new credit will also impact your credit score — but because new credit is only responsible for about 10% of your score, the impact will be less severe.

The following factors will impact your FICO Score to some extent:

- Payment history (how often you pay your bills on-time): 35%

- Credit utilization (how much of your available credit you’re using): 30%

- Length of credit history (the age of your oldest credit account): 15%

- Credit mix (the different types of credit you have): 10%

- New credit (hard credit inquiries): 10%

Frequently asked questions

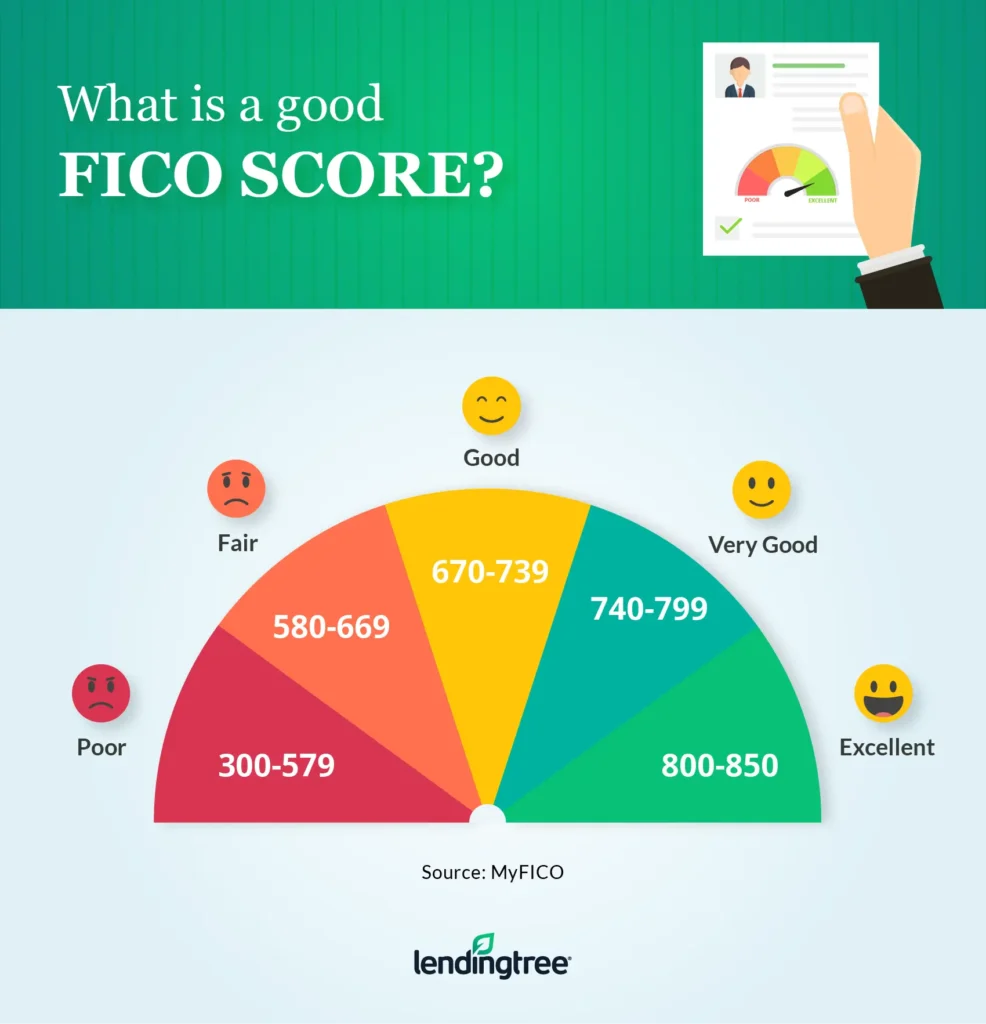

While there are many credit-scoring models, the FICO Score is the most common. FICO credit scores range from 300 to 850. In general, scores above 800 are considered excellent, scores between 740 and 799 are considered very good and scores between 670 and 739 are considered good.

Credit scores are calculated using factors from your credit report, such as payment history, debt balances and the length of your credit history. If you want to find out the specific factors that are affecting your scores, you can request a free copy of your credit report at AnnualCreditReport.com.

There are many ways to check your credit score. With LendingTree Spring, you can track your score and get personalized recommendations for free.

Learn more about your credit score!

Want to know your credit score? Click here.

Learn more about credit repair companies!

How is my credit score calculated?

Get debt consolidation loan offers from up to 5 lenders in minutes