66% of Parents Struggle to Afford Summer Activities, Spending Almost $900 per Child

School’s out for the summer, and that’s a great thing for kids. For parents, however, summer break often means finding daytime child care arrangements — which isn’t cheap.

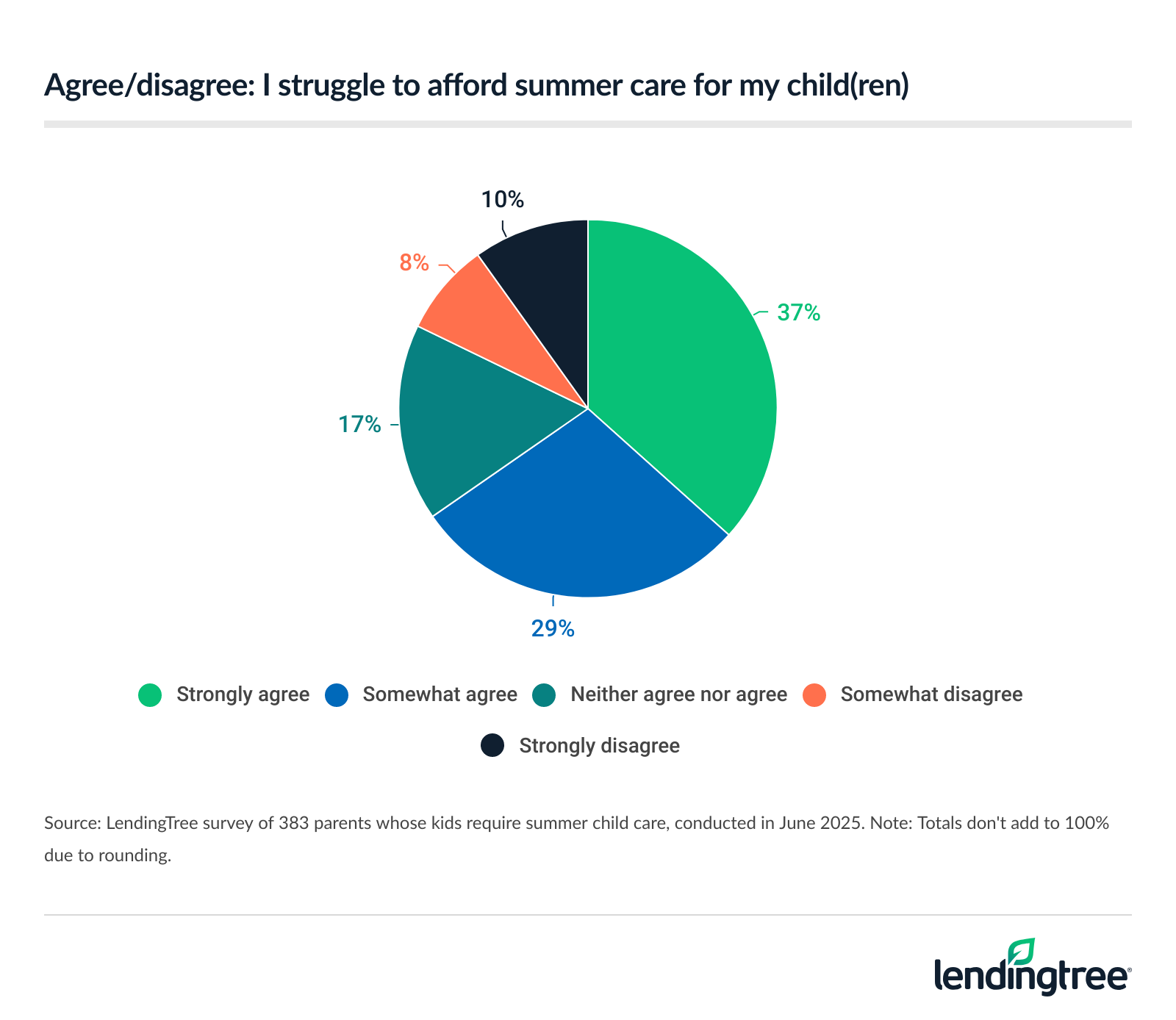

According to a LendingTree survey of 600-plus parents with kids younger than 18, 66% of parents who require summer child care struggle to afford it. Parents who require it spend almost $900 per child on activities and care.

Here’s what else we found.

Key findings

- Summer child care, camps and activities are a financial burden for many families. 66% of parents who require summer child care struggle to afford it. Parents who require it spend almost $900 per child on activities and care. To offset expenses, 48% cut back on nonessential spending like dining out and entertainment, while 19% reduce spending on essentials like groceries and utilities.

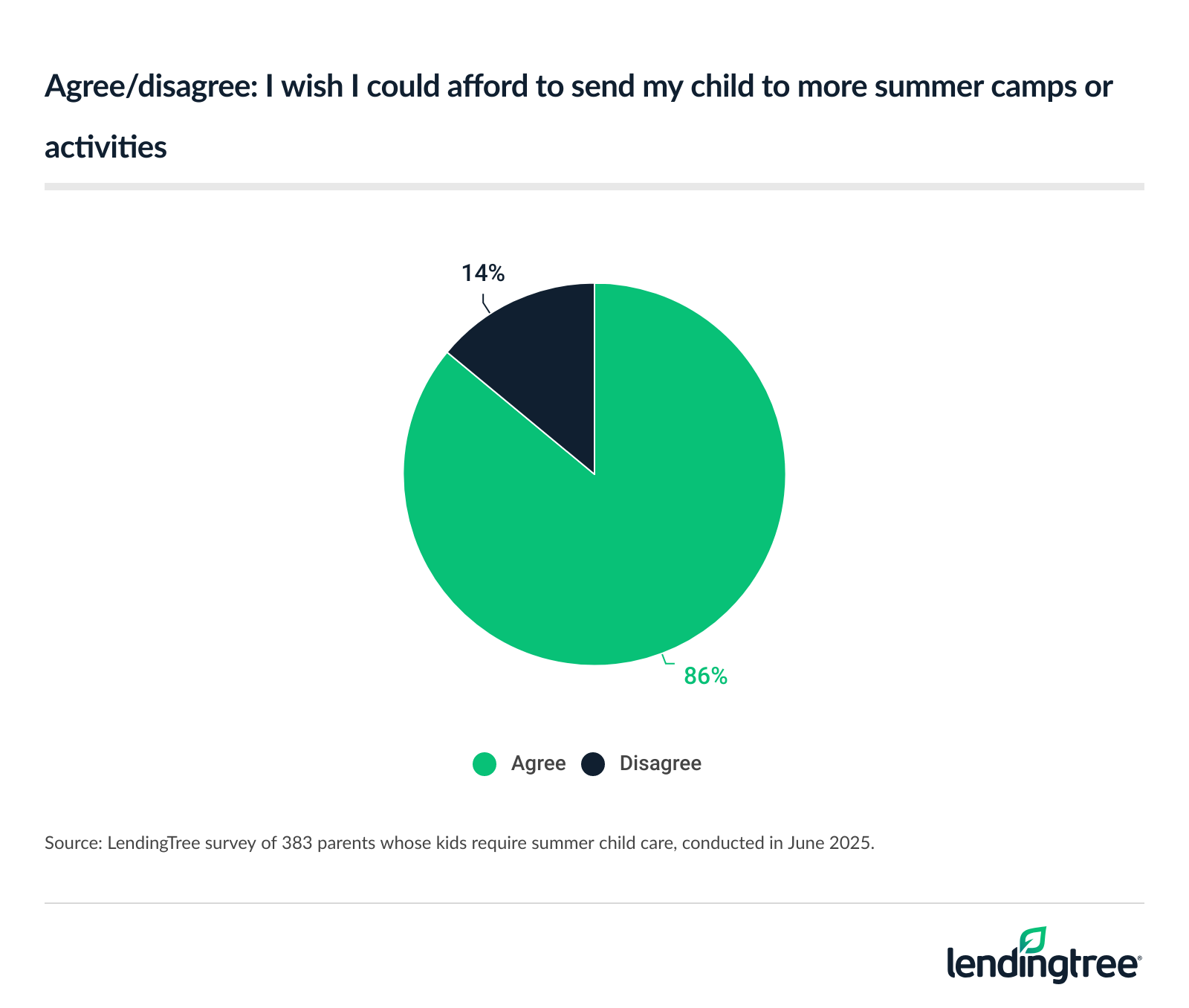

- Parents want to do more but face financial and accessibility barriers. 86% wish they could afford to enroll their child in more camps or activities. Although 44% receive tuition assistance or subsidies, 36% say there simply aren’t enough affordable summer care options available in their area.

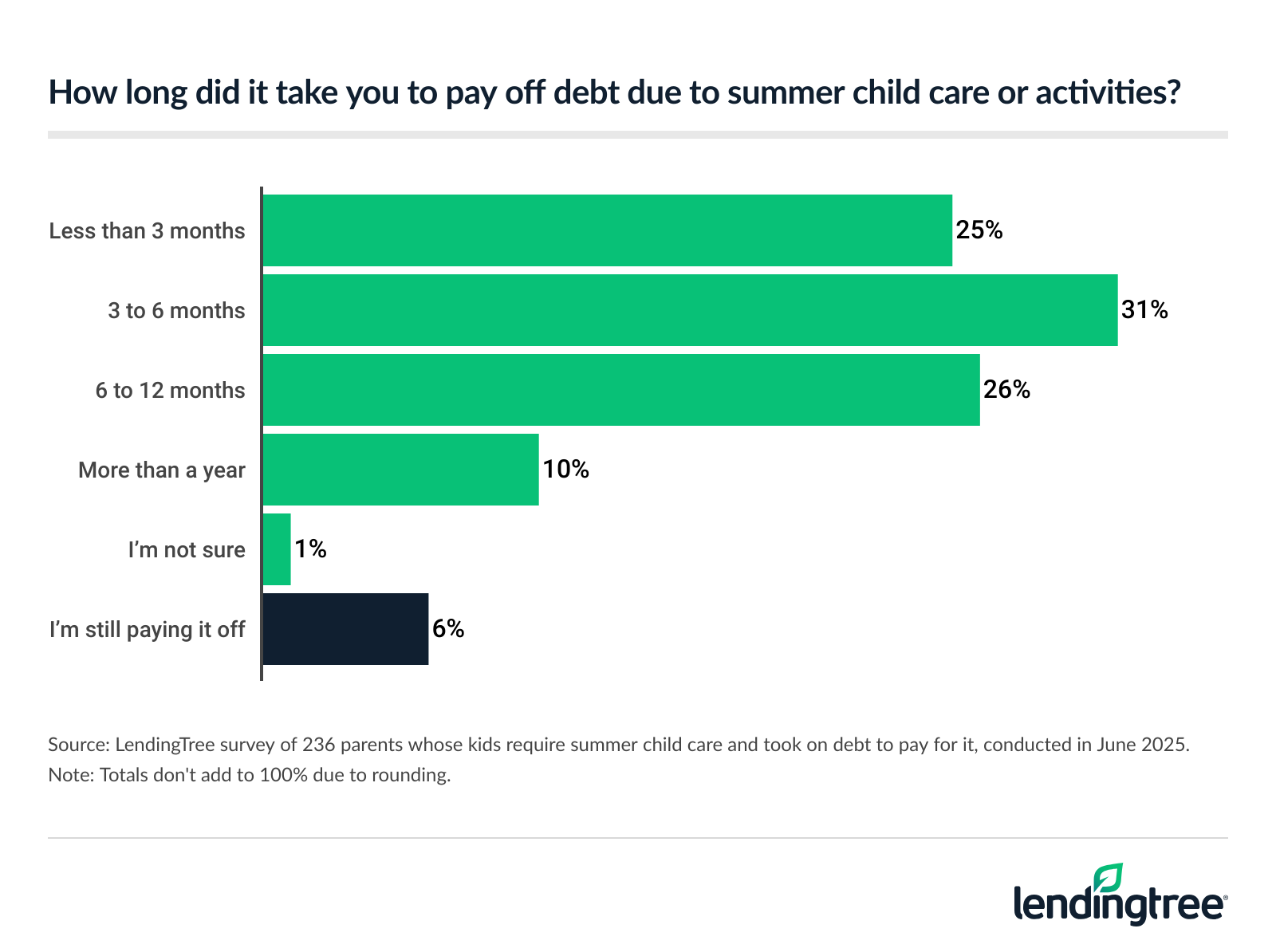

- Many parents go into debt to cover summer expenses. As 71% say expenses increase during the summer months, 62% have taken on debt to pay for summer child care, camps and activities. Of those who took on debt, 26% took six to 12 months to pay it off, 10% needed more than a year and 6% are still paying it off.

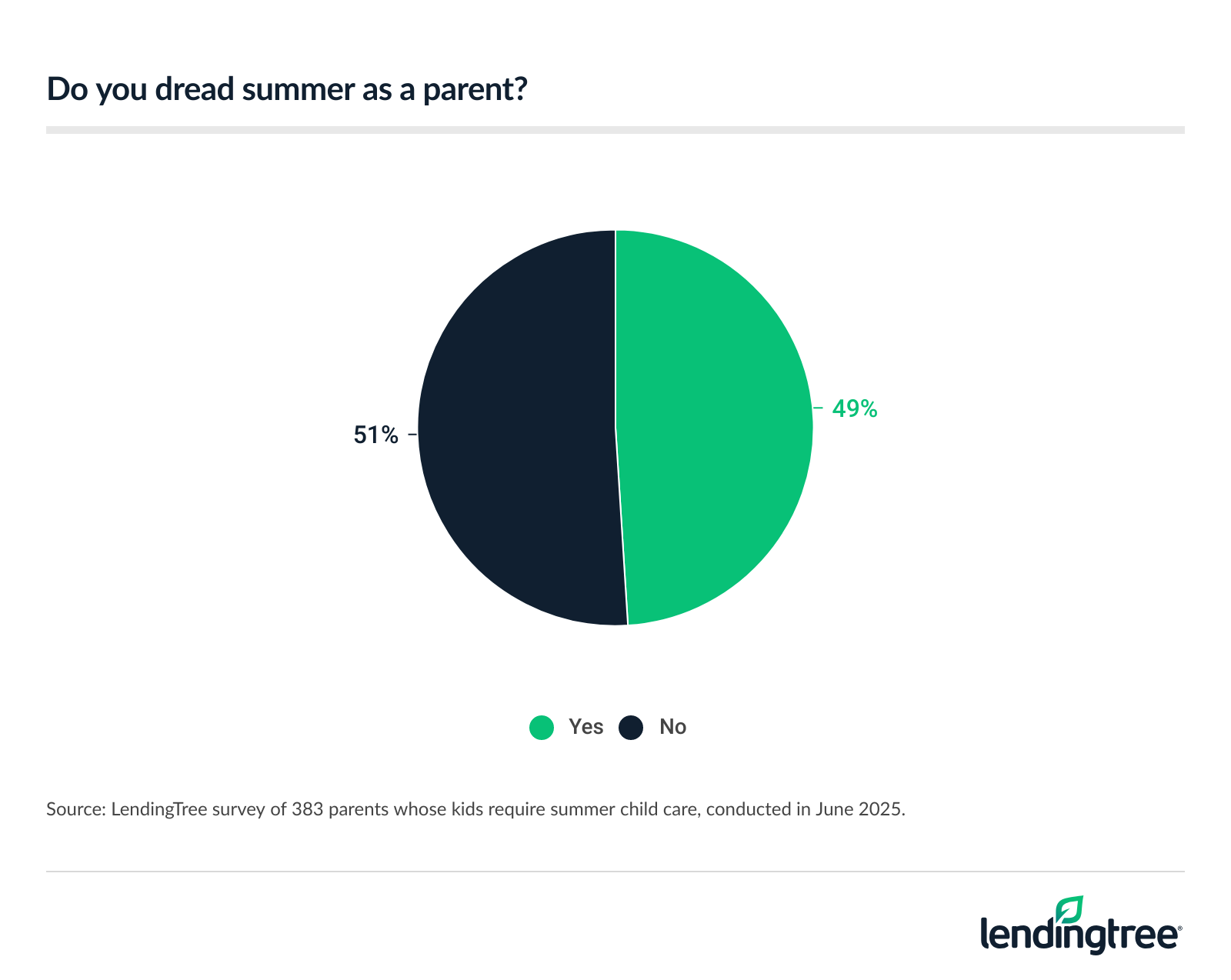

- Despite financial strain, parents see the value in summer activities. While 49% of these parents admit they dread summer, a strong majority (91%) say it’s important for their children to stay engaged in structured activities. And 91% agree summer programs are worth the investment.

Summer child care is a financial burden

Among parents with kids younger than 18, 60% require summer child care. While summer child care, camps and activities can be deeply enriching and beneficial, they can also be a financial burden for many families. In fact, 66% of these parents struggle to afford summer care.

In total, these parents spend an average of $893 per child on activities and care — which rises to $976 among dads and $954 among millennial parents ages 29 to 44. To help pay for this massive expense, 48% cut back on nonessential spending like dining out and entertainment — the most common response. Following that:

- 19% reduce spending on essentials like groceries and utilities

- 7% borrow money or use credit

- 6% delay paying other bills

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says it’s concerning that parents have to cut to afford child care, but it doesn’t surprise him.

“In the summertime, many parents don’t have any other option but to pay for child care,” he says. “As much as they’d love to take a bunch of time off during the summer to spend with their kids, that just isn’t a realistic thing for most Americans, so they’re forced to shell out for child care. That extra cost often requires sacrifice.”

As much as they’d love to take a bunch of time off during the summer to spend with their kids, that just isn’t a realistic thing for most Americans, so they’re forced to shell out for child care.

Parents are likely to put their children in sports camps

When it comes to the primary arrangements parents find for their kids during the summer months, 33% enroll them in a day camp — the most common response. Following that:

- 14% use a traditional day care

- 14% say they have family members to provide child care

- 13% say they or their partner provide care at home

- 8% enroll their kids in summer school

Of those who rely on camps, sports camps (46%) are the most common. General day camps (44%) and art camps (39%) follow, as well as music (37%), nature (34%) and science (25%) options.

Following a child’s interest or passion (30%) is the most common reason parents choose their child care arrangement or activity, with costs (25%) close behind. Meanwhile, 13% choose their child’s activity because it fits their schedule the best, while 13% prioritize socialization opportunities.

Money makes it tough to do more

Parents want to do more for their kids, but financial and accessibility barriers prevent them from achieving that goal. A whopping 86% wish they could afford to enroll their child in more camps or activities.

Meanwhile, 44% receive tuition assistance or subsidies — particularly dads (54%). Although that may help to some extent, 36% of parents requiring summer child care say there aren’t enough affordable options in their area. This is perhaps one reason why 44% have to adjust their work schedules in the summer.

Schulz believes those running camps and other summertime activities for kids should offer more tuition assistance and subsidies.

“The more that can be done, the better,” he says. “However, I do think that parents also spend more than they need to sometimes because they don’t ask for help.”

Why are parents reluctant to ask for assistance? “Some are nervous about confrontation and rejection,” Schulz explains. “Others may not know how to ask — or that they can. In my book, I have an entire section devoted to helping people ask for help paying for kids’ activities.”

Parents go into debt to pay for summer activities

Many parents will do anything for their kids — including going into debt. A whopping 71% say expenses increase during the summer months.

With that increase in mind, 62% have taken on debt to pay for summer child care, camps and activities. Of those who took on debt, just over a quarter (26%) took six to 12 months to pay it off, while 10% needed more than a year and 6% are still paying it off.

Summer activities are worth the price

Although summer activities may require significant financial sacrifices, parents believe it’s worth it — though they don’t look forward to it. Nearly half (49%) of parents who require this care admit they dread summer, particularly dads (58%).

Still, a massive 91% say it’s important for their children to stay engaged in structured activities. Meanwhile, 91% agree that summer programs are worth the investment. Along with the programs’ benefits for children, 65% of parents say this child care arrangement or activity allows them to maintain their regular work schedule.

Affording summer care: Top expert tips

When it comes to affording summer child care, Schulz says there are a few things to keep in mind. He recommends the following:

- Lower your interest rates. “Summer child care costs often go straight on our credit cards, and that can be an even costlier move with interest rates as high as they are today,” he says. “However, a credit card that offers 0% interest on new purchases can be helpful for managing these types of short-term debt. Consolidating your current debts with a 0% balance transfer credit card or a low-interest personal loan can be useful, too. You may even be able to get your credit card issuer to lower your interest rate just by asking. It works more often than you’d realize.”

- Save now for next summer. “It may be too late to save and make a dent in this year’s summer child care costs,” he says. “However, if you know that you’ll be in a similar situation next year, you can start saving for these costs today. Even a few dollars consistently tucked away in a high-yield savings account over the next several months can make a real difference when summer 2026 comes around.”

- Leverage friends and family. “Small things can make a difference when you’re looking to cut costs,” he says. “For example, putting your kids in the same camp as some of their friends can allow you to share the load a bit. If a group of parents can divvy up pickup and drop-off duties throughout the week, it can save each parent some gas, time and possible aggravation.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 638 parents with kids younger than 18 — 383 of whom require child care arrangements or activities in the summer — from June 2 to 3, 2025.

The survey of those ages 18 to 79 was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

Get debt consolidation loan offers from up to 5 lenders in minutes