Obsessively Checking Your Credit Score Won’t Improve It (Though It Won’t Lower It)

The first step to fixing a problem is acknowledging that it exists. If monitoring your credit score is a healthy financial habit, can checking your score often lead to improvements? Not really, according to a new study using LendingTree data.

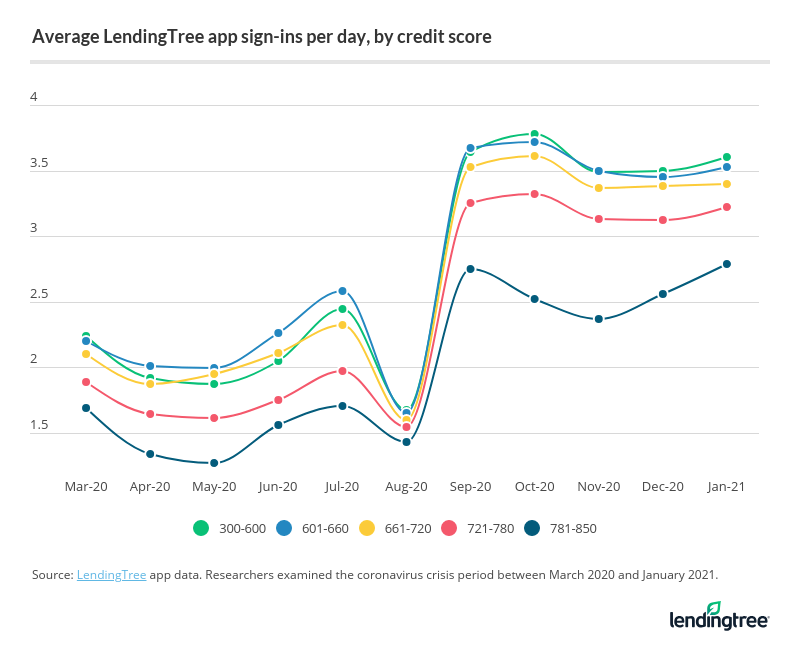

Each month between March 2020 and January 2021, people with the lowest credit scores checked theirs more frequently, on average, than people with the highest scores. But doing so didn’t have a net impact on the scores of those with poorer credit, the data shows.

Regardless of the impact, you can’t check your credit score too often — even if doing so won’t magically improve it, says Matt Schulz, LendingTree chief consumer finance analyst.

“It’s something that should be part of your regular financial routine,” he says. “At a minimum, it’s a good idea to check your score at least once a month, perhaps when you’re sitting down to pay your bills.”

Key findings

- People with the lowest credit scores check theirs more often than people with the highest scores. In January 2021, LendingTree users with very poor or fair credit scores between 300 and 600 signed in an average of 3.60 times a day. Users with very good or exceptional scores between 781 and 850 did so 2.79 times a day — or 29% less.

- People with poorer credit scores didn’t see a boost from obsessively checking. The average credit score for users with a score between 300 and 600 — those who check most often — generally stood still at 544 from March 2020 to January 2021.

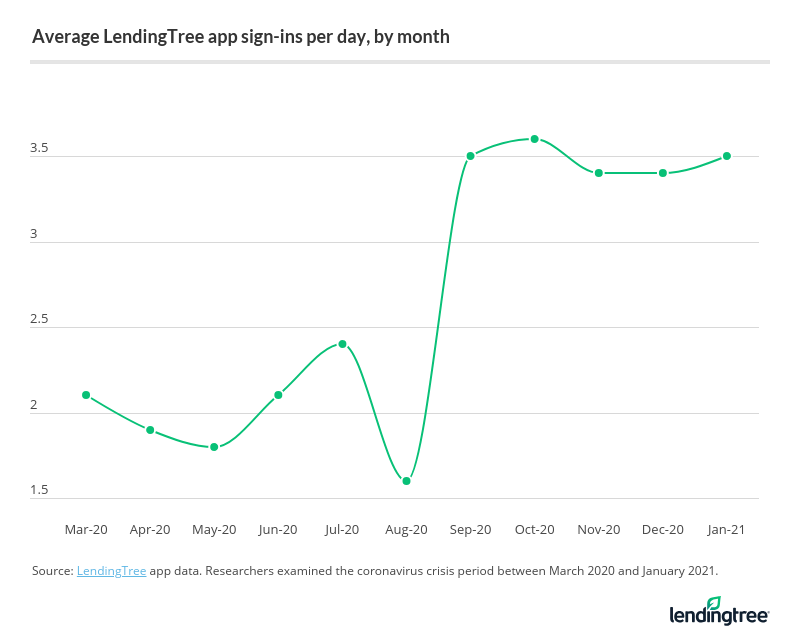

- People tend to check their credit scores the most during the holidays and post-holidays, while doing so the least in the summer. LendingTree users between September 2020 and January 2021 signed in an average of 3.5 times a day. A few months earlier — August 2020 — was the lowest at an average of 1.6 times a day.

- The average credit score of users who log into the LendingTree app tends to be low. Between March 2020 and January 2021, the average credit score of someone logging in — and potentially checking their credit — was nearly 607.

People with lower credit scores are more persistent about checking them

The majority of Americans should have an idea about their financial situation on some level. Even consumers with serious credit card debt who might not want to know the truth about the financial hole they’re in should at least be aware that they aren’t in great financial shape.

LendingTree data shows that people with the lowest credit scores are more persistent about tracking their credit scores and other financial metrics. People with the lowest credit scores checked their finances on LendingTree about 37% more often, on average, between March 2020 and January 2021 than people with the highest credit scores.

In October 2020, for example, users with very poor or fair credit scores between 300 and 600 signed into the app an average of 3.78 times a day — the highest in the period examined. That compared to 2.52 times a day for people with very good or exceptional credit scores between 781 and 850 — a drop of 50%.

That trend continues at each credit score level. Continuing the October example:

- People with good and very good credit scores between 721 and 780 check the app 3.32 times a day

- People with fair and good credit scores between 661 and 720 check the app 3.61 times a day

- People with fair credit scores between 601 and 660 check the app 3.72 times a day

“For many of those folks, they’re checking their progress toward a higher score and celebrating every little step of the climb because they know good credit can save them real money going forward,” Schulz says.

The time of year impacts how often people check their scores

The holiday and post-holiday periods can be stressful for those needing to manage their money more strongly. When the world isn’t in a global pandemic, many people often end the year pushing their credit cards to the limit to pay for the travel, dining and gift-giving that come with the holiday season.

Researchers examined the same March 2020-to-January 2021 period here, too. LendingTree data shows that people were more diligent about logging into LendingTree between September and January.

The elevated sign-in activity around the holidays might also be tied to people applying for new credit cards and trying to see what they qualify for, Schulz says.

“It makes sense because it is also a time where people tend to overspend,” he says. “People tend to take stock in their finances around the end of a year and the start of a new year, so reviewing their credit score might simply be part of their yearly financial checkup.”

The back-to-school period is also one where the LendingTree data reflects an uptick in activity for people checking in on their finances. The average number of daily sign-ins more than doubled between August and September 2020 for people with the lowest credit scores.

3 ways to boost your credit score

Keeping a close eye on your credit score is important to growing it. Here are some tips.

- Analyze your credit report regularly. This goes for people with bad or good credit. Consumers can receive free weekly credit reports — which differ from their credit score — from the three credit-reporting agencies (Equifax, Experian and TransUnion) at AnnualCreditReport.com until April 20, 2022. Examine carefully, as there could be surprises. “A major decrease in your score could be an indicator that you’ve been a victim of identity theft, and that’s an important thing to address in a hurry,” Schulz says.

- Look for mistakes. Beyond surprises, you want to check your credit report for mistakes. Everyone, including credit-reporting agencies, can make mistakes — and they may appear on your credit report, which could damage your score. If you don’t know what to do if you discover a mistake, here’s how to dispute an error on your credit report.

- Aim for consistency. “People tend to overthink credit,” Schulz says. “It really comes down to three things: paying your bills on time every time, keeping your balances low and not applying for too much credit too often. If you do those three things over and over again, your credit will be just fine.”

Methodology

Researchers analyzed data on hundreds of thousands of anonymized LendingTree users between March 2020 and January 2021.

LendingTree allows users to check their credit score for free. Researchers tracked how often users logged into the app and grouped them by credit score:

- 300 to 600

- 601 to 660

- 661 to 720

- 721 to 780

- 781 to 850

Researchers also tracked the data by month during this period.

Get debt consolidation loan offers from up to 5 lenders in minutes