56% of Americans Are Fearful of Their Future Financial Situations, With 35% Losing Sleep Over Money

With soaring prices and economic uncertainty, Americans find themselves grappling with concerns about their future financial well-being. And with consumers increasingly taking on personal loan debt to help make ends meet, the challenges seem endless.

Still, 73% of Americans have been able to contribute money to their savings in the past 12 months, according to the latest LendingTree survey of nearly 2,000 U.S. consumers. Keep reading to find out how they did it.

Key findings

- More than half of Americans are fearful of their future financial situations — and it’s keeping them awake. 56% of Americans say they’re worried about their future financial situations, with 35% losing sleep over money. Parents with children younger than 18 and those who earn less than $35,000 annually are most likely to say they’re worried about what the future holds for their wallets (both 63%), followed by Gen Xers (61%) and women and millennials (both 60%). Those who may need the most rest — parents with young children — are also the most likely to experience restless nights due to financial concerns (45%).

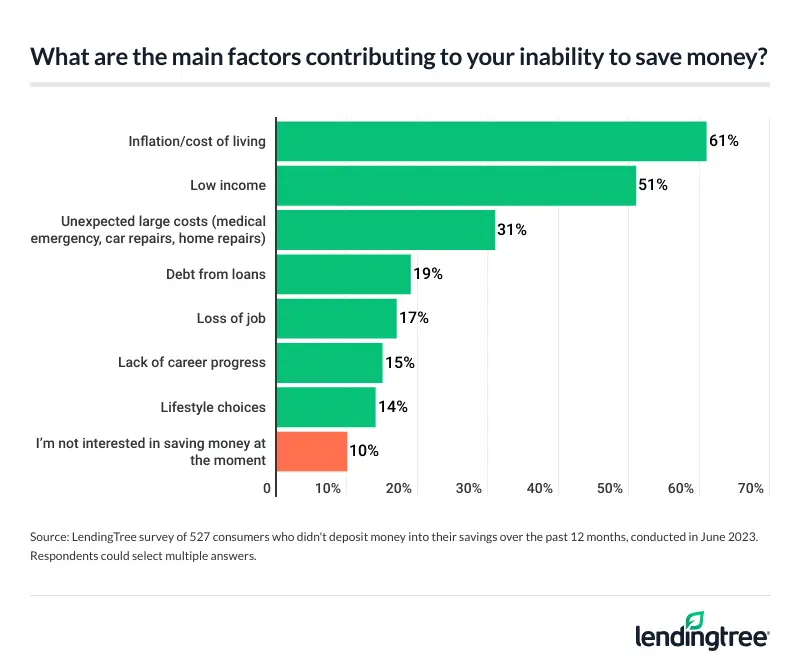

- Inflation, higher costs and personal spending vices make it difficult for some to grow their savings, adding to financial woes. More than a quarter of Americans (27%) didn’t deposit funds into their savings accounts in the past 12 months, despite 79% of Americans considering themselves good money managers. Inflation or a higher cost of living (61%), low income (51%) and unexpected large expenses (31%) are the biggest roadblocks for those who haven’t saved. In addition, 39% of Americans admit that vices get in the way of stashing cash, with excessive self-spending and tobacco products being the most-cited guilty pleasures.

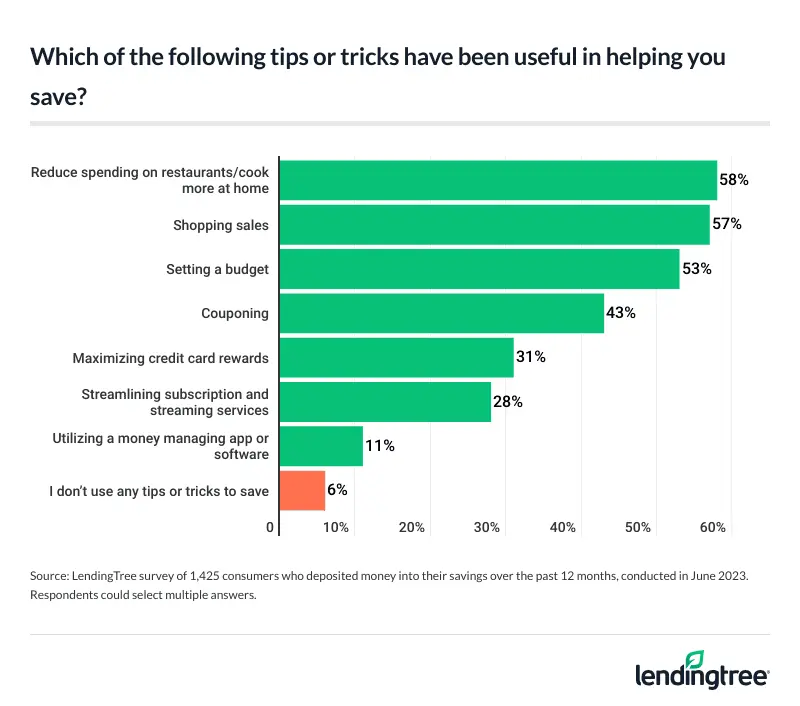

- Among those who’ve been able to grow their savings, 66% say they follow certain budgeting or savings strategies, and the majority (85%) mostly stick to their spending limits. Aside from sticking to and setting a budget, 58% say cooking more at home rather than dining out at restaurants has helped grow their savings, while 57% bargain hunt or shop for sales. However, even for those who managed to save money this past year, 72% regret not depositing more money into the bank.

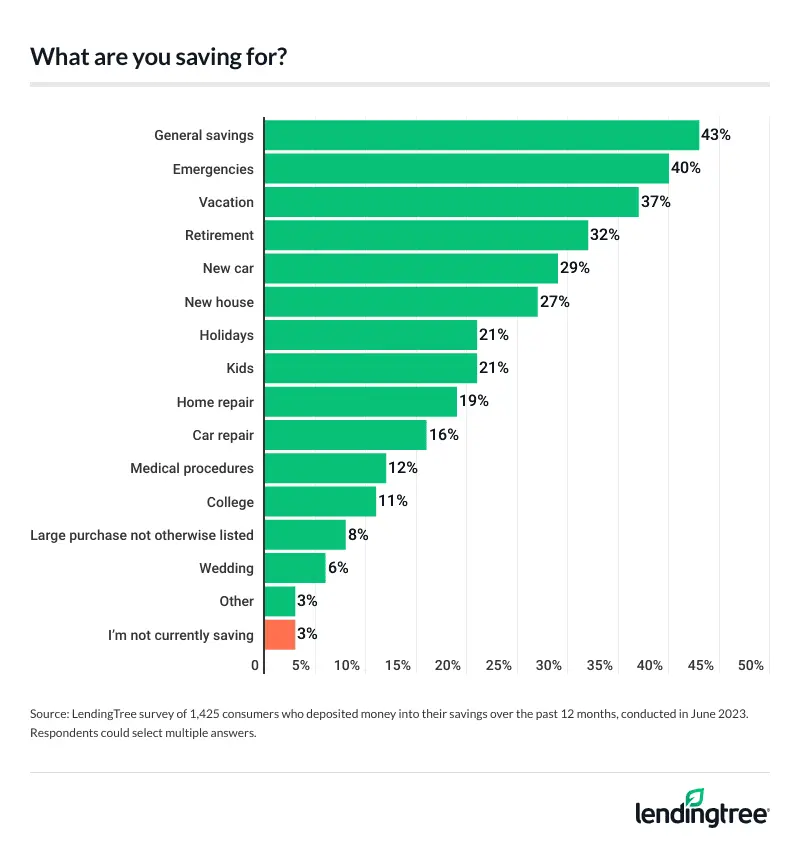

- There may be a multitude of reasons to save money, but successful savers are primarily stashing cash for general savings (43%), emergencies (40%) and vacations (37%). And although not everyone is working for the weekend, 35% of Americans agree that they save during the week to spend on the weekends — this is especially true for men and younger generations.

56% of Americans are worried about their future finances

Inflation hasn’t only impacted consumers’ wallets — it’s also affected their outlooks. In Inflation hasn’t only impacted consumers’ wallets — it’s also affected their outlooks. In fact, 56% of Americans say they’re worried about their future financial situations.

Credit scores may play a role in consumers worrying about future finances. Those with poor (between 300 and 579) and fair (between 580 and 669) FICO Scores are the most likely to worry about what the future holds for their finances, at 65%. On the other end of the spectrum, those with exceptional (between 800 and 850) FICO Scores are least likely at 45%.

Outside of the credit score demographic, parents with children younger than 18 and those who earn less than $35,000 annually are the most likely to say they’re worried about their financial future at 63% for both. By age group, 61% of Gen Xers (ages 43 to 58) say they’re worried about their finances — making them the most likely generation to cite this. They’re followed by:

- Millennials (ages 27 to 42) (60%)

- Baby boomers (ages 59 to 77) (51%)

- Gen Zers (ages 18 to 25) (50%)

Meanwhile, women (60%) are more likely to worry about their financial future than men (53%).

Some consumers’ financial fears may even be affecting their health — in fact, 35% of Americans say they lose sleep over money. Parents with young children are again the most likely to wrestle with financial concerns, with 45% admitting to experiencing restless nights over money. That’s significantly more than the 32% of consumers with no children and 26% of consumers with adult children who say similarly.

Millennials (41%), Gen Xers (38%), those making between $75,000 and $99,999 (38%) and those making less than $35,000 (38%) are the next most likely to lose sleep over money.

Despite money-managing confidence, consumers are struggling to grow their savings

As Americans grappled with a year of high inflation, it may be unsurprising that more than a quarter (27%) didn’t deposit funds into their savings accounts in the past 12 months.

“Many Americans have very little financial margin for error even in the best of times,” LendingTree chief consumer finance analyst Matt Schulz says. “Add inflation and rising interest rates to the mix and what little wiggle room they might have had vanishes completely. Unfortunately, we can also be our worst enemy when it comes to our finances. This survey is further proof of that.”

By demographic, 44% of consumers making less than $35,000 say they haven’t put any money toward their savings accounts recently — making them the most likely by a wide margin. Following that, Gen Xers (31%) and consumers without children (31%) haven’t put anything toward their savings in the past 12 months. Women (31%) are also more likely to have neglected their savings accounts than men (23%).

Despite these difficulties, 79% of Americans consider themselves good money managers — and those who’re more confident are more likely to have put money toward savings in the past 12 months. That’s particularly true of six-figure earners (90%), baby boomers (84%), parents with children younger than 18 (82%) and those making between $75,000 and $99,999 (82%).

In addition, men (82%) are more confident in their money management skills than women (77%).

What’s preventing some Americans from saving? Of those who haven’t saved in the past 12 months, 61% blame inflation or a higher cost of living — making it the most likely reason. That’s followed by low income (51%) and unexpected large expenses (31%).

Separately, 39% of Americans say their vices get in the way of saving, with excessive self-spending and tobacco products being the most-cited guilty pleasures at 16%, followed by:

- Alcohol (10%)

- Gambling or betting (7%)

- Lottery tickets (6%)

- Drugs (5%)

- Adult entertainment (4%)

Around half of consumers aren’t aware of higher APYs available

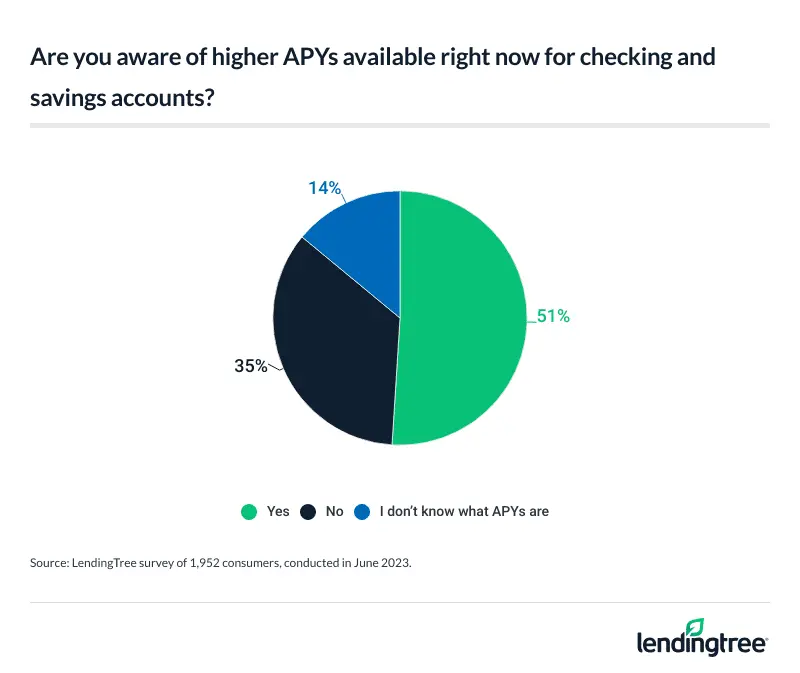

Many consumers may be missing out on extra cash, including those who’ve recently added to their savings accounts. In fact, only 51% of Americans are aware of higher APYs available for checking and saving accounts. Gen Zers (38%) and those earning less than $35,000 (40%) are the least likely to know about higher APYs for their accounts.

Women (44%) are also significantly less likely to know about higher APYs available than men (61%).

According to a DepositAccounts study from November 2022, the difference between the lowest and highest checking account APY can make a massive difference in interest earnings — so it pays to shop and compare. At the time of the study, shopping for the best APY on a checking account could boost account balances by as much as 5.1% in a year and 64.5% in 10 years.

Similarly, consumers could boost their savings accounts by as much as 3.6% in a year and 41.7% in 10 years.

Successful savers strategize, stick to spending limits

For those who’ve saved some cash in the past 12 months, strategy is key. Among those who’ve been able to grow their savings, 66% say they follow certain budgeting or savings rules. That’s particularly true of six-figure savers (77%), those with kids younger than 18 (76%) and Gen Z savers (76%).

What’s more, the majority of those adhering to budget rules (85%) mostly stick to their spending limits. Baby boomers (92%) and those with children older than 18 (91%) are the most likely to keep their budgets on track.

Aside from sticking to and setting a budget, 58% say cooking more at home than dining out at restaurants has helped them grow their savings — making it the top successful savings tip — though women (65%) are most likely to have saved money by eating at home. Following that, 57% say bargain-hunting or shopping for sales helped save them some cash. That’s particularly true for women (64%), baby boomers (62%) and those with adult children (60%).

Why are savers stashing their cash?

There’s no bad reason to save, but successful savers have different reasons for stashing their cash. Of these, general savings top the list, with 43% of savers saying they’re pocketing their cash for this reason. Baby boomers (49%) and savers without children (49%) are the most likely to save for this reason.

Following that, savers are most likely to be putting their money away for emergencies (40%) and vacations (37%).

Americans are also working for the weekend. Overall, 35% of Americans agree they save during the week to spend on the weekends. This is especially true for Gen Zers (51%), millennials (49%) and men (44%).

Saving during inflation: Top expert tips

While saving can be extra difficult when prices are high, Schulz says consumers can do a few things to pocket some cash at the end of the month.

“Saving money can certainly be easier said than done, especially with how expensive life is in 2023, but it’s essential to financial security,” he says. “Whatever your goals, putting aside a little extra money when possible is usually a good idea. The best news is that with today’s high-yield savings accounts offering such large returns, that money you put away will grow more quickly than you might expect.”

Beyond that, he recommends the following:

- Budget, budget, budget. There’s a reason why successful savers use budgets. Once you have a handle on how much money is coming in and out of your household each month, you can decide how best to spend your money based on your priorities.

- Small steps matter. “It’s easy to bury your head in the sand and try to wish your problems and stresses away, but one of the best ways to feel more in control is to take action,” Schulz says. “Even small steps, done repeatedly, can add up to big changes. Perhaps most important, they can give you a greater sense of control over your situation, ideally leading you to sleep better and motivating you to work toward your goals.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,952 U.S. consumers ages 18 to 77 from June 5-6, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Get debt consolidation loan offers from up to 5 lenders in minutes