More Than a Third of Americans Are Relying on Their Tax Refund This Year, With Paying Down Debt the Top Priority

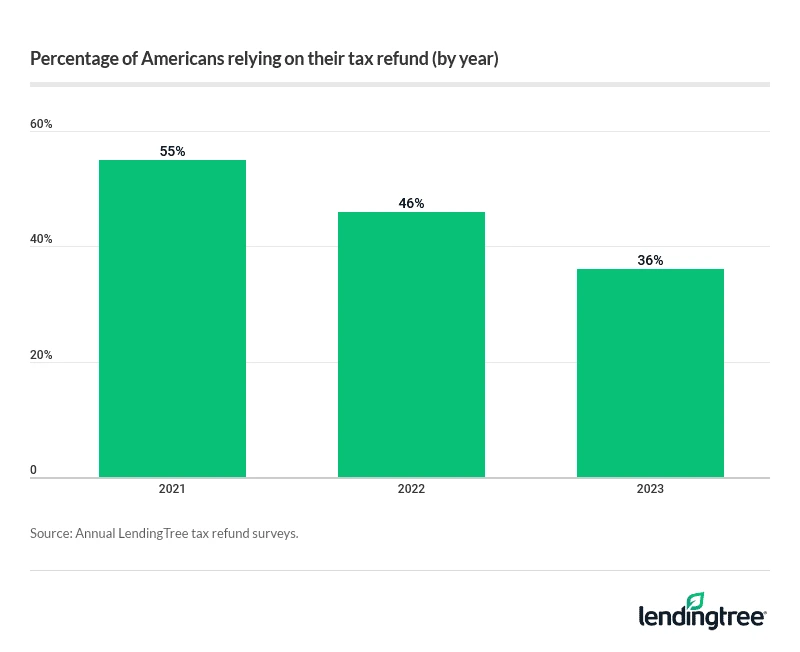

We’re more than a month into the 2023 tax filing season, and many consumers eagerly anticipate their refunds — though fewer Americans say they’re relying on that cash than before. Among those who plan to file a federal tax return this year, 36% are relying on their refund, according to the latest LendingTree survey. That’s 22% fewer consumers than last year.

We asked more than 2,000 U.S. consumers about their tax return expectations and what they plan to do with their refunds (if they’re getting them) this year. Here’s what we found.

Key findings

- Tax refunds can’t hit bank accounts soon enough for some Americans. Of the 77% of Americans who plan to file a federal tax return this year, 36% are relying on their refund. This rate is down substantially from the 46% who relied on their refunds in 2022 and the 55% who did so in 2021. Of the 73% who plan to receive a refund this year, 34% expect it to be less than $1,000 and 39% expect it to be a grand or more.

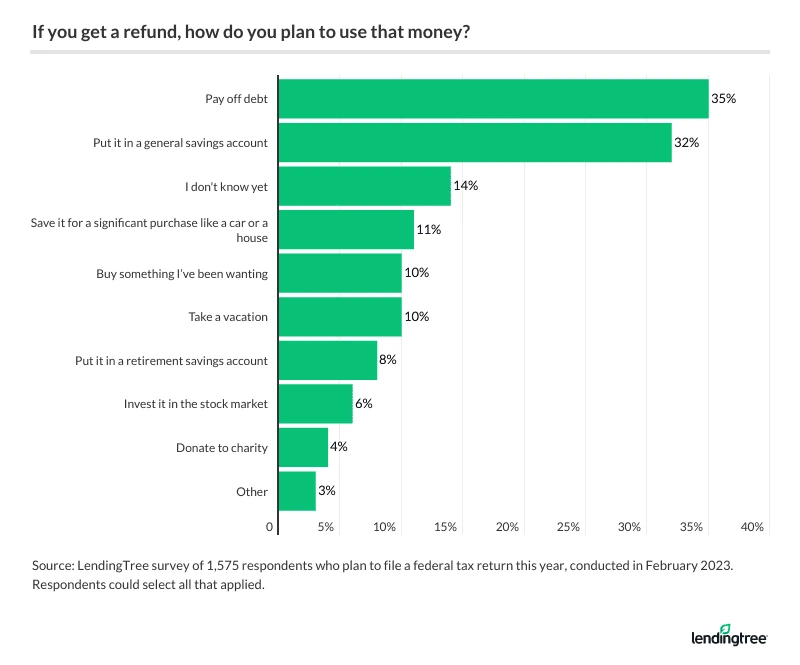

- As financial priorities change, only 32% of planned filers will put their refunds into savings this tax season. This is a significant decrease from the 46% who planned to save their refund last year. Paying down debt is a more pressing concern for tax filers, with 35% saying they’ll apply this year’s refund to those piled-up bills.

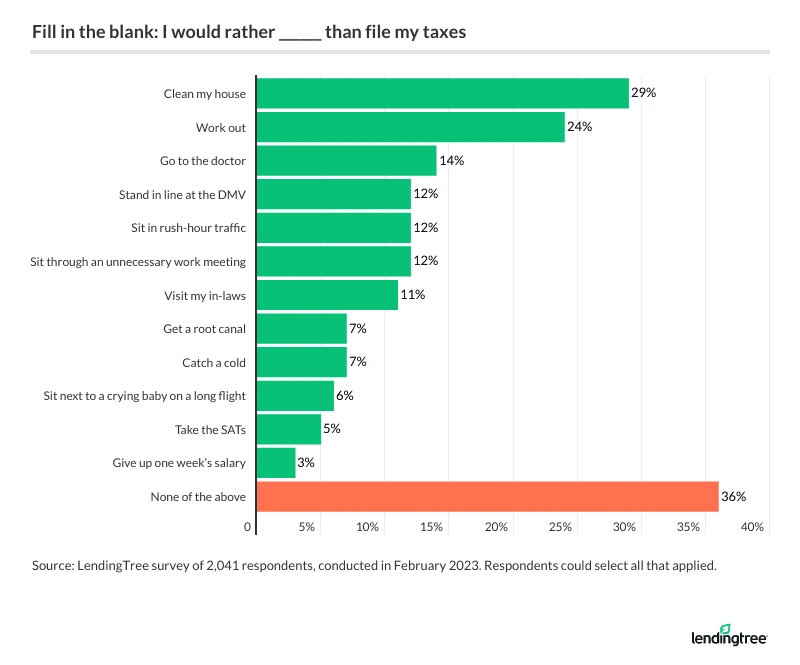

- Not everyone is looking forward to the April tax deadline. Among Americans planning to file their taxes, 27% say they’re dreading doing so. When asked what sounds more appealing than filing taxes, 29% of Americans would rather clean their house, 24% would rather work out and 14% would rather go to the doctor.

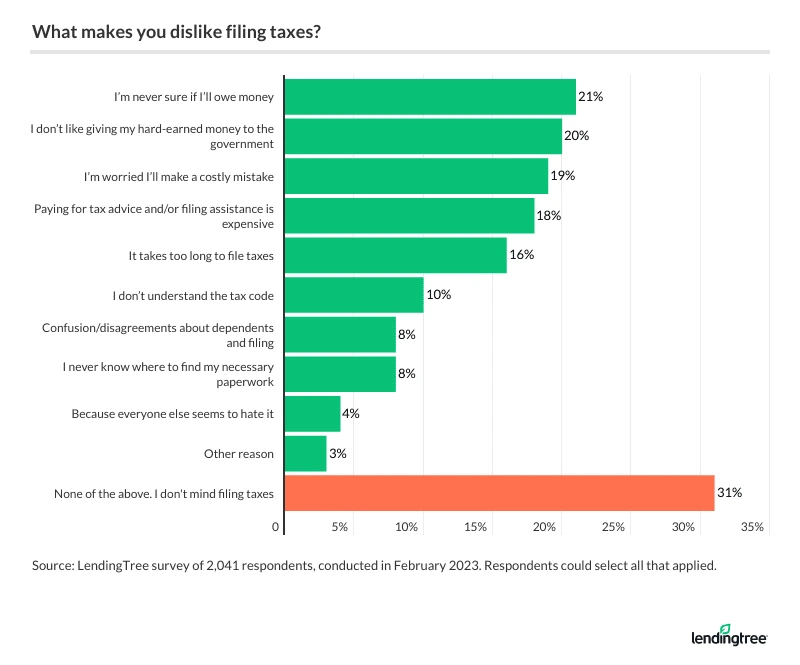

- Unsurprisingly, the most common reason that a majority of Americans (69%) don’t enjoy doing their taxes relates to money. 21% say they don’t like not knowing if they will owe money, 20% don’t like giving their hard-earned money to the government and 19% are worried about making a costly mistake. Although filing taxes can be a headache for many, 56% of Americans say receiving their refunds is a silver lining.

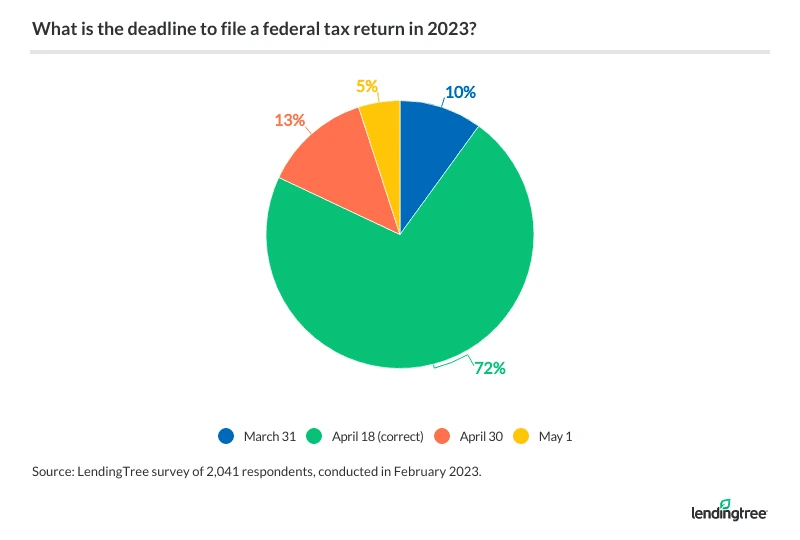

- Thanks to weekend and holiday conflicts of the past, some Americans are confused about when they need to file taxes. Nearly 3 in 10 (28%) Americans don’t know that this year’s Tax Day is April 18. The confusion is even higher for younger generations as 56% of Gen Zers and 37% of millennials don’t know the filing deadline.

36% of taxpayers are relying on their refund

Uncle Sam’s visit might not be enjoyable for every American, but some consumers are eager for him to give them back their change. In fact, of the 77% of Americans who plan to file a federal tax return this year, 36% say they’re relying on their refund.

Still, that’s significantly lower than the 46% of taxpayers who relied on their refunds in 2022 and the 55% who did so in 2021. With inflation as high as it is, that decrease may be surprising, but LendingTree senior industry analyst Ken Tumin has a few theories on why that figure’s falling.

“With America getting back to a pre-pandemic normal, more people are back to work,” he says. “Also, a lot of people started home improvement projects at the beginning of the pandemic. Home improvement is expensive, and I wouldn’t be surprised if tax refunds didn’t pay or partially pay for some of those improvements throughout the last two years.”

Notably, those most likely to rely on their refunds are consumers with low credit scores. Nearly 6 in 10 (59%) of those with poor credit scores between 300 and 579 and 52% of those with fair scores between 580 and 669 say they’re relying on their refunds this year. Comparatively, 38% of those with good scores between 670 and 739 and 27% of those with very good scores between 740 and 799 say similarly.

Meanwhile, 55% aren’t relying on a refund this year, but they say receiving one would be a pleasant surprise. Not everyone feels that way, though. In fact, 8% of taxpayers don’t like getting a refund because it means they overpaid throughout the year — a sentiment felt particularly among baby boomers ages 59 to 77 (19%).

How much do consumers expect to get? Of the 73% who expect to receive a refund this year, 39% expect it to be a grand or more. To break it down:

- 19% expect to get less than $500

- 15% expect to get $500 to $999

- 15% expect to get $1,000 to $1,999

- 8% expect to get $2,000 to $2,999

- 6% expect to get $3,000 to $3,999

- 3% expect to get $4,000 to $4,999

- 7% expect to get $5,000 or more

Millennials ages 27 to 42 (50%) and six-figure earners (45%) are the most likely to expect $1,000 or more. Meanwhile, 34% of consumers expect their refunds to be less than $1,000, leading with consumers making less than $35,000 (43%) and Gen Zers ages 18 to 26 (37%).ing less than $35,000 (43%) and Gen Zers ages 18 to 26 (37%).

It’s not all roses and refunds, though. While the majority of consumers expect to receive a refund, 15% say they expect they’ll owe money to the IRS this year and 11% expect they won’t get a refund or owe any money.

Only 32% will put their refunds toward savings

Although fewer Americans are relying on their refund, they’re not planning on stashing it away, either. In fact, only 32% of filers will put their refunds in a savings account this tax season — significantly lower than the 46% who planned to save their refund last year.

Tumin attributes that change to inflation. “As inflation has increased, more people — even people with good-paying jobs — are living paycheck to paycheck,” he says. “Some may have decided to pare down their withholdings to have that money every month instead of a bigger refund check.”

Instead, consumers are more concerned with paying down debt. In fact, 35% say they’ll use this year’s refund to pay their bills. That’s a particular concern for millennials — of this group, 43% say they’ll use their refund to pay off some debt.

While 14% aren’t sure how they’ll use their refunds yet, 11% say they’ll save it for a specific purpose like a car or house. A quarter (25%) of Gen Zers say they’re putting their refunds toward a specific goal — making them the most likely age group to do so. Meanwhile, Gen Zers (17%) and millennials (15%) are the most likely groups to say they’ll use their refund to buy something they’ve been wanting.

27% dread doing their taxes — here are the painstaking tasks they’d rather do

Tax season is an understandable headache for consumers. In fact, 27% of Americans who plan to file their taxes say they’re dreading doing so. What would they rather do instead? To put off filing their taxes, 29% of Americans would rather clean their house, 24% would rather work out and 14% say they’d rather go to the doctor. Following that, 12% would rather stand in line at the DMV — tying with two other responses as the fourth most preferred task over tax filing.

Despite the dread most consumers feel, it’s worth noting that 82% of those planning to file taxes will get help from an outside source — particularly Gen Z filers (87%). To break it down, taxpayers are most likely to get help filing taxes through the following methods:

- 41% plan to use an online filing service such as TurboTax

- 30% plan to use a paid accountant or advisor

- 14% plan to use a family member or friend

- 7% plan to use an online search engine

Meanwhile, 18% of filers just do it themselves, with baby boomers (21%) the most likely age group to do so.

Given how many consumers would rather handle painstaking chores over filing their taxes, it’s worth wondering why filing is such a dreaded task. For nearly 7 in 10 (69%) Americans who dislike filing taxes, the most common response involves money.he most common response involves money.

To break it down more specifically, 21% say they’re never sure they’ll owe money and 20% don’t like giving their hard-earned money to the government — the most common responses. Gen Zers, in particular, are the most likely age group to say they’re unsure they’ll owe money, at 27%.

Meanwhile, baby boomers are the most likely age group to have that anti-government sentiment, with a quarter (25%) of this age group reporting they don’t like handing off their cash to Uncle Sam. Above that, 29% of six-figure earners feel similarly — the most likely demographic group to say so.

Despite the pains of tax season, 56% of Americans say receiving their refunds is a silver lining. Following that, 15% enjoy filing their taxes because they like knowing how much money they made in the most recent tax year and 14% like completing tasks.

Some consumers are confused about the deadline

April Fools Day’ might be on the first, but some consumers may be getting tricked by Uncle Sam well into the month. In fact, 28% of Americans don’t know that this year’s Tax Day is April 18 — particularly Gen Zers (56%) and millennials (37%).

There are a few reasons consumers might be confused. “April 15th is so ingrained into our culture as Tax Day,” Tumin says. “Also, because Emancipation Day — the reason that Tax Day is April 18th this year — is a holiday regional to Washington, D.C., most people are probably unaware of the date change. My suggestion is that we all pretend that April 15th is the official tax date just to be safe.”

That’s not the only cause of confusion. According to the IRS, certain consumers in California have until May 15 to file their taxes due to flooding across the region. (Those affected should double-check which counties qualify for the extension.)

For the 10% of consumers who think the deadline is on March 31, they may get away without penalty. However, 18% think the deadline is later than April 18 — which may spell trouble if they put off filing. According to the IRS, those who pay late must pay 5% of the unpaid taxes for each month that a tax return is late.

Expecting a refund? Here’s what experts recommend doing with it

Whether you’re looking forward to a refund or miffed you overpaid, putting that cash to use is an important consideration. But what’s the best use of your refund?

“If you have any debt, like credit card debt or student loans, put the refund toward bringing down that debt,” Tumin says. “If you’re not in debt, then the best option would be to put the money into their emergency fund.”

If you don’t have an emergency fund, Tumin says this would be a great time and way to start one. It’s also worth noting that the interest rates for online savings accounts are at their highest level in more than a decade, making it a great time to start a savings account for your emergency savings funds.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,041 U.S. consumers ages 18 to 77 from Feb. 7 to 10, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Get debt consolidation loan offers from up to 5 lenders in minutes